At the moment, the UK Chancellor is getting headlines with her tough talk on government…

Options for Europe – Part 61

The title is my current working title for a book I am finalising over the next few months on the Eurozone. If all goes well (and it should) it will be published in both Italian and English by very well-known publishers. The publication date for the Italian edition is tentatively late April to early May 2014.

You can access the entire sequence of blogs in this series through the – Euro book Category.

I cannot guarantee the sequence of daily additions will make sense overall because at times I will go back and fill in bits (that I needed library access or whatever for). But you should be able to pick up the thread over time although the full edited version will only be available in the final book (obviously).

Chapter X The first few years – a sense of smug self-congratulation amidst mass delusion

[CONTINUING THIS SECTION WITH THE FOLLOWING QUOTE AND PARAGRAPH AFTER TO GIVE CONTEXT FROM FRIDAY]

The underpinning of the bankrupt policy framework was dubbed in the Sapir Report (2003: 41) as the ‘Brussels-Frankfurt consensus’ and was represented as follows:

The maintenance of price stability – reflected in low rates of inflation – facilitates achieving higher rates of economic growth over the medium term and helps to reduce cyclical fluctuations. This shows up in a lower variability of output and inflation. In turn, sound public finances are necessary both to prevent imbalances in the policy mix, which negatively affect the variability of output and inflation, and also to contribute to national savings, thus helping to foster private investment and ultimately growth. The latter beneficial effect is magnified as low deficits and debt, by entailing a low interest burden, create the room for higher public investment, “productive” public spending and a low tax burden. Finally, the beneficial effects of price stability and fiscal discipline on economic performance reinforce each other in various ways. On the one hand, fiscal discipline supports the central bank in its task to maintain price stability. On the other hand, prudent monetary and fiscal policies avoid policy-induced shocks and their unfavourable impact on economic fluctuations while ensuring a higher room for manoeuvre to address other disturbances that increase cyclical instability.

The Washington consensus and the Brussels-Frankfurt consensus thus dovetail perfectly and the whole world was gripped by the austerity culture and the urgency of deregulation. The pre-conditions for the global crisis that would come a few years later were being laid but the creators were blind to their actions, such was their enthusiasm for the agenda and their capacity for Groupthink.

[NEW MATERIAL TODAY]

This is a classic example of the neo-liberal dogma, which asserted, as an article of religious faith, that the creation of independent central banks and the imposition of fiscal austerity would insulate economies from recession. The EMU exemplified their policy utopia. All that was needed was further labour market and financial deregulation, continued suppression of the capacity of workers to maintain wages growth in line with inflation and the productivity growth, and a deeper retrenchment of existing welfare safety nets for low income workers and the unemployed. The confidence exuded by the neo-liberal politicians and their ‘hired’ economists was only possible because they redefined the mass unemployment that they had created away as being ‘optimal’ (that is, a virtue of free choice). They also were blind to the fact that the massive imbalances in capital flows and trade that emerged within Europe in the first several years of the EMU were caused by the single monetary policy and deregulation.

These imbalances would soon combine with the flawed design of the EMU to amplify the negative consequences of the collapse of the housing market in the US and push the Eurozone to the brink of collapse. Such was the magnitude of the threat to the monetary union that the Euro cabal was forced to break its own ban on bailouts, despite their continued denials to the contrary. It also forced the ECB to break their taboo on funding government deficits when they bought billions of euros worth of public bonds and maintained the solvency of several EMU national governments. While they denied they were doing that and resorted to opaque explanations about ‘managing liquidity requirements’ the fact is they were ‘funding’ deficits and everyone knew it. And, despite all the protestations of economists of the Sapir-mould, deflation not inflation emerged as the problem as unemployment skyrocketed.

In a 2011 paper, Sapir and another regular European Commission consultant, Jean Pisani-Ferry, who was on the ‘panel of experts’ that produced the Sapir Report, acknowledged that the EMU was beset with imbalances – the benefit of hindsight one might say! (Darvas et al., 2011). However, as they waxed lyrical about the way forward for Europe, they largely ignored the role played by Germany (Modell Deutschland) and, instead, chose to blame nations such as Greece, Ireland, Portugal and Spain, for the crisis. These nations had been living “beyond their means by accumulating private and/or public debt and running large current account deficits” (p. 2). They fail to emphasise that that the peripheral nations were buying French and German exports using large swathes of capital supplied by German financiers, who were diverting funds away from the stagnant German domestic market. The lack of profitable investment opportunities within Germany was the result of the Government-led attack on real wages and working conditions (the Hartz reforms). What is often forgotten is that for every ‘over-spending’ importer there has to be an ‘over-supplying’ exporter.

Some questions immediately arise:

1. Wasn’t the ECB telling Greek consumers and firms that they were free to borrow at the interest rates that Frankfurt considered to be appropriate?

2. Did the ECB seek to place restrictions on bank lending to Greek consumers and firms?

3. Did the EU cabal tell Ireland (the “Celtic Tiger”) or Spain or Greece to stop their consumers buying houses? Why didn’t the ECB or Brussels seek to place restrictions on banks and financial engineers who were plying consumers with credit? Did anyone in the cabal tell Greece to stop buying ageing German military equipment to satiate their territorial paranoia about Turkey?

4. Who allowed Greece and the other peripheral nations to enter the EMU in the first place when it was obvious that they had not remotely satisfied the convergence criteria?

None of the questions were on the minds of Sapir and his colleagues in 2003.

The imbalances start to reveal themselves – while the policy makers remained obsessed with fiscal rules

In the special 10th Anniversary of the ECB publication of its Monthly Bulletin (ECB, 2012) there was a lot of self-congratulation about the achievements of the ECB in its first decade of operation. The ECB (2012: 11) said it was “fulfilling its primary objective to maintain price stability” and had delivered “low interest rates” (p. 15). On the real economy, it concluded that “All in all, good progress has been made” (p. 65) but it urged more deregulation (for example, reduction of employment protections and reduced welfare benefits) to further free up markets and “to increase incentives to work” (p. 70).

On July 10, 2008, the then ECB President, Jean-Claude Trichet delivered a speech ‘The euro’s 10th anniversary: history and presence of the euro’ at a conference of the same name in Munich, which traversed the same ground. Trichet particularly noted that:

The achievements I have just described have accompanied an impressive performance in terms of job creation. From the start of EMU to the end of last year … the number of people in employment in the euro area has increased by 15.7 million, compared with an increase of only some 5 million in the previous nine years, and the euro area unemployment rate has fallen to its lowest level since the early 1980s.

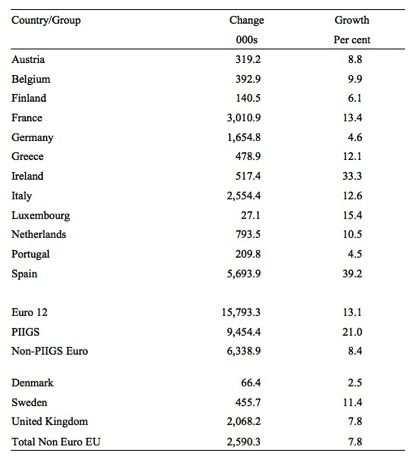

While on the surface the facts were accurate and the employment generation sounded impressive relative to the ‘convergence years’ prior to formal union, the devil is in the detail. In which countries and sectors were these jobs created? Table X.1 shows what happened to employment between 1999 and 2007. The nations shown are the original Eurozone nations plus Greece who entered two years later in 2001 and the non-Euro nations who joined the European Union but did not adopt the Euro as their currency. The employment growth in Ireland and Spain was spectacular over this period while Germany’s performance was very poor. Overall, 15.7 million net jobs were created between 1999 and 2007. Taken together, employment growth in the peripheral Eurozone nations (Portugal, Ireland, Italy, Greece and Spain – the so-called PIIGS) was 2.5 times the rate for the remaining Eurozone nations. The PIIGS accounted for 60 per cent of the total change in total Eurozone employment, while their share in total Eurozone employment in 1997 was just 37 per cent.

Table X.1 Change and growth in employment, European Union, 1999-2007, 000s and per cent

Source: Eurostat, Employment by sex, age and economic activity (1983-2008, NACE Rev. 1.1), Table lfsa_egana.

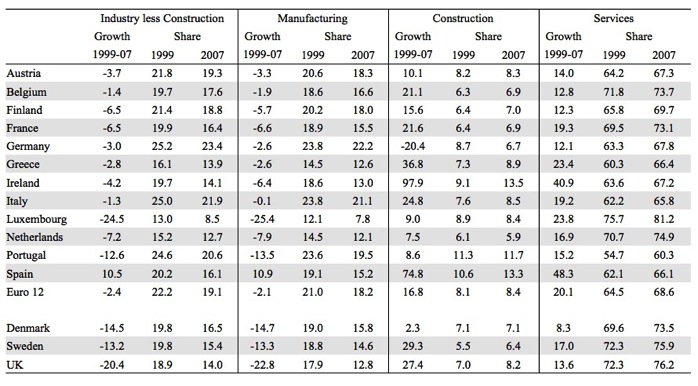

The data in Table X.2 tells the story of what was happening at the industry sector level in the first 8 years of the Eurozone. It shows the growth in employment (per cent) and the shift in employment shares (as a proportion of total for each country) by selected broad industry sectors. The spectacular growth in employment in Ireland and Spain shown in Table X.1 occurred in the Construction sector as a result of the housing boom in both economies. The Construction sector nearly doubled in size between 1999 and 2007 in Ireland (97.9 per cent growth) and grew by 75 per cent in Spain. This growth led to a major shift in the balance of these economies, with the Construction sector increasing from 9.1 per cent of total Irish employment in 1999 to 13.5 per cent in 2007, and from 10.6 per cent of total Spanish employment in 1999 to 13.3 per cent in 2007 (see Table X.2). These are radical shifts in a nation’s employment mix in such a short period.

There was also above-average Eurozone growth in the Construction sector in Greece and Italy among the PIIGS and Belgium and France. The strongest Eurozone employment growth was in the services sector and within that sector the Real estate, renting and business activities sub-sector experienced very strong growth, associated with the building boom.

Table X.2 Employment growth and shares of total employment by sector, 1999 and 2007, per cent

Source: Eurostat, Employment by sex, age and economic activity (1983-2008, NACE Rev. 1.1), Table lfsa_egana.

Modell Deutschland starts shrinking its jobs and gaming its EMU partners

The German government played a rather particular role in this shift in employment mixes. A reasonable argument can be made that Gerhard Schröder helped caused the Eurozone crisis. His government’s response to the restrictions that entering the EMU placed on Germany, are certainly part of the story and one of the least focused upon aspects. Before the EMU, the Bundesbank had regularly intervened into international currency markets to manipulate the Deutsch mark exhange rate to ensure the German export sector remained very competitive. For example, during the ESM years, the regular complaint from France and others was that the Mark was grossly undervalued, which forced them to reduce domestic demand and increase unemployment in order to maintain the agreed ESM exchange parities. The maintenance of an undervalued currency is one of the reasons Germany became an export powerhouse. It is the same strategy that the Chinese have followed in recent years, which, ironically has attracted German criticism.

Upon entering the EMU, the Germans lost control of their exchange rate and hence they had to manipulate other ‘cost’ variables to retain their international competitiveness. Gerhard Schröder also was under immense political pressure to do something about the high unemployment in the East after reunification. The Germans understood that international competitiveness can be increased by depreciating the exchange rate or by domestic deflation (reducing domestic production costs and inflation rate relative to other nations). The latter strategy is the so-called ‘internal devaluation’ route that are all the rage in Europe now, given that the nations surrendered the option of exchange rate flexibility when they entered the EMU.

On March 14, 2003, Gerhard Schröder announced to the Bundestag his Government’s ‘Agenda 2010’, which was aligned in concept, design and timeframe with the European Union’s Lisbon Strategy and signified that the SPD-B’90/Greens coalition was now unambiguously pursuing a neo-liberal agenda. Agenda 2010 aimed to attack income support systems and ensure that Germany’s export competitiveness endured despite abandoning its exchange rate flexibility. It was dressed up in the language of flexibility and incentive but was based on the mainstream view that mass unemployment was the result of a workforce rendered lazy by the welfare system, rather than the more obvious alternative, that it arose when there was a systemic failure to generate enough jobs.

The so-called ‘Hartz reforms’ were a major plank in Schröder’s Agenda 2010 strategy and resulted from a 2002 commission of enquiry, presided over by and named after Peter Hartz, a key executive from German car manufacturer Volkswagen. The aim was clear unemployment benefits had to be cut and job protections had to go. The recommendations were fully endorsed by the Schröder government and introduced in four tranches: Hartz I to IV, starting in January 2003. The changes associated with Hartz I to Hartz III, took place over 2003 and 2004, while Hartz IV began in January 2005. The changes were far reaching in terms of the labour market policy that had been stable for several decades. The changes were consistent with those that had have been pursued in other industrialised countries, following the agenda outlined in the OECD’s Job Study in 1994. The so-called supply-side focus saw unemployment as an individual problem and continued income support became conditional on a raft of increasingly onerous activity tests and training schemes. Government abandoned the idea that they could reduce unemployment with properly targetted job creation schemes. This type of policy intervention fell foul of the new fetish for budget surpluses. Public employment agencies were also privatised, which created a new private sector industry managing the unemployed!

The reforms accelerated the casualisation of the labour market and the precariousness of work increased. Hart II introduced new types of employment the ‘mini-job’ and the ‘midi-job’ and there was a sharp fall in regular employment after the introduction of the Hartz reforms. Mini-jobs provide marginal employment (no security or entitlements) and allow worker to earn up to 450€ per month without paying taxes, while the on-costs for employers are significantly lower. The no tax obligations also mean that the worker receives no social security protection or pension entitlements. A job is classified as a ‘midi-job’ or a ‘low wage’ job if the monthly wage is between 450 and 850 Euros and place different responsibilities on employers to pay on-costs and workers to pay taxes.

The official line is that during the Eurozone years, Germany underwent a ‘jobwunder’, or jobs miracle (for example, Caliendo and Wrohlich, 2006). However the speedy increase in employment can also be viewed less optimistically, “From the bottom of the cycle, in mid-2003, employment grew much less quickly than in previous upturns. And much of the rise took the form of ‘mini jobs’ – part-time posts paying no more than €400 a month, regardless of hours. By contrast, employment in the ‘primary’ labour market, where social insurance contributions are compulsory is still well below what it was seven years ago” (The Economist, 2007).

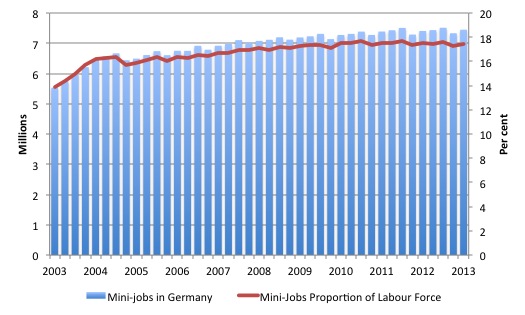

Figure X1 shows the growth of ‘mini-jobs’ in Germany from the start of the scheme in June 2003. In September 2013, there were 7.4 million ‘mini-jobs’ which represented 17.4 per cent of the labour force between 15 and 64 years of age. The proportion has been fairly steady since late 2007 after a rapid increase in the earlier years of the scheme. The rapid increase in the mini-job means an increasing (and sizeable) proportion of the German workforce are forced to work in precarious jobs with extremely low pay and are thus excluded from enjoying the benefits of national income growth and the chance to accumulate pension entitlements.

Figure X.X Mini-jobs in Germany, 2003-13, 000s and percent

Source: Analyse des Arbeitsmarktes für Frauen und Männer, 2.8 Tabelle: Geringfügig entlohnt Beschäftigte am Arbeitsort nach Geschlecht in Deutschland, Statistik der Bundesagentur für Arbeit. Labour Force data from Eurostat, Table lfsi_act_q.

The neo-liberals claim that part-time work in general and, in Germany, the ‘mini-jobs’ provide a greater chance of full-time work for those who would otherwise remain unemployed – the so-called ‘stepping stone’ hypothesis. This hypothesis has several components. First, the ‘mini-jobs’ provide work experience while unemployment leads to skill atrophy. Second, the ‘mini-job’ workers signal their ability and willingness to accept work relative to those who remain on unemployment. Third, participating in the ‘mini-jobs’ enlarges the social network of job seekers, which in turn, provides valuable linkages to a wider knowledge of job vacancies. The evidence in Germany (and everywhere else for that matter) disputes this claim (see Bill et al., 2007).

A joint workshop on transitions from marginal employment in 2010, organised by the Institut Arbeit und Qualifikation (IAQ) at the Universität Duisburg-Essen and der Uni und dem Wirtschafts- und Sozialwissenschaftlichen Institut (WSI) at the Hans-Böckler-Stiftung (Hans-Böckler Foundation), found that while employers are increasingly splitting regular jobs into low-paid and insecure ‘mini-jobs’, there was no evidence of large-scale worker transition from ‘mini-jobs’ to other, more regular work (Universität Duisburg-Essen, 2010). ‘Mini-jobs’ are increasingly trapped in this form of marginalised employment.

Further, with no minimum wage in Germany, these structural changes caused pay differentials to widen considerably over the last decade. In a comparative analysis of German low-wage workers with 17 other European nations for 2010, Thomas Rhein, a research officer at the Institute for Employment Research (IAB), which is attached to the Bundesagentur für Arbeit (BA, or German Federal Employment Agency), found that the low-wage threshold for Germany was 9.54 Euros per hour. Rhein (2013: 3) found that 24.2 per cent of German workers in 2010 received less than this hourly rate. Rhein (2013: 3) noted that Lithuania at 27.5 per cent had a higher proportion of workers in the low-wage category (“Die auf Basis von Stundenlöhnen ermittelten Niedriglohnquoten weisen für Deutschland mit einem Anteil von 24,1 Prozent an allen Beschäftigten den höchsten Wert unter den Vergleichsländern auf, wenn man einmal von Litauen (27,5 Prozent) absieht.”).

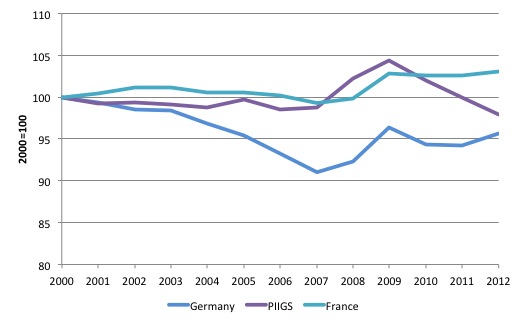

In general, German real wages (the purchasing power equivalent of the wages received by workers each week) failed to keep pace with growth in productivity (how much workers were producing each hour). The European Union AMECO database shows that the share of wages as a percentage of GDP in Germany went from 61 per cent in 1995 to 55.1 per cent in 2007. Between 2003 and 2007, the share fell from 59.7 per cent to 55.1 per cent. This was a more rapid decline than the average for France and the PIIGS (which were both relatively constant). Figure X.X1 shows the movement in wage shares (indexed to 100 at 2000) from 2000 to 2012 for Germany, France and the PIIGS. You interpret a graph in index number form as deviations in percent from the base of 100. So by 2007, Germany had reduced its wage share by 9 per cent on its 2000 value. The rise in the the shares during the crisis signifies the fact that national GDP (output) was falling while total wages were not falling as fast or were relatively constant. As a consequence the ratio of the two rose.

Figure X.X1 Index of wage share movements in Germany, France and the PIIGS, 2000-12, 2000=100

Source: Eurostat.

Why does this matter? Until the early 2000s, real wages and labour productivity typically moved together in Germany as they did in most advanced nations. While to complex a topic to go into here, if real wages and labour productivity grow proportionately over time, the share of total national income that workers (wage earners) receive remains constant. Indeed, this relationship was so constant that famous Cambridge economist Nicholas Kaldor listed it as one of this six ‘stylised facts’ about economic growth (Kaldor, 1957). However, once the neo-liberal attacks on the capacity of workers to secure wage increases intensified in the 1980s in many nations and, later in Germany, a gap between the growth in real wages and productivity growth opened and widened. This led to a major shift in national income shares away from workers towards profits.

The capitalist dilemma was that real wages typically had to grow in line with productivity, to ensure that the goods produced were sold. If workers were producing more per hour over time, they had to be paid more hour in real terms to ensure their purchasing power growth was sufficient to consume the extra production being pushed out into the markets. How does economic growth sustain itself when labour productivity growth outstrips the growth in the real wage, especially as governments were trying to reduce their deficits and thus their contribution to total spending in their economies? How does the economy recycle the rising profit share to overcome the declining capacity of workers to consume?

The neo-liberal period found a new way to solve the dilemma. The ‘solution’ was so-called ‘financial engineering’, which pushed ever-increasing debt onto households and firms in many nations. The credit expansion sustained the workers’ purchasing power, but also delivered an interest bonus to capital, while real wages growth continued to be suppressed. Households, in particular, were enticed by lower interest rates and the vehement marketing strategies of the financial engineers. It seemed too good to be true and it was.

The German approach nuanced this trend. The growth in employment they experienced in the lead up to the crisis was was not due to the good functioning of the monetary union but to its malfunctions. It depended on widening trade imbalances – huge surpluses in Germany and some of its neighbours against widening deficits in the periphery, covered by unsustainable capital flows from the former to the latter.

[NEXT – FINISH THE IMBALANCE CHAPTER TOMORROW – THEN THE NEXT CHAPTER ON THE NEAR COLLAPSE OF THE SGP IN 2003]

[TO BE CONTINUED]

Additional references

This list will be progressively compiled.

Bill, A., Mitchell, W.F. and Welters, R. (2007) ‘Labour Reform and Labour Mobility within Cities: have the Hartz reforms succeeded?’, Working Paper No. 07-16, Centre of Full Employment and Equity, University of Newcastle. http://e1.newcastle.edu.au/coffee/pubs/wp/2007/07-16.pdf

Caliendo, M. and Wrohlich, K. (2006) ‘Evaluating the German “Mini-Job” Reform Using a Natural Experiment’, Working Paper, German Institute for Economic Research (DIW), Berlin.

Darvas, Z., Pisani-Ferry, J. and Sapir, A. (2011) ‘A Comprehensive Approach to the Euro-Area Debt Crisis’, Bruegel Policy Brief, 2011/02, February. http://www.bruegel.org/download/parent/491-a-comprehensive-approach-to-the-euro-area-debt-crisis/file/988-a-comprehensive-approach-to-the-euro-area-debt-crisis

Kaldor, N. (1957) ‘A model of economic growth’, The Economic Journal, 67 (268), 591-624.

Rhein, T. (2013) ‘Deutsche Geringverdiener im europaeischen Vergleich’, IAB-Kurzbericht, Issue 15.

Schuknecht, L., Moutot, P., Rother, P. and Stark, J. (2011) ‘The Stability and Growth Pact: Crisis and Reform’, Occasional Paper Series No 129, European Central Bank, September.

The Economist (2007) ‘Back above the bar again’, July 12, 2007.

Universität Duisburg-Essen (2001) ‘Workshop: Wege aus der geringfügigen Beschäftigung, Minijob mit Nebenwirkungen’, March 2010. https://www.uni-due.de/de/presse/meldung.php?id=2020

Wyplosz, C. (2006) ‘European Monetary Union: The Dark Sides of a Major Success’, Economic Policy, April, 208-261.

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Not sure if it is relevant to this section of your book or not, however, it seems that Germany has just recently approved a minimum wage?