I started my undergraduate studies in economics in the late 1970s after starting out as…

If only they were operating in the tradition of Minsky!

In the last week, it was alleged that economists such as the IMFs Olivier Blanchard were alleged to be working in the tradition of Hyman Minsky, which by association inferred that they were on top of the crisis – foresaw it, understand why it occurred and offer the best ways out of the mess. Please read my earlier blog – Revisionism is rife and ignorance is being elevated to higher levels – for an introduction to this issue. I argued that this attempted association is plainly false and Blanchard’s monetary economics is more in the Monetarist tradition, which is the anathema to the endogenous money framework that Hyman Minsky worked within. This is no small issue. The economists mentioned are often in leading positions (media, universities, policy) and influence the way the public (and students) think about the policy choices available. By promoting erroneous understandings of the way the monetary system operates, such economists become part of the problem not the solution, no matter if they are currently opposing fiscal austerity. If only they were operating in the tradition of Minsky!

There was an article in the Wall Street Journal (December 17, 1997) – Rx for Japan: Back to the Future, which was reprinted in the Hoover Digest (April 30, 1998) with the revised title of – Reviving Japan. The article was written by Milton Friedman, the doyen of the free market Monetarists – the antipathy of the Minsky-type tradition.

Milton Friedman was providing “step-by-step instructions for resuscitating the Japanese economy” to the Bank of Japan. It should be noted that Milton Friedman’s reputation had taken a severe dent during this period as central banks abandoned their attempts at monetary targetting, a policy approach that was at the core of the Monetarist myth.

One after another central banks learned that no matter what nominal monetary growth targets they set they were unable to control the growth of broad money. This finding was in contradiction with the textbook models that students were taught and the prognostications from upon high by Milton Friedman and his Chicago acolytes.

In this article Milton Friedman was telling the Bank of Japan that:

The surest road to a healthy economic recovery is to increase the rate of monetary growth, to shift from tight money to easier money, to a rate of monetary growth closer to that which prevailed in the golden 1980s but without again overdoing it.

Defenders of the Bank of Japan will say, “How? The bank has already cut its discount rate to 0.5 percent. What more can it do to increase the quantity of money?”

The answer is straightforward: The Bank of Japan can buy government bonds on the open market, paying for them with either currency or deposits at the Bank of Japan, what economists call high-powered money. Most of the proceeds will end up in commercial banks, adding to their reserves and enabling them to expand their liabilities by loans and open market purchases. But whether they do so or not, the money supply will increase.

There is no limit to the extent to which the Bank of Japan can increase the money supply if it wishes to do so. Higher monetary growth will have the same effect as always. After a year or so, the economy will expand more rapidly; output will grow, and after another delay, inflation will increase moderately. A return to the conditions of the late 1980s would rejuvenate Japan and help shore up the rest of Asia.

So the myths in order:

1. The central bank is alleged to be able to control the money supply via open market operations.

2. It does this by buying bonds and expanding the monetary base (“high-powered money”). Note that Friedman says that it would buy the bonds either with “currency or deposits at the Bank of Japan”. Later I will explain why that is an important difference.

3. This will add to the reserves of the commercial banks.

4. In turn, they will be in a better position to lend out the reserves but the money supply will increase irrespective of that because the monetary base has increased.

This is the standard mainstream approach that students in economics courses are forced to learn – it is indoctrination rather than education.

And now let’s consider what Olivier Blanchard’s Macroeconomics textbook imparts to his students. Part Two of the Text is headed The Basics.

Any reasonable interpretation of that would suggest that the material covered in that section of the book would be the essential elements of macroeconomic theory that the students should become familiar with and understand. If they are to “learn” anything then it should be at least “The Basics”

In a Chapter 5 Financial Markets of that part of the Text, students come across a section – The Determination of the Money Supply, which again has a straight-forward meaning.

Two balance sheets are presented – one of the central bank and the other of an aggregate called “banks”. The central bank assets are government bonds and its liabilities are the sum of what Olivier Blanchard calls “central bank money”. We learn that this is the sum of bank reserves and currency (notes and coins).

The banks’ assets are its reserves (at the central bank), the outstanding loans and any government bonds it holds. It liabilities are its deposits.

There is nothing problematic about any of that.

Blanchard defines the money supply as currency held by the public plus the deposits held by banks and clearly it is different to the central bank money.

He then examines “the relation between central bank money and the money supply and says:

We shall see that the money supply is given by

money supply = money multiplier x central bank money

You can think of what we do now as deriving the value of the money multiplier.

What follows is some definitions – central bank money become the monetary base or alternatively high-powered money. He explains that the “origin of this expression is that an increase in central bank money leads, because of the money multiplier, to a more than one-for-one increase in the money supply, and thus is ‘high-powered'”.

Note the causality – “because of”. There is no hint that the money supply might cause the monetary base.

What follows is the tortured algebra/arithmetic that students are forced to learn which shows how changes in the reserve ratio (the ratio of reserves to deposits) and the ratio of currency to deposits (which is influenced by habits, convenience, the cost of getting cash out of the bank etc) influence the money multiplier.

He then speculates on “the size of the money multiplier in the United States” (noting that I am quoting here from the first edition 1997). AFter some arithmetic he derives a value of 2.7 and concludes that:

An increase in the monetary base of $1 increases the money supply by $2.70.

There is a joke among economics lecturers (at the expense of their students). It relates to the expenditure multiplier but could equally be applied to the money multiplier. It goes like this – when a student is asked what is the multiplier, the response is an immediate and confident 5. The joke for those who haven’t studied economics is that the students get so drilled in the algebra and arithmetic (with exercises etc) and rote learn that the expenditure multiplier is equal to 5 rather than understand the concept. The 5, by the way, comes from the assumption that there is not trade or government sector and the households save 20 cents in each extra dollar they receive.

The US Federal Reserve reports that its broad money supply measure (M2) increased by 9.5 per cent in the 12 months from May 2011 to May 2012, rising from 9017.6 billion US dollars to 9874.9 billion.

Over the same period, the US Federal Reserve reports that the monetary base rose from $US2,559,321 million to $US2,614,323 million (at as May 30) an increase of 2.1 per cent.

The alleged money multiplier is given by M = m x H, where the symbols are M is the money supply, m is the multiplier and H is the monetary base, then m = M/H.

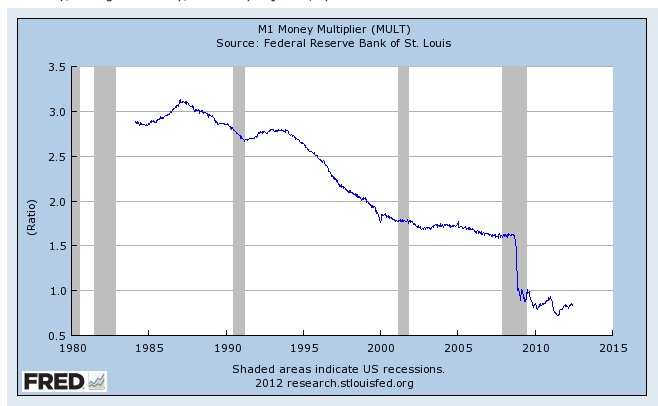

The following graph shows the M1 multiplier (the ratio of M1 to the St. Louis Adjusted Monetary Base) taken from the St. Louis Federal Reserve Bank Fred2 Database. While M1 is a narrower measure of the money supply than M2, this graph for the M2/H ratio would be similar.

The point is that there is no explanatory value in the concept of the money multiplier. Why is this important? Answer: because Olivier Blanchard talks about the central bank controlling the money supply via open market operations:

Now, think of the central bank as changing the stock of money in the economy by buying and selling bonds in the bond market. It it wants to increase the stock of money, the central bank buys bonds and pays for them by creating money. If it wants to decrease the stock of money, the central bank sells bonds and removes from circulation the money it receives in exchange for the bonds.

Later in the Chapter, he says “we can think of the ultimate increase in the money supply as the result of successive rounds of open market operations …” The successive rounds are as the alleged money multipliers works its way through the banking system.

The derivation presented to students by Olivier Blanchard is consistent with the standard mainstream macroeconomics approach that appears in most textbooks. No person operating in the Minskyian tradition would proceed down that route when discussing the role of the central bank or the credit-creation capacity of commercial banks.

The idea that there is a money multiplier m that transmits changes in the so-called monetary base (H) (the sum of bank reserves and currency at issue) into changes in the money supply (M) is at odds with the way the modern monetary system actually works.

The standard treatment (followed by Blanchard) alleges that multiplier works as follows (assuming the bank is required to hold 10 per cent of all deposits as reserves):

- A person deposits say $100 in a bank.

- To make money, the bank then loans the remaining $90 to a customer.

- They spend the money and the recipient of the funds deposits it with their bank.

- That bank then lends 0.9 times $90 = $81 (keeping 0.10 in reserve as required).

- And so on until the loans become so small that they dissolve to zero

None of this adequately describes how the banks actually make loans. It is an important device for the mainstream because it implies that banks take deposits to get funds which they can then on-lend. But given that the prudential regulations require the banks keep a little in reserve, we get this credit creation process ballooning out due to the fractional reserve requirements. Of-course, many nations have not reserve requirements.

The money multiplier myth also leads students to think that as the central bank can control the monetary base then it can control the money supply. These two considerations are crucial to the mainstream approach to inflation and its antipathy to government deficits.

They assert that as inflation is (in their approach) the result of the money supply growing too fast then the “government” is to blame because the monetary base must have been expanding too fast. This leads to claims that if the government runs a budget deficit then it has to issue bonds to avoid causing hyperinflation. This is at the basis of the opposition to central banks facilitating treasury spending without any bonds being issued to the private markets

Unfortunately, none of the arguments hold water.

First, the central bank does not have the capacity to control the money supply in a modern monetary system. In the world we live in, bank loans create deposits and are made without reference to the reserve positions of the banks. The bank then ensures its reserve positions are legally compliant as a separate process knowing that it can always get the reserves from the central bank. The only way that the central bank can influence credit creation in this setting is via the price of the reserves it provides on demand to the commercial banks.

Second, this suggests that the decisions by banks to lend may be influenced by the price of reserves rather than whether they have sufficient reserves. They can always get the reserves that are required at any point in time at a price, which may be prohibitive.

Third, the money multiplier story has the central bank manipulating the money supply via open market operations. So they would argue that the central bank might buy bonds to the public to increase the money base and then allow the fractional reserve system to expand the money supply. But a moment’s thought will lead you to conclude this would be futile unless a support rate on excess reserves equal to the current policy rate was being paid.

Why? The open market purchase would increase bank reserves and the commercial banks, in lieu of any market return on the overnight funds, would try to place them in the interbank market. Of-course, any transactions at this level (they are horizontal) net to zero so all that happens is that the excess reserve position of the system is shuffled between banks. But in the process the interbank return would start to fall and if the process was left to resolve, the overnight rate would fall to zero and the central bank would lose control of its monetary policy position (unless it was targetting a zero interest rate).

In lieu of a support rate equal to the target rate, the central bank would have to sell bonds to drain the excess reserves. The same futility would occur if the central bank attempted to reduce the money supply by instigating an open market sale of bonds.

In all cases, the central bank cannot influence the money supply in this way.

Fourth, given that the central bank adds reserves on demand to maintain financial stability and this process is driven by changes in the money supply as banks make loans which create deposits.

So the operational reality is that the dynamics of the monetary base (MB) are driven by the changes in the money supply which is exactly the reverse of the causality presented by the monetary multiplier.

So in fact we might write H = M/m.

Please read my blogs – Money multiplier and other myths and 100-percent reserve banking and state banks and Building bank reserves is not inflationary and Building bank reserves will not expand credit and – Lost in a macroeconomics textbook again for more discussion on this point.

Which brings me to this interesting blog in the Financial Times Alphaville column (July 3, 2012) = The base money confusion. The article (blog) reported an E-mail exchange the author had with one Peter Stella, who was formerly head of the Central Banking and Monetary and Foreign Exchange Operations Divisions at the International Monetary Fund and is now a private economic consultant.

He had E-mailed the FT because “he feels is a gross misunderstanding in policy and journalistic circles regarding the nature of central bank reserves, and the myth that banks are not lending because they prefer not to.”

He told the FT that:

From journalists, former colleagues, professors at Harvard, Yale and Columbia. I have been reading similar ideas/commentary for almost 5 years. That is, somehow bank reserves at the central bank ought to be “lent out”, i.e. should exit the “vault” of the BOE, Fed or ECB and begin circulating in the economy. The obverse of this is that an increase in excess reserves at the central bank reflects commercial banks “hoarding” liquidity rather than lending it “out”.

Those who appreciate Modern Monetary Theory (MMT) will know that this has been one of our central themes – that banks do not lend out reserves. Reserves are to facilitate the smooth functioning of the payments system.

This is one of our key points when considering why quantitative easing has not stimulated aggregate demand as much as some policy makers considered it would.

The FT concludes that “base money quantity is always determined by the central bank and nobody else. If the central bank chooses to create excess base money, no matter how much lending goes on, excess base money will remain on the balance sheet at the central bank.”

It is clear that the central bank does not determine the money supply (broad money) but it does have discretion as to the reserves that are outstanding – to a point. That point is that it has to be ready to supply reserves to the commercial banks if requested. If it refused to do so, then the payments system would be compromised and financial stability would be threatened.

So while the central bank may demand a penalty for supplying reserves on demand to the commercial banks, it has little choice but to supply them according to its charter to maintain financial stability.

The FT quote Peter Stella as follows:

My frustration lies in my inability to explain to “sophisticated” people why in a modern monetary system-fiat money, floating exchange rate world-there is absolutely no correlation between bank reserves and lending. And, more fundamentally, that banks do not lend “reserves”.

Commercial bank reserves have risen because central banks have injected them into a closed system from which they cannot exit. Whether commercial banks let the reserves they have acquired through QE sit “idle” or lend them out in the interbank market 10,000 times in one day among themselves, the aggregate reserves at the central bank at the end of that day will be the same.

There is nowhere else they can go in a closed system. I cannot hold a deposit at the ECB, or at the Fed, or at the Bank of England. Not even the Fed’s primary dealers have accounts at the Fed, they operate through clearing banks who are depository institutions. So it simply not possible for the banking system as a whole to make its deposit balances at the central bank decline by trading with anyone other than the central bank itself.

Another central concept in MMT is the distinction between vertical and horizontal transactions. The latter – between non-government entities (banks, households, firms) all net to zero in terms of their impact on net financial assets in the economy.

It is only by vertical transactions – those that occur between the government (consolidated as the treasury and central bank) and the non-government sector – that changes in net financial assets denominated in the currency of issue can occur.

That is why, in the absence of a support rate being paid on reserves, the central bank has to issue to debt to drain excess reserves from the system if it wants to target a positive interest rate (its policy rate). It has no choice. The commercial banks will try to lend their excess reserves to other banks on the interbank market overnight but such a move will only shuffle the excess around not eliminate it.

The FT explains it this way “Reserves, also known as base money, can only be extinguished by the central bank as part of strategic balance sheet reduction policy. This in itself can only be achieved through outright asset sales, reverse repos, negative rates or to a lesser extent by auctioning term deposits.”

Please read the following introductory suite of blogs – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3 – for basic Modern Monetary Theory (MMT) concepts.

There is one exception that is noted by Peter Stella:

It is true that banks could reduce their excess deposits at the central bank by exchanging them for physical banknotes and then lend (sic) those banknotes out to retail customers.

While this strategy has been deployed in cases of financial crisis (usually in less developed banking systems) it is definitely not normal practice.

Conclusion

One could hardly call Peter Stella a MMT adherent. But he clearly has a good understanding of how banking operates and some of his recent IMF papers (before he left) provide similar accounts that are quite at odds with the mainstream view of financial operations.

Given how diametric the two versions of monetary system (and banking in particular) operations are, one wonders why the erroneous mainstream theory has been able to hold on to its dominant position.

Even policy makers are infused with these incorrect understandings provided to them by economists from leading schools – Harvard, Yale, Princeton, Berkeley and others.

University lecturers just have to stop using these textbooks. They have to give their students a chance to learn. If they are too lazy to update their own knowledge as they abandon the mainstream myths then they should resign forthwith.

I have to run for a flight now.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

And Federal Taxation – a vertical drain?

Dear Bill

You wrote about the 2nd myth, “It does this by selling bonds and expanding the monetary base …”. Shouldn’t that been “It does this by buying bonds …”

Regards. James

Regarding:

“It is only by vertical transactions – those that occur between the government (consolidated as the treasury and central bank) – that changes in net financial assets denominated in the currency of issue can occur.”

I continue to wonder why critical ideas like this one get jumbled and lost through sheer verbal or typographic ineptitude. MMT is big enough to support some proof-reading for its heavy hitters.

Dear Dale (2012/07/05 at 22:06)

Thanks for pointing out the unfinished sentence. I appreciate the scrutiny.

You might also like to start fund-raising for us to employ a host of people to help us in our work. Time is always short for me.

best wishes

bill

Dear James Schipper (at 2012/07/05 at 20:44)

Exactly right. Thanks very much. I was rushing this morning to get to the airport and that is what happens when one rushes and has other interruptions.

best wishes

bill

I believe this should be that they have a reserve requirement of 0%, i.e., the reserve balance must not be negative at the close of reserve operations.

I find it fantastic (as in fantasy land) that “sophisticated” people pass this over without note. If their multiplier theory were true, these 0% reserve economies could hyperinflate at any time, a divisor of zero yielding a multiplier of infinity, which of course none do. This is simple arithmetic, not some complicated theory of economic causality. This is real time evidence that the multiplier cannot possibly exist (or at least that it is irrelevent), yet this seems to be completely ignored by the mainstream.

I can see debating theories of causality, even if one’s theory is wrong, but how does one debate arithmetic?

Perhaps it would help if readers are reminded that Wikipedia is a good place to find about terminology.

http://en.wikipedia.org/wiki/Chartalism#Vertical_transactions

I am not sure if this is the right place to be asking these questions but I will anyway. It is relatively recently that I have been attempting seriously to understand how money and the banking system work and I am making progress. Perhaps someone can help me further.

1. Taking Westpac as an example, total housing, personal and business loans are, in round figures, $500bn. Deposits are $370bn. Debt issues are $166bn. This seems to indicate that when Westpac has issued loans and created deposits to match, one quarter of those deposits have leaked elsewhere. Since the other banks are in a similar position, it seems that something like one quarter of the total endogenous money created by loans has gone outside the banking system. Where has it gone?

All the banks have borrowed money so that the total borrowings plus deposits are slightly more that their loans. This means that although the banks can create money out of thin air, as someone has described it, they need to borrow at least one quarter of that to maintain a secure position. This means that they do need to have some money in order to lend money, contrary to what is often said, even though this need may be after the event.

If we look at the Bank of America, the situation is slightly different, if I have read the balance sheets correctly. They list their deposits as being greater than their loans.

2. On different tack, let’s consider the financial system to consist of the three agents: the banking sector, the private (non-banking) sector, i.e. firms plus householders/workers, and the government/central bank. When the banks make a loan to the private sector and then charge interest on that loan, the private sector has a loss of net financial assets. If such loans are continued to be made by the banks, the private sector becomes insolvent when all its previous funds are used up paying the interest on the loans. There is no way the private sector can repay the loans, even if it acts in concert, unless:

The government injects funds with deficit spending;

There is an external surplus;

The banks spend all their profits into the private sector.

Doesn’t this mean that continual bank loans must lead to bankruptcies?

It also seems to me that this analysis applies if we consider the agents as being the European banks, the countries of the eurozone and the European central bank. The current situation is therefore no surprise. Am I missing something in all this?

Great article Bill. I love it when you do the banking stuff.

Ignore the typo terrorists.

Friedman’s “monetary base” is not now, nor has ever been, a base for the expansion of new money & credit. Today both increases in excess reserves, & currency held by the non-bank public, are contractionary. I.e., the “money multiplier” (MULT) is not an expansion coefficient either.

However, in fact, the Fed can control the money stock via OMOs. Open market operations should be divided into 2 separate classes (#1) purchases from & sales to, the commercial banks; & (#2) purchases from, and sales to, others than banks. (#2) always results in an increase in both legal reserves & the money supply.

See: http://bit.ly/yUdRIZ

Quantitative Easing and Money Growth:

Potential for Higher Inflation?

Daniel L. Thornton

Monetarism has never been tried. The Keynesian economists on the Fed’s research staff have now cooked up IOeR’s (remunerated excess reserve balances) that:

(1) ABSORB both existing bank deposits within the CB system (taking Treasuries, or safe assets, off the market), as well as;

(2) ATTRACT monetary savings from the non-banks (shadow banks).

The runs on the shadow banks stemmed not from their inherent risks (credit, liquidity, & market), nor their complex financing practices (e.g., re-hypothecation), but from Bernanke’s self-destructive money policies (contractual money policy & the payment of interest on inter-bank demand deposits). It was Bernanke’s monetary policies that caused destablizing disruptions (fast markets) in currencies & interest rates (e.g., the collapse of Bear Sterns & Lehman Bros.).

IOeR’s have displaced reserve requirements as the Fed’s credit control device. The introduction of IOeR’s (like a Pyrrhic victory), induced dis-intermediation within the non-banks (where the size of the commercial banking system remains the same), but the size of the shadow banks shrinks (broad credit).

IOeR’s impound monetary savings within the CB system. IOeR’s result in a cessation of circuit income, & the transactions velocity of funds. IOeR’s reduce real-output. IOeR’s require large doses of new money to counteract (their deflationary & contractionary impact). IOeR’s propagate stagflation. IOeR’s have stunted the economic recovery.

@Tony:

Loans are assets and deposits are liabilities for the banks. When they loan, the create an equal and opposite amount of both – which cancel each other out. Before it was 0 = 0, after it’s 10 – 10 = 0. As for interest, think of it as a simple fee for privilege of borrowing money. It’s just a payment, like when you buy a burger, except you get a loan in return instead of something more tangible.

“always results in an increase in both legal reserves & the money supply”

Except that it doesn’t – because those selling were already predisposed to sell.

As usual the focus is on the supply side, without consideration of what the demand is. For the Fed to be able to buy those bonds it had to outbid a buyer. What happens to the money the outbid buyer has in their hands?

That buyer was predisposed to *save*. That’s why they were in the market for bonds. They are not going to go off and spend that money. They are going to do the next best thing with it – pay down debt, or stick it in the bank and wait for the next auction in a few days time.

And the evidence of QE is that is exactly what is happening.

When they loan, the create an equal and opposite amount of both – which cancel each other out. Grigory Graborenko

Not really. The purchasing power creation (the liability, the loan) is immediate while the destruction of that purchasing power (the asset, the repayment of the loan) takes place over time. One is trying to cancel the certain present with the uncertain future! Moreover, since the loans create the principal but not the interest for the loan repayment then in aggregate some loans MUST default unless the interest itself is loaned into existence or the government creates new money (deficit spending).

And then there is the moral problem of determining who is “creditworthy.” Since credit is new purchasing power, it necessarily dilutes existing purchasing power, at least temporarily. So credit creation is essentially a tax on the less or non “creditworthy”.

Not that private money (for private debts only) creation is bad; it isn’t. But we can do better than usury for stolen purchasing power. Common stock, for example, is one form of ethical private money that “shares” wealth rather than reaps it.

Bill,

I don’t know if I missed something this week on the subject but i’d like to know your opinion about the policy now being implemented in argentina forcing banks to lend fixing a maximum rate.

Thanks

Professor, as always a very informative article.

To Tony

No, you’re not missing anything.

It’s an international endogenous ponzi sheme.

Not that important to MMT, generally.

Google up ‘How Debt Money Goes Broke’.

sshhhhh.

“”The standard treatment (followed by Blanchard) alleges that multiplier works as follows (assuming the bank is required to hold 10 per cent of all deposits as reserves):

A person deposits say $100 in a bank.

To make money, the bank then loans the remaining $90 to a customer.””

Bill, either NOBODY can really believe that, or its mis-stated.

Banks neither “hold” 10 percent of their deposits in reserves, nor do they lend their “remaining” deposits.

Banks hold ALL of their deposits and make additional loans that represent a maximum proportional relationship to the amount of their deposits – in order to meet their reserve management requirements.

Otherwise money wouldn’t really expand.

The Fed’s Modern Money Mechanics has this to say about deposits($10K) that increase their excess reserves by $9K:

“”If business is active, the banks with excess reserves probably will have opportunities to loan the $9,000. Of course, they do not really pay out loans from the money they receive as deposits. If they did this, no additional money would be created. What they do when they make loans is to accept promissory notes in exchange for credits to the borrowers’ transaction accounts. Loans (assets) and deposits (liabilities) both rise by $9,000. Reserves are unchanged by the loan transactions. But the deposit credits constitute new additions to the total deposits of the banking system.””

New Money as we call it.

Perhaps another problem I have with the myth of the ‘money-multiplier myth’.

Perhaps just mis-stated.

Thanks.

“Except that it doesn’t – because those selling were already predisposed to sell”

“Not really. The purchasing power creation (the liability, the loan) is immediate while the destruction of that purchasing power (the asset, the repayment of the loan) takes place over time”

Your both wrong.

Professional economists have no excuse for misinterpreting the savings investment process. They are paid to understand and interpret what is happening in the whole economy at any one time. For the commercial banking system, this requires constructing a balance sheet for the System, an income and expense statement for the System, and a simultaneous analysis of the flow of funds in the entire economy.

The expansion of bank credit and new money-TRs (transaction deposits) by the CBs can be demonstrated by examining the differences in the consolidated condition statements for the banks and the monetary system at two points in time.

Increases in CB loans and investments/earning assets/bank credit, are approximately the same as increases in TRs & time deposits/savings deposits (TDs)/bank liabilities/bank credit proxy (excluding IBDDs).

That the net absolute increase in these two figures is so nearly identical is no happenstance, for TRs largely come into being through the credit creating process, and TDs owe their origin almost exclusively to TRs – either directly through transfer from TRs or indirectly via the currency route.

There are many factors, which can, and do, alter the volume of bank deposits, including: (1) changes in currency held by the non-bank public, (2) in bank capital accounts, (3) in reverse repurchase agreements, (4) in the volume of Treasury currency issued and outstanding, and (5) in Reserve Bank credit. Although these principle items are largest in aggregate, they nevertheless have been peripheral in altering the aggregate total of bank deposits.

For the Monetary System:

Thus the vast expansion of deposits occurred despite:

(1) an increase in the non-bank public’s holdings of currency $801.2b

(2) an increase in other liabilities & bank capital $39b

(3) an increase in matched-sale purchase agreements $32.2b

(4) an increase in required-clearing balances $6.7b

(5) the diminution of our monetary gold & silver stocks; etc.(-)$6.6

(6) an increase in the Treasury’s general fund account $4.9b

Factors offset by:

(1) the expansion of Reserve Bank credit $847.5b

(2) the issuance of Treasury currency; $35.9b

These “outside” factors made a negligible contribution in bank deposit growth the last 67 years of $4.4b (deposits declined by $877.4b and were offset by the expansion of $883.4b).

For the incredulous reader I make this assignment: Please explain how the volume of TRs and TDs could grow since 1939 from $48 billion, to $ 8,490 (NSA) billion, even while the banks were paying out to the non-bank public a net amount of (-)$801.2 billion (NSA) in currency.

Federal Reserve Bank credit since 1939 (2.6b), has expanded by billion 847.5 (NSA), (-$801.2 of which was required to offset the currency drain from the commercial banks. The difference in the above figures outlined above was sufficient to supply the member banks with $46b of legal reserves.

And it is on the basis of these legal reserves that the banking system has been able to expand its outstanding credit (loans and investments) by over (+) $8,462 trillion (SA) since 1939. (40.7)

@Tony: don’t waste your time googling silly rants about Ponzi schemes. There is a simple answer to your questions: holdings of Government bonds and other securities. When banks report their “loans” they refer to loans to customers, so these represent only a portion of their assets. A bank’s balance sheets will balance: Assets = Liabilities + Equity. But liabilities include more than just deposits (wholesale borrowing is there too, as you noted) and assets include more than just loans. So, in general, a bank may have more loans than deposits or vice versa. For some years now, Australian banks have made significant use of wholesale markets, particularly offshore (linked to the fact that Australia runs a current account deficit) and so they all have deposit balances that are less than their loan balances. In some other countries, the opposite is the norm.