I started my undergraduate studies in economics in the late 1970s after starting out as…

A lost decade for Australia – only if we allow fools to continue governing

It is almost unbelievable what some journalists think passes for quality writing. Today (December 9, 2014) Australians were trying to deal with the vicious new scheme designed by the Federal government to herd unemployed indigenous people in remote communities into below legal wage work-for-the-dole schemes because the government refuses to use its fiscal capacity to generate jobs where there are none, and then, just after lunch we were confronted with an article in the Fairfax press – Australia adrift: Lost decade beckons as good fortune wanes – that beggars belief. Australia will have a lost decade if it continues to elect governments, which work against the national interest. There is nothing predetermined about it. The rise and fall of the mining sector is an historical given – we have been through these cycles before. It all depends on how the Federal government deploys its fiscal policy tools. If it continues to run pro-cyclical policy (cutting when private spending is weak) then things will get worse. It we break out of the austerity trap, then the Government can easily redirect growth back to domestic spending. A major public sector job creation program and a large-scale public infrastructure redevelopment would be ideal ways to begin this policy shift.

First, it was reported overnight that Japan’s recession is deeper than it was first thought after the revised GDP data showed that it contracted by 1.9 per cent in the September-quarter instead of the earlier estimates of 1.6 per cent.

Recall that earlier this year, the Japanese government raised the sales tax (1997-style) in response to the demands by the mindless financial commentators and international organisations such as the IMF that it had to reduce its fiscal deficit.

Virtually immediately, consumer spending collapsed, then private business investment collapsed (as sales fell) and the economy plunged into recession. 1997 was being repeated almost exactly.

Reuters reported that its latest ‘sentiment index’ of business confidence:

… showed that confidence among Japanese manufacturers fell in December and is expected to deteriorate further.

Who is learning from that? We already knew what would happen. But such is the grip that neo-liberal Groupthink has on the policy debate and such is the level of denial among these idiot financial and economic commentators, that it was actually predicted that private spending in Japan would grow faster because people would be less scared of future tax increases if the fiscal deficit was lower.

The so-called fiscal contraction expansion nonsense. 1997, 2014. Eurozone – 2008-2014 and still going. Lessons everywhere, all ignored.

Anyway, in that context, you know that Fairfax/Bloomberg journalist Wiliam Pesek is just p**sing in the wind when you read this:

The economy Down Under has avoided recession for more than two decades. The government enjoys a fiscal position that inspires envy in Washington and Tokyo.

I doubt that anyone in Washington or Tokyo looks enviously at Australia with its high unemployment and underemployment. They might like our climate, which itself is deteriorating, but our ‘fiscal position’ is of no relevance.

We avoided recession for two decades because:

1. We allowed households to build up record levels of household debt during the irrational credit binge, which is now over. Households are saving again and will not return to the levels of dissaving that we saw earlier this decade.

2. We have enjoyed record levels of primary commodity prices which spawned strong growth in private investment spending.

3. But when both waned sharply in 2008, it was a relatively large expansion in the fiscal deficit that staved off the ‘official’ recession.

4. China was prepared to also use large fiscal deficits in 2008-09, which maintained its domestic growth and provided for an early recovery in commodity prices.

But never be mislead into believing that it was the mining sector that saved Australia from the GFC. It contracted sharply in 2008 and 2009.

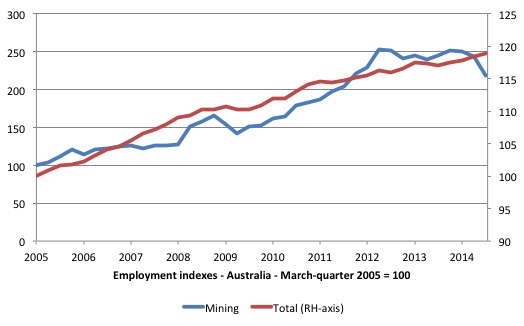

The following graph shows employment indexes (100 = first-quarter 2005) for the Mining sector and the total economy as a whole.

Be careful when interpreting the graph. The national index is on the right-hand scale. As you can see, over the period shown total employment has risen from an index value of 100 in the first-quarter 2005 to 116 in the third-quarter 2012. There has thus been barely been any growth at all and if plotted on the same axis as the mining employment index, the national line would be nearly flat.

By plotting Mining on its own axis you can more easily see the dynamics around the recession (2008-09) when employment growth fell marginally but was sustained by the fiscal stimulus. You can also see that as the stimulus was withdrawn, and the Federal government began its obsession with pursuing budget surpluses, that national employment growth stalled and began trending down. It has been flat ever since.

The mining employment index (100 in first-quarter 2005) is shown on the left-hand axis and you can see clearly

that there was substantial growth in Mining employment over the period shown.

However, that doesn’t negate the fact that there was a significant contraction in employment at the time of the slowdown as commodity prices started to fall.

One could argue that the recovery in the mining sector was prompted by fiscal policy stimulus – not in Australia but in China!

To put this growth in context though, the Mining sector accounted for 1.1 per cent of total employment in February 2005 and by the third-quarter 2012 that proportion had risen to 2.4 per cent, a spectacular shift in industry composition to be sure, but still a miniscule proportion overall. Further, the proportion has dropped back to 2 per cent by the August-quarter 2014.

Employment in mining cannot rise sufficiently (because of scale and capital substitution) to become a major employer in Australia.

Further, the contribution of the external sector to Australian real GDP growth remains negative – that is, a drain on national income growth. It is only the related domestic investment in the mining infrastructure that was pushing growth along.

The recent national accounts data showed that private investment is now sharply negative. Mining employment peaked in the second-quarter 2012 and has been in decline since as commodity prices have fallen because World (Chinese) demand is moderating.

While this boom has been longer than most in our history and tapered more slowly, history tells us that when the boom is over the domestic economy looks very ugly unless the government steps in to stimulate the economy.

Please read my blogs – A veritable pot pourri of lies, deception and self-serving bluster and More myths from the mining oligarchs – for more discussion on this point.

Pesek has interpreted this decline in mining sector fortunes as the beginning of an extended period of deterioration.

He claims that a:

Lost decade beckons as good fortune wanes …

It is as if we haven’t been through mining booms before.

Pesek claims that his “mere suggestion will strike many as hyperbolic”. Definitely.

It is true that “Slowing growth in China, driven in part by the government’s efforts to rebalance the economy, has devastated commodity prices”. Which is one of the reasons that despite continued growth in export volumes (as evidenced in last week’s national accounts data), our real net national disposable income is now falling (for two consecutive quarters).

But that decline must be seen in the context of a government that is insisting on imposing pro-cyclical fiscal austerity on the nation. We would have been in a deep recession in 2009 if the stimulus packages were not invoked and the government had behaved as the current federal government is behaving.

I also agree that the collapse in commodity prices “are long-term, not cyclical trends”. Which just means that our base commodity exports are unlikely to be the source of considerable wealth that all the neo-liberals claimed when they were eulogising about the so-called once-in-a-hundred-years boom.

The mining boom was strong and longer than usual but it was always going to unwind. It always does. There is a theory in economics called the Cobweb Theorem, which was developed by Cambridge economist Nicholas Kaldor in 1938 to describe the particular way that demand and supply for a commodity evolve when production must occur before the price is known.

Production is driven by the expectations of the firms who anticipate profits. But there is inertia in these expectations (in part driven by herd behaviour) so that supply decisions are based on ‘old’ prices and they lag the current market reality.

Mining firms pump out massive volumes of output in anticipation of high commodity prices but do not immediately realise that the extra supply on the market actually reduces the prices, which then, with a lag, drive future production decisions. In other words demand and supply chase each other but eventually as expectations catch up with the reality, the boom ends.

That is the current state as shown by the sharp decline in mining employment in recent months in the above graph.

Pesek builds his argument on the poorly conceived policy position currently adopted by the conservative federal government.

The government, elected in September 2013, has proven to be a disaster and they are now at very low levels of popularity and would be routed if a federal election was held today. Unfortunately, we have just under two years to go until the next election.

Pesek is correct in saying that the Australian government is struggling because:

A needlessly austere budget slashed education, health and welfare spending. The government appears to be coddling mining billionaires and backtracking on its environmental pledges. It even cut funding for national icon Australia Broadcasting Corporation.

In that context, he notes “how rapidly the world is changing around the Lucky Country” and that the Federal government “has talked about diversifying the economy away from its dependence on China, his policies have effectively done the opposite”.

All of which is true.

Just yesterday, the Climate Change Performance Index – “produced by the thinktank Germanwatch and Climate Action Network Europe”, showed that “Australia has been named the worst-performing industrial country in the world on climate change” (Source).

The Report concluded that:

The new conservative Australian government has apparently made good on last year’s announcement and reversed the climate policies previously in effect. As a result, the country lost a further 21 positions in the policy evaluation compared to last year, thus replacing Canada as the worst-performing industrial country.”

And we should all hang our heads in shame for having elected such a pack of morons as the Federal government.

But some historical perspective is needed.

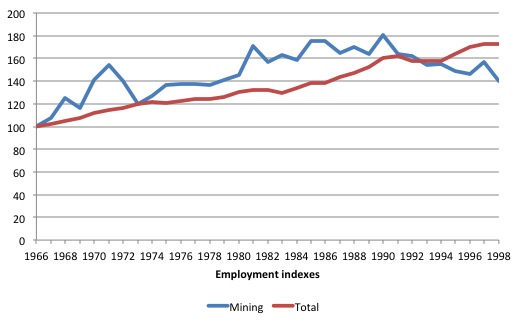

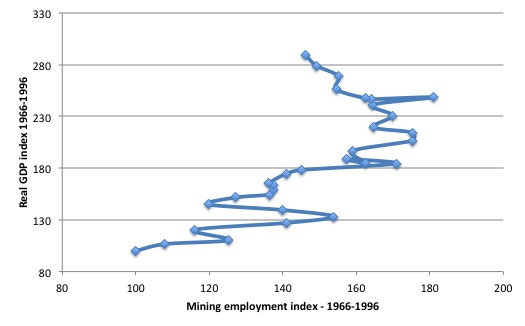

There have been some massive mining boom crashes in the past. The following two graphs use historical data available from the RBA – Australian Economic Statistics 1949-1950 to 1996-1997 – for the period 1966 to 1996.

The first shows employment indexes in Mining and for the economy as a whole (1966 = 100). You can see the massive fluctuations in Mining employment, including the sudden declines over this period.

The second graph shows the impact of these swings on real GDP growth (vertical axis). Not much sustained impact is the answer. In the latter part of the period as Mining was contracting, real GDP growth was strong. This was the years of the recovery from the 1991 recession, which the Mining sector definitely didn’t contribute to.

I am not underestimating the fact that for those workers currently being laid off from the mining projects daily now that life is not hard. The local communities that rely on the income flow from those wages are also seriously affected.

But from a macroeconomic perspective we can easily digest these changes as we have in the past.

The recession in 1982 was severe and accompanied by a major decline in the mining sector. But it was caused by the conservative government at the time trying to impose its nascent neo-liberal vision on the country. It failed.

The new Labor government, elected in 1983, initially stimulated the economy and employment growth was the most rapid in the OECD block of countries.

William Pesek is correct in arguing that we have relied too much on monetary policy (low interest rates) which has just spawned a real estate boom rather than encouraging investment in productive infrastructure.

He is also correct in saying that:

… the government needs to rethink urgently its austerity policies. Big investments in human capital – via education and training – as well as infrastructure are the only way to raise productivity and promote job growth in the long run. Along with re-imposing the carbon tax, the government should capture and redistribute more of the spoils of Australia’s resources, replace the high income-tax burden on households with a goods and services tax, and encourage a new wave of entrepreneurship by supporting small companies.

I think the current government has a limited life span. They have demonstrated gross incompetence across the gamut of policy spheres.

Conclusion

If things continue as they are currently, they will be dispatched by the voters in September 2016 or thereabouts. The previous government was also infested with neo-liberalism but managed to contain that religious zeal in 2008 when they introduced an old-fashioned Keynesian stimulus.

It was a desperate time and they allowed pragmatism to triumph over ideology – for a time anyway.

I think that will be the case again should things continue to deteriorate. So a lost half-decade is possible but I don’t think Australians will tolerate a Eurozone-type stagnation.

The recent State election results in Victoria, which tossed out the austerity conservatives and the swing against the conservatives in the South Australia by-election are redolent of the mood of the electorates.

That is enough for today!

(c) Copyright 2014 William Mitchell. All Rights Reserved

“The government, elected in September 2014, has proven to be a disaster”

The problem though is that the other lot are just as mad. So we’re in a situation where the government is changing between the two main parties – both of whom are dedicated to the destructive cause.

What can a population do when *all* of its political class are just presenting variations on a narrow theme?

“replace the high income-tax burden on households with a goods and services tax”

Bill, just wondering why you agree with this – is it not regressive taxation?

Neil’s “narrow theme” is a nice example of what’s called the “Overton window”. That’s the fact that in all societies, only a narrow range of views are permissible.

It’s a very cogent article. We do indeed have a mob of incompetents in government today. And yes both sides are infected with the same malaise, neoliberal economic theory.

Just yesterday it was in New Matilda, John Pilger calling for a 5th Estate, so oversee the 4th estate. Now so corrupted by vested interests as to be utterly counterproductive they have to be made accountable.

Vested interests, the corporate world are not interested in any debate that might slow their own agenda.

Probably though we are fortunate that the current LNP are so cack handed that even their own side is discomforted and a majority can see how sterile and biased are their policies. This at least is good news.

“The government, elected in September 2014”

Should be 2013

Our establishment,oligarchy,powers that be or whatever, appear to be in need of a refresher course on Mr Murphy’s Laws.

One that is especially relevant at present is – “If everything seems to be going well you have obviously overlooked something”.

Dear petermartin2001 (at 2014/12/10 at 5:22)

Thanks. Fixed.

best wishes

bill

“So a lost half-decade is possible but I don’t think Australians will tolerate a Eurozone-type stagnation”.

I hope you are right, but fear you are wrong.

There is a strong public perception of a link between government surpluses and economic prosperity. People not realising economic growth in the early 00’s was driven by a private sector debt explosion, and a CAPEX boom. Both of which are now behind us.

I think the “beatings will continue until moral improves”.

Apart from the Vic and SA election results, the current mood of the electorate is also manifested by (a) very unfavourable (and protracted) opinion poll results for the current federal government, (b) an unprecedented low rating for the popularity and performance of the PM as also revealed by recent opinion polls, (c) a surprising turn-around in opinion poll indicators for the QLD governing coalition, which won office in a landslide and no doubt imagined that second and third terms of office were guaranteed.