The other day I was asked whether I was happy that the US President was…

Spain bank bailout – fails to address the problem

Its a public holiday in Australia – Queen’s Birthday – so all is quiet. Why the Queen of England is also the Queen of Australia and our Head of State is one of those puzzling things that escape logic. Anyway, for the record, the latest Eurozone development – the request of a 100 billion euro bailout from the Spanish government – does not address the major problem facing the Eurozone – the Euro itself. The intransigence of the EU elites has meant that they are unwilling to reform the poorly designed European monetary system and seem to think that a sequence of band-aid remedies which only buy a little time without addressing the main issue demonstrates leadership. Meanwhile, the real economies deteriorate further and unemployment rises. The current policy proposals that are abroad in the Eurozone, are, in my view, the anathema of leadership.

On June 8, 2012, the IMF released its latest assessment – Spain – Financial System Stability Assessment – which said that:

Post-shock, the Spanish banking system’s capital needs to comply with a 7 percent core Tier 1 ratio would amount to an aggregate € 37 billion,

This figure was derived after so-called “stress tests” conducted by the IMF. The IMF note that their estimates did not take into account “(f)urther bank strains, for example, that force a severe loan contraction that cause a self-reinforcing cut in domestic demand, deterioration in loan quality, and further bank funding pressures, are not captured in existing models”.

Indeed, they acknowledge that Spain is “expected to contract by 1.8 percent in 2012 … and unemployment is 24 percent and rising … The outlook is challenging given: large-scale fiscal consolidation to come, market concerns and sovereign spread widening caused by external and domestic events … house prices sliding further, and substantial bank and private sector deleveraging”.

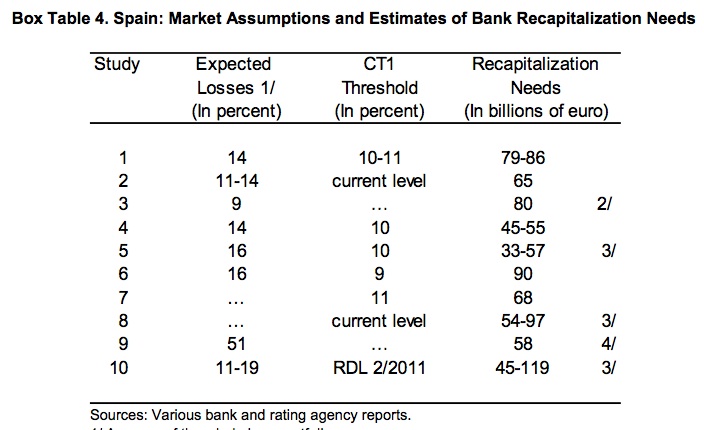

The following Table appeared in the IMF document (page 36) showing the “market estimates” of Spanish bank recapitalization needs. You can see that while the estimated ranges are broad, they generally are well below the 100 billion euros requested by the Spanish government.

The day after the IMF released its assessment of the situation, the Spanish government requested 100 billion euros from the European bailout fund (EFSF and the European Stability Mechanism) to recapitalise its banks.

Where the cash comes from matters because the ESM rules dictate that its loans are senior to all other debt. Another haircut coming?

Why was the IMF estimate so low (some 2.7 times lower) than the amount actually requested? In his Press Conference, the Spanish Prime Minister claimed that they asked for a “cushion” – more than what the market had estimated would be needed to bring the banks into line with the BIS capital adequacy guidelines because the (Source):

… message it sends to the market is much clearer and more forceful …

But there are other issues. Given that the problem has been present for at least 3 years – since the crisis hit – why has it taken so long for the European leaders to react?

There is a familiar ring to all of this. Recall the Greek bailout last year which followed the 2010 bailout. The pattern is as follows: the EU leaders scripted by the Germans talk tough about no bailouts and demand the member state invoke harsh austerity measures; the situation worsens both in real terms (real GDP falls further and unemployment rises) and in market credibility – so funding costs to the government rise; this situation because unworkable (with spreads going through the roof) and the EU leaders, after days of speculation and delay, announce a bailout with even harsher fiscal austerity conditions attached.

There are pictures of the various elites signing documents or hold press conferences. One or more claim that the bailout will stabilise the situation.

Recall, the then Greek Prime Minister saying that ((Source):

We now have a programme and a package of decisions which create … a sustainable debt management for Greece … And this in the end of course will mean not only the funding of a programme but it will also mean the lightening of the burden on the Greek people.

The French President at the time said it was the only way to save Greece. Please read my blog – EU agreement on Greece – no solution at all – for more discussion on this point.

Neither political leader is still in office and the first was removed by the Troika when he had the audacity to propose that the Greek people should vote on whether to accept the accompanying austerity package.

Since that time the Greece problems have worsened and the upcoming election will, in part, determine what happens to their place in the Eurozone disaster.

And now it is Spain’s turn to beg for assistance because it surrendered its own currency sovereignty when it joined the Eurozone. Had it not done that then the Spanish economy would not be in the state it currently is.

And as in the past, the bailout is being characterised as a triumph by the Spanish Prime Minister (Source) claiming that the:

Yesterday the credibility of the euro won, the future of the euro won, the European Union won and the chances that Spain can soon recover a level of lending that will improve investment and job creation also won.

Like those leaders that have gone before him elsewhere, I suspect the Spanish leader’s assessment will not stand empirical scrutiny.

I noted that the financial commentators are claiming this is “bailout lite” because the conditions of the loan will not be accompanied by harsh Greek-style fiscal austerity conditions.

The UK Guardian article – Spanish PM claims bank bailout ‘triumph’ amid eurozone crisis – reports that the Spanish media are claiming that the development is a:

… bailout without humiliation

For example, the Financial Times article (June 10, 2012) – Bailout lite: How rescue differs from Greece – said:

Although EFSF loans must still go to a national government before being injected to struggling banks, the new “recapitalisation tool” allows the aid to be provided without the kind of terms forced on Greece, Ireland and Portugal. Most importantly, Madrid will not have delegations from bailout lenders showing up on a quarterly basis to pore over the government books.

The point is that the Spanish government is already wrecking the economy thanks to existing fiscal austerity. The fact that the current request for funding does not worsen that begs that question – how much worse can it get when 25 per cent of the willing workforce (at least) is officially unemployed, more than a half of the 16-24 year olds are similarly burdened and the real economy continues to contract?

So the Spanish citizens are already being humiliated by their political classes, who largely are taking instructions from the Euro elites.

Sparing them some “extra” humiliation at this stage is rather moot.

It is hard to see how this will change much. The Spanish government is attempting to accomplish a fiscal shift over the next year from a deficit to GDP ratio of 8.9 per cent in 2011 to under 3 per cent in 2013 at a time that GDP is forecast to decline by a further 1.7 per cent. The outlook is for their crisis to worsen

So will the bank bailout loan solve this crisis? Answer: Absolutely not!

All we are learning is that the crisis is spreading into the larger economies of the Eurozone. Last month, the Spanish Prime Minister was denying there was a bank crisis in his country. Now he is telling us that this bailout was required to restore the credibility of the Euro.

The real crisis in the Eurozone is the Euro itself. Until the deep flaws in the design of the EMU are addressed the crisis will simmer on. The EU leadership either has to establish a credible and functional federal fiscal authority and allow it to run deficits that are commensurate with the output gaps existing in the zone or abandon the experiment.

At present the former option would require such an authority to run deficits continuously for many years into the future, which were well in excess of the Stability and Growth Pact rules. The latter should be abandoned and a growth strategy with direct job creation programs (especially for youth) prioritised.

When you consider that currently, the EU elites are pushing through the fiscal compact which is an even harsher version of the SGP, one concludes that they are not even close to understanding the reality and what is required.

The alternative to establishing a federal fiscal authority along the lines mentioned above is to manage an orderly dismantling of the failed experiment. I don’t sense that such a strategy is likely.

So the reality is that the cancer will spread and disorderly events will emerge, which by definition are likely to be more costly than a managed withdrawal from this ideologically-driven madness.

The other interesting (in a tragic way) aspect of the Spanish situation is that the German-fat-lazy-profligate-Greek explanation for the crisis cannot be mounted.

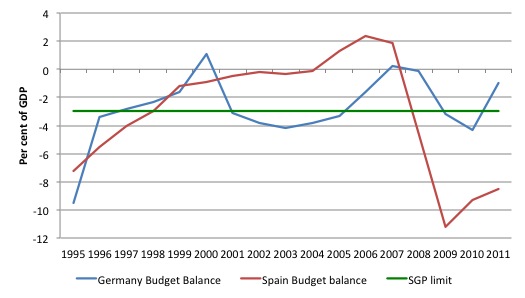

The following graph shows the Spanish and German budget outcomes from 1995 to 2011 (from Eurostat data).

I covered the fact that Germany was in violation of the Stability and Growth pact for several years between 2001 and 2005 – in this blog – The hypocrisy of the Euro cabal is staggering. France violated the Treaty between 2002 and 2004 and Italy between 2001 and 2006

In terms of the fiscal performance of the Spanish economy, the international organisations, such as the OECD and the IMF praised the Spanish government prior to the crisis.

For example, in the May 2005 edition of the OECD Observer 49 – Spain’s economy – Closing the gap – we read that:

Fiscal consolidation, the fall in interest rates due to the introduction of the single currency, structural reforms pursued since the mid-1990s and a surge in immigration have created a virtuous circle of rapidly rising activity sustained by strong job creation.

The only modest caveats noted did include the housing market which “needs to cool down” and that the “rapid increase in household indebtedness also makes domestic demand more vulnerable to higher interest rates.”

There was no attempt to associate the fiscal developments – surpluses – which were unambiguously praised to the rapid growth in household debt driving overall GDP growth. There was no attempt to appraise the vulnerability that this mix exposed the Spanish economy too.

As far as the mainstream went, Spain was in a “virtuous cycle”.

But when you consider that the rapid growth was driven by real estate and construction on the back of the private debt binge and the speed at which the growth collapsed you have to question the robustness of the assessments of these organisations. They are, of-course, now heading the fiscal austerity charge. Neither viewpoint – pre-crisis or current – is valid.

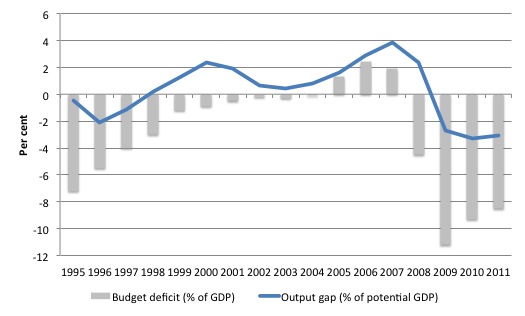

The following graph shows why the Spanish deficit has increased. It shows Eurostat deficit data for Spain and IMF World Economic Outlook Output gap estimates (biased downwards by the way) from 1995 to 2011. The surpluses that the Spanish government achieved in the pre-crisis period were unsustainable given that they relied, largely, on the massive escalation in private indebtedness.

As the IMF noted (see above) the private sector is now deleveraging and export markets are not conducive to the external sector driving growth. Under those circumstances it is not possible to reduce the massive output gap through the imposition of fiscal austerity.

All of which helps us understand why the Spanish government is being denied funding by the private markets on conditions that are bearable? It is clear it has shown a willingness to operate within the EMU rules and run surpluses. It is clear it is willing to impose harsh austerity on its citizens.

The answer lies in the intrinsic structure of the Eurozone. The bond markets know that the Spanish government carries the risk of insolvency, like all EMU member states).

They also know that the only way out of this crisis is for growth to build taxation revenue by increasing incomes. It is clear to all those who are not in denial that fiscal austerity will not accomplish that end.

There is thus two conflicts that the Spanish bank bailout does not resolve:

1. The EMU nations use a foreign currency and so can run out of money. Without a federal fiscal authority all member states are exposed to sharp downturns in economic activity (as shown in the output gap graph above). The only way out is for the ECB to step in and play the role of the “treasury” and “central bank” as the currency issuer and fund growth. It has refused to do that and, instead, in return for buying some more time (via the Securities Markets Program), they have demanded further austerity which has made matters worse.

2. The EMU nations are in the irrational SGP straitjacket which declares cyclical deficits of the sort we have witnessed across many EMU economies in recent years to be problems in themselves and so the leaders have imposed pro-cyclical fiscal contractions.

Discretionary fiscal policy should never be pro-cyclical when there is high unemployment. It just makes matters worse. The bond markets know that growth cannot occur while the SGP rules are driving the policy agenda of the EU leaders.

So the bailout just gives some life to the Spanish banks although it is unclear whether the Government will use the funds to write-off the banks’ bad debts, which is essential given that the housing market is likely to deteriorate even further as a result of the rising unemployment.

But it doesn’t increase aggregate demand because the banks lending, while capital constrained, also requires borrowers. Who is going to borrow when the economy is going backwards and government policy is fast-tracking the return to deep recession?

As growth continues to deteriorate in Spain, the EU elites will be demanding even more austerity in a never-ending spiral of decline.

Further, this sort of policy intervention is likely to fuel further antagonisms among Euro member nations. First, Greece has been able to wipe of billions in debt via the PSI raising the question of why the other nations should honour their debt obligations, which under the SGP rules, are crucifying their economies.

Second, Ireland bailed out the banks “on budget” and while they socialises the written down assets at a discount the government is also liable for the servicing of the loans.

In both cases, harsh additional austerity was imposed.

As I understand the Spanish deal (if formalised), the government will carry the debt but the banks will service the loans and, as noted above, no additional austerity will be imposed.

That is hardly a recipe for solidarity.

Conclusion

The latest Eurozone machination does not address the basic related problems – a lack of economic growth and rising unemployment. Until they realise that growth requires increased spending irrespective of the “structural” issues that are present, the EU leadership will oversee a deteriorating situation.

It has been a relatively short blog today because of the holiday and other pressing writing deadlines.

That is enough for today!

As the economic situation in Europe continues to deteriorate, I predict that we will see the rise of extremist political movements, on both the right and the left. One thing that we learn from history is that we never learn from history.

Word is that Ireland, having witnessed the Spanish bank bailout [url=http://www.zerohedge.com/news/here-they-come-ireland-demands-renegotiation-its-bailout-terms-match-spain]is now seeking to re-negotiate it’s own terms[/url].

The article’s author thinks that such a demonstration has just shifted the Greek election outcome firmly in SYRIZA’s favour, by showing that it is possible (or at least making it appear that way to the electorate) to get a no-austerity-strings-attatched bailout.

“Why the Queen of England is also the Queen of Australia and our Head of State is one of those puzzling things that escape logic. ”

Aussie pragmatism. Saves you paying another politician with their nose in the trough.

“Why the Queen of England is also the Queen of Australia and our Head of State is one of those puzzling things that escape logic. ”

Aussie pragmatism. Saves you paying another politician with their nose in the trough. The one thing you know about the Queen is that she isn’t swayed by the barely disguised bribery of lobbyists.

Simon Jenkins in the UK Guardian likened the Euro to the ‘Black Rat’ of Plague torn Europe – it gets off scot-free while everything else is blamed for the disaster.

Dear Bill

Your real head of state is the Governor General. That the Queen is your head of state is a constitutional fiction. Here in Canada we have the same situation. Our fictional head of state is the Queen, our real head of state is the Governor General. Papier is geduldig, so you can write anything in a constitution. The Dutch constitution says that the capital of The Netherlands is Amsterdam. That is another constitutional fiction since the entire Dutch government is in the Hague. Let’s not get exceited about constitutional fistions.

Cheers. James

I live in a Republic (with a President Head of State) and I can tell you something – monarchy is much cheaper! In absolute terms, the Spanish monarchy of 40m people is 1/5 of the cost of the Portuguese Presidency of 10m people (per inhabitant, the Portuguese presidency is 18x more expensive than the Spanish Monarchy). This excluding the generous benefits ex-presidents get, like security, cars, transportation, driver, office, retirement benefit, etc.

German panhandlers (and the IMF) have been making the rounds in North America, asking for contributions for their EU bailout fund.

“German panhandlers (and the IMF) have been making the rounds in North America, asking for contributions for their EU bailout fund.” Meanwhile French panhandler (Hollande) cuts the retirement age in France, and trots off to Berlin with the begging bowl in an attempt to get the Germans to foot the bill.

All of which nicely illustrates Margaret Thatcher’s dictum that, “Eventually, Socialists run out of other peoples’ money.”

“Eventually, Socialists run out of other peoples’ money.” Maggie Thatcher

Trying to undo the harm the bankers have done with other people’s stolen purchasing power, Ms Thatcher?

Australia has 6 state governors plus the governor general,all on substantial salaries and perks.Every time some Oinklish royal feels a yen to visit the colonies we pay the bill. So there are plenty of the monarchist persuasion with their snouts in the trough.

Australia also has generous retirement provisions for retired politicians.Especially retired PMs and there are 6 of them still living.Lots of snouts in the trough there too.

Then we have insult added to injury when,on the Queens birthday (not)and other memorable (not) occasions, some oink is “honoured” with a pathetic gong.

Meanwhile,the country is being run in the same way that lunatics would run an asylum.

‘All of which nicely illustrates Margaret Thatcher’s dictum that, “Eventually, Socialists run out of other peoples’ money.”‘

Of course Ralph, the Socialists will run out because the banking plutocracy have already taken most of it.

Thank you for your analysis Bill. I wonder with Spain, Greece and Ireland all getting different ‘bailout’ conditions, if Syriza will seek to renegotiate something less austere, or reject completely?

James Schipper is not entirely wrong, but he greatly underestimates the role of the monarchy in Canada. The important thing is not the person of the monarch, but the institution of the monarchy. The reason that Canada and Australia still have a monarchies is that the alternatives are clearly worse. Living next to the US, it is very apparent to Canadians that adding the symbolic role of the monarch to the political role of the executive, as they do in the US presidency, stymies open and honest political debate and makes it easier to raise public support for foreign military interventions and other populist endeavours. Having a Cabinet that is not responsible to the electorate is also a grave error. Don’t believe me? Just take a gander at Transparency International’s reports on corruption etc. over the last decade. Almost all the best governed countries, by those measures, are constitutional monarchies (and have some form of proportional representation), and the republics in the top 15 (there are one or two) tend to be quasi-constitutional monarchies, with parliamentary government and merely symbolic presidents.