It is true that all big cities have areas of poverty that is visible from…

Central banks can sometimes generate higher inflation

I haven’t much time today with travel commitments coming up at later. But I filed this story away earlier in the week in my ‘nonsense’ list but with a note that it contained a lesson, which would help people understand Modern Monetary Theory (MMT). The demonstration piece was written by the UK Daily Telegraph journalist Ambrose Evans-Pritchard (December 15, 2014) – Why Paul Krugman is wrong – which asserts a number of things about the effectiveness of fiscal policy (or the lack of it this case) and the overwhelming effectiveness of monetary policy. Indeed, apart from trying to one-up Paul Krugman, the substantive claim of the article is that the difference between the poor performance of the Eurozone and the recoveries in the US and to a lesser extent the UK is not because of the fiscal policy choices each nation/bloc made. This is articulated in a haze of confusion and misconceived discussion. So here is the lesson.

Evans-Pritchard claims that the differences between the Eurozone and the US for example, reflect the fact that:

The eurozone has been through roughly equivalent fiscal contraction over the last four years but without monetary stimulus. The lamentable consequences are before our eyes.

So according to the writer it is all down to monetary policy.

His beef with Krugman is over “whether central banks can generate inflation even when interest rates are zero” whenever they want to.

Evans-Pritchard claims that:

Central banks can always create inflation if they try hard enough.

He is actually talking about accelerating inflation rather than inflation per se, but that is a nuance.

He draws on a quote from an IMF economist who says that “The interest rate is totally irrelevant. What matters is the quantity of money. Large scale money creation is a very powerful weapon and can always create inflation.”

This is described as a “self-evident truism” and he refers back to Milton Friedman who invoked a aviation analogy to support his view that central banks can always generate inflation through monetary policy changes.

Evans-Pritchard says that:

Mr Congdon’s claim is a self-evident truism. Central banks can always create inflation if they try hard enough. As Milton Friedman said, they can print bundles of notes and drop from them helicopters. The modern variant might be a $100,000 electronic transfer into the bank account of every citizen. That would most assuredly create inflation.

He is astounded that anyone (include “Prof Krugman”) could possibly refute this idea.

Please read my blog – Keep the helicopters on their pads and just spend – for more discussion on this point.

The helicopter references comes from Milton Friedman’s suggestion in the introduction (page 4) to his collection of essays – ‘The Optimum Quantity of Money and other Essays”, Chicago: Aldine Publishing Company, 1969 – that a chronic episode of price deflation could be resolved by “dropping money out of a helicopter”.

First, the two examples – the helicopter drop and electronically crediting peoples’ private bank accounts with new deposits are not equivalent events. But that is a small issue.

Second, neither will necessarily cause the price level to accelerate more quickly (that is, increase inflation).

Why not? What if all the cash from the helicopters fell into the fields and stayed there?

What if the bank customers, fearing future unemployment and the income uncertainty that accompanies that fear, decided to build saving deposits up further and considered the electronic crediting of their accounts to be a boost to that effort.

In either case, there will be no price level effects of the central bank operation.

If, the bank customers took all the increased deposits provided by this central bank operation and used the funds to purchase TVs, food, cars, holidays etc – that is, real goods and services then there is the possibility of accelerating inflation.

If there is idle capacity in the economy and firms who supply TVs, food, cars, etc have the capacity to supply those goods and services then they will defend their market share by increasing output and sales at the current price levels on offer. Firms typically ‘quantity-adjust’ rather than ‘price-adjust’ when there is excess (idle) capacity. Otherwise, they risk losing market share.

So in that case there will be no acceleration in inflation. The increased spending will generate a positive output and employment response and the nation will enjoy higher real incomes.

The possibility of inflation will only become a reality, if the bank customers start liquidating the increased deposits through increased expenditure and the economy is incapable of meeting that increased growth in nominal spending through increased output.

When firms can no longer ‘quantity-adjust’ they ‘price-adjust’.

So it is not a self-evident truism that central banks can always increase the inflation rate.

The truism reference comes from the classical theory of inflation based on the Quantity Theory of Money. I have dealt with this previously and here is a summary of the problems.

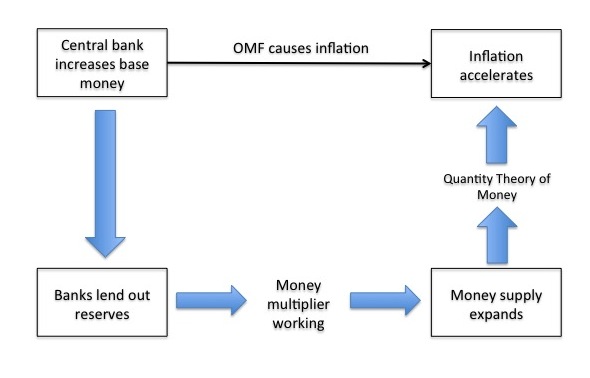

The following graph comes out of my upcoming Eurozone book (will be published in May 2015 in English). Please read my blog – Options for Europe – Part 68 – for a detailed discussion of the graph. I only consider the right-hand side of the diagram here.

There are two arcane notions that are relied on to claim it is truistic that central banks cause inflation when they expand bank reserves (which is effectively what Evans-Pritchard is doing in his experiment).

One is just plain wrong while the other has limited applicability in a recession. The first notion is the rather official sounding concept called the ‘money multiplier’, which links so-called central bank money or monetary base to the total stock of money in the economy (the money supply).

The second notion then links the growth in that stock of money to the inflation rate. The combined causality linking these notions then allows the mainstream economists to assert that if the central bank expands the money supply it will cause inflation.

The Quantity Theory of Money (QTM) (see Figure) links the expansion of the money supply with accelerating inflation.

The QTM postulates the following relationship M times V = P times Y which can be easily described in words as follows. M is a symbol for how much money there is in circulation. V is called the velocity of circulation in the text books but simply means how many times per period (say a year) the stock of money ‘turns over’ in transactions.

To understand velocity think about the following example. Assume the total stock of money is $100, which is held by the two people that make up this economy. In the current period, Person A buys goods and services from Person B for $100.

In turn, Person B buys goods and services from Person A for $100. The total transactions equal $200 yet there is only $100 in the economy. Each dollar has thus be used “twice” over the course of the year. So the velocity in this economy is 2.

When we make transactions we hand over money, which then keeps being circulated in subsequent purchases. The result of M times V is equal to the total monetary transactions in the economy per period, which is a flow of dollars (or whatever currency is in use).

The P times Y is the average price in the economy times real output produced. So economists value the total sum of all the goods and services produced to get real GDP and then value this is some way using the price level.

So P times Y is the total money value of the output produced in the period or GDP. Clearly, all the sales of goods and services (M times V) have to equal the total money value of output or GDP (P times Y).

At this level, the relationship M time V = P times Y is nothing more than an accounting statement that total value of spending in a period must equal the total value of output, that is, a truism.

It is true by definition and at that level is totally unobjectionable. So at that level – as an accounting statement – the claim is truism.

But that does not make the truism a theory. How does the QTM become a theory of inflation? The answer is by sleight of hand.

The Classical economists who pioneered the use of the QTM assumed that the labour market would always be at full employment, which means that real GDP (the Y in the formula) would always be at full capacity and thus could not rise any further in the immediate future.

They also assumed that the velocity of circulation (V) was constant (unchanged) given that it was determined by customs and payment habits. For example, people are paid on a weekly or fortnightly basis and shop, say, once a week for their needs. These habits were considered to underpin a relative constancy of velocity.

These assumptions then led to the conclusion that if the money supply changed the only other thing that could change to satisfy the relationship M times V = P times Y was the price level (P).

The only way the economy could adjust to more spending when it was already at full capacity was to ration that spending off with higher prices. Financial commentators simplify this and say that inflation arises when there is ‘too much money chasing too few goods’.

The problem with the theory is that neither assumption typically holds in the real world. First, there are many studies which have shown that velocity of circulation varies over time quite dramatically.

Second, and more importantly, capitalist economies are rarely operating at full employment. The fact that economies typically operate with spare productive capacity and often, with persistently high rates of unemployment, means that it is hard to maintain the view that there is no scope for firms to expand real output when there is an increase in nominal aggregate demand growth.

Thus, if there was an increase in availability of credit and borrowers used the deposits that were created by the loans to purchase goods and services, it is likely that firms with excess capacity will respond by increasing real output to maintain or increase market share rather than by pushing up prices.

In other words, there is no truism at the behavioural level. Whether this central bank operation causes an increase in the inflation rate depends on the state of the economy as noted above.

If there is idle capacity then it is most unlikely that such central bank operations will be inflationary. At some point, when unemployment is low and firms are operating at close to or at full capacity, then any further spending will likely introduce an inflationary risk into the policy deliberations.

Having settled that we move on to the next lesson. Is the operation proposed by Evans-Pritchard – the helicopter drop an example of monetary policy?

He anticipates the problem:

I don’t see how Prof Krugman can refute this, though I suspect that he will deftly change the goal posts by stating that this is not monetary policy. To anticipate this counter-attack, let me state in advance that the English language does not belong to him. It is monetary policy. It is certainly not interest rate policy.

Unfortunately, it is not a matter of linguistics or nuances of the English language. Whether we term an operation by the government (whether the treasury or the central bank, noting they form together the consolidated public sector for reasons explained below), depends on the impact of a specific government operation on the net wealth of the non-government sector.

Monetary policy operations do not of themselve alter the net wealth of the non-government sector but rather result in compositional changes to the non-government wealth portfolio, which can alter interest rates and spur spending in that way. This is what Quantitative Easing is about, for example.

Please read my blog – Quantitative easing 101 – for more discussion on this point.

Fiscal policy operations whether instigated by the central bank or the treasury do alter the net wealth of the non-government sector, a point that Evans-Pritchard appears to be confused about.

He cites Ben Bernanke who said in 2002:

Sufficient injections of money will ultimately always reverse a deflation. Under a fiat money system, a government should always be able to generate increased nominal spending and inflation, even when the short-term nominal interest rate is at zero.

Note this quote does not support the claim by Evans-Pritchard that expanding bank reserves alone will increase the inflation rate.

Bernanke said clearly that “a government should always be able to generate increased nominal spending and inflation” – note the link – increased spending and increased inflation. That is the point here.

But is this monetary policy?

Evans-Pritchard becomes confused at this point. He starts discussing what he calls “Monetarism” and says:

The relevant monetarist prescription is to buy assets from non-banks. The authorities do not have to purchase state bonds (though to do so is convenient, politically neutral, and easily reversible). They could equally create and inject money by buying land, or herds of Texas Longhorn cattle. Central banks can buy anything they want, and it should be obvious that the effects of buying cattle do not work through the rate of interest.

Should the world fall back into a fresh recession at a time when deflationary pressures are gathering in all the major economic blocs, when rates are already zero and when fiscal policy is already stretched, we may have to resort to QE yet again. If so, let us stop buying bonds, and stop creating windfall profits for the holders of assets in the hope that some largesse will trickle down.

If we have to do it again, let us inject the money directly into the veins of the economy by spending the money on building roads, railways, high speed internet, scientific research centres, solar parks, or whatever parliaments consider to be the best investments in future prosperity.

It is obvious the proposal is a fiscal policy operation funded by an increase in central bank money. Instead of the central bank conducting what economists call an open-market operation (buying financial assets in return for increasing bank reserves and perhaps bank deposits of private citizens who may have been holding the assets), he is proposing the central bank directly purchase real goods and services.

That is a fiscal operation and it will spur output, income and empoyment and, under the conditions noted above, could spur inflation, but not before there is a real stimulus provided.

To understand the distinction between a monetary policy operation and a fiscal policy operation consider the following discussion.

Please also consult the following blogs – Why history matters – Building bank reserves will not expand credit – Building bank reserves is not inflationary – The complacent students sit and listen to some of that.

A monetary operation might see the central bank purchase a financial asset from the non-government sector (as in an open market operation or during quantitative easing exercise). What happens is this:

1. Central bank adds the sum to the reserves of the bank where the individual who sold the asset to the central bank has an account.

2. That private bank will increase the deposits of that individual equally.

3. From the private bank’s perspective – the rise in assets (reserves) exactly offsets the rise in liabilities (deposits) and there are no net changes.

4. For the individual, there assets increase by the deposits made but decline by an equal amount because they not longer have the bond (having sold it to the central bank).

5. For the individual, there is thus no change in net financial assets – bonds down, deposits up – a compositional shift.

QE works exactly like that and hopes to stimulate spending by increasing the demand for bonds and driving down yields, which then drive down competitive interest rates at the maturity of the bonds being bought. It is a very indirect effect and will not spur spending if there is no confidence that the increased borrowing would lead to an increased earnings stream.

We could document other monetary policy operations such as central bank lending funds to the private banks and all of the operations would not change the net financial asset position of the non-government sector.

Contrast this to a fiscal policy operation which does change the net financial asset position. For example, if a government was to increase net spending (that is, increase its fiscal deficit) in an attempt to revive a flagging economy, it would:

1. Spend by purchasing goods and services in the non-government sector which would increase the deposits of the sellers in their bank accounts.

2. There is no corresponding liability that the seller incurs and so there net worth rises by the proportion of the public deficit spending they enjoy. Summed across all sellers – net worth rises by the change in the fiscal deficit.

3. The private banks observe a rise in reserve balances (assets) as government cheques clear and an equal and offsetting rise in deposits (liabilities).

4. Fiscal operations in the form of increased deficits (surpluses) increase (decrease) non-government net worth.

If we consider the helicopter example, it is clear that it falls into the fiscal policy category. If the central bank was to start dropping dollar notes from the air over the suburbs or dropped funds into private bank accounts then:

1. Private citizens would have more currency (in the helicopter case) or higher deposits with no offsetting liability increase.

2. In other words, their net worth would increase.

Evans-Pritchard seemingly doesn’t understand the difference and what he is actually proposing, which is sound, is that the government spend more on real goods and services to stimulate overall demand and employment.

He thus unambiguously is advocating a fiscal expansion. Further, such an expansion may be inflationary under the conditions noted above but in the environment where a large-scale fiscal stimulus was required – that is entrenched unemployment etc – an inflationary outcome is highly unlikely.

You can find another version of these transactions in the article written by MMT colleague, Scott Fullwiler in 2010 – Helicopter Drops Are FISCAL Operations.

Finally, this should make it obvious that his claim that the Eurozone hasn’t recovered because its monetary policy hasn’t been as accomodative as in the case of the UK and UK is nonsense.

He wants to claim that “the doctrine of fiscal primacy” is wrong and that the:

… recoveries should not really be as strong as they are, especially in a depressed world of flat global trade. America has carried out the most drastic fiscal squeeze since demobilization after the Korean War without falling into recession. The economy is growing briskly. The jobless rate is plummeting.

Ditto in Britain where the alleged double-dip never actually happened …

The eurozone has been through roughly equivalent fiscal contraction over the last four years but without monetary stimulus. The lamentable consequences are before our eyes.

Which is distorting the facts.

First, the fiscal shifts in each nation/bloc have not be uniform in timing or cause. The enforced (discreationary) fiscal consolidation in the Eurozone was much larger than anything in the UK and the US. Indeed, these nations were maintaining the fiscal stimulus while the Eurozone was imposing austerity.

Second, the sharp reductions in the US fiscal deficit have come about largely because the earlier stimulus spawned growth which boosted tax revenue and allowed public spending to be modified without damaging total spending.

It comes down to timing and what has driven the deficit reductions. The Eurozone has tried to do it via discretionary austerity, which has had massive negative consequences for economic growth and employment.

The US and the UK largely have retained their discretionary stimulus and allowed the recovery in private incomes and employment to whittle away at the deficit outcome.

That is a fundamental difference and explains the fortunes of each case much more than whether the Federal Reserve engaged in QE and the ECB did not.

Conclusion

I am doing some research on Russia at present. I might write something next week.

That is enough for today!

(c) Copyright 2014 William Mitchell. All Rights Reserved.

Excellent article clearing up some of the confusion in Evans-Pritchard’s article.

I am not well versed in economic conditions, but equating Y in M times V = P times Y with real output produced doesn’t make sense to me.

Is the formula based on the following?

M=Total money supply

V=Average number of transactions “experienced” by each unit of money

P=Average price per transaction

Y=Number of transactions

How are the “number of transactions” related to “real output produced”?

In any case, keep up the good work. I look forward to reading your perspective on Russia’s current state of affairs.

“A monetary operation might see the central bank purchase a financial asset from the non-government sector ”

The problem I have with that is that it is just a matter of where you put the dividing line. Put it in another place and you get a different view – which I suspect is where the differences of opinion come from.

If a so called ‘monetary’ operation purchases a financial asset *created by the private sector* then it could cause more financial assets to come into being. Just buying a corporate bond for example causes the creation of a reserve asset at a bank and a commercial deposit held by the previous bond holder. The bank now has more reserve assets than it did before.

So two entities now have more ‘spendable’ assets – just like the helicopter drop.

Both might decide to do nothing – just like the helicopter drop ending up under the mattress or in a field.

Or they might decide to spend. Or a corporate entity might detect the sudden shortage of bonds in the market and take the opportunity to either refinance or expand their borrowing with a bond issue.

On the fiscal side there is direct purchase of goods for distribution – a health service for example – and ‘monetary’ operations that might result in something real happening (tax cuts for example).

So the whole difference between fiscal and monetary operations seems a bit artificial to me.

It seems almost a semantic accounting point between ‘liability’ and ‘equity’, when in reality the problem is roughly the same – what is the best way to cause more real activity to happen?

Perhaps it is my personal cross to bear, however, I cannot understand why the economists, intelligentsia, the elite, the ruling class et al choose to deny reality?

How is it possible for a CB, which has no mandate nor mechanism to spend local currencies into the economy and thereby increase aggregate demand beyond the real output capacity of the economy and thereby cause inflation?

Japan has been working day and night for over two decades and still cannot manage to prove the monetarists correct. Does Japan just need more time …… ?

The CB has a balance sheet effect only on the non-government sector, and has no income statement impact whatsoever.

Whether the CB buys a corporate / sovereign bond, so what?

The US Fed did such things and made a windfall for WS in transaction fees ……. other than that, it was simply swapping financial assets ?

They also purchased a lot of trash which did nothing other than socialize private sector banking losses.

All the CB did, as far as I can ascertain was be another bidder in an open market?

John Asher – that equation is just an identity. The equation isn’t the problem. It is assuming that there is something called the money supply which is controllable; then that increasing M will increase M x V; then that this will cause P to rise, rather than just Y. Each of these assumptions is invalid.

Neil Wilson – I think you might have misunderstood. It is not about the total amount of financial assets, but about the net financial assets of the non-government sector, which is identical to the net financial liabilities of the public sector. Any change in this is fiscal. If the central bank buys a corporate bond, this does not change the net financial assets of the non-government sector, as it is an asset swap. If more corporate bonds are created, this does not change the net financial assets of the non-government sector, as they are both liabilities and assets.

Bill –

I think Ambrose is right and you’re wrong on this one.

Central banks can always generate higher inflation, for two reasons:

1) The one thing you can be sure about with humans is that they won’t all react the same way. So even if most of them choose to save the money they’re given, there’s no way they all will.

2) Theoretically if they did, the central bank could still generate higher inflation by devaluing the currency by buying foreign currency.

Steve Hail – I don’t think Neil Wilson misunderstood the point about monetary operations not affecting ‘net’ asset positions, but was rather deepening the discussion by pointing out that different non-government net asset positions might conceivably have different economic effects on V and thus ‘imaginably’ on inflation. In my view, by conducting open market operations central banks are not swapping like for like, but seeking to create liquidity effects that ripple through classes of non-government financial assets, making them more or less ‘money like’, or as Neil put it ‘spendable’. Of course, the key point here is not the ‘spendability’ of an asset but the desire of the owner to spend it. Unless the asset owners want to spend a central bank will struggle to generate inflation, however much it seeks to accommodate it. Other than through house prices (ceteris paribus) it simply cannot create the sufficient distributional effects on broad money to get an over-indebted household sector facing flat or falling real wages to spend, or the corporate sector that faces them over the till to borrow and invest, however good the asset side of their balance sheet looks.

The rather amusing irony of Evans-Pritchard’s view of central bank ‘monetary’ spending is that he effectively admits that when no one else wants to spend, the government sector (in this case the CB) is free to do so (albeit with discretionary institutional constraints). He says – ‘The relevant monetarist prescription is to buy assets from non-banks’, and goes on to specify these assets as non financial (cattle??). He wins monetary policy primacy by de-facto demolishing the distinction with fiscal policy. And so we have a politically pro-creditor, pro-austerity monetarist arguing for the primary of monetary over fiscal policy on the basis that if we use it in a fiscal way it has the power to be inflationary. Strange times. Have the long horned cows come home?

To turn the quantity theory of money on its head, it would be more likely that the central bank create inflation by increasing interests rates. This would increase the cost of leveraged commercial real estate, which would increase rents which would flow through to consumers.

Inflation is a funny beast, I don’t think it is so quantifiable as push-pull … Personally I think a lot of it is psychological, but where that decision occurs is the interesting part.

I noticed living in Argentina that prices were linked to the cost of black market $$US. Even though inventories must have already been existing, a rise in the blue rate would precipitate a rise in prices. It was more about perceived value.

Shortages (inflation) can also be politically engineered, as in Chile in the last days of Allende, only to be reversed with Pinochet’s assent to power. The same thing is occurring in Venezuela and Argentina right now as the merchant (capital) class wages war against socialist governments. The central banks in both countries are powerless, even with absolute capital controls.

Dear Aidan Stanger (at 2014/12/18 at 19:22)

1. If humans go on a wild spending spree then inflation will generally accelerate. Sure enough. That wasn’t the point though.

2. You only demonstrate that a central bank via official intervention (in foreign exchange markets) can alter import prices in the local currency. That is not necessarily going to cause domestic inflation to accelerate. Remember the title of the blog is that “Central banks can sometimes generate higher inflation”. If the local product market is depressed then even if import prices rise in the local currency, importers are likely to suppress mark-ups to maintain market share rather than pass through the exchange rate effects especially if there are close substitutes in the form of import competition. It happens all the time like that.

I cannot be wrong if all I am rejecting is the proposition that central banks can always generate accelerating inflation. The answer is a very definite – no they cannot – and history tells us that in addition to the logic that helps us understand that history.

best wishes

bill

Bill – I like the clarity you have brought to bear on this subject.

I only wish that theoretical knowledge gave rise to accurate predictions as to what will happen to asset markets going forward so that I could allocate my investment funds accordingly.

My current understanding is that the US economy improved due to the automatic stabilisers of welfare payments being allowed to operate along with some stimulus being done in 2008 onwards. The US has also benefited from shale oil production (industrial expansion in the oil states and cheaper energy input costs) and greater exports driven by a reduced $US and the commodity price boom.

US households have paid down some of their debt, so are now in a better position to spend more and this should mean an increase in house starts and consumer durables spending in 2015 and 2016, if the US congress does not engage in austerity going forward.

This doesn’t necessarily mean the sharemarket following suit – due to QE ending and because investors are so fashion conscious and herd-like.

Occasionally I will see a French fund manager imply that French and Italian equities will soar once the European QE starts. But I have my doubts that QE in Europe will be allowed to actually occur in a robust enough form to have an effect and I am not sure that it was QE alone that made the difference in the US. If the 3% deficit rule remains in place for European budgets then realistic fiscal expansion won’t occur unless the figures are fudged.

Perhaps Mr Ambrose-Evans understands this and is trying to make the case that a further slowdown in Europe needs a different policy from the austerity in play now. He seems to be saying to his conservative followers – call it what you like, fiscal policy can be monetary policy if the central bank does it, but let’s find a face saving way to do some Europe-wide govt spending, because maybe QE won’t actually work in the European context without a fiscal component.

It’s not a straightforward matter to define “liquidity”, however I like to think of it as the conjunction of useable money and other high quality financial assets which are readily convertible into money at short notice. If it is assumed that a sizeable fraction of Treasury securities issued to the private sector are liquid assets of this type, then the net result of deficit spending is to increase private sector liquidity. The extent to which the central bank’s purchase of securities from the private sector increases liquidity depends on the nature of the securities being purchased. Certainly the purchase of junk bonds, as in quantitative easing, increases the stock of the private sector’s liquid assets.

The eurozone is at capacity at the moment as the bankers cannot raise inflation to 2 %……..

Again – they only see inflation as a increase of costs which they create through investment.

Generally what we see is almost all energy goes into the production of conduit goods leaving almost nothing for bread or wine.

I fail to see what full employment has got to do with this.

This is a very obvious mechanism.

A extreme use of capital as a tool to destroy European civilisation.

The guys on top of the pyramid have no choice now.

The must maintain the rate of destruction so as to preserve concentration,

If they lose the power of concentration and have no other conduit continent to run too they are dead.

Just listen to the CSIS guys talk the talk.

Their functionaries observations are very bland but the top guys don’t hold back.

The mask is well and truly off.

We are possibly near the end game of post Tudor corporatist destruction in Europe but with nothing remaining but dead air.

Its looking much like a collapse of the Spanish empire but on a much grander scale.

Dear bill (at Thursday, December 18, 2014 at 21:27)

1) Some humans will go on a wild spending spree. It was the point in 2009 so why isn’t it the point now?

2) It depends how much the currency falls. A small fall may be absorbed by suppressing markups, but importers and retailers have a limited capacity to do that.

You can and you are!

‘Tis an innate ability they have.

History tells us that central banks tend to act cautiously, and that they’re right to act cautiously because inflation can be very destructive if they get it wrong.

Increasing inflation is rarely if ever itself a worthwhile objective anyway. It’s not something I’d expect a central bank to try to do. But with a floating currency, the central bank does have the power to do so.

Bill,

What economic policies would you advocate for Egypt? It would be quite a tough test for MMT.

Egypt currently has about 3.7% GDP growth, an unemployment rate of 13.1%, inflation rate of 9.1 %, a budget deficit of 9.1 % of GDP and government debt to GDP ratio of 87.1%. Their balance of trade is -3,898 USD Million. Food inflation is 11.52%. What would MMT prescribe for Egypt?

I think recent history in MENA (Middle East and North Africa) shows that food inflation is a good indice for social unrest and even revolution and civil war. So I am not sure that pushing food inflation further by a bigger deficit is a playable card. What other cards are playable? There are some but one don’t especially need MMT to think of them. Cutting that part of military spending which goes offshore and internally shifting part of the army’s personnel from military duties to infrastructure work might help. Of course, such solutions would be well-nigh politically impossible while the army runs the country. So one would think that Egypt would need a governance revolution (hopefully peaceful and democratic) before an economic revolution. But oh wait, the people tried that and reaction set in.

The sarcasm of that last sentence is not directed at you but at reactionary powers that be wherever they be. It raises the issue that before MMT style prescriptions or any left-socialist prescriptions could be enacted in say Egypt or even in the US for that matter, a democratic revolution would have to happen first. By way of context, I hold that the USA is not a democracy but an oligarchy “with soft pretensions to democracy” to use John Ralston Saul’s phrase.

Whilst nor forgetting my question above I want to ask another question related to the following video about Russia’s economic crisis. Its claims are incendiary and terrifying if correct.

https://www.youtube.com/watch?v=VT085isnyB0

Overview

“Economic hardship is being created by the foreign-controlled Bank of Russia’s monetary policies, to spread mass discontent and facilitate a Maidan in 2015 to remove Putin. So claims Evgeny Fedorov, citing the colonialist Central Bank law, established after Washington’s victory in the Cold War, and the system of fifth-column levers, methodically operated to steer the revolution.

2:59 Foreign banks own the production in Russia.

8:23 Putin has no authority over the Central Bank.

13:56 Bank of Russia is legally a foreign-controlled Central Bank.

15:21 Road map to Maidan 2015.”

Are the first three time-stamped claims above correct in relation to the Central Bank of Russia?

It’s worth watching the whole video. It is a bravura or tour de force perfomance by the interviewee but is it objectively true?

I love his early statement about international and central banking;

“It’s a dreadful colonialist system but it does at least protect stability.”

This debate reaffirms for me why all economic decisions, even central bank operations are inherently political. As a reader above points out, poor Ambrose has to advocate fiscal expansion through a technocratic body rather than a body of elected representatives of the people. Thats what modern conservatism, classical conservatism and every other creed of the right wants ultimately – to sidestep or abolish democracy (whose policies always tilt to the left by virtue of the fact that average people have a say in its operations) and transfer power to country club elites and Ayn Rand worshippers like Greenspan. All of their ideology and economics is about ultimately building a plutocracy. They just cant say it openly.

Let me add that q theory is directly applicable to fixed fx regimes, where the currency is continuously ‘reserve constrained’ and market forces determine rates, vs floating fx where the currency is in no case operationally reserve constrained and rates are a political decision. That is, if you short the $HK, which is fixed to the $US, the spot fx rate stays the same but interest rates, as expressed by the forward $HK prices, go up. However, if you short the yen, which floats, rates stay the same but the yen goes down.

However, if you include all CB/gov liabilities, including funds in ‘securities accounts’/’gov debt’ as ‘money’, you have then defined ‘money’ as ‘net financial assets’ of the non gov sector which is the ‘stuff of q theory’ as Bill described.

😉

Bill,

Correct me if I am wrong, but another refutation of the argument by Evans-Pritchard is that the only actor in the economy who can raise prices are business managers.

If business managers united and refused to raise prices – regardless of demand, regardless of taxes imposed, regardless of cost of goods sold, regardless of wages demanded, regardless of the corporate financial consequences – inflation would be zero. No increase in the supply of money or the interest rate on loans will change the rate of inflation, unless business managers chose to raise prices.

If this is accurate, then the real focus is on the factors that influence business managers to raise prices, of which the cost of money is only one of those factors.

Thanks, Joel

inflation seems best understood as a sectorial struggle for

monetary tokens and through them claims on real resources.

housing cost inflation in uk means a transfer of claims on resources

to those profiteering in the housing sector.

even more wide spread inflation would still have winners and losers

some assets would hold their relative value more than others

some current wages would fare better than some forms of savings

a generational conflict.