At the moment, the UK Chancellor is getting headlines with her tough talk on government…

Options for Europe – Part 60

The title is my current working title for a book I am finalising over the next few months on the Eurozone. If all goes well (and it should) it will be published in both Italian and English by very well-known publishers. The publication date for the Italian edition is tentatively late April to early May 2014.

You can access the entire sequence of blogs in this series through the – Euro book Category.

I cannot guarantee the sequence of daily additions will make sense overall because at times I will go back and fill in bits (that I needed library access or whatever for). But you should be able to pick up the thread over time although the full edited version will only be available in the final book (obviously).

Chapter X The first few years – a sense of smug self-congratulation amidst mass delusion

Stage III of the EMU transition covered the period from January 1, 1999 to July 1, 2002, the latter date marking the end of the national currencies. While the convergence process was farcical at best, it remained the case the nations could only ‘gild the lily’ so far, not withstanding the amazing scam that Goldman Sachs helped the Greeks perpetrate in 2001, which facilitated that nation’s entry to the 12. In other words, the exercise while fraudulent, still caused considerable self-inflicted damage as the nations imposed fiscal austerity and growth rates fell sharply. The descent into prolonged low growth was the precursor of the much greater problems that would come when the external events exposed the design flaws of the monetary system later in the decade.

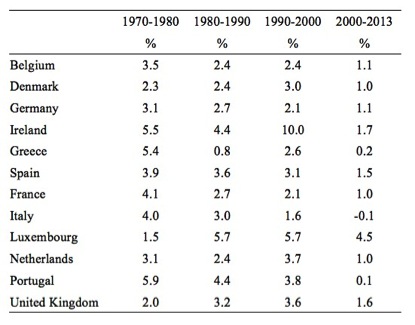

Table X.1 compares the average annual percentage economic growth rates for the decades from 1970, with the last period being 2000 to 2013. The convergence period was damaging for the large European economies (France, Germany, and Italy), which make up more than 60 per cent of the overall EMU economy. Ireland was becoming the ‘Celtic Tiger’ in the early years and the ‘darling’ of the conservatives – but it was also on its way to becoming the mangy cat that it is now.

Table X.1 Real GDP growth performance, 1970-2013, average annual percentage growth by selected periods

Source: AMECO, Annual macro-economic database, http://ec.europa.eu/economy_finance/db_indicators/ameco/index_en.htm

But among the politicians and policy makers the world economy had entered a new phase of virtue.

The Business Cycle is dead!

The early days of the EMU, coincided with an extraordinary period in economic history, where economic policy makers adopted a sort of smug, self-congratulatory triumphalism, which, in part, would lead them to make policy choices that would eventually multiply the risks inherent in the flawed design of the monetary union.

On February 20, 2004, the then Governor of the US Federal Reserve Bank, Ben Bernanke gave a speech to a group of economists in Washington, DC which was entitled ‘The Great Moderation’. The essence of the speech was that the liberalisation agenda promoted by the multilateral agencies such as the IMF and the World Bank and central banks and treasuries had ‘won’ the day. This agenda emphasised the granting of independence to central banks to prioritise ‘inflation-first’ strategies, tight fiscal policy with an obsession for surpluses, and widespread deregulation and privatisation.

In his speech, Bernanke said that one “of the most striking features of the economic landscape over the past twenty years or so has been a substantial decline in macroeconomic volatility”. The term ‘great moderation’ was coined by two Harvard economists James Stock and Mark Watson in their 2002 paper “Has the Business Cycle Changed and Why” – and referred to a reduction in ‘volatility’ during the 1990s in output growth and prices in most economies, which tended to suggest that there had been a ‘break’ in behaviour from the more variable performance experienced in the 1980s. The conservatives were eager to suggest that this ‘moderation’ was due to financial market deregulation that made credit more accessible and “improved policy, in particular improved monetary policy” (Stock and Watson, 2002: 161). Consistent with the dominant neo-liberal narrative, Bernanke claimed that the ‘Great Moderation’ had delivered numerous benefits to economies, which included more stable inflation and employment. He also claimed that “recessions have become less frequent and less severe”.

These claims seemed to reinforce the observations made in 1990 by English economist John Williamson who introduced the term ‘Washington Consensus’ into the public lexicon. The consensus referred to the liberalisation policy agenda broadly pursued Washington-based institutions such as the IMF, the World Bank and the economic agencies of the US government, the Federal Reserve Board, and the think tanks (Williamson, 1990). According to Williamson there were 10 pro-growth policy instruments which these agencies mutually supported and promoted, including the neo-liberal agenda based on free market fundamentalism, fiscal austerity, broad-based deregulation of financial and labour markets, privatisation. The narrative suggested that this agenda was responsible for the ‘moderation’.

Williamson’s ‘consensus’ terminology seemed to suggest that the economic policy terrain was uncontested. But, there were other, albeit largely ignored voices, at the time, including Robert Wade (2004) who demonstrated via his own ten-point reform agenda (based upon the East Asian experience) the centrality of the government leadership in managing the process of economic growth. Wade opposed the ‘shock therapy’ doctrine that the Washington reform agenda had advocated and eschewed the use of fiscal rules. Later, Dani Rodrik (2006) exposed the failure of reform agendas based on the Washington approach.

The underlying neo-liberal narrative that dominated policy making in the 1990s as the EMU was being crafted, was that if private markets were left free of regulation and central banks were allowed to concentrate on price stability, unfettered by the political process then economies would be able to maintain long periods of stable output and employment growth. The neo-liberal economists believed this period of ‘stability’ vindicated their claims that there was no further role for governments to use fiscal policy, the hallmark of Keynesianism, to try to ‘stabilise’ total spending in search of low unemployment.

Keynesianism was dead! The business cycle was dead!

One notable demonstration of this arrogance was the 2003 Presidential Address given to the American Economic Association, by University of Chicago professor Robert E. Lucas. Lucas (2003: 1) said that:

My thesis in this lecture is that macroeconomics in this original sense has succeeded: Its central problem of depression-prevention has been solved, for all practical purposes, and has in fact been solved for many decades. There remain important gains in welfare from better fiscal policies, but I argue that these are gains from providing people with better incentives to work and to save, not from better fine tuning of spending flows. Taking U.S. performance over the past 50 years as a benchmark, the potential for welfare gains from better long-run, supply side policies exceeds by far the potential from further improvements in short-run demand management.

In other words, economic policy should concentrate on further deregulation because the problem of recessions (business cycle downturns) was “solved”. Fiscal policy was now redundant. This type of claim also gave succour to the European politicians who used it as justification for relying on the ECB’s monetary policy position (interest rate setting) to provide European-level stabilisation.

The Brussels-Frankfurt consensus – in league with the Washington Consensus

Clearly, the Washington consensus dove-tailed closely with the policy mentality in Europe that had created the EMU and the growing ‘sense of success’ that emerged in the early days of the union. In July 2003, the European Commission published the so-called Sapir Report, which was the product of “High-Level Group of Independent Experts” who were asked to “review the entire system of EU economic policies” (Sapir et al, 2003: i). André Sapir, is an academic economist who chaired the group meetings. More recently, he was a member of European Commission President Jose Manuel Barroso’s Economic Policy Analysis Group. He also contributes to the public policy debate via his position as ‘resident scholar’ at the conservative Brussels-based ‘think tank’, Bruegel. The latter claims to be “independent and non-doctrinal” but takes the excessive deficit rules embedded in the SGP as non-contestable, which makes it a voice for neo-liberal ideology. Jean-Claude Trichet chairs Bruegel’s Managing Board.

The 183-page Sapir Report was very influential and is full of neo-liberal success rhetoric (see Mitchell and Muysken, 2006 for a critique). The Report said that – “The Group considers that three pillars upon which the European economic edifice is now built are fundamentally sound” (p. ii) – “Expanding growth potential requires first reforms of microeconomic policies at both the EU and national levels” (p. ii) – “there is no doubt that the period of the last 15 years has been a tremendous success” (p. 1). The Report claimed that the remaining policy challenges were at the microeconomic level – to free up more markets and reduce welfare budgets – the echo of the Washington consensus. The Report recommended that the European Commission should maintain a “framework of strengthened budgetary surveillance and more effective and flexible implementation of the Stability and Growth Pact, while sticking to the 3% ceiling. The Commission should reinforce its surveillance and be given more responsibility to interpret the rules of the SGP. Also, budgetary responsibility would be enhanced by establishing independent Fiscal Auditing Boards in the Member States” (p. 5).

At the time that Sapir and his colleagues were busily praising the EMU, economic growth was slowing and unemployment remained persistently high. It was rather surprising that the on-going macroeconomic losses that arise from the persistent unemployment, not to mention the massive social and personal costs, were not considered by European Commission politicians to be the most compelling policy problem that should command their highest priority. It appeared that the politicians and policy-makers, aided and abetted by the so-called ‘experts’ they wheeled in from time to time to produce these self-reinforcing reports, had the totally opposite construction of events. Unemployment was seen, at best, as an unfortunate and ephemeral consequence of policies that are required to maintain low inflation economies and are largely attributed to either rigidities (overly generous welfare and other regulations and out-of-touch unions) or to individual choice. This construction provided the political cover for governments in Europe (and elsewhere) to abandon the goal of full employment and replace it with the diminished goal of full employability.

The underpinning of the bankrupt policy framework was dubbed in the Sapir Report (2003: 41) as the ‘Brussels-Frankfurt consensus’ and was represented as follows:

The maintenance of price stability – reflected in low rates of inflation – facilitates achieving higher rates of economic growth over the medium term and helps to reduce cyclical fluctuations. This shows up in a lower variability of output and inflation. In turn, sound public finances are necessary both to prevent imbalances in the policy mix, which negatively affect the variability of output and inflation, and also to contribute to national savings, thus helping to foster private investment and ultimately growth. The latter beneficial effect is magnified as low deficits and debt, by entailing a low interest burden, create the room for higher public investment, “productive” public spending and a low tax burden. Finally, the beneficial effects of price stability and fiscal discipline on economic performance reinforce each other in various ways. On the one hand, fiscal discipline supports the central bank in its task to maintain price stability. On the other hand, prudent monetary and fiscal policies avoid policy-induced shocks and their unfavourable impact on economic fluctuations while ensuring a higher room for manoeuvre to address other disturbances that increase cyclical instability.

The Washington consensus and the Brussels-Frankfurt consensus thus dovetail perfectly and the whole world was gripped by the austerity culture and the urgency of deregulation. The pre-conditions for the global crisis that would come a few years later were being laid but the creators were blind to their actions, such was their enthusiasm for the agenda and their capacity for Groupthink.

[NEXT – THE DEAL IS DONE AND GERMANY EXERTS ITS POWER]

[TO BE CONTINUED]

Additional references

This list will be progressively compiled.

Bernanke, B.S. (2004) ‘The Great Moderation’, speech presented to the Eastern Economic Association, Washington, DC, February 20, 2004. http://www.federalreserve.gov/BOARDDOCS/SPEECHES/2004/20040220/default.htm

Lucas, R.E. Jr (2003) ‘Macroeconomic Priorities’, American Economic Review, 93(1), 1-14.

Mitchell, W.F. and Muysken, J. (2006) ‘The Brussels-Frankfurt consensus: An answer to the wrong question’, in Mitchell et al. (2006), 3-31.

Rodrik, D. (2006) ‘Goodbye Washington Consensus, Hello Washington Confusion?’, Journal of Economic Literature, 44(4), 973-987.

Sapir, A., Aghion, P., Bertola, G., Hellwig, M., Pisani-Ferry, J., Rosati, D., Viñals, J. and Wallace, H. (2003) ‘An agenda for a growing Europe: Making the EU economic system deliver’, Report of an independent high-level study group established on the initiative of the President of the European Commission, Brussels. later published by Oxford University Press, 2004. Also known as the Sapir Report.

Stock, J. and Watson, M. (2002) ‘Has the Business Cycle Changed and Why’, NBER Macroeconomics Annual, 159-230.

Wade, R. (2004) Governing the Market, 2nd Edition, Princeton, Princeton University Press.

Williamson, J. (1990) ‘What Washington Means by Policy Reform’, in Williamson, J. (ed.) Latin American Readjustment: How Much has Happened, Washington, Peterson Institute for International Economics, Chapter 2.

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

This Post Has 0 Comments