At the moment, the UK Chancellor is getting headlines with her tough talk on government…

Options for Europe – Part 63

The title is my current working title for a book I am finalising over the next few months on the Eurozone. If all goes well (and it should) it will be published in both Italian and English by very well-known publishers. The publication date for the Italian edition is tentatively late April to early May 2014.

You can access the entire sequence of blogs in this series through the – Euro book Category.

I cannot guarantee the sequence of daily additions will make sense overall because at times I will go back and fill in bits (that I needed library access or whatever for). But you should be able to pick up the thread over time although the full edited version will only be available in the final book (obviously).

Chapter X The Stability and Growth Pact fails within 2 years – so Germany alters the rules

After years of negotiating the Stability and Growth Pact (SGP), and the excessive deficit procedures (EDP) in particular, trouble emerged for the monetary union almost immediately. Given the poorly conceived nature of the SGP it was no surprise that it would fail its first test. What was surprising was the way the politicians and bureaucrats behaved in the face of what any reasonable assessment would consider to be extraordinary hypocrisy. But then, the way Theo Waigel wriggled and squirmed in the ‘convergence period’ with his ‘3 doesn’t mean 3’ denials to make sure Germany met the terms of entry into the EMU and the related slippage in allowing Belgium, Italy, and then Greece to enter, had already demonstrated how ‘flexible’ Germany would be with its ‘discipline’. The recent history has taught us that if Germany is unable to meet the fiscal rules in the SGP, then the rules will be altered. Otherwise, the EDP rules will be used as a blunt weapon to devastate the employment base and living standards of weaker nations without the political clout of Germany.

The EDP is the so-called corrective arm of the SGP and according to the European Commission (2014) “begins with a Member State either”:

- having breached or being in risk of breaching the deficit threshold of 3% of GDP or

- having violated the debt rule by having a government debt level above 60% of GDP, which is not diminishing at a satisfactory pace. This means that the gap between a country’s debt level and the 60% reference needs to be reduced by 1/20th annually (on average over three years).

A rigid procedure is specified for countries “placed in EDP” with financial penalties imposed for nations who are in “serious” breach or who fail to meet deadlines imposed by the European Commission. The “EDP is stepped up” for nations that fail “to take effective action to correct the excessive deficit in time”. The fiscal austerity that is enforced becomes more severe. The rules have been strengthened unto the ‘Two Pack’ and the ‘Fiscal Compact’ which augmented the SGP in May 2013. We will consider them separately in a later Chapter.

As we have seen, these rules and procedures were, in no small way, the product of the demands made by Germany as a pre-condition for surrendering the Deutsch Mark and ceding the control of the Bundesbank to the ECB. The insistence by Germany that the SGP would be binding was a reflection of its fear that once the single currency was introduced and a common monetary policy was in force, some nations would exploit the likelihood that their public debt interest rates would be conditioned by the presence of Germany in the EMU (that is, would be lower), and overspend and over-borrow. As a consequence, the SGP rules defined a state of ‘over spending’ and ‘over borrowing’ without recourse to the normal indicators one would reasonably use to make such assessments, such as the state of the economic cycle, the extent of idle capacity in the economy, including the unemployment rate, and the inflation rate.

Germany was one of the first nations to transgress these rules along with France. What followed was astounding, especially in the context of the machinations during the current crisis, where Germany has played it tough with its smaller, more fragile EMU partners.

By early 2002, German economic growth was fairly subdued with a further slowdown likely. The European Commission met to consider the implications of this outlook for German’s ability to meet the SGP fiscal rules. The Commission concluded that it was likely that Germany would “require a substantially higher adjustment effort” to achieve the projected fiscal balance by 2004 (European Commission, 2002a). On January 30, 2002, the European Commission, acting under the EDP rules, proposed “to give Germany an early warning on the basis of Regulation 1466/97 of the Stability and Growth Pact (SGP)”, which would be forward to the Ecofin Council for its determination (European Commission, 2002a).

At an Ecofin meeting on February 12, 2002, the Finance Ministers considered this warning in the light of the ‘updated Stability Programmes’ for Germany. The Council concluded that Germany’s “new update broadly complies with the requirements” (European Commission, 2002b: 7) and that Germany was expected to record a balanced fiscal position by 2004. The risk was that economic growth would fall and the automatic stabilisers would push the fiscal balance “even closer to the 3% of GDP reference value” (p. 8). The Council clearly understood that any further slowdown in the German economy would generate a larger deficit but still demanded that “a balanced budget position must be reached as soon as possible” (p. 8). For these technocrats the rules were binding and the warning remained that if the reference value was exceeded, then Germany would be cited under the EDP. The likely impact on unemployment and the prosperity of the German population didn’t enter their minds. The Council also urged Germany to ensure there was a “decisive implementation of structural reforms … in particular in he labour market and in social security and benefit systems” (p. 8). The neo-liberal mindset was thus firmly in place despite the obvious risk that Germany’s insipid growth would falter as planned fiscal austerity was increased. The Council determined that the German government had “effectively responded to the concerns expressed” (by promising more fiscal austerity than previously indicated) and the EDP was closed (p. 9).

At the same Ecofin meeting, the case of France was also considered. A similar narrative was recorded – downside risks of low growth pushing out the deficit; the need to be in balance or surplus by 2004; more fiscal austerity promised by the French government; the need for more cuts “as soon as possible” in the pension system (p. 15). But there had been no ‘early warning’ issued to France and so no further determination was necessary.

Growth slows and the choice between rigid obedience or saving jobs

While the German economy had grown by a modest 1.5 per cent in 2001, by the end of 2002 growth had stalled completely, before declining by 0.4 per cent in 2003. German unemployment, already high in 2001 at 7.9 per cent, rose to new heights over the next four years – 8.7 per cent in 2002, 9.8 per cent in 2003, 10.5 per cent in 2004, and finally peaking at 11.3 per cent in 2005. This was all down to the mindless fiscal austerity that Germany adopted within the recession-biases of the SGP. Millions lost their jobs as a result, while others increasingly found their jobs becoming more precarious and their wage prospects suppressed. If there was ever a time for reflection on how damaging the EMU structure could be, then this period should have been it. Of-course, much worse was to come within the next five years.

On November 19, 2002, the European Commission published a report on what they called the ‘Excessive deficit on Germany’. It noted that Germany’s projected fiscal deficit for 2002 would rise from 2.8 per cent of GDP in 2001 to 3.8 per cent and “therefore, the deficit will exceed the reference value of 3% by a significant margin” (European Commission, 2002c: 2). In addition, its public debt ratio was expected to exceed 60 per cent of GDP and was therefore likely to be in breach of the SGP. As a consequence, the Commission initiated the EDP against Germany for its “budgetary slippage” (p. 4). Slippage invokes imagery of dysfunction, which in this case, manifested as a move into recession and the need to expand the fiscal deficit to ensure final spending in the economy was sufficient to arrest the decline. But for the European Commission, slippage was solely defined in terms of the ‘reference values’, which were the only policy target they were focused on.

The Commission explained the “very weak” growth in terms of the decline in the construction sector as the reunification process was coming to an end and the “numerous structural impediments … inflexible labour market” (p. 4) and its welfare system. None of these things was behind the slowdown in growth and the move to recession. A responsible government would have realised the construction boom associated with the reunfication would end and need alternative forms of stimulus, given the high propensity to save of its population. But the SGP rules were forcing the government to withdraw any form of spending support for the German economy with the obvious consequences – recession and rising unemployment. The ‘structure’ of the economy had nothing to do with it – Germany had demonstrated it could grow at much more robust rates with this ‘structure’ in the past and the only change had been the imposition of this ridiculous EDP mentality.

The terminology in the Commission’s reasoning was mindboggling. They acknowledged that “budgetary developments have been adversely affected by continued weakness of economic activity” (p. 12) plus a one-off flood but “in the sense of the Treaty” the deficits were not “outside the control of the German authorities, nor … the result of a severe economic downturn” (p. 12). The German authorities could have cut its net spending more severely but growth was already stalling and unemployment rising quickly. From outside the twisted neo-liberal logic of the SGP, the downturn was already looking serious (if not severe) but the SGP defined the threshold of severity as a decline in real GDP of more than 0.75 per cent in any year. That figure was like all the rest totally arbitrary but meant that millions could lose their jobs yet the downturn would not be considered severe.

On October 18, 2002 the European Commission President, Italian Romano Prodi told the French daily newspaper Le Monde that “Je sais très bien que le pacte de stabilité est stupide, comme toutes les décisions qui sont rigides … Le pacte de stabilité est imparfait, c’est vrai, parce qu’il faut avoir un outil plus intelligent, et plus de flexibilité” Leparmentier and Zecchini (2002). Thus, for Prodi, the SGP was stupid, like all decisions that are rigid and there was a need for a more intelligent tool with more flexibility. The official spin that came out of the European Commission’s press machine in response emphasised the part of the interview where Prodi indicated that divergent economic policies within the EMU would be “totally crazy” and that Mr Prodi was also very strong on fiscal discipline (BBC, 2002).

The heat rises – Germany caught in the trap of its own making

At any rate, the game was on. Germany now had an additional problem. It was being caught up in the trap it had set for Italy, Greece and other ‘suspect’ nations. The European Commmission upped the ante in early 2003 when they concluded on January 8 that there was an excessive deficit in Germany under the terms of the Treaty (European Commission, 2003a) and accused Germany of not respecting the Treaty (European Commission, 2003b: 2). They demanded that Germany “put an end to the present excessive deficit situation as rapidly as possible” (p. 4) by cutting net spending and retrenching its labour market protections and welfare system. These decisions were accepted a few weeks later by the Council of the European Union. The Council demanded that Germany cut its deficit by 1 per cent of GDP within four months (European Commission, 2003c: 4). This type of fiscal contraction is very large in such a short-time and, if successful, would guarantee that the German economy would enter recession. Further, given the loss of tax revenue associated with this decline, there was no guarantee that the fiscal balance would even decline. History tells us that it didn’t!

The German economy contracted in 2003 and the fiscal balance rose to 4.2 per cent of GDP up from 3.8 per cent in 2002. In recognising the facts, on November 18, 2003, the European Commission then recommended to the Council that the EDP enter the next stage of ‘non-compliance’ which would require further steps to be taken (European Commission, 2003d). In its recommendation we start to see the myth of a ‘fiscal contraction expansion’, which has featured prominently in the current crisis, being introduced. The Commission said that a substantial fiscal reduction would not “necessarily depress economic activity. A lack of private confidence is a key factor holding back growth … [and that] … current high saving rates … suggest that … present income levels are no serious constraint for private consumption. Indeed, consumption is being held back by high uncertainty” (p. 3). This was one of those assessments that a reasonable economist, not infested with the neo-liberal dogma, has to blink twice about, before they are convinced they have read the text correctly.

The Commission failed to mention the growing angst in Germany with the Hartz reforms that began earlier in 2003. Combined with the rising unemployment associated with the fiscal contractions to date and the increasing attacks on real wages, which had undermined total spending, there was a very good reason why consumers were adopting a cautious attitude. With further fiscal contraction, and worsening unemployment there was no coherent reasons for consumers to reverse their saving plans and go on a spending spree. Further, without a strong consumption growth, firms could satisfy current spending (and sales) with the existing capacity and therefore had no imperative to increase investment growth. Their expectation, reasonably, was that the economic situation would worsen over the next 12 months and yield very little profitable investment opportunities.

Later in its recommendation, the Commission actually acknowledged that “prolonged stagnation” was more likely for Germany as it sought to cut its deficit and as a consequence it extended the deadline for the correction of the ‘excessive deficit’ by one year to 2005 (p. 4). As has been the case throughout this saga, it was a case of the hardline ideology behind the blind adherence to the rule enforcement coming up against the obvious facts that no person with any brain capacity could ignore. The rules were once again being ‘bent’ as they were during the convergence process and as they would be later, when the really big crisis hit.

A parallel process had been going on with respect to France. The detail can remain silent here, being very similar to the German case – economic downturn, fiscal deficits rising beyond the SGP reference values, austerity implemented, growth and deficits worsening, the technocrats mindlessly applying their rules. On March 28, 2003, the European Commission published a report on the French situation, which was intended to the next Ecofin meeting. It followed an ‘early warning’ being issued to France in January 2003. The Commission considered that France had not taken “sufficient measures to reduce” (p. 13) its deficit. It also acknowledged the “protracted weakness of the economy” (p. 13) but still recommended that the French government ensure the deficit does not exceed 3 per cent in 2003. At the time of writing the deficit was estimated to be 3.1 per cent of GDP and unemployment was on the rise, and would reach 8.9 per cent by the end of the year.

Undaunted, on May 7, 2003, the Commission determined that there was an excessive deficit in France and the Council was advised accordingly (European Commission, 2003g). On June 3, 2003, the Council took this advice and determined accordingly (European Commission, 2003h). The same bureaucratic path that applied to Germany was then taken with the determination that France was not responding adequately to the Council’s demands for fiscal retrenchment (October 8, 2003).

Le pacte de stabilite Europeen n’est pas inscrit sur le marbre

The French government was publicly hostile to the process. The problem was that the fiscal rules embedded in the SGP were ‘written in marble’ despite this protestation from the French Minister for Economic Affairs, Finance and Industry, Francis Mer in June 2003 (House of Lords, 2003). The nations had all signed up to a discipline that they found was not possible to maintain and still meet their responsibilities to maintain growth and reduce unemployment.

It was obvious that”the rising deficits from 2001 were the result of “persistently poor economic growth and, more importantly, consolidation fatigue, which started soon after the launch of the single currency” Morris et al. (2006: 15). The political reality was that the prosperity of the EMU had been suppressed for years in the race to meet the convergence criteria and there was only so much austerity that could be tolerated by the respective populations. Governments realised that public infrastructure and essential services could not be scorched indefinitely without significant negative political ramifications.

Further, most of the EMU nations had resorted to a range of ‘once-off’ accounting tricks to render their fiscal balances consistent with the criteria. Once business as usual was resumed, the fiscal balances more closely resembled the underlying economic reality (for example, the strength of economic growth driving tax revenue) in these nations and that reality was inconsistent with the rigid fiscal rules that had been arbitrarily imposed by the SGP.

On Bastille Day 2003, the Ecofin Ministers met in Paris to consider deficit situation. French President Jacques Chirac had pressured them to relax the fiscal rules to allow some room for growth (Economist, 2003). The hostility among the other EMU partners towards the French call for an easing of the SGP was evident in the reported anger from Dutch Finance Minister Gerrit Zalm who said that “(t)his is July 14, the day the Bastille was stormed, and now it’s the day the stability pact has been stormed. The storming of the Bastille was a better idea” (BBC, 2003). At that point, Germany knew it had the ally it needed to ignore the Commission and manipulate the Council when it came to the crunch later in 2003. But the Germans still tried to have it both ways. The German Finance Minister Hans Eichel told the press on July 14, 2003 that “(s)tability is not the priority right now … we need growth” but then claimed that Germany was not calling for a relaxation of the rules (BBC, 2003). Of-course, the Germans would be right next to the French later in 2003 when they colluded to plunge Europe into crisis.

The naysayers were as usual the central bankers. The ECB was “vehemently against any revisions” (Howarth and Loedel, 2003: 173) and demanded strict interpretation and enforcement of the Pact”. ECB President Wim Duisenberg during the presentation of the ECB’s 2002 Annual Report in Strasbourg on July 3, 2003 berated the national governments for their “a lack of ambition in the areas of both fiscal and structural reforms ” and stressed the “the need to speed up the pace of structural reforms”. He clearly didn’t want to understand that the rising deficits were a reflection of the failing growth as a result of attempts to implement the fiscal rules rather than causing the stagnant outcome.

In late August 2003, the French Prime Minister Jean-Pierre Raffarin was in Brussels for a European Commission meeting. He told the Commission that more flexibility was needed in the application of the SGP. There was fierce resistance within the Commission to allowing any laxity in the rules. Romano Prodi told the press that there was “no choice but to apply the rules of the treaty” (Fuller, 2003). Raffarin had a more advanced sense of his responsibilities when he declared that his ” No. 1 duty is to mobilize all of the strengths of our country for growth and employment. And I will do everything in 2004 to make sure that we return to growth and increase employment” (Fuller, 2003).

On September 4, 2003, Raffarin continued this sentiment during an interview with French television station TF1, which the Le Monde editorial on September 6, said had demonstrated contempt for Europe. Raffarin said that while the SGP was “important” his “first duty” was to ensure there is work for the French and that he was not going to compromise that for some “accounting equations and to do some maths” to satisfy the bureaucrats in Brussels (“son premier devoir était de faire en sorte qu’il y ait du travail … Mon premier devoir, ce n’est pas d’aller rendre des équations comptables et de faire des problèmes mathématiques pour que tel ou tel bureau dans tel ou tel pays soit satisfait”). He also said that while the Germans would return to austerity and undermine growth, French would not follow (“Pas les Français”).

The crisis point is reached

On November 18, 2003, the Commission recommended to the Council that the response of both the French and German governments to their earlier demands be considered inadequate under the terms of the Treaty and that further action under the EDP be triggered and a much tighter frame be required for resolution. The stakes were now high. The Commission wanted both France and Germany to be sanctioned for their obdurate behaviour with respect to the rules. One should emphasise that by not implementing the scale of the fiscal cutbacks recommended by the bureaucrats, the French and German governments were, at least, saving some jobs from destruction, amid the millions that were being retrenched as a result of them playing the game ‘somewhat’.

Five days later, on November 25, 2003, the Ecofin Council of Finance Ministers met in Brussels to vote on the Commission’s Recommendations. Under the Treaty, it was Ecofin who oversaw the process, which was laid as out follows: the Commission was responsible for the surveillance system of Member State fiscal positions and would make recommendations to Ecofin if it considered there was an excessive deficit under the rules. Ecofin would then determine whether that was the case or not and if it decided there was an excessive deficit it would require the offending nation to fix the problem within a short time period. If after that time, the excessive deficit persisted then Ecofin could impose the very harsh fine.

Further, decisions taken by Ecofin are determined by the quaint construct called a ‘qualified majority’ (or supermajority), which is a weighted voting system such that the larger nations by population are given more weight (votes) in the process. The aim was to balance the interests of small and large member states but effectively meant that the ‘big police’ were able to derail any investigations against them through collusion. The weights used in the 2003 were established in the Treaty of Nice, which came into force on February 1, 2003. They have been updated over time as more nations have joined the European Union and the system is now less vulnerable to the so-called ‘blocking minority’ (now requiring at least four states to be included in the bloc). In November 2003, there were 87 ‘votes’ in total allocated to the 15 EU nations with Germany, France, Italy and the UK each having 10, Spain 8, Belgium, Greece, Netherlands and Portugal 5 each etc. A qualified majority amounted to 62 votes out of the 87 (71.3 per cent) and 26 votes (29.9 per cent) constituted a blocking minority. So Germany and France only had to do a deal with the UK or Italy, for example, to run the show in their favour (European Union, 2012).

The upshot was that the Ecofin Council rejected the crucial European Commission recommendations in relation to both France and Germany. While a simple majority was achieved for each vote, attracting affirmative responses from Belgium, Denmark, Greece, Spain, Netherlands, Austria, Finland and Sweden or a subset where only Eurozone nations could vote, a qualified majority failed and so no decision was adopted (European Council, 2003). The Council determined that while it had found in June 2003 that an excessive deficit existed in France and that it had recommended that nation take approprite measures to reduce the deficit by the end of 2004, there had equally been several “important economic and budgetary developments” (slower growth and rising unemployment) evident in the third-quarter of 2003 which influenced its final conclusion. Accordingly, it decided that it would not act against France “at this point in time” and would hold the EDP against France “in abeyance for the time being” p. 17). The same reasoning was applied to Germany. The Council had not only ignored the recommendation of the European Commission but also suspended any action under the EDP against France and Germany.

The European Commission was furious with the Council’s decision to let France and Germany off the hook and accused it of not providing an “adequate explanation” (European Council, 2003: 22). It felt compelled to enter the following statement in the official minutes of the Ecofin meeting (p. 22):

The Commission deeply regrets that the Council has not followed the spirit and the rules of the Treaty and the Stability and Growth Pact that were agreed unanimously by all Member States. Only a rule-based system can guarantee that commitments are enforced and that all Member States are treated equally. The Commission will continue to apply the Treaty and reserves the right to examine the implications of these Council conclusions and decide on possible subsequent actions.

Where did that leave the whole enterprise? The UK Guardian reported soon after the Council had suspended the SGP that “(e)conomic stagnation in France and Germany has scuppered the budgetary constraints put in place with the euro” (Tran, 2003). The report summed up that the Council decision to ignore the Commission’s recommendation had put the SGP into “intensive care” and will motivate changes in the rules. Overall, the the decision reflected the recognition that “imposing financial penalties when they’re already mired in economic problems made little sense”. While that is a correct summation, the reality is that it was only because France and Germany were the targets of the action that this sort of recognition came to the fore. It clearly hasn’t been a consideration in the case of Greece in 2010 and onwards.

A 2011 ECB paper concluded that the “first test” of the SGP had “failed” because “France and Germany, among others, blocked its strict implementation by colluding in order to reject a Commission recommendation to move a step further in the direction of sanctions” under the EDP (Schuknecht et al., 2011: 10). The ramifications were clear. The rules would have to be renegotiated. But before that process would begin, the “subsequent actions” noted in the Commission’s qualifying statement in the Ecofin minutes, manifested in the form of a challenge by the Commission to have the Council decision annulled by the European Court of Justice (ECJ) on the grounds that the Council had not followed the rules and procedures as set out in the Treaty.

That action began on January 24, 2004, and the ECJ was asked to clarify the powers of each relating to the EDP. On July 13, 2004, the Court brought down its decision. The legal nuances of the action and resulting decision are beyond the scope of this narrative and the professional capacity of this author (see Gros et al, 2004 for one account of the legal issues). But the upshot was that the Court made several determinations. First, it declared inadmissable the request from the Commission that the suspension of action against France and Germany shuld be reversed because a suspension (“hold in abeyance”) did not constitute a decision. Second, it annulled the Council decision in favour of France and Germany on the basis that it had used the wrong procedures (European Court of Justice, 2004).

The decision was a small victory for the Commission because the ruling clearly indicated that the EMU partners could not unilaterally ignore the rules that they had formally agreed to. But the ‘law breakers’ got away with it because the impasse led to a renegotiation of the SGP and no sanction against France or Germany. A Pyrrhic victory nonetheless!

It should also be emphasised that the recessions that France and Germany were enduring at this time were mild relative to the impact of the current crisis on the peripheral Member States, but still they could not meet the reference values without seriously damaging their economies – and they knew it. We will come back to this point in Part III of the book.

The threat of the financial Markets – no response

It is often claimed that part of the justification for the SGP is to assuage concerns in the amorphous financial markets to ensure that governments can continue to sell debt to private bond investors at affordable interest rates. If any should have tested the pacifity of these markets, the November 25 Ecofin rejection was a prime candidate given that it plunged the SGP into crisis. There was no reaction from the financial markets to the November 25 impasse.

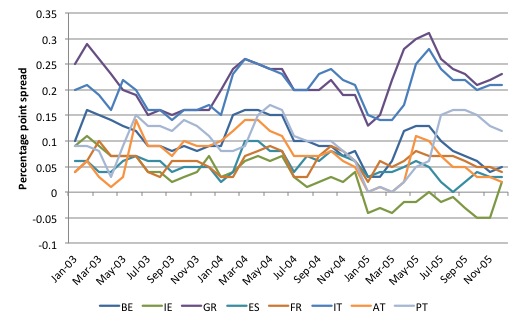

Figure X shows the ten-year government bond spreads relative to Germany in basis points. Graphs of these types have figured large in the current debate and have shown the spreads for Greece, Portugal, and others widening. The spreads are meant to reflect the risk of government default, the wider they are the greater the perceived risk and the larger return demanded for lending funds.

The variations in the spreads shown are less than 3 basis points, which in context is best interpreted as next to nothing. Even when the Italians threatened to leave the Europe in March 2005 there was no major deviations (Wyplosz, 2006).

Figure X1 Ten-year government bond spreads relative to Germany, basis points

Source: European Central Bank.

The Financial Times reported the same day that the financial markets saw the Ecofin rejection of the Commission’s recommendation as a positive sign for growth in the EMU (Hargreaves, 2003). This was followed up next day in the Financial Times with more detailed analysis. Ed Crooks (2003) wrote “If the European Union’s fiscal rules died yesterday – at least in their strictest version – few in the financial markets mourned their passing”. The article quoted a Goldman Sachs executive as saying “Our view is that it is not that big a deal. Its a good thing that the stability pact in its strictest interpretation is dea … its interpretation is moving in the direction of allowing more cyclical leeway for budget deficits during economic downturns, and that is something we think should have been there from the beginning” (Crooks, 2003).

The horse trading that ensued followed the usual European script – protracted with nothing much achieved

The upshot of this saga was that the European Commission decided to alter the SGP rules. The horse-trading that followed was consistent with the whole enterprise – drawn out, political and, ultimately producing a more flexible, but still rigidly, unworkable formula.

[NEXT – THE RENEGOTIATED SGP – SMALL SECTION – THEN PART III – THE OPTIONS – FOUR CHAPTERS TO GO]

[TO BE CONTINUED]

Additional references

This list will be progressively compiled.

BBC (2002) ‘Row over ‘stupid’ EU budget rules’, October 17, 2002. http://news.bbc.co.uk/2/hi/business/2336823.stm

BBC (2003) “Chirac’s budget plea creates EU storm’, July 15, 2003. http://news.bbc.co.uk/2/hi/business/3066861.stm

Crooks, E. (2003) ‘Europe’s Stability Pact: EU May Yet Feel the Bite of the Paper Tiger’, Financial Times, November 26, 2003.

Duisenberg, W. (2003) ‘Presentation of the ECB’s Annual Report 2002 to the European Parliament’, Strasbourg, July 3, 2003. http://www.ecb.europa.eu/press/key/date/2003/html/sp030703.en.html

Economist (2003) ‘Chirac storms the stability pact’, July 17, 2003. http://www.economist.com/node/1921623

European Central Bank (2005) ‘Statement of the Governing Council on the ECOFIN Council’s report on improving the implementation of the Stability and Growth Pact’, 21 March 21, 2005.

European Commission (2002a) ‘Commission assesses the German Stability Programme Update (2001-2005)’, January 30, 2002. http://europa.eu/rapid/press-release_IP-02-164_en.htm?locale=en, Accessed April 9, 2014.

European Commission (2002b) ‘Council decision to close an early warning procedure’, February 12, 2002.

http://www.consilium.europa.eu/ueDocs/cms_Data/docs/pressData/en/ecofin/69429.pdf#page=7

European Commission (2002c) ‘Report from the Commission, Excessive deficit in Germany’, November 19, 2002.

http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/104-03/2002-11-19_de_104-3_en.pdf

European Commission (2003a) ‘Recommendation for a Council Decision on the existence of an excessive deficit in Germany – Application of Article 104(6) of the Treaty establishing the European Community’, January 8, 2003. http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/104-06_commission/2003-01-08_de_104-6_commission_en.pdf

European Commission (2003b) ‘Recommendation for a Council Recommendation to Germany with a view to bringning an end to the situation of an excessive government deficit – Application of Article 104(7) of the Treaty’, January 8, 2003. http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/104-07_commission/2003-01-08_de_104-7_commission_en.pdf

European Commission (2003c) ‘Recommendation for a Council Recommendation to Germany with a view to bringning an end to the situation of an excessive government deficit – Application of Article 104(7) of the Treaty’, January 8, 2003. http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/104-07_council/2003-01-21_de_104-7_council_en.pdf

European Commission (2003d) ‘Recommendation for a Council Decision giving notice to Germany, in accordance with Article 104(9) of the EC Treaty, to take measures for deficit reduction judged necessary in order to remedy the situation of excessive deficit’, November 11, 2003. http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/104-09_commission/2003-11-18_de_104-9_commission_en.pdf

European Commission (2003e) ‘Recommendation for a Council Decision establishing, in accordance with Article 104(8) of the EC Treaty, that the action taken by Germany in response to the recommendatoins made by the Council pursuant to Article 104(7) of the Treaty is proving to be inadequate’, November 11, 2003. http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/104-08_commission/2003-11-18_de_104-8_commission_en.pdf

European Commission (2003f) ‘Deficit Excessif en France: Rapport Prepare Selon L’Article 104.3 Du Traite’, March 28, 2003. http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/104-03/2003-04-02_fr_104-3_en.pdf

European Commission (2003g) ‘Commission Opinion on the existence of an excessive deficit in France, Application of Article 104(5) of the Treaty establishing the European Community’, May 7, 2003. http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/104-05/2003-05-07_fr_104-5_en.pdf

European Commission (2003h) ‘Council Decision on the existence of an excessive deficit in France, Application of Article 104(6) of the Treaty establishing the European Community’, Official Journal of the European Union, L165/29, June 3, 2003. http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/104-06_council/2003-06-03_fr_104-6_council_en.pdf

European Council (2003) ‘2546th Council Meeting, Economic and Financial Affairs’, Council Press Release, Brussels, November 25, 2003. http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/11_council_press_releases/2003-11-25_council_press_release_en.pdf

European Commission (2014) ‘The Corrective Arm’, http://ec.europa.eu/economy_finance/economic_governance/sgp/corrective_arm/index_en.htm, Accessed April 9, 2014.

European Court of Justice (2004) ‘Press Release No. 57/04’, July 13, 2004. http://ec.europa.eu/economy_finance/economic_governance/sgp/pdf/30_edps/other_documents/2007-04-13_de_fr_verdict_ecj_en.pdf

European Union (2012) ‘Consolidated versions of the Treaty on European Union and the Treaty on the Functioning of

the European Union’, Official Journal of the European Union, C 326, Volume 55, October 26, 2012.

Fischer, J., Jonung, L. and Larch, M. (2006) ‘101 proposals to reform the Stability and Growth Pact. Why so many? A Survey’, European Economy – Economic Papers, No. 267, European Commission, December.

Fuller, T. (2003) ‘France Defends Its Flouting of Europe’s Rules on Deficits’, New York Times, August 27, 2003.

House of Lords (2003) ‘Debate’, Hansard, June 4, 2003. http://www.publications.parliament.uk/pa/ld200203/ldhansrd/vo030604/text/30604-09.htm

Gros, D., Mayer, T. and Ubide, A. (2004) ‘The Nine Lives of the Stability Pact’, Centre of European Policy Studies, Brussels.

Hargreaves, D. (2003) ‘Market Insight: A Kickstart for the Eurozone?’, FT.Com, November 25, 2003.

Leparmentier, A. and Zecchini, L. (2002) ‘La France sera en minorité si elle n’est pas le levain de l’Europe’, Le Monde, October 18, 2002.

Posen, A. (2005) ‘German Experience with Fiscal Rules: Lessons for the US Budget Process’, Testimony before the House Subcommittee on Legislative and Budget Process Committee on Rules, July 27, 2005.

Schuknecht, L., Moutot, P., Rother, P., and Stark, J. (2011) ‘The Stability and Growth Pact: Crisis and Reform’, Occasional Paper Series No. 129, September, European Central Bank.

Tran, M. (2003) ‘What is the stability and growth pact?’, Guardian, November 27, 2003. http://www.theguardian.com/world/2003/nov/27/qanda.business

Wyplosz, C. (2006) ‘European Monetary Union: The Dark Sides of a Major Success’, Economic Policy, April, 208-261.

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

This Post Has 0 Comments