I grew up in a society where collective will was at the forefront and it…

US government has not exhausted its fiscal options

Today, I read a Bloomberg article – How the IMF Can Help Reduce Unemployment – which, in part, makes out that the IMF know what they are talking about when it comes to macroeconomic policy (that was the hilarious aspect). The article also claims that the US government has pursued “expansionary fiscal policy … aggressively but growth has remained too weak”. That claim, which surfaces most days, is being used to indoctrinate people into holding the view that fiscal policy has failed and there is little the government can now do other than turn it over the market (with very substantial handouts to the powerful lobby groups – of-course – but that isn’t really government spending is it – not like helping the pitifully poor unemployed who have no income and no power)! This theme repeats like a worn out record. The reality is that the US government didn’t give fiscal policy a chance to work fully. It was clear that the stimulus packages underpinned economic growth in 2009 and 2010 and led to an increase in private confidence (backed by growth in consumption and private investment spending). But the fiscal support was withdrawn too soon as the latest national accounts data clearly shows. The point is that the US government wasn’t aggressive enough, got cold feet too soon, and has never exhausted its fiscal options.

The Bloomberg article also claims that:

The U.S. isn’t expected to return to full employment for at least six more years, and the consensus in Washington seems to be that President Barack Obama’s administration has no options to improve that dreary outlook.

The “consensus” in Washington. I am sure the gang at the Washington-based – Center for Economic and Policy Research – don’t agree with that fatalism (aka as ideological banter designed to convince the public that government has not effective policy tools) – which means there is no consensus in Washington.

The pitifully-weak and ignorant political class and their hangers-on might want American people to believe that all stops have been pulled out but the data tells us a different story.

Last week (January 30, 2013) the – US Bureau of Economic Analysis – published the – US National Income and Product Accounts – for the December-quarter 2012 (the advanced estimates – which might be revised subsequently as new data comes in).

The BEA said in the release that:

Real gross domestic product — the output of goods and services produced by labor and property located in the United States — decreased at an annual rate of 0.1 percent in the fourth quarter of 2012 … In the third quarter, real GDP increased 3.1 percent … The decrease in real GDP in the fourth quarter primarily reflected negative contributions from private inventory investment, federal government spending, and exports that were partly offset by positive contributions from personal consumption expenditures (PCE), nonresidential fixed investment, and residential fixed investment. Imports, which are a subtraction in the calculation of GDP, decreased.

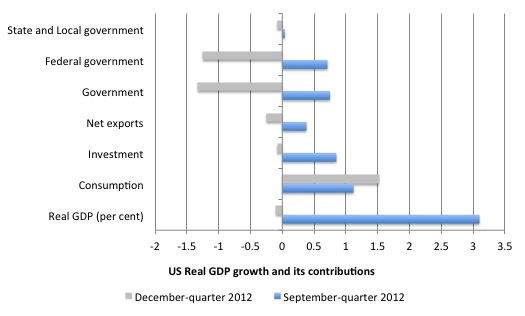

The following sequence of graphs captures the story. The first compares the September-quarter 2012 with the December-quarter 2012 contributions to real GDP growth at the level of the broad spending aggregate. The only aggregate source of growth came from private consumption spending, which contributed 1.52 points to the overall figure of -0.1 per cent real GDP growth.

The contraction of the government sector scythed 1.33 points of real GDP growth in the December-quarter with the largest component of that coming from the federal level. Net exports were responsible from 0.25 points contraction, by in the scheme of things, net exports rarely is the driver of real GDP growth in the US.

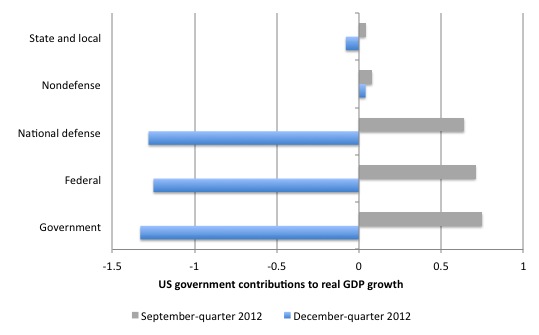

The next graph decomposes the government sector into its parts and reveals that it was the contraction in military spending that did the damage. Now for the likes of me the reduction in US military spending is a massive bonus for world peace. I don’t buy the argument that peace only comes if all nations arm themselves to the teeth. The massive military spending in the US allows it to bully nations, invade them illegally and generally worsen localised ethnic tensions, dramatically infringe on human rights and, overall, destabilise World peace.

But the macroeconomist in me says that with unemployment as high as it is – (see yesterday’s blog – The US labour market is still in a deplorable state) – and growth now lagging well below that which is necessary to reduce that unemployment, particularly to be able to eat into the pool of long-term unemployed, now is not the time to be cutting federal spending overall.

Yes, I support a dramatic cut in US military spending. Yes, I support a dramatic increase in spending on job programs, public infrastructure, public education, public health (and the destruction of the hold that the private insurance industry and the pharmaceutical companies have on health spending in the US), and environmental investments in renewable energy.

No, I don’t support an overall contractionary fiscal policy position in the US (or nearly anywhere for that matter). That is, the latter “dramatic” should be a few percentage points of GDP larger than the former “dramatic”.

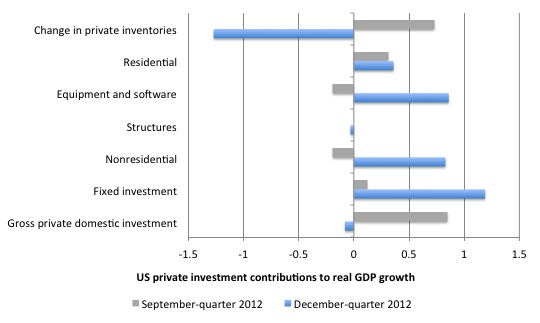

In the first graph, you will note that private investment spending was also a drag on real GDP growth in the December-quarter 2012 – by -0.08 points. However, that is not the full story. The next graph decomposes the spending categories that constitute total gross capital formation.

While overall investment dragged on growth, fixed investment added 1.19 points, non-residential added 0.83 points, structures dragged -0.03 points, equipment and software added 0.36 points and the change in private inventories dragged growth down by a fairly large 1.27 percentage points.

The BEA say:

The change in real private inventories subtracted 1.27 percentage points from the fourth-quarter change in real GDP after adding 0.73 percentage point to the third-quarter change. Private businesses increased inventories $20.0 billion in the fourth quarter, following increases of $60.3 billion in the third and $41.4 billion in the second.

The question that is unclear is whether this buildup of inventories was unintended. That is, whether it marks the start of an inventory cycle that reflects weak demand and a further contraction in output and income in the coming year.

My guess at this stage (and I will wait until the “second” estimate for the fourth quarter, based on more complete data … [is] … released on February 28, 2013″ before I firm up the guess into a view – is that with private consumption spending being strong (increased by 2.2 per cent in the fourth quarter) – building on growth of 1.6 per cent in the third-quarter 2012 – that the build-up in inventories may have been more planned than involuntary. Judgement is reserved on that one at present though.

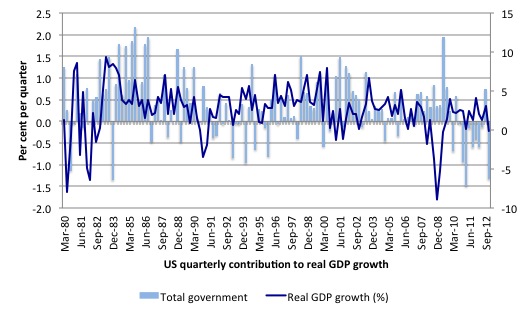

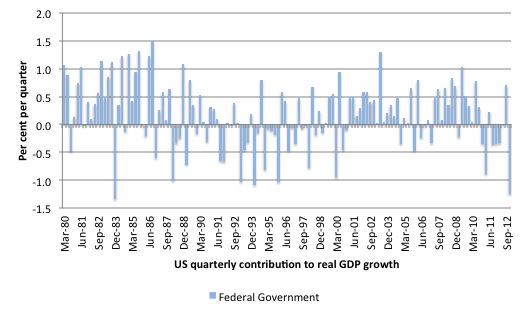

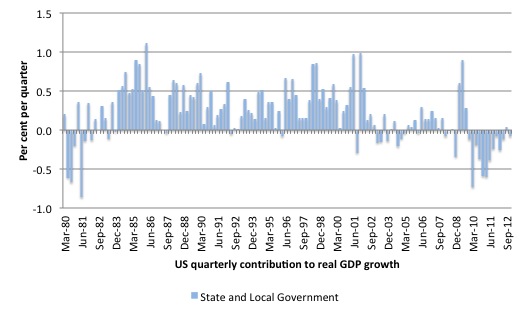

The following sequence of graphs show the contributions to quarterly real GDP growth in the US since the March-quarter 1980 to the December-quarter 2012 by government level (total, federal and state/local in order).

It allows us to see the behaviour of government during the very severe 1982 recession relative to its current behaviour. In the lowest graph I have superimposed the quarterly percentage real GDP growth (right-axis) to let you see the turning points in the cycle and the recovery aftermath over the course of recent history.

The 1982 downturn began after real GDP growth peaked in July 1981 and it took 16 months to reach the trough in November 1982. There had been an earlier official recession – (see NBER cycle dating) – from January 1980 to July 1980 (a 6-month descent).

The data shows that the US government sector (under the self-styled Thatcherite “Ronny Raygun”) consistently supported growth through the recession (one quarter of contraction) and, importantly, maintained that support in the recovery phase.

That stands in stark contrast to the behaviour of the federal government in the current downturn and recovery.

Since late December 2010, the overall government sector in the US has been undermining real GDP growth as its dysfunctional Congress battles for the title of which political party can do the most damage.

The US government overall started to drag on real growth almost immediately after it had begun. Overall real GDP growth turned positive again in September 2009.

The federal level has been a negative contributor to quarterly real GDP growth for 8 of the last 9 quarters since December 2010. That should put in perspective the claims that “we tried aggressive fiscal policy and it didn’t work”.

The correct statement is that the US government injected a stimulus throughout 2008 and maintained it until September 2009, whereupon it got bullied into submission by the lunatic right, which includes Blue Democrats, most of the Republican party and all the fringe groups with money that consistently lie to the American people about matters fiscal.

The situation is even worse at the State and Local government levels.

Since March 2008, state and local governments together have been negative contributors to real GDP growth in 16 of the 20 quarters, and every quarter since September 2010.

If you consider the previous recession periods, both levels of government were running counter-cyclical strategies (contributing positively to growth) in contrast to the present recession.

This is especially so when you consider the State and Local governments.

So as the private sector struggles to build momentum, the support that is typically (and correctly) provided by the public sector in the early phases of recovery has been absent in this crisis.

State and Local government revenues cannot expand when their economies are stagnating or recessing. It is a myopic strategy to attempt to run budget balances by cutting spending in a downward chase of cyclically declining revenue. We have several years of data to confirm that proposition.

While many (most) states are tied by balanced budget legislation (which I urge them to repeal and allow themselves fiscal freedom) the solution to their declining tax bases was clear.

The Federal government which has not such legislative constraint should have engaged in significant transfers to the states to ensure that state and local employment and activity was maintained during the crisis.

While I am extremely critical of the Eurozone for designing a flawed monetary union from the outset that was always destined to fail once it was hit by a large negative aggregate demand shock, the US system is not doing that much better. However, the Europeans will have to alter their entire monetary system to overcome its intrinsic flaw if it wants to avoid a worsening situation.

In the case of the US, all that was needed was some responsible federal fiscal policy initiatives to buffer the declining state revenues and allow these non-currency issuing levels of government to maintain employment.

The fact that the US government has largely failed to do that is an indictment of their fiscal irresponsibility.

Conclusion

The pro-cyclical government cutbacks have introduced a vicious circle of income loss, saving loss, wealth destruction, continuing real estate crisis, loss of state and local revenue, further cutbacks according to the application of their inappropriate fiscal rules (balanced budget amendments).

The pro-cyclical nature of state and local government employment is one of the principle reasons the US recession has endured and will ensure the long-term damage to that nation’s vitality and ability to provide high quality services to its people.

The reasoning in the public debate about the future consequences of government budget deficits is wrong-headed. The capacity of the US to provide for an ageing society amidst the long-term decline in its industry doesn’t depend on cutting in to public spending now – which is patently causing law and order to deteriorate, the standard of public education and health to slip.

Exactly the opposite response is required. Schools need to be revitalised. Communities need to be sure the streets are safe so that businesses will have an incentive to invest. People need to be mentally and physically well.

As I noted yesterday, the true burden the US government is leaving the grandchildren of American is not the public debt that it has outstanding (however large that level might become). Rather, it is the lost employment opportunities, the lost public investment opportunities, the decline of the US urban environments and the persistently high unemployment, especially among the youth.

They can never regain those opportunities and the damage is enormous. They should stop adding to the damage today.

As a postscript – Spain has found a clever way to avoid producing anything much – just make sure overall unemployment rates continue to rise (approaching 26 per cent) and have upwards of 55 per cent of the willing youth labour force out of work. Devilishly clever economic strategy! That is what the latest data shows – which I might comment on in more detail if I can overcome the depression associated with reading it.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Hi Bill, You make many good points. Particularly important, in my view, is that Federal Government has reduced jobs in many areas.

Federal Government payments to employees (employees in the broadest sense) have gone up considerably in the last 4 years. One might think this increase would be enough to supply demand ample to employ the “reduced” workers. Obviously, this has not happened. Not much additional labor is needed to create more goods in this day of mechanization and imports.

Amateur Economist

Excellent ~ I’ll be using it next week in class as the “Economics in the News” story.

Poor macroeconomic policy is clearly an important reason for the poor performance of the US economy. But is it the only reason? I think not. Other important causes exist also. These factors include the fact that peak oil consumption occurred in the US in about 2004. US oil consumption has declined since that year. Oil prices have also been very high recently, since about 2005. The fact is nothing happens without energy. It is the key resource for the appropriation and use of every other resource. High price and relative scarcity of oil has a knock on effect right through the economy as it is currently our most useful energy source for many applications. It has a high energy content (by volume and by weight) and is easily transportable by tanker and pipelines. It is a necessity still for our internal combustion engine powered personal transport, general transport and distribution systems.

The trend in US electricity consumption by sector is also revealing. Since 1994, residential and commercial electricty consumption each rose by over 40% but appear to have flattened (failed to grow further) since about 2007 i.e. since the GFC. However, the trend in industrial use of electricity has run flat from 1994 to the present day. These electricty use patterns are probably diagnostic of other causes and trends rather than being first causes in their own right. The major fuels for electricity generation in the US (coal and fissile materials) are not in short supply… yet.

Industrial use of electricty being flat from 1994 would seem to indicate that the US manufacturing sector has stagnated since that date. This is consistent with the off-shoring of some industries to Asia and with the US’s poor record on infrastructure building over the last few decades. The relative growth in domestic electricty consumption reflects the US skewing to become a consumption economy rather than a production economy. Ditto for commercial electricty use. The unproductive FIRE sector (finance, insurance, real estate) also grew until the GFC and has gone sideways since.

Increasing damage to the US economy and indeed to many economies around the world is being caused by effects due to global warming. The global trend in natural disaster costs since the 1960s has seen an increase in costs by close to 10 times after adjustment for inflation. This number has to be set against global economic growth in that period which might account for a considerable amount of the increase. More extant infrastructure and cropland means more is there to be damaged by extreme events. However, the climate record shows that extreme events have been accelerating far beyond previous trends in the last two decades. It is arguable that a greater proportion of apparent GDP is now being employed to repair existing damaged infrastructure and not to build new infrastructure for an expanding population. While the activity still shows up in GDP statistics it is maintenance work not growth work in the real infrastructure sense. This will negatively affect overall productive (and employment) capacity in subsequent years.

In summary, as well as endogenous ideological, financial and macroeconomic reasons for economic stagnation in the US and elsewhere, there are also exogenous, real material factors involved. Current world economic problems (US, EU, Egypt etc. etc. etc.) are also the result of real material and energy limits being reached. The economy cannot be discussed as if it exists free standing without the support of the environment.

The useful fusing of the three strands of thought (MMT, Limits to Growth and Environmentalism) can occur via large government spending programs to address transition of the economy to a renewable and sustainable basis along with environmental protection and remediation as well as stabilisation of the population. In Australia, one of the most useful things the Federal Government could do, as well as more spending on health, welfare and education, would be to agressively phase out coal power plants and adopt the Beyond Zero Emissions – Australia plan for 100% stationary energy generation via solar and wind power by 2022.

Note: I have no connection with Zero Carbon Australia but as a citizen I strongly support their vision and plans.

Ikonoklast, you bring up many important points. However, you miss Bill’s point.

Namely, that US Governmental Spending at all levels, but particularly at the federal level should

be redirected into activities that build the nation. Specifically maintenance and repair of key infrastructure, neighborhood security via beat patrolmen walking the streets, and development of renewable energy. Were the 2 trillion spent on the failed wars to control the resources of central asia, to dismember Pakistan, Iran, Iraq, Libya, Mali, and Syria, instead spent on construction of GeoThermal, Wind, and Solar Photo Voltaic electricity generating plants, conversion of existing housing stock to passive solar heating and cooling, unification of the US rail network followed by quadruple tracking of 60,000 miles of mainline, double tracking of 80,000 miles of secondary lines, double tracking of 100,000 miles of tertiary (light)rail, and electrification of all rail lines, we could reduce petroleum consumption of the US from 18 MBbl/day to 5Mbbl/day, eliminating imports altogether, decreasing the need for govt stimulus, and making jobs for the citizens of the US.

Were, physicians and surgeons encouraged to switch to the Direct Primary Care Model, enmasse, in which patients subscribe to a medical provider at the fee of $100/patient-month, for which the patient gets 4 – 30 minute long sessions with his doctor / year, for which the patient gets all immunizations needed, for which the patient is guided into a regime designed to improve his health, we could improve public health in the US, eliminate emergency rooms as primary treatment centers for the poor, and dramatically reduce the cost of medical care in the US, not to mention improve the working conditions of the nations primary care physicians.

Were, hospitals nationalized nationwide, replacing subsidies, with direct support, for which the populace is charged $100/citizen-year, we could eliminate copayments, improve access to critical care, eliminate incentives for bogus procedures, and fund the entire hospital system.

The latter two changes would decrease US medical costs from ~ $8,000/citizen-year to $2,400/citizen-year.

Bill makes the same point again and again, economics should provide guidance as to how the nation can achieve the goal of increasing the well being of it’s citizens, not act as a petty tyrant demanding destructive ends, which benefit a few.

INDY

Dr. Oprisko, with respect, I do not miss that point at all. In my first sentences I made that point. “Poor macroeconomic policy is clearly an important reason for the poor performance of the US economy. But is it the only reason?”

I am saying that Bill’s (almost) exclusive focus on formal macroeconomic policy needs to be widened to also look at real resource issues more often. Bill needs (IMHO) to address each of these issues with 50 – 50 importance. At the moment it is more like 99 – 1. He focuses almost entirely on one side of the coin. Or at least that is the way it appears to me. I would like to see him do real resources analysis as comprehensive as his macroeconomics analysis. If he needs to bring on board a guest biophysical-economist colleague for this side of matters then I think he should do so.

We are right now entering the historical era of real near limits to growth. This is going to radically alter economics. IMO, most economists pay too much attention to pure economic theory, of whatever school they belong to, and tend to ignore the biophysics of the real economy. Ultimately, the economy is 100% dependent on the real energy and real materials of the real world. Even when a lot of economists say they understand the primacy of the laws of thermodynamics and the general laws of physics (energy and material limits in a finite, closed system) over the economy, it’s only lip service. They “know” it in broad terms but they don’t know it thoroughly and profoundly. If they did they would look at the fact of exponential growth now hitting near limits and they would be suitably terrified and obsessed with the biophysical problems too.

Instead, they think limits to growth is still off in the never-never. Not saying Bill fits this caricature of economists but a heck of a lot do. If I had my druthers I would make all would-be economists study history, economic history, general political economy, physics, thermodynamics and ecology before I let them near technical economics of the macro and micro kind. Most orthodox economists (not Bill who is heterodox) live in a fantasy model land where the economy is free standing and independent from the environment and real physical laws. They are about to get a huge shock as the global economy hits the wall of real limits. It is doing so now. It will a slow motion train wreck of about 30 to 50 years duration. Heaven knows what will be left at the end of it. Not much I should think.

Dear Ikonoclast

see

Modern Monetary Theory and environmental sustainability – Part 1

Posted on Monday, December 31, 2012 by bill

https://billmitchell.org/blog/?p=22222

” … We conclude that those who seek to dismiss MMT because it doesn’t satisfy their particular pet solution to climate change issues have probably not read some of the earlier MMT literature nor understood fully what is required to develop and disseminate a new way of thinking about the economy. Further, MMT is not a theory about everything! What we will see is that when MMT advocates economic growth it does so with a very different view of what that economic growth might be comprised of and driven.

At an early Centre of Full Employment and Equity Conference (CofFEE) held in 1999 in Newcastle, Australia, I presented a paper, which probed the question of the “Future of Work” and the environmental constraints facing capitalist economies. This conference paper was subsequently published as W.F. Mitchell (2000) ‘The Job Guarantee in a Small Open Economy’. Economic and Labour Relations Review, Vol. 11, supplement). A scanned copy is available – The Job Guarantee in a Small Open Economy.

At the same conference, UMKC MMT colleague Mat Forstater gave an exceptional paper – Full Employment and Environmental Sustainability – where he outlined the way in which the central themes of MMT (with respect to policy implications) were consistent with the goal of environmental sustainability.

( http://www.cfeps.org/pubs/wp/wp13.html > Full Employment and Environmental Sustainability

Working Paper No. 13, Jun 2001, Mathew Forstater )

So it is clear that at least 14 odd years ago, the early developers of MMT were intent on placing their ideas within a debate about environmental limits and sustainability. There was no naivety, ignorance or disdain to the issues and it was obvious that a credible alternative economic framework had to be compatible with the broader challenges of our day.

Statement from commentators that MMT is not a valid theory because it does not provide a “full, rigorous and empirically supportable answer” to the issues of Limits To Growth and biospheric homeostatic boundary problems thus reflect the failure of the readers to appreciate the full MMT literature, how we have decided to develop the economic thought process, and the scope of the ideas. … Which leads me to admit, that unfortunately, MMT is not a theory of everything. …”

Kind regards

I have seen that. It was written because I was so annoying and strident about the issue. If MMT is attempting to be even a theory of everything of macro significance for the economy then it must explicitly and regularly address material and energy limits as well as macroeconomic settings. It’s no good saying we wrote about it a decade ago and have scarcely addressed it since (apparently). The planning for a sustainable and renewable future needs to be integrated and constantly addressed. It’s not a tack-on, it’s an integral piece. Just my view I guess. If my harping on is not considered constructive I’d better be quiet.

A lot of people are doing good work in silos but where is the great synthesising thinker who is going to put it all together? Humanity desperately needs that person to arise.

Dear Ikonoclast

You said:

Which is probably a reasonable proration.

But my blog is not a free-for-all where I wax lyrical about anything I have an opinion about. I have lots of opinions and prejudices just like anyone. But I am a professional macroeconomist and that is the area that I research and would claim to have the required skills base and knowledge to offer professional analysis. That is what my blog is about.

I see my blog as a user-friendly (I try), accessible window to my more inaccessible academic work. I certainly use it for advocacy but that policy advocacy is always evidence-based.

I do not have a PhD in environmental science, climate change or any of those areas. Therefore I cannot make professional judgements and it would wrong of me to do so.

But if you want to hear my opinions on all and sundry catch up with me sometime for a cup of tea with me and then we can talk!

best wishes

bill

Bill, point taken. I would like to see ideally a small team of macroeconomists (not neoclassicals tho!) and biophysical economists get together and work out a comprehensive plan for shifting to a material steady state (sustainable and renewable) economy. Call me a crazy dreamer I guess.

Every say of BAU without a new plan brings a us closer to global disaster.

Good suggestion, Ikonoclast. From what I have seen, many energy, environmental, and ecological economists and related experts think that there are financial problems like affordability and debt in addition to real world issues relevant to real resources. I’ve occasionally tried to bring this up in comments on various blogs and run into a brick wall since they are thinking in mainstream terms.

Commenting more broadly, I had misconstrued Bill’s tight focus on macro as obliviousness to some other issues. I am obviously wrong on that score.

Perhaps my mistake can be understood from the perspective of a general personal exasperation with the Business As Usual thinking which dominates our society. Limits To Growth and environmental damage (to the point of wrecking the holocene benignity of climate and environment) are the elephants in the room. We can do whatever else we like. It will make absolutely no difference if these problems are not addressed.

To give you some examples why I (and anyone who “gets” the fundamental irrefutability of the LTG and sustainability arguments) am in a position of almost terminal furstration with the institutionalised stupidity of our system.

1. Politicians often say (in effect) we can’t protect the environment at the cost of jobs. Tony Burke is the latest environment minister to make this argument by his actions on the Tarkine.

My answer: Don’t they get the simple fact that if there is no sustaining environment left then there will be NO economy and NO jobs? And not very many people.

2. Politicians say (some of them) we must limit CO2 emissions by a carbon price and then they set an inadequate price. BTW, they should have used a pigovian tax. Then in the next breath they say we must improve coal export infrastructure because coal exports are good for Australia. At the same time they continue to support billions in subsidies for fossil fuels, ludicrously low resource rent taxes and derisory assistance to renewable energy.

My answer: Surely I am not the only one to see the complete self-contradicting nature of these policies? It’s an arrangement of public discourse and public policy which the autocrats of “1984” (Orwell) would instantly recognise and applaud. It’s doublethink pure and simple.

Maybe so many people are into doublethink on these issues because the truth now is too terrible to admit. It’s pretty clear we are beyond the point of safe return.

What we need is somebody prepared to give the ‘I believe this nation should commit itself’ speech.

Any carbon extracted from fossil fuels needs to be treated as waste effluent and rendered into a safe form – largely by technologically short-circuiting the long run carbon cycle.

In english we need to create carbonate rocks with it.

So it’s not a matter of setting a price for carbon. It’s a matter of saying you will not be permitted to put it into the air.

None one bit.

Any more than we allow arsenic into the river system.

Businesses that can’t cope with that will have to close – replaced by something less likely to boil the planet.

And during the transition Job Guarantee will deal with the jobs and income issue.

Ikonoklast “Don’t they get the simple fact that if there is no sustaining environment left then there will be NO economy and NO jobs? And not very many people.”

Same attitude as in the financial sector in the lead up to the crisis: IBGYBG – “I be gone and you be gone” with our loot before the collapse.

I agree with Neil above. Zero tolerance is the way to go. It’s the only thing that these people will understand.

Tom:From what I have seen, many energy, environmental, and ecological economists and related experts think that there are financial problems like affordability and debt in addition to real world issues relevant to real resources.

Exactly. But much of the curriculum reform Ikonoclast proposes would IMHO exacerbate the above, serious problem, not diminish it. Look at the loony Austerianism of Australian & many other Green parties. (OTOH, Jill Stein’s Green New Deal is exactly right.) Do the simple, easy, fundamental worldly philosophy first – MMT, genuine monetary economics – whose message is simply that what seems good sense IS good sense.

MMT theory & recommendations boil down to: “Don’t do obviously insanely stupid things”. The particular application of this excellent maxim is harder and will involve studying all the suggested things – mostly afterwards, or by other people, life being finite.

Ikonoclast: As DeusDJ and I commented here, you can find a good number of relevant publications from Mat Forstater’s classes: Econ 5688: Colloquium On Political Economy Readings (sec. IV. ENVIRONMENTAL ECONOMICS) and Econ 420: ENVIRONMENT, RESOURCES, AND ECONOMIC GROWTH Also, not directly relevant or MMT, but here is a recent article I found interesting: The Planetary Emergency.

Another worthwhile billyblog to read imho is Timor-Leste – beyond the IMF/World Bank yoke. Charlie Scheiner and “Arrhenius” mean well, but Scheiner’s lack of understanding of money leads him to disregard the essential policy of currency sovereignty. Migeru’s excellent comment at the Modern Monetary Theory and environmental sustainability – Part 1 billyblog mentioned above says similar things very well.