It’s Wednesday and I just finished a ‘Conversation’ with the Economics Society of Australia, where I talked about Modern Monetary Theory (MMT) and its application to current policy issues. Some of the questions were excellent and challenging to answer, which is the best way. You can view an edited version of the discussion below and…

IS-LM Framework – Part 5

I am now using Friday’s blog space to provide draft versions of the Modern Monetary Theory textbook that I am writing with my colleague and friend Randy Wray. We expect to complete the text during 2013 (to be ready in draft form for second semester teaching). Comments are always welcome. Remember this is a textbook aimed at undergraduate students and so the writing will be different from my usual blog free-for-all. Note also that the text I post is just the work I am doing by way of the first draft so the material posted will not represent the complete text. Further it will change once the two of us have edited it.

Previous Parts to this Chapter:

- The IS-LM Framework – Part 1

- The IS-LM Framework – Part 2

- The IS-LM Framework – Part 3

- The IS-LM Framework – Part 4

Chapter 16 – The IS-LM Framework

[PREVIOUS MATERIAL HERE IN PARTS 1 to 4]

16.6 Introducing the price level

Our derivation of the IS-LM framework initially assumed that the price level was fixed and all changes in output were real. This is consistent with the simple income-expenditure model developed in Chapter 12 where the focus was on the manner in which output and employment responds to changes in aggregate demand.

We assumed that firms were willing to supply whatever was demanded up to full capacity without changing their prices. In this vein, we also treated the nominal and real interest rate has being interchangeable.

In this section we consider how changes in the price level impact on output and interest rates.

The price level is introduced into the IS-LM framework as an exogenous variable, that is, determined outside of the interest rate-income equilibrium defined by the intersection of the IS and LM curves. There are several complications involved in adopting this assumption, which we will abstract from for the sake of simplicity.

The income-expenditure model developed in Chapter 12, which underpins the derivation of the IS curve was defined in real terms. Thus, the expenditure components – consumption, investment, government spending and net exports – are all measured in constant prices.

We would expect the IS curve therefore to be invariant to changes in the general price level given that housholds, firms, government and the external sector have made decisions regarding real expenditures.

However, to date our analysis of the money market has fudged the question of the price level. The demand for money is a demand for real balances, motivated by the need to make transactions for the exchange of goods and services which we have just noted are defined in real terms.

But, the money supply is specified in nominal terms – an amount of dollars – and forms the unit in which all the other variables are accounted.

The real value of a given stock of money on issue, however, varies with the price level. For a given stock of dollars on issue, the real value is higher when the price level is lower, and, vice versa.

For example, assume that the money supply on issue is $1000 billion and the price index is 1. The real value of the money supply would be $1,000 billion.

Now if the price level rose by 5 per cent the price index would be 1.05 and the real value of the money supply would drop to $952.4 billion.

This means that users of the currency have less available in real terms to use for purchases and speculative holdings.

The same contraction in real value of the money supply could arise if the price level was unchanged (that is, the index remained at 1) and the nominal money supply fell to $952.4 billion.

In other words, the real value of the money supply can fall if the price level rises (for a given nominal money stock) or if the nominal money stock falls (for a given price level).

Alternatively, the real value of the money supply can rise if the price level falls (for a given nominal money stock) or if the nominal money stock rises (for a given price level).

Within the logic of the IS-LM framework, it is clear that if the price level rises and reduces the real value of the money supply, the interest rate will rise because at the previous equilibrium interest rate, there will now be a shortage of real balances relative to the demand for them.

The introduction of the general price level modifies our LM curve derivation. If a rising price level (with a constant nominal money stock) is equivalent in real terms to a declining nominal stock of money (at constant prices) then we can capture this impact via shifts in the LM curve.

The LM curve shifts to the left when the price level is higher, other things equal, and to the right when the price level is lower.

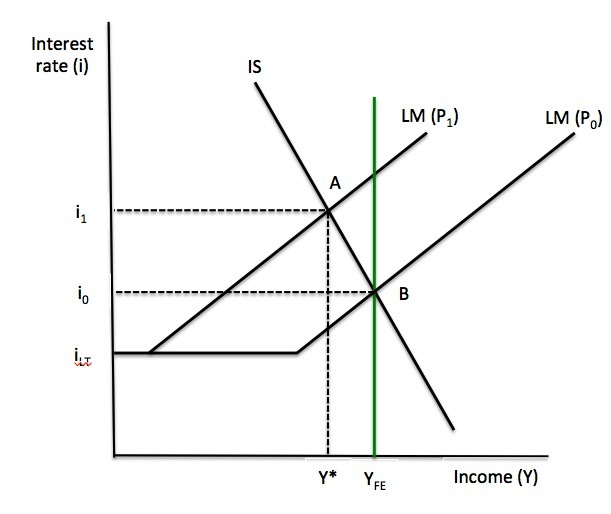

Figure 16.10 depicts two different LM curves at different price levels (P1 > P0).

The introduction of the price level now means that our interest rate-income equilibrium is now contingent on the price level. If there is a different price level, the equilibrium changes as noted.

This means that within this framework, the national economy equilibrium can shift without any change in monetary or fiscal policy if the price level changes.

Figure 16.10 IS-LM Equilibrium and the General Price Level

This observation was central to the debates between Keynes and the classical economists during the 1930s, which we examined in detail in Chapter 15.

Assume that the economy is currently at Point A, where the interest-rate is i1 and national income is Y*. The general price level is P1.

Point B is the full employment output level so that the current equilibrium is what Keynes would refer to as a underemployment equilibrium.

At Point A, the product and money markets are in equilibrium but there is an output gap and there would be mass unemployment in the labour market.

Keynes considered this to be the general case for a monetary economy and depicted the neo-classical model as a special case in which the equilibrium that emerged was also consistent with full employment. For Keynes, a monetary economy could be in equilibrium at any level of national income.

The neo-classical response to this was that unless we impose fixed wages on the model, the persistent mass unemployment would eventually lead to falling nominal wages and prices.

While this might not lead to a fall in the real wage (if nominal wages and prices fall proportionately), which would negate the traditional neo-classical route to full employment via marginal productivity theory, the fact remains that the lower price level increases real balances in the economy.

The reasoning that follows is that the reduction in prices leads to a decline in the transactions demand for money at every level of income because goods and services are now cheaper.

With the nominal stock of money fixed, the expansion of real balances combined with a decline in the demand for liquidity, results in a decline in the rate of interest.

As long as future expectations of returns are not affected adversely by the deflationary environment, the reduction in the rate of interest, stimulates investment spending, which leads to increased aggregate output and income via the multiplier effect.

As long as there is an output gap, deflation will continue and the interest rate will continue to fall until the economy is at full employment.

The link between real balances and the interest rate was referred to as the Keynes effect.

In terms of Figure 16.10, the LM curve shifts outwards as the price level falls and the rising investment is depicted as a movement along the IS curve. The new equilibrium is Point A.

This observation then led to neo-classical economists to consider the possibility of an underemployment equilibrium as a special case when wages and prices were fixed.

The view that Keynes’ underemployment equilibrium was a special case of the more general flexible price model became known as the Neo-classical synthesis. This approached recognised that aggregate demand drove income and employment (the so-called Keynesian contribution) but that the economy would tend to full employment if wages and prices were flexible (the Classical contribution).

There are several arguments against the view that a Keynes effect will be sufficient to generate full employment.

Keynes’ General Theory, – Chapter 19 – which is devoted to the impacts of money wage changes on aggregate demand.

Among other impacts, Keynes argued that lower money wages and prices will lead to a redistribution of real income (FIND PAGE NUMBERS):

(a) from wage-earners to other factors entering into marginal prime cost whose remuneration has not been reduced, and (b) from entrepreneurs to rentiers to whom a certain income fixed in terms of money has been guaranteed.

He concluded that the impact of “this redistribution on the propensity to consume for the community as a whole” would probably be more “adverse than favourable”.

Moreover, falling money wages will have a (FIND PAGE NUMBERS):

… depressing influence on entrepreneurs of their greater burden of debt may partly offset any cheerful reactions from the reduction of wages. Indeed if the fall of wages and prices goes far, the embarrassment of those entrepreneurs who are heavily indebted may soon reach the point of insolvency, – with severely adverse effects on investment.

Overall, Keynes concluded that there was “no ground for the belief that a flexible wage policy is capable of maintaining a state of continuous full employment”.

The debt-deflation argument was also recognised by other economists such as Irving Fisher in 1933, Michal Kalecki in 1944 and Hyman Minsky in 1982).

[TO BE CONTINUED IN PART 6]

Conclusion

PART 6 next week – CRITIQUE OF FRAMEWORK.

Saturday Quiz

The Saturday Quiz will be back again tomorrow. It will be of an appropriate order of difficulty (-:

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Hi,

here are some comments:

“(a) from wage-earners to other factors entering into marginal prime cost whose remuneration has not been reduced, and (b) from entrepreneurs to rentiers to whom a certain income fixed in terms of money has been guaranteed.”

This is page 262 in my copy, the other quote is from page 263.

Why not include the Pigou effect, too? It would only be one additional paragraph.

This typo might be hard to find: “This approached recognised”

best,

Dirk

Bill, I was hoping you might be able to help me with these questions:

1. You argue that government spending comes before taxation and borrowing, but how can this be the case if the Treasury is not allowed to borrow directly from the Central Bank? In this situation, for the Treasury to get a positive balance in its account at the CB it has to tax or sell bonds to the non-government. So how can the government ‘spend first’ in this situation?

2. How does government deficit spending increase demand overall if government bonds are sold to non-banks?

If the government deficit spends $100 then this increases demand, but if it simultaneously sells a $100 bond, doesn’t this reduce potential spending by the (non-bank) bond buyer by the same amount?

If I buy a government bond, my net financial wealth doesn’t change but the amount of money I have to spend decreases by the amount of the bond. Doesn’t the bond sale remove as much money from the economy as the deficit spending adds, if the bond is sold to a non-bank (thus reducing bank deposits)?

Many thanks,

Phil.

“You argue that government spending comes before taxation and borrowing, but how can this be the case if the Treasury is not allowed to borrow directly from the Central Bank?”

Government tends to have an infinite intra-day overdraft at the central bank – as do all other central bank holders. They then clear that by the end of the day. The prohibition, such that it is, is on having negative balances over night.

Think of it that the government spends at 11am, taxation is collected at midday and the bond selling happens at 2pm with what is left.

Reality is a lot more dynamic than that, but this mental model is useful to understand how it works.

“If I buy a government bond, my net financial wealth doesn’t change but the amount of money I have to spend decreases by the amount of the bond.”

But your assets do not change. And you wouldn’t have swapped it for a bond if you didn’t intend to save.

Remember that spending causes taxation which reduces the need for bonds. Spending essentially means that the government gets its money ‘for free’. So it is only excess saving over investment that causes a need to issue bonds in the first place.

Essentially there is an amount of liquidity in the system that the central bank ensures is sufficient for transactions to clear via the banking sector. So you can always get cash when you need it. That’s the fundamental principle of a dynamic currency.

“Government tends to have an infinite intra-day overdraft at the central bank”

Does this happen in the US? Do you have any evidence that the Treasury gets intra-day overdrafts from the Fed?

“But your assets do not change. And you wouldn’t have swapped it for a bond if you didn’t intend to save.”

Ok, but how does government spending increase demand overall if each increase in government spending is matched by an equal decrease in private sector spending (i.e. saving and buying government bonds)?

“1. You argue that government spending comes before taxation and borrowing, but how can this be the case if the Treasury is not allowed to borrow directly from the Central Bank? In this situation, for the Treasury to get a positive balance in its account at the CB it has to tax or sell bonds to the non-government. So how can the government ‘spend first’ in this situation?”

“Government tends to have an infinite intra-day overdraft at the central bank – as do all other central bank holders. They then clear that by the end of the day. The prohibition, such that it is, is on having negative balances over night.”

So because of an overdraft facility at the cb the government is able to spend before it taxes? It doesnt seem as if most of the money comes into circulation that way.

It appears as if private bank lending which accounts for most of the money supply places money into circulation for the gov to tax without government spending first. Bank lends 100 to someone, that money circulates and some of it becomes tax. After the bank lends it can borrow reserves to fulfil its RR. Maybe the gov has to issue treasuries so the banks can use in exchange for reserves but the government doesnt have to spend first.

“So you can always get cash when you need it.”

Do you mean you can always sell a government bond if you want to? But then doesn’t someone else have to decide to save?

“Do you mean you can always sell a government bond if you want to? But then doesn’t someone else have to decide to save?”

The dealers in government bonds have to make a market. So you can guarantee that they will want to ‘save’. And that guarantee is back-stopped by the central bank which has to ensure there is sufficient liquidity for the transaction to complete – and bonds are swapped for cash where necessary to make sure that happens.

It’s all smoke and mirrors in a fiat currency system with a load of money men creaming off a living via all these pointless transactions.

“Maybe the gov has to issue treasuries so the banks can use in exchange for reserves but the government doesnt have to spend first.”

What do you buy the treasuries with?

If the bank has an overdraft with the central bank, it would need to extend that overdraft to buy the treasuries in order to borrow reserves from the central bank.

You can’t buy treasuries with bank money. It has to be central bank money.

The current system may be controlled by the commercial banks, but we haven’t yet got to the point where the Treasury is giving gifts of Treasuries to commercial banks.

Ultimately you have to do a reserve add to match a reserve drain if you have an enforced zero boundary.

“that guarantee is back-stopped by the central bank which has to ensure there is sufficient liquidity for the transaction to complete – and bonds are swapped for cash where necessary to make sure that happens.”

The central bank has to supply enough reserves to maintain its target base interest rate, but it doesn’t have to intervene in the secondary treasury market in any way, does it? I don’t see why you say the central bank has to get involved.

Also don’t treasury dealers buy treasuries to sell them on? They don’t buy them to hold them and ‘save’.

So isn’t the equation better stated that private bank lending leads to taxation? The private banks lend first create taxes and then later fulfil their reserve and treasury obligations. The only reason treasuries are required is for exchanging into reserves. But for example in Australia there is no reserve requirements so this doesn’t apply at all.

“So isn’t the equation better stated that private bank lending leads to taxation? ”

You can’t pay taxation unless there is some central bank money in the system to pay it with. And a government that is taxing but not spending has no need to issue bonds since it has no deficit.

As I said ultimately you have to have a reserve add before you can do a reserve drain if you have an enforced zero bound (ie no overnight central bank overdrafts allowed). Whether there is a ‘reserve requirement’ is irrelevant for the point.

To pay taxes a bank must transfer central bank reserves to the Treasury. So the bank has to obtain reserves to clear the overdraft. And that means, transitively, some non-government sector product must be transferred to the government sector in return for those reserves, or the government sector has to gift a non-government entity those reserves. Both of which are ‘government spending’.

“The central bank has to supply enough reserves to maintain its target base interest rate, but it doesn’t have to intervene in the secondary treasury market in any way, does it?”

A system short of reserves is generally supplied with reserves by the central bank repoing treasuries. That’s intervening in the secondary market since it is reducing the overall free supply of treasuries.

“Also don’t treasury dealers buy treasuries to sell them on? They don’t buy them to hold them and ‘save’.”

They do, but not necessarily instantly. A market maker ensures that the market is liquid by providing a liquidity buffer. That means they provide a saver of last resort function. You can always sell to the market maker even if there isn’t necessarily a matching buyer at that point in time. And the spread between the bid and offer price compensates the market makers for the risk of providing that saver of last resort function.

“You can’t pay taxation unless there is some central bank money in the system to pay it with. And a government that is taxing but not spending has no need to issue bonds since it has no deficit.”

In the example of Australia when it was running surplusses and had little debt the gov issued bonds just to underpin the operation of monetary system. In order to underpin the payment system without reserve requirements only a small amount of treasuries is needed.

“A system short of reserves is generally supplied with reserves by the central bank repoing treasuries. That’s intervening in the secondary market since it is reducing the overall free supply of treasuries.”

Ok but I don’t see how the central bank’s decisions regarding the base interest rate have anything to do with what’s going on in the secondary treasury market per se.

“You can always sell to the market maker even if there isn’t necessarily a matching buyer at that point in time.”

But in the end someone other than a dealer has to buy the treasury, as the dealer’s intention is in most cases not to hold on to the treasuries indefinitely. What happens if everyone tries to sell their treasuries at the same time? I’m guessing the prices collapse and interest rates shoot up.