The other day I was asked whether I was happy that the US President was…

Ireland national accounts and inversion

Apparently, the mangy cat that was the Celtic Tiger is about to become the Celtic Tiger again. One of many reports that suggest Ireland is about to have a “here we go again” boom – The mauled Celtic Tiger is ready to roar again (UK Telegaph, July 5, 2014) – claimed last week that while “few Western nations suffered more than Ireland” as the GFC unfolded, it is now “perhaps” about “to stage a convincing recovery”. This statement followed the release of the “latest GDP rebound, driven by a 1.8pc rise in exports over the first quarter and an inventory turnaround”. I am not yet convinced nor should I say was the journalist in question. The so-called recovery is very tentative and domestic demand remains weak. Further, as before the crisis, a substantial portion of the growth is being repatriated offshore to foreign owners of capital. Moreover, a new phenomenon has crept into the picture – the so-called ‘tax inversion’, which makes it harder to disentangle what is actually happening with the Irish National Accounts.

Last week (July 3, 2014), the Irish Central Statistics Office (CSO) released the – Quarterly National Accounts, Quarter 1 2014 -which showed that real GDP grew by 2.7 per cent (Q4 2013 to Q1 2014), while Gross National Product (GNP) grew by 0.5 per cent.

That result tells us two things:

1. There was solid real GDP growth in the first-quarter 2014.

2. Most of the benefits did not flow to the Irish, given that GNP growth was very modest (see below for more explanation).

The CSO reports that:

Net exports made a positive contribution of €541m in volume terms on a seasonally adjusted basis between Q1 2014 and Q4 2013. Personal expenditure was largely unchanged, declining by 0.1 per cent. Capital Investment … decreased by 8.1 per cent. Government expenditure also decreased by 2.1 per cent.

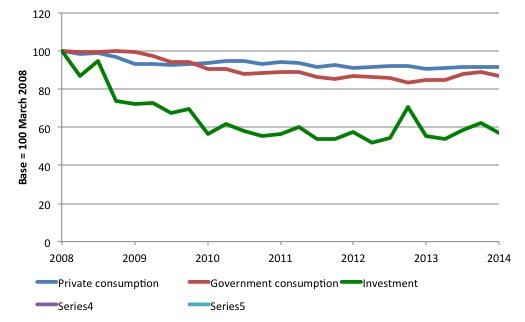

Consider the following graph which shows the evolution of personal consumption, government consumption and investment (indexed at 100 in the March 2008 quarter peak) to the March-quarter 2014.

Investment now has an index number of 57 compared to 100 in the peak quarter March 2008, indicating a massive drop. Both public and private spending are still well below the peaks before the crisis began.

In other words, after six years of crisis, the domestic economy is still no where near its previous peak. The related index number for domestic demand in the March-quarter 2014 is 80.3 (compared to 100 at the peak), which means it has fallen by around 20 percentage points since the March-quarter 2008.

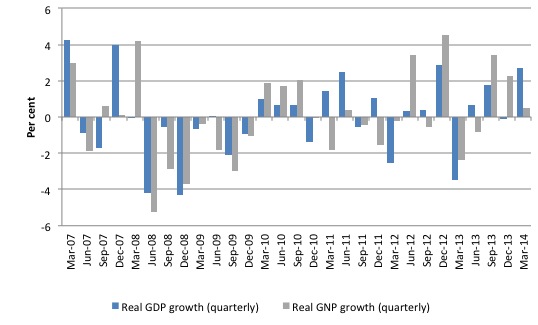

The following graph shows quarterly growth rates in real Gross Domestic Product (GDP) and Gross National Product (GNP) from the first quarter 2007 to the March-quarter 2014. Real GDP grew strongly in the first-quarter 2014 on the back of export growth, which ties Ireland’s prospects to the growth in the world economy.

However, real Gross National Product (GNP) barely grew in the March-quarter 2014, an increase on the estimated 0.5 per cent growth in the December-quarter 2012.

What does that mean?

First, one needs understand the difference between GDP and GNP. This is a particularly important point when it comes to understanding the Irish predicament (both before the crisis and now).

You can gain a thorough understanding of these concepts from this excellent publication from the Australian Bureau of Statistics – Australian National Accounts: Concepts, Sources and Methods, 2000

The two concepts are defined as such:

- Gross domestic product (GDP) is defined as the market value of all final goods and services produced in a country in any given period”.

- Gross National Product (GNP) is defined as the market value of all goods and services produced in any given period by labour and property supplied by the residents of a country.

The Irish CSO publication says that GNP = GDP + Net factor income from the rest of the world (NFI). NFI is defined as:

Net factor income from the rest of the world (NFI) is the difference between investment income (interest, profits etc.,) and labour income earned abroad by Irish resident persons and companies (inflows) and similar incomes earned in Ireland by non-residents (outflows).

In this blog – The sick Celtic Tiger getting sicker – I argued that the so-called “Celtic Tiger” growth miracle was an illusion and was driven by major US corporations evading US tax liabilities by exploiting massive tax breaks supplied to them by the Irish government.

In a New York Times article (May 20, 2010) – Irish Miracle – or Mirage? – by Peter Boone and Simon Johnson, we read that:

… 20 percent of Irish gross domestic product is actually “profit transfers” that raise little tax for Ireland and are owned by foreign companies – the Irish miracle was a mirage driven by clever use of tax-haven rules and a huge credit boom that permitted real estate prices and construction to grow quickly before declining ever more rapidly. The biggest banks grew to have assets twice the size of official G.D.P. when they essentially failed in 2008.

In relation to the rise in real GNP, the CSO have previously told journalists that the “increase should be treated with caution as it represented profit inflows into Ireland from overseas subsidiaries of companies that had set up headquarters in the country” (Source).

In other words, we cannot interpret that as a bonus for the Irish people (more on this below).

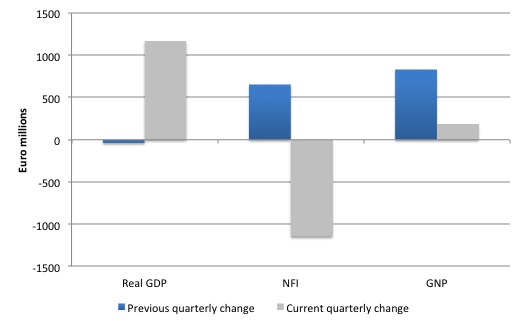

The following graph shows the changes (in millions of Euros) for the December-quarter 2013 and the March-quarter 2014 in real GDP, GNP and NFI. The data tells us that the return to growth in Ireland in the March-quarter was of little benefit in income flows to the Irish people.

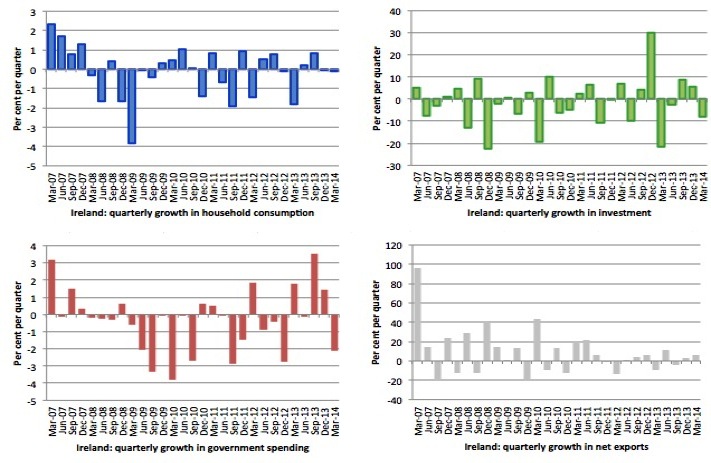

The following graph shows the quarterly growth in the major spending aggregates since the downturn took hold in Ireland (March quarter 2007).

On a quarter-by-quarter basis, personal consumption growth has declined for the last two quarters and remains well below its pre-austerity levels. There is no revival evident in private consumption expenditure.

All those Ricardian Equivalence arguments that claimed there would be a surge of private consumption once the austerity was invoked would seem to be silent well and truly now.

Government consumption spending growth picked up in the latter half of last year but dropped by 2.1 per cent in the March-2014 quarter.

Private investment (capital formation) fell dramatically in the March-quarter by 8.1 per cent.

The behaviour of investment expenditure shown is sensitive to large lumpy items (especially in an economy the size of Ireland). For example in 2012, there were large airline purchases by leasing companies which use Dublin as a tax haven. Overall, there is no sign of a major investment-led recovery about to swamp Ireland anytime soon.

Ireland’s growth strategy has been based on increasing exports of real goods and services which are a cost to the domestic economy (forgoing local use).

Further, in the current-quarter the growth dividend expatriated to foreigners rose sharply.

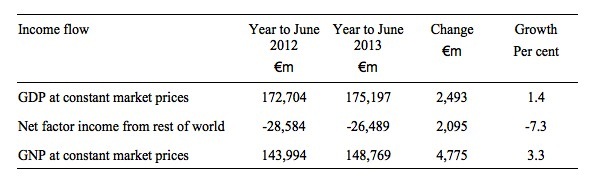

The following Table provides a longer view to see beyond the volatility of the sometimes large capital flows which occur given that there are some very large companies sheltering in the a relatively small nation.

The Table compares real GDP, NFI and GNP for the 12 months to March 2013 with the 12 months to March 2014.

Real GDP rose by 1.4 per cent over the last 12 months compared to the previous 12 month period, while real GNP grew by 3.3 per cent over the same period. Net factor income to foreigners fell by 7.3 per cent over the last 12 months compared to the previous 12 months but as we will see, lying under the GNP figures is an increasingly disturbing trend.

Tax inversions

The New York Times article last week (June 30, 2014) – At Walgreen, Renouncing Corporate Citizenship – discussed the case of a Walgreen executive claiming that his company was “proud of our Illinois heritage” as the US state had given it huge company tax credits over the last decade, but was negotiating at the time to become a Swiss company to lower its “tax bill even further”.

This is all about so-called ‘tax inversion’, which the New York Times says is an “increasingly popular tax-skirting tactic”:

Under the strategy, companies merge with foreign rivals in countries with lower tax rates and then reincorporate there while still enjoying the benefits of doing a large part of their business in the United States. AbbVie, a drug company spun off from Abbott Laboratories, is in talks to merge with its rival Shire, based in Ireland, Europe’s equivalent of a tax haven. Medtronic announced plans to merge with Covidien, also based in Ireland.

The San Francisco Chronicle article last week (June 30, 2014) – Walgreens may be next big firm to ‘move’ overseas wrote:

Seagate Technology, inventor of 5.25-inch hard disc drive, is a Silicon Valley company, right? Er, no, actually it’s Irish.

Jazz Pharmaceuticals, the Palo Alto developer of a host of new drugs, is also an Irish company.

All … have undergone a “corporate inversion,” also known as a “tax inversion,” whereby a business acquires an overseas company, switches official tax domicile to the overseas country, and – voila! – no more U.S. taxes on overseas earnings.

The SFGate article also notes that one of Walgreen’s shareholders “Goldman Sachs … [is] … reportedly pushing hard for Walgreens to change its country of citizenship”. Of-course.

The Wall Street Journal article (June 19, 2014) – Medtronic’s Tax Inversion: Not as Easy as It Seems – provides further useful information.

So tax inversion just means that a US corporate group its head office (top holding company) in a foreign land and avoid paying US taxes.

Ireland just happens to be one of the preferred destinations for these company transformations because of the low company tax rates and the lax compliance costs.

To comply with Irish law such a company either has to have a lot of business in Ireland (called ‘self inversions’) or has to merge with (acquire, take-over) an Irish company and then situate the head office of the merged entity in Ireland (these are called ‘deal inversions’).

The vast majority are ‘deal inversions’. There are rules in the US and Ireland to limit this activity but they are easily evaded.

Satisfying the rules about having a head office in Ireland amounts to not much more than the executives swanning (or should I say jetting) into Ireland for board meetings of the company on some regular basis.

You can easily see how this increasing practice undermines the basis of the Irish National Accounts. We have already seen that for Ireland, real GDP growth is likely to seriously overstate the strength of the Irish economy.

Inversions also make GNP a difficult measure to interpret. The difference between GDP and GNP is obvious and is mainly due to the profits of multinational companies (head offices elsewhere) operating in the Irish economy being repatriated back to the foreign entity.

But the inverted companies are actually channeling their ‘income’ through the Irish National Accounts to avoid it being taxed in the US.

The matter is dealt with in the Economic and Social Research Institute’s Research Note 2013/1/2 – The Effect of Redomiciled Plcs on GNP and the Irish Balance of Payments.

The author John FitzGerald notes that the “redomiciled plcs, hold major investments elsewhere in the world but they have established a legal presence in Ireland”. The companies:

… receive large profits in Ireland, because they are head quartered here, they pay out only some of these profits to their shareholders abroad when they declare a dividend. The retained earnings in Ireland enhance the value of the companies.

But:

… the benefits of the retained profits of redomiciled plcs are attributed to their foreign owners – there is no benefit to the Irish economy.

And:

Nonetheless, this has the effect of raising the measured current account surplus in the Balance of Payments and increasing the level of nominal GNP arising in Ireland.

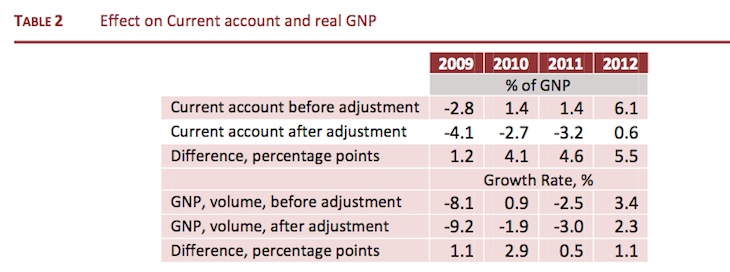

FitzGerald’s research shows that the undistributed profits for the inverted companies are a significant portion of GNP. He produced the following Table (Table 2) to show the impact on the various growth rates and aggregates between 2009 and 2012.

So by discount GNP for these income flows, growth in real GNP in say 2012 would be 1.1 percentage points lower than was stated.

Conclusion

I didn’t have time to analyse the Irish labour market for this blog – the story remains bleak even though the unemployment rate has eased a little on the back of growth. Further, the net outflow of skilled labour continues, which combined with the poor investment performance will limit the prosperity of the Irish economy in the future.

In this blog from July 2010 – The Celtic Tiger is not a good example – I noted that Ireland’s growth was coming from the modest growth in the US economy. As the Euro depreciated against the US dollar, Ireland’s exports (pharmaceuticals, software, food and services) had become increasingly cheaper and more attractive to its two major trading partners Britain and the US.

Exports were driving Ireland’s growth then and the current growth is also being driven by exports.

The fiscal austerity has undermined domestic growth and with investment so flat (or falling) the future growth potential will be limited.

The UK Telegraph article (cited at the outset) reminds us that “Household debt remains twice as big as annual Irish GDP. Mortgages in six-month arrears are close to 20pc. House prices have lately picked up, at least in Dublin – but remain 45pc below their 2007 peak.”

Some 6 years after the crisis began – is this really the sort of data one would use to demonstrate the success of the EMU and fiscal austerity? One would have to be pretty perverse to think so.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

I can’t see how Bill is surprised.

The banks are engaged in the oldest trick in their very large books.

Expecting repayment of their loans via limited circulating money thus destroying all rational domestic exchange as Ireland is forced to export so as to gain access to currency.

http://www.centralbank.ie/press-area/press-releases/Pages/MoneyBankingStatisticMay2014.aspx

After the 2008 crisis the UK and other financial centers began to choose real goods rather then income from their credit hyperinflaionary policies

This can clearly be seen in recent UKs balance of payments stats.

Ireland & other european countries is the mirror image of such events.

Ireland is in the 1820s phase of collapse

Its moving out of the banking crisis period and into the famine stage of development.

Also Ireland is perhaps a obsolete political and social construct now.

As always its people (other then the cabal who run ireland from the Pale) have no control over their money but also now we have no control over the physical realm via the use of various laws via Europe which promote even further scarcity.

The majority of the young workforce is not Irish and as soon as the current irish 40 somethings die off it will no longer be irish in any real meaning of the term.

We need to look at another name for this island conduit.

Any suggestions ?

A country not in control of its currency but in control of its borders and domestic banking would not allow a little credit sensitive car boom to develop via the car giants / free banks issuing credit poison.

vlftm/vehicleslicensedforthefirsttimejune2014/

This is the source of Irelands current mini boom.

However Ireland has accepted it must be pushed forever into physical surplus so that the countries which orbit closely the banks can remain in defecit.

The recent stabilzation of Irelands oil consumption comes at a cost.

The destruction of basic domestic services such as health.

We live within a very weird health fascist system which is in fact a mercantile system using various laws to keep its dastardly system alive.

People must spend vast amounts of money to repair their old cars so as to conform to European car safety laws while their health system gets picked apart.

European car safety laws purpose is not to save lives – its to force people to buy new cars.

These safely laws perhaps save 50 people a year at the most but at a huge cost.

The money spent on keeping your car up to european standards would save many thousands of people in the health system.

The purose of the laws coming from the european market state have a very different purpose from what it say on the tin.

Dear Bill

Countries, like Ireland, which design tax laws in such way that foreign companies will declare most of their income there are not really doing much for their own population, but they are undermining the fiscal policies of other countries. In my view, the US is perfectly entitled to punish Ireland through special tariffs on Irish imports. That should be a general rule: impose high tariffs on the goods of countries that decide to become tax havens.

Regards. James

Irelands diesel consumption has now returned to near 2011 levels.

http://omrpublic.iea.org/demand/ir_dl_ov.pdf

This can be simply explained.

The neo liberal government impose a artificial scarcity of a product onto its people.

Lets use the more obvious example of water and a tax on it to prevent “waste”

Ireland is now becoming much like the Australian outback it seems.

System mamagers fill this new niche of non problems to solve.

They have cash flow and now can be given credit by the car / banking scarcity engine.

Hey presto – we never can consume basic products as a smaller and smaller segment of society gain acccess to brand new “super efficient” European cars who burn any Industrial surplus before it can be used by the general mass of population.

This is a real world manifestation of concentration of capital using the mechanism of scarcity.