Well my holiday is over. Not that I had one! This morning we submitted the…

Real wages falling and Treasury continues to deceive

There is growing pressure on Australia’s wage setting tribunals to scrap penalty and overtime rates, allegedly because they damage employment and firms are just busting to put more workers on as long as wages drop. I have had a long association with these tribunals as an expert witness and I cannot recall the employers’ representatives ever agreeing that the time is right for wage rises. If their submissions are to be taken on their word then there would never be any wage increases. The facts are that real wages continue to fall in Australia – more rapidly in the private sector than the public. The Australian Bureau of Statistics published the latest – Wage Price Index, Australia – for the June quarter yesterday (August 13, 2014) and the data shows that hourly wage inflation is running at 2.4 per cent per annum, which is well below the current inflation rate. Real wages growth is also well below the growth in hourly productivity, which means that the Australian distribution system is still redistributing real national income to profits. And all the while employment growth is flat or negative. Meanwhile, our cigar-smoking Treasurer sees it as his role to berate the poor for being poor and distorting the public data to hide the fact that the May fiscal statement (aka budget) significantly cuts the real standard of living for low income earners and leaves the top income earners relatively unscathed. But all of this is in the name of fiscal austerity (aka madness).

The wage series is the quarterly ABS Wage Price Index. The Non-farm labour productivity per hour series is derived from the quarterly National Accounts.

A compact dataset can be downloaded from the RBA Table H2 Labour Costs and Productivity. I extrapolated the average growth over the last five years to get the June-quarter productivity result, given the national accounts data is not released until early September.

The facts are plain.

Real wages continue to fall in Australia

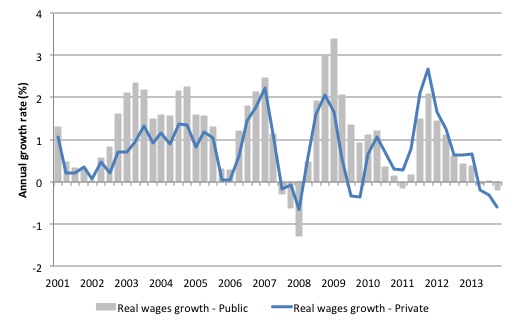

The following graph shows the annual growth in real wages from the first-quarter 2001 to the June-quarter 2014. The private sector is now cutting real wages harder than it did during the early days of the GFC before the fiscal stimulus.

Workers not sharing in productivity growth

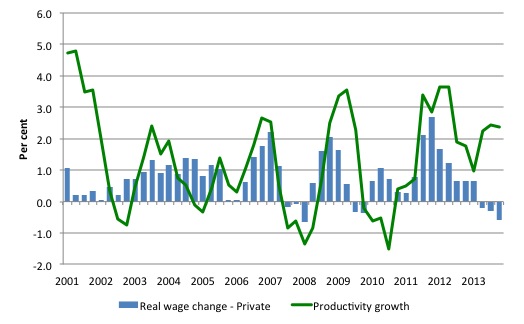

The next graph shows the annual hourly real wage change for the private sector (blue bars) and the annual hourly productivity growth (green line) since the March-quarter 2001. Productivity growth is booming at present, which is one reason why employment growth is so flat. For each extra dollar of real output, less workers are needed when productivity growth rises.

The usual payoff is that the rising productivity growth is shared out to workers in the form of improvements in real living standards. Higher rates of spending then spawn new activity, which soaks up the workers lost to the productivity growth.

The problem is that the payoff has been clearly absent over the last 3 years with real wages growth lagging productivity growth.

Real wages growth overall has been negative for the last three quarters (driven by the private sector).

Real wages and productivity growth – a massive redistribution to profits

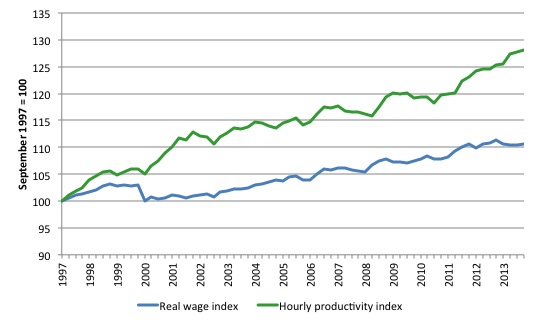

The following graph shows the indexed growth in hourly real wages and labour productivity per hour since the September-quarter 1997. If I started the index in the early 1980s, when the gap between the two really started to open up, the productivity index would stand at around 170 and the real wage index at around 115.

Starting the index in the September-quarter 1997 produces a smaller gap, which just goes to show that one can manipulate data to achieve a range of ends (often quite contrasting) by altering the sample size. That is one of the oldest tricks in the book.

Sometimes just dropping one or two observations produces radically different results. Remember our spreadsheet champions R&R who deceived the world with their public debt threshold nonsense only to be found to be incompetent at best as a result of poor spreadsheet use.

What is clear is that since the September-quarter 1997, real wages have grown by only 10 per cent (so just over 0.6 per cent on average per year), whereas hourly labour productivity has grown by 28 per cent (or 1.65 per cent on average per year).

This is a massive redistribution of national income to profits and away from wage-earners and the gap is widening each quarter.

The gap widened in the June-quarter 2014.

Where does the real income that the workers lose by being unable to gain real wages growth in line with productivity growth go? Answer: Mostly to profits. One might then claim that investment will be stimulated.

As the real wage declines and the gap between productivity rises, the Investment ratio (percentage of private investment in productive capital to GDP) has barely risen over the course of the crisis period (since February 2008) and since the June-quarter 2013 it has fallen from 24.4 per cent to 22.1 per cent. Quite a drop.

Some of has gone into paying the massive and obscene executive salaries that we occassionally get wind of.

Some will be retained by firms and invested in financial markets fuelling the speculative bubbles around the world.

For workers, the problem is that they rely on real wages growth to fund consumption growth and without it they borrow or the economy goes into recession. The former is what happened around the world in the lead up to the crisis (and caused the crisis).

The latter is more or less what is happening now.

One of the essential changes that needs to happen to ensure that another bout of financial instability doesn’t hit soon is that real wages have to grow in proportion with productivity growth – exactly the reverse of what is happening now.

Real wages growth and employment

The claim that real wage cuts are necessary to stimulate employment are never borne out by the evidence. Wages have two aspects.

First, they add to unit costs, although by how much is moot, given that there is strong evidence that higher wages motivate higher productivity, which offsets the impact of the wage rises on unit costs.

Second, they add to income and consumption expenditure is directly related to the income that workers receive.

So it is not obvious that higher real wages undermine total spending in the economy. Employment growth is a direct function of spending and cutting real wages will only increase employment if you can argue (and show) that it increases spending and reduces the desire to save.

There is no evidence to suggest that would be the case.

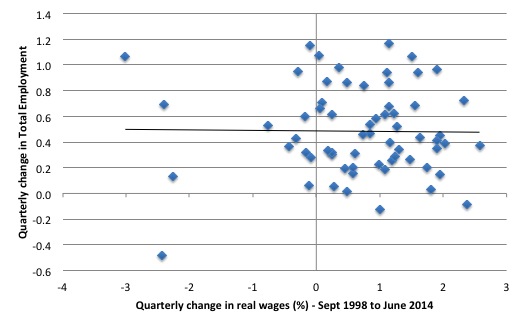

The following graph shows the quarterly growth in real wages (horizontal axis) and the quarterly change in total employment. The period is the September-quarter 1998 to the June-quarter 2014. The solid line is a simple linear regression.

Conclusion: No discernible direct relationship! There is strong evidence that both employment growth and real wages growth respond positively to total spending growth and increasing economic activity.

At present, total spending in the economy is subdued and moderating.

Our cigar-smoking Treasurer

Yesterday, our cigar-smoking Treasurer (see photo taken outside Parliament House in Canberra with his mate in austerity the Finance Minister) told the press that:

… the poorest people either don’t have cars or actually don’t drive very far in many cases.

His motive was to defend the meltdown associated with the May Fiscal Statement, which is widely unpopular and obviously targetted at damaging the poorest in our society more than the richest (in both income and wealth).

The specific policy change he was defending was the decision to increase the excise tax on fuel, which has been frozen for the last 13 years.

His hamfisted justification for the policy has caused a furore with the main accusations being that he is “out of touch with the Australian community” (Source).

The opportunist, but unprincipled Labor opposition has, of-course, lamblasted him for being arrogant calling him the “Foghorn Leghorn of Australian politics” but they too miss the points that should be made.

This also has implications for the way the progressive side of the debate presents its arguments.

There are several points.

First, the whole justification for putting up the fuel taxes is the “raise tax revenue” to “repair the “budget”. Both sides of politics mount narratives along those lines, which are, of-course, totally false constructions of reality.

Tax revenue does not fund government spending. It certainly reduces the amount of income that the non-government sector has available to spend and in doing so creates the fiscal space for government spending to use the real resources that the non-government sector would have deployed had they had that income available.

A government should only raise taxes if it wants the non-government sector to have less purchasing power. With massive rates of labour underutilisation, unless the government wants to ramp up its own spending in a major way, there is no justification along these grounds for raising taxes.

Second, taxes can be used to alter the allocation of resources. So we want to stop people smoking so we make it more expensive to do so. This is the principle reason why I support an increase in the fuel excise tax (yes, I support that decision by the conservatives but for different reasons).

We should be discouraging private car and truck use and instead providing incentives for people to use more public transport, shared private transport, railways for freight etc.

My support is conditional though. It requires a significant shift in thinking about infrastructure provision – railways instead of roads etc and a significant investment in public assets – exactly the opposite of what governments around the world are engaging in at present.

Third, progressives talk about regressive taxes as being bad. The more accurate statement is that a regressive public net spending system is bad. What is the difference?

An isolated tax might be regressive – that is, it impacts disproportionately on lower incomes earners (we are talking as a share of their income or expenditure not in absolute dollars) – but still be part of a progressive fiscal system.

So a VAT or GST is regressive if it is a single rate tax on all goods and services. But if government spending is well-targetted at helping lower income workers, then the overall fiscal system might be progressive.

Progressives that just single out a tax and say it is regressive are missing the point. They should be focusing on how the fiscal system overall impacts on the poor and the rich. In Australia, the impact is undesirable at present but that is another story for another day.

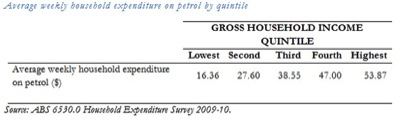

Fourth, the Treasurer was somewhat correct in his rather crude statement. The – ousehold Expenditure Survey, Australia – provides significant detail about the patterns of expenditure by income cohorts. The latest edition is 2009-10.

The Treasurer was using data provided in that survey as the basis of his claim about spending on fuel.

The – HES 2009-10 Detailed Tables – breakdown the expenditure into classes by income and wealth quintiles.

Table 3A. GROSS INCOME QUINTILE, Household expenditure on goods and services is where the Treasurer gleaned his information. Under Transport, we find item “1001030101 Petrol” which shows that:

The graphic is from the Treasury briefing document released by the Treasurer’s office.

But that expenditure is coming out of very different income levels and the question is what is the proportion of spending on fuel across the income quintiles.

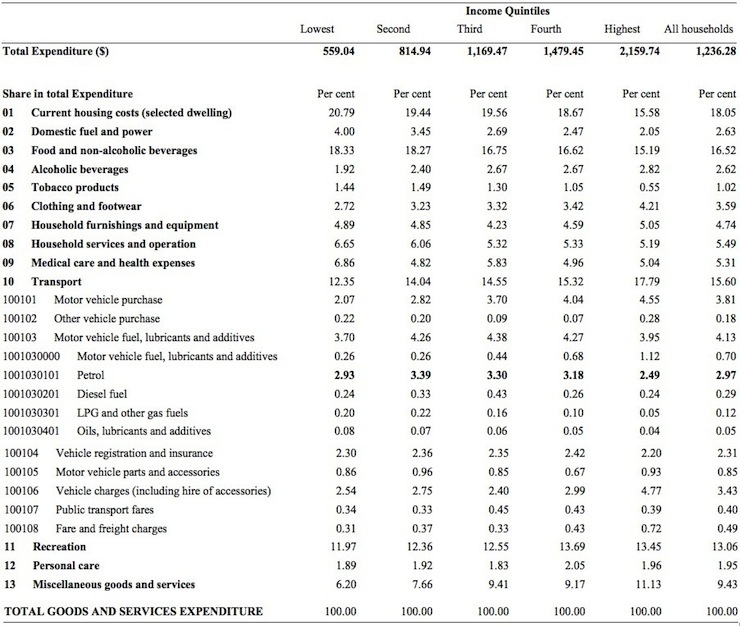

I prepared the following Table to show that information. The first row is the total expenditure (% per week) by the Income Quintiles. The top 20 per cent thus spend 1.75 times the average household and 3.9 times the lowest quintile per week.

The subsequent rows shows the weekly expenditure by category (with Transport broken down) as a proportion of total weekly spending by income quintile.

You can see that the lowest 20 per cent of income earners in Australia spend more of their weekly budget (proportionally) on Petrol (2.93 per cent) than the top income quintile (2.49 per cent).

The second quintile spends 3.39 per cent of their total budget on fuel. Taken together, it is clear that the increase in the fuel excise will be more damaging for the lower income groups in terms of squeezing their weekly expenditure budgets.

It should also be noted that the lower quintiles have virtually zero saving while the higher quintiles save a significant portion of their disposable income.

The question is: Why didn’t the Treasurer and his officials present this sort of table to show the true nature of the impact?

Reason: they want to confuse the issue and hide what they are up to.

Conclusion

Not a wages breakout or explosion in sight!

And a very damaging fiscal strategy being deployed.

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

I was surprised – and then utterly not surprised – when I received my tax return and attached was a letter explaining where my tax dollars were being spent! I had a good laugh for a minute but then remembered that the 99% of the Australian public will take it as Gospel because it came from the ATO. I wonder which lackey was responsible for that?

Not exactly on theme but Guy Rundle has today (14 Aug 2014) written a great article on Crikey on Joe Hockey’s car remarks and all that gets wrong. I quote: “Call urban and transport planning what it is — a war on the poor and low-income, nothing else. It is simply one feature of the neoliberalisation of Australian life — let private developers shape cities, define services as a public cost, thus essentially privatising the profits of social development and socialising the losses. The result is to build relentless service decline and inequality into the system. When that is underway, slug the poor inequitably for costs produced by the system you’ve imposed on them. When you’re embedded in the logic of that system, as Slow Joe and his advisers are, you don’t see its contradictory nature. You don’t see the poor either, marooned in low-service suburbs, or dying towns — except when you’re targeting them. But they see you. Suicide machines indeed.”

Bill,

UK experience is fuel tax increase has knock on effect for most prices and inflaton. Oil prices currently soft (Saudi seeking max revenue ) so fuel price may remain static for now.

things will get worse before they can get better?

just because they can?

current “Democracies” are NOT run by electorates?

then who IS running them … why, and for what purpose?

Biggest questions are how long it will take electorates to wake up to that mal-adaptive purpose, and what will accelerate that wake-up day.

Getting rapidly growing readership for this blog would help. Anyone have additional marketing methods to suggest?

«hourly wage inflation is running at 2.4 per cent per annum, which is well below the current inflation rate. Real wages growth is also well below the growth in hourly productivity, which means that the Australian distribution system is still redistributing real national income to profits. And all the while employment growth is flat or negative.»

Your explanation seems to me is that this is the result of the will of the elites and that the population is powerless. But Australia, like the UK and the USA, are still functioning democracies.

The most plausible reason why real wages are falling is that this is *very popular* with voters. Most swing voters in marginal seats are delighted when wages are driven down by neoliberal governments.

Most voters, or at least most swing voters in marginal voters in the USA, UK, Australia are so-called “aspirational” voters and their aspirations mean mainly two things:

* Ever higher asset prices with ever lower interest rates so the capital gains they enjoy can be cashed in tax-free with cheap remortgages.

* Ever lower wages and reduced rights for workers, because cheap hired help is hard to find today.

This is because neoliberal governments have made speculating on assets, in particular housing property, much more profitable than fighting for better wages and work conditions, and a lot of property owners don’t work or work part time (for example middle aged and older women who got their property via divorce or inheritance).

The numbers are startlingly clear, and I’ll use an example from the UK because I have it handy:

http://www.bbc.co.uk/news/business-19288208

«In 2001, the average price of a house was £121,769 and the average salary was £16,557, according to the National Housing Federation. A decade on, the typical price of a property is 94% higher at £236,518, while average wages are up 29% to £21,330»

The above involves a pretty modest two-up-two-down terraced house and middle income people like plumbers, nurses, bookeepers, etc.

That is £12,000 a year of extra tax free income via property capital gains on top of an after-tax income from working of perhaps around £14,000.

These people reckon that no trade union, no raise, no strike, no worker rights could have given them an extra £12,000 a year free case without raising a finger other than to vote smugly for neoliberal parties every several years.

They cote relentlessly for higher property prices for themselves and lower wages for everybody else, especially if they are non-working or retired, and there are plenty of retired people that vote, especially women, both because life expectancies have extended and women traditionally have been able to retire 5 year before men and live 5-10 years longer than me. These retired people (mostly women and some men) see their property as their main income producer, and the wages of younger workers as a cost.

It is not a story of evil elites screwing everybody else for me; it is a story “F*ck YOU! I got mine” middle class or middle income people voting their wallets as if they were rapacious elites. It is the mass-rentier mindset.

On the transport needs of the less well off :

It appears that the Boofhead Treasurer and the High Flying Economics Professor share at least one delusion.

Save us from the Stupidity,Ignorance and Arrogance of the 1%.

Hi Bill,

It occurred to me that there should be a union of unemployed people in Australia. With 700k people out of a job, together they might have the power to cause all sorts of grief for the government. They might even demand a Job Guarantee!

A quick google search reveals that there is an American version, called “U Cubed” with a somewhat modern looking site, and it seems to be international as well:

http://www.unionofunemployed.com/

Looking around it though, it seemed to be all about training and network support, and very little in the way of any kind of disruptive strike action or protests.

There’s also an Australian version:

http://unemploymentunion.com.au/

Looks a bit more proactive, but vague.

Bill, might it be worthwhile for you to contact them and help them out with more concrete demands?

Blissex, that’s not far from truth and not anecdotal as first appears. I live in a suburban and social microcosm (a suburban street in a formerly working-class suburb now upgrading to yuppie) and work at a stable company where everyone imagines jobs are forever.

And both my neighbours and workmates (and relatives!) are all of that “I’m ok” mindset. Your description of me and them is, well, exactly what I have noticed during 4 decades of earning and consuming. It’s exactly how I see my fellow Australians -at least, those blessed with incomes and assets.

However, the evil elites are nevertheless out to get us all. Fixed that for you.

The elites are still evil and the sheep are still sheep,no matter how matter how much fleece they are carrying. There you are,fixed that for you too.

This might sound and be silly, but has the high dollar, with cheapo imports help to keep wage pressures down over the last few years. I know that the dollar being so high, has harmed our industrial sector. I also note, that the cost of cheap clothes is slowly rising for the first time in ages. Same goes for electric and electronics goods.

Just a thought,. Also one cannot keep pushing down wages and welfare benefits, while lowering taxes of the wealthy and industry, without something giving way.

How can one discuss the budget, without looking at the revenue side. Does it not start with, what is essential spending. What is debt. What is investment,

How can discussion of the economy come down to the word deficit, without any other consideration be talked about. What does a deficit or surplus really mean, What does it really tell us.

How does extending the gap between rich and poor, really help any economy?

Maybe Hockey and his ilk can explain it to us.

Maybe he can also tell us, who is the mythical taxpayers he is defending, I am a taxpayer, he is not talking about me, as I am also a full pensioner, who has worked most of my adult life.

I might be naïve but I see government expenditure, not as a a toxic debt, but investment in the country’s future.

Debt is used across the economy, from the household to business, to government as a means of growing the pie, is it not.

It is not the debt that one worries about, but how it is invested.

I actually agree with the fuel tax increase. It is effectively rent for public roads. If we didn’t have the tax there would many more cars on the road, so that would wipe out the benefits.

Although it is regressive I would include it in a generally progressive budget.

Other than that, agree.

Blissex, this is why land value tax is important. That land value belongs to all of us, but its benefit has been gained by a few. The price of buildings/improvements has not went up.

It is very important to do this to get us out of the rentier mindset, also land value taxes have no dead weight losses and can’t be avoided. They also reduce the number of vacant buildings. They are not coercive and help ground the currency.

We need to combine the insights from Georgism and MMT, otherwise the gains from JG will go to landlords and banks, who don’t want to grow the pie and will demand rent increases.