I grew up in a society where collective will was at the forefront and it…

Yet another solution for the Eurozone

The basis of a fiat currency, which is issued under monopoly conditions by the government and has no intrinsic value (unlike say gold or silver currencies) is that it is the only unit that the non-government sector can use to relinquish its tax and related obligations to the government. That property immediately makes the otherwise worthless token valuable and demanded. If there was no capacity to use the currency for this purpose then why we would agree to use the government’s preferred currency? Recently, some economists in Italy have come up with a hybrid scheme to save the euro yet allow Italy to resume growth without violating the rules governed by the Stability and Growth Pact and without the ECB violating its no bailout clause, even though both violations have occurred in the last 5 years and been overlooked by the elites. The plan is similar to that proposed in 2009 by the Government in California. It has merit but ultimately misses the point. The Eurozone problem is the euro!

Regular (long standing readers) might recall that in 2009, I proposed that the then Governor of California issue its own currency to overcome its fiscal crisis at the time.

Please read my blog – California IOUs are not currency … but they could be! – for more discussion on this point. I followed up the conceptual outline of the idea with – My letter to the Governor (arnie)

I noted that California’s fiscal deterioration was particularly severe in 2009. The deficit ($US24.3 billion) rose after economic activity ground to a halt and tax revenue fell off a cliff.

Data from the State Controllers Office, which is California’s independent fiscal watchdog, clearly demonstrated the cash crisis that the State was facing. Unlike a national government, which issues the currency and could never run out of it, California could face a situation where it would not be able to pay its bills (in USD).

For any state or local government (that is, one that uses the currency of the nation but does not have the capacity to issue it), any fiscal deficit has to be ‘funded’ because this level of government always faces a revenue constraint.

Such a government has to increase taxes, cut spending or increase its borrowing (state debt issuance) to resolve the fiscal deterioration.

As a general observation, it is madness for such a government to attempt to use discretionary policy changes to ‘fight against’ the automatic stabilisers (the cyclical loss of tax revenue as its economy deteriorates).

Trying to resolve a burgeoning ‘state’ fiscal deficit by increasing taxes and cutting spending at the height of a major economic downturn is not recommended if: (a) the aim is to return to growth as quickly as possible, and (b) actually bring the cash shortfall back into manageable dimensions.

Such a strategy almost certainly undermines both objectives and makes matters worse. There is every reason to increase borrowing during this period to finance infrastructure and other projects which will not only provide a fiscal kick-start for the economy but also leave a long-lived legacy of public goods. These infrastructure investments leave a legacy that generations for years to come can benefit from and as such the spreading of the “payment burden” via the debt finance is considered equitable on an intergenerational basis.

Of course, such a ‘state’ might find it hard accessing the private capital markets given the increased risk of default. The cost of accessing funding might also be prohibitive and without federal (national) backing, the capacity to borrow could be limited.

So even though the national government never has a problem issuing and honouring liabilities denominated in the currency that it issues, the same cannot be said for a ‘state’ government, which is a user of the currency and, in that sense, sees the currency as foreign.

At the time, the Californian government proposed that it would overcome the crisis by issuing IOUs (reserved warrants) in lieu of making cash payments, given it was likely to run out of the latter.

It was clear that the IOUs would not become a second currency alongside the USD under the conditions that were being proposed.

The original proposal (to begin in July 2009) from the State Controllers Office was accompanied with some href=”http://www.sco.ca.gov/eo_news_registeredwarrants.html”>analysis of how the IOU system would work.

First, there was no guarantee of convertibility into cash. But the state indicated that if it had enough cash it would redeem them with interest. They actually stopped redemptions on outstanding warrants on November 10, 2010. There was no stipulation the IOUs could be traded as if they were cash.

Second, and most importantly, there was no provision that a Californian resident could pay their state taxes using the warrants as contra payments. In other words, the warrants are not currency.

But it was also clear that one simple extra announcement by the State would be enough to allow California to be sovereign in their IOUs.

As noted in the introduction – if the State of California had have announced that it would accept these IOU vouchers (their face value in $US) as legitimate vehicles to liquidate one’s tax obligations to the State then the situation would have changed dramatically.

Such as system would work in this way. To circulate the vouchers, all state employees would receive some (or all) of their pay in the IOUs (bits of paper or via electronic transfer into special voucher banks), which they could then use to pay their taxes. If all Californian citizens could similarly extinguish their tax obligations using these vouchers then there would be a generalised demand for them, which means that State employees would be able to spend the IOUs in shops as they would the $US.

The State of California would have no financial constraint in the IOU vouchers. It would simply spend them (pay its workers) and collect the taxes later as people handed them back to satisfy their legal obligations. Imposing the tax obligation (in vouchers) creates a demand for them and allows them to circulate as a “currency”.

Soon enough, the banking system would develop IOU Voucher Accounts and related products. In this way, the State of California could more easily maintain its level of services without imposing huge costs on the disadvantaged which they are forcing to accept the IOUs. The State could also expand public employment to attenuate the labour market impacts of the recession.

There might be some reluctance to hold the vouchers. In general terms whether Californians would desire to demand the IOUs would depend on how enforceable the tax obligations are. The State of California could probably enforce the tax obligations and allow them to be extinguished using vouchers. This would be sufficient to generate a viable demand for the IOUs as an operating currency. I am not considering any constitutional issues here. Just the logical point.

If the state had have decreed that any resident could extinguish their tax obligations using the warrants then they would become more broadly accepted as an alternative currency in California and the disadvantage that those citizens face who will be forced to accept them in lieu of cash payments would be considerably reduced (or eliminated entirely).

As it turned out, the Californian government baulked at the solution (under pressure from the Federal Reserve) and instead went down the austerity route by announcing massive cuts in public spending and the economy deteriorated further and the rise and persistence in mass unemployment was worse than the nation as a whole.

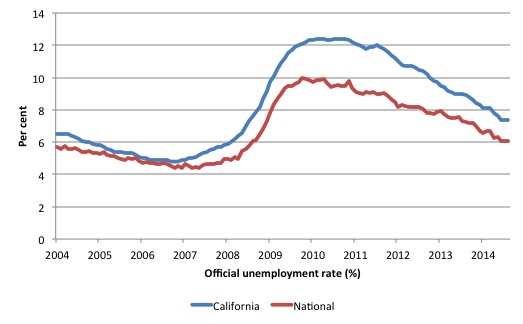

The following graph shows the official unemployment rate between January 2004 and August 2014 for California and the US as a whole. After rejecting the use of IOUs as a alternative sovereign currency, the unemployment rate in California kept rising for another year or so, and turned well after the turning point in the national economy.

And another Eurozone solution

In the case of the Eurozone, the problem is the Euro itself. There is no getting around that. However, despite the economies that make up the euro area being still mired in stagnant conditions, there is continued denial of that fact.

Even progressives offer new solutions which avoid jettisoning the euro. That is, which avoid addressing the major issue.

In my book on the Eurozone, now to be titled – Eurozone Dystopia: Groupthink and denial on a grand scale – and published in early 2015, I examined in one chapter a number of proposed schemes to circumvent the crisis including establishing a European-wide unemployment benefits scheme and various debt-shuffling schemes designed to satisfy the Stability and Growth Pact (SGP) constraints.

I labelled them all – austerity schemes – because they avoid facing up to the facts. If a nation is using a foreign currency within a common currency zone it must have fiscal support at the currency-issuing level, which in this case is the European Central Bank, if it is to meet the challenges presented when there is an asymmetric decline in total spending.

Further, to not only deny the nations that support but then to limit the scope they have to meet these challenges within their own fiscal dimensions – as the SGP does – is to commit the region to almost long period of economic recession and hardship.

The design of the Eurozone is flawed at the most elemental level and in the book I recommend Italy or France taking the lead and negotiating a way to leave the common currency so that the other smaller nations, which do not enjoy the same clout as these large economies, can also leave without pernicious penalties being imposed.

So up until now I have not been enamoured with any of what I termed hybrid solutions which aim to address the consequences of austerity by keeping it.

Recently, another solution has been proposed, which comes close to the Californian solution that I outlined above, and also includes the additional feature that would have given that American state a separate currency within the UD dollar zone.

An article in EconoMonitor (July 3, 2014) – Which Options for Mr. Renzi to Revive Italy and Save the Euro? – by Biagio Bossone, Marco Cattaneo and Giovanni Zibordi calls on the Italian Prime Minister, Matteo Renzi to introduce what they call “Tax Credit Certificates” to allow the Italian economy to come out of its austerity-induced recession yet stay within the Eurozone rules.

They begin by documenting the collapse of Italy’s industrial production, which is now 25 per cent smaller than it was in 2008. A catastrophe by any stretch of imagination. Private investment is also down by 26 per cent and the “capacity loss in manufacturing hovering around 15 per cent”.

Yet, Italy’s public debt continues to rise as a proportion of GDP even though the austerity-obsessed government is now running the largest primary fiscal surplus in the Eurozone. A primary fiscal balance excludes interest servicing payments so reflects the difference between spending and taxation revenue net of interest payments on outstanding debt.

They argue that the situation is impossible – Italy cannot create new jobs (net) and reduce its massive pool of unemployment under these circumstances. There has to be more spending and it is unlikely to come from the private sector, given the jobless rate and the falling incomes.

They also correctly argue that:

Structural reforms (such as in justice, education, governance, and doing business), while necessary to modernize the country and improve the economic environment, won’t jumpstart any recovery any time soon, if at all.

They might have also said that these reform processes are more effective when the economy is growing strongly because resources are more mobile then.

Structural change always involved the necessity to shift productive resources from one use to another. Imposing these processes when there is substantially depressed demand for labour and slack sales, typically means that resources displaced from one sector under reform will become idle rather than be absorbed into growing sectors.

Try telling that the Eurozone elites who only think in terms of scorched Earth.

The authors also reject the idea that monetary policy innovations (such as the recent ECB move to negative interest rates) will provide any stimulus. That conclusion is sound. The bias towards monetary policy as the solution since the outset of the GFC reflects the neo-liberal antagonism towards fiscal policy.

They emphasise monetary policy because they hate fiscal policy despite the obvious fact that the former is not a suitable policy tool to deal with a massive spending collapse.

Sure interest rates can be cut and central banks can pump cash into bank reserves out of thin air. But that doesn’t ensure people will access more credit and spend more. That has been another neo-liberal myth – that rising central bank reserves would stimulate credit and allow banks to lend easier.

It doesn’t work like that. Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

The authors, instead, draw on a plan that they trace to Hitler’s Germany in the early 1930s where the central bank and finance ministry created an imaginary ‘company’ – the Metallurgische Forschungsgesellschaft (Mefo) whose sole task was to issue – Mefo bills.

The operation of the Mefo is outlined in this – Drittes Gesetz zur Neuordnung des Geldwesens (Umstellungsgesetz) (If you read German).

The Nazis realised they would not be able to reconstruct Germany with tax revenue nor issue sufficient public debt given how poor the nation was after the Versailles Treaty. It also was fearful of igniting inflation again.

The solution was to establish Mefo as the major vehicle for rebuilding Germany’s military capacity. They also knew this had to be a secret process so they used the front of the Mefo to accomplish that aim.

Essentially, the system worked as such.

First, the government ordered German armament manufacturers to build new weapons.

Second, the companies would draw Mefo bills of exchange (promissory notes) which the Mefo Company accepted. It was a system of deferred payments.

Third, the drawer of the bills could then present them to German banks at a discount who could also rediscount the bills with the Reichsbank (central bank).

Fourth, the government (Reich) guaranteed the bills for a period of five years after they were issued.

Effectively, while the central bank was prevented from directly funding the treasury, the Mefo bills allowed the latter to acquire huge loans from the former, which allowed it to fund the build up to 1939.

Our Eurozone authors channel the same idea although one could dispute the historical accuracy of their conclusion that the scheme was abandoned when full employment was reached.

In fact, the scheme brought the German Finance Ministry into direct conflict with the central bank and in 1939, the person who designed the scheme, Hjalmar Schacht – resigned from his position as Minister of Economics. He would later turn up at Nuremberg and was set free as he had also been jailed by Hitler after the July 20 plot to assassinate the Fuhrer.

The authors also do not mention the covert nature of Mefo as a way to hide the build up of armaments in Germany from its eventual belligerents.

But those observations are by the way.

What they propose is that:

… the Italian government could issue new bills called CCF (Certificati di Credito Fiscale = Tax Credit Certificates) by amounts necessary to gradually close the economy’s output gap, taking into consideration plausible values of the fiscal multiplier for an economy with large unutilized capacity where monetary policy operates under the zero lower bound.

And, the CFC would have the essential capacity that renders a currency sovereign:

The CCF represent government bills of exchange: the government has no obligation to reimburse them in the future. Rather, two years after issuance, they are accepted to fulfill any financial obligation towards the Italian state (taxes, public pension contributions, national health system contributions, etc.). The deferral allows for output to start recovering and generate resources to offset the shortfall of the euro-denominated tax receipts that follows when CCF start being accepted by the State for payments of taxes and other obligations.

In other words, the CCFs would be equivalent to the euro in the sense that they could be used to pay all taxes and other statutory obligations.

In that sense, they would be immediately acceptable in exchange within the non-government sector.

How would the government issue these bills?

The authors propose that the State would give them out freely to “private sector enterprises and employees” and “may assign an additional CCF allocation to itself, which it will use to implement further demand-support actions (e.g., supplementing income to financially distressed families, improving the national health system, speeding up payments of overdue bills to government suppliers, etc.).”

While the authors do not say this, it is obvious that the Italian government could introduce a Job Guarantee scheme immediately and fund it with CCFs. The workers would treat the bills as income as they would be exchangeable for euros which would then stimulate spending overall.

The authors note that the “market will discount them like any zero-coupon two-year (default-free) government bonds” while those who hold them as portfolio items “past the deferral date” would use them “to pay taxes and obligations to the State”.

The authors believe the scheme would not violate the “State aid” provisions under EU law. I cannot comment on that without further scrutiny of the law and I prefer to leave those discussions to the lawyers.

What is clear is that the scheme would work just like the IOUs could have worked in California. The fact is that Italy and all the rest of the Eurozone Member States are like the states of America or Australia, although the latter have considerably more fiscal autonomy given the lack of anything like a SGP. Sure enough states in the US have elected to introduce balanced budget rules but they are products of their own legislation and they could alter the law without being ejected from the US dollar zone (which we call America).

There is no doubt that the scheme would provide the necessary stimulus to engender growth.

But the authors are still wedded to the Eurozone and the SGP constraints as ‘normal’ parameters for Italy.

They characterise the Tax Credit Scheme as an “unconventional measure for extraordinary times”. They say:

The use of CCF should be intended for very critical situations only, such as the economic depression that Eurozone crisis countries have faced for too long now, characterized by huge resource slack, deflationary tendencies, no autonomous monetary policy, and heavily constrained fiscal policy. Obviously, recourse to CCF issuance should not be abused. Issuance should take place under specific law provisions, strict and transparent parliamentary control, and a predetermined framework specifying the target to be achieved and the related timeframe.

I don’t agree with that conceptualisation.

The ability of a country to have currency discretion is the hallmark of sovereignty. Without it, the government is incapable of fulfilling its responsibilities to promote full employment and equity and meet challenges that arise like climate change etc.

To claim that a scheme that restores that sovereignty should be temporary only and only be introduced when output to

depression levels or there is “huge resource slack” is, in itself, extraordinary.

The current, on-going crisis in the Eurozone and Italy, in particular, is not that extraordinary, given the design of the monetary system that they introduced. It was always going to converge on recession and stagnation. The current performance of the Eurozone is more or less exactly what was foreseen back in the early 1990s by those who opposed the creation of the monetary union.

Sovereignty is intrinsic to responsible government. It shouldn’t be restored when there is a deep recession and then withdrawn again.

Conclusion

What is not disclosed by these authors and others who propose these hybrid schemes is why they are so wedded to hanging onto the euro.

Italy would be much better off if they left the Eurozone behind and established currency sovereignty unconditionally. Not just when it is depression!

Why is all the effort being taken to devise ‘ingenious schemes’ that retain the euro and all the baggage that makes it unworkable as a monetary system?

That is enough for today!

The advantage of this scheme is that is a proof-of-principle of the MMT version of economics. Personally, I hope that it comes to fruition (assuming that it is indeed legal), not least because I don’t want to wait another decade or so for the Euro to finally collapse.

Also, I can see some very specific ways in which it could be used to employ currently unemployed labour to help meet Italy’s policy commitments.

Thanks for this interesting post, Bill.

I have a question somewhat related to today’s topic.

Many argue that one of the problems of the Euro is that it lowered interest rates for all peripheral countries (suddenly, they were almost as creditworthy as Germany), which caused a credit binge in those countries. What do you think of this explanation? Why were interest rates so high in Greece, Spain or Italy before the introduction of the Euro if sovereign states control these rates through their CB? Did they just choose to have high rates?

Thanks!

Alex

Hi Bill,

Nice post.

Firstly I would like to point you to Yanis Varoufokis’ solution to the EU crisis – http://yanisvaroufakis.eu/2014/09/07/can-europe-escape-its-crisis-without-turning-into-an-iron-cage/ . What is your opinion on it?

Secondly, my concern with introducing CCF’s, along side the Euro, is the exchange rate between them? What would be needed to ensure that the CCF’s are strong enough against the Euro to make them useful for individuals transacting with businesses, and vice versa?

They worked closely with me on this as well

😉

Dear Bill

I went to take a peek at the German website that you mentioned. It says Ausfertigungsdatum = date of issuance: 20/06/1948. It is about the currency reform introduced in West Germany after WWII.

Regards. James

Bill,

MMTers have proposed at least two similar schemes. Rob Parenteau has gone down the tax credit route:

http://neweconomicperspectives.org/2013/12/exit-austerity-without-exiting-euro.html

While Mosler and I suggested tax-backed bonds:

http://www.levyinstitute.org/publications/the-continued-relevance-of-tax-backed-bonds-in-a-post-omt-eurozone

I even got the tax-bonds idea to the Irish finance minister and had him respond to it in Irish Parliament (details in policy note).

While you may be right on the euro the public has a right to know that even if they keep the euro they are being lied to by politicians. It might be worth discussing these plans in your book if you still have time before publication.

By saying that CCF issuance shouldn’t be abused, we are just implying that, in a system where euro and CCF exist together, it may be possible that euro are around in a quantity such, and demand is enough, that CCF are not necessary. But you still have the ability to issue CCF and support demand if this is not the case (as today). Which is the monetary sovereignty you need.

Please also note the following (sorry for the links being in Italian, Google translator should suffice to make them understandable for English speakers 🙂 )

“What is not disclosed by these authors and others who propose these hybrid schemes is why they are so wedded to hanging onto the euro.”

We are not “wedded to hanging onto the euro”… we just realize that engineering a euro breakup is very complex from a political standpoint, dangerous as concerns potential “chain effects” in the financial market, and creates unnecessary damages to foreign creditors and to foreign trading partners.

See this for a few comments on the complications involved in a breakup process:

http://bastaconleurocrisi.blogspot.it/2013/10/claudio-borghi-sagge-parole-ma-serve-un.html

this, for additional problems that the CCF avoids (and a breakup doesn’t):

http://bastaconleurocrisi.blogspot.it/2014/04/la-riforma-morbida-e-la-soluzione-per.html

and this, which explains how the CCF solutions leave a path open to reintroduce national, circulating currencies later on:

http://bastaconleurocrisi.blogspot.it/2014/04/dalleuro-alla-lira-fiscale-passando-per.html

We are trying to put forward a compromise solution, something workable now

In the 390 pages book we published in march 2014 to detail the idea (http://www.hoepli.it/libro/una-soluzione-per-leuro/9788820359164.html) there are 2 chapters to explain why the Euro does not make sense and at least 100 pages about MMT and sovereign money creation. Also the full proposal is Fiscal Credit + Tax Based or “Mosler” bonds, because to issue 200 billions of “Euro-CCF” would crash the italian bond market and you need something else to protect it.

I personally do not agree with the passage you quote about being an extraordinary tool, but as I say we try get published first and even watering down a bit che concepts it is not easy, ft.com, wsj.com and the italian financial press so far did not accept to publish us (in spite of the fact that we put together a tick book with a university publishing house)

In Italy the main issue is that is equivalent to “money printing” and giving the money to peple instead of the banks and that would create some inflation, although less than if it would be used to fund public expenditure.

Since a month or two some establishment economists have come around to this concept, see Giavazzi e Tabelllini who propose coordinating a monetary and fiscal expansion in the Eurozone through a money-financed temporary tax cut of 80 billions

Leaving aside that they still want the ECB to agree and we say Italy can act alone, they are faced with the “but the bond market will panic” objection, see http://www.voxeu.org/article/eurozone-recovery-there-are-no-shortcuts

Wether you create 200 billions through credit certificates “Hjialmar Schacht style”, hope to persuade the ECB to buy the extra debt or return to the lira that is major obstacle

It would seem that whatever these new proposed financial credits are called: CCFs , IOUs whatever, they would, in effect, be a parallel currency pegged to the Euro on a 1:1 basis. That may have some short term advantage in that it could be pretended that they weren’t actually Euros and so Euro rules did not apply to their issuance.

However, ultimately, the ability of the issuer to maintain that peg will be tested by the financial speculators.

Any European country could guarantee a few. But would they be able to guarantee enough to make an appreciable difference to their economies?

petermartin 2001: ability to mantain a 1:1 peg to the euro is not a problem as there is no commitment to redeem CCFs in euro. Rather, there is a commitment (from the issuing state) to accept CCFs to pay taxes (two years from their issuance, in out proposal). So there is no peg which financial speculators could possible test. A CCF maturing eg in 2017 will be worth one euro less a time discount, declining as the maturity date approaches.

Btw let me confirm that Warren Mosler coauthored the article discussed by Bill Mitchell in the post (and wrote a foreward for our book); that the CCF proposal is clearly related to the money-as-tax-credit MMT concept, as discussed by Bill himself, Rob Parenteau and others; and that Warren’s and Philip Pilkington’s tax-backed-bonds scheme was a direct inspiration for CCFs.