It is true that all big cities have areas of poverty that is visible from…

Euro leaders need to eat humble pie at this summit – but they won’t!

The European leaders are preparing for yet another summit, where the good food will be served and the fine wine will be flowing. One loses count of how many summits there have been since the crisis began. They all promise to deliver the solution but usually end up with some weak worded document about fiscal integration and growth, which quickly descends into increasingly zealous statements about obedience to fiscal rules and monitoring and punishment frameworks and, if you will excuse me, the whole Spanish Inquisition thing! I don’t mean to malign the Spanish here. Rather just calling up historical patterns of behaviour that always end in pain and suffering. The latest signs are that the ECB is continuing to keep the whole boat from sinking while the Germans continue to claim they are the victims. The Euro leadership continues to be obsessed with rules. The financial markets continue to punish the whole setup. Another day in the European crisis. There is a collective denial operating at present and until facts are faced up to (which might require some humble (vegetarian) pie being eaten rather than what is probably on offer in Rome during the current summit) – nothing much is going to be achieved other than rising unemployment and social dislocation. This is truly a mad situation.

But first to Britain where the British Office of National Statistics put out their latest – Public Sector Finances, May 2012 – data yesterday (June 26, 2012), which showed what happens when a government tries to work against the economy by imposing pro-cyclical fiscal policy (that is, deliberately contracting when the non-government sector is also fragile or contracting).

In trying to reduce budget deficits in those circumstances, fiscal austerity only increases them.

The ONS said that:

For measures excluding financial interventions:

the public sector current budget was in deficit by £16.9 billion; this is a £2.7 billion higher deficit than in May 2011, when there was a deficit of £14.2 billion;

public sector net borrowing was £17.9 billion; this is £2.7 billion higher net borrowing than in May 2011, when net borrowing was £15.2 billion;

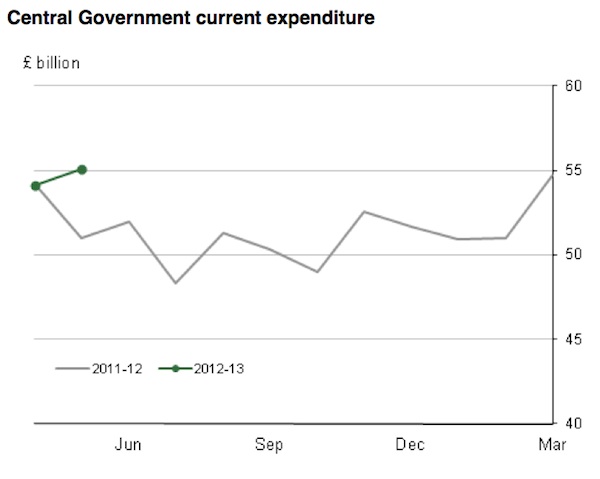

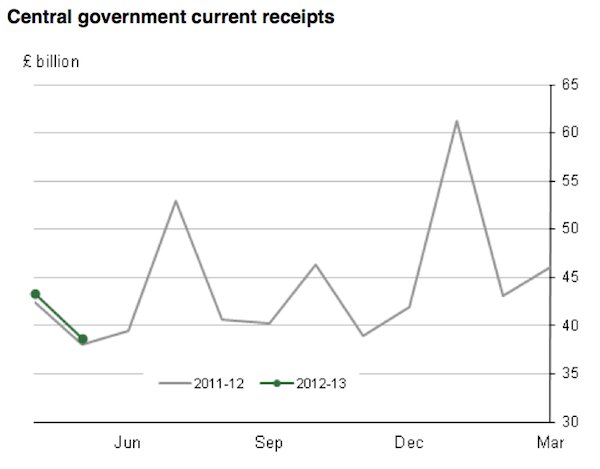

What has been going on? The following two graphs are taken from the ONS publication and show central government spending (first) and revenue (second). Due to the fiscal austerity, the British economy is now in a double-dip recession and income tax receipts fell by more than 7 per cent over the 12 months to May 2012 while government spending rose by 8 per cent.

This is the classic demonstration of the endogenous nature of budget balances. Please read my blog – Structural deficits – the great con job! – for more discussion on this point.

The government should never work with the cycle – that is, engage in what we call pro-cyclical fiscal policy. It should always be prepared to temper the business cycle not reinforce it.

Fiscal austerity is the exemplar of irresponsible and damaging fiscal conduct. That view is not confined to proponents of Modern Monetary Theory (MMT). In fact, most economists (other than the those extreme free market-government hating ideologues) would agree with that assessment.

It is obvious that the British Chancellor will claim it is all Europe’s doing. But then he would be lying. If you examine the data carefully it is clear that the slowdown in the British economy started well before the latest shenanigans in Europe. And if Europe was really the problem why would Mr Osborne and Co change fiscal course and recognise that an export-led recovery is passing Britain by and the persistently high unemployment is killing private domestic sector confidence?

He prefers to mislead the British public. Meanwhile, the rising deficit will help dampen the dive into recession.

And … over the Channel

The President of the European Council distributed a Report from Brussels on June 26, 2012 – TOWARDS A GENUINE ECONOMIC AND MONETARY UNION. This is the final public document with covering letter.

It says that:

The economic and monetary union (EMU) was established to bring prosperity and stability across Europe. It is a cornerstone of the European Union. Today the EMU is facing a fundamental challenge. It needs to be strengthened to ensure economic and social welfare.

Yes, because it has failed to fulfill its charter. It has brought economic pestilence to Europe.

The Report proposes “a strong and stable architecture in the financial, fiscal, economic and political domains, underpinning the jobs and growth strategy

The first part of the proposal deals with the creation of an “integrated financial framework” with an emphasis on coordinated banking supervision and bank deposit guarantees. In general, I agreed with the points made and I will consider them in another blog.

The second part of the proposal focuses on an “integrated budgetary framework”.

The vision of a federated Europe presented in the proposal is one of obedience to “common rules” and a compliance structure to enforce these rules.

The EC President confirms that they desire:

… the swift and vigorous implementation of the measures already agreed under the reinforced economic governance framework (notably the Stability and Growth Pact and the Treaty on Stability, Coordination and Governance), but also a qualitative move towards a fiscal union.

That is, fiscal austerity driven by a set of rules that are incapable of dealing with asymmetrical fluctuations in aggregate demand in such a way that recessions and high levels of unemployment can be avoided.

The fiscal compact that claim is necessary promises an austere future of entrenched unemployment and rising poverty.

The EC President proposes:

… upper limits on the annual budget balance and on government debt levels of individual Member States could be agreed in common. Under these rules, the issuance of government debt beyond the level agreed in common would have to be justified and receive prior approval. Subsequently, the euro area level would be in a position to require changes to budgetary envelopes if they are in violation of fiscal rules …

Why should a member-state within such a system be forced to target and be accountable for aggregates that they cannot strictly control. Think about Spain – they were running budget surpluses before the crisis hit.

The operation of the automatic stabilisers (counter-cyclical fluctuations in tax revenue and welfare spending) ensure that the spending and saving decisions of the non-government sector ultimately determine the budget outcome.

In a world where the governmental structure is committed to prosperity – which means low unemployment is a necessary condition – the federal system has to allow the budget balance to vary with the business cycle – quite apart from discretionary net spending levels that might be required to maintain full employment independent of the cycle.

Normally, a small, continuous deficits will be required independent of the cycle to ensure there is sufficient aggregate demand growth to generate full employment.

These deficits will increase, in some cases by a relatively large amount, when non-government spending deteriorates. The fact we have seen deficits up around 10 per cent of GDP in the recent crisis is not a reason to be alarmed. The reality is that to maintain full employment in most nations, the deficits would have had to have been significantly larger than this.

But that flexibility in the budget process is what is required to fulfill the charter of advancing public purpose.

The proposed “fiscal union” in Europe presents the anathema of that required flexibility. In other words, while a sound and responsible currency-issuing government allows the budget to adjust to non-government aggregate demand fluctuations, the proposed European model will force employment to adjust.

That is a poorly conceived model of fiscal union that should be rejected.

The EC President’s proposal also says that:

In a medium term perspective, the issuance of common debt could be explored as an element of such a fiscal union and subject to progress on fiscal integration. Steps towards the introduction of joint and several sovereign liabilities could be considered as long as a robust framework for budgetary discipline and competitiveness is in place to avoid moral hazard and foster responsibility and compliance.

There are only two options for an effective federal-state monetary system.

First, the federal entity – the currency-issuer – has to be able to spend freely and issue debt to match that net spending if there are voluntary rules in place to prevent the central bank from directly “funding” the treasury operations at the federal level. That is the least preferred option.

Second, the central bank and the treasury – the two parts of the consolidated government sector – ensure that the treasury operations are executed without disruption to financial system. That is, the central bank credits private bank accounts according to the spending desires of the treasury. That is the preferred option. The federal government – as the currency-issuer does not issue debt to the private sector.

As I explain further on, this sort of system works best if the federal and state governments have clearly delineated spending and taxation responsibilities. The EC President’s proposal is light-years from anything like that.

Even within the current flawed state, the only way a fiscal union will work is if the ECB (the currency-issuer) cooperates with the “federal fiscal arm” in Brussels, to underwrite a Euro-bonds issue. This central bank underwriting is implicit in all effective federal systems such that the “financial markets” form the view that the federal entity and its debt is always solvent. The markets know that, ultimately, the central bank will ensure the obligations are always met.

Relying on “bailout funds” such as the proposed European Stability Mechanism (ESM), which is the current plan (to avoid common liabilities such as Eur bonds) will fail to appease the markets because they know that this is just a fund largely supported by governments that all face solvency risk – given that most of the participants do not issue their own currencies.

In other words, once again, the Euro leadership is failing to appreciate the real problem facing them.

As an aside to the ESM, consider this report from the Irish Times (June 22, 2012) – German court halts stability fund ratification – which reports that the German Constitutional Court has demanded that the German President does “not to sign into law the Bill for the permanent bailout fund until the judges have ruled on several constitutional complaints, likely to be filed as early as next week”.

This relates to the European Stability Mechanism, which was expected to be activated on July 9, 2012, after next week’s EU leader’s meeting in Brussels.

The German government had stitched up enough votes (“the necessary two-thirds Bundestag majority”) to push it through this Friday although 9 nations are “still to ratify the treaty”.

Clearly if the Court rules in favour of those that oppose the German involvement in the ESM then the crisis will deepen, even though the financial markets understand that the ESM without ECB backing is really the insolvent lending to the insolvent.

The Irish Times quoted the German finance minister Wolfgang Schäuble who said “I don’t view it as clever when constitutional organs communicate with each other in public.”

In terms of the fiscal union plan, Wolfgang Schäuble gave a lengthy interview to German newspaper Spiegel – – on June 25, 2012, where he said that there was always the intention to create a fiscal union:

If we had always said we would only take steps toward integration if they would immediately work 100 percent, we would never have advanced by so much as a meter. That’s why we wanted to introduce the euro first and then quickly make the decisions needed for a political union.

I laughed when I read “quickly make the decision”. They have been dragged into creating a fiscal union by 4 years of damaging economic crisis. And still the Germans fail to understand exactly what a successful fiscal union would look like.

He was asked whether he wanted “nothing less than a United States of Europe” to which he replied:

Even though the term is used repeatedly, it doesn’t make it any better. No, the Europe of the future will not be a federal state based on the model of the United States of America or the Federal Republic of Germany. It will have its own structure. It’s an extremely exciting venture.

And further on what that “extremely exciting venture” might look like:

No, we must not and cannot ever make decisions in Europe that apply uniformly to all. Europe’s strength is precisely its diversity. But there are things in a monetary union that are done more effectively at the European level … The most important thing is that we create a fiscal union, one in which the nation states give up their jurisdiction in terms of fiscal policy.

And what does that mean?

The Finance Minister agreed that if there was a fiscal union then the concept of “joint liability for debts” would be entertained (but not before). The fiscal union:

In an optimal scenario, there would be a European finance minister, who would have a veto against national budgets and would have to approve levels of new borrowing. It would be up the individual countries to decide how to spend the approved funds, that is, how to answer the question: “Should we spend more money on families or on road construction?” … one thing is also clear: Those who want a strong Europe also have to be willing to surrender decisions to Brussels … the [European] Commission has to develop into a real government. To that end, it ought to be elected directly, either by the parliament or through the direct election of a Commission president … the European Parliament has to be strengthened, of course. That’s why it must finally be given the power to enact bills.

He also indicated there should be a “states house” as part of the overall Federal goverment similar to the US or Australian Senate which is designed to protect the interests of the member states

So there is some confusion in this thought-process.

In federal systems there is usually a constitutional split in spending and taxation powers which means that the member states have autonomy

When Australia became a Federation (a nation) in 1901, having previously been a collection of colonies, the Australian Constitution gave the Federal (Commonwealth) government responsibilities for external affairs and national economic policy, while the State governments continued to provide a range of services including education, health, law and order, local roads, utilities, rail and ports and water. Some of these infrastructure and utility responsibilies are shared with Local government.

Over time, various agreements have seen the Federal government involved in education, health and telecommunications. Further, other changes (for example, the handing over of income tax powers to the Commonwealth) have meant that the Commonwealth has most of the revenue raising capacity while the states have most of the spending responsibilities.

To overcome the vertical imbalance, an elaborate structure of revenue-sharing evolved and is supervised by the Commonwealth Grants Commission in liaison with the State and Local Governments.

Further, via the Australian Loan Council, which is “a Commonwealth-State ministerial council that coordinates public sector borrowing” loans are raised to accommodate the individual state budgets.

The Loan Council arrangements “operate on a voluntary basis and emphasise transparency of public sector financing rather than adherence to strict borrowing limits. These arrangements are designed to enhance financial market scrutiny of public sector borrowing and facilitate informed judgments about each government’s financial performance”. In other words, the Federal government does not send a “Finance Minister” to any state to reject their budgets.

The State governments are elected directly and the Federal government does not interfere with their fiscal decisions, allowing the individual states to rise and fall on their own fortunes. In part, this is because the fiscal responsibilities are clearly delineated.

However, as the currency-issuer, the Federal government always stands ready to provide funds to the States in times of crisis (for example, the 2011 floods and cyclone damage in Queensland) and instigate spatially targetted fiscal stimulus if a particular state or region is in trouble.

The flexibility of this system as in the US is that the Federal Government always has the capacity to defend the overall economy in times of major aggregate demand failure. Whether they issue federal debt to the private markets or instruct the central bank to purchase their debt is irrelevant in this case.

The bond markets understand that such a government is risk-free because it issues its own currency and if worse comes to worse (say, its tax base collapses) it will always change regulations to make that currency-issuing capacity transparent. That is, the central bank will always ensure the government is solvent in its own currency.

The federal plan that the German Finance Minister proposes would not appear to accord with that model. The concept of a fiscal union being pushed does not propose (as well as I can glean from all the current literature) a division of responsibilities (spending and taxing) and level of government accountability (via the ballot box) for the execution of those responsibilities.

Rather, it conjures up a vision of a centralised watchdog who will monitor member-state budgets and reject them if they exceed some fiscal rule – presumably as specified in the fiscal compact that was placed on the table last December. If that is true, then the fiscal union will fail because it would be in the same bind as the member-state is now.

Faced with a deteriorating domestic economy, the fiscal rules would be breached and austerity would be demanded. There is no hint that the “federal arm” of the fiscal union would act as the Australian or US governments act and defend the interests of particular member states if asymmetry reigned.

So where does all that sit with Dr Merkel?

There was a Reuters Report overnight (June 27, 2012) – ‘Not as long as I live’ – Merkel buries euro bonds – which claims that the German leader:

… sought to bury once and for all the idea of common eurozone bonds overnight, saying Europe would not share total debt liability “as long as I live”, as the bloc’s big four finance ministers met to narrow differences on how to solve a worsening debt crisis.

That sounds pretty final – at least for today!

The story says that in the context of the EC President’s Report (discussed above) the German chancellor:

… immediately stamped on the idea of mutualising debt – favoured by France, Italy and Spain …

They quoted her:

I don’t see total debt liability as long as I live … [Euro bonds are] … economically wrong and counterproductive …

From which you conclude that she, for one, want unemployment to be the buffer stock and given the fiscal rules – significant pools of unemployment and low wage workers to become the norm.

And then there is Cyprus.

Conclusion

My guess is that the Euro leaders will appease the markets for about one day when they announce some form of dialogue to implement a fiscal union. The next day it will be all on again as Spain and soon Italy head for the same oblivion that Greece is now in.

They have to eat that humble (v) pie before there will be real change and a renewed focus on employment generation and poverty alleviation in Europe.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

‘Meanwhile, the rising deficit will help dampen the dive into recession.’ A point made by Warren Mosler. But, how can one be happy about that? I wonder also if dismantling the automatic stabilizers is next on the agenda.

“They have to eat that humble (v) pie before there will be real change and a renewed focus on employment generation and poverty alleviation in Europe.”

That can come only on a sustainable basis from the nation-states of EZ re-assuming the basic rights of self-determination and independence.

States in EZ summing up the majority of population were colonizers in ways small to big. One is tempted to hypothesize that one of the forces under this disgrace is an underlying Christian-like mindset. Becoming colonies of no one in the present to pay for the sin of having been colonizers of some one in the past…

Rhetorically, Bill asked, “One loses count of how many summits there have been since the crisis began.”

The Answer, rhetoric be d*mned, “20th such ‘make or break’ summits in 2-1/2 years.”

Good idea for a movie. The assassination of Angela Merkel.

Maybe the best thing is for Germany to leave the Euro (nobody mentions this). Then the others might agree, the value of the Euro would drop (Hopefully most of their debts are in Euros and not Yuan) and Europe would become more competitive.

Of course then the Deutschmark would shoot up (for a short time) and Germany would be less competitive – and I don’t suppose they’d like that.

Hello Jim Underwood (Thursday, 28th June 2012 at 12:17hrs)

I agree that Germany leaving (or being kicked out of) the Eurozone doesn’t get proposed nearly as often and as widely as it should in the mainstream media, however I have seen it mentioned several times by one of the journalists at the UK’s Telegraph newspaper website (not sure about the printed edition of that paper). The journalist’s name is Ambrose Evans-Pritchard.

\\.

Jim Underwood: Marshall Auerback has often proposed Germany leaving the Euro as a solution for the Euro’s immediate, dire problems. It would surely be popular in Germany. If Germany were reasonable, of course it would welcome the rise in the new Mark. All it would have to do to keep its economy humming & deal with new competitiveness “problems” is to print enough of them, run a big enough deficit. But that’s a big “if”.

Marshall Auerback: To Save the Euro, Germany Has to Quit the Eurozone

WHAT HAPPENS IF GERMANY EXITS THE EURO?

Germany Faces a Messy Break-up with the Euro