I started my undergraduate studies in economics in the late 1970s after starting out as…

Drowning in a morass of mis-education

I was sent a copy of a survey report – Grand Old Party for A Brand New Generation – which was produced by the so-called College Republican National Committee, which is a conservative university-based organisation in the US aiming to recruit people into the GOP. What emerges is that a lot of opinions are expressed but once you consider them in detail the only possible conclusion is that American college students (inasmuch as this is a representative sample) are hopelessly mis-educated on these matters – like the rest of the population. The level of internal inconsistency with respect to positions taken on macroeconomic policies that is demonstrated in the survey results is quite stunning. But don’t blame the students, their teachers and political leaders let them down too. The economic debate around the world is so infested with neo-liberal myths that it is hard for any alternative viewpoints to get oxygen. Yet the data keeps rejecting the mainstream views, which, it seems, only serves to solidify them further. We are all caught in a morass of mis-education – and our societies are drowning as a consequence. Nero fiddled. We do something else. Civilisations do not last forever.

As a technical document the presentation of the Survey Report is terrible. It is full of hype and schoolish rah-rah. The technical details are on Page 91 – sample size, interview formats etc. It seems that the results reflect the views of 800 registered voters in the 18-29 age group spread across the nation.

So the proverbial grain of salt hangs perilously over this exercise.

From the perspective of the educator, the results are worrying in the extreme. There is very little “knowledge” indicated in the responses with respect to the economy and the government budget.

A lot of opinions are expressed but once you consider them in detail the only possible conclusion is that American college students (inasmuch as this is a representative sample) are hopelessly mis-educated on these matters – like the rest of the population.

Which means that it is little wonder when things get a little complex – like handling a massive private sector debt meltdown – the policy responses are poor.

Of-course, ideology gets in the way of reason all the time. I use the term ideology to refer to that component of our focus that resists evidence by continually recasting it to suit our own priors and framing questions in such a way we selectively screen out possible facts. We all do it. However, I always thought that education was a means of providing some balance whereby when rogue facts come along we question our priors rather than deny the facts.

In other words, we change our views as we traverse the road from ignorance to knowledge.

I don’t intend to analyse the document in detail because it doesn’t deserve that attention. But it serves to demonstrate how our so-called progressive political leaders have failed us badly over the last few decades.

Despite all the hype that the youth generation is all about entrepreneurship and have long eschewed the concept of worker and boss that the rest of us still consider is a reasonable depiction of what goes on everyday in between when we leave our homes and return, mostly in the dark, 37 per cent of the respondents said that “economy and jobs” was the top issue. Other top issues included environmental protection, gay marriage

16 per cent more respondents thought the Democrat economic policies were superior to those proposed by the Republicans.

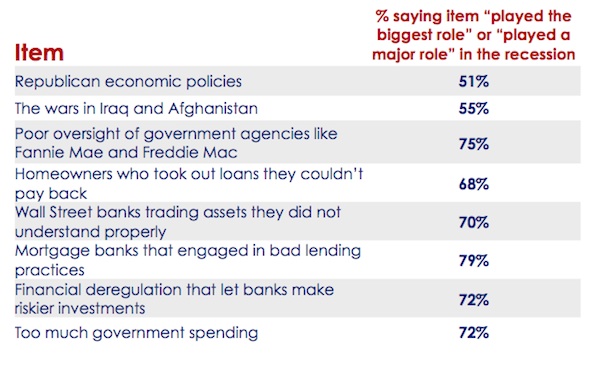

Representative of the confusion in the respondent’s answers though is the table on Page 32, which itemises the reasons that young people considered “played the biggest role” or “played a major role” in the recession with percentage scores against each item. I have reproduced that Table below.

The information presented is not finely-grained enough to determine the overlapping responses or what was actually asked. I guess I could find out by E-mailing the survey providers but it wouldn’t alter things anyway.

The Table demonstrates a mixture of pure ideology (fed to the students by their parents and Fox News), folksy intuition (a very dangerous thing to rely on) and, probably, kernels of insight into what is actually going on.

Quite clearly some of the same respondents who answered that “Too much government spending” was to blame also thought that “Republican economic policies” were the biggest or major cause of the crisis.

Later on in the report you find that the main myths paraded by both major parties figure as central points of agreement among the respondents (see Table on Page 77). So “We need to reform Social Security and Medicare now so that the next generation isn’t left cleaning up a huge mess down 90% the road” (90 per cent agree); need deregulation (86 per cent agree); “We need to make tough choices about cutting government spending, even on some programs some people really like, because the national debt is simply out of control” (82 per cent agree) and 72 per cent think that “We need to reduce the size of government, because it is simply too big” (that is, pure ideological response).

If you try to marry the logic that might lead to these responses, given that a very high proportion of respondents believe these propositions, you will come to a screeching halt.

Just like several of the propositions in the previous table (above) there is so much internal inconsistency in the responses.

For example, the responses about banking all point to a failure of regulation (insufficient, poorly administered etc) just as the

“way forward” the respondents want less government and less regulation.

They clearly don’t like GOP policies but then advocate as the “way forward” central GOP policy myths.

Extraordinary levels of illogicality not to mention ignorance.

But don’t blame the students, their teachers and political leaders let them down too.

If I was to ask a moderate economist (that is, one who was not totally confused by Chicago logic) whether there was a private debt issue in most advanced nations right now I imagine a large majority would agree.

There would be ums and ahs about the debt being backed by wealth and the primacy of private choice and all the rest of it. But most would agree that this crisis started as a private debt explosion after years of growth driven by unsustainable private credit expansion.

The facts surrounding the banking behaviour – the pursuit of profits in the sub-prime markets, the inability to assess the extent of risk on their books etc – are broad areas of agreement.

The fact that private sector spending has been cautious since the crisis relates to the recognition that balance sheets have to be repaired and brought back into the realm of sustainable debt positions. The massive increase in joblessness has also put a dampener on spending enthusiasm.

So I imagine I could get agreement on those issues – and, indeed, I do. Even among economists who I would term to be thoroughly mainstream.

If I have have started the questioning with something like “do you think government budgets should be balanced over the economic cycle?” I would also get broad agreement.

Some economists (the lunatic Chicago fringe) would never agree and would argue that government should be very small and run surpluses most nearly all the time irrespective of the business cycle.

But the broader mainstream would think that deficits at times of deep crisis are inevitable (even if they thought they were undesirable).

I could tease those responses out somewhat and the logic would go that the budget will typically go into deficit when the automatic stablisers respond to a major private spending collapse. The task is then to get the deficit down as quickly as possible and as private spending growth recovered to push it back into increasing surpluses “to pay for the deficits”.

This logic is almost a folksy rendition of reality – which means it probably totally ignores reality. Apparently, unless the deficits are “paid back” there will be rising interest rates and an explosion of public debt.

The fact that deficits are flows and that flows are never “paid back” is too finer detail at this level of argument. The fact that reversing a deficit flow in some future period takes purchasing power off the private sector is also ignored just as the fact that the deficit in the first place provided purchasing power – income.

The emphasis is on the stock implications of the flows – the public debt. If you try to get the economists to then consider what might happen if there was no matching debt issued they roll their eyes and start hyperventilating – or hyperinflatilating.

That is, despite the other fact that there is no increased inflation risk from government deficit spending with matching debt-issuance when compared to the same spending with matching debt-issuance.

The inflation risk is in the spending impact on aggregate demand and the monetary operations that the government (treasury and central bank) choose to accompany the spending is somewhat irrelevant.

But note that if I was having this discussion with a mainstream economist all the lateral thinking would be too subtle and the discussion would concentrate on debt and inflation.

If I then brought the two questions together, private debt and budget deficits, the majority of the same economists would claim that all debt had to be brought down for a recovery.

Those who favour austerity would prioritise public debt retrenchment while those who were against austerity but still held mainstream views about deficits (that is, the so-called deficit doves) would umm and ahh and conclude that you need a mix of retrenchment.

Modern Monetary Theory (MMT) proponents would strongly argue that if private debt is the problem then larger deficits are required if the external sector is in deficit and therefore draining growth.

More about that in a moment.

I was at a dinner the other night where two economists were speaking about the challenges and opportunities for Australia in Asia (the so-called Asian Century that the Government is beating up at present). In the question and answer session they were asked to comment on the obsession with budget surpluses that dominate the way governments (and the conservative pushers) think these days.

The two in question are hardly at the right of the spectrum. The substantive view reflected by both of them was that there were times when the budget could be in deficit (as the automatic stabilisers responded to a major private spending collapse) but that the government should aim to balance the budget over the cycle or err on the side of surpluses over the cycle.

There was some recognition that where we start and end the cycle is a matter of debate but the substantive principle was strongly expressed – deficits have to be paid back with surpluses.

The point is that the way macroeconomics is taught in mainstream departments students do not get exposed to the frameworks that allow them to see the reality.

If I asked a second-year macroeconomics student taught in a mainstream program the following question they would stare at me and not know where to start:

If a nation is running an external deficit, can the private and public sectors both run simultaneous surpluses?

If I also noted that a nation that runs an external deficit over the cycle, can only run a balanced budget over the cycle if it accepts that the private domestic sector will run a deficit exactly (dollar-for-dollar) equal to the external deficit over the same cycle, I wouldn’t get much recognition from the respondent.

If I also teased out the flow-stock implications of these various flow conjectures their eyes would soon glaze over.

The fact is that the mainstream macroeconomics program doesn’t build analytical capacity which allows the students to understand the major relationships between these sectoral balances.

It is all in there somewhere but never brought together to an internally consistent whole.

That is why economists can say that both private domestic debt and public debt are problems, and both have to be reduced, with the prescription for government action being to run surpluses (to buy back the debt).

But when there is an external drain on demand occurring (external deficit), a government cannot run a surplus, without severely damaging economic growth, unless the private domestic sector takes on increasingly large volumes of debt.

That is the pre-crisis model for most nations. It is unsustainable because the private domestic sector cannot take on increasingly large volumes of debt – and run its debt build-up faster than its income growth (so that the debt to disposable income ratio rises indefinitely).

The failure of even professional economists (the two at the dinner, for example) to realise that is symptomatic of the whole problem.

The knowledge generating frameworks in mainstream macroeconomics are irretrievably flawed.

The fact is that if an economy is running an external deficit, the government has to be in deficit, if the private domestic sector desires to run a surplus (that is, spend less than it is earning).

Most governments ran continuous deficits for years before the crisis because the private domestic sector does not seek to run on-going and increasing deficits and most nations do not run external surpluses.

The flawed macroeconomics education also produces politicians that have little idea of the capacity their policy tools provide or the best way they can be used.

A few weeks ago I made reference to the statements by the Opposition Chancellor in the UK, which were reported in the UK Guardian article (June 3, 2013) – As Labour’s iron man, Ed Balls could do the trick.

The article related how Ed Balls would cut spending hard under a Labour government. So-called progressive journalist Polly Toynbee assessed his contribution as being an “impressive speech set out a credible economic plan, tough as titanium – too tough for some Labour tweeters”. Which at the time I concluded told me that she also knows nothing about economics.

Given the economic circumstances in the UK at present, there can be no reasonable case made for cutting net public spending if you desire to increase employment and reduce poverty rates – an alleged ambition of the Labour Party there.

In fact, the UK needs a substantial increase in the Budget deficit at present and under the current economic trajectory, that will not alter by the time the people vote to elect the next national government.

I note that the British Labour leader gave a speech last week advocating putting a cap on welfare spending in the UK if the was elected.

The UK Guardian article (June 6, 2013) referred to the speech he gave on Thursday as:

… reframing of the welfare debate and an attempt to unify the country after Tory attempts to divide people over the issue …

Which is code for moving further to the neo-liberal right to buy votes instead of showing leadership and disabusing the British people of the basis of these neo-liberal fallacies about welfare and austerity.

The whole package he unveiled – welfare caps, wage subsidies to increase employment, user-pays welfare, more harsh activity tests for the unemployment etc – are all neo-liberal mainstays.

An assessment of the way the Labour Party in Britain is approaching policy development in opposition was provided in this UK Guardian

article (June 7, 2013) – Ed Miliband’s austerity-lite is already out of date.

The journalist said:

The worrying context of Miliband’s speech is the acceptance of the austerity paradigm – as in Ed Balls’s speech earlier this week. Again, time has moved on. In 2010 Labour gave the intellectual space to the Tories to allow them to define the cause of the economic crisis and it is now failing to appreciate the world is rapidly moving on from austerity solutions.

An economic crisis provides the space for major changes in the political narrative. Leadership is required to articulate that change but if there was ever an opportunity to demonstrate the poverty of the neo-liberal approach it has been this drawn-out crisis where advanced economies go from one negative piece of data to the next, and the extolling of the austerity-polity looks increasingly wan.

This is why:

Increasingly, people are angry at the cesspit of corruption that our corporate sphere has become. The lingering disgust at bankers’ bonuses is daily reinforced by new revelations about corporate tax scams and the price-fixing of our energy bills, while privatised former public services are used as the vehicles for large-scale profiteering. Labour’s politics of austerity-lite look like irrelevant party political triangulation when more radical systemic change is coming on to the agenda.

The problem is that British Labour hasn’t the capacity to provide that leadership. They need to jettison the neo-liberal economics framework that they seek security within. They think that poking their heads out of the austerity paradigm and advocating a few “progressive” embellishments (like abandoning the ridiculous and cruel ATOS disability tests) will demonstrate leadership.

The problem is that they haven’t understood the big picture – the monetary system. So austerity lite is only slightly less worse than austerity central.

The British people have no-one credible to vote for. All sides of politics are now infested with the neo-liberal disease of ignorance and malice.

In 2007, the Australian Labour Party won office in a landslide. The electorate categorically rejected the neo-liberal policy positions that had finally started to undercut their real wages growth and had promoted increased inequality. There were other elements as well – an inhumane treatment of refugees, indigenous Australians and a denial of climate change. But it was the economic policies that were the clincher.

The ALP had a massive chance to re-educate the public that was drowning in private debt after the credit binge, which allowed the federal government to run increasing surpluses and squeeze the hell out of the economy.

It started badly – arguing that it would continue to run surpluses because there was a massive inflation threat. There had been some price rises due to a major drought then floods. Further, world oil prices were pushing up the cost of petrol. Neither of these temporary price impulses had anything to do with the small rise in inflation at the time.

As soon as they started on that tack, inflation started to fall anyway (as food prices started to fall).

Then the crisis hit and they were forced into deficit. It is true they chose to implement a fiscal stimulus program, which was well-timed but not large enough to stop unemployment and underemployment from rising.

But almost as soon as they implemented the stimulus they apologised and started on their obsessive budget surplus rhetoric and the austerity began. The consequences are that they undermined the nascent growth the stimulus had created and they (treasury and the RBA) grossly over-estimated the growth impacts of the mining boom.

Very few economists argued in 2009, 2010 and 2011 that the government should increase its deficit. I was pretty much alone in that regard (there were a few others perhaps – but then they adopted highly qualified positions). It was surplus or bust.

I predicted bust. Bust is what we have at present. The government undermined its own aspirations because they failed to appreciate that the austerity would destroy growth and that would kill their revenue base.

The point is that this was a period that the Government could have dramatically changed the debate by educating the population on the need for deficit and assuring the voters that the sky wasn’t about to fall in any time soon. Instead they chose to perpetuate the deficit myths and that window of opportunity for a major shift in the debate was lost.

Now we are mired in a austerity downward spiral just like the rest of the nations where neo-liberals are in charge.

I agree with the sentiment (if not some of the detail) in Paul Krugman’s column yesterday (June 10, 2013) – The Big Shrug – where he says that:

… our policy discourse is still a long way from where it ought to be … Why isn’t reducing unemployment a major policy priority …

So the US students are just following the adults – it is just that it is the future prosperity of the students that is being undermined by the neo-liberals. And the former are too poorly educated to understand that.

Conclusion

At the same dinner I mentioned above, I was involved in a conversation as to whether MMT was left-wing or not. My standard comment is that it is neither left- or right-wing it just is. Is, in this case, is a framework for describing and understanding the mechanics of monetary systems and the consequences of various policy choices.

The left- or right-wing elements then enter the frame when we discuss the objectives that a government should pursue and how it might go about achieving those objectives.

So it might be construed as being a right-wing position if a person advocates running a budget surplus even though the private sector is clearly attempting to run a surplus and the external sector is in deficit.

The person advocating that position would, if they understood MMT (and hence the way the monetary system operates), have to admit that they preferred higher unemployment, more inequality and increased poverty rates to the alternative and that is why they advocated that economic policy stance.

They would not be able to engage in sophistry about reducing the burden of debt on grandchildren, or saving up for the future, or taking the pressure off interest rates or any of the other nonsense that the right-wingers deploy to hide what their underlying value positions are when they advocate surpluses under the circumstances noted above.

A left-wing position would clearly not tolerate unemployment above the frictional level and so would advocated increasing deficits under the circumstances noted above.

So MMT is not a statement of values but could underpin an extreme right-wing, free market approach or the polar opposite, or … plenty of positions in-between.

As soon as we get over that myth – that MMT is left-wing – the sooner more serious debate can occur.

By the way, I also don’t think it is a left-wing position to advocate low unemployment. That benefits all sectors. The problem is that the right-wingers are so ingrained with class conflict thinking that they cannot tolerate workers have stable jobs and growing real incomes.

Congratulations

To all Phd students I know who submitted their dissertations today! Congratulations. Brilliant effort. x

That is enough for today!

(c) Copyright 2013 Bill Mitchell. All Rights Reserved.

Dear Bill

The human capacity to hold contradictory thoughts is immense. Nowhere do we see this more than among Republicans. As someone once said, a Republican thinks that the government is always part of the problem, but he expects to get his Social Security every month. Many Republicans come close to thinking that, if only taxes are low enough and everybody works hard enough, then everybody can belong to the richest 1%.

Of course, your typical Republican is only skeptical of the civilian part of the government. He is usually full of praise for the military, the police and the jail guards. Remember, a lazy, incompetent, useless bureaucrat becomes a selfless, heroic, totally admirable patriot when he puts on an American military uniform.

Professor: “Peter makes 15,000 a year and pays no taxes. Paul makes 3 million a year and pays 1.5 million in taxes, which leaves him with 1.5 million, 100 times more than Peter. Who is better off, do you think?”

Republican student: “Obviously, it is Peter. The lucky guy pays no taxes at all.”

A Republican seems to think that the poor always have too many incentives to be idle and the rich never have enough incentives to invest.

Why is it that people talk about paying taxes to the government but about fighting for one’s country. A typical Republican seems to think that people should hate paying taxes but obey immediately when the government orders them to fight some foreigners. Paying taxes for the benefit of one’s compatriots is an intolerable burden but fighting in faraway places against foreigners is a great honor.

Regards. James

Well said, James. I would change one sentence though. “A typical Republican seems to think that people should hate paying taxes but obey immediately when the government orders them to fight some foreigners” would be better put as “A typical Republican seems to think that people should hate paying taxes but obey immediately when the government orders someone other than them or their children to fight some foreigners.”

Dear Tom

Amendment accepted. Regards

My view is that it is desirable to keep Australia as a high-wage, high tech economy, and to prevent a plunge to the bottom — one of the basic requirements of the predator class, and of the neoliberal philosophy which underpins it and serves its interests. It is my belief that Paul Keating completely misread the intent and significance of the neoliberal (economic rationalist) agenda.

Owing largely to Keating’s misunderstanding, and following his time in office, his party has been saddled with a policy full of internal contradictions — one in which it has been trying to embrace the objectives of neoliberalism on the one hand, and of retaining decent incomes/working conditions/educational opportunities/health facilities for the population as a whole on the other hand. It has clearly failed to serve the irreconcilable interests of both the people as a whole and of the predator class, and in consequence is now largely poll-driven and represents little that is of lasting value to the community.

More troubling, and what most people seem to be unaware of, is that the federal opposition — destined to be swept into office with a sizeable majority in September — will be working exclusively in the interests of the predators.

The Guardian article of 7th June you refer to wasn’t written by a journalist, but by one of Ed Miliband’s own MPs !

I’ll keep this one short … wouldn’t those of us who understand MMT (at least I think I do, thanks to Bill and others such as Randall) understand that most self-styled “right-wingers” in the US are of average or below-average means? In such a case, backing the views of certain plutocrats (who presumably want government surpluses, a la Pete Peterson) in actuality be counter to their own interests? A slightly different take on the “useful idiots” characterization (attributed to Lenin), wouldn’t you say? I have fun putting this question to some of them at some of their more insipid web forums.

If I read him correctly I would say that Warren Mosler seems to define right-wing and left-wing in terms of the desired size of government. What part of the economy do we want the government to run and what part the private sector? Either large or small government can be part of a full employment / price stability regime given the MMT understanding of the monetary system.

” would say that Warren Mosler seems to define right-wing and left-wing in terms of the desired size of government. ”

Unemployment is an indication that you are overtaxed for the size of government you have. So you either increase the size of public provision or you reduce the overall taxation level.

The debate we should be having is that given the increased level of private saving and decreased level of private investment we are seeing how should we respond to that. How much via reducing the taxation level and how much by new government provision?