It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

External economy considerations – Part 7

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to publish the text sometime in 2013. Our (very incomplete) textbook homepage – Modern Monetary Theory and Practice – has draft chapters and contents etc in varying states of completion. Comments are always welcome. Note also that the text I post here is not intended to be a blog-style narrative but constitutes the drafting work I am doing – that is, the material posted will not represent the complete text. Further it will change as the drafting process evolves.

Chapter 21 Policy in an Open Economy: Exchange Rates, Balance of Payments, and Competitiveness

This material updates the work already done on Chapter 21 that appeared in the following blogs:

- External economy considerations – Part 1

- External economy considerations – Part 2

- External economy considerations – Part 3

- External economy considerations – Part 4

- External economy considerations – Part 5

- External economy considerations – Part 6

Today, I am just continuing filling in the gaps in the Chapter.

21.7 Currency crises

[CONTINUING THIS SECTION FROM LAST WEEK]

What about currency crises?

In the 1990s, there were three major currency crises in the world economy. First, the European currency crisis that followed the break down of the Berlin Wall. Second, the Mexican currency crisis in 1992 when the peso plunged in value after capital flows, attracted by rising US interest rates moved against Mexico.. Third, the Asian debt crisis in 1997. We will briefly examine each episode and highlight the essential characteristics of the prevailing monetary system at the time of each, which precipitated the crisis.

Are there lessons we can learn from these relatively recent events?

The European Exchange Rate Mechanism crisis – 1992

In 1992, as the German government moved to unify the country after the breakdown of the Berlin Wall, the fiscal expansion required to improve the public infrastructure in the former East Germany, was accompanied by rising interest rates as the Bundesbank, (the German central bank) feared inflation.

The German mark appreciated significantly as a result of capital inflow attracted by the higher interest rates and net exports fell.

The problem was that the German mark was the benchmark currency in the European Exchange Rate Mechanism (ERM), which other Western European nations fixed the currencies. This arrangement had been in place since March 1979.

Under any pegged currency arrangement, the nations pegging their currencies have to increase their own interest rates in line with increases in rates in the benchmark nation.

However, the other nations did not have a commensurate fiscal expansion to offset the damaging effects of the rising interest rates on their local economy. It became apparent that the commitment to the fixed exchange rate system (ERM) would mean rising unemployment in these nations and the associated political difficulties.

Players in the foreign exchange markets predicted that eventually the pegging nations would abandon the ERM and let their currencies depreciate against the German mark.

This led to the currencies of these nations being sold off in the foreign exchange markets, which immediately forced the nations to consider the fixed arrangements.

The impetus to the breakdown of the system, was the “short selling” attack on the British pound by speculator George Soros. In foreign exchange markets, a speculator can contract to sell a currency at some future date for a predetermined price.

The contract, of-course, means that when the contract comes due, the speculator also has buy the other currency in the contract.

If the contracts are large enough they can thus have a significant impact on the value of the currency and lead other speculators following suit. George Soros short sold the British pound against the German mark.

Britain left the program in September 1992 after the Bank of England had spent over £6 billion purchasing foreign currencies in an attempt to maintain the currency within the agreed ERM limits as the speculative activity drove its price down. The British government was not prepared to increase its interest rates in line with Germany, which they considered would cause a major recession.

In this case, the speculators won but only because these governments were intent on pegging their currencies but were not prepared to accept the monetary policy interdependence that came with the decision to peg.

The 1994 Mexican Peso Crisis

The Mexican peso or Tequila crisis was termed “the first financial crisis of the twenty-first century” by the then Managing Director of the International Monetary Fund (Camdessus, 1995).

The facts are well-known although different economists emphasise different causes.

In the 1980s, Mexico endured a debt crisis, which led to mis-placed policy responses that essentially led to the 1994 currency crisis. The debt-crisis was the result of the large foreign-owned commercial banks taking on massive foreign-currency denominated floating interest rate loans. The funds were sourced from the petroleum exporting nations who were cashed up after the OPEC oil price rises in 1973-74 and later in the 1970s.

In the late 1970s, US interest rates were pushed up to deal with domestic inflation, and the private debt burden for Latin American nations became severe. The US recession in 1981 also damaged primary commodity export markets, a principal source of foreign exchange for the Latin American economies.

In 1982, Mexico announced that it could no longer service its external debts and lending to Latin American nations ceased thwarting the normal refinancing of outstanding loans as they became due. Much of the debt was of a short-term nature.

The IMF became involved and as a price for the bailout funds provided, the nations had to introduce sweeping free market reforms and severe fiscal austerity, consistent the ideological position of the Fund. Widespread unemployment results and poverty rates rose sharply as state-owned industries were privatised, and tariff protection and welfare nets cut.

Growth returned in the early 1990s, and capital inflow, particularly from the growing US financial sector, boomed. The free market Mexican government, under guidance from the IMF also sought to make the economy as attractive as possible to the financial speculators.

The Bank of Mexico managed a fixed peso parity against the US dollar within a so-called “slippage regime” between November 11, 1991 and December 21, 1994, where the rate was allow to vary within certain daily bands.

The upshot was that the Mexican government stood ready to convert the peso into US dollars (and vice versa) at a fixed rate which meant it always had to have sufficient reserves of US dollars to guarantee convertibility. Reliable convertibility was thought to be essential to establish the monetary credibility of the Mexican government and instil confidence into the international financial markets.

The reality was that all the risk was shifted from the foreign speculators to the Mexican government, a risk that ultimately the Mexican economy was unable to bear.

The domestic growth pushed out the current account deficit, which was being funded by the massive capital inflows. While the government, under pressure from the IMF was running a small budget surplus, it was forced to keep issuing government debt to foreign creditors to provide financial instruments that would attract increasing capital inflow.

The capital inflows also led to an accelerating money supply and nominal demand growth began to outstrip the real capacity of the domestic economy, with rising inflation the result.

These developments meant that the peso should have depreciated but the Mexican government, under pressure from the IMF and the US government, maintained the peg even as speculators started to sell off the peso in favour of the US dollar. The Bank of Mexico stock of foreign exchange reserves (so-called “hard” currency) started to exhaust and this led to further speculative attacks.

There was some political turmoil (an assassination in March 1994), which didn’t help the deteriorating confidence in the Mexican economy.

The short-sighted commitment to the fixed parity by the Mexican government led them to further compound the crisis when they acceded to demands from large foreign investors (particularly Wall Street banks) to significantly increase the issuance of so-called Tesobono bonds, which were US-dollar denominated, government debt instruments that insured the holder against any foreign exchange risk.

The foreign-currency denominated bonds were increasingly substituted for peso-denominated debt to keep the foreign investors happy. The foreign risk insurance explicit in the Tesobonos, lowered the price the government had to pay on this debt but also dramatically increased its own exposure to any depreciation in the peso.

Despite the tension within the government and between the government and central bank, the fixed parity was maintain even though it was obvious that the Government could no longer support the currency.

However, the IMF continued to argue that the Mexican policy settings were sound. At the Executive Board Meeting (November 30, 1994), the IMF were discussing the introduction of a new “short-term financing facility” for eligible nations to assist in the alleviation of short-term balance of payments pressure that might destabilise their currencies.

In the Minutes of that meeting (Minutes of the Executive Board of the IMF (EBM/94/104 – November 30, 1994), the IMF said that:

… all countries that have sound macroeconomic policies and do not have structural balance of payments problems would be eligible …

The Minutes reported that one member (Mr Kiekens from Belgium) noted that:

Countries with a genuine need for short-term Fund financing are few, If not very few … Rare are those … countries, which have a perfect track record and an external position that would otherwise be considered as viable and as having sound fundamentals. This is evident in that, of the three cases presented by the staff, only the Mexican case is a strong one.

However, less than a month later, the speculative outflow of pesos became too great and on December 22, 1994, the Mexican government floated the peso.

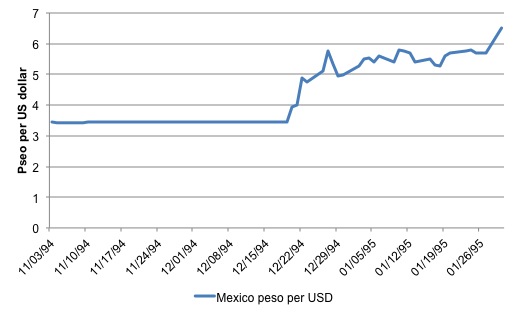

Figure 21.5 shows the evolution of the Mexican peso against the US dollar for the period November 1994 to the end of January 1995. On December 19, 1994 the peso was trading at 3.4662 per US dollar. Eight days later on December 27, 1994, the parity had reason to 5.7625 per US dollar, a depreciation in the peso of 66.2 per cent.

Figure 21.5 Mexican peso depreciation, December 1994

[I WILL CONTINUE THIS SECTION NEXT WEEK – IT IS A FASCINATING CASE STUDY IN HOW NOT TO RUN A CURRENCY – I WILL ALSO CONSIDER THE ASIAN DEBT CRISIS 1997 AS A PRECURSOR TO CONSIDERING CAPITAL CONTROLS]

27.8 Capital controls

The history of financial crises indicates that large-scale financial speculation can undermine a nation’s real economy relatively quickly if the government attempts to peg their currency to another or the economy has significant foreign-currency denominated debt exposure (private or public).

while the international community could agree that certain forms of speculative activity would be considered illegal, in lieu of that, the nation under attack has to defend its own prosperity.

One such suggestion is to introduce capital controls which limit the size and flexibility of international financial flows.

In September 1998, during the Asian debt crisis, the Malaysian government introduced capital controls after the currency had appreciated significantly and the central bank had pushed interest rates up towards 18 per cent and undermined the viability of many local businesses.

Capital controls are policies that restrict the free movement of capital, either in terms of inflows or outflows.

There are broadly two types of capital controls used:

- Administrative or direct controls, which impose limits or bans on capital flows.

- Market-based controls, which impose extra costs on capital flows which reduce the incentives to shift funds across national borders.

A government might, for example, place limits on foreign exchange transactions, international bank transactions, or bank withdrawals. Restrictions on movements of precious metals such as gold might also be considered.

The aim is to limit the scope of speculative flows (in or out) to manipulate the exchange rate and strain the central bank’s foreign exchange reserves.

Capital controls allow the central bank to run an autonomous monetary policy and the treasury to use fiscal policy to manage domestic demand in the interests of the nation.

[WILL FINISH THIS DISCUSSION NEXT WEEK]

Conclusion

ONE MORE WEEK ON THIS CHAPTER DESPITE WHAT I SAID LAST WEEK.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

“In this case, the speculators won but only because these governments were intent on pegging their currencies but were not prepared to accept the monetary policy interdependence that came with the decision to peg.”

And the Bundesbank refused to help out by using its infinite capacity to buy pounds on the other side. (Bear in mind that the UK did indeed put interest rates up very high on ‘Black Wednesday’ – but it was too late by then).

In other words the Bundesbank wasn’t committed to maintaining the peg at the stated value – as shown by the number of complaints by the Bundesbank about the exchange rate previously.

With a currency peg, it take two to tango.

Under section “21.7 Currency crises”, you could include a separate entry for the Brazilian Real crisis of 1999 (http://en.wikipedia.org/wiki/Samba_effect). Alternatively, the the Brazilian Real crisis of 1999 could be a subsection under the “ASIAN DEBT CRISIS 1997” section, as it is directly related to that event.

The nation as I see it in the post 1648 world is the bank which owns it …..if you replace restrictions on the movement of Gold in this context the bank through state violence / force will just take it all for their friends…..when they have it all they will then revalue it to rebalance their dud double entry assets.

As the banks control the fiat system via government who wish to remain a jurisdiction of the bank in their own narrow financial interests rather then a country the hidden power can make Gold legal tender and therefore fiat when they have it all.

MMT harks back to the post 1648 world of nation states therefore it is not a true fiat system.

A true fiat system is pretty simple – by Kings decree.

This debate provides a false dichotomy -wishing to go back to the old nation state system of mass destruction rather then the not so slow decay of the modern market state.

If people understood how these systems truly work I imagine they would want neither.

Thank you, Bill, for allowing us access to your textbook home page – Modern Monetary Theory and Practice. Billy blog is the highlight of my day!

In order to organize MMT material that I have collected from the internet, I’ve set up a website described as: This website is a portal to information on Modern Monetary Theory, with particular interest and relevance to Canada.

In case this might be helpful to students and others, the site is located at

http://mmtincanada.jimdo.com/

Thanks again for all your efforts and wonderful material!

Hi, Dork! Fancy meeting you here. Do you come here often? Missed you from the other place. Should we call this site “The Ballroom of Romance?”

Brian.

Bill, I think this sentence has a typo

“Britain left the program in September 1992 after the Bank of England had spent over £6 billion purchasing foreign currencies in an attempt to maintain the currency within the agreed ERM limits as the speculative activity drove its price down.”

Don’t you mean BoE purchased pounds and sold foreign currencies?

I am really enjoying reading all these chapters. Thank you for doing this.

William Allen

Ah yes …The Ballroom ……Ireland is a perfect little petri dish for the various structural adjustments which the banking system just loves to do.

http://www.youtube.com/watch?v=vA9VqHNjoTU