At the moment, the UK Chancellor is getting headlines with her tough talk on government…

Options for Europe – Part 62

The title is my current working title for a book I am finalising over the next few months on the Eurozone. If all goes well (and it should) it will be published in both Italian and English by very well-known publishers. The publication date for the Italian edition is tentatively late April to early May 2014.

You can access the entire sequence of blogs in this series through the – Euro book Category.

I cannot guarantee the sequence of daily additions will make sense overall because at times I will go back and fill in bits (that I needed library access or whatever for). But you should be able to pick up the thread over time although the full edited version will only be available in the final book (obviously).

Modell Deutschland starts shrinking its jobs and gaming its EMU partners

[ONE REWRITTEN PARAGRAPHS FROM YESTERDAY]

The neo-liberals found a new way to solve the dilemma. The ‘solution’ was so-called ‘financial engineering’, which pushed ever-increasing debt onto households and firms in many nations. The credit expansion sustained the workers’ purchasing power, but also delivered an interest bonus to capital, while real wages growth continued to be suppressed. Households, in particular, were enticed by lower interest rates and the vehement marketing strategies of the financial engineers. It seemed too good to be true and it was.

[NEW MATERIAL TODAY]

The funds to underwrite this credit explosion came from the increased profits that arose from the redistributed national income. For some nations, such as Germany, the large export surpluses also provided the funds to loan out to other nations.

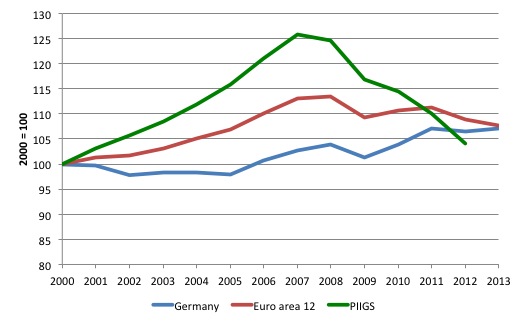

Germany didn’t experience the same credit explosion as other nations. The suppression of real wages growth in Germany and the growth in the (very) low-wage ‘mini-jobs’ meant that Germany severely stifled domestic spending up to 2005. Figure X1 shows the index of domestic demand (total spending on goods and services by residents – includes imports) for Germany, the first 12 Eurozone nations and the PIIGS from 2000 to 2013, with the index set at 100 in 2000. The domestic restraint forced onto German workers and other consumers by the austerity policies of Gerhard Schröder and the fact the Government was seeking to reduce its own deficit meant that the only way the German economy could grow would be through widening external surpluses.

Figure X1 Domestic demand, Germany, Euro12 and PIIGS, 2000-2013, 2000=100

Source: Eurostat.

[LAST PARAGRAPH YESTERDAY REWRITTEN]

The German approach thus nuanced the neo-liberal trend. The growth in employment they experienced in the lead up to the crisis was was not due to the good functioning of the monetary union but to its malfunctions. It depended on widening trade imbalances – huge surpluses in Germany and some of its neighbours against widening deficits in the periphery, covered by unsustainable capital flows from the former to the latter.

[NEW MATERIAL TODAY]

Current account imbalances

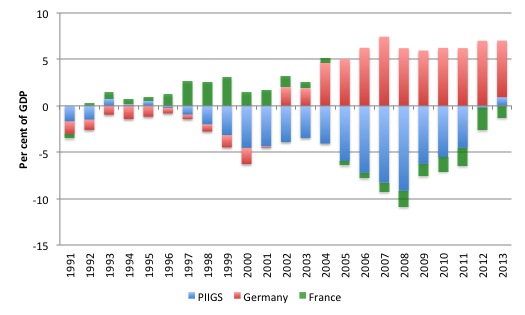

To see the employment data presented earlier in this chapter in context we also have to consider the trade imbalances that accompanied the shifts in employment in various nations. As the European nations started to share a currency, there were dramatic shifts in the current account balances (which reflect trade and income flows between nations). With the loss of its exchange rate flexibility, Germany adopted a ‘mercantilist’ strategy by exploiting its rising international competitiveness that arose from the dramatic suppression of domestic costs and domestic spending in the early days of the EMU. Germany started to record very large external surpluses which were mirrored by expanding external deficits in the peripheral economies (the PIIGS) (see Figure X.1). The two movements were intrinsically linked.

Figure X.1 Current Account Balance, 1991-2013, per cent of GDP

Source: IMF World Economic Outlook database.

The German approach overall had overtones of the old canard of federal system – ‘smokestack chasing’. One of the problems that federal systems can encounter is disparate regional development (in states or sub-state regions) driven by tax and other ‘business cost’ concessions that a state might offer business firms to entice them to locate in that state in preference to another state. The states thus compete for firms and the concessions granted often end up countering any economic value that the activity might bring to the state. This was a common practice in the strong growth period after World War 2 in several countries. There is a large literature which shows how this practice not only undermines the welfare of other regions in the federal system but also compromises the position of the state doing the ‘chasing’.

The suppression of consumption in Germany and the reliance on capital export to the ‘south’ to maintain growth was very damaging to the peripheral member states. That sort of unilateralism is not sensible in a monetary union. The dramatic suppression of domestic costs and domestic spending in the early days of the EMU by Germany, not only meant that the Germans would ultimately undermine the welfare of the other EMU nations but also meant that the living standards of German workers were being driven down in the process.

What are these current account imbalances that commentators talk about all the time? For an economy as a whole, imports are real goods and services coming into the nation from abroad and as such represent a real benefit to residents. Conversely, exports are real goods and services that are sold to foreigners. Exports represent a real cost to residents because the real resources (labour, capital and other productive inputs) embodied in the goods and services become unavailable to the local residents for their own use. It is obvious that the only motivation for a nation to export, and incur the real costs involved in exporting goods and services abroad, is to gain foreign currencies, which, in turn, allow the nation to purchase imported goods and services that it does not produce itself. If imports exceed exports then a nation is able enjoy higher material living standard by consuming more goods and services than it produces for foreign consumption. Transactions between nations also involve financial flows, which are the currency flows in and out of a nation in search of return on financial assets or other investments (for example, direct investment in a factory in another country).

All transactions between a nation and the rest of the world are recorded in the Balance of Payments, which is assembled by national statistical agencies under agreed accounting rules. There are two main accounts in the Balance of Payments – the Current Account and the Capital Account. The former records exports and imports of goods and services and income flows between nations (for example, dividends on investments abroad). If a nation runs a current account surplus it means that the sum of its exports of goods and services plus investment income received from abroad exceeds the spending on imports and income paid to foreigners. A surplus means that the external sector is contributing to total spending in the domestic economy and helping it grow. A deficit is the opposite.

The capital account records the financial side of the current account transactions, including the purchase and sale of financial assets such as shares to foreigners, the purchase and sale of land to foreigners and capital transfers between nations.

What happens if a nation exports more than they import (ignore, for simplicity, the income side of the current account)? The net outflow of real goods and services would be accompanied by accumulating financial claims against the rest of the world. This is because the demand for the nation’s currency to meet the payments necessary for the exports would exceed the supply of the currency to the foreign exchange market to facilitate the import expenditure. How might this imbalance be resolved? There are a number of ways possible. A most obvious solution would be for foreigners to borrow funds from the domestic residents. This would lead to a net accumulation of foreign claims (assets) held by residents in the surplus nation. Another solution would be for non-residents to draw down local bank balances, which means that net liabilities to non-residents would decline.

Thus a nation running a current account surplus will be recording net private capital outflows and/or the central bank will be accumulating international reserves (foreign currency holdings) if it has been selling the nation’s currency to stabilise its exchange rate in the face of the surplus. Current account deficit nations will record foreign capital inflows (for example, loans from surplus nations) and/or their central banks will be losing foreign reserves.

Large current account disparities emerged between nations in the 1980s as capital flows were deregulated and many currencies floated after the Bretton Woods system collapsed. European nations such as Germany, the Netherlands and Switzerland were typically recording large and persistent current account surpluses and with a significant proportion of their trade being with other European nations, the imbalances grew within Europe as well as between Europe and elsewhere. German government policy deliberately created widening imbalances in Europe by undermining the competitiveness of the other nations through the harsh attack on their own workers.

To some extent the German government understood the logic of the flawed design of the EMU more fully than the other nations. They knew the monetary system encouraged a race to the bottom and exploited the ‘solidarity’ of its workers to game the other nations, who, in turn, could not have been accused of living vicariously. But in a relative sense that is the comparison that emerged as the crisis hit.

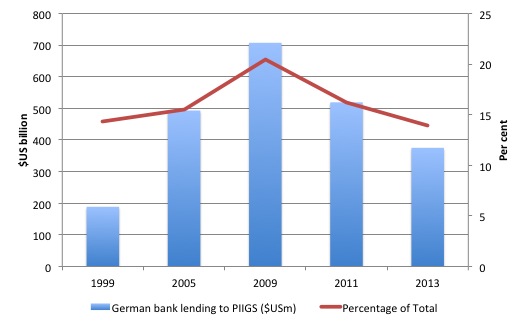

The huge current account surpluses resulted in German banks accelerating their lending to other nations, in particular Spain and Italy, and less so Ireland. Figure XX shows the dramatic acceleration in lending to the PIIGS. In June 1999, at the onset of the EMU, total German bank lending to the PIIGS was $US 188.7 billion or 14 per cent of the total foreign lending by German banks. By 2009, this total had reached $707.3 million and was 20.4 per cent of the total foreign lending by German banks.

The common monetary policy meant that interest rates fell in the peripheral nations because rates were essentially set to reflect conditions in Germany rather than elsewhere. The lower interest rates encouraged this massive lending spree, which then in Spain and Ireland, among other nations, found its way into the construction and housing boom. Much of the debt was private.

The massive shift in the employment mixes we saw earlier was caused by these imbalances in trade and financial flows. German capital could find more profitable opportunities elsewhere, given that domestic conditions were suppressed by the austerity being imposed. The related issue was the poorly regulated banking sector that allowed the German and other banks to build up such risky portfolios. That is another part of the neo-liberal story that needs to be understood.

Figure XX German bank lending to the PIIGS, at at June, various years, $US millions

Source: BIS Quarterly Review, Statistical Annexe, Table 9B, various editions.

The accusations that would emerge as the crisis hit that the PIIGS were ‘spending beyond their means’ and gorging on debt were rather thin when you realise that Germany’s growth strategy required the PIIGS to borrow heavily. For every dollar loaned there has to be a lender.

[NEXT – THE NEAR COLLAPSE OF THE SGP IN 2003]

[TO BE CONTINUED]

Additional references

This list will be progressively compiled.

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

This Post Has 0 Comments