The other day I was asked whether I was happy that the US President was…

Germany contracts as the French suggest defiance

According to data just published by the French National Institute of Statistics and Economic Studies (INSEE), its national statistics agency, the French economy has stalled in the second-quarter 2014. In its – Informations Rapides, Principaux indicateurs 14 août 2014 – n°186 – we learn that the “le PIB en volume est stable”, which is a cute French way of saying that real GDP growth was zero, building on the zero growth from the first-quarter, which means their terminology that it is “stable” is accurate but an understatement. The latest data from Eurostat (August 14, 2014) – GDP stable in the euro area and up by 0.2% in the EU28 – show that the three largest economies in the Eurozone (and Europe) are either in recession (Italy) or teetering on recession (France, Germany). The French Finance Minister reacted to this news by calling for a rethink of economic policy in Europe with a shift in emphasis to growth. He indicated that the French government would reduce its deficit in its own time without undermining new stimulus measures aimed at kickstarted domestic growth and reducing the unemployment rate. It is looking like 2003 all over again.]

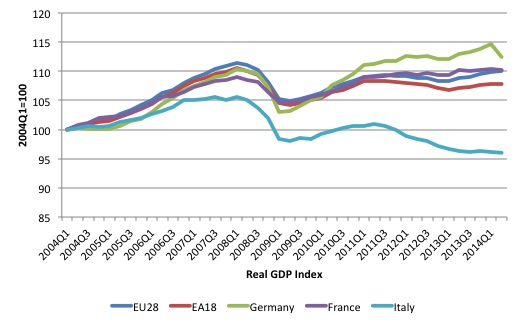

The following graph shows real GDP (indexed at 100 at March-quarter 2004) for the EU28, Eurozone 18, Germany, France and Italy.

It paints a very dour image with stagnation now entrenched and Italy spiralling downwards with no end in sight.

The situation is obviously much worse in the peripheral nations of the Eurozone but the three nations shown in this graph account for around 65 per cent of total Eurozone output and thus drive the overall results.

The overall Eurozone has not grown at all since the austerity zealots went to work in early 2011 and in overall size of the economy it is back to around 2006 levels.

It stretches belief that the policy mix is correct. The Germans and their mouthpieces in Brussels keep harping on about structural reform being the cue for growth. But one can hardly say there was massive structural change around 2008 which precipitated the collapse and subsequent stagnation.

What happened was obvious – a major macroeconomic collapse in spending occurred and spread across the Eurozone nations in accordance with their exposure to private debt and the housing market. A generalised malaise then set in once any notion of fiscal stimulus was ruled out by the Groupthink. There is nothing structural about it.

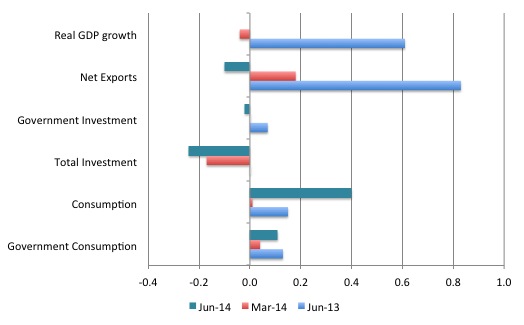

The following graph shows the contributions to real GDP growth in France for the June-quarter 2013, March-quarter 2014 and the current June-quarter 2014.

Only domestic consumption and government spending is keeping the economy from negative growth. Private investment is deteriorating further and net exports have turned negative. That will worsen given the deterioration in the German economy.

Any attempts to reduce the fiscal deficit in line with the European Commission requests would certainly plunge the French economy into recession.

The French Finance Minister Michel Sapin responded to that news in an Opinion piece in Le Monde on August 14, 2014 – Pourquoi il faut réorienter les politiques économiques européennes – or “why we must refocus European economic policies”.

It is starting to feel like 2003 all over again. Germany going into negative growth again and France stuck in zero growth with recession staring them in the face – and calls for a relaxation of the rigid rules.

On October 18, 2002 the Commission President, Italian Romano Prodi told the French daily newspaper Le Monde that:

… the SGP was stupid, like all decisions that are rigid and there was a need for a more intelligent tool with more flexibility.

Sapir was clear that the evidence base was providing a damning indictment of current policy stances. He called for attention to “truth” and “attention to the facts” if France is to move forward (“La vérité est indispensable pour prendre la mesure des faits, la volonté est nécessaire pour faire bouger les lignes et redresser le pays”).

He particularly railed against the mantras coming out of the IMF, the European Commission, and the OECD who he said produced forecasts that were in denial of the facts:

La vérité donc, c’est que, contrairement à toutes les prévisions du Fonds monétaire international (FMI), de l’Organisation de coopération et de développement économiques (OCDE) ou de la Commission européenne, la croissance est en panne, en France comme en Europe.

These organisations had been predicting growth rates of around 1 per cent rather than the nation being stuck in zero growth.

He noted that the problem is not confined to France and that Italy is in recession and Germany is stagnating (“l’Italie est en récession, l’Allemagne est en stagnation”).

Accordingly, the fight against high unemployment is being lost.

He noted that inflation is much lower than expected (“l’inflation est beaucoup plus faible que prévue”) and a reflection of the weak economy (“La trop faible inflation est le reflet de la trop faible croissance”).

Significantly, despite the French government maintaining a tight rein on public spending the automatic stabilisers triggered by the slow growth (lower then expected taxation revenue) has meant the fiscal balance is much higher than expected (“Moins de croissance, moins d’inflation entraînent mécaniquement moins de recettes, et donc plus de déficit que prévu, malgré la réalité des efforts pour le réduire”).

Which is no surprise and demonstrates that rigid fiscal rules can never be a feasible goal for governments to pursue because they do not control the final outcome and in trying to do so will undermine growth (in the case of austerity) and make

matters worse.

For France this means that its fiscal deficit will be above 4 per cent in 2014 despite promising the European Commission as part of an – Excessive Deficit Mechanism – process, signed of on March 5, 2014, to reduce its fiscal deficit in 2014 to 3.6 per cent of GDP and achieve a balance of 2.8 per cent in 2015.

Based on current economic parameters there is no way the French will achieve those targets and Michel Sapin knows that further efforts to accord with the Commission’s ridiculous goals will further undermine prosperity in France.

In 2003, the French were facing an almost identical situation. In late August 2003, the French Prime Minister Jean-Pierre Raffarin called for more flexibility in the application of the Stability and Growth Pact (SGP).

There was fierce resistance within the Commission to this idea. Raffarin had a more advanced sense of his responsibilities when he declared that his “No. 1 duty is to mobilize all of the strengths of our country for growth and employment. And I will do everything in 2004 to make sure that we return to growth and increase employment”.

On September 4, 2003, Raffarin continued this sentiment during an interview with French television station TF1, which the Le Monde editorial on September 6, said had demonstrated contempt for Europe.

Raffarin said that while the SGP was “important” his “first duty” was to ensure there is work for the French and that he was not going to compromise that for some “accounting equations and to do some maths” to satisfy the bureaucrats in Brussels. He also said that France would not follow Germany into austerity.

Now, more than a decade later, the French Finance Minister is calling for a European-wide change to policy to introduce more flexibility. He indicated that the French government would prioritise fiscal support for the local economy and local businesses to reduce unemployment (“redonnés aux entreprises, pour leur permettre de retrouver une bonne part de leur compétitivité dramatiquement amoindrie en dix ans, une capacité d’investissement et d’innovation, une force suffisante pour faire reculer durablement le chômage”).

They would still abide by the Treaty rules but in their own way – reducing the fiscal deficit at a pace that did not undermine their growth strategy.

Of-course, that ‘pace’ is much slower than the European Commission has in mind and it remains to be seen what the Council will do when it reviews the failure of France to meet their demands.

Stay tuned for some more mealy-mouthed give from the Council! They lost out to France and Germany in 2003 when both countries failed to meet their demands. That will happen again.

The SGP is an unworkable framework and forces nations to stagnate.

It is a pity that the ‘socialist’ Hollande government doesn’t show some leadership in Europe and tear up the Treaty. It could be my rogue nation or form a rogue alliance with Italy and crunch the whole ridiculous show.

Hollande is also now compromised by Sapin’s remarks given that he has been touting a 3 per cent deficit by 2015 as a central government policy target. At least Sapin knows that is unrealistic and undesirable.

Germany’s reaction to Sapin’s remarks will be negative. Wolfgang Schäuble has been recently berating the Italians and French for failing to implement so-called structural reforms (aka scorch the earth and undermine workers’ job conditions and entitlements).

Conclusion

I am mostly travelling today so we will leave it there.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Macroeconomic policy is playing a role as austerity is indeed the wrong policy. At the same time, I consider that something deeper is at work too. Europe has very likely hit the Limits to Growth for the following reasons;

(1) In terms of mineral and energy resources, Europe (west of Russia) is a now a relatively exhausted continent.

(2) Importing minerals and energy is becoming more expensive and more difficult as China (in particular) out-competes other zones for minerals and energy.

Economies run on energy and resources although economists tend to forget this. Economists, for the most part, think or act as if the economy is free-standing and independent of the environment. In point of fact, the economic system is a sub-system of the biosphere and it is ultimately limited by the finite stocks and finite flows of minerals and energy available to it from the biosphere.

Here is today’s news from Daily Mail Australia;

“Russia cut gas exports to Europe by 60 per cent today, plunging the continent into an energy crisis ‘within hours’ as a dispute with Ukraine escalated.

This morning, gas companies in Ukraine said that Russia had completely cut off their supply.

Six countries reported a complete shut-off of Russian gas shipped via Ukraine today, in a sharp escalation of a struggle over energy that threatens Europe as winter sets in.

Bulgaria, Greece, Macedonia, Romania, Croatia and Turkey all reported a halt in gas shipments from Russia through Ukraine.

Croatia said it was temporarily reducing supplies to industrial customers while Bulgaria said it had enough gas for only ‘for a few days’ and was in a ‘crisis situation’.” [End of Quote.]

The EU could go for fiscal stimulus but without energy what could it make or buy? MMT needs to integrate with biophysical economics or its (considerable) insights will be useless.

My mistake, that appears to be an old outdated report about Russian gas. However, the point stands that Europe is highly reliant on imported energy and world energy supplies are becoming tighter and tighter. Energy under-supply will soon limit the global economy and is already limiting Europe.

Ikonoclast:

You do know that with regards to MMT and “energy” or “ecology” there is nothing that refutes what you’re saying.

If anything MMT is a set of tools that address ‘hard’ constraints versus imposing ‘soft’ constraints in a fiat money system. In effect: Is a better tool for dealing with sustainability issues than neo-liberalism because it has tools to rapidly respond to challenges of growth and environmental issues.

I think you should remember that you’re posting on a progressive economists blog whom deals with this stuff all the time, moreso his focus is employment/unemployment and the inefficiencies which arise from this.

So saying things like:

“Economies run on energy and resources although economists tend to forget this.”

Seems to imply that Bill is in the subset of economists whom in you’re opinion are missing the point? To the contrary I dont think he is at all missing the point on these issues. (He certainly does not think an economy is a free standing omnipotent being/MMT does have a pretty clear idea about ‘shocks’ and inflation which is political/physical manifestations of scarcity of resources). Look at his old blog posts about ETS/Carbon tax and you will see the MMT solution: government can always afford to build massive base load renewables the money side is a soft constraint.

Unemployment can be thought of as a misuse/waste of ‘energy’ in the same way that there are more/less efficient ways of using energy. So by crollary MMT IS addressing these issues.

Also:

I believe Robert Ayres is doing some collaboration with Steve Keen so we may see a book about how endogenous money+economy interacts with environment soon. Should be an interesting read. youtube.com/watch?v=4O_xIks4N3Y (102 mins in)

Sam, point taken. However, I would like to see an explicit multi-disciplinary approach from someone or some group who consider “soft” and “hard” constraints together in a comprehensive economic approach. I would like to see the ultimate need for a renewable, circular economy acknowledged and addressed. I would to see explicit admission that population/material/infrastructure growth (quantitative growth) cannot continue indefinitely on a finite planet. This is while accepting and advocating that qualitative growth (knowledge, technology, sciences, arts, education and human services improvements) can continue for a very long time. I also want to see acknowledgement and exploration of the political economy dimension, specifically addressing the problems of monopoly capital and oligarchic control of our society. I do not consder a society democratic until workers own and manage enterprises under worker cooperative socialism. What we currently have is corporate-oligarchic command economy. That is why so many bad and biosphere-destroying decisions are being made.

Ikonoclast is a typical ‘limits to growth’ guy, that wants everyone to live in a grass hut and eat fish heads.

Like all of his ilk he is simply dead wrong. We are not reaching any sort of ‘limits to growth’ at least not limits to the world-wide improvement in the human condition and the environment. My perspective is that of a Scientist and there are plenty of technical solutions … our problems are all of the type addressed by Professor Mitchell, or even more broadly, the tendency for (some) human being to treat others like crap.