I am late today because I am writing this in London after travelling the last…

Australian labour market – still slipping backwards

Today’s release by the Australian Bureau of Statistics (ABS) of the Labour Force data for January 2013 reveals that the Australian labour market continues to slide. While total employment rose modestly (very), full-time employment fell for the third consecutive month and working hours also fell. The small rise in unemployment would have been much worse had not the participation rate fell again. The unemployment rate remained unchanged at 5.4 per cent but would have been at least 0.1 per cent higher had the participation rate not fallen. So both unemployment and hidden unemployment rose. The rate of employment growth is not sufficient to even keep pace with the underlying population growth. The data is not consistent with any notions that the Australian labour market is booming or close to full employment. The most continuing feature that should warrant immediate policy concern is the appalling state of the youth labour market. My assessment of today’s results – a failing economy with further weakness to come. The Government realised late in 2012 that its obsessive pursuit of a budget surplus was going to fail. It should now go one step further towards becoming economically responsible and reverse the direction of fiscal policy by introducing some significant direct job creation. The budget deficit is too low in Australia by perhaps 2-3 per cent of GDP.

The summary ABS Labour Force (seasonally adjusted) estimates for January 2013 are:

- Employment increased 10.400 (0.1 per cent) with full-time employment falling by 9,800 and part-time employment rising by 20,200.

- Unemployment increased 2,000 (0.3 per cent) to 659,600.

- The official unemployment rate remained unchanged at 5.4 cent.

- The participation rate fell by 0.1 points to 65 per cent, which helped attenuate the rise in unemployment.

- Aggregate monthly hours worked decreased 3.9 million hours (0.24 per cent).

- The quarterly ABS broad labour underutilisation estimates (the sum of unemployment and underemployment) are published on a quarterly basis (last published November). In November the total labour underutilisation rate was rising and stood at 12.5 per cent. With the continued decline in full-time employment and total hours declining plus the rise in unemployment it is certain that the broad rate has increased in the last month – perhaps by around 0.3 points.

The ABC National News Report – Unemployment steady, despite full-time job loss – noted that:

The participation rate – the proportion of people in work or actively looking for it – declined 0.1 of a percentage point to 65 per cent.

That is the same as it was in August last year, and is the joint lowest rate in six years.

The story quoted some bank economists who are now moving away from their position of the last few months that everything was fine to making statements like “very weak employment growth” and “the underlying details are rather soft …. The broader suite of labour market data is pretty weak overall”.

The problem is that these commentators seem to operate with a long lag. The data has been weak for the last 18 months and it has been clear the labour market is deteriorating and once the mining investment tapers (which it has started to do) then the impacts of the fiscal drag will become more visible.

The government has been in denial that its obsessive pursuit of a budget surplus in the coming year will not damage employment (despite it factoring a rise in the unemployment rate in the May 2012 Budget papers).

The Sydney Morning Herald article – Jobless rate holds steady as part-time jobs jump – on the data release chose to mislead readers with that optimistic headline.

The journalist then followed it with a statement from one of the bank economists:

This certainly suggests that the labour market might be a bit tighter than many commentators have been touting and have been concerned about … We remain of the view that policy setting and global conditions are conducive for a pick up in local growth, so the steady jobs market is consistent with that view.

I wonder how that bank will perform in the coming year if they make their own speculative positions on this sort of analysis. This is the same economist, by the way, that is predicting that the RBA will hike interest rates this year and who has claimed that the Australian economy is growing at trend. The latter is false and the former unlikely.

But his comments bring a new definition to a tight labour market – unemployment rises, working hours fall, participation falls – and that is a sign that things a “bit tighter” than we thought.

The data release today indicates the labour market is deteriorating from an already fragile state.

On a related topic, I did an interview for the ABC this morning on a report that came out yesterday on the rising exploitation of workers forced into unpaid work. The Sydney Morning Herald article (February 7, 2013) – Intern exploitation is rife, says report – reported that:

Researchers from the University of Adelaide found unpaid work trials, internships and other forms of work experience are on the rise as job seekers clamber to stand out in industries such as retail, hospitality, media and law.

This is one of several strategies that are accelerating to further undermine the ability of workers to enjoy real wage growth commensurate with productivity growth. This sort of thing could not happen in a “tight” labour market.

First, there is a rise in casual work yielding underemployment.

Second, there is a rise in the use of labour hire companies that force all the risk onto the worker who gets no holiday or sick pay, no superannuation instalments, and has no redundancy rights.

Third, I am involved in a case for a major national union at present who are fighting the employer bodies who are seeking to do away with penalty rates for non-standard work in the Restaurant and Cafes sector. These workers are already the lowest paid and have the most precarious jobs yet the greed of the firms is unsatisfied – they want to pay their workers less. I have written a position paper for the union on this matter and I will report more after the industrial case is heard.

And now, we get news that workers are being forced to engage in free work as interns. The motivation for the workers is clear – there is a severe shortage of jobs – and they are desperate. The motivation for the firms is also clear – they are without ethical values and will do what it takes to get a larger share of real income.

That is why there has to be coherent regulation of the market. Without it, the weak gets weaker.

The fact is that in this so-called mature stage of capitalism, capital is refining the idea that it is all about privatising the gains and socialising the losses.

The government should stamp this out immediately – but they won’t – and will hide behind ambiguities in the law (for example, “what constitutes a working relationship”).

I wonder what our banker friend who thinks things are tighter than they look thinks of these intern arrangements.

Employment growth – very weak

The January data shows that employment growth barely increased with total employment rising by 10,400 (0.1 per cent). Full-time employment fell for the third consecutive month, this time by by 9,800 while part-time employment rose by 20,200.

The further drop in full-time employment (and the decline in working hours – see later) means that underemployment will have risen in addition to the rise in unemployment.

Employment growth is currently not sufficient to absorb the growth in the labour force arising from underlying growth in the working age population.

Today’s data reasserts the message that the labour market data is switching back and forth regularly between negative employment growth and very subdued positive growth. This monthly behaviour is producing a slightly negative underlying trend, which has been fairly stable for some months now.

There have been considerable fluctuations in the full-time/part-time growth over the last year with regular crossings of the zero growth line.

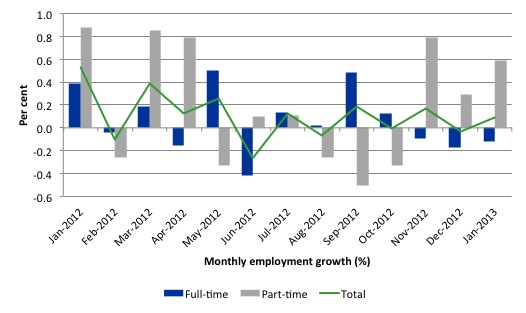

The following graph shows the month by month growth in full-time (blue columns), part-time (grey columns) and total employment (green line) for the 12 months to January 2013 using seasonally adjusted data.

Today’s results just repeat the topsy-turvy nature of the data over the period shown. The Australian labour market is struggling with the declining real GDP growth creating a near jobless growth environment.

While full-time and part-time employment growth are fluctuating around the zero line, total employment growth is still well below the growth that was boosted by the fiscal-stimulus in the middle of 2010.

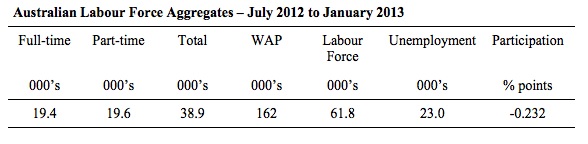

The following table provides an accounting summary of the labour market performance over the last six months. The monthly data is highly variable so this Table provides a longer view which allows for a better assessment of the trends. WAP is working age population (above 15 year olds). The first three columns show the number of jobs gained or lost (net) in the last six months.

The conclusion – overall only 38.9 thousand jobs (net) have been created in Australia over the last six months with a miserable 19.4 thousand full-time jobs being matched by 19.6 thousand part-time jobs (net). By historical standards, this represents extremely weak employment growth.

The Working Age Population has risen by 162 thousand in the same period while the labour force rose by 61.8 thousand. The weak employment growth has thus not been able to keep pace with the underlying population growth and unemployment has risen as a result (by 23 thousand).

The rise in unemployment would have been greater had not the participation rate fallen (by 0.232 percentage points), which reduced the growth in the labour force (see detailed analysis below).

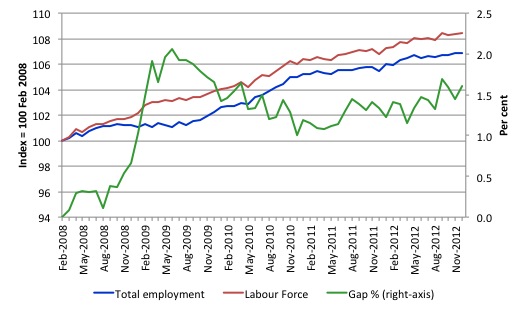

To put the recent data in perspective, the following graph shows the movement in the labour force and total employment since the low-point unemployment rate month in the last cycle (February 2008) to January 2013. The two series are indexed to 100 at that month. The green line (right-axis) is the gap (plotted against the right-axis) between the two aggregates and measures the change in the unemployment rate since the low-point of the last cycle (when it stood at 4 per cent).

You can see that the labour force index has largely levelled off and now falling and the divergence between it and employment growth has been relatively steady over the last several months with this month showing some improvement.

The Gap series gives you a good impression of the asymmetry in unemployment rate responses even when the economy experiences a mild downturn (such as the case in Australia). The unemployment rate jumps quickly but declines slowly.

It also highlights the fact that the recovery is still not strong enough to bring the unemployment rate back down to its pre-crisis low. You can see clearly that the unemployment rate fell in late 2009 and then has hovered at the same level for some months before rising again over the last several months.

The gap shows that the labour market is still a long way from recovering from the financial crisis that hit in early 2008. There hasn’t been much progress since January 2010, when the fiscal stimulus started to run out.

Teenage labour market – school leavers face a life of part-time casualised work

The teenage labour market deteriorated further in January 2013. When will the media take this issue up (Peter M?).

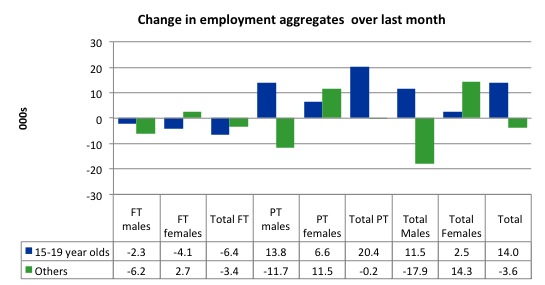

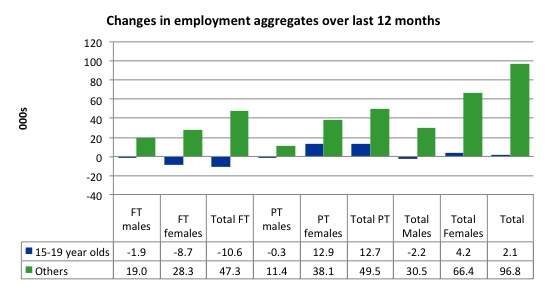

The following graph shows the distribution of net employment creation in the last month by full-time/part-time status and age/gender category (15-19 year olds and the rest)

Over the last month, teenagers gained 14.0 thousand jobs while the rest of the workforce lost 3.6 thousand jobs. The surge in teenage employment in January 2013 is all down to the rise in part-time work. Full-time employment for 15-19 year olds continued to collapse.

However, all the gains for teenagers have been in part-time employment (11.4 thousand) with 9.1 thousand full-time jobs vanishing (net) over the last month. So teenage underemployment is certain to have risen.

Given the timing of the survey, the data suggests that school leavers who are seeking a foothold in the labour market are only able to find part-time and casual work. Full-time, career-oriented employment is vanishing.

If you take a longer view you see how poor the situation is.

Over the last 12 months, teenagers have lost 2.1 thousand net jobs overall which the rest of the labour force have gained 96.8 thousand net jobs. Teenagers have lost 10.6 thousand full-time opportunities and gained 12.7 thousand part-time opportunities in net terms.

So the Australian labour market has further undermined the opportunities for this cohort over the last year.

The teenage segment of the labour market is being particularly dragged down by the sluggish employment growth, which is hardly surprising given that the least experienced and/or most disadvantaged (those with disabilities etc) are rationed to the back of the queue by the employers.

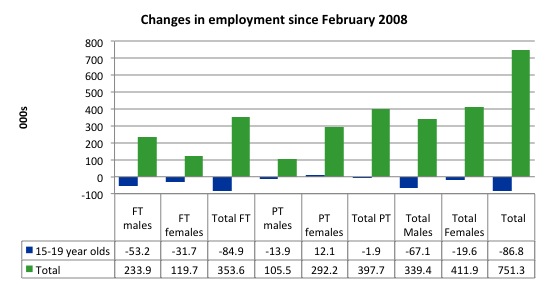

The following graph shows the change in aggregates over the last 12 months. Australian teenagers are going backwards which is a trend common around the world at present.

To further emphasise the plight of our teenagers I compiled the following graph that extends the time period from the February 2008, which was the month when the unemployment rate was at its low point in the last cycle, to the present month (January 2013). So it includes the period of downturn and then the “recovery” period. Note the change in vertical scale compared to the previous two graphs. That tells you something!

The results are stunning and represent a major policy failure.

Since February 2008, there have been 751.3 thousand (net) jobs added to the Australian economy but teenagers have lost a staggering 86.8 thousand over the same period. It is even more stark when you consider that 84.92 thousand full-time teenager jobs have been lost in net terms. Even in the traditionally, concentrated teenage segment – part-time employment – there have been 1.9 thousand jobs (net) lost.

Further, around 53 per cent of the total (net) jobs added since February 2008 have been part-time, which raises questions about the quality of work that is being generated overall.

Overall, the performance over the last 12 months is poor and should receive a much higher priority in the policy debate than it does.

The longer-run consequences of this teenage “lock out” will be very damaging.

The Australian government has no coherent strategy to resolve this appalling state. Ensuring teenagers are included in paid work, if they do not desire to remain in school, should be a number one policy priority.

The Government’s response is to push this cohort into endless training initiatives (supply-side approach) without significant benefits. The research shows overwhelmingly that job-specific skills development should be done within a paid-work environment.

I would recommend that the Australian government announce a major public sector job creation program aimed at employing, in the first instance, all the unemployed 15-19 year olds.

It is clear that the Australian labour market continues to fail our 15-19 year olds. At a time when we keep emphasising the future challenges facing the nation in terms of an ageing population and rising dependency ratios the economy still fails to provide enough work (and on-the-job experience) for our teenagers who are our future workforce.

Unemployment

The unemployment rate remained unchanged at 5.4 in January 2013 and official unemployment rose by 2,000. The rise in unemployment would have been slightly worse if the participation rate had not fallen – we analyse that issue in the next section.

The reality is that employment growth remains below the underlying population growth and it is only the sluggish labour force growth (being held back by these regular contractions in the participation rate) that has prevented a substantial rise in unemployment.

Overall, the labour market still has significant excess capacity available in most areas and what growth there is is not making any major inroads into the idle pools of labour.

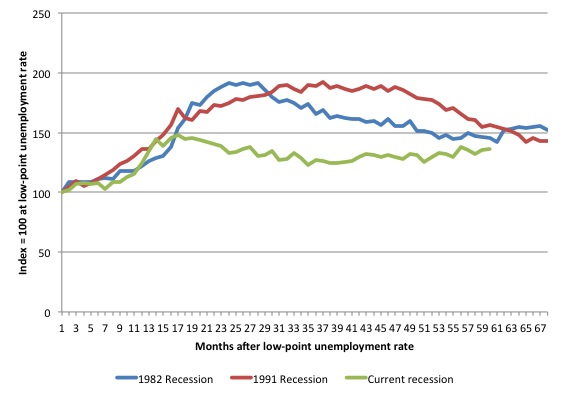

The following graph updates my 3-recessions graph which depicts how quickly the unemployment rose in Australia during each of the three major recessions in recent history: 1982, 1991 and 2009 (the latter to capture the 2008-2010 episode). The unemployment rate was indexed at 100 at its lowest rate before the recession in each case (January 1981; January 1989; April 2008, respectively) and then indexed to that base for each of the months as the recession unfolded.

I have plotted the 3 episodes for 68 months after the low-point unemployment rate was reached with the current episode now in its 60th month. For 1991, the end-point shown is the peak unemployment which was achieved some 38 months after the downturn began although the recovery was painfully slow. While the 1982 recession was severe the economy and the labour market was recovering by the 26th month. The pace of recovery for the 1982 once it began was faster than the recovery in the current period.

It is significant that the current situation while significantly less severe than the previous recessions is dragging on which is a reflection of the lack of private spending growth and declining public spending growth.

The graph provides a graphical depiction of the speed at which the recession unfolded (which tells you something about each episode) and the length of time that the labour market deteriorated (expressed in terms of the unemployment rate).

From the start of the downturn to the 60-month point (to January 2013), the official unemployment rate has risen from a base index value of 100 to a value 136 – peaking at 148 after 17 months. After falling steadily as the fiscal stimulus pushed growth along (it reached 122.8 after 35 months – in January 2010), it has been slowly trending up for some months now. Unlike the other episodes, the current trend, at this stage of the cycle, is upwards.

At 60 months, 1982 index stood at 145.7 and was falling, while the 1991 index was at 156.7 and was also falling. It is clear that at an equivalent point in the “recovery cycle” the current period is more sluggish than our recent two major downturns.

It now appears that the recoveries are converging, which tells us that the current policy has failed to take advantage of the fact that the latest economic downturn was much more mild than the previous recessions. In other words, the policy failure is locking the economy into a higher unemployment rate than is desirable and otherwise attainable.

Note that these are index numbers and only tell us about the speed of decay rather than levels of unemployment. Clearly the 5.4 per cent at this stage of the downturn is lower that the unemployment rate was in the previous recessions at a comparable point in the cycle although we have to consider the broader measures of labour underutilisation (which include underemployment) before we draw any clear conclusions.

The notable aspect of the current situation is that the recovery is very slow.

Broader labour underutilisation

The ABS last published its quarterly broad labour underutilisation measures in November 2012 and the next estimates will be available in February 2012.

In the last issue, underemployment overall rose from 7.1 per cent in the August-quarter to 7.2 per cent in the December-quarter. Taken together with the unemployment rate, the ABS broad labour underutilisation rate was at 12.5 per cent up from 12.4 per cent in the August-quarter.

Given that full-time employment continues to contract and monthly working hours is down again, it is certain that underemployment will have risen in January. Combined with the rise in the unemployment rate, the broad labour underutilisation measure will have risen by person 0.3 to 0.4 points.

In other words, total labour underutilisation rate will be running around 12.8 per cent at present and signals that things are getting worse.

The other point to emphasise, is that an economy that is wasting (at least) 12.8 per cent or so of its willing labour resources is not close to being at full employment and is in need of fiscal stimulus.

The fact that no stimulus will be forthcoming in the light of this sort of data signals policy failure.

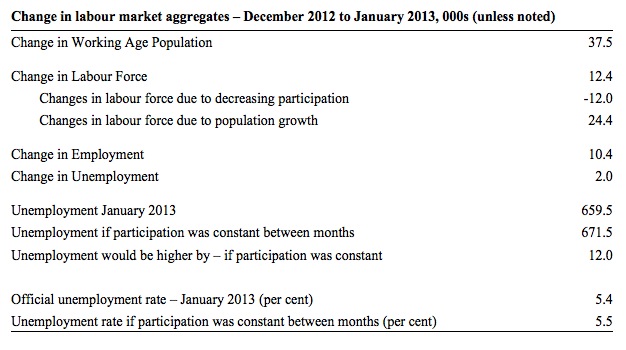

Aggregate participation rate fell in January

The participation rate fell for the second month in January 2013 to 65 per cent, down from 65.1 per cent. The fall in participation meant that 12 thousand persons who would have been counted as unemployed dropped out of the labour force.

The most obvious point though is that the participation rate remains 0.3 percentage points lower than it was 12 months ago.

It is also still substantially down on the most recent peak of 66 per cent (January 2010) when the labour market was gathering pace courtesy of the fiscal stimulus.

This drop in participation in the last year or more has meant the labour force growth has been relatively subdued with the additional result being that the unemployment rate is considerably lower than would otherwise been the case.

In the current month, the unemployment rate remained unchanged at 5.4 per cent. What would have the unemployment rate been had the participation rate not fallen?

The labour force is a subset of the working-age population (those above 15 years old). The proportion of the working-age population that constitutes the labour force is called the labour force participation rate. So changes in the labour force can impact on the official unemployment rate and so movements in the latter need to be interpreted carefully. A rising unemployment rate may not indicate a recessing economy.

The labour force can expand as a result of general population growth and/or increases in the labour force participation rates.

The following Table shows the breakdown in the changes to the main aggregates (Labour Force, Employment and Unemployment) and the impact of the rise in the participation rate.

In January 2013, employment rose by 10.400 while the labour force grew by 12,400 persons. As a result, unemployment rose by 2 thousand.

The labour force rise in January was the outcome of two separate factors:

- The underlying population growth added 24.4 thousand persons to the labour force. The population growth impact on the labour force aggregate is relatively steady from month to month; and

- The fall in the participation rate meant that 12 thousand workers left the labour force (relative to what would have occurred had the participation rate remained unchanged).

Clearly, employment growth was not sufficient to match the underlying population growth (a deficiency of 14 thousand odd).

If the participation rate had not have fallen a little, total unemployment, at the current employment level, would have been 671.5 thousand rather than 659.6 thousand as recorded by the ABS.

Thus, without the drop in the participation rate, the unemployment rate would have been 5.5 per cent rather than 5.4 per cent as officially published.

The conclusion is that hidden unemployment rose by some 12 thousand workers and this took some of the pressure off the official unemployment rise. In functional terms this signals an overall deterioration in the labour market.

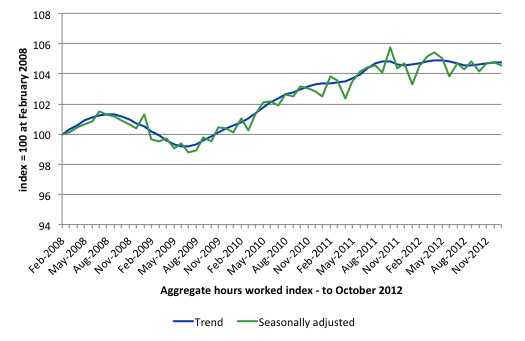

Hours worked fell again in January 2013

Aggregate monthly hours worked decreased 3.9 million hours (0.24 per cent) in seasonally adjusted terms and the trend is now about flat if not pointing down and signalling a labour market that is deteriorating.

The small swings up and down in monthly hours worked each month since the beginning of 2011 is being driven by similar fluctuations in full-time employment.

The following graph shows the trend and seasonally adjusted aggregate hours worked indexed to 100 at the peak in February 2008 (which was the low-point unemployment rate in the previous cycle). The rising trend which marked the early recovery courtesy of the fiscal stimulus is now clearly gone.

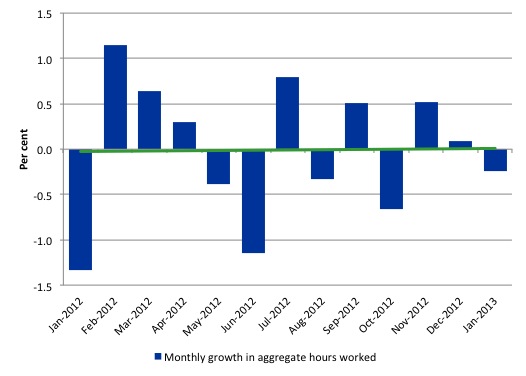

The next graph shows the monthly growth (in per cent) over the last 12 months. The green linear line is a simple regression trend – basically flat – that is if you can find it running along the horizontal axis. You can see the pattern in working hours that is also portrayed in the employment graph – zig-zagging across the zero growth line. The economy cannot get any head of steam up as any growth in private spending is being offset by the fiscal contraction.

Once again the data doesn’t support the notion of a fully employed labour market that is bursting against the inflation barrier.

Conclusion

Overall, today’s data confirms that the labour market is continuing to weaken. The employment growth trend is weak to negative. Employment growth is clearly not strong enough to keep pace with the growth of the underlying population let alone eat into the huge pool of unemployment and underemployment.

Within this pattern of weak employment growth, variations in the participation rate from month to month have been driving rises or falls in the unemployment around a slightly increasing trend.

That pattern has been evident for the last 18-24 months or so and leads to the conclusion that the Australian economy is not being well managed by the Government.

We always have to be careful interpreting month to month movements given the way the Labour Force Survey is constructed and implemented. But the underlying trend is weak as a result of the withdrawal of the fiscal stimulus undermining employment growth.

The most striking aspect of a sad picture remains the appalling performance of the teenage labour market. Employment has collapsed for that cohort although the January data suggests the new entrants from the schools were able to get part-time work. But the trend has been clear and I consider it a matter of policy urgency for the Government to introduce an employment guarantee to ensure we do not continue undermining our potential workforce.

The data certainly doesn’t support the Federal Government’s current macroeconomic settings, which are biased towards contraction. More fiscal stimulus is definitely needed.

That is enough for today.

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

This Post Has 0 Comments