Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – September 21, 2013 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

When an external deficit and public deficit coincide, the private sector is in balance (spending is equal to income).

The answer is False.

This question relies on your understanding of the sectoral balances that are derived from the national accounts and must hold by defintion. The statement of sectoral balances doesn’t tell us anything about how the economy might get into the situation depicted. Whatever behavioural forces were at play, the sectoral balances all have to sum to zero. Once you understand that, then deduction leads to the correct answer.

To refresh your memory the balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

Equating these two perspectives we get:

C + S + T = GDP = C + I + G + (X – M)

So after simplification (but obeying the equation) we get the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

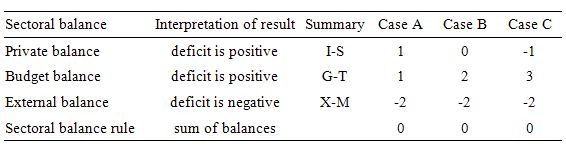

To help us answer the specific question posed, we can identify three states all involving public and external deficits:

- Case A: Budget Deficit (G – T) < Current Account balance (X - M) deficit.

- Case B: Budget Deficit (G – T) = Current Account balance (X – M) deficit.

- Case C: Budget Deficit (G – T) > Current Account balance (X – M) deficit.

The following Table shows these three cases expressing the balances as percentages of GDP. You can see that it is only in Case A when the external deficit exceeds the public deficit that the private domestic sector is in deficit.

The answer is false because the coexistence of a budget deficit (adding to aggregate demand) and an external deficit (draining aggregate demand) does not have to lead to a private domestic sector balance of zero.

It depends on the relative magnitudes of the budget deficit and external deficit.

With the external balance set at a 2 per cent of GDP, as the budget moves into larger deficit, the private domestic balance is zero (Case B). Then once the budget deficit is large enough (3 per cent of GDP) to offset the demand-draining external deficit (2 per cent of GDP) the private domestic sector can save overall (Case C).

The budget deficits are underpinning spending and allowing income growth to be sufficient to generate savings greater than investment in the private domestic sector but have to be able to offset the demand-draining impacts of the external deficits to provide sufficient income growth for the private domestic sector to save.

The following blogs may be of further interest to you:

Question 2:

Which scenario represents a more expansionary outcome:

(a) A budget deficit equivalent to 5 per cent of GDP (including the impact of automatic stabilisers equivalent to 3 per cent of GDP).

(b) A budget deficit equivalent to 3 per cent of GDP.

(c) You cannot tell because you do not know the decomposition between the cyclical and structural components in Option (B)

The answer is Option (a).

The question probes an understanding of the forces (components) that drive the budget balance that is reported by government agencies at various points in time and how to correctly interpret a budget balance.

In outright terms, a budget deficit that is equivalent to 5 per cent of GDP is more expansionary than a budget deficit outcome that is equivalent to 3 per cent of GDP irrespective of the cyclical and structural components.

In that sense, the question lured you into thinking that only the discretionary component (the actual policy settings) were of interest. In that context, Option (c) would have been the correct answer.

To see the why Option (a) is the best answer we have to explore the issue of decomposing the observed budget balance into the discretionary (now called structural) and cyclical components. The latter component is driven by the automatic stabilisers that are in-built into the budget process.

The federal (or national) government budget balance is the difference between total federal revenue and total federal outlays. So if total revenue is greater than outlays, the budget is in surplus and vice versa. It is a simple matter of accounting with no theory involved. However, the budget balance is used by all and sundry to indicate the fiscal stance of the government.

So if the budget is in surplus it is often concluded that the fiscal impact of government is contractionary (withdrawing net spending) and if the budget is in deficit we say the fiscal impact expansionary (adding net spending).

Further, a rising deficit (falling surplus) is often considered to be reflecting an expansionary policy stance and vice versa. What we know is that a rising deficit may, in fact, indicate a contractionary fiscal stance – which, in turn, creates such income losses that the automatic stabilisers start driving the budget back towards (or into) deficit.

So the complication is that we cannot conclude that changes in the fiscal impact reflect discretionary policy changes. The reason for this uncertainty clearly relates to the operation of the automatic stabilisers.

To see this, the most simple model of the budget balance we might think of can be written as:

Budget Balance = Revenue – Spending.

Budget Balance = (Tax Revenue + Other Revenue) – (Welfare Payments + Other Spending)

We know that Tax Revenue and Welfare Payments move inversely with respect to each other, with the latter rising when GDP growth falls and the former rises with GDP growth. These components of the budget balance are the so-called automatic stabilisers.

In other words, without any discretionary policy changes, the budget balance will vary over the course of the business cycle. When the economy is weak – tax revenue falls and welfare payments rise and so the budget balance moves towards deficit (or an increasing deficit). When the economy is stronger – tax revenue rises and welfare payments fall and the budget balance becomes increasingly positive. Automatic stabilisers attenuate the amplitude in the business cycle by expanding the budget in a recession and contracting it in a boom.

So just because the budget goes into deficit or the deficit increases as a proportion of GDP doesn’t allow us to conclude that the Government has suddenly become of an expansionary mind. In other words, the presence of automatic stabilisers make it hard to discern whether the fiscal policy stance (chosen by the government) is contractionary or expansionary at any particular point in time.

To overcome this uncertainty, economists devised what used to be called the Full Employment or High Employment Budget. In more recent times, this concept is now called the Structural Balance. The Full Employment Budget Balance was a hypothetical construct of the budget balance that would be realised if the economy was operating at potential or full employment. In other words, calibrating the budget position (and the underlying budget parameters) against some fixed point (full capacity) eliminated the cyclical component – the swings in activity around full employment.

So a full employment budget would be balanced if total outlays and total revenue were equal when the economy was operating at total capacity. If the budget was in surplus at full capacity, then we would conclude that the discretionary structure of the budget was contractionary and vice versa if the budget was in deficit at full capacity.

The calculation of the structural deficit spawned a bit of an industry in the past with lots of complex issues relating to adjustments for inflation, terms of trade effects, changes in interest rates and more.

Much of the debate centred on how to compute the unobserved full employment point in the economy. There were a plethora of methods used in the period of true full employment in the 1960s. All of them had issues but like all empirical work – it was a dirty science – relying on assumptions and simplifications. But that is the nature of the applied economist’s life.

As I explain in the blogs cited below, the measurement issues have a long history and current techniques and frameworks based on the concept of the Non-

Accelerating Inflation Rate of Unemployment (the NAIRU) bias the resulting analysis such that actual discretionary positions which are contractionary are seen as being less so and expansionary positions are seen as being more expansionary.

The result is that modern depictions of the structural deficit systematically understate the degree of discretionary contraction coming from fiscal policy.

So the data provided by the question unambiguously points to Option (a) being the more expansionary impact – made up of a discretionary (structural) deficit of 2 per cent and a cyclical impact of 3 per cent. The cyclical impact is still expansionary – lower tax revenue and higher welfare payments.

Option (b) might in fact signal a higher structural deficit which would indicate a more expansionary fiscal intent from government but it could also indicate a large automatic stabiliser (cyclical) component.

You might like to read these blogs for further information:

Question 3

With rising aged dependency ratios, the fact that a sovereign government is never financially constrained means that it can always provide first-class health care to its aeging citizens.

The answer is False.

Does the dependency ratio matter? It surely does but not in the way that is usually assumed.

The standard dependency ratio is normally defined as 100*(population 0-15 years) + (population over 65 years) all divided by the (population between 15-64 years). Historically, people retired after 64 years and so this was considered reasonable. The working age population (15-64 year olds) then were seen to be supporting the young and the old.

The aged dependency ratio is calculated as:

100*Number of persons over 65 years of age divided by the number of persons of working age (15-65 years).

The child dependency ratio is calculated as:

100*Number of persons under 15 years of age divided by the number of persons of working age (15-65 years).

The total dependency ratio is the sum of the two. You can clearly manipulate the “retirement age” and add workers older than 65 into the denominator and subtract them from the numerator.

If we want to actually understand the changes in active workers relative to inactive persons (measured by not producing national income) over time then the raw computations are inadequate.

Then you have to consider the so-called effective dependency ratio which is the ratio of economically active workers to inactive persons, where activity is defined in relation to paid work. So like all measures that count people in terms of so-called gainful employment they ignore major productive activity like housework and child-rearing. The latter omission understates the female contribution to economic growth.

Given those biases, the effective dependency ratio recognises that not everyone of working age (15-64 or whatever) are actually producing. There are many people in this age group who are also “dependent”. For example, full-time students, house parents, sick or disabled, the hidden unemployed, and early retirees fit this description.

I would also include the unemployed and the underemployed in this category although the statistician counts them as being economically active.

If we then consider the way the neo-liberal era has allowed mass unemployment to persist and rising underemployment to occur you get a different picture of the dependency ratios.

The reason that mainstream economists believe the dependency ratio is important is typically based on false notions of the government budget constraint.

So a rising dependency ratio suggests that there will be a reduced tax base and hence an increasing fiscal crisis given that public spending is alleged to rise as the ratio rises as well.

So if the ratio of economically inactive rises compared to economically active, then the economically active will have to pay much higher taxes to support the increased spending. So an increasing dependency ratio is meant to blow the deficit out and lead to escalating debt.

These myths have also encouraged the rise of the financial planning industry and private superannuation funds which blew up during the recent crisis losing millions for older workers and retirees. The less funding that is channelled into the hands of the investment banks the better is a good general rule.

But all of these claims are not in the slightest bit true and should be rejected out of hand.

So the predominant debate is that a fiscal crisis is emerging and that we have to make people work longer despite this being very biased against the lower-skilled workers who physically are unable to work hard into later life.

We are also encouraged to increase our immigration levels to lower the age composition of the population and expand the tax base. Further, we are told relentlessly that the government will be unable to afford to provide the quality and quantity of the services that we have become used too.

However, all of these remedies miss the point overall. It is not a financial crisis that beckons but a real one. Dependency ratios matter because they tell us how many workers will be available to produce real goods and services at any point in time. So we can make projections about real GDP growth for given projections about productivity once we have an idea of these underlying dependency ratios.

Clearly we want to be sure that the projected real needs of the population are capable of being met with the likely available resources.

So the only question we need to ask about the future population trends relate to whether there will be enough real resources available to provide aged-care, etc at a desirable level in the future? However, that is never the way the debate is framed. The worry is always that public outlays will rise because more real resources will be required “in the public sector” than previously.

However these outlays are irrelevant from a financial point of view. The government can purchase anything that is for sale in the currency it issues at any time. There is never a question that the government cannot afford to buy something that is available.

It is the availability that is the issue. As long as these real resources are available there will be no problem. In this context, the type of policy strategy that is being driven by these myths will probably undermine the future productivity and provision of real goods and services in the future.

It is clear that the goal should be to maintain efficient and effective medical care systems. Clearly the real health care system matters by which I mean the resources that are employed to deliver the health care services and the research that is done by universities and elsewhere to improve our future health prospects. So real facilities and real know how define the essence of an effective health care system.

Further, productivity growth comes from research and development and in Australia the private sector has an abysmal track record in this area. Typically they are parasites on the public research system which is concentrated in the universities and public research centres (for example, CSIRO).

Unfortunately, tackling the problems of the distant future in terms of current “monetary” considerations which have led to the conclusion that fiscal austerity is needed today to prepare us for the future will actually undermine our future.

The irony is that the pursuit of budget austerity leads governments to target public education almost universally as one of the first expenditures that are reduced.

Most importantly, maximising employment and output in each period is a necessary condition for long-term growth. The emphasis in mainstream integenerational debate that we have to lift labour force participation by older workers is sound but contrary to current government policies which reduces job opportunities for older male workers by refusing to deal with the rising unemployment.

Anything that has a positive impact on the dependency ratio is desirable and the best thing for that is ensuring that there is a job available for all those who desire to work.

Further encouraging increased casualisation and allowing underemployment to rise is not a sensible strategy for the future. The incentive to invest in one’s human capital is reduced if people expect to have part-time work opportunities increasingly made available to them.

But all these issues are really about political choices rather than government finances. The ability of government to provide necessary goods and services to the non-government sector, in particular, those goods that the private sector may under-provide is independent of government finance.

Any attempt to link the two via fiscal policy “discipline:, will not increase per capita GDP growth in the longer term. The reality is that fiscal drag that accompanies such “discipline” reduces growth in aggregate demand and private disposable incomes, which can be measured by the foregone output that results.

Clearly surpluses help control inflation because they act as a deflationary force relying on sustained excess capacity and unemployment to keep prices under control. This type of fiscal “discipline” is also claimed to increase national savings but this equals reduced non-government savings, which arguably is the relevant measure to focus upon.

So even though the government is not financially constrained it might adopt a policy platform that undermines productivity growth and leaves the economy short of real productive resources at a time in the future when they will be needed to fulfill its socio-economic program.

You might like to read this blogs for further information:

Dear Bill-

I must complain about question 1. The word “coincide” means not only that they external and government deficits each exist, but that they are the same in magnitude. So I believe that your explanation (that it depends on the relative magnitudes) is rather unfair.

Thank you so much for running this blog- it is outstanding!

Dear Burk (at 2013/09/22 at 9:14)

Thanks for your comment. I thought about the wording before I posted the question. The adjective coincident means “occurring together in space or time” and I do not think it implies they are of the same magnitude.

But if you interpret it that way, then your criticism is sound. Either way, it provokes thinking in the right direction, irrespective of the “correct” answer.

best wishes

bill