Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

Saturday Quiz – May 11, 2013 – answers and discussion

Here are the answers with discussion for yesterday’s quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of modern monetary theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

The crucial difference between a monetary system based on the convertible currency (gold standard) model and a fiat currency monetary is that under the former system:

The correct (best) answer is – that under the former system, the national government had to issue debt to cover spending above taxation.

Under the gold standard the paper money issued by a central bank was backed by gold. A currency’s value was expressed in terms of a specified unit of gold and there was convertibility which allowed a person to swap the paper money for the relevant amount of gold. A parity was fixed and central banks agreed to maintain the “mint price” of gold fixed by standing ready to buy or sell gold to meet any supply or demand imbalance.

Further, the central bank (or equivalent in those days) had to maintain stores of gold sufficient to back the circulating currency (at the agreed convertibility rate).

Gold was also considered to be the principle method of making international payments. Accordingly, as trade unfolded, imbalances in trade (imports and exports) arose and this necessitated that gold be transferred between nations to fund these imbalances. Trade deficit countries had to ship gold to trade surplus countries.

This inflow of gold would allow the governments in surplus nations to expand the money supply (issue more notes) because they now had more gold to back the currency. This expansion was in strict proportion to the set value of the local currency in terms of grains of gold. The rising money supply would push against the inflation barrier (given no increase in the real capacity of the economy) which would ultimately render exports less attractive to foreigners and the external deficit would decline.

From the perspective of an external deficit nation, the loss of gold reserves forced their government to withdraw paper currency which was deflationary – rising unemployment and falling output and prices. The latter improved the competitiveness of their economy which also helped resolve the trade imbalance. But it remains that the deficit nations were forced to bear rising unemployment and vice versa as the trade imbalances resolved.

The proponents of the gold standard focus on the way it prevents the government from issuing paper currency as a means of stimulating their economies. Under the gold standard, the government could not expand base money if the economy was in trade deficit. It was considered that the gold standard acted as a means to control the money supply and generate price levels in different trading countries which were consistent with trade balance. The domestic economy however was forced to make the adjustments to the trade imbalances.

Monetary policy became captive to the amount of gold that a country possessed (principally derived from trade). Variations in the gold production levels also influenced the price levels of countries.

After World War 2, the IMF was created to supercede the gold standard and the so-called gold exchange standard emerged. Convertibility to gold was abandoned and replaced by convertibility into the US dollar, reflecting the dominance of the US in world trade (and the fact that they won the war!). This new system was built on the agreement that the US government would convert a USD into gold at $USD35 per ounce of gold. This provided the nominal anchor for the exchange rate system.

The Bretton Woods System was introduced in 1946 and created the fixed exchange rates system. Governments could now sell gold to the United States treasury at the price of $USD35 per ounce. So now a country would build up US dollar reserves and if they were running a trade deficit they could swap their own currency for US dollars (drawing from their reserves) and then for their own currency and stimulate the economy (to increase imports and reduce the trade deficit).

The fixed exchange rate system however rendered fiscal policy relatively restricted because monetary policy had to target the exchange parity. If the exchange rate was under attack (perhaps because of a balance of payments deficit) which would manifest as an excess supply of the currency in the foreign exchange markets, then the central bank had to intervene and buy up the local currency with its reserves of foreign currency (principally $USDs).

This meant that the domestic economy would contract (as the money supply fell) and unemployment would rise. Further, the stock of $US dollar reserves held by any particular bank was finite and so countries with weak trading positions were always subject to a recessionary bias in order to defend the agreed exchange parities. The system was politically difficult to maintain because of the social instability arising from unemployment.

So if fiscal policy was used too aggressively to reduce unemployment, it would invoke a monetary contraction to defend the exchange rate as imports rose in response to the rising national income levels engendered by the fiscal expansion. Ultimately, the primacy of monetary policy ruled because countries were bound by the Bretton Woods agreement to maintain the exchange rate parities. They could revalue or devalue (once off realignments) but this was frowned upon and not common.

Whichever system we want to talk off – pure gold standard or USD-convertible system backed by gold – the constraints on government were obvious.

The gold standard as applied domestically meant that existing gold reserves controlled the domestic money supply. Given gold was in finite supply (and no new discoveries had been made for years), it was considered to provide a stable monetary system. But when the supply of gold changed (a new field discovered) then this would create inflation.

So gold reserves restricted the expansion of bank reserves and the supply of high powered money (government currency). The central bank thus could not expand their liabilities beyond their gold reserves. In operational terms this means that once the threshold was reached, then the monetary authority could not buy any government debt or provide loans to its member banks.

As a consequence, bank reserves were limited and if the public wanted to hold more currency then the reserves would contract. This state defined the money supply threshold.

The concept of (and the term) monetisation comes from this period. When the government acquired new gold (say by purchasing some from a gold mining firm) they could create new money. The process was that the government would order some gold and sign a cheque for the delivery. This cheque is deposited by the miner in their bank. The bank then would exchange this cheque with the central bank in return for added reserves. The central bank then accounts for this by reducing the government account at the bank. So the government’s loss is the commercial banks reserve gain.

The other implication of this system is that the national government can only increase the money supply by acquiring more gold. Any other expenditure that the government makes would have to be “financed” by taxation or by debt issuance. The government cannot just credit a commercial bank account under this system to expand its net spending independent of its source of finance.

As a consequence, whenever the government spent it would require offsetting revenue in the form of taxes or borrowed funds.

The move to fiat currencies fundamentally altered the way the monetary system operated even though the currency was still, say, the $AUD.

This system had two defining characteristics: (a) non-convertibility; and (b) flexible exchange rates.

First, under a fiat monetary system, “state money” has no intrinsic value. It is non-convertible. So for this otherwise “worthless” currency to be acceptable in exchange (buying and selling things) some motivation has to be introduced. That motivation emerges because the sovereign government has the capacity to require its use to relinquish private tax obligations to the state. Under the gold standard and its derivatives money was always welcome as a means of exchange because it was convertible to gold which had a known and fixed value by agreement. This is a fundamental change.

Second, given the relationship between the commodity backing (gold) and the ability to spend is abandoned and that the Government is the monopoly issuer of the fiat currency in use (defined by the tax obligation) then the spending by this government is revenue independent. It can spend however much it likes subject to there being real goods and services available for sale. This is a dramatic change.

Irrespective of whether the government has been spending more than revenue (taxation and bond sales) or less, on any particular day the government has the same capacity to spend as it did yesterday. There is no such concept of the government being “out of money” or not being able to afford to fund a program. How much the national government spends is entirely of its own choosing. There are no financial restrictions on this capacity.

This is not to say there are no restrictions on government spending. There clearly are – the quantity of real goods and services available for sale including all the unemployed labour. Further, it is important to understand that while the national government issuing a fiat currency is not financially constrained its spending decisions (and taxation and borrowing decisions) impact on interest rates, economic growth, private investment, and price level movements.

We should never fall prey to the argument that the government has to get revenue from taxation or borrowing to “finance” its spending under a fiat currency system. It had to do this under a gold standard (or derivative system) but not under a fiat currency system. Most commentators fail to understand this difference and still apply the economics they learned at university which is fundamentally based on the gold standard/fixed exchange rate system.

Third, in a fiat currency system the government does not need to finance spending in which case the issuing of debt by the monetary authority or the treasury has to serve other purposes. Accordingly, it serves a interest-maintenance function by providing investors with an interest-bearing asset that drains the excess reserves in the banking system that result from deficit spending. If these reserves were not drained (that is, if the government did not borrow) then the spending would still occur but the overnight interest rate would plunge (due to competition by banks to rid themselves of the non-profitable reserves) and this may not be consistent with the stated intention of the central bank to maintain a particular target interest rate.

Importantly, the source of funds that investors use to buy the bonds is derived from the net government spending anyway (that is, spending above taxation). The private sector cannot buy bonds in the fiat currency unless the government has spent the same previously. This is a fundamental departure from the gold standard mechanisms where borrowing was necessary to fund government spending given the fixed money supply (fixed by gold stocks). Taxation and borrowing were intrinsically tied to the government’s management of its gold reserves.

So in a fiat currency system, government borrowing doesn’t fund its spending. It merely stops interbank competition which allows the central bank to defend its target interest rate.

The flexible exchange rate system means that monetary policy is freed from defending some fixed parity and thus fiscal policy can solely target the spending gap to maintain high levels of employment. The foreign adjustment is then accomplished by the daily variations in the exchange rate.

The following blogs may be of further interest to you:

- Gold standard and fixed exchange rates – myths that still prevail

- Deficit spending 101 – Part 1

- Deficit spending 101 – Part 2

- Deficit spending 101 – Part 3

Question 2:

Bank reserves are maintained to ensure that all the cheques written every day clear when presented. If a bank doesn’t have enough reserves then cheques drawn against it will bounce.

The answer is False.

Banks can always get reserves from the central bank. So if they have extended loans to credit-worthy customers these loans are made independent of their reserve positions. Depending on the way the central bank accounts for commercial bank reserves, the latter will then seek funds to ensure they have the required reserves in the relevant accounting period.

They can borrow from each other in the interbank market but if the system overall is short of reserves these “horizontal” transactions will not add the required reserves. In these cases, the bank will sell bonds back to the central bank or borrow outright through the device called the “discount window”. There is typically a penalty for using this source of funds.

At the individual bank level, certainly the “price of reserves” will play some role in the credit department’s decision to loan funds. But the reserve position per se will not matter. So as long as the margin between the return on the loan and the rate they would have to borrow from the central bank through the discount window is sufficient, the bank will lend.

So the idea that reserve balances are required initially to “finance” bank balance sheet expansion via rising excess reserves is inapplicable. A bank’s ability to expand its balance sheet is not constrained by the quantity of reserves it holds or any fractional reserve requirements.

The bank expands its balance sheet by lending. Loans create deposits which are then backed by reserves after the fact. The process of extending loans (credit) which creates new bank liabilities is unrelated to the reserve position of the bank.

The major insight is that any balance sheet expansion which leaves a bank short of the required reserves may affect the return it can expect on the loan as a consequence of the “penalty” rate the central bank might exact through the discount window. But it will never impede the bank’s capacity to effect the loan in the first place.

So a cheque will only bounce if the account that the cheque is drawn on has insufficient funds and there is no overdraft arrangement in place. That process has nothing to do with banks running out of reserves.

The following blogs may be of further interest to you:

- Money multiplier and other myths

- Building bank reserves will not expand credit

- Building bank reserves is not inflationary

Question 3:

Assume inflation is stable, there is excess productive capacity, and the central bank maintains its current monetary policy setting. Iff government spending increases by $X dollars and private investment and exports are unchanged then nominal income will continue growing until the sum of the changes in taxation revenue, import spending and household saving equals $X dollars.

The answer is True.

This question relates to the concept of a spending multiplier and the relationship between spending injections and spending leakages.

We have made the question easy by assuming that only government spending changes (exogenously) in period one and then remains unchanged after that.

Aggregate demand drives output which then generates incomes (via payments to the productive inputs). Accordingly, what is spent will generate income in that period which is available for use. The uses are further consumption; paying taxes and/or buying imports.

We consider imports as a separate category (even though they reflect consumption, investment and government spending decisions) because they constitute spending which does not recycle back into the production process. They are thus considered to be “leakages” from the expenditure system.

So if for every dollar produced and paid out as income, if the economy imports around 20 cents in the dollar, then only 80 cents is available within the system for spending in subsequent periods excluding taxation considerations.

However there are two other “leakages” which arise from domestic sources – saving and taxation. Take taxation first. When income is produced, the households end up with less than they are paid out in gross terms because the government levies a tax. So the income concept available for subsequent spending is called disposable income (Yd).

To keep it simple, imagine a proportional tax of 20 cents in the dollar is levied, so if $100 of income is generated, $20 goes to taxation and Yd is $80 (what is left). So taxation (T) is a “leakage” from the expenditure system in the same way as imports are.

Finally consider saving. Consumers make decisions to spend a proportion of their disposable income. The amount of each dollar they spent at the margin (that is, how much of every extra dollar to they consume) is called the marginal propensity to consume. If that is 0.80 then they spent 80 cents in every dollar of disposable income.

So if total disposable income is $80 (after taxation of 20 cents in the dollar is collected) then consumption (C) will be 0.80 times $80 which is $64 and saving will be the residual – $26. Saving (S) is also a “leakage” from the expenditure system.

It is easy to see that for every $100 produced, the income that is generated and distributed results in $64 in consumption and $36 in leakages which do not cycle back into spending.

For income to remain at $100 in the next period the $36 has to be made up by what economists call “injections” which in these sorts of models comprise the sum of investment (I), government spending (G) and exports (X). The injections are seen as coming from “outside” the output-income generating process (they are called exogenous or autonomous expenditure variables).

For GDP to be stable injections have to equal leakages (this can be converted into growth terms to the same effect). The national accounting statements that we have discussed previous such that the government deficit (surplus) equals $-for-$ the non-government surplus (deficit) and those that decompose the non-government sector in the external and private domestic sectors is derived from these relationships.

So imagine there is a certain level of income being produced – its value is immaterial. Imagine that the central bank sees no inflation risk and so interest rates are stable as are exchange rates (these simplifications are to to eliminate unnecessary complexity).

The question then is: what would happen if government increased spending by, say, $100? This is the terrain of the multiplier. If aggregate demand increases drive higher output and income increases then the question is by how much?

The spending multiplier is defined as the change in real income that results from a dollar change in exogenous aggregate demand (so one of G, I or X). We could complicate this by having autonomous consumption as well but the principle is not altered.

So the starting point is to define the consumption relationship. The most simple is a proportional relationship to disposable income (Yd). So we might write it as C = c*Yd – where little c is the marginal propensity to consume (MPC) or the fraction of every dollar of disposable income consumed. We will use c = 0.8.

The * sign denotes multiplication. You can do this example in an spreadsheet if you like.

Our tax relationship is already defined above – so T = tY. The little t is the marginal tax rate which in this case is the proportional rate (assume it is 0.2). Note here taxes are taken out of total income (Y) which then defines disposable income.

So Yd = (1-t) times Y or Yd = (1-0.2)*Y = 0.8*Y

If imports (M) are 20 per cent of total income (Y) then the relationship is M = m*Y where little m is the marginal propensity to import or the economy will increase imports by 20 cents for every real GDP dollar produced.

If you understand all that then the explanation of the multiplier follows logically. Imagine that government spending went up by $100 and the change in real national income is $179. Then the multiplier is the ratio (denoted k) of the Change in Total Income to the Change in government spending.

Thus k = $179/$100 = 1.79.

This says that for every dollar the government spends total real GDP will rise by $1.79 after taking into account the leakages from taxation, saving and imports.

When we conduct this thought experiment we are assuming the other autonomous expenditure components (I and X) are unchanged.

But the important point is to understand why the process generates a multiplier value of 1.79.

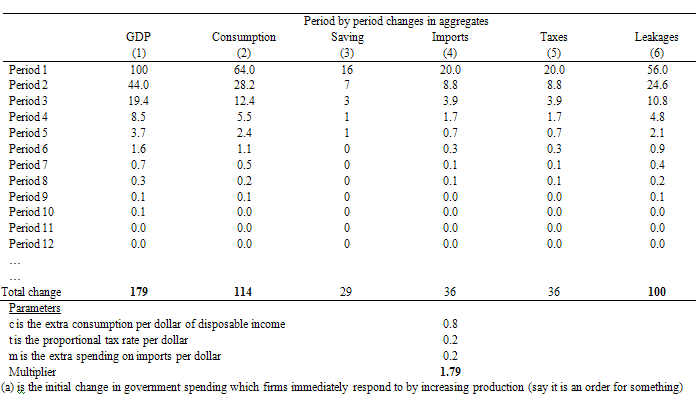

Here is a spreadsheet table I produced as a basis of the explanation. You might want to click it and then print it off if you are having trouble following the period by period flows.

So at the start of Period 1, the government increases spending by $100. The Table then traces out the changes that occur in the macroeconomic aggregates that follow this increase in spending (and “injection” of $100). The total change in real GDP (Column 1) will then tell us the multiplier value (although there is a simple formula that can compute it). The parameters which drive the individual flows are shown at the bottom of the table.

Note I have left out the full period adjustment – only showing up to Period 12. After that the adjustments are tiny until they peter out to zero.

Firms initially react to the $100 order from government at the beginning of the process of change. They increase output (assuming no change in inventories) and generate an extra $100 in income as a consequence which is the 100 change in GDP in Column [1].

The government taxes this income increase at 20 cents in the dollar (t = 0.20) and so disposable income only rises by $80 (Column 5).

There is a saying that one person’s income is another person’s expenditure and so the more the latter spends the more the former will receive and spend in turn – repeating the process.

Households spend 80 cents of every disposable dollar they receive which means that consumption rises by $64 in response to the rise in production/income. Households also save $16 of disposable income as a residual.

Imports also rise by $20 given that every dollar of GDP leads to a 20 cents increase imports (by assumption here) and this spending is lost from the spending stream in the next period.

So the initial rise in government spending has induced new consumption spending of $64. The workers who earned that income spend it and the production system responds. But remember $20 was lost from the spending stream so the second period spending increase is $44. Firms react and generate and extra $44 to meet the increase in aggregate demand.

And so the process continues with each period seeing a smaller and smaller induced spending effect (via consumption) because the leakages are draining the spending that gets recycled into increased production.

Eventually the process stops and income reaches its new “equilibrium” level in response to the step-increase of $100 in government spending. Note I haven’t show the total process in the Table and the final totals are the actual final totals.

If you check the total change in leakages (S + T + M) in Column (6) you see they equal $100 which matches the initial injection of government spending. The rule is that the multiplier process ends when the sum of the change in leakages matches the initial injection which started the process off.

You can also see that the initial injection of government spending ($100) stimulates an eventual rise in GDP of $179 (hence the multiplier of 1.79) and consumption has risen by 114, Saving by 29 and Imports by 36.

The following blog may be of further interest to you:

I’ve puzzled over what is behind the money multiplier myth -why is it still perpetuated as a myth?

Could it be because some myth is needed so as to make bank lending consistent with the ideology that aggregate demand never constrains the economy? If that ideology were true then banks would always have an unlimited pool of credit worthy customers as supply would endlessly create its own demand. Retained profits of the banks would build bank capital and so lending would spiral rapidly upwards and onwards without pausing for breath. The money multiplier myth is a fiction necessitated to explain why in reality banks are generally reluctant to lend.

I think most people are still stuck in the gold era or Bretton Woods era actually. They don’t understand a full fiat currency system and its implications.

At the naive level, people still believe that money is real. It is not real, it is notional. Only real quantities of matter and energy are real. Sure notional realities have a definite social reality. The word “table” is a real word and it refers to real tables as a category. However, the reality of the word is very different from the reality of the thing. Thus money refers to use value and accounts for use value in goods and services but it is not the same thing as the goods and services or their usefulness.

Question 3

“nominal income will continue growing until the sum of the changes in taxation revenue, import spending and household saving equals $X dollars.”

For the answer to be true, is the word “household” actually appropriate? Could it not be corporate savings?

Bill, sorry if this is a bit off topic but do you have a description of the eurodollar lending system from the MMT perspective? A lot of that lending denominated in USD is intermediated in London and neither borrowers nor lenders are US based. Does it nevertheless entail settlement by transfers within the ledger on the computer at the federal reserve in America? Wikipedia says eurodollar is by definition USD lending outside the jurisdiction of the federal reserve but I’m not in a muddle thinking that the federal reserve has to be (passively) involved am I?

Stone,

Think building society but with a clearing account at a US bank.

Dr. Mitchell,

I am a partially informed layman in the US who has been reading your blog for several months. Your answer to question 3 contains a link to Spending Multipliers from Dec 2009. I am swayed by the data in this article that indicates a spending multiplier of around 1.5 is likely.

Now that it is 2013 I suspect there is data that will provide the “true facts” about this issue and that it is somewhere in your archives but I do not know where. I you could continue my education on this issue, it would be appreciated.

Best Regards,

Will Kanaley

PS: We had a temporary seven month business assignment in Melbourne a few years ago and got to know a bit of your country. Loved it! Australia is truly the “lucky country”.

The answer to question 3 is very interesting but it can also be answered in a couple of lines from the sectoral balance equation.