I grew up in a society where collective will was at the forefront and it…

Accounting smokescreens excite the conservatives

I haven’t much time today as I have been travelling most of the day. But the news is that Japan – soon after its government announced it would increase taxes to “rein in the deficit” is now facing a dramatic slowdown as a result of the on-going crisis in Europe and the slowdown in the Chinese economy. Perfect time to increase taxes really! But today we revisit (for the nth time) the way in which conservatives get excited by the accounting smokescreens that have been overlaid onto the monetary system to obscure certain fundamental capacities of government. The excitement or should I say – hysteria – then leads to pressure being put on policy makers by the billionaires that control the media – and, invariably – leads to poor policy choices being made. So for the nth time – the US social security system cannot go broke. The “financial gaps” that are wheeled out to prove that it will become insolvent are just accounting structures that can be altered by Congress anytime they want. If the accounting systems led to the system being in jeopardy then Congress would quickly assert their intrinsic capacities.

Japan is slowing quickly because its exports are falling – a major issue for a nation that suppresses domestic demand and relies on domestic demand in other nations to drive its growth. The commentators (Source) note that recession is likely to be avoided because “the reconstruction demand continues to support the recovery”. While this source of spending is the result of a major natural disaster the fact is that it is public spending that is driving the reconstruction.

The Japanese government could easily extend its net spending into “investment in green technology and agriculture, and subsidies for environmentally- friendly housing” to ensure the export slowdown is replaced by a growth in domestic demand. But the government seems obsessed by reducimg its deficit at a time it should be increasing it.

The budget deficit is a buffer stock that rises and falls inversely with non-government spending and that counter-cyclicality can be reinforced by discretionary decisions to make strategic investments in public infrastructure and job rich community building projects.

Others are also – unnecessarily – worrying about budget deficits too. The worry is clouding their judgement and leading them to say some ridiculous things that cannot be supported by any reasonable understanding of the situation.

For example, this Bloomberg Op Ed (August 28, 2012) – Social Security’s Woes Are Worse Than You Think – perpetuates all the false premises that pervade this issue.

The writer, on Ramesh Ponnuru is a senior editor at National Review, which I guess is appropriate – given the leaning and quality of that rag.

As I have noted previously, the National Review was started by the doyen of American conservatives William F. Buckley – who wrote the book – God and Man at Yale – in 1951. National Review was introduced to give him a platform for spreading falsities. Not much has changed.

Buckley was a supporter of Joseph McCarthy in his attempted purge against Communism, a white supremacist (in the context of the US Civil Rights movement), and later, a supporter of Augusto Pinochet and his ruthless, murderous attack on civil rights in Chile.

An all round good sort of bloke really.

The 1951 book recounted Buckley’s life as an undergraduate at Yale and he claimed that academics had forced liberal ideology onto their classes. He also claimed that academics had tried to undermine the religious beliefs held by students by introducing “liberal” ideas.

He demanded that Yale teach courses that did not challenge the “beliefs of the students”. He seemed to have a curious view of what education is. His book openly identified individuals he considered to be dangerous radicals, communists and socialists (or all of them in one :-)) and one of the characters he and his hench-persons assassinated was the Canadian economist Lorie Tarshis.

Please read my blog – On strategy and compromise – for more discussion on this point.

The Bloomberg Op Ed remains faithful to this tradition – a tradition of misinformation and erroneous analysis. Mr Ponnuru has a B.A. in History yet feels comfortable lecturing the Bloomberg readers on matters of monetary systems and macroeconomics generally. From what he writes he is unqualified to do that.

He is a consistently conservative voice however. He wrote a book in 2006 – The Party of Death: The Democrats, the Media, the Courts, and the Disregard for Human Life – where he accused the Democrat party of being murderers. This critical book review written in 2006 – A Frigid and Pitiless Dogma – is interesting. I should add that the book reviewer was himself a National Review writer in the past. When conservatives eat themselves up it is always a good sign.

Anyway, to something I know a bit about – macroeconomics.

Mr Ponnuru writes that neither of the major political parties, which he claims have reached a “bipartisan consensus on entitlements” for Medicare, have got it right.

He thinks that while Medicare requires major changes the real powder keg for fiscal sustainability is Social Security.

He claims that Medicare – which “has much higher costs than Social Security” is the:

… driver of America’s long-term debt problem.

Which problem is that? It is astounding really that the mainstream press publishes this sort of statement without any due diligence.

There was an interesting article – taking us off in another direction – but for a purpose – in the UK Guardian today (August 27, 2012) – Why Obama should run on the success of the stimulus – which reviews a new book – The New New Deal: The Hidden Story of Change in the Obama Era – written by Time Magazine writer Michael Grunwald.

The Guardian article thinks it is the “single best book to date on the inner workings of the Obama presidency and the $800bn stimulus measure”.

We read that “Grunwald persuasively argues is Obama’s greatest political achievement” because:

While the Recovery Act created 2.5 million jobs, stopped the country’s economic hemorrhaging and launched a weak recovery, its long-term, transformative impact is the real story … while Republicans blast the bill as socialist government spending run amok, the stimulus has, in just a few years, transformed America and laid the foundation for future economic growth.

The book documents in “exhaustive detail” the areas that have gained from the stimulus. The Guardian concludes that:

That, three and a half years after it was passed into law, most Americans simply have no idea what the Recovery Act wrought is a truly damning indictment of the US media.

That is the point of the little diversion. The media has been too busy pumping out articles claiming the stimulus package was “a boondoggle that exploded the debt and did precious little to turn around the country’s economic malaise”.

The media gives too much space to the likes of Ponnuru to fabricate and pontificate on matters he is unqualified to comment on – but who cares in this age of conservativism. As long as they oppose abortion, want to cut public spending, and demand more control of public education by mainstream religious zealots the conservative media will let them write whatever they want.

Pity the unsuspecting reader who is also unqualified but genuinely trying to make sense of the world around them and for very good reasons is scared or apprehensive for their future and the future of their children if they have any. The conservatives prey on that uncertainty and fear with the dramatic licence they wield in columns such as the Bloomberg Op Ed.

Mr Ponnuru says that while Medicare is the big one, the “Social Security gap looks small, though, only in relation to Medicare. On any other scale, it’s pretty big.”

He claims that:

In 1983, the financing gap over the next 75 years amounted to 1.8 percent of payroll … the gap today, measured using the same standards as in 1983, is 3.5 percent: almost double what it was then. And every year that passes without action, that number gets bigger.

What exactly is a financing gap in this context?

The figures (estimates) he is talking about are really elaborate (voluntary) accounting smokescreens in a nation that has full currency sovereignty.

To understand this we need a little background. The US Social Security and Medicare systems are organised into two separate Trust Funds, each having six trustees – including the current Secretary of the Treasury (the Managing Trustee), the Secretary of HHS, the Secretary of Labor, and the Social Security Commissioner. Two Public Trustees are added (one Democrat and one Republican) to provide scrutiny on the conclusions of the other four.

The Trustee’s Reports are annual legal requirements under the US Social Security Act and aim to report on the “financial status” of each of the “trust funds” to the US Congress.

They provide elaborate projections of the revenues and outlays expected of each the funds based on actuarial and economic assumptions and modelling.

In operational terms, should there not be a positive balance in the funds then the attached social security programs are unable to pay benefits. That should alert you to the obvious question – why would they construct these Trust Funds in such a way when siting underneath them is a fiat currency issuing government that can always ensure benefits are paid (in nominal terms).

That capacity is intrinsic to the monetary system. However, to obscure that intrinsic capacity successive generations of politicians have placed a series of restrictive layers on top which the conservatives then focus on and pursue their anti-government agenda by purporting to the public that these voluntary layers are in some way binding to any federal government.

They are not – they could be removed at any time there was the political will.

The smokescreen manifests trhough the US governments decision to allocate payroll tax and income tax revenue to the revenue side of these Funds. Such an explicit gesture – totally unnecessary from a financial perspective – gives the impression to the general public that: (a) their taxes are being put to some specific use; and (b) that without those taxes funding those uses there would be not capacity to provide the services.

Of-course, both perceptions are false. Taxpayers do not fund anything in a fiat monetary system and the government doesn’t need any “funding” to provide whatever goods and services to the non-government sector it chooses.

Please read my blog – Taxpayers do not fund anything – for more discussion on this point.

But in the US Social Security system, the deception is very powerful. Should the current revenues be insufficient to match current obligations then the prior Trust Fund balances are used (which mainly represent past surpluses). These past surpluses were then invested in Treasury bonds.

It looks to be an elaborate mechanism for the government lending to itself and pretending to raise revenue that is necessary to “fund” pension and medicare entitlements. Looks deceive.

In fact, the US government (via the Congress) can always pass legislation which transfers “General Funds” into “Trust Funds”. A stroke of the pen funding increase.

What gets the conservatives (and faux progressives) in a spin is the so-called Trust Fund exhaustion date which indicates when the Funds go broke (that is will not be able to make full benefit payments).

This is the “funding gap” that Mr Ponnuru is wanting us to believe is an issue worth worrying about. I suspect he is worried about it having deceived himself with his erroneous logic.

In the US Social Security Trustees Report 2011 we read the following:

Under the long-range intermediate assumptions, annual cost for the OASDI program is projected to exceed non-interest income in 2011 and remain higher throughout the remainder of the long-range period. The … Trust Funds are projected to … become exhausted and unable to pay scheduled benefits in full on a timely basis in 2036 … For the combined OASDI Trust Funds to remain solvent throughout the 75-year projection period, the combined payroll tax rate could be increased during the period … scheduled benefits could be reduced during the period in a manner equivalent to an immediate and permanent reduction of 13.8 percent, or some combination of these approaches could be adopted.

The US Old-Age, Survivors, and Disability Insurance (OASDI) program “makes available a basic level of monthly income upon the attainment of retirement eligibility age, death, or disability by insured workers”.

So the report notes that within the logic (which is not questioned) of the elaborate accounting system adopted to accompany social security provision, the Social Security system is running a more or less permanent deficit which will grow in magnitude over time.

The “funding gap” has widened in recent years because the tax-sourced revenues collapsed as a result of the crisis and because stimulus packages have provided a (temporary) reduction in payroll tax rates.

The reason that the Trust Fund continues to grow even though there are deficits is because of interest payments on the investment assets it holds. But they are just a transfer from one US government bank account to another – the net effect on overall fiscal situation is zero.

The Report says that by 2035, social security benefits will be about 13-15 per cent of taxable dollars. The Report says that the Trust Fund will be exhausted by 2036 whereupon the projected incomes would only match 77 per cent of scheduled benefits.

Mr Ponnuru believes all of that and writes:

Right now, we spend more money on Social Security than on Medicare, and that will remain the case for a while. The programs’ trustees project that by 2035 Social Security will consume 6.4 percent of the economy and Medicare 5.7 percent. The Medicare projection may be optimistic about recent attempts to impose cost controls, but we shouldn’t expect Medicare to become vastly larger than Social Security in the next two decades. After that point, Social Security costs start going down as demographics play out while Medicare becomes a vastly larger problem.

But our finances will be in what’s technically called a world of hurt before Social Security costs peak. Under current projections by the Congressional Budget Office, by 2025 public debt will have reached 106 percent of gross domestic product. By 2035, it will have reached 181 percent. What would happen after that point is an academic question: We can’t allow ourselves to get there.

Well it is an academic question that Mr Ponnuru is not qualified to answer. The answer is simple. The US government will continue to honour all of its outstanding liabilities and the recipients of the income flow from the bond holdings will enjoy themselves.

Presumably, unless the mad-dogs gain power, the benefits will continue to be paid. Whether the growth in benefit income bestows the same real living standards as pension recipients enjoy now is a moot point. But it is not the point that the conservatives make.

They are worried the government will simply not make the payments. The main debate should be on how the US economy can stay ahead of the rising dependency ratio which will see less workers making and providing things and more workers wanting to consume those things.

Productivity is the answer along with a shift in attitudes away from mass material consumption and a more focused strategy on environmental conservation. But none of those issues relate to these spurious financial arguments.

If there are goods and services for sale in 2050 in US dollars the US government will be able to purchase them, irrespective of the public debt ratio. The real challenge is to ensure that pensions translate into better real outcomes (higher living standards).

I was also interested in his technical jargon – a “world of hurt”. How is that technical? This literary license is common among the conservatives. They just make things up to sound authoritative which adds to the scare factor. World of hurt – indeed.

He has proposals to fix both Social Security and Medicare in the US.

First, raising “the retirement age, for example, would encourage people to work longer and thus pay more taxes into both programs”. Raising the retirement age is a good strategy for cheating the dependency ratio but it has nothing to do with the fact that the workers who work longer into their lives would pay more taxes.

Remember – productivity growth is the key to this not raising funds to provide benefits.

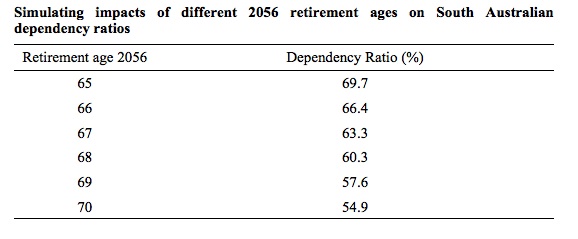

The following Table is taken from some commissioned work I am doing for the trade unions in South Australia (a state of Australia) who are facing major job cuts as a result of the governments obsession with getting back into surplus. The South Australian government hired some management consultants to come up with a technical efficiency analysis of the health system and have recommended major cuts. But that is another story.

The Table just shows the impact on the dependency ratio for 1-year incremental increases in the retirement age. I do not advocate enforced increases in the retirement age because they are highly discriminatory against those who perform manual task (hard labour). Their bodies quite often give up the ghost before the current legal retirement age is reached. But for some professions it is appropriate that a person be able to work beyond the age of 65 years should they wish to do so.

The point is that substantial reductions in the dependency ratio can be achieved by increasing retirement ages.

Second, Mr Ponnuru wants to cut benefit levels. He says:

One promising option is to reduce the growth of Social Security benefit levels, especially for high earners.

Whether it is sensible for high-income earners to receive Social Security benefits is a debate about equity and access to real resources provided by the public sector – it is not a debate about the solvency of these funds.

I would not give a social security benefit to a high-income earner. But that is another debate again.

The point is that the debate and policy suggestions are being driven by false premises. In that environment, sound decision making is likely to fail and poor outcomes chosen.

The summary facts are as follows:

- The US government could pay all of the benefits in each year with the stroke of a computer key. The only question would be if the nominal transfers were possible in real terms – that is, will there be enough real goods and services for older Americans to enjoy in 2085?

- There is no need to eliminate any deficits in these contrived Trust Funds – now or later. They are accounting fictions. The reality is summary fact 1.

- There is no impending financial crisis in the US Social Security Trust Fund. The US government can always fund any entitlements at any time – summary fact 1.

- The billions that go to Social Security each year will not make it harder to find money for other government programs or require large and growing tax increases. The US government is not financially compromised in meeting spending on Y by spending on X. It might be politically compromised but that is nothing to do with the underlying features of the monetary system and the capacities that the US government enjoys as the monopoly issuer of the currency. Summary Fact 1 again.

- Younger workers have nothing at all to worry about the fact that their parents and grandparents are enjoying benefits from the Funds. The largest problem facing younger workers is the entrenched unemployment and rising duration of unemployment brought upon by the failure of the US government to expand its deficit enough to support appropriate levels of job creation. This unemployment will cause intergenerational disadvantage and trying to cut spending now to “fix up social security” will worsen the situation for younger workers.

Some might get confused by the the accounting structures that a particular government overlays on the spending and taxing flows that support a social security scheme. For example, the US Social Security Administration has two separate funds which underpin its social security system. First, the Old-Age and Survivors Insurance Trust Fund is the accounting device that the US government uses in relation to the payment of future retirement benefits. Second, the Disability Insurance Trust Fund is the accounting device that the US government uses in relation to the payment of disability support pensions.

But to restate – the contributions to these funds are just taxes that the US government levies. They don’t actually fund anything. They drain disposable income and result in net financial assets held by the private citizens being destroyed forever. The fact that they are recorded against the Social Security Trust Fund for accounting purposes is irrelevant. The fund is just an accounting record of the payments. There is no store of dollars sitting somewhere as a result of the taxation flows.

The fact that the fund might hold financial assets which seem to be bought with the excess receipts over outgoings is another source of illusion (and confusion). The financial assets it holds are purchased with US government spending, which of-course, is not revenue-constrained.

Additionally, the social security payments are just another type of US government spending. The spending comes from political decisions to provide a certain level of social welfare in the US and involves the Government crediting bank accounts of recipients on a regular basis in US dollars.

It is crucial, if you want to understand the underlying monetary economics involved, not to get seduced by the illusions created by the accounting structures which sit on top of the essential monetary operations.

As background, please read this blog – Social security insolvency 101.

Here is a restatement of some of the rudiments of MMT which bear on this debate:

- Modern monetary economies use fiat currencies within a flexible exchange rate system, which means that the monetary unit defined by the sovereign government is convertible only into itself and not legally convertible by government into gold as it was under the gold standard, or any real good or service. The currency of issue is defined as the only unit that which is acceptable for payment of taxes and other financial demands of the government of issue.

- Government spending is not revenue constrained. Unlike the government of issue, a private citizen is constrained by the sources of available funds, including income from all sources, asset sales and borrowings from external parties. Government spends simply by crediting a private sector bank account at the central bank. Operationally, this process is independent of any prior revenue, including taxing and borrowing. When taxation is paid by the private sector cheques (or bank transfers) that are drawn on private accounts in the member banks, the RBA debits a private sector bank account. No real resources are transferred to government. Nor is government’s ability to spend augmented by said debiting of private bank accounts.

- A household, the user of the currency, must finance its spending, ex ante, whereas government, the issuer of the currency, necessarily must spend first (credit private bank accounts) before it can subsequently debit private accounts, should it so desire. The government is the source of the funds the private sector requires to pay its taxes and to net save (including the need to maintain transaction balances), making government solvency in its currency of issue a given and a non issue. A sovereign government can always afford to purchase anything that is available for sale in the currency it issues and pay any entitlement/liability that is denominated in the same currency.

- National income accounting defines the government deficit (surplus) as equal ($-for-$) to the non-government (residents and non-residents) surplus (deficit). In aggregate, there can be no net savings of financial assets of the non-government sector without cumulative government deficit spending. In other words, the only entity that can provide the non-government sector with net financial assets (net savings) and thereby simultaneously accommodate any net desire to save and thus eliminate unemployment is the government.

- The systematic pursuit of government budget surpluses is necessarily manifested as systematic declines in private sector savings. Pursuing budget surpluses is necessarily equivalent to the pursuit of non-government sector deficits.

So is there an issue about Social Security that MMT recognises as being important? Answer: definitely.

Financial commentators often suggest that budget surpluses in some way are equivalent to accumulation funds that a private citizen might enjoy.

Accordingly, accumulated surpluses are allegedly ‘stored away’ for the future which will help government deal with increased public expenditure demands that may accompany the ageing population.

The Social Security hysteria in the US is just one application of the idea that ‘taxpayers’ funds’ will be squeezed by the ageing population. But, as we have seen above, the notion that taxpayers fund ‘anything’ is without application. Taxes are paid by debiting accounts of the member commercial banks accounts whereas spending occurs by crediting the same.

The notion that debited funds have some further use is nonsensical. When taxes are levied the revenue does not go anywhere. The flow of funds is accounted for, but accounting for a surplus that is merely a discretionary net contraction of private liquidity by government does not change the capacity of government to inject future liquidity at any time it chooses.

One has to acquire the capacity to see beyond the elaborate accounting smokescreens that are erected to blur the true operations of the monetary system.

The mainstream economic intertemporal (across time) analysis that deficits lead to future tax burdens is also problematic. The problem is that the federal budget is not really a ‘bridge’ that spans the generations in some restrictive manner. Each generation is free to select the tax burden it endures. Taxing and spending transfers real resources from the private to the public domain. Each generation is free to select how much they want to transfer via political decisions mediated through political processes.

When I say that there is no financial constraint on federal government spending I am not, as if often erroneously claimed, saying that government should therefore not be concerned with the size of its deficit. I would never advocate unlimited deficits. Rather, the size of the deficit (surplus) will be market determined by the desired net saving of the non-government sector. This may not coincide with full employment and so it is the responsibility of the government to ensure that its taxation/spending are at the right level to ensure that this equality occurs at full employment.

This insight puts the idea of sustainability of government finances into a different light. What we know is that if the national government continues to run budget surpluses to “keep government debt low” then it will ensure that further deterioration in non-government savings will occur until aggregate demand decreases sufficiently to slow the economy down and raise the output gap.

Clearly the goal should be to maintain an efficient social security and health systems. Clearly the real health care system matters by which we mean the resources that are employed to deliver the health care services and the research that is done by universities and elsewhere to improve our future health prospects. So real facilities and real know how define the essence of an effective health care system.

How much a national government devotes to social security and health care reflects political choices rather than government finances. Real resources are involved and if the government is allocating X real resources to a pensioner then that may reduce the real resources available for another age cohort when those resources are finite.

The government can always “afford” to provide that many X real resources and transfer them (via pensions) but it may not have a political mandate to do so. What the attacks on social security are about is a demand for less real resources to be made available to the elderly and more to the younger generations. While I have a position on that issue as a private citizen, MMT has no position. But the deficit terrorists should admit publicly that is their view and stop lying about solvency issues.

Moreover, by achieving and maintaining full employment via appropriate levels of net spending (deficits) the Government provides the best basis for growth in real goods and services in the future. But in a fully employed economy, the intergenerational spending decisions always come down to political choices sometimes constrained by real resource availability, but in no case constrained by monetary issues, either now or in the future.

Conclusion

Mr Ponnuru should desist from writing about matters he doesn’t understand.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Yep. Somehow we never hear that the military is going bankrupt although its “fund” has ZERO dollars in it (since there is no fund! – they just assign money to be keystroked in each year). These guys are shrewd.

Peter P, It’s better than that: Republicans immediately turn into Keynsians when it comes to military spending. That is, they claim cuts in military spending will destroy jobs – but the same (mysteriously) does not apply to other government spending cuts. See this article by Krugman:

http://krugman.blogs.nytimes.com/2011/10/28/coalmines-and-military-keynesians/

I particularly like this phrase of Krugman’s:

“A Keynesian is an Austrian whose campaign contributors are about to lose a lucrative contract.”

They confuse the purely symbolic (fiat) with something that has inherent value like blood. But even if one chose to store blood for a later need it would be recognized that there would be at least a short term loss in productivity (that one might never make up) until the blood supply was replenished. So taxation to fund future spending, besides being silly, might easily jeopardize the economic growth necessary to produce the real goods to be bought with that future spending.

Good points, F Beard, but the confusion is worse than just confusing the nominal, the symbolic fiat & the real. Accumulating surpluses of somebody else’s fiat, having someone else owe you favors, can make some sense, as in China & Japan accumulating dollars. “Accumulating surpluses” of your own fiat money is like writing yourself a check for a million dollars and thinking you are rich as long as you have it. Stark raving mad.

What the attacks on social security are about is a demand for less real resources to be made available to the elderly and more to the younger generations. No, what they are about is depriving the elderly in general, retired workers & benefitting the already rich (many of whom are already elderly). The younger generation can go to hell, as can the economy in general. Saying it that way presumes full employment & real trade-offs.

“What the attacks on social security are about is a demand for less real resources to be made available to the elderly and more to the younger generations.” via Some Guy

I’d say the attacks on government spending are to protect/increase the real yields of existing sovereign debt holders – those whom Bill says are receiving “corporate welfare.” Since a monetary sovereign cannot default (unless it chooses to) then deflation does not increase default risk for its debt holders. So deflation is an unmixed blessing for the debt holders of monetary sovereigns?

So another reason to abolish borrowing by monetary sovereigns is that it creates a class of people who profit from deflation and misery?

“So another reason to abolish borrowing by monetary sovereigns is that it creates a class of people who profit from deflation and misery?”

Bingo!

Unfortunately part of this is simply the nature of capitalism as it is understood by modern Americans. Look at our privatized prison system where investors seek returns on their dollar. How do they get good returns? First cut prison guard pay, second incarcerate more people, third use money to influence lawmakers to change sentencing of crimes and make more and more things illegal. What a country!!

Ever wonder what a Greek stimulus package looks like ?

http://www.youtube.com/watch?v=-VkiQdocDTw

This from wiki (can’t confirm – I don’t do Greek , but take it as the Gospel according to Dork)

Mainline, passenger and freight train services on OSE lines are operated and provided by TrainOSE S.A., a former OSE subsidiary which is now an independent state-owned company.

TrainOSE also operates the suburban and commuter rail services of Greece (called Proastiakos), on a modernised network around the cities of Athens, Thessaloniki and Patras. Proastiakos was founded as a separate company, which became later part of TrainOSE.

Due to the financial problems of Greece TrainOSE has come to suspend regional services on following lines:

Athens – Alexandroupolis (although the connection Thessaloniki – Alexandroupolis remains in service)

Edessa – Florina

Patras – Pyrgos – Kalamata

Kalamata – Messene

Corinth – Nafplio – Tripoli

Since 13th February 2011, due to the Greek financial crisis and subsequent budget cuts by the Greek government, all international services have been suspended,[9] as outlined below.

Thessaloniki – Skopje – Belgrade

Thessaloniki – Sofia – Bucharest

Thessaloniki – Istanbul (Dostluk/Filia Express)

Athens – Sofia

Dork – these actions do not save real real resourses – it merely pushes people over monetary and physical cliffs so the national resourses can be transfered to the core so that they can waste them and call this waste “Growth”

So in the Darling of the Euro club – Turkey( some of that sick fraternity want it in the rocky horror euro show) – is building high speed lines and in Greece they are closing normal rail stuff……..epic failure coming again…….to a cinema near you…………..

Me thinks Turkey will lose favour soon as International capital can’t get the returns it was getting two years ago

omrpublic.iea.org/demand/tu_dl_ov.pdf ….. ready to fall off a cliff me thinks.

It would be truely funny if Greece gets a few scraps of meat from the Euro table as their investments in Turkey implode once again.

omrpublic.iea.org/demand/gr_dl_ov.pdf

How do you know what to invest in if your investments are the only thing creating the demand signal…me thinks you will get the wrong signals.