The other day I was asked whether I was happy that the US President was…

An intellectual storming of the beaches is required in Europe

Seventy years ago today there was a major mobilisation – D Day – designed to free Europe from the German military (and ideological) oppression. The allied troops stormed the beaches at Normandy as part of the so-called ‘Operation Overlord’, which quickly liberated France and set up the campaign that would end Germany’s dominance. Unfortunately, modern day Europe is caught up in a different form of German ideological oppression and the economic consequences have been devastating. The European Central Bank showed yesterday how stifling this oppression is when they made what were considered ‘historic’ changes to policy, which any reasonable assessment would conclude will do very little to stimulate growth. The policy mentality is in denial of history and economic logic. But with fiscal policy bolted down by the neo-liberal ideology there is no room to grow. Another major invasion of Europe is needed – an intellectual storming of the beaches. That is the only way the euro-zone nations will liberate themselves from the current malaise.

As a note: I am now finalising the editing of my Euro book and I hope it will get to the publishers in the coming month – a little behind schedule but then it is about 100 pages longer than I initially planned. Anyway, I can now catch up on current events.

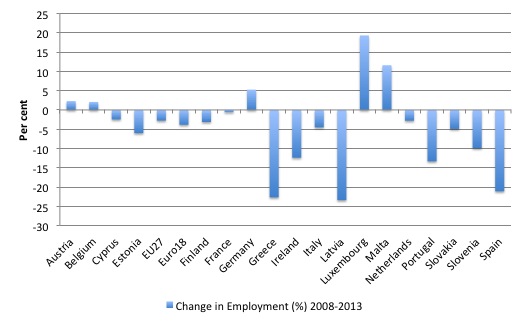

The following graph shows the percentage change in employment from 2008-13 in the EU and the individual euro-zone nations. It is not a very sobering image.

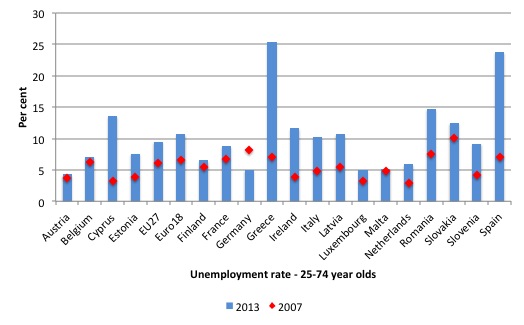

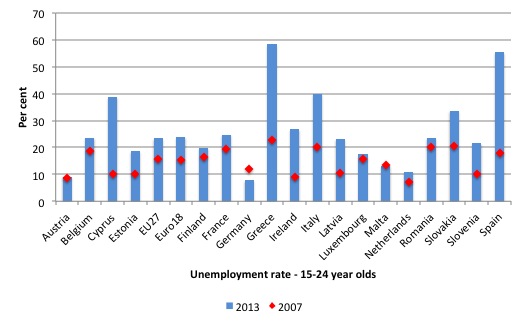

The sharp decline in employment has its analogue in the sharp rise in unemployment rates. The following graphs show the shift in unemployment rates between 2007 (red markers) and 2013 for 25-74 year olds (first) and the 15-24 year olds (second).

The data represents a catastrophic waste of human potential and underlying the pictures are untold stories of human despair, alienation, mental health breakdown, family separations, increased incidence of alcohol and other drug abuse, increased poverty, higher rates of suicide, abuse etc.

This is the context in which policy makers are dithering with monetary policy while other policy makers are refusing to realise that their approach to fiscal policy only delivers failure. They are locked into a dangerous groupthink.

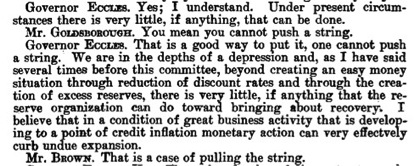

On the afternoon of Monday, March 18, 1935, members of the US House of Representatives Committee on Banking and Currency were considering the introduction of the ‘Banking Act of 1935’, which was designed to “provide for the sound, effective, and uninterrupted operation of the banking system, and for other purposes”. The Transcript of the hearings is very interesting (Beware – it is a large file, 31.9 mb). The hearings ran between February and April 1935.

On that particular afternoon, the Chairman of the US Federal Reserve Bank, Marriner Eccles was being interrogated by the Democrat Congressman Thomas Goldsborough about what the central bank could do in terms of monetary policy in the context of the parlous state of the US economy at the time. The unemployment rate at the time was around 21 per cent and the economy was mired in a deep depression, not unlike the situation that the euro-zone finds itself in today.

On Page 377 of the Transcript an interesting exchange occurred. Marriner Eccles was asked “… what you would do if given this power under present conditions …”. The graphic captures what was said.

The expression – ‘Pushing on a String’ – came to mean the situation that central banks might be able to inhibit credit creation by the commercial banks (by making the price it provides reserves prohibitive) but it cannot force the banks to lend.

The point is that if monetary policy works are all to influence total spending in the economy it is likely to be only effective in one direction (pulling the string) and not the other (pushing).

As an aside, I would not recommend anyone reads the Wikipedia site about this phenomena because the narrative is mostly incorrect – infested with myths about money multipliers etc.

John Maynard Keynes who is often credited with the ‘pushing on a string’ analogy, wrote an – Open Letter to President Roosevelt – on December 16, 1933, and noted that the “object of recovery is to increase the national output and put more men to work” and that requires “one or the other of three factors”.

1. “Individuals must be induced to spend more out of their existing incomes” …

2. “the business world must be induced” to invest more in productive capital …

3. The “public authority must be called in aid to create additional current incomes through the expenditure of borrowed or printed money”.

He considered the first option would not be likely in a highly recessed economy. Then he assessed that business firms would resume investment “as the second wave of attack on the slump after the tide has been turned by the expenditures of public authority”.

Conclusion: “It is, therefore, only from the third factor that we can expect the initial major impulse”.

In terms of the ‘pushing on a string’ analogy with respect to monetary policy he said:

Some people seem to infer from this that output and income can be raised by increasing the quantity of money. But this is like trying to get fat by buying a larger belt. In the United States to-day your belt is plenty big enough for your belly. It is a most misleading thing to stress the quantity of money, which is only a limiting factor, rather than the volume of expenditure, which is the operative factor.

The macroeconomist Robert Gordon summarised the 1930s experience when he wrote (Gordon, 1980, 111):

The major event that had discredited monetary policy was the juxtaposition between early 1938 and late 1940 of a weak economic recovery, explosive monetary growth, complete price rigidity, and a short term interest rate near zero. Despite a monetary growth that was rapid and constant between early 1938 and late 1941, the economy’s recovery floundered until defense spending began in earnest in late 1940, after which real GNP jumped by almost 20 per cent in a single year, a chronology that ingrained a deep-seated belief in the potency of fiscal policy and the “pushing on a string” analogy for monetary policy.

[Reference: Gordon, R. (1980) ‘Postwar Macroeconomics: The Evolution of Events and Ideas’, in Feldstein, M. (ed) The American Economy in Transition, Chicago, University of Chicago Press, 101-182]

It is interesting to note that Keynes’ views shifted somewhat in the early years of the Great Depression. In the 1930 publication, Treatise on Money, his major work before the 1936 publication of his ‘General Theory’, he wrote (pages 331-2)

My remedy in the event of the obstinate persistence of a slump would consist, therefore, in the purchase of securities by the central bank until the long-term market rate of interest has been brought down to the limiting point.

He was expressing frustration that the “monetary authority often tends in practice to concentrate upon short-term debts and to leave the price of long-term debts to be influenced by belated and imperfect reactions from the price of short-term debts” (p.206) and thought the central bank should be more aggressive in manipulating long-term interest rates.

So there was some transition in his views between 1930 and 1936, which are well documented. It is not true though that he had rejected monetary policy as a useful tool in 1936. He just didn’t really trust central bankers to do what was needed. Even in 1930, he said that they had “always been too nervous hitherto” with respect to agressive targetting of long-term interest rates.

But in his 1930 incarnation, Keynes was giving support to what we now call Quantitative Easing (QE). Fortunately, for the world, whether it was because of his lack of trust in central bankers or that he had seen the light (that issue is not resolved in the literature), his message by 1933 to Roosevelt was clear – the government should increase spending to stimulate the economy if private spending is weak.

Japan has demonstrated the ineffectiveness of monetary policy in its struggle to maintain growth since the property market collapsed in the early 1990s.

In the recent crisis, the US Federal Reserve Bank and the Bank of England have been engaged in massive QE programs all to no avail.

Remember that QE involves the central bank exchanging a non- or low-interest bearing asset (that is, adding funds to the reserve accounts that banks have to hold with the central bank to facilitate the clearance of cheques) for some higher yielding and longer-term assets (for example, 10-year government bonds or commercial bonds).

It is nothing more than a simple asset swap between the central bank and the private sector. Proponents of QE claim it adds liquidity to a system where lending by commercial banks is seemingly frozen because of a lack of bank reserves.

They say that giving the banks more reserves will stimulate more lending to the private sector with commensurate higher rates of investment and economic growth.

The mainstream belief is that it will stimulate the economy sufficiently to put a brake on the downward spiral of lost production and the increasing unemployment. It is based on the erroneous belief that a bank is an institution that accepts deposits in order to build up reserves, which, in turn, provides it with the funds to on-lend at a margin in order to profit.

But this is not how banks operate. Bank lending is not ‘reserve constrained’. Banks lend to any credit worthy customer they can find without, initially, worrying about how much funds they have in their reserve accounts. They know that if they are short of reserves (their reserve accounts have to be at least in positive balance each day) then they borrow from each other in the so-called ‘interbank market’.

If that is not possible, then, ultimately, they know they can borrow from the central bank, which always stands ready to provide funds to meet reserve shortfalls. Ensuring there are adequate reserves (liquidity) in the system is part of the central bank’s charter to maintain financial stability.

If the central bank refused to supply bank reserves on demand (at a price) then cheques might fail to clear and the financial system would be plunged into turmoil.

Please read my blog – Quantitative easing 101 – for more discussion on this point.

The ECB, itself, debunked the myth that banks need reserves before they will make loans, in their – Monthly Bulletin – for May 2012. In considering whether “a large increase in central bank liquidity … necessarily implies rapid broad money and credit growth”, the ECB said (ECB, 2012a: 20-24):

The occurrence of significant excess central bank liquidity does not, in itself, necessarily imply an accelerated expansion of … credit to the private sector … The Eurosystem, however, as the monopoly supplier of central bank reserves in the euro area, always provides the banking system with the liquidity required to meet the aggregate reserve requirement … the Eurosystem always provides the central bank reserves needed on aggregate, which are then traded among banks and therefore redistributed within the banking system as necessary. The Eurosystem thus effectively accommodates the aggregate demand for central bank reserves at all times and seeks to influence financing conditions in the economy by steering short-term interest rates.

In sum, holdings of central bank reserves are thus not a factor that limits the supply of credit for the banking system as a whole. Ultimately, the growth of bank credit depends on a set of factors that determine credit demand and on other factors linked to the supply of credit.

In their recent Quarterly Bulletin, the Bank of England also rrejected the idea bank lending is constrained by prior reserve holdings. They conclude that the “reality of how money is created today differs from the description found in … economics textbooks” (Bank of England, 2014: 14). Banks do not “receive deposits” and lend them out. Rather “bank lending creates deposits” (p. 14).

The point is that building bank reserves will not increase the bank’s capacity to lend, which has been a central premise of those advocating QE. The reality is that loans create deposits, which then generate reserves not the other way around. The reason that bank lending in is constrained at present is because there is a dearth of credit worthy customers.

In the current climate the assessment of what is credit worthy has become very strict compared to the lax days prior to the crisis.

It is also important to understand that QE does not change the net financial position of the private sector. When the central bank exchanges one type of financial asset (an increase in a private bank’s reserve balance) for another type of financial asset (private holdings of bonds, etc), the net financial assets in the private sector are unchanged although the portfolio composition of those assets is altered.

Typically there will be more short-term assets in the mix, a shift referred to as maturity substitution (short for long in this case). QE thus increases central bank demand for so-called ‘long maturity’ assets held in the private sector (for example, 10-year bonds), which reduces their ‘yields’ in the market place and, in turn, makes interest rates on longer-term loans cheaper.

This might increase aggregate spending overall given the cost of investment funds is likely to drop. But on the other hand, the lower rates reduce the interest-income of savers who will reduce consumption (demand) accordingly. How these opposing effects balance out is unclear. The central banks certainly don’t know!

Overall, this uncertainty points to the problems involved in using monetary policy to stimulate (or contract) the economy. It is a blunt policy instrument with ambiguous impacts.

QE is not a sensible anti-recession strategy. The pursuit of so-called ‘non-standard’ monetary policy tools, which are ambiguous in impact, when we know that every extra dollar of government spending goes straight into the expenditure stream and stimulates sales and jobs, is a reflection of the neo-liberal bias against fiscal policy that we have discussed throughout this book.

What will motivate consumers to borrow if they are scared of losing their jobs? Why would a company borrow if they expect their sales to remain depressed?

The major problem facing the euro-zone and elsewhere at present is that the private sector is not willing to spend as robustly as it did before the crisis. The only way to fill the resulting spending gap is for governments to increase their deficit spending. There is a crying need in all euro-zone nations at present for increased government deficits.

Further, policies that think that by placing a penalty on the banks’ holdings of excess reserves and eliminating any standing facility that provides the excess reserves an interest-bearing ‘parking spot’, consumers and firms will suddenly rise like phoenixes from the mire of recession, rising unemployment, increasing poverty, and flat sales and hit the banks up for more loans – is … well you can fill in the missing letters … totally f*ck*ng stupid.

And so we come to yesterdays ECB monetary policy decisions, which have a strong sense of déjà vu about them. It is amazing that the stifling design of the Economic and Monetary Union (EMU) was driven by the deep (but flawed) memories of the 1920s Weimar hyperinflation, but the policy makers cannot remember the next decade very well.

As an aside, in his 2012 article – The Last Days of Pushing on a String – Mark Blyth talks about the early days of the crisis when “the ECB was at first busy fulfilling its mandate of fighting an inflation that died in 1923 by raising interest rates in the middle of a recession –

Now they are adopting equally stupid strategies as if they have any power to alter the course of the crisis. The ECB would be better admitting that their greatest power is the fact that they alone issue the euro and the Board should be telling Brussels that it was time for Overt Monetary Financing – that is, fund increased fiscal deficits across the euro-zone to whatever level was necessary to restore total spending to levels commensurate with high employment rates and stable growth.

Please read my blog – OMF – paranoia for many but a solution for all> – for more discussion on this point.

In its Monetary policy decisions (June 5, 2014) the ECB:

1. The interest rate on the main refinancing operations of the Eurosystem will be decreased by 10 basis points to 0.15%, starting from the operation to be settled on 11 June 2014.

2. The interest rate on the marginal lending facility will be decreased by 35 basis points to 0.40%, with effect from 11 June 2014.

3. The interest rate on the deposit facility will be decreased by 10 basis points to -0.10%, with effect from 11 June 2014.

What does that all mean?

First, the main policy rate is now down to 0.15 per cent. The ‘main refinancing operations’ describe the way the ECB conducts so-called Open Market Operations (OMO), which allow it to manage liquidity in the banking system and therefore maintain control of their interest rate targets (and hence its monetary policy position).

These operations, in the Eurosystem context, are known as ‘repurchase agreements’ where a commercial bank will offer acceptable assets as collateral with the ECB and receive euros in return as increased bank reserves. These operations are conducted on a weekly, montly and ad-hoc basis via an auction tender process.

The ECB tells the market how much liquidity it needs to issue (allotted amount) and banks tender for a portion of it at the fixed rate set by the ECB. Sometimes, the tender is conducted on a variable interest basis..

The banks agree to repurchase the assets at some later date at the ‘repo rate’.

Second, the marginal lending facility, one of two ECB ‘standing facilities’, provides overnight credit to participating commercial banks who are short of liquidity in return for sufficient eligible assets as collateral. In other words, this is where banks get reserves from to cover their loan book if they find themselves short on any particular day.

Third, they now propose to force commercial banks to pay are penalty rate (0.10 per cent) on any funds that are in reserve accounts held at the ECB. This rate is associated with the ‘deposit facility’, the other ECB standing facility. It provides the commercial banks with a capacity to deposit excess reserves with the ECB. It is thus the obverse of the ‘marginal lending facility’.

The ECB also said it would continue to offer long-term, low interest loans to banks until the end of 2018 under the targeted longer-term refinancing operations (TLTROs). They claim that an additional 400 billion euros on offer will stimulate bank lending (although loans for housing are excluded).

In addition to these changes, the ECB also suspended its “weekly fine-tuning operation sterilising the liquidity injected under the Securities Markets Programme”. See their Statement.

Remember that the SMP was introduced in May 2010 and involved the ECB buying government debt in the secondary bond markets from troubled nations to control the bond market yields. It was successful in that sense but was accompanied by requirements that the nation had to be cooperating with Brussels in a fiscal austerity program so didn’t allow for any growth.

It would have been much better to ramp up the SMP (later replaced by the Outright Monetary Transactions program in September 2012) and allow the nations to run larger deficits. The ECB could have then bought any debt that the private sector refused to buy at low yields – effectively dealing the bond markets out of the equation.

Whatever spin one wants to put on the SMP, it was unambiguously a fiscal bailout package which amounted to the central bank ensuring that troubled governments could continue to function (albeit under the strain of austerity) rather than collapse into insolvency.

But the ECB officials tried to reduce the inflationary fears by distancing the SMP from QE by ‘sterilising’ the intervention which amounted to all the funds spent by the central banks on government bonds being re-absorbed every week back into ECB interest-bearing accounts.

In other words, the ECB was purchasing bonds in the secondary bond market with euros which it creates as the monopoly issuer of the currency. It would then, on a weekly basis, propose a tender to offer deposits with the ECB (with a ceiling of 1.25 per cent yield) up to the volume of outstanding SMP bond purchases.

So they swap the Euros they ‘spent’ in purchasing the bonds for an interest-earning account with the ECB instead of leaving the interest-earning bond in the hands of the private sector.

Economists call this type of swap a ‘sterilisation operation’ because it neutralises the liquidity of the initial bond purchases by draining the equivalent amount injected from the banking system.

But an astute mind will see the smoke and mirrors here. First, QE was never about giving the banks more money to loan out. Bank lending is never constrained by a lack of reserves. Rather lending requires credit-worthy customers seeking loans.

Any risk of inflation has to come from spending. Cash in reserve accounts is not spent nor loaned. So the fears that the SMP would be inflationary because they increased bank reserves were bogus. The sterilisation operation was just a farce and provided banks with returns that gave no benefit to the average citizen.

Second, the fact that most central banks have been offering a return on excess bank reserves means that the SMP is virtually indistinguishable from QE. Both strategies keep bond yields lower than otherwise by strengthening demand in the private bond markets and both provide an interest-bearing alternative to the bond-holders.

QE added bank reserves (cash) and the US central bank paid interest on excess reserves, whereas the ‘sterilisation’ functions associated with the SMP merely shunted the excess Euro reserves created by the bond purchases into a separate ECB account, which earned interest.

So suspending the weekly liquidity drain is aiming to force banks to reduce their reserve balances.

What is the purpose of all these changes?

The ECB boss Mario Draghi said in his – Introductory statement to the press conference (with Q&A) – that the changes were aimed at supporting “lending to the real economy”. The ECB is worried about deflation and wants to push economic activity up such that there is a return to a 2 per cent inflation rate.

The logic of the negative deposit rates is that banks will try to minimise their balances (that is, reserves) and will instead seek to increase their loans.

As we noted above when discussing QE, the logic is awry. The reality is that banks do not lend these reserves out anyway. It is true that they need to have reserves to back their loan book up but the causality is very much loans driving a need for funding not the other way around.

So in this case, the ECB is hoping banks will start being more aggressive in their lending activities. But with the private sector largely in subdued borrowing mode given the crisis, the only way the banks might increase lending is to enter the world of ‘sub-prime’ loans again – that is, reduce their risk assessments and start lending to customers that currently do not qualify.

It is hard to see how these changes will alter the psychology of the current credit-worthy potential customers who are sitting on their hands.

The logic of the changes suggests the banks are short of funds when in fact, bank reserves are at record levels.

Conclusion

The lessons of the 1930s should be recalled. This stupid reliance on monetary policy as the saviour has not historical precedent. Quite the opposite in fact.

With the Stability and Growth Pact and the Fiscal Compact bearing down heavily on growth, these changes will do nought to alter the trajectory in the euro-zone

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2014 Bill Mitchell. All Rights Reserved.

Nice to see you back to berating the idiots in charge. There’s a lot of idiots that need the treatment. You might have to set up a team!

As I understand the release, it is not just the commercial banks that will be charged for using the deposit facility. It is everybody involved in the ECB framework (including governments and NCBs).

Given that you can’t get rid of the reserves, it would seem that somebody is going to be paying the ECB tax.

To echo Neil its nice to see the usual blog style return even though I appreciate the textbook work too, I tried to stick with it!

‘it is NOT a sobering image’ – should this be ‘it is a sobering image’ ?

As an aside at about 10:20am on radio4 (UK) this morning a french speaker was on, I didnt catch his name but he was referred to as some sort of authority on Christine Lagarde. When asked if she made a good IMF chief he replied that she did because she was ‘good-looking’ and ‘a lawyer aware of the rules’ … no wonder she is Angela’s choice for further high positions within Europe……….

Brilliant discussion, Bill.

The storming of the beaches is an apt metaphore.

I think that Thomas Piketty book essentially looking at the mechanics within the private sector and wealth inequality got a lot of attention but MMT is the larger picture here. I hope Bills book ‘storms the beaches’ and focuses the debate on sound observable locical macroeconomic constructs.

The mechanics of the eurozone are so-misconstrued. Stupid concepts like ‘debt ceiling being 3.5% defecit’ has to be removed for a start. Its going to take a lot more to get them back out the monetary system dark ages.

may I suggest “Storming of the SOBs” ? 🙁

ps: Just point out the Bankster Maginot Line! MiddleClass militia with pitchforks are standing by.

Nowadays this question do banks loan out reserves is the stuff of the news, very unusual topic

https://www.youtube.com/watch?v=0wgd30DnoDk

I asked dr Kruman now that both BoE and IMF have come out against this view why it is still in his textbook, and we will just have to see what he will write to his next textbook edition

Could this tax on reserves be countered by converting them into actual bank notes?

Are we going to see good old elaborate bank vault robberies again?