In the annals of ruses used to provoke fear in the voting public about government…

The myopia of neo-liberalism and the IMF is now evident to all

The IMF published its October – World Economic Outlook – yesterday (October 7, 2014) and the news isn’t good. And remember this is the IMF, which is prone to overestimating growth, especially in times of fiscal austerity. What we are now seeing in these publications is recognition that economies around the world have entered the next phase of the crisis, which undermines the capacity to grow as much as the actual current growth rate. The concept of ‘secular stagnation’ is now more frequently referred to in the context of the crisis. However, the neo-liberal bias towards the primacy of monetary policy over fiscal policy as the means to overcome massive spending shortages remains. Further, it is clear that nations are now reaping the longer-term damages of failing to restore high employment levels as the GFC ensued. The unwillingness to immediately redress the private spending collapse not only has caused massive income and job losses but is now working to ensure that the growth rates possible in the past are going to be more difficult to achieve in the future unless there is a major rethink of the way fiscal policy is used. The myopia of neo-liberalism is now being exposed for all its destructive qualities.

The IMF say that:

In addition to the implications of weaker potential growth, the major advanced economies, especially the euro

area and Japan, could face an extended period of low growth reflecting persistently weak private demand that could turn into stagnation. In such a situation, some affected economies would not be able to generate the demand needed to restore full employment through regular self-correcting forces. The equilibrium real interest rate on safe assets consistent with full employment might be too low to be achieved with the zero lower bound on nominal interest rates.

Be warned – this is more neo-liberal nonsense in the sense that it leaves out obvious solutions to any secular stagnation.

Here is the context. An economic cycle turns south when total spending falls below that expected by the producers of goods and services and they realise their production levels are too high relative to demand.

Inventory levels rise, sales orders fall and the spending weakness starts to multiply throughout the economy as laid-off workers adopt conservative positions with respect to the spending plans.

As the output gap (the difference between the what the economy can produce given its stock of capital equipment etc and the fully employed labour force and actual output) increases, unemployment rises and capacity utilisation rates fall.

A general malaise sets in with confidence among spenders (households who consume and firms who invest in new capital) falling. These positions are difficult to alter unless there is some external shock (for example, a government stimulus).

Income losses can be severe during this downturn and the malaise might extend for several periods (even years) if the governments do not use their fiscal capacity to fill the spending gap and provide a filip to private sector confidence.

Monetary policy (that is, the setting of interest rates or other measures such as quantitative easing) is unlikely to provide the demand boost and that incapacity has nothing really to do with the zero bound issue that the IMF mentions above.

A lot of nonsense has been written about so-called liquidity traps being the reason for the failure of monetary policy to stimulate aggregate spending.

Please read my blogs – The on-going crisis has nothing to do with a supposed liquidity trap and Whether there is a liquidity trap or not is irrelevant– for more discussion on this point.

Whether the interest rate is zero or something different there is no constraint on using fiscal policy to stimulate aggregate spending in a direct, targetted and immediate fashion.

The continual focus on monetary policy and the failure to mention fiscal policy options reflects the neo-liberal dominance and its ideological disdain for active fiscal policy intervention.

So the narratives try to eliminate any focus on the fiscal options by introducing claims that governments must maintain sustainable fiscal positions, which are usually defined in terms of deeply flawed concepts of fiscal space.

Please read my blog – Fiscal space is a real, not a financial concept – for more discussion on this point.

Most of the public angst during an economic downturn is thus focused on the immediate consequences of rising unemployment, lack of jobs, lost income and the distributional problems that emerge from these pathologies.

They can be severe and warrant immediate policy attention.

While not wanting to reduce the significance of the short-term costs of recession and the need for immediate policy interventions to restore high levels of employment, there are other reasons why policy intervention should be swift and scaled to mop up the output gap as soon as possible.

This is where the secular stagnation hypothesis enters the pictures. If governments do not set about using their fiscal capacities to restore growth as soon as they can then not only does the economy become stuck at below-full employment equilibrium states but the longer that state prevails the greater is the likelihood of long-run damage to the economy being caused.

The mainstream economics literature (text books, most of the New Keynesian models etc), which dominates the academy and the policy makers, considers the supply-side of the economy to be independent of the demand-side. The main models used in textbooks and policy advice continue to cast the supply-side of the economy as following a long-run trajectory which is independent of where the economy is at any point in time in terms of actual demand and activity.

What does that mean in English? Simply, that the path the economy takes is ultimately dependent on the growth in capital stock and population and the spending side of the economy will typically adjust through price flexibility. In other words, it doesn’t really matter if spending falls below the level required to fully engage the productive capacity of the economy at some point in time.

There will be temporary deviations from the potential growth path but soon enough, market adjustments (price and income shifts) will restore the level of spending (for example, prices fall and consumers spend more, which, in turn, stimulates more private investment spending etc). But the supply-side momemtum continues – and that defines the growth path of the economy.

A classic application of the separation of the supply and demand sides in mainstream economics is the claim that a wage cut will increase employment. They only consider wages to be a cost and so claim that if workers in a firm offer themselves at lower wages, unit costs will fall and firms can expand their sales by lowering prices accordingly.

That might happen at a firm-level because the drop in income from the wage cut is unlikely to have much effect on the sales levels of the firm in question. If true, then the supply side (the supply of labour and its cost) will be largely independent of the demand-side (total sales volume).

Even if true at that micro level, the problem is that at the macroeconomic level wages are not only a cost of production but they are also a major component of total income. If all wages are cut, national income will fall because workers will have less purchasing power and the sales of all firms will decline. As a result, the demand and supply sides of the economy are interdependent.

In the context of the secular stagnation this interdependence is a crucial factor. There is a concept in economics that I have written about before called hysteresis (which is a topic my own PhD was initially focused on).

Please read my blog – The intergenerational consequences of austerity will be massive – for more discussion on this point.

In brief, hysteresis is a term drawn from physics and is used in economics to describe where we are today as a reflection of where we have been. That is, the present is path-dependent.

An economy cannot escape its history. Mainstream economics largely ignores history or culture. The textbook models are ahistorical and assume that free market competitive principles apply universally across space and time.

There was an interesting article in today’s Sydney Morning Herald from economics writer Ross Gittins about the flaws in this starting point – see Moral trade-offs are for the common good

How is hysteresis relevant to the secular stagnation hypothesis?

The long-run position of the economy is never independent of the state of aggregate spending in the short-run. There is no invariant long-run state that is purely supply determined.

By stimulating output growth now, governments not only reduce unemployment and income losses immediately but also help relieve longer-term constraints on growth – investment is encouraged and workers become more mobile.

The longer a recession (that is, the output gap) persists the broader the negative hysteretic forces become. At some point, the productive capacity of the economy starts to fall (supply-side) towards the sluggish demand-side of the economy and the output gap closes at much lower levels of economic activity.

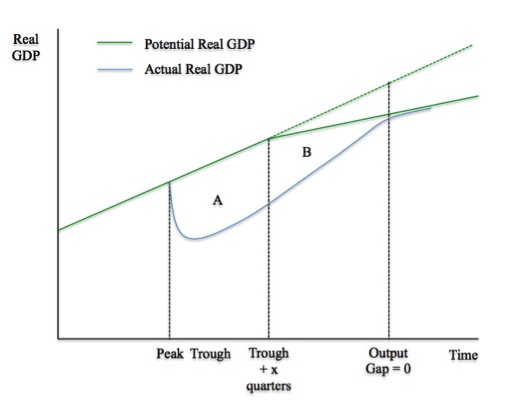

The following diagram shows how the demand-side and supply-sides interact following a recession. Unlike the mainstream macroeconomics approach, which assumes that the “long-run” is supply-determined and invariant to the demand conditions in the economy at any point in time, the diagram shows that the supply-side of the economy responds to particular demand conditions.

The potential output path is denoted by the green solid line noting the dotted green segment for later discussion. This is the level of real output it would be forthcoming if only available collective capacity (including Labour and equipment) was being fully utilised.

The potential real GDP assumes some constant growth in productive capacity driven by a smooth investment trajectory up until the point where it slow flattens.

If we assume that at the peak the economy was working at full capacity – that is, there was no output gap – then we can tell a story of what happens following an aggregate spending failure after the peak. The solid blue line is the actual path of real GDP or output that the economy takes.

You can see that the output gap opens up quickly as real GDP departs from the potential real GDP line. The area A measures the real output gap for the first x-quarters following the Trough. As the economy starts growing again as aggregate demand starts to recover (perhaps on the back of a fiscal stimulus, perhaps as consumption or net exports improve) after the Trough, the real output gap start to close.

However, the persistence of the output gap over this period starts to undermine investment plans as firms become pessimistic about the future state of aggregate spending.

At some point, investment starts to decline and two things are observed: (a) the recovery in real output does not accelerate due to the constrained private demand; and (b) the supply-side of the economy (potential) starts to respond (that is, is influenced) by the path of aggregate spending takes over time.

The pessimism by firms begins to reduce the potential real output of the economy (denoted by the divergence between the solid green line and the dotted green line).

The area B denotes a declining output gap arising from both these demand-side and supply-side effects. At some point, actual real output reaches potential real output – meaning the output gap is closed – but the overall growth rate is much lower than would have been the case if the economy has continued on its previous real output potential trajectory.

The entrenched recession is thus not only caused major national income losses while the output gap was open but is also made that the growth in national income possible in this economy is much lower and the nation, in material terms, is poorer as a consequence.

Moreover, the inflation barrier (that is, the point at which nominal aggregate demand is greater than the real capacity of the economy to absorb it) occurs at lower actual real output levels.

The estimated costs of the recession and fiscal austerity are much larger than the mainstream will ever admit. The point of the diagram is that the supply-side of the economy (potential) is influenced by the demand path taken.

Those who advocate austerity and the massive short-term costs that accompany it fail to acknowledge these inter-temporal costs.

Astute readers will note that this shrinking of the productive potential obviously has implications for the unemployment rate and what we might consider to be full employment.

This observation relates to the concept of “capacity-constrained” unemployment. This concept says that capacity constraints may create bottlenecks in production before unemployment has been significant reduced (this would be exacerbated if there are significant procyclical labour supply responses).

In this case any expansion in government spending may have insignificant real effects – that is, the real output gap is not large enough to allow all the unemployed to gain productive jobs.

However, it can be shown that while private sector investment, which is governed by profitability considerations can be insufficient (during and after a recession) to expand potential output fast enough to re-absorb the unemployed who lost their jobs in the downturn, such a situation does not apply to a currency-issuing government intent on introducing a Job Guarantee.

The point is that the introduction of a Job Guarantee job simultaneously creates the extra productive capacity required for program viability.

The spending capacity of currency-issuing governments is not constrained by expectations of future aggregate demand in the same way that pessimism erodes the spending decisions of private firms who are guided by profitability considerations.

From the research I have been involved with for many years, the majority of jobs identified as being suitable for low skill workers would be in the low capital intensity areas of work, although this would vary across the specific need areas (transport amenity; community welfare services; public health and safety; and recreation and culture etc).

The upshot is that the government has both the financial and real capacity to invest in and procure the required capital in a timely manner. Pessimism, which constrains private sector investment in productive capacity in the early days of recovery, doesn’t enter the picture.

Please read my blog – A Job Guarantee job creates the required extra productive capacity – for more discussion on this point.

The claim in the IMF World Economic Outlook, that “some affected economies would not be able to generate the demand needed to restore full employment through regular self-correcting forces” is true. Without fiscal intervention, the private market can get stuck in equilibrium states (where all decisions are being ratified by actual outcomes) which involve very high levels of unemployment.

So firms come to expect very low growth and reduce the rate of capacity creation while consumers adopt very cautious spending patterns. The resulting output and income generation reinforces these expectations and there is no dynamic to prompt a change. Firms have enough productive capacity and the economy gets stuck in this high unemployment state.

But the IMF’s claim that the “equilibrium real interest rate on safe assets consistent with full employment might be too low to be achieved with the zero lower bound on nominal interest rates” blatantly ignores the fiscal capacity of the currency-issuing governments to break into that cycle of low growth and high unemployment.

In that context, there is no comparison that can be made between the capacity of the Japanese government and those in the Eurozone to promote growth. Ignoring the ridiculous fiscal constraints imposed by the Stability and Growth Pact, the latter governments are financially constrained by the fact they use a foreign currency and the central bank (which issues that currency) is unwilling to underwrite fiscal deficits.

Japan is not constrained in that way at all. Its fiscal constraints are all voluntarily imposed and within the structure of the existing monetary system could be eliminated immediately. The Eurozone constraints are inherent in the structure of their monetary system and would require some changes to the Treaty – a torturous process. A Eurozone nation would be better advised to abandon the Euro and reinstate its own currency – something it could do in a very short time period if it had the political will.

But a currency-issuing nation could immediately create stronger economic growth with a Job Guarantee followed by other spending initiatives.

The IMF remains stuck in its neo-liberal Groupthink and claims for the Eurozone that:

… the pace of fiscal consolidation has slowed and the overall fiscal stance for 2014-15 is only slightly contractionary. This strikes a better balance between demand support and debt reduction.

But if the ECB guaranteed all debt issuance in the Eurozone, there would be no need for such austerity. European governments should in almost all cases have significantly larger deficits (double or larger in some cases) to address the medium- to longer-term effects of the crisis.

Justifying a position where fiscal policy “is only slightly contractionary” is continuing to justify the neo-liberal vandalism.

Conclusion

What all this means is that governments should do everything within their capacity to avoid recessions.

Not only does a strategy of early policy intervention avoid massive short-run income losses and the sharp rise in unemployment that accompany recession, but the longer term damage to the supply capacity of the economy and the deterioration in the quality of the labour force can also be avoided.

A national, currency-issuing government can always provide sufficient aggregate spending in a relatively short period of time to offset a collapse in non-government spending, which, if otherwise ignored, would lead to these damaging short-run and long-run consequences.

The “waiting for the market to work” approach is vastly inferior and not only ruins the lives of individuals who are forced to disproportionately endure the costs of the economic downturn, but, also undermines future prosperity for their children and later generations.

Ireland bullied by the Troika

Meanwhile, we learn from the article in the Irish Independent – Revealed – the Troika threats to bankrupt Ireland – that the Troika bullied Ireland into accepting a bailout plan.

In a new book of edited contributions just released, which considers the life and career of the former Irish Minister of Finance, Brian Lenihan, the Governor of the Central Bank of Ireland – Patrick Honohan – wrote that there was a teleconference in November 2010 between senior European and ECB officials and Irish government ministers, where:

The Troika staff told Brian in categorical terms that burning the bondholders would mean no programme and, accordingly, could not be countenanced,” Dr Honohan writes. “For whatever reason, they waited until after this showdown to inform me of this decision, which had apparently been taken at a very high-level teleconference to which no Irish representative was invited.”

Holohan was not invited nor knew about the teleconference meeting.

None of that is surprising.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

The Irish Independent is not a reliable source of information (it has always been a rag )

We Dorks don’t really know what happened and perhaps may never know as secrecy and deception is the first two cards in any masons hand.

I sense from reading the Irish Indo that the local estate managers wish to simply defend their own position.

Again this is nothing new in Irish history.

Middlemen have been a pox on the land since Lizie the 1rst was around.

We call these men in ireland ” fly boys” – people who play both sides of the field for their advantage.

Sir Nicholas White (c.1532 – 1592) is a classic example.

As for growth ?

Certainly there is no need for that in Ireland.

A return to individual purchasing power but not growth as we have enough stuff.

«The mainstream economics literature (text books, most of the New Keynesian models etc), which dominates the academy and the policy makers, considers the supply-side of the economy to be independent of the demand-side.»

I have just read a statement by an illustrious “progressive” New Keynesian that goes even further:

http://mainlymacro.blogspot.com/2014/10/more-asymmetries-is-keynesian-economics.html?showComment=1412610743797#c5335019151822385599>

«Monetary policy deals with the macro problem, relative prices in markets generally deals with the micro.»

To me that seems to say that macroeconomic policy cannot affect relative prices, such as the distribution of income.

Thanks Bill,

As I’ve said before, if governments only rely on monetary measures to stimulate growth, then they are simply relying on trickle-down economics, which in turn leads to distortions in capital markets, including commodity (and other) bubbles and unsustainable debt/risk problems. Fiscal policy can avoid this, providing the government are actually competent.

I think that the world of stock markets, commodity and currency markets cannot be stable and useful unless it is supported by the state of the real economy.

Interesting that functional finance says that interest rates should be kept at rates that broadly benefit the economy, which is not what is happening with the current ZLB situation.

A example of the strangeness of a euro economy on the micro level

Taken from cork city profile 2014

There are 47,163 housing units in Cork which represents a overal increase of 7.5 % since 2006.

There are 8,045 unoccupied housing units in the city………….

There was a 0.16% drop in population between 2006 and 2011

(I imagine there was a even greater drop in pop since 2011)

Why are housing units scarce ?

Oh yes – people don’t have the purchasing power to buy existing stock.

Now we hear voices of the Irish estate managers in talks with the European investment bank to get into further debt (socialized on us all) by you guessed it – building more social housing.

This is fabian socialism gone into some sort of ballistic trajectory.

So – if they build more overcapacity in housing this will show up as increased vibrancy in the national economy when in fact the goods produced are already in chronic surplus.

Here is another example of this but looking at a different part of the economy.

Mark Fielding ( a irish small business lobby represenative ) :

‘It’s not our responsibility to give someone a living wage.’

He may be a nice or nasty guy but he is correct if speaking from a social credit position.

It is the responsibility of the state to give social credit (not welfare) to each and every person.

wages add to prices in a unproductive fashion because in the modern era labour has little value to add.

Small business must compete against corporate superstores with access to cheap credit and other scale advantages.

Nobody has ever given a satisfactory reason why the populations of provincial cities in Ireland fell (such as Cork & Waterford) or remained static during perhaps the second biggest population rise in the history of the island.

Imagine how little capital (energy) is needed to supply once Medieval cities of this scale.(the local hinterland can supply most raw materials)

A typical union / wage inflation critic can be found in Micheal Tafts notes from the front.

Need I remind you – the irish corporatist unions were to almost a man in favour of the euro system.

Funny that.

Micheal Taft seems unaware that small business closures have gone hyperbolic since 2008 and have been in steady decline since 1979.

Dork, the social housing problem you mention would not be a problem were Ireland in control of its own currency. But since it isn’t, such housing projects will have to be paid for by some kind of taxation and/or “grants” from “central government”, i.e., Brussels in your case.

@larry

I think it goes a lot deeper then currency , don’t you think ?

The problem of course resides within credit banking in particular

Pre 1973 / 1979 -was no bloody nirvana , the real economy was dependent on remittances from mainly the UK and exports (and therefore revenue) to it.

Essentially the local credit banks forced down local scarcity so we are forced to expand (grow) so as to seek scarce money via exports and the like.

Its feels nice when you can access tea , wine and oranges but of course there comes a point when the costs become very real to people.

We have infact passed that stage many decades ago.(I would regard 1980 ~) as a turning point.

Read ,Desmond Fennells cracker “Nice people & Rednecks (ironic title) Ireland in the 1980s if you want to understand what really went on at the irish micro level

So we had pointless capitalistic transfer of tokens over a much larger scale then needed – all so that we can maintain a artificial level of concentration (then as now centered in London)

The entire landscape of Ireland has been structured to supply distant concentrations of capital since the 1600s. (the Plantations)

My core observation is that the larger the banking union the greater the waste of capital.

Why build more housing capacity (growth) that cannot be used ?

Why outsource previous Cork corporation activities (water and rubbish collection) to distant rentier organizations centered in financial capitals.

Once these capitalists have gained further concentration of money they will become desperate for us to buy more unneeded products.(see above engagement between irish estate managers and European bankers)

And so it goes on and on and on.

By the way I am of the view that society has totally collapsed already.

The costs of the banks extraction has always been on their books , the only difference is that the bastards cannot expand out of it this time.

That is why the rentier charges keep increasing.

Concentration must always be kept regardless of economic conditions it seems.

biologists study this all the time;

& call it “phenotypic persistence” – aka, random institutional momentum;

in the great scheme of things, it’s just statistical noise in aggregate processes

but all kinds of entities (people? families? businesses?), species and cultures allow their random excesses to destroy them;

for aggregates too, not just individuals, there’s no guarantee, and no free lunch

War on poverty = War on Neo-Liberalism

doesn’t matter what you call it:

White Collar Crime?

Lagging Adaptive Rate?

Cultural Suicide?

Control Fraud?

Innocent Fraud?

phenotypic persistence?

Institutional Momentum?

Error?

all are unnatural if allowed to grow to extremes, quickly or persistently

@Roger

Cultures ? whats your point in the current context.

Capitalism is a bit detached from cultures don’t you think ?

The east India company made shares free transferable ………………some people therefore have no skin in the game of local areas…i.e. They are not feudal lords.

There is a Dublin Marxist writing The Dublin opinion blog who made this point pretty well in his most recent series.

This is Marxes Fictious capital point.