The other day I was asked whether I was happy that the US President was…

The Euro crisis is all their own doing

I gave an interview today for SBS (Special Broadcasting Service), which is a national multicultural radio/television network in Australia. They wanted to know whether I thought the crisis in Europe had now stabilised given the Greeks avoided “chaos” by voting for New Democracy and more austerity. They also noted that the financial markets were turning on Spain and Italy. I responded by suggesting their question answered itself and that it would be better not to be seduced by the Euro elite spin that Greece is now firmly in the Eurozone and markets will stabilise with austerity. The reality is that the election outcome in Greece just ensures the Greek people will have to endure more debilitating austerity and their growth prospects are virtually zero. In that sense, they were let down by Syriza who promised the impossible – no austerity but retention of the Euro. Given the design of the EMU and the conduct of the ECB, as the currency-issuer, within that monetary union, austerity will be anti-growth and the problem will spread. But then the EC President Barroso is sick of outsiders lecturing the Europeans on how to run their economies. He said today – “this crisis was not originated in Europe”. It all depends on which crisis one is referring to. The Europeans have concocted their own crisis which made the initial “flu” originating in the US turn into something much more deadly. They are totally culpable in this and appear to require external education given the ham-fisted attempts they have made to solve the issue. I told SBS that the solutions proposed and implemented by the Euro elites to the non-problem merely exacerbate the actual problem which is the Euro itself.

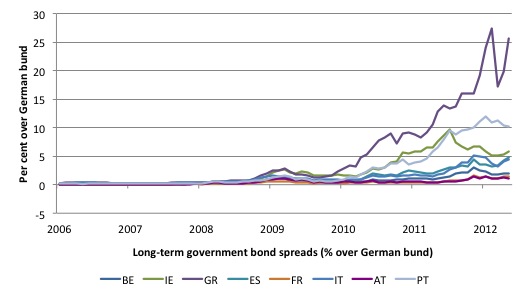

The following graphs tell you why the Greek election outcome fails to address the real problem.

They depict the long-term using ECB data – the first graph includes Greece while the second excludes it just so you get to see the spread between the remaining nations more easily and don’t get seduced by vertical scale.

It seems that Paul Krugman agrees with that position. In a syndicated article today in the Sydney Morning Herald (June 19, 2012) – Only a change in behaviour in Brussels will solve the Greek crisis – he wrote:

Ever since Greece hit the skids, we’ve heard a lot about what’s wrong with everything Greek. Some of the accusations are true, some are false – but all of them are beside the point … the origins of this disaster lie farther north, in Brussels, Frankfurt and Berlin, where officials created a deeply – perhaps fatally – flawed monetary system, then compounded the problems of that system by substituting moralising for analysis. And the solution to the crisis, if there is one, will have to come from the same places.

All the celebrations about Greece showing resolutely that they want to be part of Europe are irrelevant. I think the Greek electorate made a monumental error in voting to continue austerity and stay with the Euro. There might be some give in the severity of the fiscal package from the Euro elites but there will never be an admission that austerity is a failure.

They will also never acknowledge that a growth strategy requires larger public deficits – and hence, given the flawed EMU structure – that means the ECB has to, without exception, fund the rising deficits for as long as it takes to restore sustainable growth and bring unemployment down.

The graphs tell us that this is a distinctly Eurozone problem. The spreads for the UK, Japan and the US (from the bund are very low. What the graphs tell us is that bond markets know full well that these EMU nations use a foreign currency and have to borrow to fund their deficit spending.

The bond markets also know that without growth these nations are spiralling into an unsustainable position – and Greece and probably Portugal are already there with Spain chasing hard. The bond markets also know that austerity is anti-growth and so they will not fund the more risky nations where the recession is at its worst.

Paul Krugman asks:

So how did Greece get into so much trouble? Blame the euro.

He repeats a point I have made often – before the Euro – places like Greece were not in crisis. They didn’t have spiralling unemployment and bond markets were more or less happy to fund their deficits.

But the loss of currency sovereignty that accompanied their decision to join the EMU – has pilloried Greece. Its weaknesses are magnified and the lenders know full well that they are now a credit risk.

Paul Krugman says that the US is not in the same state because it has “a strong central government, and the activities of this government in effect provide automatic bailouts to states that get in trouble”. While that it true in theory and brings into relief the key differences between the two monetary systems, I would not say that the “strong central government” in the US has exactly drowned itself in glory during the unfolding crisis.

In fact, quite the opposite. The US government has continually denied it has the strength that Paul Krugman suggests and instead has been acting more like a Eurozone government – that is, a government that uses a foreign currency.

There was something in this article that grated however and demonstrates that Paul Krugman still operates within the conventional paradigm. He said:

… consider an older example, the US savings and loan crisis of the 1980s, which was largely a Texas affair. Taxpayers ended up paying a huge sum to clean up the mess – but the vast majority of those taxpayers were in states other than Texas. Again, the state received an automatic bailout on a scale inconceivable in modern Europe.

The general point is correct. The US federal government can always bail out a US state if it chooses and also there are transfers from federal to state which help balance the fortunes of each state, as you would expect in a true federal system.

The example I gave in my interview with SBS today was the Queensland floods earlier last year. There was no hesitation from the Federal government in announcing rather extensive infrastructure reconstruction funding for that state. There was no discussion from the other states about whether they should pay for the troubles that Queensland had found itself in. Even when people deliberately build their houses in known bushfire areas and then, inevitably, lose those houses in bush fires, we accept the federal government should help them back on their feet again irrespective of where they live and spend their incomes.

The same federal consciousness is lacking in the Eurozone which is the reason it cannot be sustainable under current arrangements (and cultural attitudes).

But Paul Krugman’s reference to taxpayers footing the bill is the point we should take exception to because it perpetuates the myth that sovereign, currency-issuing governments are bound by financial constraints. When you think about it the proposition is nonsensical. The government that issues the currency cannot be constrained in the same way as Spain is constrained.

Such a government might erect an array of mirrors (accounting and institutional structures) to make it look like they are constrained but they are as binding, ultimately, as a rule saying the US President has to run around the perimeter of the White House every day before the Congress can spend. They could impose that rule too if they wanted but like all these rules, if things turned sour then they would quickly cut to the chase and act according to the intrinsic characteristics of the monetary system – which tell us categorically there are not financial constraints on the US government.

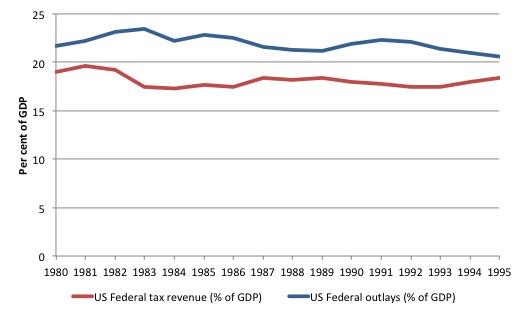

The following graph covers the Saving and Loans Crisis period and shows that total US Federal tax revenue fell during the 1982 recession as we would expect and started to recover in late 1980s as growth became more robust. There is no evidence that the Saving and Loans crisis was paid for by tax payers in any coherent way.

Detailed historical data from the US Tax Foundation – doesn’t substantiate an argument that tax rates were hiked noticeably or that there was extensive bracket creep over the course of the crisis. There were some changes to to thresholds and the structure was initially compressed then broadened again but it is hard to argue that the US government reduced the deficit on the back of tax rate increases.

Anyway I digress.

Paul Krugman concludes in this way:

Which brings us to Sunday’s Greek election, which ended up settling nothing. The governing coalition may have managed to stay in power … But the Greeks can’t solve this crisis anyway.

The only way the euro might – might – be saved is if the Germans and the European Central Bank realise that they’re the ones who need to change their behaviour, spending more and, yes, accepting higher inflation.

One could dispute the claim that inflation necessarily has to rise. It clearly doesn’t. Real growth has to rise and generate employment and income growth. With the massive idle capacity in the Eurozone at present it is highly unlikely that inflation will be a problem for some years – unless there is a supply-side shock (for example, energy prices). But that would be unrelated to any deficit-stimulated real expansion.

The Eurozone desperately requires higher budget deficits and real wage increases. In nations where the real wage-productivity gap was allowed to grow the most (for example, Germany), the growth in real wages has to be that much higher than elsewhere.

There will have to be direct public sector employment schemes, especially for the vast number of 15-24 years olds who are being cast to the scrap heap by the merchants of austerity.

But all of that sort of talk upsets Jose Manuel Barroso. The ABC reported today (June 19, 2012) – Europe fires back over G20 criticism – that Mr Barroso thinks it is gratuitous for outsiders who caused the crisis to lecture the Europeans on what they should do.

He said:

We are not coming here to receive lessons in terms of democracy or in terms of how to handle the economy … By the way, this crisis was not originated in Europe … This crisis originated in North America and much of our financial sector was contaminated by, how can I put it, unorthodox practices, from some sectors of the financial market … [G20 leaders should] … speak very clearly in favour of the approach the EU is following.

As I noted in the introduction where the crisis started depends on which crisis one is talking about. The Eurozone crisis is all their own work. The property collapse in Spain and Ireland had similar resonance with that in the US and the UK.

The flight of German capital south was, in part, driven by the deliberate suppression of real wages growth domestically (the so-called Hartz reforms) which had overtones of the same real wage suppression in the US and the resulting credit binge that fuelled the property boom.

But the Eurozone crisis transcends all that. They have converted a private debt crisis into a public debt crisis because they created an unworkable monetary union with the inflation-obsessed ECB at the centre of it. They then imposed unworkable fiscal rules (Stability and Growth Pact) which were always going to be breached in a downturn of any significant magnitude.

And when the SGP thresholds were breached they reacted in exactly the wrong way by imposing fiscal austerity, which meant that growth was virtually impossible in those states most affected. That led to a further deterioration in the beloved financial ratios – and – more austerity. The bond markets reacted predictably – boycotted the nations most in danger of running out of cash because their growth rates were so impaired by the austerity.

That is a nightmare that the Euro elites which includes Mr Barroso created for themselves. They appear incapable of facing the facts.

But the Australian Prime Minister and her budget-surplus-obsessed Treasurer, who are leading a very unpopular government back here which is in a hopeless position leading up to next year’s federal election, didn’t drown themselves in glory at the G20.

They decided to tell the G20 Summit that the Europeans should:

… adopt policies designed to stimulate the economy while also implementing austerity measures.

It really doesn’t get much more misguided than that. This is the neo-liberal mantra par excellence. Impose austerity – savage public spending and undermine private incomes and confidence but then claim that growth is possible.

Spending equals income. When all components of spending are draining growth you get … negative growth.

And if the European leaders want some more advice they might read this Bloomberg article (June 19, 2012) – Austerity Doesn’t Pay as Debt Markets Ignore Rating Cuts.

The authors interview a health worker in the UK who says that staffing in his public hospital ward has been:

… reduced by about half in the U.K.’s deepest drive since World War II to shrink its deficit. The goal was to avoid losing the top credit score, which might risk higher interest expenses, according to the government of Conservative Prime Minister David Cameron.

The negative consequences for the patients have been significant but probably not as bad, as yet, as the damage the austerity is causing the health system in Greece.

The article argues that invoking austerity to appease the credit rating agencies (the self-styled justification) is simply a flawed strategy because the bond markets don’t seem to regard the ratings agencies anyway.

Japan proved that in the early 2000s when they ignored several downgrades and continued spending and restoring growth. The neo-liberals claim that we cannot use Japan as an example because it is a special case. Well that argument fails also.

The authors say:

After Moody’s Investors Service issued a “negative” outlook for U.K. debt on Feb. 13, yields on government securities relative to benchmark U.S. Treasury debt fell over the next month, instead of rising.

We see that pattern over and over again for currency-issuing nations.

It is worth reflecting on the evidence that the Bank of England governor gave to the House of Commons in his regular – Bank of England February 2012 Inflation Report – on February 29, 2012.

He said in relation to a query about the ratings agencies’ actions:

Now what we have seen is that the action they took recently actually had no impact on the yield that people in the market were willing to lend to the UK Government at. What matters are the views of people in the market, not the view of the rating agencies, and we should not ignore that but I think it is a different issue. I do not think we should be slaves to the rating agencies.

The Bloomberg article misquotes King slightly but the same message is apparent.

The authors cite Bloomberg data which basically refutes any relationship between rating agencies decisions and movements in government bond yields. They document other damage that the ratings agencies might cause (for example, share market fluctuations) which are not of interest to this blog.

The point of the article is to note that if the recommendations of the ratings agencies were to be followed then we would have a global recession right now as a result of the austerity they appear to be demanding.

The article also highlights how the ratings agencies in a rush to be important cannot even add up. I will leave you to read about the $US2 trillion error that the company made.

Conclusion

The point is that the bond markets will always fund nations that issue their own currency because they know that the government carries no solvency risk.

At times when growth is robust, the investors will diversity into corporate debt instruments to seek higher returns. The consequence is that government bond yields will rise as demand for them falls. We cannot interpret that as saying that the bond markets think there is an increased risk in holding government debt. It is just that growth is robust enough to reduce the risk of holding private debt.

When times are tight, the bond investors will increasingly seek safe havens in government debt and yields drop. That choice is irrespective of whether the government is pursuing austerity or expansion. The bond markets know that irrespective of the state of the economy the currency-issuing governments can and will always pay up.

The opposite is the case in the Eurozone. It is only when the prospects of growth are good and tax bases strong that the bond markets will take the risk and lend at low yields to governments that use a foreign currency (the Euro). That is because they always know there is solvency risk.

Thinking that austerity will solve a sovereign debt problem in a monetary union where all the member states face solvency issues is like thinking that pigs might fly. It is a fantasy.

That is enough for today!

(c) Copyright 2012 Bill Mitchell. All Rights Reserved.

Dear Bill

I may have used the following example before. Paul smokes, drinks too much, never exercises and eats too much junk food. He also has a serious infectious disease. Instead of trying to deal with the infection, which is caused by germs, his doctor tells him to change his lifestyle. A change in lifestyle may be good for Paul’s long-term health, but it won’t cure his infection. European policy-makers are behaving like Paul’s doctor by their insistence on structural reforms to deal with an economic crisis caused by insufficient aggregate demand.

Regards. James

“The same federal consciousness is lacking in the Eurozone which is the reason it cannot be sustainable under current arrangements (and cultural attitudes).”

Federal consciousness has no meaning in the Eurozone. In the scale of organization of human societies there are nations and nation-states. A federation corresponds to a nation-state.

A federal Eurozone would imply a melting of its 17 nation-states in 1 nation-state. History shows that this have happened only by conquest and it is not a sustainable or peaceful solution.

Nations do not exist by hazard.

They are based on an extension of the kinship relation, the most powerful drive of human behavior.

The fact that human brains in charge do not recognize this is i the long term inconsequential, but in the short term can be very painful.

Frankly, SBS has disappointed me deeply these last few weeks. So, I am astounded they decided to ask alternative views on this matter.

This is a passage from their Greece in Crisis Special Report, by Mark Davis:

Mark Davis: It’s become a common insult that you have heard many times by now that why should German taxpayers have to work even harder to support Greek workers who probably don’t pay enough tax as it is.

Euclid Tsakalotos (Syriza spokesman on financial issues): It depends whether you want to be a monetary union or not and if you want to be a monetary union, you share in the gains and you share in the costs.

MD: If you want to be in a monetary union you need to abide by fundamental undertakings that you make. If you borrow money you pay it back, as the premise, as the basis.

ET: If you can pay it back. If you can’t pay it back – and I don’t think that any of the southern European economies…

MD: Do you feel any shame if you can’t pay it back, does it concern you?

I don’t know what’s more striking: the reporter’s absolute ignorance or his self-righteousness.

http://www.sbs.com.au/dateline/story/transcript/id/601483/n/Greece-in-Crisis

Dear Bill,

IIRC, this is my billy blog anniversary! 2 years of daily reading (+ all the mandatory 101) and not bored once! 🙂

Thanks a lot for sharing your knowledge and insight!

I love Bills work, but it is an uphill task to educate the groaning masses.

From the UK poling report….Almost half the UK population have fallen for the bullshit deficit spin. Only 37% have actually connected the dots and blame Tory cuts…. What a crazy world!

“There was also a question on who people blame for the current state of the economy – in this case people were asked to rate how much each thing was to blame on a scale of 0 to 10, and Populus counted those who blamed each item by 8/10 or more, so people were allowed to attribute blame to more than one item. 64% blamed the banks’ behaviour prior to the bailout, 57% blamed the Eurozone crisis, 49% the last Labour government’s borrowing, 47% blamed banks for not lending now and 37% blamed the current government’s cuts.”

Reply to PG:

Except in India which has many languages, many cultures, many religions and lots of diversity. In Europe too it might happen sooner or later.

That is an excellent critique of the European problem. In my opinion Mr. Kruman would be wise to start every day reading this blog.

In reference to the US, I must point out that our famous banking god Jamie Dimon is testifying before Congress at this time, but I am sure that after the Congressmen finish groveling at his feet he may be willing to fly to Germany and give them his expert advice the way he has our leaders.

wow…what a biased piece of reporting. is this an audition tape for Fox News?

Krugman’s inflation points hinge on convincing the people who have money parked to spend it today versus just leaving it parked. He has himself admitted it may or may not work but in these desperate days it is one of the things that the FED could try. commit to higher inflation and if the market buys it we’ll get money that is on the sidelines moving….regardless of whether or not that inflation actually shows up.

“But Paul Krugman’s reference to taxpayers footing the bill is the point we should take exception to because it perpetuates the myth that sovereign, currency-issuing governments are bound by financial constraints. When you think about it the proposition is nonsensical. The government that issues the currency cannot be constrained in the same way as Spain is constrained.”

That was not how I interpret it his remark at all so it must be dependent on the reader. Technically speaking from a budgetary point of view…tax payers foot the bill…from a monetary macro point of view we printed some money out of thing air or taxed someone for it…doesn’t matter.

from a monetary macro point of view we printed some money out of thing air or taxed someone for it…doesn’t matter. fausto412

Wrong. Taxation by a monetary sovereign destroys money while money printing creates it. That’s a huge difference.

In nations where the real wage-productivity gap was allowed to grow the most (for example, Germany), the growth in real wages has to be that much higher than elsewhere.

This is what Krugman has in mind, given that a general wage rise in Germany will most likely mean a higher inflation rate that should be “tolerated”.

“He has himself admitted it may or may not work but in these desperate days it is one of the things that the FED could try. commit to higher inflation and if the market buys it we’ll get money that is on the sidelines moving….regardless of whether or not that inflation actually shows up”

The problem is that committing to higher inflation is just as likely to create the opposite reaction – panic and an increase in saving from static wages due to the increase in fundamental uncertainty brought about by *knowing* the authorities are trying to put prices up.

Alternatively we could just give people some money.

I have found it useful to define economics as the study of asset management. Nations and individuals manage assets toward different outcomes which impacts how their projects are planned and undertaken. DeFoe identified four roles when projecting; the projector planner, the undertaker, the broker and the investor. Over time, the roles have remained and have created four classes of projecting; the creator, the producer, the consumer maintainer, the extractor. We have created an imbalance of global extractors that cannot be overcome by a stimulus. The Euro is a project that favors the extractors, the asset strippers, revenue streamers, and those seeking unearned income.

Marshall Auerbach with similar thoughts. The title is a good summary:

http://neweconomicperspectives.org/2012/06/greece-and-the-rest-of-the-eurozone-remain-on-the-road-to-hell.html

“New Democracy” didn’t win the vote, nor did the parties that they’re trying to get into Government with. In fact, more than 57% of voters voted against the austeriy parties, and voted instead for parties that ran against austerity. Even if we take out the vote for the small democratic left party, a party that said it was anti-austerity, but that may now form a Government with the pro-austerity parties, we’re still left with 51% voting for parties opposed to austerity.

The people of Greece have indeed spoken – they’ve rejected the austerity. Unfortunately, their will has been thwarted, for now, by an electoral system that awards “victory” to the losers of the vote.

This is not likely to last long.