I grew up in a society where collective will was at the forefront and it…

US government should look to France and increase its deficit

Yesterday (June 26, 2013), the – US Bureau of Economic Analysis – published the third estimates (revising the second estimates published in late April – US National Income and Product Accounts – for the March-quarter 2013. The substantive changes in the revisions are that the US economic growth rate has been revised down from 2.4 per cent to 1.8 per cent per annum once the more complete data has become available. Personal consumption spending has been revised downwards, and exports declined rather than the initial assessment of an increase. The second estimates revealed a slowing economy in the face of the fiscal drag coming from the government sector, principally the federal government. At the time of their publication, it was clear that the outlook was not optimistic given that this data seemed to exclude the impacts of the “sequester”. We considered that those impacts would manifest more clearly in the June-quarter data. The third estimates now confirm that the lag in the sequester impacts has been shorter than previously thought. The US economy clearly slowed quite sharply in the first-quarter 2013 under the weight of the fiscal drag. The output gap is now over 10 per cent with signs of deflation emerging. The danger is that the US will head towards zero growth as the sequester impacts become more pronounced. The US federal government should increase their net spending rather significantly at present to avoid this downward trend. The US just has to look across the Atlantic, where the data now shows the French economy is now back in recession as a direct result of fiscal austerity.

The BEA said in the release that:

Real gross domestic product — the output of goods and services produced by labor and property located in the United States — increased at an annual rate of 1.8 percent in the first quarter of 2013 (that is, from the fourth quarter to the first quarter), according to the “third” estimate released by the Bureau of Economic Analysis. In the fourth quarter, real GDP increased 0.4 percent … With the third estimate for the first quarter, the increase in personal consumption expenditures (PCE) was less than previously estimated, and exports and imports are now estimated to have declined … The increase in real GDP in the first quarter primarily reflected positive contributions from PCE, private inventory investment, and residential fixed investment that were partly offset by negative contributions from federal government spending, state and local government spending, and exports. Imports, which are a subtraction in the calculation of GDP, decreased.

The following sequence of graphs updates the National Accounts outlook as presented in the third estimates.

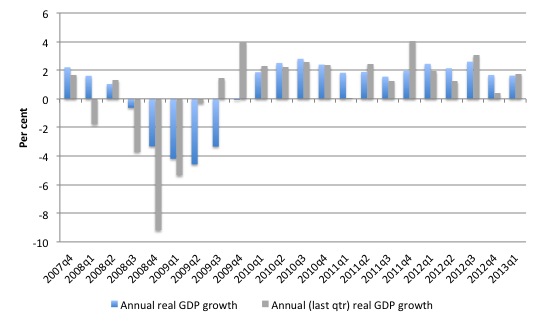

The first graph shows the annual real GDP growth rate (year-to-year) from the peak of the last cycle (December-quarter 2007) to the March-quarter 2013 (blue bars) and the annualised last quarter growth rate (grey bars).

The year-to-year growth rate was only 1.6 per cent (revised down from 1.8 per cent) and the trend is falling. The annualised version of the March-quarter 2013 growth rate was 1.77 per cent (revised down from 2.4 per cent). There is considerable volatility in the data (partly due to Hurricane Sandy), which is smoothed out by the year-to-year growth calculation. Overall, the economy is maintaining below-trend growth but is facing contractionary forces.

In the blog – US national accounts – growth but for how long? – I discussed the release of the second estimates and my estimates of potential GDP and the Output Gap in the US. For a more detailed discussion of estimation techniques, please read this blog – US problems are cyclical not structural.

The average quarterly real GDP growth rate between 2001Q4 and 2007Q4 was 0.62 per cent per quarter. If the global financial crisis had not have occurred it would be reasonable to assume that the economy would have grown at this rate.

If we extrapolate that growth rate out from the most recent peak (December 2007), then we would can create a potential reaL GDP series to the present quarter.

The gap between actual and potential real GDP in the first-quarter 2013 that emerges is $US1,5273.5 (up from $US1,523.4 billion using the second estimates data).

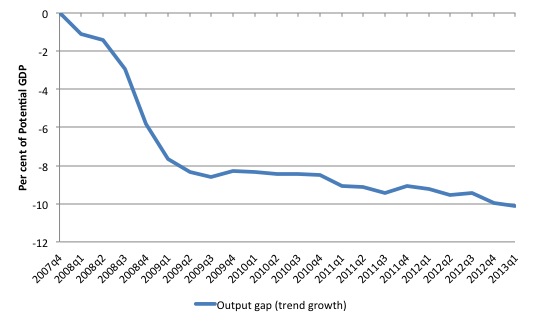

The following graph shows the estimated percentage real output gap (percentage deviation of actual from potential real GDP) that is derived from the latest National Accounts data.

It is in fact more accurately called the incremental output gap because I would not presume that there was full employment in the December-quarter 2007. In other words, my incremental output gap depicts the increase in whatever gap existed at December-quarter 2007.

The Output Gap is 10.1 per cent of potential GDP and it is getting larger each quarter as real GDP growth flags. It constitutes a massive on-going permanent national income loss and provides significant scope for spending expansion.

It also demonstrates a cyclical problem. If the gap was due to structural factors then it not have fallen as sharply as it did in early 2008. Structural deterioration is gradual and cumulative not sudden and sharp.

Contributions to growth

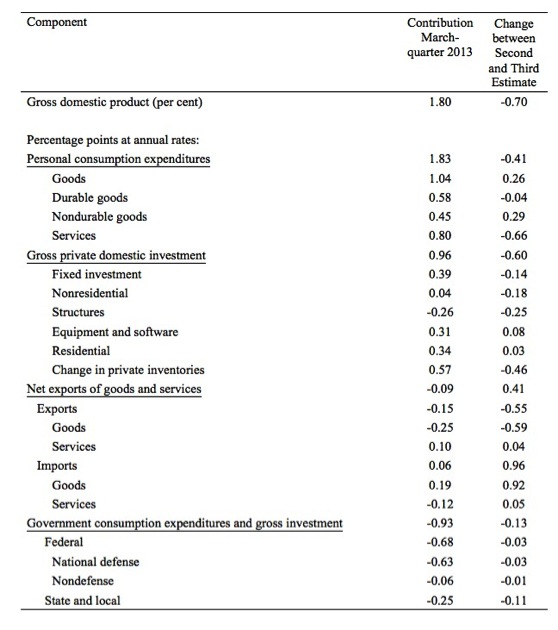

The following Table shows the revised contributions to the March-quarter 2013 real GDP growth (percentage points except for the GDP estimate which is per cent) and the detailed changes between the Second Estimates (April) and the Third Estimates (June) for these expenditure contributions in the US National Accounts.

The headline news is that while growth is still coming from Personal Consumption expenditure, the strength of that component was much lower than previously thought.

The same goes for Private investment which fell from 1.56 points to 0.96 points.

Net exports were previously estimated to be responsible for a 0.5 points contraction was revised to a 0.09 points contraction. In the second-estimates for March-quarter 2013 published in April, exports were estimated to have contributed 0.4 points, while imports drained 0.9 points from real GDP growth. That would have reflected a strengthening of private spending overall.

But in the revised estimates yesterday, the position is more grave. Exports are now estimated to be draining growth (a variation of 0.55 points down from the second-estimates), while imports drained less than previously estimated.

Taken together than means that export revenue is now falling as is import spending – signalling a declining world environment and declining domestic income generation. Neither outcome is good.

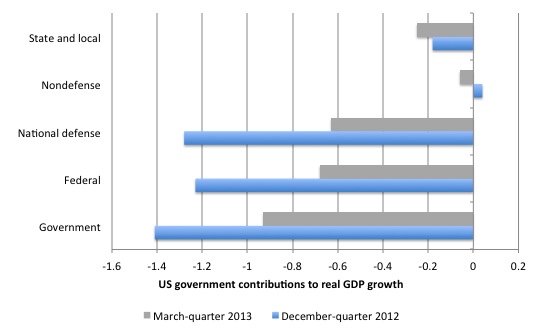

Finally, the contraction of the government sector scythed 0.93 points off real GDP growth in the March-quarter 2013 rather than the previously estimated 0.8 points. The drain on growth from the Federal level was slightly worse than previously estimated (-0.68 rather than -0.65 points). The same goes for State and Local government contributions.

Overall, the revised estimates are bad news and suggest that the June-quarter outcomes will be even worse than previously expected.

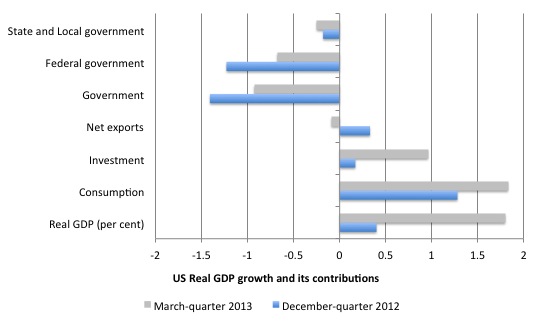

The next graph compares the December-quarter 2012 contributions to real GDP growth at the level of the broad spending aggregate with the revised March-quarter 2013 contributions.

The next graph decomposes the government sector into its parts and reveals that it was the contraction in military spending that did the damage as in the December-quarter 2012.

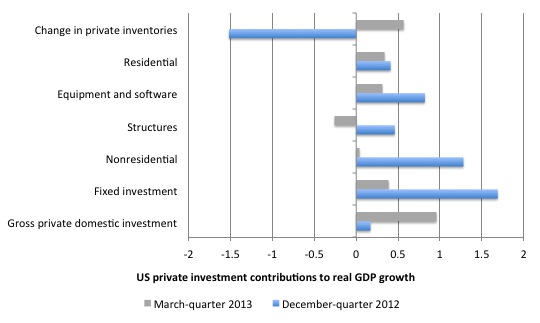

Private investment spending was previously estimated to be strong in the March-quarter 2013 but the revised estimates are much weaker.

But as the next graph, which decomposes the spending categories that constitute total gross capital formation, shows the situation is worse than previously assessed.

While overall investment contributed to growth, fixed investment added 0.39 points (down from 1.69), non-residential added only 0.04 points (down from 1.28), structures dragged -0.26 points (down from 0.46), equipment and software added 0.31 points (down from 0.82), residential added 0.34 points (down from 0.41), and the change in private inventories added 0.57 points (up from -1.52).

So the investment growth recorded was all down to the big swing in inventories, which can be interpreted as an indicator of the start of an inventory cycle that reflects weak demand and a further contraction in output and income in the coming year.

I did some further analysis using – Table 5.6.5B. Change in Private Inventories by Industry – in the BEA’s Interactive Data. The data tells us that there was a huge swing in Farm inventories in the March-quarter 2013 (swing equalled 34.6.7 per cent) after many quarters of rundown. I cannot tell you which crops actually have been stockpiled.

Manufacturing inventories also rose by 11.1 per cent. Wholesale Trade inventories showed steady growth and down from early growth rates, whereas growth in Retail Trade inventories were also steady over the last 12 months in the 2011 there were several negative quarters.

What does it mean? Overall, it suggests some weakness which is consistent with consumption and investment spending being weaker than previously estimated.

A longer view of the data (see the analysis in the blog – US national accounts – growth but for how long?) shows that the US government sector consistently supported growth through the very deep 1982 recession (one quarter of contraction) and, importantly, maintained that support in the recovery phase.

That stands in stark contrast to the behaviour of the federal government in the current downturn and recovery.

Since late December 2010, the overall government sector in the US has been undermining real GDP growth. The US government overall started to drag on real growth almost immediately after it had begun. Overall real GDP growth turned positive again in September 2009.

The federal level has been a negative contributor to quarterly real GDP growth for 8 of the last 12 quarters. That should put in perspective the claims by conservative politicians and commentators along the lines that “we tried aggressive fiscal policy and it didn’t work”.

The correct statement is that the US government injected a stimulus throughout 2008 and maintained it until September 2009 and growth began to recover fairly strongly. Then it got pressured by conservative forces to cut back and growth faltered.

The situation is even worse at the State and Local government levels.

Since March 2008, state and local governments together have been negative contributors to real GDP growth in 16 of the 20 quarters, and every quarter since September 2010.

If you consider the previous recession periods, both levels of government were running counter-cyclical strategies (contributing positively to growth) in contrast to the present recession.

This is especially so when you consider the State and Local governments. However, in recent quarters it is the Federal government that is draining growth more than its state and local counterparts.

Conclusion

The revised data shows that the US recovery is far weaker than previously estimated. If we analyse all the recoveries since in the Post World War 2 period, we would conclude that is is one of the weakest recoveries, which explains why unemployment has persisted at very high levels for around five years.

How that squares with comments made by the central bank chairman last week that there was a need to cut back the stimulus program is an interesting question. What the Federal Reserve Bank does in that regard is relatively insignificant any way, given that its belief that the monetary policy changes had provided a significant stimulus was flawed from the start.

At least Dr Bernanke got one thing right – that the fiscal cutbacks are damaging for growth and that impact will worsen in the June-quarter.

The current real GDP growth rate is so weak that the output gap is expanding. It is also not strong enough to reduce unemployment and the broader forms of labour underutilisation in any significant way.

The US government is choosing to allow long-term unemployment to continue to rise. There is no fiscal justification for that. They should explain why they consider undermining growth and deliberately maintaining people in a state of unemployment is a sensible option for their nation.

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

“They should explain why they consider undermining growth and deliberately maintaining people in a state of unemployment is a sensible option for their nation.”

Dear Bill,

I am replying on behalf of the Goverment of the USA. In short… Our bosses on Wall Street are quite happy with the profits they are making at this point in time. They say the minions have been well behaved and are accepting their rapidly diminishing prospects with little complaint. Should the opportunity arise we are to attempt draconian spending cuts and fabricate a deficit crisis. This is the code word for Wall Street to asset strip the country and take anything shiny they might fancy. Hope that clarifies your concerns.

Don’t worry about any dissent, we have already identified the potential ring leaders. The bumble bee sized execution drones are ready for deployment.

Regards

O’Bomber

There are at least three governors who have decided that their states will go for broke with austerity programs (forgive the pun), the latest of which is the Wisconsin governor, Scott Walker, who campaigned on the opposite platform (23 May 2013, Huff Post by the president of the AFL-CIO). He has also given goodies to his richer friends, among other things inconsistent with his campaign platform. If I remember rightly, there is a special place in Dante’s Inferno for people like this.

There’s no real fiscal justification for the current policies, but Washington doesn’t need that. There is plenty of political justification. It doesn’t matter what’s happening in France, or Japan, or Greece, because those are merely sidebars to the standoff over domestic issues, and sadly it looks like nothing is going to change at least before the midterm elections.

Recent behavior of the GOP house majority leads one to conclude that Congress is willing to impede and obstruct economic recovery in the interests of regaining control of the executive branch. Witness the bipartisan Farm Bill which should have passed easily in the House.

Quite simply, the GOP is making a bet that enough voters will be fed up with the economy by 2016 that they will be compelled to cast their vote, if not for the GOP candidates, then against the Democrats. One would hope that enough voters would see through this strategy, and it could still backfire for the GOP. But the important message needs to get out not to our elected leaders but to American voters, and needs to be effective enough to have a chance against the propagandist bullies.

The economic theory from this blog and others is a very useful catalyst but it will never reach the mainstream in its current form. I’ve given it a shot myself but my oratory and wordsmith skills just aren’t up to the task yet, and not from lack of trying.

I’m prepared for a very bumpy ride over the next couple years.

That Beast should be getting good and starved by now.

I predict that if #elizabethforpotus gets in in 2016, infrastructure spending and sensible regulation will start to go in place, but if Christie/Bush gets in, military spending and the security state will balloon, foreign adventures will recommence, and financial regulation will go the way of the dodo.

Oh, and TPP will rape the sovereignty of all our Pacific neighbors.

Jeff, I don’t know whether my oratorical skills are up to the task either or even whether I know enough, but I am giving a talk on an alternative to the neoclassical agenda (which will center on MMT) this coming January to a local Cafe Scientifique. Many people who come to these talks are quite well educated but not in economics and do not understand alternatives to the current agenda, which of course is rammed home week after week by the mainstream media. They may, like Balls, disagree with the Tory policies, but are unable to conceive of an alternative. And it takes more time than is available at lunch or at the pub to get the ideas across. Physicists, I have noticed, seem to have a particularly difficult time with this. I don’t know why. Maybe it is just the people I know. Or perhaps part of the difficulty is getting to grips with the quite fundamental differences that separate the natural and social sciences.

Jeff, obstructionism with the goal that Obama would get the blame has been GOP strategy since the 2008 election. Did some good for them in 2010, but not so well in 2012. You have to wonder about keeping it up until 2016, with hopes of a different outcome.

Without the relentless opposition Obama probably would have followed a more expansionary policy, but how much would be a guess. He seems to have bought into most of the fallacies.

Bill said earlier; “As an aside, I am giving a public lecture tonight on “The relevance of Marx today”.”

I hope Bill can post a video or transcript of this lecture when it is available.

I have come to the conclusion that capitalism is unreformable even by MMT (at least by MMT alone). Further, it is clear that capitalism with its requirement for endless growth and wasteful production and consumption is unsustainable in a finite world. Capitalism will fall due to both internal and external (environmental) contradictions. We need to prepare the theoretical ground for a new system.

The most fertile strands of thought for this transformation include (in no particular order) MMT, environmentalism, eco-socialism, eco-Marxism and biophysical economics or thermoeconomics. A synthesis of these fields is IMO most likely to assist us in planning and building a sustainable and equitable future (within the constraints of the heavily damaged biosphere which capitalism is now bequeathing to us).

Oddly enough, I think the current stand-off in Washington gives us the best chance for continuing the economic recovery. I realize most of us want to see more Federal spending, particularly on infrastructure, but the deadlock in Congress precludes that for the time being. The “sequester,” though not particularly helpful, is probably not large enough to do great damage to the economy (as it is only in the tens of USD billions). The Repubicans likely believe they can hold onto the House next year and perhaps gain enough seats to control the Senate, but winning the White House now is starting to seem impossible. This is because the electorate is very different in the mid-terms as opposed to presidential years. In 2016, they could well lose the whole shebang.

If only you could visit the US and see and hear some of the off-the-wall ranting that goes on here. There is a newsletter huckster who raves about the “end of America” (which presumably results from a loss of “reserve currency” status for the USD and thus a refusal of foreign governments to accept US Treasuries in payment for their trade surplusses – clearly this fellow believes we still live under a gold standard; I am immensely enjoying the drop in gold prices right now and watching these dolts take a bath) and though he has been spewing this garbage for the past five years, there are many here who swear by it. They quickly pull out Bibles and point to one verse or another that signifies the hell that awaits a nation for “running the printing press” and “living beyond our means.” All manner of various “survival” goods are on offer at various websites and these seem to sell briskly because “everybody knows” there will be a financial collapse and then it will be every man for himself. When is this happening, I ask them. “Pretty soon”, “before you know it,” and my favorite: “it’s already started!”

Liberally sprinkled throughout these diatribes are various racially-tinged invectives aimed at the current US President. If one tries to point out that he is mostly a political centrist and more or less agrees with the neoliberal mainstream, these people get quite indignant and they insist that he was “trained” by Marxists and it is “only a matter of time” before he declares martial law and sets himself up as a dictator. Once again, of course, this will take place because he and his cronies, among them Fed Chairman Bernanke, are “deliberately” plotting the destruction of the US Dollar by engaging in “‘reckless” deficit spending.

Bill likes to single out Congressman (and recent VP nominee) Paul Ryan for criticism, but to the hardcore right wing, he is considered a sellout because he doesn’t propose a “balanced budget” for the current fiscal year. Trying to explain to these people that attempting to do this would actually cause the financial destruction that they claim Obama wants is an absolute waste of time. They are what is now being termed “epistemically closed” and no new evidence will permeate their skulls.

Fortunately, the rabid Right is a distinct minority, and the continuing change in the US electorate ensures they will remain that way. It would help, however, if more of the so-called “progressives” would learn about actual economics and be better at explaining it. Right now, it’s practically Don Quixote tilting at windmills. I do make some headway, however, when I point out that an understanding of MMT could be quite profitable – for example, the US treasury bond rally that took place after the S&P downgrade in 2011. This was quite easy to see coming and so is the current pullback in the gold and silver markets, as well as the outperformance of the Japanese stock market. Of course, to understand how these things take place is to “suspend disbelief” and open one’s eyes. Seeing profits roll in can be of great help in doing so.

Ikonclast,

A few suggestions…..This is an excellent (easy to understand) starter to open up the minds of the audience.

http://ineteconomics.org/institute-blog-0/dirk-bezemer-debt-good-bad-and-ugly

Once they are listening, you can introduce the concept of sectoral balances and countercyclical deficits so the private sector can save and pay down their debts. This should get your foot in the door and counter “we must reduce the deficit” mantra.

Then focus on nothing but managing inflation. To counter the inevitable “print and spend Weimar Republic” concerns.

If you still have time you can blow their minds with the MMT spending precedes taxation concept. This helps counter the “wasting taxpayer money” and the other tax and spend themes.

I’d say JG would be the last piece in the jigsaw. You could approach it as a more humane work for the dole.

You need to get the sequence right and get as much information in as possible before a circuit blows in their heads.

Ooops… I just re-read the comments and saw its Bill giving a talk not Ikonoclast. Plus it’s about the relevance of Marx so I completely missed the mark…..never mind. If anyone wants to risk life and limb introducing MMT to the baying hordes, the above is my suggestion.

…..

I know it seems like piing on, as the examples of how destructive the austerians have been are all too many, however, even the Emerald Isle is once again proving that 1 + 1 doesn’t equal 3.

Ireland is officially back in recession

The economy shrank in the first quarter of 2013. And in the last quarter of 2012. And in the third quarter of 2012

I doubt that there will be any change in US policy until the stock market collapses. As it is the rich aren’t suffering from the economy so their paid politicians have no reason to do anything about it. I also suspect that Michael Hudson is correct that this slowdown benefits the interest of the privatizers and will allow them to buy up public assets on the cheap. So, why should paid politicians complain?

Also, I too would like to blame the “conservatives” but in my mind the Democrats are just as much to blame as the Republicans. I suspect that Obama wants to replicate Bill Clinton and have a balanced budget for his legacy. All in all the future seems bleak for the US economy in my mind.

I appreciate your hard work. I don’t know how you do all that you do.

“I’d say JG would be the last piece in the jigsaw. You could approach it as a more humane work for the dole.

You need to get the sequence right and get as much information in as possible before a circuit blows in their heads”

I’d suggest you’ve got it entirely the wrong way around.

I’d start with the Job Guarantee, and then state that capping the amount that banks can lend would allow you to make a significant reduction in taxes.

That immediately puts two real benefits in front of the individual. Then they’re interested in the ‘how’.

Ikonoclast,

You might find the views of Gar Alperowitz interesting in terms of a what a post-capitalist world could look like.

Neil:

I happen to like the Job Guarantee idea (for many of Bill’s stated reasons – that it would greatly spur aggregate demand as well as to serve as a wage floor), but when starting off a discussion aimed at opening eyes on MMT, this is rather “heavy lifting.” Americans tend to see this as a form of Marxism and call it “make work,” with no productive outcome. Those with a sense of history are quick to call attention to the CCC and WPA in the New Deal period, and some will even bring up the Amity Schlaes tome “The Forgotten Man.” They tend to get rather hot when you point out that this book is little more than a collection of anecdotes and that the author tends to fudge her data, but (similar to their feelings about Ayn Rand) iconoclasts are rarely popular.

I’ve found that a better way to go is simply to throw out ideas such as “bond issuance is voluntary”, and “tax collection at the federal level is mostly to relieve inflationary pressure.” As these notions tend to drastically contradict what the mainstream believes, they can be a good way to open up the entire topic. But you need to be dealing with people who are at least moderately open to hearing new ideas, which, sadly, are becoming ever fewer in number these days.

Showing people graphs comparing productivity growthversus real wages growth is pretty much all you need to show why Neo-Liberalism only works for the top end of town.

Most people feel like they are working harder than ever and yet don’t feel like they are moving forward financially at the same rate. A graph comparing productivity growth and real wages growth demonstrates why in a very simple and easy to understand format.

If you want to really lay the boot into neo-liberalism you compare the minimum wage over time with the average wage over time. What you will see is how in relative terms the minimum wage does not keep up with the growth in the average wage.

This provides undeniable and easy to comprehend evidence as to why the majority of the population should oppose Neo-Liberalism.

All of this information has been very well presented throughout Bill’s Blogs. The only problem is that not enough people realise just how powerful a tool a few simple graphs can be – if distributed in an effective manner.

Trying to explain the role of taxes, or bonds, or indeed the sectoral balances is simply a waste of time becuase the audience will pretty much just sum you up as another bloody economist.

” Americans tend to see this as a form of Marxism and call it “make work,” with no productive outcome. ”

Start with the Paradox of Productivity then. The better the machines the less people are needed to produce everything we need. But that means the people don’t have the income to consume everything the machines could produce if they had the income. That demonstrates that it is irrational for the private sector to provide work for all – hence we have to invent retirement, extended schooling, and public sector jobs like the police, fire service, etc. As the machines get better that process continues.

Then move on to show how guaranteeing everybody a job protects their job and income, and how capping bank lending ratios would allow a large tax cut. It’s easy to play to a self-centred pioneer style view if you need to and how that process undermines their share of the pot.

The US psyche is indeed very odd and atypical across the world. After all in aggregate they believe in guns and oppose universal healthcare.

The rest of the world is a bigger place and somewhat more enlightened. There ensuring everybody has something to do and an income is largely seen as a given.

Having said that you still have to sell MMT as what’s in it for the individual. So frighten them with job losses and job insecurity and then show how sensible policies using the policy space MMT reveals can help them get a bigger share of the pie.

Neil Wilson – It’s like I said in my first post. Sometimes the way to a person’s heart is via his/her pocketbook. If we can explain that a knowledge of MMT can help one to better understand the gyrations in various world markets, then that can lead to major profits. It’s been my experience that people are far more generous when they have surplus financial assets. Right about now, I see one of the biggest obstacles to be Angela Merkel and the voting bloc that keeps her in power. If they could somehow understand that helping out the Greeks and the Spanish does not come straight out of their pockets then much progress could be made.