The other day I was asked whether I was happy that the US President was…

The Euro is a spectacular success – growth down, unemployment up …

I am not doing much work today. But I was organising some snippets that I collected last week and I thought I would pass this one on – it doesn’t need much analysis – it is from the chief economist at the European Central Bank, Peter Praet who gave an – Interview with La Stampa – last weekend. While the interview was focused on Italy specifically, he presented the sort of message that we are used to getting from him and the ECB in general. A sort of warped triumphalism – extolling the success of the Euro and the role played by the ECB in achieving that success. And then, as is often the case, straying from the brief as a central banker and lecturing all and sundry on the need for more fiscal discipline (meaning increase the vandalism quotient)! It makes me laugh that when it suits them these central bankers cry that they should be independent from government but then at other times of convenience they assume they can use their “official independence” to lecture governments on how to behave. Anyway, Praet thinks the Eurozone is a big success and the policy makers have some “major” and “enormous achievements” under their belts. The interview was in English but not a dialect I understand.

He claimed that the creation of the Euro “created an internal market which is working, it was worth creating …”

He claimed that the:

EFSF, ESM and the Banking Union are enormous achievements …

He said the reality is “that the euro is an irreversible project.”

He lectured the Italians on fiscal matters thereby breaching the so-called independence of the central bank – which is just another part of the confidence trick anyway.

He said that:

Italy needs to be attentive to and cut expenditures … a major achievement is to have put the Fiscal Compact into the Italian constitution.

He told the Italians they need to make it easier to sack people and that policy should be focused on enhancing the “easiness of doing business”.

Previously (February 27, 2012), the same Mr Praet presented a speech – Sound money, sound finances, a competitive economy – principles of a european culture of stability – where he said:

The financial crisis we are experiencing is not a “monetary crisis” in its essence. The ECB has secured price stability. It is also remarkable that inflation expectations have remained anchored throughout the crisis. Looking ahead they remain anchored even in the distant future. Yet, the ECB has to continue earning the confidence it has acquired.

Inflation expectations are “anchored” because GDP gaps have been so large. The ECB may have “secured price stability” but has been a partner in the fiscal austerity (which makes a mockery of its claim to be independent of fiscal processes).

The obsession with price stability has come at the expense of the real economy. The key policy target variables of the past (for example, low unemployment) are now policy tools.

The massive costs in terms of sacrifice ratios and GDP gaps are ignored by the Euro bosses and the price stability is eulogised even though the evidence clearly indicates that there has been very little difference in performance between nations that embraced the ECB approach and those who didn’t target inflation.

Please read my blog – Inflation targeting spells bad fiscal policy – for more discussion on this point.

A week earlier (February 20, 2012), Peter Praet gave a speech – Monetary Policy at crisis times – to the International Center for Monetary and Banking Studies, Geneva.

In that speech he made the astounding claim that the crisis was fiscal in origin:

The fiscal stimulus measures in response to the financial crisis, large-scale government support programmes for ailing domestic banking systems, the working of automatic stabilizers and eroding tax bases in the face of weakening growth have put government budgets in the euro area countries under intense pressure … [but] … some euro area countries government budgets had already suffered from lax fiscal policy before the crisis.

He didn’t mention that Germany or France were the first to violate the Stability and Growth Pact fiscal rules long before the crisis manifested.

He didn’t mention that Ireland and Spain were in surplus before the crisis.

He claimed that fiscal policy should be “solid” (that is, balanced budgets) and not hinder the monetary policy in its inflation targetting.

He also proclaimed that:

As a currency, the euro has been a success …

He then applauded the new approach to the SGP which was labelled the Fiscal Compact:

… it is encouraging to see that important steps have recently been taken … strengthens both the preventive and the corrective arm of the Stability and Growth Pact and establishes minimum requirements for national budgetary frameworks … a new “fiscal compact” with a view to achieving a more effective disciplining of fiscal policies. Major elements of the fiscal compact are the strengthening of the role of the balanced budget rule and a further tightening of the excessive deficit procedure. It is of utmost importance, that the rules are now fully implemented in the spirit of this agreement. All these measures aim to ensure that individual countries live up to their responsibilities to bring their public finances in order.

Nations have to “live up to their responsibilities” which is expressed as achieving balanced budgets! Nothing about looking after people or helping communities be happy.

By advocating fiscal austerity when private spending growth is flat or declining, these officials are ensuring fiscal policy becomes pro-cyclical.

Anyway, in my brevity today, I just reminded myself of the “Euro success story”.

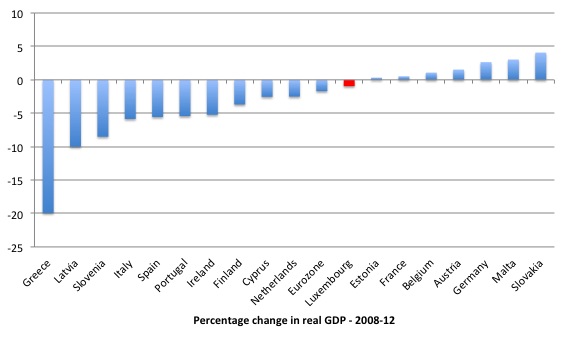

The following graph shows the percentage change in real GDP growth between 2008-12 for the Eurozone (red bar) and its member states (with Latvia added).

Description: Chronic malaise, economies shrinking in size, divergence rather than convergence.

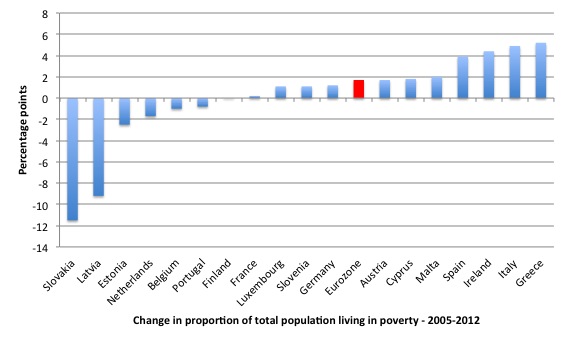

The next graph shows the percentage point change between 2005 and 2012 in the proportion of the total population who are in poverty.

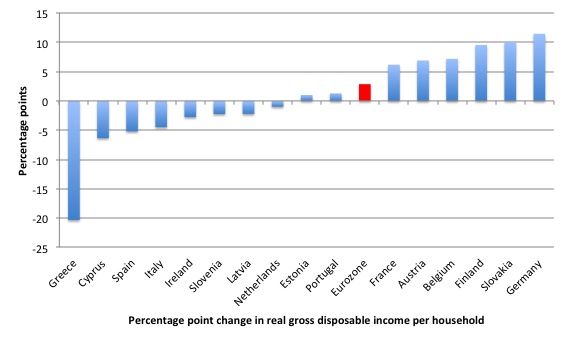

There is also massive divergence in real gross disposable income per capita as is shown in the next graph.

The overall result (red column) is highly influenced by the German and Austrian outcomes.

For Greeks, they have seen a decline of just over 20 per cent in the 4-year period. It is of-course worse when you consider the high income households will have insulated themselves from the contraction. This data is just a national indicator.

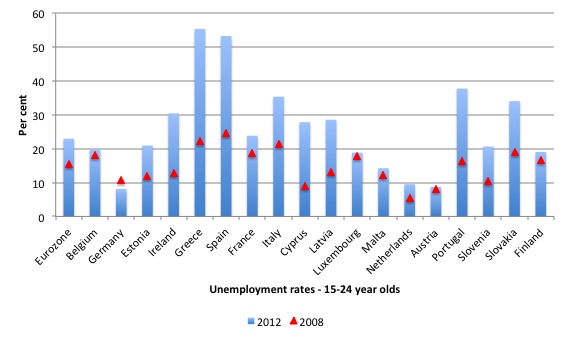

And Europe has abandoned its youth.

The following graph shows youth unemployment rates (15-24 year olds) at 2008 (red triangle) and 2012 (blue bar). The high rates in many nations have persisted now for several years.

The future prospects for this cohort are dire. This will undermine the future prosperity and productivity growth for the entire regions for decades to come.

Conclusion

This eulogisation of an “economy” that is somehow assessed on criteria that have little value to us people is typical of the neo-liberal socio-pathology.

It constructs the economy as a natural force that we need to serve and if we treat it right it will be healthy. The remedies they propose, of-course, make millions of people and the natural environment unhealthy but we are servants to this deity.

Until we make the break with that sort of construction, the likes of Praet will continue to draw high salaries and advocate damaging policy structures.

The reason I was looking into this today is that I am starting to finalise a new book (hopefully published in April 2014) about the Eurozone – a view from the South-type project.

My blog will become increasingly a day-by-day summary of the progress of this project in the next few months.

Enjoy the season and think about the unemployed.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Bill. Hope you find time to get to the beach this Xmas. Thanks for all your articles over the last year.

As I was starting my little project to try and do my bit earlier this morning I remembered when I first started to get it. 09/09/2010 as a result of reading Deficit Spending 101. Haven’t stopped learning since and don’t intend to.

I think we need to concentrate on the kids as you and others already do. Many adults may be a lost cause.

I’m also thinking of even younger kids though. I know a few primary school teachers and I have had a few discussions with them about coming up with a practical classroom exercise that would highlight Modern Money principles so I intend to pursue that in the coming year. I’m not sure it will pass academic scrutiny but I’m not really bothered about that.

Best wishes for 2014

Andy

Definitely got to break that deity meme.

Since we’re already into the human sacrifice stage, it is well past time such primitive thinking was consigned to history.

We all draw strength from this blog Bill. Long may it continue.

Many thanks and the best wishes of the season to you and to all.

Keep passing up the ammunition Bill.

Every day there’s more of us popping up out of our foxholes, sniping away at the bastards.

Thanks too Neil for your cutting insights over the last year.