The other day I was asked whether I was happy that the US President was…

A rogue nation is needed to exit the Eurozone

I plan to send my final manuscript for my Eurozone book to the publishers tonight. I have some final checks to make on the 390 pages. I hope it will be published in both English and Italian later in the year. Obviously I will promote it here once it is ready. The book contends that the Eurozone is structurally biased towards stagnation because of the neo-liberal rules that constrain national governments from dealing with large spending collapses with appropriately scaled fiscal responses. The crisis in now into its 6th year and there is little sign that the stagnation is over. Indeed, the latest data would suggest that some of its largest economies are going backwards still. Italy has just announced it is back in recession and factory orders to Germany have plunged. I have been saying it for years but repetition is no sin – they should dismantle the currency union in an orderly manner and allow the national governments to return to growth in their own way. The nations are incapable of doing that collectively given the neo-liberal Groupthink that has them in a vice. So, a rogue nation is needed to break out of the straitjacket and provide a blueprint for the others. Italy should be that nation. In many ways it has panache and flair – it is time to show it in this specific way.

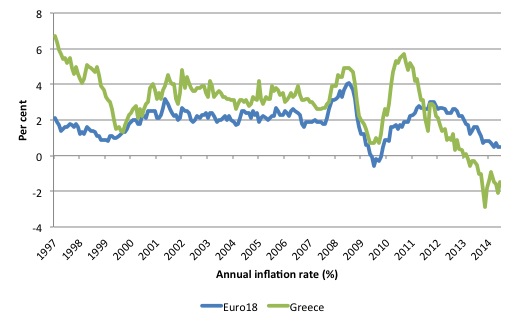

Eurostat published the latest – inflation data – for Europe on July 31, 2014.

The following graph shows the annual inflation rate for the Euro 18 nations and Greece from January 1995 to June 2014. The Eurozone is heading for a deflationary situation (negative inflation rate – that is, prices dropping across the board). Greece has been in that state since March 2013.

Above all, it signals that total spending is too low and if the private sector won’t resolve that then fiscal deficits have to rise. Exactly the opposite to what is happening in Europe under the iron grip of the Troika.

The layperson often thinks that falling price levels are a good thing. But the reality is that deflation is incredibly damaging to an economy. Why is that so? There are several reasons why an economy wants to avoid deflation.

First, debtors are hit with rising real debt burdens and falling asset prices. Creditors gain but the overall impact on aggregate spending is negative because debtors cut their spending by more than creditors increase theirs. In turn, this can promote further deflation and a spiral into depression.

Second, the falling asset prices, particularly homevalues, lead to bankruptcies and sharp decreases in mobility as workers get locked into housing they can not sell without massive losses. In such cases, even if the unemployed worker desired to move elsewhere in search of work, their housing situation makes that nigh on impossible.

Third, deflation usually only occurs when there is mass unemployment.

Fourth, falling inflation leading to deflation engenders expectations of further price falls, which has two negative impacts. Consumers and firms will postpone spending in the hope they can get the product cheaper later on. Further, people postpone decisions to borrow because there are no losses involved in holding cash balances (the real value rises) and it is reasonable to assume interest rates will be cut thus making loans cheaper in the future.

All of these impacts reinforce the deflationary spiral downwards, building on each other to make matters worse.

On the same day (July 31, 2014), Eurostat released the latest – Unemployment data – for Europe.

The unemployment rate for the Eurozone was 11.5 per cent, down by only 0.1 percentage points from the May 2014 level and only 0.5 points lower than a year ago.

Unemployment rates in Spain remain at 24.5 per cent, Italy 12.3 compared to 12.2 per cent a year ago; Greece last reported in April 2014 to be 27.3 per cent and static. Compare that with Iceland which has seen unemployment drop over the year from 5.6 per cent to 5.1 per cent.

Youth unemployment (under 25s) rose to 53.5 per cent in Spain up from 53 per cent in May; Greece unreported since April 2014 when it stood at 56.3 per cent. In Italy, it rose to 43.7, up from 39.4 per cent a year ago. Compare that with Iceland which has seen youth unemployment drop over the year from 11.3 per cent to 9.4 per cent.

Eurostat also announced (July 29, 2014) that the “Business investment rate was down to 19.3% in the euro area” (Source), which corresponds to a drop in investment itself of 0.8% per cent in the first-quarter 2014. So not only a spending hit but also a slowdown in capacity building, which will undermine future growth.

The investment rate is heading to its lowest level since the Eurozone began. It was 18.7 per cent in the first-quarter 2013 and 19.2 per cent in the third-quarter 2013. It is heading back towards those levels.

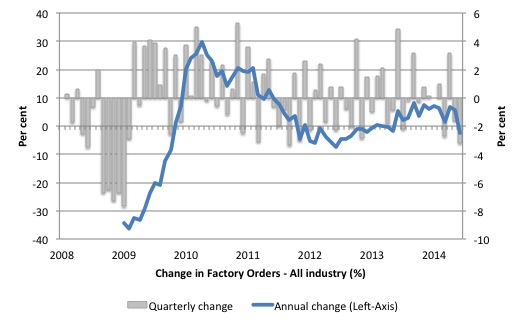

Last week, we also learned that German factory orders are now in decline on the back of weak demand (spending). The German Federal Ministry for Economic Affairs and Energy released new data last week (August 6, 2014) – Entwicklung des Auftragseingangs in der Industrie im Berichtsmonat Juni 2014 – which indicated that:

1. Factory orders had slumped by 3.2 per cent in June (from May) and had fallen by 1.6 per cent in May (“im Juni preis-, kalender- und saisonbereinigt gegenüber dem Vormonat um 3,2 % zurückgegangen. Im Mai waren sie um 1,6 % gesunken”).

2. Capital goods (plant, machinery and equipment) were down by 6.4 per cent, reflecting the drop in the investment rate (“Von den geringen Großaufträgen waren insbesondere die Bestellungen für Investitionsgüter betroffen (-6,4 %)”).

3. The major decline in orders came from within the Eurozone where there was a decline of 10.4 per cent (see (AUFTRAGSEINGANG in der Industrie).

4. Demand for German capital goods from other Eurozone nations fell by an amazing 19.5 per cent in June 2014, signalling a major cutback in investment elsewhere in the Eurozone.

The following graph shows the monthly and annual change since January 2008 in the All Industries orders index produced by the BfWE (German Federal Ministry for Economic Affairs and Energy).

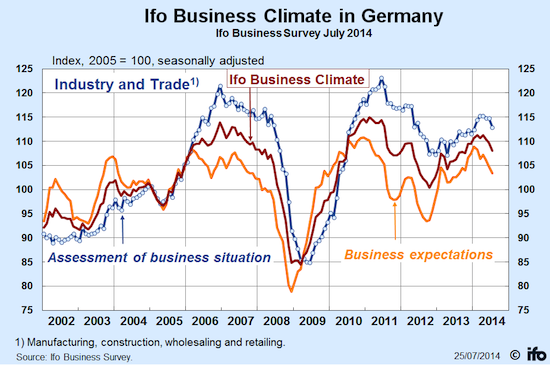

Germany’s – Ifo Business Sentiment Index – also fell in July from 109.0 points to 108.0 points. The press release said:

This marks the third decrease in succession. Assessments of the current business situation were less favourable than in June. Companies were also less optimistic about future business developments

The Ifo survey produced the following graph of the business climate in Germany.

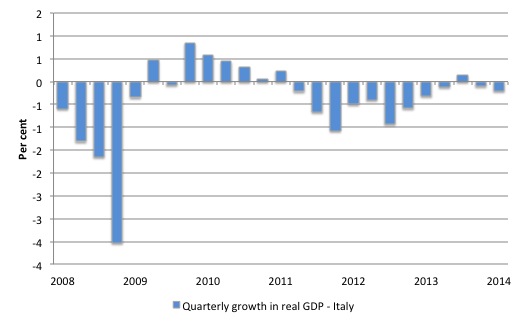

And then the big news came last Wednesday, when Istat.it (the central statistics office) published the – Preliminary estimate of GDP – II quarter 2014 – that revealed Italy was back in recession having endured a decline in real GDP of 0.2 per cent in the second-quarter 2014, which followed a decline of 0.1 per cent in the first-quarter 2014.

In the last 12 quarters, Italy has recorded on one quarter of positive growth, which was the fourth-quarter 2013 (0.1 per cent).

Over the year, the Italian economy has shrunk by 0.3 per cent.

Since March 2008, the Italian economy has shrunk by 9.1 per cent in real terms.

The estimates are preliminary and will be revised but that will not alter the message – Italy is faltering and its membership of the Eurozone is the direct cause.

The following graphs shows the growth in real GDP (quarterly) since June 2008 up until the June-quarter 2014. It is hardly an inspiring endorsement for Eurozone membership.

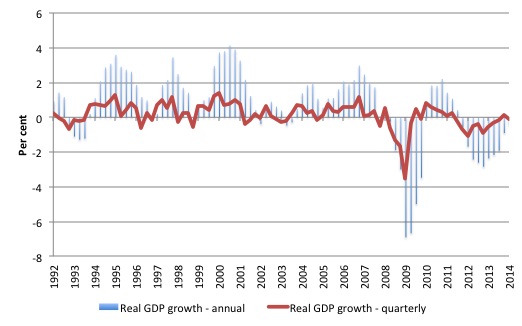

But you get a better idea from this longer series from March 1992 of what has been going on in Italy when its economy has been held in a vice like grip of fiscal austerity – first, with the convergence farce leading into Stage III entry (the final stage that launched the currency), the fiscal crisis in the early 2000s (when Germany and France flouted the Stability and Growth Pact rules), and then the GFC.

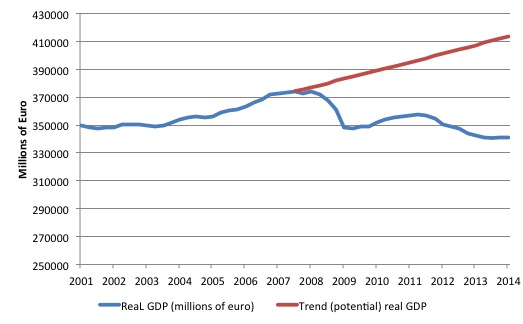

The average quarterly growth rate between June 2003 and the GDP peak in September 2007 was 0.4 per cent. If we extrapolate the real GDP series from that peak at that trend growth rate we get a graph like this, which shows the extended trend and the actual real GDP.

The gap between the extrapolated trend and actual, as at June 2014 is around 17 per cent. That means that if the Italian economy had have kept growing at that steady 0.4 per cent per quarter without the GFC and austerity interruptions, then it would be 17 per cent larger than it is now. That is a huge output gap and suggests there is massive scope for domestic fiscal expansion.

With the lengthy recession and decline in investment, it is highly likely that the red line is fictional and the potential GDP is somewhere below it, which just goes to show that the damage of the self-imposed austerity is greater than the lost current output and income.

In 1995, Reuters reported the Italian Labour and Welfare Minister Roberto Maroni as saying that Italy:

… should consider leaving the single currency and reintroducing the lira … [the euro was a] … disaster … [and] … has proved inadequate in the face of the economic slowdown, the loss of competitiveness and the job crisis … [he said that Italy should] …. to give control over the exchange rate back to the government …

It is a pity for the Italian workers and workers elsewhere in Europe that the Italian government didn’t take his advice.

It is also a pity that common sense came out of a right-wing nationalist (he is associated with the Lega Nord party) although the party is not easily stereotyped.

The most responsible strategy for Europe when the crisis hit, especially given its severity and the particular exposure of some European economies and banks, would have been for the Council to immediately suspend the SGP provisions and for the ECB to announce that they would support all necessary fiscal deficits to offset the private spending collapse.

The former decision could have been justified under the ‘exceptional and temporary’ circumstances provision of Article 126 of the TFEU relating to the EDP. It was clear that the situation was ‘exceptional’ and with appropriate policy action would have been ‘temporary’.

The Council had already demonstrated a considerable propensity to bend its own rules. The ECB could have immediately announced a program such as the Securities Markets Program (SMP) whereby they promised to buy up unlimited volumes of national government debt in the secondary markets.

If the SMP had been introduced in 2008 rather than 2010 and without the conditional austerity attached, things would have been much different.

No Treaty change would have been required for either of these ad hoc arrangements to be put in place.

While obviously inconsistent with the European Groupthink, these policy responses would have saved the Eurozone from the worst.

Fiscal deficits and public debt levels would have been much higher but, in return, there would have been minimal output and employment losses and private sector confidence would have returned fairly quickly. The response of the private bond markets would have been irrelevant.

The European policy makers did exactly the opposite and guaranteed the economic collapse would be deeper and longer than otherwise.

In a recent blog – Italy should lead the way out of the euro-zone – I concluded that the ECB should immediately introduce so-called – Overt Monetary Financiing – to facilitate a major increase in fiscal deficits without any further increase in public debt.

I would go further. The ECB should purchase all outstanding public debt in Europe and write-it off – that is, with a stroke of the keyboard delete it as an asset on its books. The capital loss would be immaterial as it issues the currency.

The Council should also scrap the Stability and Growth Pact and all its current incarnations (Fiscal Compact, 6 and 2-packs, etc). Instead, it should request nations submit plans for how they are going to achieve full employment and support those plans. End austerity, stimulate growth.

Dreaming!

Given the reality though, it is clear that the best thing for Italy to do is follow Roberto Maroni’s advice and exit the Eurozone.

Italy should use its place as third-largest economy in Europe to provide the exit blueprint that other Eurozone nations can follow without being bullied by the Troika.

Its intention to exit could not be ignored by the technocrats and conservatives. It could force Brussels to negotiate sensible redenomination rules to avoid lengthy legal challenges and it could immediately set about reversing the growth situation.

The decline in the second-quarter 2014 was mostly because exports have fallen. But with its own currency, it could rely on domestic spending growth for a return to stronger employment growth and lower unemployment.

It would not only restore its own prosperity but help the smaller nations like Greece, Portugal and Spain see a better path.

Conclusion

By restoring its own central bank functions, Italy could expand its fiscal deficit (targetted at job creation programs) and instruct the central bank to just credit bank accounts to facilitate this spending. That is, allow Overt Monetary Finance to accompany the fiscal stimulus.

It could ignore the ECB and the Troika, and redenominate all outstanding public debt in lira. No further public debt would need to be issued. The Banca d’Italia could progressively buy up all the outstanding debt and write it off.

The bond markets would have no influence on any of the future developments given the restoration of currency sovereignty and the OMF strategy of the government and its central bank.

My Eurozone book outlines in considerable detail how this exit strategy can work.

I urge progressive Italian politicians to introduce as their central mandate an exit plan.

That is enough for today!

Bill,

Your 3rd sentence set off alarm bells in my brain: “The book contends that the Eurozone is structurally biased towards stagnation because of the neo-liberal rules that constrain national governments from dealing with large spending collapses with appropriately scaled fiscal responses.”

If neo-liberalism is the central problem, then exiting the Euro won’t necessarily solve the problem because countries that have exited might be plagued with the same neo-liberal anti-deficit philosophy. Indeed, the UK, US and other monetarily sovereign countries suffer from a fair amount of the latter philosophy.

Strikes me the central and valid reason for exiting the Euro is the inherent problem of all common currencies, namely that given a loss of competitiveness by country X, that country has to endure years of deflation in order to get its costs and prices down, i.e. effect an internal devaluation.

Roberto Maroni said in 1995.. ? Is that correct, given the euro came in later than that.. Possibly should be 2005? –3 Jun 2005 – Roberto Maroni, Mr Berlusconi’s social security minister and a joint acting leader of … in London, one source said: “The European process should go on. … said that if Italy were to leave the euro zone, it would be committing .. —–

Ralph, No. Once more, you fail to see that the problem you cite has been overcome numerous times in history with the joining of almost any two tribes/regions/cities/states/nations. See. Australia! On-going federalism and sharing of resources for the mutual benefit of its citizens through redistribution from wealthier regions to the less well endowed. Or the USA, where the entire nation is funded by California, texas and parts of the north east. Or the UK, or Germany, or etc etc etc.

This does bring me to where Bills point could actually be contended, which is to say that the eurozone COULD recover, if full fiscal federalism were brought about and democratic principles were obeyed by those running this bastardised empire. However it seems unlikely and if I were an Italian I would be advocating the position of this blog to my ‘ragged trousered’ contemporaries.

Dear Bill

Let me briefly make 2 comments.

1 – There is no magic to zero. To go from 1.5% inflation to 0.5% inflation should have the same effect as to go from 0.5% inflation to 0.5% deflation.

2 – The postponement effect of deflation should be negligible at low levels. Suppose that inflation is 2.4% a year. Then it is 0.02% a month. This means that, if an item costs 100 on 15/01, it will cost 99.98 on 15/02. Is someone going to wait a month just to save 20 cents? I doubt it.

Regards. James

James,

It may not be magic, but there is something special about zero. It’s the figure above which banknotes under the provebial mattress lose their value, and below which, cause them to gain in value. The same applies to money in all accounts which don’t pay interest.

There’s also the nature of human psychology to consider. If prices are falling then workers may well be asked to take a pay cut. Most workers would be unhappy to accept that, even though their pay may be the same in real terms. They’d be happier to not have a pay rise if inflation was say 1% which actually meant lower pay in real terms.

Interesting post as usual, but I agree with James about the postponement effect.

Claiming that people will postpone their purchases because the price of the goods/services will be a tad lower next year reminds me very much of the ‘rational agent’ hypothesis.

Surely deflation is a good thing if debt contracts are wiped out and a capital ration is given to each person.

As for capital goods……

Capital goods have been coming out of the EU wazoo since then very beginning.

Europeans work for the machines rather then the machines working for them….

Bill is merely calling for another bout of capitalistic overproduction but within national borders.

It would be a nicer place then current euroland but not by a whole lot.

A greater rejection of the American century is needed if Europe is to become Europe again. (Aka pre 19th century and the dastardly sov bond market imposed on it by the victorious bankers of London)

CH Douglas speaking in 1941

The present war, and

the obliteration of nationalities, the talk of Federal Unions and the United States of Europe, a

purely Masonic conception, are all directed to that end. That is to say, war provides the

opportunity, perhaps the necessity, for conditions of existence in which the individual is wholly

at the mercy of institutions, and those institutions are ultimately controlled by an international

junta.

To say that the present crisis is adventitious – that it “just happened” and that everyone did

their best to avoid it, seems to me to be merely perverse.

The major strategy was simple, if grandiose. You bring about a state of affairs in which

International Finance controls trade, industry, and distribution, and would have no check on its

extortions but for private enterprise. You bring about, as in 1928, major depressions and crises,

and when you have intolerable conditions, as in Germany and the Distressed (Pardon me,

Special) Areas, you say nothing can be done about it because there’s no money.

When these conditions inevitably bring about war, you say War is the major evil of the world

and comes from “private enterprise”; you spend eleven million pounds a day in pure

destruction when you were unable to spend eleven million pounds a month for constructive

purposes; and you set every available type of propaganda to work to advocate that the affairs of

the whole world shall be finally and irrevocably handed over to a monopoly of the powers

operating through finance and subterranean intrigue, so that effective revolt becomes forever

impossible”

We are dealing with a pox of unimaginable scale and demonic intensity.

And……

“Secret Societies all follow the same pattern. Hence the vigorous and entirely sincere and in his case,

justified claim made by the ordinary Freemason, in England, that there is no politics in Freemasonry.

In 1852, Disraeli wrote:

It was neither parliaments nor populations, nor the course of nature, nor the course of events,

that overthrew the throne of Louis Phillippe . . . the throne was surprised by the Secret

Societies, ever prepared to ravage Europe.

– Lord George Bentinck, p. 552.

Whether Disraeli told all he knew, is something else, again.”

“The problem is simply this. Is it true, as has been stated in many well informed quarters, that all

visible Governments are mere executives of a dictated policy? If that is so, then the Dictators

of this policy are the Arch Criminals for whom we are looking, and are responsible for the

misery of the ages. And our task is to find a method by which the War can be turned upon its

Authors.

Before leaving this aspect of the matter, I may perhaps introduce a personal experience.

Some years ago, certain financial proposals I had made were put before a British Cabinet

Minister of the inner ring, by an influential intermediary. The reply received, of which I have

an extract, was: “Whether Major Douglas’s proposal is sound in theory, I do not know. It is a

matter of little consequence. I can assure you that no British Government would remain in

Office for three weeks, if it attempted to put it into practice”.

Nevertheless, as I have suggested, I believe that it was the fear of British revolt against this

Occult Power which produced a decision to confront us “with war, or the threat of war”.

We have chosen war.”

CH Douglas 1941

Dork : again the inner power has chosen war over the truth………

The Dork of Cork,

“Bill is merely calling for another bout of capitalistic overproduction …”

As I understand it MMT doesn’t use the Marxist phrase “overproduction”, instead it sees the problem as a lack of demand which can be offset by larger fiscal deficits. Overproduction only occurs when governments do not support demand for the goods and services currently being produced.

Where a demand is less than supply in an economy, and where there is an output gap, an increase in spending generates an increase in output (poduction), as firms match the increases in demand with increases in supply.

Kind Regards

@Charles J

Perhaps I do Douglas a disservice by speaking in marxist terms as I am but a Dork

Let the man speak for himself.

CH Douglas speaking in 1942.

Exchange or Distribution

Question.-Is the correct object of the monetary system to facilitate the interchange of goods and

services?

Answer.-The modern productive system does not primarily involve interchange of goods and

services. The fundamental factor in production is power-driven machinery, and you cannot

exchange services between power-driven machinery. That is why it is incorrect to say that money

is, primarily, a medium of exchange. Money is primarily a demand system, so that the individual

can demand from the productive system those things which he does himself contribute to it.

The Object of Industry

Question.-Would Social Credit increase employment at first?

Answer.-Yes-although of course, it is not our objective to provide employment-I think that

for a short time probably there would be increased employment.

What certainly would happen quickly would be a complete difference of emphasis on what is

produced. Without going into technicalities, I want to stress this point. We are often told that it is

obviously absurd to say that the financial system does not distribute sufficient purchasing power

to buy the goods that are for sale. We never said it! What we do say is that, under the present

monetary system, in order to have sufficient purchasing power to distribute goods for

consumption, it is necessary to make a disproportionate amount of capital goods and goods for

export.

Sweden is held up as a wonderful example of how well the monetary system can work. Sweden

is producing about three times as much as she is actually consuming, but owing to vagaries of

exchange she is able to export the remaining two-thirds. She has to take three times as much

trouble as is really necessary in order to make the monetary system work.

Whoever owns the largest stock of debt wins during war mobilization me thinks.

Correct me if I am wrong but when HMT printed those 10 shilling notes and stuff the BOE bought the stock at interest – thus insuring the continuation of the concentration of power.

The Treasury and bank became as one – and we all lived happily ever after……………..

I would suggest the big difference between MMT and Social credit is the ultimate nature of the goods produced as the demand signal is so very different.

TDC

“…so that the individual can demand from the productive system those things which he does himself contribute to it. etc”

I interpret that to mean that “the correct object of the monetary system” is no to just intechange goods and services but also to produce those that we need in the first place. No argument there.

“it is necessary to make a disproportionate amount of capital goods and goods for

export.”

The proper purpose of those capital goods is to ensue we can collectively make more or better goods/services with less effort, and so improve our standard of living. If financial interests (financial capital makets etc) hijack that system for their own ends and at wider society’s cost, then those practices needs to be regulated or made illegal.

As for exports, MMT does not say that ever large exports are necessary. Govenment can always offset a net-import position by running a larger fiscal deficit and spending it in the right ways. It can issue government bonds to match that deficit or not. Either way it can always run that larger fiscal deficit if it is required to fill an output gap.

Kind Regards

The Dork or Cork,

Just for the record, I do not oppose some fom of social credit (or universal credit) system. With one, or without one there are plenty of jobs which need doing in the economy (which machines and computers cannot do), and plenty of unemployed or underemployed persons available to do them. If the private sector will not provide these services and hire these people, then government should do so with a Job Guarantee.

Kind Regards

@CharlesJ#

“If financial interests hijack that system”

Listen charlie my boy – you need a crash course history lesson.

You have got the image of the entire trajecory back to front.

The bankers use MMT to save their claims – the normal course of extraction can thus continue between the wars.

Every 100 years ago the UK authorties go to war to save their sorry asses and on the + side it further concentrates their power over us .

Look at the Great Tommie Weirs series on utube – in particular the Money in Muck (Isle of Muck) where people were used for domestic war production (sea weed – ash – gun powder) during the Napoleonic Wars

One must always look at the micro to understand the macro.

You must get down into the ditches and avoid the compromised academic slurry production.

The Dork of Cork,

“Every 100 years ago the UK authorties go to war to save their sorry asses and on the + side it further concentrates their power over us .”

Certainly during the times of the great royal families and nobilities across Europe that was true. Then as that age started to fade, those who replaced them (WW2) took over that role to some extent, right up to the present day with wars in the middle-east etc. These things are seperate from MMT in the sense that MMT is not a description of everything.

Much of what you say seems right to me with regard to the historical context, which is why I always read your comments.

I understand now what you meant by “overproduction” – presumably driven by a high concentration of capital etc – but most people mean something else by that.

Kind Regards

TDC,

“One must always look at the micro to understand the macro.”

I would say:

“One must always look at the macro to understand the micro.

I would also say:

“One must always look at the “real” to understand the “nominal”.

As MMT says that government net-spending is only limited by the amount of “real” goods and services for sale in the currency of issue.

@Charles

Every hundred 100 or so………..

The people from Muck were posted off to Canada after the war as the banking system scaled up.

The war is over……..get the F$£K out.

What was this national thingy you were taking about again… ??? – A fiction.

“Certainly during the times of the great royal families and nobilities across Europe”

Again I read it differently

The English civil war and all that other Jazz from that period was about the divine right of Kings vs the divine tight of the money power disguised by the oligarchy of Parliament and their talk of “democracy”

Any King after that was no longer King – he also served the banks as he depended on a yield from the banks assets.

Things can get a little confused ……..think of a cockney (Micheal Cane) playing a wonderful Alan Breck

The best film adaption of Kidnapped (1971) ever put on screen in my humble opinion.

But when David Balfour walks into Lord Grant, Lord Advocate room ( Trevor Howard)………..the simple man gets a wonderful explanation of whats what…………The Nation (The Bank) always usurps the individuals perceived rights.

“The layperson often thinks that falling price levels are a good thing. But the reality is that deflation is incredibly damaging to an economy.”

Exactly, Bill. It’s always a simple, perverse, instance of withholding public initiative (aka, current fiat) … which incontrovertibly decreases the options that could have been accessible to our grandchildren.

Cultural suicide, by any other name.

oops, forgot to add a link to that last comment

http://mikenormaneconomics.blogspot.com/2013/12/conflating-current-fiat-with-future.html

My problems with MMT are two-fold. One, it does not go far enough on the issue of ownership. The problem with our capitalist system is the ownership of the means of production by a tiny wealthy minority. This oligarchic group runs our society for its benefit alone. They have captured and suborned our governments and our governments act only in the interests of these capitalists (with a few populist policies and some bread and circuses thrown in to appease the masses and keep them compliant). The policies that MMT-ers or even Keynesians want will never be enacted under this ownership system. Until we change that system, we will change nothing substantive.

Two, MMT needs to take cognizance of the fact that we have hit the limits to growth. In fact, we have overshot the capacity of the earth to sustain the current population at the current living standards. Overshoot is possible, of course, because we are living on and destroying natural capital (stocks) not just living on natural income (flows that are sustainable and renewable). Stimulus of more of the same kind of aggregate demand that capitalism specialises in (unsustainable production of wasteful consumer junk) will be even more damaging long term than the austerity and stagnation which actually slow a little our destruction of the biosphere.

The entire economy must be profundly reformed to be (i) owned by the workers and (ii) produce the new sustainable and renewable infrastructure required as a priority above all other production.

I’m European, (Spaniard), so I believe I’m some things to say about. Bill Mitchell is completely right about all he say about the euro and ECB. Spain had the lower rate pot debt/GDP before the crisis: 37%. Now it is around 138% and rising. The strategy for reducing debt has been a complete mistake -as Bill says: increase your primary surplus. The consequences have been a huge growth in rate of debts and in unemployment rate.

I’m with Ralph Musgrave on this one, but I’ll go further: if the ECB were doing its job properly, the Euro would be a good thing. Having banks skimming money off nearly all cross border transactions is an impediment to trade that Europe’s better off without. Most of the problems the Euro’s caused can be solved by letting Eurozone governments borrow from the ECB.

(And yes, of course I know the reasons they don’t are mostly political.)

Surely deflation is a good thing if debt contracts are wiped out and a capital ration is given to each person..

That’s always been your problem, Dork. There’s no assumption too unrealistic for you to make, but that’s par for the course with ideologically driven Marxians.

ideologically driven Marxians. ?????

Thats news to me.

Where have I used the terms proletariat , class struggle , labour value…….etc etc etc.

Capital is now very distinct from labour – labour in the modern world has little value – at least for this moment in time)

I am not materialist in the main (but do hold a affection for hand crafted Tele Vue refractor telescopes of New York which I understand as the product of very good advertising combined with great ergonomics)

I mean WTF are you saying ?

I am talking New testament man.

The loaves and the fishes

Water into Wine.

I ain’t no Marxist.

@BEN

Capitalistic decadence combined with simplicity of design

The TV 102

– now out of production because it was not complex enough and therefore could not make a profit in todays monetary ecosystem.

http://www.scopereviews.com/page1k.html#2

“I’ve often wondered in the past if there was an informal competition

among TeleVue designers to see who could cram the most lenses into their

products (JUST kidding, Al…) Open case and you’ll be surprised as well.

Where’s all the…all the…STUFF that usually comes with a TeleVue scope?

There’s no diagonal, no eyepiece, no finder, no tube ring even. Call it the

Zen of Al Nagler.

(OR BUY MORE STUFF)

I’ll risk World War III by saying this, but I think the simpler doublets in the

TeleVue 85 and this TV102 are consistently sharper, clearer, and more

contrasty than the more complex four-element-in-two-groups systems in

the TV101/Renaissance duo (and the old Genesis sdf.)”

(NO NEED TO ADD FURTHER VALUE , FURTHER VALUE ADDED IS POINTLESS AND INDEED DEGRADES PERFORMANCE)

Welcome to the western world.

Wow! Too much sophisticated conspiracy.

“The best film adaption of Kidnapped (1971) ever put on screen.

Glad to see the issue of pirates brought up.

I think we are dealing with pirates and robber barons.

Off with their heads.

Agree completely bill – look forward to the book

@Mick StJohn

You don’t know much of anything really – most of all Scotland. ……the novel or film for that matter had little to do with pirates really.

EBENEZER BALFOUR (imagine Donald Pleasance) was completly corrupted by money and the hoarding of it – perhaps at first it was not his fault – perhaps money became scarce at one point in his life as was likely to happen in a country full of money changers.

Anyhow he betrayed his family for the love of it and only at his death bed did he realize the true wealth he lost in his life)

Anybody who knows the scottish character is aware of his tightness in almost all situations but also his strange keeness to blow it all in one go as the psychological stress of it all becomes just too much.

This is a product of the intense usuary common in that wet cold place since the middle ages.

Sometimes the truth resides in the telling of it and not cold hard facts presented without context.