Well my holiday is over. Not that I had one! This morning we submitted the…

Australian fiscal statement – attacks the weakest and will undermine prosperity overall

The Australia government released its annual fiscal statement (aka ‘The Budget’) last night and I admit it is the first time in many years (as long as I can remember) that I haven’t actually listened to the speech. Granted at times when I have lived abroad I missed it. But usually I watch or listen to it if I can. Last night I just could not bring myself to listen to the hubris. The build up has been too much. Australia, despite our pretensions to being the ‘clever’ country, despite our high literacy rates, despite being among the wealthiest nations in the world, is a highly ignorant nation. We allow a fool (the Treasurer) to wheel out a catalogue of lies and half-truths before us every day without stopping for a second to question them. This fiscal statement is harsh, will deliberately undermine the well-being of our weakest citizens, will damage our position in the region (cutting foreign aid) and for no reason other than the government wants to hand over real income to the corporate elites at the expense of almost everyone else. When the spending cuts and tax hikes finally come into play, they will damage the prosperity of our nation. That is much more important than the media flurry about whether the Government has broken its promise not to introduce higher taxes. Of-course they broke their promises. They always do. But we should not accept actions that undermine our welfare. That is more important.

The overwhelming emphasis among those attacking the fiscal statement has been on equity issues – that is, who is bearing the burden etc. These issues deserve mention but they should not be the starting point. The first thing a fiscal stance should address is not who gets what and who bears the cost. Rather it is whether the net spending position adopted by the government is appropriate for the net spending position taken by the non-government sector, which includes households, firms and the external sector.

That is, the fiscal statement is primarily about macroeconomics – what is the state of the overall economy? Is there an output gap? Is unemployment rising or falling? What is happening to inflation? These questions relate to interrelated aggregates.

On equity matters – the fiscal statement is a disaster if you care about the weakest people in society. It not only punishes the weakest Australians but also foreshadows are harsh cutback in foreign aid – so as one of the wealthiest nations in the world we are now deliberately reducing the support we give the poorest nations in our region. Our record on foreign aid is already appalling and we are in constant default on our international obligations (in UN treaties) in this respect. This fiscal change will just elevate our pariah status. Shame is deep.

The unemployed will find no joy. Instead of creating jobs the government has decided to make it hard to receive the below-poverty line income support that the unemployment have to live on. Young unemployed Australians will now be denied any income support for lengthy periods and in between have to submit to pernicious activity tests.

The government is hacking $A80 billion out of education and health. The future will only be better if we are better educated and healthier. The government seems to ignore that.

There are so many little mean-spirited things in the fiscal statement that I will leave it to you to ferret them out and be angry about.

In terms of its macroeconomics qualifications I have listed a few facts (with graphs for those that prefer to learn that way) as context. To understand why context matters, please read the following blog – MMT Budgetary principles.

There you will see that a responsible fiscal policy requires two conditions be fulfilled:

1. The discretionary fiscal position (deficit or surplus) must fill the gap between the non-government saving minus investment minus the gap between exports minus imports.

2. When filling that gap, the government has to ensure that the non-government saving, import and investment levels are at their full employment levels.

These conditions specify a strict discipline on fiscal policy if the aim is to achieve full employment. The 2014-15 Budget fails badly when judged against these conditions. It doesn’t even consider them.

Not many other commentators seem to understand them either. The other day, there was a ‘market economist’, the type the national public broadcaster features every day as their spokespersons on the economy, raving on about the imperative to get back into surplus as soon as possible. The obvious question that the journalist should have asked is “Can you explain why we have to get back into surplus?”. Not once have I heard a journalist ask that question. It is just taken as given. That has been the standard of the debate.

There are also commentators continually raving on about the need to ‘repair the budget’. National broadcast anchors in the morning the other day were concentrating on the alleged ‘need to fix the budget’. And so it goes on – there is no meaning in the terminology – repair, deterioration, fix – when applied to the federal government fiscal balance.

Deterioration means a worsening. A government balance cannot become worse or better – it is what it is. Employment growth or unemployment – things that matter – can deteriorate and that would present a problem. But a rising government deficit is of no concern in its own right. We should understand it in the context of other events in the economy which matter – in that sense, the shifts in the fiscal position are reflective rather than being intrinsically interesting.

Further how can we view a rising deficit as a deterioration when it is clearly providing spending support for some growth?

The chief economist at Fairfax newspapers, Ross Gittins excelled today. He has taken to giving out university ‘grades’ for the fiscal performance of the government. In today’s assessment – Federal Budget 2014: Tough and unfair, it’s business as usual – Ross Gittins gave this government’s:

… first budgetary exam a distinction on management of the macro economy, a credit on micro-economic reform and a fail on fairness.

A distinction means the student has done very well. It seems that the Gittin’s College or whatever it is is following the general trend in education as funds are squeezed – the race to the bottom of the standards. I would advise no-one to enrol in his courses.

The unfortunate thing is that Ross Gittins occupies a very powerful position in Australian life. He gets to be read by a national audience at least twice a week in all the Fairfax newspapers and there is very little alternative comment ever permitted. People complain about the Murdoch News Limited press coverage. Well with guys like Ross Gittins the rival Fairfax press is not much better. A little less strident and obvious perhaps but in macroeconomic content mostly appalling.

Ross Gittins justified his distinction grade for macroeconomic performance of the fiscal statement with this logic:

Labor supporters want to believe that because Hockey and Tony Abbott are exaggerating about a ”budget emergency” and ”tsunami of government spending”, we don’t really have a problem. They are refusing to face reality.

After running budget deficits for six years in a row, we faced the prospect of at least another decade of deficits unless Hockey took steps to bring government spending and revenue back together. Failure to make tough decisions wouldn’t have turned us into Greece, but since when was that the most we aspired to?

We can disregard the snipe about Greece. The only thing that most of Australia shares with Greece is the Meditteranean climate in some regions and the fact that Melbourne is the second largest Greek speaking city in the world after Athens, given the post WW2 migration.

Australia issues its own currency and could never get into the strife that Greece is in – which is the direct result of surrendering that currency sovereignty upon joining the euro-zone. Why even mention Greece? Obvious reasons.

Fact 1 – Continuous fiscal deficits are normal

But there is the notion abroad that continuous deficits are somehow abnormal or bad. The public think – courtesy of the likes of Ross Gittins etc that responsible governments ‘balance their budgets over the business cycle’. Where did anyone get that idea from other than ideologically-laden mainstream macroeconomic textbooks that our students forced to use.

The reality is that fiscal deficits have been the norm over any of the successive business cycles. There is no evidence that Australian governments ‘balance budgets’ over the cycle.

The further evidence is that as the neo-liberal persuasion has become dominant in macroeconomic policy, Australian governments have attempted to run discretionary surpluses. The outcomes of this behaviour have not been good and overall this period (since around the mid-1970s) have been associated with lower average real GDP growth and more than double the average unemployment rate.

You can compile a reasonable dataset to explore this question spanning the period 1953-54 to the present day from two sources. The earlier data (1953-54 to 1970-71) is from the historical publication by R.A. Foster and S.E. Stewart (1991) Australian Economic Statistics, 1949-50 1989-90, Reserve Bank of Australia, Sydney.

The second time series (1970-71 to 2010-11) is from Statement 10 which is the data appendix to Budget Paper No. 1 published by the Commonwealth Government when it delivers its annual fiscal statement.

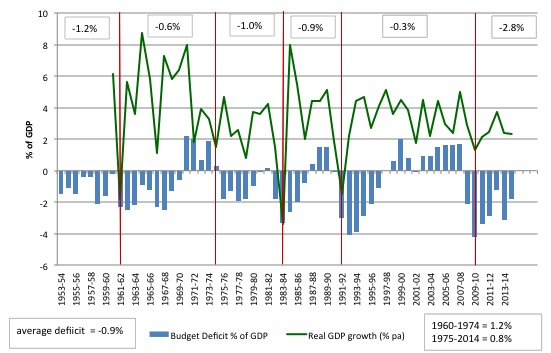

There are some issues about combining this data set and also with each individual data set. But in general the graph below is a reasonably reliable depiction to the history of Federal government fiscal outcomes outcomes over this period. The columns show the Federal fiscal balance as a per cent of GDP (negative denoting deficits) while the green line shows the average quarterly real GDP growth (averaged over the financial year at June).

The red vertical lines denote the trough of the respective business cycles. So the real GDP growth line approximates where in the year the negative real GDP growth manifested. But for our purposes it is near enough.

The upper numbers in boxes are the average deficits over each cyclical periods. The average deficit over the whole period was 0.8 per cent of GDP. The average real GDP growth per quarter from 1959-60 was 1.2 per cent and after 1975 this dropped to 0.8 per cent. The unemployment rate averaged below 2.0 per cent in the pre-1975 period and averaged around 5.5 per cent after 1975.

The 1975 Budget was a historical document because it was the first time the Federal Government began to articulate the neo-liberal argument that budget deficits should be avoided if possible and surpluses were the exemplar of fiscal responsibility.

Some points to note:

1. One the rare occasions the budget was pushed into surplus (usually by discretionary intent of the Government) a major recession followed soon after. The association is not coincidental and reflects the cumulative impact of the fiscal drag (that is, the surpluses draining private purchasing power) interacting with collapsing private spending.

2. There is no notion over this period that the budget outcome was “balanced” over the business cycle. The historical reality is that the federal government is usually in deficit. If I had have assembled more historical data which is available in the individual budget papers going back to the 1930s then it would have just reinforced the reality that surpluses have been rare in our history independent of the monetary system operating (the old convertible system or today’s non-convertible system).

3. The Australian federal government ran fiscal deficits of varying sizes in 75 per cent of the years between 1953-54 and 2014-15 (46 out of the 61 years).

4. The fact that the conservatives were able to run surpluses for 10 out of 11 consecutive years (1996 to 2007) is often held out as a practical demonstration of how a disciplined government can run down public debt and provide scope for private activity. The reality is that during this period we have witnessed a record build-up in private indebtedness (see below).

The only way the economy was able to grow relatively strongly during this period was that private spending financed by increasing credit growth was strong. This growth strategy was never going to be sustainable and the financial crisis was the manifestation of that credit binge exploding and bringing the real economy down with it.

5. The higher deficits in the recent period is testament to the fiscal stimulus package and, perversely, the fiscal contraction that followed. Remember this is a ratio of the fiscal balance to GDP. So if the numerator (fiscal balance) goes up faster than the denominator (GDP) then the ratio rises and vice-versa. But if the denominator falls more quickly than the numerator (at a time of fiscal austerity) the ratio can also rise. The previous government cut hard in their second last fiscal statement and that caused the economy to slow.

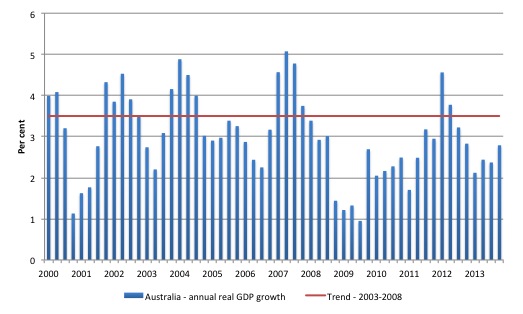

Fact 2 GDP is well below trend

The second fact is that real GDP growth is still well below its recent trend. The following graph shows the recent history of real GDP growth in annual terms. The trend line relates to the five-year period between September 2003 to September 2008. Even if we took a longer trend (say from the beginning of 2000 up to the beginning of the downturn in 2008) the result is similar. In general a trend growth rate between 3.25 and 3.5 is found for Australia.

The economic cycle is not overheating or even heading upwards. If anything a further slowdown would be expected.

Fact 3 Labour Underutilisation is high and rising

The Australian economy is far from being close to full employment. The following graph shows the ABS Broad labour underutilisation series, which simply adds the official unemployment rate to the underemployment rate. It is currently around 13.5 per cent and has been rising as the economy slowed after the retrenchment of the fiscal stimulus package.

Fact 3 Size of fiscal shift is immense

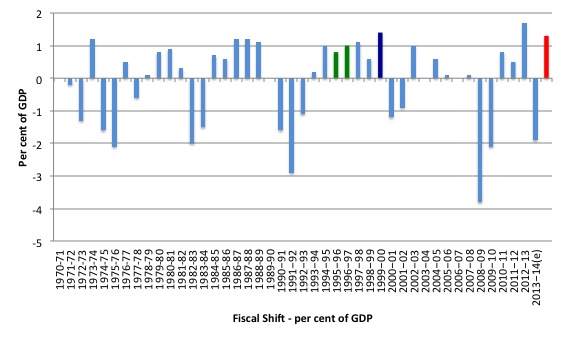

The ABC’s most-used economist (an ex Treasury official) who works for a Canberra-based consulting firm claimed today on ABC radio that the fiscal shift was not as severe as the first two Costello fiscal statements (1996-97 and 1997-98). Costello was the treasurer in the last conservative government which held office between 1996 and 2007.

Unfortunately, the Access Economics commentator (who also continually claims there is a need to “repair the budget”) is incorrect on this fact. The first two Costello shifts (being the swing in the final fiscal position in a given year relative to the previous year) are shown by the green bars (1 per cent and 1.1 per cent, respectively).

The biggest fiscal swing in the previous Conservative government’s tenure was in the financial year 1999-2000 (a shift of 1.4 per cent) which is shown in navy blue. A sharp slowdown in the economy followed that contraction and as you can see the fiscal balance was in deficit two years later (2001-02) – the only deficit they recorded in the 11 years in office. The Australian economy only returned to growth after that because the Communist Chinese government ran large fiscal deficits themselves as part of their urban and regional development strategy. That spurred demand in our mining sector.

The following graph shows the recent history (from 1970-71) of fiscal shifts. You can see that the forward estimates imply a tightening of fiscal policy. The largest fiscal shift in the sample period shown was the second-last fiscal statement from the previous Labor government in 2012-13 which was equivalent to 1.7 per cent of GDP.

That government was obsessively trying to achieve a fiscal surplus in the next year and was blind to the reality that the private sector was not going to fill the spending gap left by the retrenchment in net government spending. The result – which was totally predictable – was that the economy took a nosedive, tax revenue fell even further and the fiscal balance moved further into deficit with unemployment rising. The reversal in the fiscal balance was larger than the attempted contraction the year before (1.9 per cent compared to 1.7 per cent), which just tells you that it is folly to try to cut a deficit when private demand is weak.

In last night’s fiscal statement, the fiscal shift planned is also very large – equivalent to 1.3 per cent of GDP (some $A20 billion). That is a huge amount to be taking out of the economy in one fiscal year.

Unless there is an extraordinary pick up in private spending or net exports then the economy will not achieve the underlying growth assumed and we will be left at the end of the fiscal year with a fiscal deficit higher than they forecast and an even weaker economy than exists now.

In other words, the government is invoking a pro-cyclical fiscal policy change, which are the anathema of responsible fiscal management. Discretionary changes in fiscal policy should typically be counter-cyclical – to manage output gaps. The only time an expansionary discretionary fiscal change should be pro-cyclical is when growth is positive but not strong enough to achieve full employment. Once capacity is reached, fiscal policy should counteract non-government spending changes.

Here are some further questions the journalists should be asking but are not:

1. What reason does the government give for contracting net spending while the real GDP growth rate is falling (well below trend) and the unemployment rate is rising (well above even what the Government claims is full employment)?

2. Why would a government deliberately impose massive daily national income losses on the economy, which are disproportionately endured by the poorest members of our society?

It is also clear that the Treasury was not even remotely correct in its economic assessment. What is going on there? The simple answer is that their model frameworks are based on flawed macroeconomic theory – the same theory that led to policies around the world that caused the financial crisis.

Fact 4 The fiscal position will worsen the economy

By the government’s own forward estimates, this is a pro-cyclical fiscal shift. They are forecasting unemployment to rise to 6.25 per cent and remain at that level until at least through 2015-16 (two more years). What responsible government attacks the unemployed with the range of harsh measures in this fiscal statement yet knows that unemployment is going to worsen?

To me that amounts to a socio-pathological exercise.

They are also estimating that the participation rate will be at 64.5 per cent intil 2015-16. As I explained in the recent commentary on the latest Labour Force data release – Australian labour force data – stagnation setting in – the most recent peak in labour force participation was November 2010 where it stood at 65.9 per cent.

At present, the participation rate is 64.7 per cent and the difference between that November 2010 peak and the current rate, assuming the workers who ahve left the labour force in that period are discouraged workers, that is, hidden unemployed, adds 1.6 percentage points to the official unemployment rate. In other words, if the participation rate was at the November 2010 peak, the official unemployment rate now would be 7.4 per cent rather than the actual 5.8 per cent.

But according to the forward estimates, participation will fall by an additional 0.2 percentage points as the official unemployment rate rises to 6.25 per cent over the next two fiscal years. A quick calculation reveals that this would add a further 50 thousand workers to those already dropping out of the labour force and the adjusted unemployment rate would be around 7.8 per cent.

We also know that underemployment would be higher under these circumstances, being an additional response to a flat or deteriorating economy, so it is not inconveivable that the sum of official unemployment, underemployment and hidden unemployment (discouraged workers) could approach 18 or 19 per cent if the other parameters in the fiscal statement turn out to be accurate.

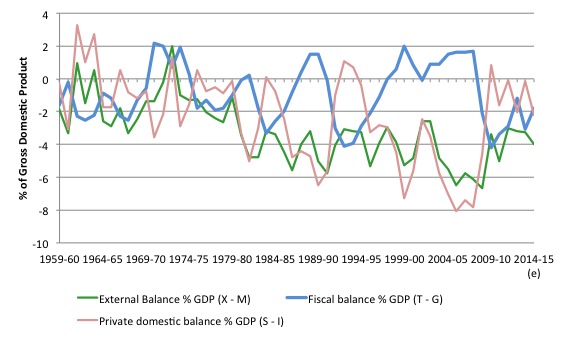

Fact 5 The private sector’s debt position is set to worse

The economic predictions, which underpin the fiscal statement and are contained in Budget Paper No.1 show that the Treasury is forecasting the current account deficit to be at 4 per cent of GDP in the coming fiscal year With a fiscal deficit estimated to be 1.8 per cent of GDP, that means they believe the private domestic sector will be spending more than they are earning by an equivalent of 2.8 per cent. That means they expect the private domestic sector to maintain the growth in the economy by increasing its indebtedness.

We are heading in the same direction as before the crisis – growth becomes reliant on private debt buildup.

The following graph shows the sectoral balances and it is clear that the recent move into overall saving by the private domestic sector is being undermined by the squeeze on private income from the fiscal retrenchment.

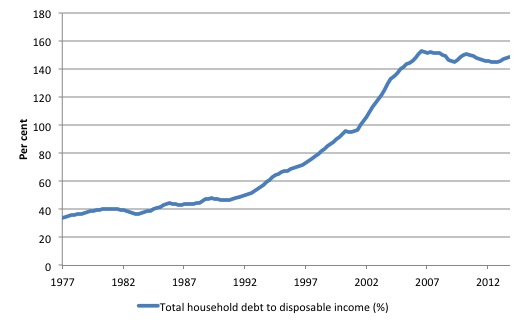

The following graph shows the movement in the household debt to disposable income since March 1977. The rapid rise in the ratio during the credit boom allowed households to maintain spending and was the only reason in the late 1990s that the government was able to run fiscal surpluses. Even though the fiscal drag coming from the governments surpluses was a negative factor for growth the credit-fuelled spending binge offset it.

Later the spending was also driven by the mining boom.

Last week, the ABS released the most recent data which caused a number of headlines. The ABC (national broadcaster) ran the news item – – which quoted an ABS official as saying:

David Skutenko from the Australian Bureau of Statistics says the figure is not just high in historical terms, but by global standards our debt burden is among the highest in the developed world.

“We often compare household debt with household disposable income and, at the moment in Australia in 2013, it was 1.8 times household disposable income,” he said.

“In comparison to the G7 countries such as the United States – 1.1 times household disposable income. The UK – 1.5 times disposable income.”

While households in the US and UK having been paying off debts, Mr Skutenko says Australians have merely reduced the pace of their borrowing.

The whole nation is transfixed on fears that the government debt in Australia is too high – courtesy of all the scaremongering that has been going on. But nary a word gets mentioned about the dangerous private debt levels. It is true that most of the debt is owed by higher income people in Australia, which makes an insolvency crisis of the likes of the sub-prime less likely here.

But the reality is that the debt levels and the growth in them (about the same as disposable income) means that consumer spending is likely to remain fairly subdued overall. It is unlikely we will see a return to the pre-crisis period when debt grew much faster than disposable income and the resulting spending maintained stronger economic growth.

Conclusion

Overall, a very predictable fiscal statement from a nasty government that is keen to do the bidding of the elites and big business and use the rest of the citizens, particularly the weakest among as, as pawns in their wealth-generating activities.

It will reduce growth and increase joblessness.

It will increase hardship on those least able to cope with it.

And why? For no substantive economic reason. This is not an economic statement. The annual fiscal statement has become an annual statement of dogma from a deeply flawed economic paradigm.

The same paradigm that cause the mess is dominating the so-called solution.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

The only thing worse than a lawyer pretending to be an economist is a tri-athlete pretending to be a cyclist.

For fun I will pretend to be a politician answering your questions.

1. What reason does the government give for contracting net spending while the real GDP growth rate is falling (well below trend) and the unemployment rate is rising (well above even what the Government claims is full employment)?

Real GDP growth has been rising over the past four quarters. Just because you can draw a trend line through the past 13 years worth of GDP growth data doesn’t mean we should necessarily be targeting the trend value of 3.5%. Anything above 0% is positive growth.

Further, our priority is winning the next election. By tightening the belt now we are creating an opportunity (for us) to enter the next election campaign making big spending announcements to win voter support.

2. Why would a government deliberately impose massive daily national income losses on the economy, which are disproportionately endured by the poorest members of our society?

To bring the budget back to surplus.

We have also put in place pay rise freezes for all our ministers and top level bureaucrats.

By ‘national income losses’ I assume you are talking about the idea that if the Government runs a surplus it must mean the private sector are running a deficit, i.e. they are spending more than they are earning, assuming imports/exports are balanced.

This idea of sector balances is nice, but I haven’t seen any evidence the idea has actually been calculated properly from good data in Australia, hence I will have to ignore the idea for now. If it’s a valid idea it should be made into a reliable indicator that can be used by journalists to spread the message. Why should a journalist have to do work to try and build current sector balance data for Australia each month or so when the data comes out? If no one else can be bothered doing that why should they bother discussing the idea or asking politicians about it?

The poor are not our concern. Our concern is winning elections and as a Liberal party it is imperative that we are able to go into election campaigns pointing to our track record of being able to get our budget back in the black. It supports our narrative that Labor always spends and Liberals get things back in order.

But finance experts are championing this budget!

Why do people care when even the mainstream ECONOMISTS are lamenting it? Are we so far down the rabbit hole of governments being owned, bought and paid for that business analysts are now considered a higher authority on government fiscal matters than economists? I’m livid, and as far as I can tell this budget won’t even affect me (directly).

There is so much misinformation and obfuscation in the media the average Australian doesn’t haven’t a snowball’s chance in hell of spotting the curve balls aimed at his testicles.

Let’s face it, the Koch brothers billions have provided a compelling (though perverse) rationale that a budget deficit is an almighty demon that must be slayed at all cost. Every vested interest expecting to benefit from the associated assault on Government has picked up the ball and run with gusto. The mainstream media oligopolies largely staying on message.

Unless someone has a few billion in spare change to launch a counter propaganda campaign ASAP, we (the 99%) are well and truly stuffed and trussed for the next few generations.

We’ve missed the opportunity for a counter/counter revolution immediately after the GFC. With Artificial intelligence advances in surveillance and killer drones the size of bumble bees being developed, a short period of fascism followed by a few centuries of neo-feudalism is all but guaranteed.

I have two teenagers and I can tell you, it’s quite a depressing prospect.

Thanks,Bill,for this reiteration of basic,sensible MMT principles.

Unfortunately,even if you were able to get your message onto the mainstream media,the wilfully deaf will ignore it.The culpably deaf will target you,probably through your employment.

We are living in an age of Flat Earth conventional wisdom. It will take a major crisis to even look like changing that mindset. There are a whole raft of potential crises in the offing.Some of them are known,such as climate change and excessive population. There is a strong probability for the occurrence of unknown unknowns.

Given the capabilities of our CiC (Cretins in Charge) I’m not sanguine that any crisis in the Australian context will be handled well. They can’t even get the Australian economy even half right.

Anyway,you can only keep trying to educate the educable,minority that they may be. That alone is a Herculean task.

Net national growth requires net public investment. Politicians are the only ones who don’t know that.

right balance growth?

with right-sized currency supply?

with right-distributed liquidity/income/wealth & degrees_of_freedom? (aka, less micromanagement of small biz)

to achieve growing resiliency?

Just impose some obvious tolerance limits?

Any 10yr old can grasp the keys to teamwork. (And most can by age 5.)

WTF is wrong when tens of millions of citizens can’t keep these simple guiding facts straight in their heads? Hint, the error is ~ 5 steps back in preparatory training.

If citizens can’t orient to context … it doesn’t matter WHAT data they’re fed.

Forcing under-30s to work for the dole is a significant step along the path to your “Jobs Guarantee”. Why are you suddenly against it?

Dear SomeGuyOnTheInternet (2014/05/15 at 11:13)

There is a big difference between a punishment/compliance regime like Work-for-the-Dole and the JG. They are different paths of policy development. One leads nowhere, while the other is based on mutual responsibility and hope. WFD doesn’t even pay a wage!

best wishes

bill

I had to smile when my daughter, who isn’t overtly political, wrote on her Facebook page

“Listening to lateline. You know you live in a ridiculous country when Clive titanic II palmer talks the most sense…”

She’s absolutely right. He said there was no debt crisis, and there isn’t. He went on to say that it was all an ideological exercise to cut spending and force the States to sell off their assets at a knock-down price to Liberal Party supporters. Abbott and co are a bunch of crooks basically.

The Labor opposition have naturally attacked Abbott for breaking his promises but they haven’t got to the root of the problem like Clive did.

The Liberal leadership know full well there is no debt problem and all the talk about the desirability of having a budgetary surplus just a cover for a criminal conspiracy against the Australian public.

Sometimes opponents of Job Guarantee prefer that people will remain in idleness, and sometimes they prefer that they should work without pay. If they prefer idleness, what do they have against work? And if they prefer work, what do they have against working people earning wages?

I asked this from so called modern money realist Cullen Roche (MMR is against JG), which one does he prefer, people remaining in idleness or that they work without pay but he never answered back. What do they want? Either way it is weird.

When people signed up they were led to believe that the cost would be indexed to the CPI.

Given that the RBA rigorously keeps inflation within a narrow band that sounded like a rather good deal.

Now the cost is to be tied to the 10 year Treasury Bond Rate and capped at 6%.

Given my time over I would never have attended University. [ I owe 28k on a degree I can never use]

I wonder how many others are having similar thoughts.

In what sense does WFD not pay a wage? They work for the dole, and get the allowance, or they don’t work and don’t get the money.

If by wage you mean “hourly wage” ie. paid per hour worked, well that is incompatible with the idea of the JG setting a floor “living wage”. You define the JG “living wage” (nee “minimum wage”) as a minimum amount society aspires to pay its citizens. If it is a minimum, then it is irrelevant how many hours the JG employee works.

If a JG employee is allowed to receive less money for less work (ie hourly pay) then it defeats the definition and purpose of the JG “living wage”. If you can earn less than the minimum, by definition it is no longer a minimum.

It really does seem to me that just because a conservative government has implemented your policy, you suddenly oppose it. The only remaining step from here is to remove the gap between the WFD/newstart allowance and the minimum wage. Certainly the amount of the WFD/JG allowance will and should be disputed, but you should be happy that we are closer to your JG policy.

Someguyontheinternet,

You don’t seemed to have grasped the point. A Wage for a job is not the same as a dole payment. When you work in a job you have to pay tax. You have to pay superannuation. You are entitled to a minimum wage or an award rate for the job done.

The clue to what Bill is suggesting is in the name: Job Guarantee

petermartin2001,

1. A JG employee paying tax is just churn – the govt pays them a wage and they give some of it back. It’s not a meaningful difference.

2. Assuming that the old-age pension (OAP) remains, that will define the minimum level of income someone past working-age is to receive. It is reasonable to expect (in the hypothetical worst-case scenario) that if someone is in a JG job for life, then when they reach retirement age, they will go straight on to the old-age-pension. A JG employee contributing to superannuation is meaningless: the govt already indemnifies their retirement income through the OAP, it does not need to do it a second time through the JG (and even if it did, the OAP would be correspondingly reduced by govt).

WfD is currently required for 11 months of the year but there are two forms of the Compulsory Activity Phase, one is getting an extra $20.80 pf by doing the WfD activity or doing an activity that does not include the WfD payment. Not to mention lack of sickness circumstances, etc when involved in such an activity.

So if a full NS payment + WfD activity is approximately $14K a year, is that enough for a single individual to live on with a mortgage payment, a car with insurance, registration and fuel. I know it is not.

Keep in mind even LNP aligned economists like Judith Sloan has previously said the NewStart allowance should be raised. Most welfare groups recommend an increase of $100. That would be approximately $16.5k a year but only if doing the extra payment activity. These figures currently include the carbon tax compensation. Without the additional WfD payment the increase would take it to about $16k a year.

If followed through the safety net might actually be functional once again.

However, if you think the current compensation is sufficient , I would love to see a breakdown of your budget for this individual, SomeGuyOnTheInternet.

Senexx, I have not and am not making any comment at all about the sufficiency, or lack thereof, of the current WFD payment. As I said before “the amount of the WFD/JG allowance will and should be disputed”.

What I am saying is that _structurally_ we are closer to the JG policy than before. Eliminate the minimum wage as a separate policy, raise the WFD payment to a comparable level, and you have Prof Mitchell’s Job Guarantee.

I will observe that the Job Guarantee is actually very easy to sell to conservatives such as myself, because in implementation it is equivalent to abolishing the minimum wage, and compulsory work-for-the-dole. The only difference in your minds is the level of compensation (closer to the current minimum wage for you, I prefer closer to the newstart allowance).

It will be quite hard, however, to sell the Jobs Guarantee to the Left, since there would be an incentive for Federal, State, and Local government departments to replace full pay staff with JG staff (I think this is a good thing, but YMMV) .

Also, unionisation of JG employees will be a problem – they will spend all their time lobbying govt to raise the JG wage rather than move out of JG jobs into the economy proper. Unions will also put a stop to JG jobs actually being useful work – can you imagine the CPSU or shoppies union allowing government cafeterias to employ Job Guarantee staff to bus tables?

The difference between wfD and the JG is that wfD serves no purpose other than to lower peoples self esteem and make it near impossible for them to find work.

Many wfd programs are little more than participants sitting around in a room staring at the walls until they are excused for the day.

Even the governments own research shows the entire system does nothing with respect to helping people move from welfare to paid employment.

The conservatives are also against the JG because they don’t believe anyone should be gifted a job unless they are related to Kevin Andrews.

SGOTI,

The idea is that JG or sometimes called Employer of Last Resort should be work for the public purpose. Therefore JG employees wouldn’t displace existing employees. It’s really nothing new as you can see from this link:

http://en.wikipedia.org/wiki/Works_Progress_Administration

There’s plenty of useful work to do without displacing existing employees. The work could involve an element of training to increase JG employee’s chances of finding higher paid work.

I would suggest starting off the program on a voluntary basis in a small way in some of the highest areas of unemployment. A cost benefit analysis should be undertaken to evaluate the benefits in comparison to other programs including WFTD if that is going to go ahead anyway.

My money would be on the JG option being far more successful. Treat people well, pay them to do a job, recognise the value of their work and they will respond. On the other hand make them feel that they are being treated harshly, that their work isn’t recognised as a proper job, tell them they are burden to the taxpayer and they’ll be sullen and resentful.

Having said all this, there is no reason why unemployment in Australia should be any higher than about 4% with the right economic management. Whether there then would be a need for such as scheme would be less certain.

The trouble with Work for the Dole is, at the moment, the extra $20.80/fortnight would be eaten up (and then some) by the cost of public transport, at least in Perth. If you live in the suburbs and get placed in the city, for example, that’s $4/day you have to pay in fares, even with a concession ticket.

Anyway – the cynic in me would like to think that Labor threw the election because there was so much pressure to get the budget in the black, so why not let Tony throw the economy under a bus and ride it out in Opposition?

petermartin2001,

You are sort of confirming my point, in that if a great deal of effort is put into ensuring that JG jobs do not displace existing employees, then it follows that it will be more difficult for JG employees to transition to a real job, because whatever experience they had in the JG job is designed not to be transferable.

Take my example of a government cafeteria job clearing away dishes (bussing). Actually, even better, lets consider someone pushing a tea trolley from floor to floor serving tea & coffee to government employees. Now that used to be a job, but wages have grown that tealadies (teapeople? teastaff?) are no longer economical to employ. I could make an argument that there is a lot of lost productivity with govt staff spending time going to the tearoom and back, and/or unproductively decaffeinated. Seems to me that would be an excellent JG job – low level of training required, but has skills & experience transferable to other hospitality jobs.

However, I bet you that the unions would consider it a “real job” that should be paid at higher than the JG rate and put a stop to it, destroying the tea-trolley job.

Another example – a 50-year-old processing clerk who has been unemployed for a couple of years and can’t get a job because their older. I think if that 50-year-old displaces (say) a 20-year-old government processing clerk on a higher salary, that’s a good outcome. The 20-y.o. can get a job in private industry and generate positive net tax, while the job still gets done for cheaper by the 50-y.o. But by ensuring that JG jobs don’t replace existing jobs, the 50-y-o will be planting trees or something instead.

If JG jobs are going to pay real wages, then they need to be real jobs, not makework. The nature of the JG jobs on offer will be vital to the success of the program. Successfully replacing higher paid public sector employees with Job Guarantee employees yields a triple dividend: it gives govt jobs to the most needy and gets them working again, it reduces the real cost to the taxpayer of government services, and turns someone who is a burden on the taxpayer (the unemployed) to someone who creates value for the taxpayer.

some guy on the internet. Why don’t you just read the lengthy material out there and then come back with an informed opinion instead of just trolling. You might be surprised as to the purpose and proposed function of a job guarantee. From time to time I read this blog and the comments to get away from opinions like yours that fill the comments sections in the daily papers. that is , ill informed and simply mean. Life is too short to advance one’s self at the expense of the happiness of another. Something that is lost on the vast majority of the people out there.

” it reduces the real cost to the taxpayer of government services, and turns someone who is a burden on the taxpayer (the unemployed) to someone who creates value for the taxpayer.”

Oh dear. Are you suggesting that the unemployed are a burden upon taxpayers because taxpayers fund government spending?

Dear SomeGuyOnTheInternet

It is one thing to disagree with a proposition but another to disagree with something you do not fully understand. You have obviously not read all the literature on the Job Guarantee given some of the assertions you have been making in the last day.

I encourage comments and debate but I won’t tolerate on-going ignorance.

I recommend you read all the blogs in this category – https://billmitchell.org/blog/?cat=23

Then after you have thought about the material, please feel free to seek clarification.

Until then no more comments on this topic from you will be published.

best wishes

bill

Thanks Bill – I have shared this with quite a few friends/family.

I took a trip to Ireland on a ferry full of English people recently.

The ‘budget’ and ‘defecit’ issues are all the hype over there with the far right/center right/coalition style governments that are chosen there are just as appauling as Australias Liberal Labor monetary policy. Its just Libs are so malicious with their ideology that sets them apart.

*About 3 years ago there was that awful EU idea to limit ‘debt’ ‘ceilings’ to 3.5% and the ruse used by politicians was that ‘would stop another banking crisis’. Which when you stop and think is absolute rubbish and so very damaging to any sort of expansion, innovation, employment or qulity of life for europeean citizens.

Must compliment you: Your approach to economic theory is very scientific for me it reads like this:

The ‘top down’ + ‘establish domain of problem’ + ‘modelling system behaviour iteratively’ logic of MMT really appeals to friends whom are engineers, computer scientists, mathematicians and scientists in general.

Eg: Simple algorithms like (S – I) ≡ (G – T) + (X – M) are a great example hard limits on a problem domain and the transitivities between ‘objects’.

Thanks once again!

Will get a copy of that great euro book when it comes out. Im stumbling through the drafts still!

Wonderful article, Bill. Much needed. Ellen Fanning had Tim Costello on Radio National Breakfast this morning to discuss an increase to the GST. She opened the discussion, “it is obvious we have a budget crisis”. I rang the producer and challenged this point. She was reasonable and said to me that Ellen should not have said that. I tried to point to the fact, I was not complaining that the budget was NOT BAD but that talk of it as a problem at all is misplaced. I urged her to have you on the programme.

Is it just wishful thinking on my part or are the number of people that actually understand the basics of MMT growing rapidly ?

I have visited several sites / blogs recently and there appears to be quite a good deal of MMT inspired posts and many appear to be from people not recognisable from this blog / forum.

Like myself, they are not familiar with more technical aspects of MMT research but many do seem to understand the basics enough to demonstrate what a rort neo-liberalsim is.

Happy days.

@Warren,

Yes I agree that the unwillingness of even those who are hostile to the Abbott government to challenge the ‘obviousness’ of the “budget crisis” is a big problem. I find this to be particularly true of the Australian Guardian journalists such as Lenore Taylor, Greg Jericho, Katharine Murphy and Daniel Carr.

It would not be particularly difficult for them to explain in comprehensible terms why the underlying assumption of the desirability of an overall government budget surplus is a fallacy, yet none of them seem to want to go there. I found Greg Jericho quite responsive, for example, when I made a fairly innocuous point about income splitting, but he just doesn’t want to engage at all on the question of ‘the surplus’.

In his mind a government surplus must be a good thing even though it clearly puts everyone else, who he claims to support, into deficit!

It is really very odd.

I wouldn’t worry about trying to explain budget surpluses vs deficits to a cardboard cut-out like Ellen Fanning. She doesn’t even understand the most basic rule of macroeconomics. Spending equals income.

I expect the federal government to be a one-term administration. The mood of the media, including the Murdoch-controlled media, is one of shock and anger. The proposal to rip $80 billion from health and education funding has instantly alienated every state and territory government. The Liberal premiers in particular have been the most vocal opponents of this new regime of austerity budgeting, and it seems their fury will persist for a long time. Many of those who voted for the Liberals in last year’s federal election – as a protest against the disunity and perceived mistakes of Labor Party – will be wondering whether the Coalition’s largely unexpected program of slash and burn will now place their own jobs at risk. If they had been more aware of the the overseas pattern of austerity budgeting exhibited by all conservative governments, they might have thought a little more carefully about the consequences of their voting.

From the Shakespearean play “As you like it”: The fool doth think he is wise, but the wise man knows himself to be a fool.

I am disposed to be tolerant of fools, as the world is so full of them. And although it might be true to say that the Treasurer is a fool, it is even more telling to describe him as an economic illiterate, without any reasonable grasp of macroeconomic principles.

John,

You shouldn’t assume the likes of Abbott and Hockey do not know what they are doing. Look to who benefits and the intentions become transparent.

SomeGuyOnTheInternet, I read one of the links in the category Bill mentioned, being ‘What is a job guarantee?’ and I am confident it will address some of your hesitations: https://billmitchell.org/blog/?p=23719

There are quite a few comments there disagreeing with the idea for one reason or another but I don’t see that any of them dislodge the merit of the JG. As with all things the devil is in the detail and I believe Bill has done as much as one person can do to outline the idea. I don’t expect the JG to be a cure for everything and magically get us all into the job of our dreams, but it could be a better system than what we have now.

Just for fun, an alternative nickname I saw someone using while posting comments on a blog recently, which you may also like, was similar to: “TooembarassedtousemyrealnamebecauseIalwaysgetthingswrong”. 🙂

Thanks Bill for your thorough analysis.

Looks like we are in the midst of a transition from a stakeholder society to a slaveholder society. The masses are to be driven into indentured servitude, their options curtailed by their debt obligations, and increasingly naked forms of oppression used to control the inevitable unrest that will follow.

Welcome to neoliberal nirvana.

If you say something like goverment surplus means all others are in deficit it sounds a little bit abstact, but you could also just say that goverment deficits are the way that goverment issues new money into the economy, and if goverment is in surplus it is actually reducing money from the economy, that does not sound very healthy does it?

Alan Dunn,

“Is it just wishful thinking on my part or are the number of people that actually understand the basics of MMT growing rapidly ?”

I hope you’re right! I think you might be but there is still a lot of work to be done. It would be good if we could get Bill, and with maybe Stephanie, Randall and Warren on the TV to give a series on the “History of Economics” a bit like David Attenborough gives his natural history programs.

I was tempted to write that Bill could try to communicate with Austrian economists in the same way David did with his gorillas but that wouldn’t have been fair to the gorillas 🙂

If anyone from the BBC or ABC is looking for an idea for a new series, they could do a lot worse!

@PZ

“just say that government deficits are the way that government issues new money into the economy,”

The conservatives will be flying the hyperinflation flag quicker than you can blink.

Alternatively, why even use the term Government Budget Surplus ? Why not just refer to it as a non-government deficit ?

Examples:

Mr Hockey, can you please explain to the electorate the benefits of households spending more than they earn; or

Mr Hockey, Why is it important for households to increase their levels of private debt ? And how will the insolvency of households benefit future generations ?

If only the media had the gumption to apply the blow-torch to these fools.

” You shouldn’t assume the likes of Abbott and Hockey do not know what they are doing. Look to who benefits and the intentions become transparent. ”

Even if their intentions – in terms of redistributing wealth – are clear enough, this does not imply that they know what they are doing. It may well be true to say that conservative governments tend to be the puppets and hatchet men of the mega-corporations and other powerful vested interests, however I think it also true to say that politicians in office eventually come to believe their own ideologically-motivated spin. And this attachment hinders their ability to change direction when circumstances (perhaps occurring as a direct consequences of their faulty policies) warrant and demand such a change. Apart from the desirable impact of such change upon society as a whole, it also might be an imperative in terms of political survival. In this respect at least, one can make a case that they do not know what they are doing.

Alan Dunn,

surely rather than conservatives you mean few internet trolls?

People realize – even the conservatives realize – that we already have that kind of system and still hyperinflations are very rare occurences indeed. And all that deficit spending that has been done to combat GFC has not created a single hyperinflation.

People think that money must come somewhere and this is as good explanation as any.

@PZ

In my pseudo economic life ten years or so ago I knew a few conservative economists reasonably well.

I regret to inform you that they are indeed clueless when it comes to macroeconomics.

Hi Bill and Commenters,

Thank you for the thorough analysis above and I have to say I am delighted in the fact that there are like minded people out there regarding state of the Australian budget and also the idea of a Job Guarantee instead of a WFD. As I have only recently had my interest sparked in macroeconomics since it was made a massive issue by the Liberal’s and Murdock Press about getting “Back in the Black” and I refused to stay ignorant. I have a fair amount of reading since discovery of this blog to go before I feel I can add to the discussion but if anyone has any tips/links on what to look at for a beginner in MMT and Macroeconomics then please feel free to message me.

Yesterday Tony Abbott said:

“The government cannot keep using its credit card to pay the nation’s mortgage”

Does anyone have a photo of this government credit card Tony Abbott talks about ? Or indeed, can he produce these mortgage papers ?

Abbott’s using a metaphor and he’s speaking through his …. And that’s another metaphor! 😉