I started my undergraduate studies in economics in the late 1970s after starting out as…

More myths from the mining oligarchs

Australia is in the grip of a group of mining oligarchs, who are spending enormous amounts of monety to shape the economic debate to suit their own very narrow interests. They are opposed to the mining tax (a resource rent tax) and have in the past denied the state (on behalf of all of us) owns the resources that they plunder for private profit. They have also sponsored national tours of leading climate-change deniers (such as Lord Monckton) who are known to trade on distortions of the truth. Overall, there personal resources guarantee them access to the daily media and they use it relentlessly. They also write books which get national coverage and have a record of suing peope who criticise their views. The result is that there is very little critical scrutiny of the propositions they advance to justify their claims. Some of the propositions are pure fantasy yet they have gained traction with the public who have been too easily duped by the promotional onslaught. Here is a little sojourn into the fantasy world on one such oligarch.

The most recent example of this oligarchic-intervention is launch of a new book last week by the richest person in Australia, Ms Gina Rinehart.

I last wrote about Ms Rinehart in this blog – A veritable pot pourri of lies, deception and self-serving bluster.

At that time, the richest person in Australia – mining heiress – who has been fighting it out in the courts with her own children over their grandfather’s inheritance – echoed the Ayn Rand line that the “billionaires and millionaires” create all the jobs and help the poor but the latter are too lazy to do their bit.

She claimed that “billionaires and millionaires are doing more than anyone to help the poor by investing their money and creating jobs”.

Even though the current mining boom has seen her wealth (derived from an inheritance from her father who was a mining magnate) increase by more than $A20 billion in a few year claims that “anti-business and socialist policies for hurting the poor”.

She also claimed that socialism in Australia is “killing off investment in Australian projects” and called for the minimum wage to be cut.

She attacked the poor by saying that:

If you’re jealous of those with more money, don’t just sit there and complain; do something to make more money yourself – spend less time drinking, or smoking and socialising, and more time working. Become one of those people who work hard, invest and build, and at the same time create employment and opportunities for others.

The reality is that she inherited her wealth and didn’t have to do any work to be at the top of the wealth distribution. And then came the socialist state we call China who launched its development phase at just about the right time for Gina – she has made a fortune from companies that dig our resources up, put it into trucks, take it to a ship and send it to China and other Asian nations.

In that blog I also provided evidence to refute her claims that the poor are the big drinkers and socialisers.

Anyway, she is back in the news with her new book – and the book release was covered – in a sycophantic way – by the Fairfax media (Sydney Morning Herald) – in which Ms Rinehart has a major shareholding.

The Sydney Morning Herald artice (November 22, 2012) – Passionate Rinehart deplores too many heads buried in the sand – quoted, in an uncritical way, Ms Rinehart’s very strange views about how the economy operates.

First, apparently Australia is in danger of joining the Eurozone and surrendering our currency sovereignty.

Ms Rinehart told the audience at her book launch that:

We don’t want to see Australia continue on a course with too many heads buried in the sand, critical investors discouraged by bad policies, even hated, too few understanding the problems while Australia moves towards being another Greece, Spain or Portugal

It might have escaped me but my daily reading of a copious amount of literature has not indicated that the Australian government has approached the European Union (EU) or been approached by the EU to join their failed monetary system.

Australia is a sovereign nation in its own currency, unlike Greece, Spain, or Portugal and all the rest of the Eurozone member-states. The latter use a foreign currency – the Euro – have no capacity to set their own monetary policy and surrendered the capacity to enjoy a flexible exchange rate.

Australia issues its own currency – and can do so with no intrinsic financial constraints, which means it is not beholden, ultimately, to the private bond markets for funding. Our central bank sets the interest rate and while the ideological persuasion at present means there is an excessive emphasis on monetary policy over fiscal policy, the fact remains that interest rates are at our discretion and that separates our inflation rate from world inflation rates.

Further, our exchange rate adjusts to imbalances in the foreign exchange markets, partly due to trade imbalances. That flexibility allows fiscal policy to pursue domestic policies.

I am not saying that this means that Australian government policy is sound. It is anything but that. But the fact is that the government can more or less choose its own policy settings, with the consequences that flow from that choices.

Greece, Spain, Portugal, Germany, France, etc are in a totally different policy space as a result of the monetary system they have chosen. Their governments are currency-users while the Australian government is a currency issuer. A world apart in more ways than one.

Ms Rinehart clearly doesn’t understand the nuances of monetary economics and should thus refrain from writing about such matters. Otherwise, her writing are in the category of fiction and should be promoted by the press as such.

It is no surprise that she fails to understand basic economics.

Earlier this year (May 2012), the Monthly profiled Madam Rinehart in the article – What Gina Wants: Gina Rinehart’s quest for respect and gratitude.

She grew up in a family marked by its extreme politics – which might be labelled “irrational and phobic conservatism” – given that most of the views that were publicly-expressed reflected a flimsy grasp on reality overlaid with a constant fear of socialism. The latter was equated with anything the Federal government did. Socialism became synonymous with “Canberra-ism”.

The Monthly article captures it well when it writes:

It also fuels Gina’s sense that she should get the kind of respect, recognition and influence that is commensurate not so much with her wealth but rather her contribution to the nation’s prosperity. Australia is lucky, the Hancock thinking goes, because they have made it so. The discovery story sustains a powerful sense of entitlement: the view that the federal government should express gratitude to the likes of the Hancocks rather than slugging them with additional taxes. The notion that minerals automatically belong to the state was the cry, harrumphed Lang, of “slogan-slinging windbags”.

That narrative has been constantly rehearsed in the public sphere by this family and the other mining oligarchs. They also get a lot of publicity because they have the monetary resources to ensure it.

There is also an account of her failed university studies:

Gina studied economics at the University of Sydney, an experience that appears to have hardened her outsider status. She had little in common with fellow students, who devoured the fashionable theories of John Kenneth Galbraith, the left-leaning economist described by her father as one of America’s “greatest fiction writers”. “I thought economics was about producing things,” Gina later complained. “When I found out they were teaching the wrong things, I quit.”

It might have been better had she stayed at University and gained some knowledge that transcends day to day experiences in business.

Her appalling grasp of basic economics is also exemplified by her claim at the book launch that Australians are ignorant of “the consequences of the nation’s declining competitiveness”, She was quoted as saying:

We need to focus on earning, not spending and we need to have a good environment for investment.

Now the only real question is not the sheer ignorance expressed in this quote but why the journalist didn’t probe the issue further.

Basic economics tells us that there is no earning without spending. Spending equals income which then drives employment growth.

In this blog – Why budget deficits drive private profit – you can learn how budget deficits and more generally how spending drives private profits.

Further, investment is spending. To provide a “good environment” for investment means that we are focusing on spending.

The problem is not that these characters seem intent of sharing their personal views with the Australian population. The issue is that the media, partly owned by this group, feels compelled to perpetuate these personal views and rarely provide any critical scrutiny. In the case of Ms Rinehart, her views on economics are simplistic and mostly wrong. That should be explained to the public.

The other recurring myth is that the mining sector saved the economy from recession in 2008-09. It is an absolute lie. Fiscal policy, both here and in China saved the Australian economy.

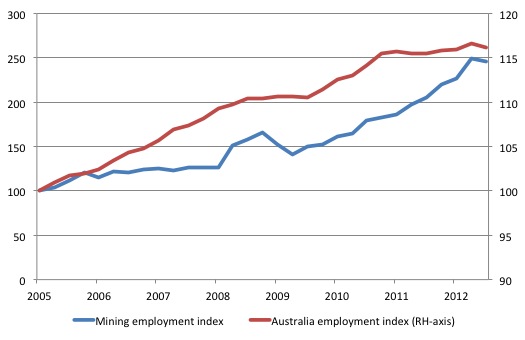

The following graph shows employment indexes (100 = first-quarter 2005) for the Mining sector and the total economy as a whole.

Be careful when interpreting the graph. The national index is on the right-hand scale. As you can see, over the period shown total employment has risen from an index value of 100 in the first-quarter 2005 to 116 in the third-quarter 2012. There has thus ben barely been any growth at all and if plotted on the same axis as the mining employment index, the national line would be nearly flat.

So I plotted on its own axis to allow you to see the dynamics around the recession (2008-09) when employment growth fell marginally but was sustained by the fiscal stimulus. You can also see that, more recently, as the stimulus has been withdrawn, and the government has been relentlessly pursuing its obsession with budget surpluses, that national employment growth has stalled and is now trending down.

The mining employment index (100 in first-quarter 2005) is shown on the left-hand axis and you can see clearly that there has been substantial growth in employment in that sector over the period shown.

However, that doesn’t negate the fact that there was a significant contraction in employment at the time of the slowdown as commodity prices started to fall.

One could argue that the recovery in the mining sector was prompted by fiscal policy stimulus – not in Australia but in China!

To put this growth in context though, the Mining sector accounted for 1.1 per cent of total employment in February 2005 and by the third-quarter 2012 that proportion had risen to 2.4 per cent, a spectacular shift in industry composition to be sure, but still a miniscule proportion overall.

Since the February 2005 quarter, the Australian economy has added 1588.4 thousand jobs while the Mining sector has added 160.4 thousand jobs – that is, 10.1 per cent of the total jobs created in Australia (in net terms) since that quarter have been in the Mining sector.

The sector is thus operating well above its proportions – there is no doubt about that. This structural shift is causing all sorts of issues for the Australian economy, not the least being the location of the Mining employment in remote areas a long way from where the majority of Australians live.

But three points should be made. First, employment in mining cannot rise sufficiently (because of scale and capital substitution) to become a major employer in Australia.

Second, the contribution of the external sector to Australian real GDP growth remains negative – that is, a drain on national income growth. It is only the related domestic investment in the mining infrastructure that is pushing growth along.

Third, there are now firm signs that the boom is tapering. Mining employment fell in the third-quarter 2012 (by 1.7 per cent) which was the first quarter since May 2009 that there has been a decline. Commodity prices are falling and world demand is moderating. While this boom has been longer than most in our history and is likely to taper more slowly (given the investment that is already in train), history tells us that when the boom is over the domestic economy looks very ugly.

I expect that ugliness (real GDP slowdown) will be worse this time once it becomes obvious because of the extent of the growth in employment during the boom. Very suddenly a lot of Fly-In-Fly-Out workers from the populated East Coast will be not heading to airports. Then the loss of income to their communities will be stark.

CofFEE Timor-Leste Workshop

Here is the edited presentation I gave to the Economic Prospects for Timor-Leste Workshop staged by the Centre of Full Employment and Equity (CofFEE) at the Charles Darwin University, November 20, 2012.

The video is 38 minutes long.

Conclusion

This week is going to be fairly dis-jointed (blog-wise). Today, I am in Melbourne and have a meeting with the Victorian Labor Opposition leader to discuss policy options. Then I am presenting a workshop for the Victorian Branch of the Community and Public Sector Union on a major Report that CofFEE finished for the Federal body of that union. The Report is not publicly available at this stage but documents the loss of services that have followed outsourcing, privatisation and public-private partnership agreements imposed by a succession of neo-liberal governments.

Tomorrow I have work at the University of Melbourne and then Wednesday I am back in Darwin. So a bit of travelling to do.

Early Thursday, I am off to Timor-Leste to meet with various government officials including the President and Prime-Minister. I will be back in Darwin next Saturday. I do not know whether I will get time to write anything in those two days or whether I will get sufficient connectivity to publish anything I write. I expect neither.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

This article on the ABC raises some interesting issues.

http://www.abc.net.au/news/2012-11-07/rba-might-be-printing-money-for-foreign-banks/4358864

Here are three sentence-paragraphs from the article:

‘UBS analysts Gareth Berry and Andrew Lilley say the evidence that the RBA may have been printing Australian dollars is compelling, but not yet conclusive.

The main evidence the analysts cite to support their theory is a rise in the Reserve Bank’s foreign currency reserves at the same time as the deposits of foreign institutions lurched upwards by a similar amount.

“It is as though freshly-minted Australian dollars are being sold directly to foreign central banks and the proceeds added to the RBA’s pool of FX [foreign exchange] reserves,” they wrote in an analysis.’ – End of Quote from ABC.

Clearly, the RBA could “print” money by hitting an electronic switch and crediting the accounts of foreign banks with Aussie dollars in exchange for foreign exchange credits to RBA’s reserves. When the dollar is high this seems like a good idea. Get foreign currency for nothing (Money for Nothing!) and pull down the exhange rate to assist exports.

My questions are;

Does the Reserve do this?

Does it have the remit to do this at its own discretion?

Do the Minister or Cabinet get involved?

Why wouldn’t the RBA does this as much as it could?

What are the practical limits on any national reserve bank playing this game?

The Industrial history of the Ales Bessages railway line (now closed since July) is interesting.

These lines need a mixed freight / passenger use to remain viable , but heavy Industry has declined over the years

Now incrediably the bus service to these villages has stopped since october 15.

http://gareauxgares.canalblog.com/archives/2012/10/07/25267602.html

These protestant mountain villages were ancient 19th century coal mining areas.

fr.wikipedia.org/wiki/Bessèges

This was near the part of the world that Robert Louis Stevenson visited with his Donkey back in 1879

en.wikipedia.org/wiki/Travels_with_a_Donkey_in_the_Cévennes

http://fr.wikipedia.org/wiki/Salindres

“Salindres is thus the oldest industrial site producer of aluminum in the world, started production in 1860 until 1889 3 . That is, for almost 30 years, the only factory producing aluminum in the world.”

The area now seems deeply depressed.

Given that France produces the cheapest electricity in the EU (cheaper then even coal rich Poland) it is surprising why energy intensive operations such as the above is now not a runner.

France now exports more and more primary goods (electricity) rather then secondary goods.

This is obviously a function of a incorrect exchange rate.

Hi Ikonoclast,

I’ll do my best to answer but I’ll probably be corrected on a few points.

It’s certainly within its power. Since the float, they’ve made a point of keeping out of the foreign exchange markets allowing the foreign exchange markets to set the price. But they’re certainly able to sell any quantity of AUD for foreign currencies that the markets are willing to buy. You will find this whole FAQ by the RBA an interesting read.

I believe so, and I believe not – but I may be wrong. Ultimately the treasurer sets the RBA board members, so it’s a fallacy to think they’re truly independent of government.

It’s vital to realise this (yet so few do): Exports are the cost of imports.

If they’re not ultimately providing you with more imports, they’re just jobs for the sake of jobs providing you with no real goods/services for you yourselves to consume.

We can devalue our currency to an arbitrarily low value, yes, but ultimately that’s printing money, selling it on foreign exchange markets below market rates, and having them employ your people and take their produce. What we get in return is a bunch of foreign currencies that we fear spending for damaging our protected export industries, a ‘la China today. The whole point is: you could print the same amount of money, spend it employing your people instead of selling it to foreigners, and the results would be better. Damage to the exchange rate would be less, inflation pressure would be the same, but you’d get to keep the fruit of your labour instead of losing it offshore.

What we cannot do is arbitrarily raise the value of our currency. If we could, we’d hardly need to work at all. We could just import everything we need/desire. Ask yourself: what would you rather, a worthless currency with a huge export sector working just to bring in the essentials from overseas with a small sector providing goods/services for personal consumption or a strong currency, with a small export sector bringing in masses of exports from overseas, and a large sector providing goods/services for personal consumption? I’d take the latter every time.

Although you’re right that the latter may find difficulty keeping everyone employed in the presence of the valuable currency, but this is a problem that MMT solves by pointing out that we can always keep everyone fully employed if the government just makes that a policy objective and stops worrying about debt (which is just non-government savings, and need not be scary at all).

Besides from the fact that it’s not a smart game to play, see the Wikipedia article on currency wars.

One thing I will say though: If it’s believed that this is a temporary spike in the value of the dollar, it’s best that we suppress it rather than have our exporters go bust and then cause us pain once the spike is over. If it’s long-term, we ought to restructure. So I’m not saying the RBA’s doing the wrong thing – just that we wouldn’t want to be doing this long-term. Ideally, we want to eventually spend those accumulated foreign reserves (at least down to a base level) buying our hard-earnt imports; long-term devaluation means we’d never get a chance to do this.

From Article: ‘One could argue that the recovery in the mining sector was prompted by fiscal policy stimulus – not in Australia but in China!’

This is so clearly the case, that I would be surprised if it were not widely recognized in Australia. The mining companies would probably like a more ‘heroic’ portrayal, but I think most people in the world have recognized the importance of China to the commodities-exporting countries.

Fundamentally, there are two paths to acquire wealth other than gifting; the diggers and the do-ers. The diggers walk the land with a forked stick seeking buried treasure, or they extract nationally owned minerals under favorable economic conditions or they imperialistically enslave populations and exploit their wealth, both labor and resources by force or by guile. Do-ers produce goods and services, primarily using the labor of skilled hands and skilled minds to transform materials in a manner which enhances society with necessities, comforts and luxuries. A majority of the output of do-ers are derived from projects that employ a plan, division of labor and labor multiplying inventions with the exchange of the produced goods and services being voluntary and market based. Generally, labor tends to get the skim milk and management the cream. The proportions are an internal source of tension.

Diggers tend to be exploitative, extracting as cheaply as possible, sometimes leaving behind legacy toxic waste and economic-environmental destruction. King Leopold was the gold standard for a digger imperialist. He extracted ivory and rubber from the Congo by means of debt slavery. Natives were paid wages in worthless brass rods for harvesting rubber vines and ivory. The land occupied by their villages was taxed at 100% of their earnings. This clever economic system avoided the expense of slave up-keep. Leopold exclaimed to the world that he was civilizing the native population while millions died. American mining used script, the company store, a sub-living wage and child labor as a variation on this theme. Leopold was the kind of wealthy job creator that a digger could admire.

There is a subset of financial capitalists called private equity that are diggers. They use capital, accounting and the rule of law as universal solvents to strip-mine company assets, leaving behind economic waste in the form of destroyed assets, unemployment and unused skills.

A question to ask, if the wealthy create jobs, why are some so intent on laying off workers, raiding pension funds and cutting wages? In all my years managing projects, no one asked me to create a single job. When lists of the world’s wealthy, past and present, are generated, diggers are very well represented. Nationalizing the nation’s mineral wealth or asking for a fair return is a digger’s nightmare. This perspective assumes that society and the political economy takes precedent over an individual’s balance sheet. Not all wealthy have a digger’s mindset of free lunches and stream beds full of gold nuggets waiting to be plucked. We have many examples of visionaries that used acquired capital and assets to create a better society for all, eventually accumulating wealth in the process. Keynes summed it all up with a reality check; eventually we are all dead. He classified those that were so obsessed with money-getting, by any means, as mentally ill. Wouldn’t a nest egg of $1 million be a sufficiency for most and better for an economy seeking full employment and maximum prosperity for all citizens?

Mariana Mazzucato has been doing the rounds recently on BBC News she seems to talk some sense. Do you know of her and what do you make of the link?

http://www.policy-network.net/publications/4295/The-Risk-Reward-Nexus