The other day I was asked whether I was happy that the US President was…

When a poet knows more than most economists

It is Friday and I have been reading poetry. Then I read some ECB statements and some Spanish government documents after some number crunching (not reported here). And as usual I conclude the elites in Europe still think they will bluff their way through a deteriorating situation – some 4 years or so after it began – and stick to their ideological precepts as if there is no tomorrow. The problem for them is that the rest of us including bond markets, households, private firms and banks don’t follow the script that the Troika have written. Madame Lagarde can strut around on her tax-free salary telling Greeks they should pay their taxes and that it was payback time but that does little other than to make her look poor while the situation worsens. The Spaniards, facing bank failure, crippling unemployment generally, and specifically, more than half of their 15-24 year-olds jobless and, presumably, becoming alienated and dislocated from mainstream ambitions, came up with a plan that might have eased their own problems (for a while). It seems that the plan would not violate EMU rules. The right-wing BuBa types however, obsessed with an imaginary fear that inflation is about to swamp the Eurozone and end life as we know it, responded as only they can – by posing a non-problem while leaving the real problem to deteriorate further. A poet and a playwright could not have come up with text portraying this level of paralysis and madness even if they had tried.

A little journey back in time

Before we get on to SMPs, LTROs and the rest of the acronym soup I thought a little reflection from the great English poet, philosopher and writer – Samuel Taylor Coleridge – is in order.

Upon mention of Coleridge’s name I immediately started reciting the – Rime of the Ancient Mariner – which reflects the era that I attended secondary school – “… with my cross-bow I shot the albatross”.

But alas the reason I introduce Coleridge is that he would have been very familiar with the budget deficit and national debt hysteria that commands the daily financial press and has filtered into our common-folk lives as scary stuff.

While enduring the burden of his opium addiction, Coleridge had very clear understandings on the role of credit and government spending backed by taxes. In his essay – On the Vulgar Errors Respecting Taxes and Taxation – which was published in The Friend, No. 12, Thursday, November 9, 1809 and is worth reading in full, he revealed these understandings.

There was a massive debate in England at the time about taxation and national debt, in particular due to the wars that Britain had been waging with France and in the American colonies.

Among the gems are this statement:

But how often do we hear, even from the mouths of our parliamentary advocates for popularity, the taxes stated as so much money actually lost to the people; and a nation in debt represented as the same both in kind and consequences, as an individual tradesman on the brink of bankruptcy ? It is scarcely possible, that these men should be themselves deceived; that they should be so ignorant of history as not to know that the freest nations, being at the same time commercial, have been at all times the most heavily taxed : or so void of common sense as not to see that there is no analogy in the case of a tradesman and his creditors, to a nation indebted to itself.

In a section discussing the claims that taxation is evil, he wrote:

There are so many real Evils, so many just causes of Complaint in the Constitution and Administration of Governments, our own not excepted, that it becomes the imperious Duty of every Well-wisher of his Country, to prevent, as much as him lies, the feelings and efforts of his Compatriots from losing themselves on a wrong scent. Whether a System of Taxation is injurious or beneficial on the whole, is to be known, not by the amount of the sum taken from each Individual, but by that which remains behind.

Reflecting the fact that aggregate demand is what is important in determining the growth of a nation.

He also reflected on the hysterical claims that the National Debt would constrain all activity and cause national insolvency. While out in the South West of England with friends:

… one of the Company turned the Conversation to the weight of Taxes and the consequent hardness of the times. I answered, that if the Taxes were a real weight, and that in proportion to their Amount, we must have been ruined long ago … the National debt … has more than quintupled … [and] … instead of being poorer and poorer, we are richer and richer … what can we attribute this stupendous progression of national Improvement, but to that System of credit and paper Currency, of which the national Debt is both the Reservoir and the Water-works?

And further on the benefits of government spending:

To what then do we owe our strength and our immunity? The sovereignty of Law: the incorruptness of its administration; the number and political importance of our religious Sect, which in an incalculable degree have added to the dignity of the Establishment; the purity, or least the decorum of private Morals, and the independence, activity, and weight, of public Opinion? These and similar Advantages are doubtless the materials of the Fortress but what has been the cement? What has bound them together? What has rendered Great Britain, from the Orkneys to the Rocks of Scilly, indeed and with more than metaphorical propriety a BODY POLITIC, our Roads, Rivers, and Canals being so truly the veins, arteries, and nerves, of the State, that every pulse in the Metropolis produces a correspondent pulsation in the remotest Village on its extreme Shores? What made the stoppage of the national Bank the conversation of a day without causing one irregular throb, or the stagnation of the commercial Current in the minutest Vessel? I answer without hesitation, that the cause and Mother Principle of this unexampled Confidence, of this system of Credit, which is as much stronger than mere positive Possessions, as the soul of Man is than his Body, or as the force of a might Mass in free motion, than the pressure of its separate component parts would be in a state of rest – the main cause of this, I say, has been our NATIONAL DEBT.

That is a nice way to start on a Friday, n’est-ce pas?

The Irish vote and Greek intentions

And while on scary public perceptions, I urged the Irish overnight to vote No! No! and again No!. We will find out later today what the outcome was.

Here is a little pre-Saturday Quiz warm-up – so you ease into tomorrow’s quiz, imbued with a renewed sense of confidence 🙂

Which of these posters was put up by representatives of the right-wing elites who are bent on impoverishing their nation so their leaders can continue to travel to Brussels and enjoy the sumptuous wining and dining associated with EC Summits and which one was altered by those who care about the people? (Hint: think right and left).

But I also received an interesting E-mail from my mate in Athens (thanks Vassilis) about the voting intentions and preferences of the Greek people. We are told daily that the Greeks do not want to abandon the Euro and the EU elite bullies are playing on that and threatening them with all hell if they elect a government later this month that opposes austerity and the bailout.

Madame Lagarde as one – to wit!

But it seems that when the situation is really examined the preferences are not exactly as the popular pro-Euro, pro-Austerity Western press is depicting.

There is now a more detailed public poll (available only in the Greek language at present) which tells us the following:

1. If the Greeks are asked the question – Euro or Drachma? The majority reply Euro.

2. The responses change dramatically when this question is framed in the context of the austerity measures.

Specifically (translated) the question was:

Please state if you agree, Yes or No, with the following statement: Greece must stay in the Euro, under any circumstances, even if this means the implementation of all the austerity measures necessary for this.

The responses ran 54 per cent negative (people do not agree with that statement) and 46 per cent positive, among those who responded meaningfully, that is, excluding those who did not respond or refused to answer.

Spain and the ECB

Now we get to the real topic for today – Spain.

Bloomberg reported today (June 1, 2012) – Merkel’s Isolation Deepens as Draghi Criticizes Strategy – that “German Chancellor Angela Merkel was besieged by critics for letting the euro crisis smolder, with the leaders of Italy and the European Central Bank demanding bolder steps to stabilize the 17-nation economy”.

The Italian duo – Monti (Prime Minister) and Draghi (ECB) are urging (pushing was the word used):

… Germany to give up its opposition to direct euro- area aid for struggling banks.

The latest meltdown drama is playing out in Spain as its funding costs rise and its banking system continues in its zombie state.

The Spanish government came up with a plan earlier this week to help its most obvious first candidate for failure Bankia – that they claim was completely within the current (ridiculous) EMU rules and may have staved off an increasing crisis (for a time).

The plan was simple but would have been an effective and sensible way of easing the growing crisis:

- The Spanish government issue bonds to Bankia (around 19 billion euro worth only!) in return for shares – thus fixing up the solvency issue on the balance sheet.

- To then restore liquidity, Bankia would swap these bonds for cash via the 3-month refinancing operations that the ECB offers banks – these loans are currently being offered at 1 per cent.

The Spanish government is clearly now pushing the ECB to increase its “lender of last resort” capacity to help nations grow without being crippled by the rising funding costs.

It didn’t take long for the hysteria to mount. The Financial Times article (May 29, 2012) – ECB rejects Madrid plan to boost Bankia – quoted “two European officials”, conveniently un-identified as saying that the:

ECB told Madrid that a proper capital injection was needed for Bankia and its plans were in danger of breaching an EU ban on “monetary financing,” or central bank funding of governments

Which one said what doesn’t really matter does it because it is likely no-one really said anything official. I know how the media operate as I get many calls a week from journalists asking for background etc. It is likely someone rang their mates in the BuBA or ECB and these “officials” vented their ideological preferences. Not that I do that when they ring me 🙂

The official response came via the ECB tweet on May 30, 2012:

Contrary to media reports published today, the European Central Bank (ECB) has not been consulted and has not expressed a position on plans by the Spanish authorities to recapitalise a major Spanish bank. The ECB stands ready to give advice on the development of such plans.

The concern about “monetary financing” is a frequent narrative coming out of the German bankers.

For example, in November last year, Bloomberg carried the headline Weidmann Says ECB Can’t Print Money to Finance Public Debt. It said:

European Central Bank council member Jens Weidmann as said the ECB cannot bail out governments by printing money.

Well yes they can and they have been doing that. The ECB – Securities Market Programme (SMP) which was established on May 14, 2010 – does just that although in a curious, roundabout fashion.

Article 1 of the ECB Decision says:

Under the terms of this Decision, Eurosystem central banks may purchase the following: (a) on the secondary market, eligible marketable debt instruments issued by the central governments or public entities of the Member States whose currency is the euro; and (b) on the primary and secondary markets, eligible marketable debt instruments issued by private entities incorporated in the euro area.

You can read more recent information about the programme HERE.

As of November 4, 2011 the ECB has bought 183,019 million euros worth of bonds under the programme.

Please read my blogs – S&P ? ECB – the downgrades are largely irrelevant to the problem and The ECB is a major reason the Euro crisis is deepening and Don’t tell the Germans – the ECB weekly deposit tender failed – for more discussion of these points.

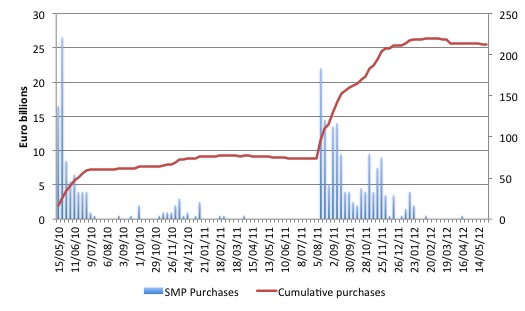

I updated the graph showing the history of the SMP since May 2010 (up to the most weekly statement from ECB – May 28, 2012). The bars shows the weekly purchases (or redemptions) while the blue line shows the cumulative asset holdings associated with the program (now at 212 billion Euros).

The graph is interesting. Clearly the ECB accelerated their purchases when the private bond markets were withdrawing from tenders (as evidenced by the widening spreads of member state bonds against the bund).

As you can see, there was a sudden escalation of purchases just before the last Greek crisis (around the August last year) – in two months the stock held went from 74 billion Euros (July 29. 2011) to 160 billion Euros (September 30, 2011). This action effectively stabilised the mounting attacks on Italian and Spanish debt issues.

The program has been in neutral gear since late November 2011 as the ECB came under increasing attack from the likes of Weidmann and his ilk. In part, the LTRO (Long-term refinancing operation) which pushed billions of very low interest-rate loans into the EMU banking system to prevent a liquidity meltdown has staved off some of the urgency.

But the point is that the SMP is unambiguously a fiscal bailout package which amounts to the central bank ensuring that governments can continue to function (albeit under the strain of austerity) rather than collapse into insolvency.

And the Spanish plan to save Bankia is really just a variant. The EMU is so badly designed from inception that these essential monetary operations at times of crisis have to be elongated and “sneaky” just to keep the system solvent.

At any rate, the ECB will have no choice but intervene again or else Spain will go broke like Greece and in relative sizes, the reverberations of that failure will be much more significant for the viability of the EMU than Greece’s default.

The graph will have to spike up soon as it did last August unless they come up with another plan to take Spain (and soon Italy) out of the bond markets.

The ECB are still publicly contributing the uncertainty though. ECB boss Mario Draghi was quoted in the FT article cited above as saying:

… it’s not our duty, it’s not in our mandate … [to] … fill the vacuum left by the lack of action by national governments on the fiscal front … [on] … the structural front, and on the governance front.

Which is not the issue. The problem is not structural at all. There is a failure of the governments to run their economies because they all signed away their currency solvency to the ECB.

There might be “structural” problems and the Greeks might be having trouble electing a government but the problem is that the system demands they fund their net spending through borrowing from private bond markets and the latter are not playing along with the script.

The structural issues (if any) will take a long time to sort out. In the meantime there is a banking and government funding crisis which needs resolution today!

Conclusion

The only institution within the EMU that can do that is the currency issuer. That happens to be – unfortunately – the ECB. They need to get over their BuBa hang-ups and step up to the plate and start adding certainty and growth into the member-state economies.

Samuel Taylor Coleridge knew 200 odd years ago that government spending was essential to provide infrastructure and economic growth that bound the nation together “from the Orkneys to the Rocks of Scilly”.

I suggest the ECB officials take a break for a few days and read some of his poetry and essays and then turn up at work on Monday and announce a major funding package for all struggling member states.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – and it should be easier now you have had your warm-up.

That is enough for today!

I like the idea of solving the financial crisis with music and poetry.

Definitely an area for more research!

Dear Bill

I have seen many diagrams showing the “alarming” growth in public debt over time. For instance, an American may show a sharply rising curve of American public debt from George Washington to today. Even if such a graph is in constant dollars, those who use them clearly overlook that American population was under 5 milllion when George Washinton took office and that, most important of all, Americans today are much more prosperous than in George Washinton’s time. That’s what your poet clearly understood.

Regards. James

“…by posing a non-problem while leaving the real problem to deteriorate further…”

This is SOP for the neo-liberals. When Microsoft did it we called it FUD.

the main cause of this, I say, has been our NATIONAL DEBT. Samuel Taylor Coleridge

Close but not quite? Isn’t it defict spending that is good with or especially WITHOUT borrowing? Didn’t you say, Professor Mitchell, that ‘The issuing of public debt is an entirely voluntary act by the US government and provides the bond markets with “corporate welfare”?

@Bill ~ Thanks for finally fessing up. You stole MMT from a 200-year old poet. Luckily however, your Nobel Prize is not in jeopardy, as the Prize cannot be awarded posthumously. 🙂

@F. Beard ~ The borrowing is irrelevant to the funding of government operations. It makes no difference whether it does so or not (except for the interest liability incurred, which can always be funded.) The booked current liabilities remain the same in either case. (The borrowed money extinguishes the liability created when the money was created, the spending creates an equal liability in its place. Net = Zero.) — As for the “corporate welfare” aspect, these bonds also create a 100% secure annuity for pension funds. It is not so easy (perhaps impossible) to eliminate this corporate welfare with out exposing these pension funds to greater risk.

How come “There is a failure of the governments to run their economies because they all signed away their currency solvency to the ECB.” is not THE Eurozone structure?

As for the “corporate welfare” aspect, these bonds also create a 100% secure annuity for pension funds. Benedict@Large

If pensioners need welfare then give it to them as needed. We need to eliminate the fascism in our money system and sovereign borrowing is a huge part of it. Plus, the hysteria about the National Debt is reason enough to pay it off with new fiat as it comes due and fund all new deficits the same way.

“of which the national Debt is both the Reservoir and the Water-works? “

Coleridge also seems to have got the concept of stocks and flows.

Well sadly, here in Ireland, 60% of the voting public voted ‘Yes’ to the Fiscal Compact (or ‘Stability Treaty’, as it was referred to throughout the mainstream media in this country). There was a lot of alleged ‘scaremongering’ by the ‘No’ side, who warned that this Compact would lead to intensified austerity, and were accused of having no credible alternatives. It also helped that the media decided not to talk to economists and academics who did have credible alternatives and arguments, and instead handed the mic over to Sinn Féin, a handful of misguided Socialists and a demagogue who pops up in every EU-connected referendum, with shady connections to right-wing ‘think-tanks’ and arms-dealers, all of whom refused to offer an alternative that included the options of (a) putting political pressure on the ECB directly to drop their ideological blinkers, and start funding struggling countries without the need to take any money from those beleaguered German/Austrian/Finnish taxpayers (which the ESM is actually going to do); or (b) threatening to pull out of the euro, and calling its inception into question.

In the meantime, the people of Ireland were bombarded, as I was, by their local Government party Members of Parliaments (T.D.’s, in Ireland), telling them that voting ‘Yes’ would ensure that we ‘balanced our budget….like a household’ and the rest of the usual array of lies spouted about fiscal austerity by its proponents. Also contained on said leaflets, was the promise that one day, ‘when the economy recovers’ (as it inevitably will, yes?), we could run surpluses, allowing us ‘to put money aside’ in case we needed it one day! Bill, am I getting confused about the precise limitations of MMT vis-á-vis currency-users like EZ countries, when I say that if Ireland runs a fiscal surplus (as it did – and only ever did – in the years leading up to the current economic fiasco), it can’t ‘put money aside’: it’s just means the private sector (consumers and business) are saving less than the public sector? If I am getting confused, could you please point me to a blog of yours which explains the implications of a budget surplus for a EZ country?

Anyway, we now have our coveted access to the ESM, all of which has to be funded from existing monies in EZ countries, which serves only to increase resentment among taxpayers in Germany, Austria, etc., who will continue to believe that they are funding the lavish lifestyles of profligate Greeks, Irish and Portuguese, while the ECB stands at the side, warning everyone to keep up the austerity, and refusing to provide any meaningful aid to any country, what with it being morally offensive to them, while claiming that they themselves are on the brink of insolvency!