Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Our pathological meanness to the unemployed is just bad economics

A lot of attention is being focused on the Eurozone at the moment given the scale of the economic and social crisis that is unfolding there. It is clear that the unemployed and other pension recipients are being made to pay very significant costs for the policy folly imposed upon them by the Euro political leadership. However, the mean-spirited treatment of the disadvantaged is not confined to Europe. In the US, for example, the Congress is soon to debate and vote on a serious reduction in income support for the already beleaguered unemployed. There is a tendency to think about this from the perspective of a commitment to social democracy as being immoral, iniquitous, and a violation of the human rights of the disadvantaged. While I have great sympathy with all of those emphases, there is an easier attack that can be mounted on cutting unemployment benefits in the US or elsewhere. Such a strategy only serves to further undermine the spending capacity of the private sector at a time when the principal problem is a deficiency of aggregate spending. A simple understanding of macroeconomics leads to the conclusion that our pathological meanness to the unemployed is just bad economics.

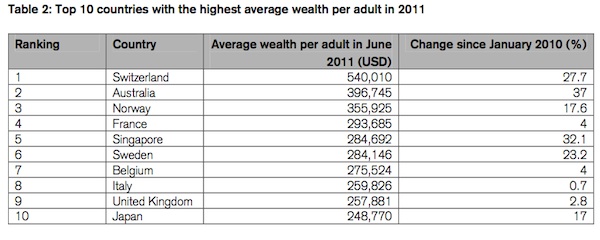

On October 19, 2011, Credit Suisse released their latest – Global Wealth Report and estimated that in terms of median wealth, Australia was ranked first. On an average wealth (per capita) basis, Australia was ranked second to Switzerland.

Their Table 2: Top 10 countries with the highest average wealth per adult in 2011 is reproduced in the following graphic.

Australia’s median wealth of $US222,000 was the highest in the world and nearly four times the amount of each US adult. The average Australian is 55 times wealthier than the average wealth for the whole world.

So you might expect our income support schemes to be generous to a tee. You would be wrong.

Australia supports a government that deliberately creates unemployment by refusing to run budget deficits commensurate with the spending gap left by non-government saving decisions (and outcomes).

But if that wasn’t bad enough, we then allow the Government to deliberately force the unemployed to live in poverty and continually punish them for not having a job (via a pernicious activity test regime).

And all this in an advanced and very wealthy nation?

This mean treatment of the unemployed is a topic that was considered by former IMF economist Simon Johnson in a recent article (February 9, 2012) – Mean-Spirited, Bad Economics.

Simon Johnson began by noting the obvious:

The principle behind unemployment insurance is simple. Since the 1930s, employers – and in some states employees – have paid insurance premiums (in the form of payroll taxes, levied on wages) to the government. If people are laid off through no fault of their own, they can claim this insurance – just like you file a claim on your homeowner’s or renter’s policy if your home burns down.

The rationale for public intervention into this “insurance” market was that the private sector failed to provide adequate insurance. The principle that Johnson notes underpins the public role is that the aim is to “(h)elp people to help themselves in the face of shocks beyond their control”.

He notes that this principle is being stretched by the “severity and depth of our current recession” and raises the question:

What should we do when large numbers of people run out of standard unemployment benefits, much of which are provided at the state level, but still cannot find a job? At the moment, the federal government steps in to provide extended benefits.

Which is an entirely sensible development given that the currency sovereignty lies at the federal level. In fact, one might ask why state governments in a fiat monetary system are providing this type of support at all given the aim is to attenuate the shocks at the macroeconomic level.

In Australia, for example, unemployment benefits are provided at the national level and require no prior contribution from the recipient. They are considered a national responsibility rather than something an individual should “insure” against.

The problem, however, that all of these income support systems are now encountering, is that their underlying philosophy is being challenged by the severity of the crisis.

In Australia, the system of unemployment benefits was designed to cope with a labour market were unemployment spells were typically short and different individuals moved in and out of the jobless queue at regular intervals.

The chronic nature of unemployment over the last 20 years (when long-term unemployment has been high and persistent) has meant that unemployment benefits have moved from being a short-term breach in income while a worker moved between jobs to being the principal income received by the unemployed worker.

Simon Johnson then notes that the Republicans in the US Congress want to “cut back dramatically on these benefits, asserting that this will push people back to work and speed the recovery”.

In this context, he asks the question:

Does this make sense, or is it bad economics, as well as being mean-spirited?

He concludes, categorically, that these proposals are not only mean-spirited, but also plainly and simply, bad economics. Noting that the US “has lost more jobs than in any other recession in the last 70 years” (some 8 million jobs) and that the scale of idle labour in the US is well above the official unemployment rate (a rough rule of thumb is to double the official estimate), Simon Johnson says that:

However you want to count it, the financial crisis of 2008 brought on a jobs disaster

Further, the “disaster is still with us” and unlike previous recessions “the share of long-term unemployed in total unemployed” has risen dramatically (now close to 45 per cent).

Simon Johnson attempts to justify the structure of unemployment income support in the US by arguing that the federal government “has the strongest ability to borrow at low interest rates”, while “most states are much more strapped for cash”.

He might have actually said, which would have been closer to the truth, that the federal government can never be involuntarily strapped for cash.

He implicitly acknowledges that when he says that we should:

… not be deceived by claims that the federal government is “broke,” in the sense that it cannot afford to provide additional support to states and people at this level. This is a myth, pure and simple.

Any financial constraints that the US government experiences are purely voluntary and not intrinsic to the monetary system that it is at the head of.

He then makes the case that the unemployed are hardly to blame for the parlous current situation that they find themselves in. One of the underlying narratives relating to the unemployment benefit discussion is whether the individual is responsible for his/her own joblessness. Note Johnson’s phrase – “laid off through no fault of their own.

He notes that the “jobs crisis was caused by recklessness in the financial sector, made possible by irresponsible deregulation … and resulting in enormous unconditional bailout protection for the bankers at the heart of the disaster”.

With the mainstream economists trying to reconstruct this crisis as a sovereign debt problem, the roots of the crisis – in terms of private-sector extravagance – are being obscured.

It is quite clear that the unemployed can do little to improve their individual circumstances. It is a fallacy of composition to think if all the unemployed tried harder to get a job that they could all succeed.

The unemployed cannot search for jobs that are not there. A particular individual might be able to improve their chances of gaining a job, but in macro terms, that will only serve to shuffle the jobless queue.

The overall problem is a deficiency of jobs which is a demand rather than a supply issue.

In that vein, he says that:

Let’s be generous for a moment and simply state that mistakes were made – on an enormous, macroeconomic scale with gut-wrenching consequences for families around the country. Why would anyone now seek to punish these people when they seek work but cannot get it?

He notes that the extended unemployment benefit in the US puts a worker on around “70 percent of the poverty level for a family of four”.

Interestingly, even if you choose not to adopt a caring approach to the unemployed as an exercise in humanity, the logic of depriving them of adequate income support a time when there is a severe deficiency of jobs, doesn’t even have a in terms of cold economics.

Simon Johnson notes that cutting unemployment income support in this type of labour market “you will push more individuals and families onto the streets and into shelters” with the consequence that costly ” fall-back services” will be required.

The cost of the services are ” much higher than providing unemployment benefits”.

These costs extend to the damage to overall spending that these cuts would cause. He says:

How does it help any economic recovery when the people who lose jobs cannot even afford to buy basic goods and services – enough to keep their family afloat?

We worked out long ago (during the Great Depression) that, apart from the morality of providing income support to those that could not take care of themselves through no fault of their own, that economic downturns are the result of a slowdown in spending.

As a consequence, the further undermining of the spending capacity of those who lose their jobs as a consequence of this slowdown in demand only worsens the situation.

Simon Johnson notes that this logic – which is just basic macroeconomic theory – is now ” likely to collapse” in “the face of our modern mean-spiritedness”.

What a bunch of morons we are!

I last considered this issue in relation to Australia in this blog (September 23, 2009) – Why are we so mean to the unemployed? September 23rd, 2009

The unemployed in Australia are also forced by government to live below the poverty line even though we do not have an insurance-type contributions scheme as in other nations.

Unlike the unemployment compensation insurance schemes that operate in most countries, the Australian unemployment benefits system is paid by the federal government at set rates for an indefinite period (subject to work tests). Employers and employees do not contribute to the scheme and everyone gets the same rate (adjusted for marital and parental status).

The current Australian government claims it cares about equity. It was pressured in the May 2009 Budget, to increase pensions and it did so for all groups except the unemployed and single-parents. The increases were a major realignment of these pensions relative to average weekly earnings (a benchmark).

But given that the economic crisis has impacted mostly on the unemployed, the question that was asked at the time was how could the government justify not increasing the unemployment benefits as well?

This is the same question that Simon Johnson is asking about the current proposals in the US to cut unemployment benefits.

Here is the latest update on the plight of unemployment recipients in Australia. At present, a single adult unemployed worker receives $A6.760 per annum less than a single aged pensioner. That is, the single adult unemployed worker receives only 65 per cent of the single aged pension.

More detailed analysis shows how bad things have become for the unemployed. You can get access Australian pension and benefits data available from FACSIA.

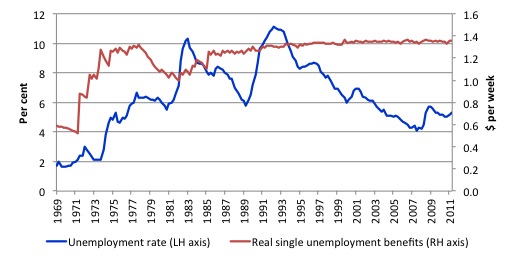

The following graph shows the real single unemployment benefit (right-hand axis) (using CPI with base=100 at 1989-90) and the unemployment rate (left-hand axis) since September 1969. You can see the cyclical pattern of the unemployment rate after the step increase in the mid-1970s as major public spending cutbacks occurred. The step rise in real unemployment benefits in 1972 coincided with the election of the Whitlam Labor Government which had been out of power for 23 years.

With the conservatives out of power for the first time in a generation, the Labor Government, which was social-democratic in leaning, set about making changes to a range of entitlements and pay scales.

However, real benefits fell sharply in the early years of the conservative government that took over from Whitlam and during the 1982 recession which it oversaw, real benefits fell sharply at the same time unemployment sky-rocketed. After some initial realignments in benefits by the 1983-elected Hawke Labor government which saw real unemployment benefits rise, that Government’s neo-liberal colours started to shine brightly and from then until they lost office in 1996 (with Keating as Prime Minister) the unemployment enjoyed on minuscule real growth in entitlements.

Then the bad years under the immediate past conservatives (1996 to 2007) has seen virtually no real growth at all in the single unemployment benefit (and related scales) despite unemployment persisting at high levels throughout this period (only slowly declining during the commodities boom).

And then in 2007, a new Labor government was elected just before the onset of the worst global downturn since the Great Depression. Without knowing how badly the Australian economy was going to be affected, the recession budget in May 2009 failed to provide any increase in unemployment entitlements. This resulted in real benefits remaining unchanged since the beginnning of the crisis in March 2008. By way of comparison, the real aged pension for singles over the same period has increased by some 23 odd per cent.

How can that disparity be justified?

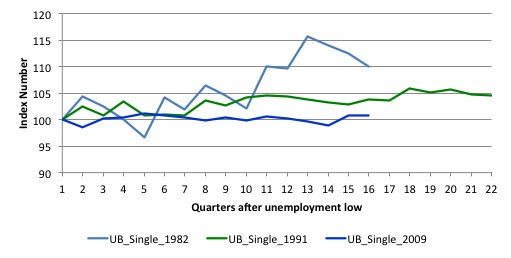

The next graph shows the response of the real single unemployment benefit after the low unemployment quarter was passed during the 1982, 1991 and current downturn. It shows the response between the low-unemployment to peak-unemployment rates and then 8 quarters after the peak (excepting the 2009 downturn which is incomplete).

The graph is interesting because the Labor Party has been in government during the 1991 and 2009 recessions and during the aftermath of the 1982 recession. In the early recessions, they increased real benefits for the unemployed although modestly at best.

However, in the current period, it is clear that real benefits are falling sharply as unemployment rises.

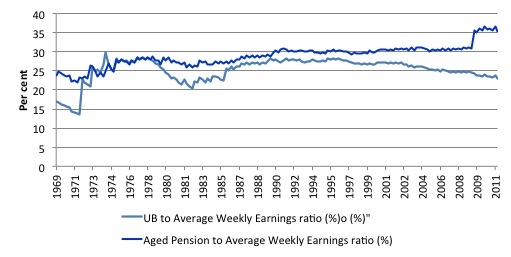

The next graph shows the evolution of the ratio of single unemployment benefits (UB_single) to average weekly earnings (AWE) and the ratio of single aged pension (UB_single) to average weekly earnings since September 1969.

It is clear that since the mid-1990s, the unemployed have been increasingly disadvantaged relative to average weekly earners and the aged pension recipients. This has been a deliberate strategy of the successive federal governments to make life increasingly harder for that group and reflects their conceptualisation of the problem as being of an individual nature rather than a systemic failure.

Unemployment benefits and the Poverty Line

You will note that Simon Johnson indicated that unemployment benefit recipients in the US were receiving income support that placed them well below the estimated poverty line.

The same situation applies in Australia. Last time I examined this issue I just asserted that point. So I decided I should provide some more detailed analysis (that can be used in the public debate) to support the claim.

You can find rather detailed analysis of the Australian poverty line from the Melbourne Institute.

This is the Centre (formerly known as the Institute of Applied Economic and Social Research) the University of Melbourne founded by the great economist Ronald Henderson who pioneered the development of poverty line estimate and conducted the famous Poverty Inquiry which released the first estimate for the December quarter 1973.

While maintaining this part of the research history, the Melbourne Institute has moved towards neo-liberal viewpoints particularly on labour market issues over the last few decades, consistent with the general move within the economics profession. It no longer represents the values that its founder considered important.

You can compute poverty line estimates back to 1973/74 using data provided in the September 2011 publication (linked to above) combined with Australian Bureau of Statistics estimates of household disposable income.

For a single unemployed person we learn that in September 2011 the poverty line was estimated to be at $A372.85 per week inclusive of housing costs.

June quarter 1996 for any household type, multiply the current value of its poverty line by the ratio of per capita household disposable income in the June quarter 1996 to that in the current quarter; that is, the poverty line for a benchmark household in June 1996 would be 863.68×350.11/736.92 = $410.33.

So the way to compute the poverty line estimate for a particular quarter in the past is to multiply that value ($A372.85 per week in September 2011) by the ratio of the September quarter 2011 HDI to the HDI in the quarter that you are interested in.

I did this for the entire period since the first estimates came out in the September quarter 1973 using ABS household disposable income data.

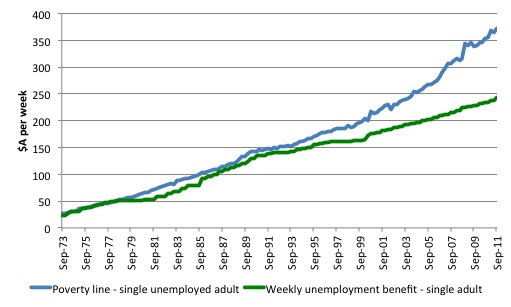

The following graph compares the single weekly unemployment payment to the poverty line since the September quarter 1973 until the September quarter 2011. The results are a stark demonstration of policy failure.

You can see that the deviation started around 1981-82 when the Australian economy experienced a major recession (at that time, the worst since the Great Depression).

The then conservative government was under massive political pressure as the budget rose via the automatic stabilisers and instead of meeting the challenge of recession by actively attempting to stimulate aggregate demand, they tried to claim that fiscal austerity was the way forward.

Undermining the generosity of the unemployment benefits was one manifestation of this mania. They lost office in 1983 and the newly installed Labour government said about providing some relief for unemployment benefit recipients. It still remained that a fact that the single unemployment benefit was close to (just below) the poverty line.

The next major recession, worse than the 1982 downturn, occurred in 1991-92 under that same Labour government and their response to the cyclical downturn was poor. By then they were completely obsessed with achieving budget surpluses and failed to stimulate the economy quickly and sufficiently enough to prevent a major deterioration in the labour market.

But their response to the recession from the perspective of the unemployment benefit recipient was appalling. You can see from the graph and a major divergence between the single adult unemployment benefit and the estimated poverty line began during this recession and there’s been no resolution to that since.

It seems that when unemployment rises during a downturn, the government deliberately chooses to degrade the income support they receive at the very time that the income support not only provide some level of security for those who lose their jobs, but also helps to maintain some aggregate demand in the economy.

As Simon Johnson noted this is just bad economics. There is no economic logic attached to the notion that cutting spending and a time when reduced spending is the problem is beneficial.

The only interpretation we can place on the behaviour of successive governments, conservative or otherwise, in relation to the treatment of the unemployed during a recession is that they are reflecting the mean-spirited mentality of the electorate.

This is an electorate that has been conditioned by years of neo-liberal ideology to construct unemployment as an individual problem rather than a reflection of the failure of the macro system to generate enough jobs. That is, a systemic failure is reconstructed as individual failure and so the individual should pay.

This erroneous reasoning leads to bad economic policy, which reduces overall prosperity.

Rental Assistance

When I last considered this issue I did not explicitly discuss supplementary benefits that are available to income support recipients in Australia.

It might be argued that because income support recipients in Australia receive rental assistance, for example, the problem is less severe than I have suggested. That is correct but the scale of assistance for the unemployed is short of pitiful.

The shift to the provision of rental subsidies in Australia was part of the ideological shift away from the government taking responsibility for social policy.

In the past, the Federal government (in liaison with the states) provided public housing to low income earners. While in short supply and of a fairly rudimentary quality, most lost income earners could expect to be given access to a secure, affordable home.

That changed when the neo-liberal ideology became dominant and the Government moved progressively to providing rent subsidies to private market suppliers.

There is a large literature which analyses the consequences of this shift for low income earners, which is tangential to this blog. But the major conclusions are as follows:

1. CRA is capped and so as housing costs have risen the the value of the subsidy has been undermined.

2. This erosion in value has ment that single unemployed people find it almost impossible to rent in the private markets in the major capital cities such as Melbourne and Sydney which means that the spatial concentration of disadvantage rises and the unemployed are forced to live in areas where there is less job creation (notwithstanding the overall lack of job creation in Australia per se.

3. CRA relies on an adequate provision of affordable housing being made available by private providers. It is clear that supply has been lagging well behind demand for a number of reasons including the incentives given via the tax system to high income earners to invest in higher valued investment housing as tax dodges under negative gearing. This high income-earner welfare is a major source of inequity in the Australian system.

4. Many unemployed are forced to live in group (shared) housing and the maximum CRA entitlement is then dramatically reduced.

What are some relevant facts pertaining to rental assistance in Australia?

The Australian Bureau of Statistics release – Australian Social Trends – (latest being September 2011) provides some recent information about housing assistance in Australia.

There is a more detailed ABS publication (September 2011) available on this topic – Housing Assistance.

There was also a major Productivity Commission Report (released January 28, 2011) – Report on Government Services 2011 – which provides a comprehensive analysis of housing services provided by the Australian Government (including detailed data).

The ABS say that Commonwealth Rent Assistance (CRA) is the:

… largest single component of housing assistance for renters … [and] … is paid by the Australian Government to provide additional assistance to income support recipients and low income families in the private rental market. As at June 2010, CRA was paid to over 1.1 million singles and families, at an average of $98 per fortnight, and totalled nearly $3 billion.

This data is provided in the Productivity Commission Report.

The average fortnightly payment of $A97.92 was paid to recipients who on average paid $A392.16 per fortnight in rent.

Given the dramatic decline in housing affordability in Australia over the last few decades, the proportion of CRA recipients (so-called “income units”) who were entitled to the maximum assistance has also risen from 56.9 per cent in 2001 to 72 per cent in 2010.

The ABS Social Trends publication reveals that the majority of the recipients of CRA were not in the labour force (51 per cent in 2009-10). 19 per cent of the recipients were in full-time employment (which indicates how low wages are for a significant portion of the fully-employed workforce in Australia (as at 2009-10), 20 per cent of the recipients were in part-time employment (wages even lower) and only 10 per cent of the recipients were unemployed.

So around 110 thousand in 2010 of the CRA recipients were unemployed – that is, around 17 per cent (there were 620 thousand people unemployed on average throughout 2010 in Australia).

In the September quarter 2011, the gap between the single adult unemployment benefit and the poverty line estimate was $A129.45 per week. So on average the CRA payment to those unemployed that received it would not have lifted them beyond the poverty line.

The conclusion is that while there is some rental assistance in addition to the unemployed the amounts are trivial and do not push them above the poverty line.

Conclusion

What sort of government deliberately creates unemployment by refusing to run budget deficits commensurate with the spending gap left by non-government saving decisions (and outcomes) and then deliberately chooses to force the unemployed to live in poverty – in an advanced and very wealthy nation?

You can answer that question for yourself.

Last week I was in Darwin (Australia) where the tropical weather was very hot (35 degrees) and humidity high. This week I am working in upper New York state where the weather is freezing cold. The locals keep saying that it is a mild winter. This morning before I came to work I went for a long run in the countryside nearby and my outfit suggested something akin to the Michelin Man. That is, very rugged up!

That is enough for today!

My single unemployed mother whom lives in regional WA (Mandurah) receives some $310 total unemployment benefits, she has chronic back and feet problems however was rejected the higher disability pension after a 12 week application process. A tiny rental in the area would run over the $310 however thankfully she has a private agreement for $200/week leaving $100 to live on. Unemployment benefits are so aggressively cut when you participate in part time work that it would barely be worth it even if she could find a job, however as you can imagine there are simply nill jobs for her essentially unskilled age group.

I attend UNSW and receive $260/week assistance, my rent is $243. I too am struggling to find any work as it seems given the enormous labour selections available to employers currently, anything less then 2 years experience for a kitchen hand job simply won’t do.

Go get that surplus guy’s you can do it! Sigh.

freezing cold?

I live in NYS and it’s been so mild that I think winter is passing us by this year.

Rental assistance is a subsidy for landlord scum rather than a payment to help the unemployed or low income earners.

The tenant merely passes the money on to the landlord.

Bill suggests that our governments could just guide their policy by humanitarianism OR economic logic. Either on its own would be sufficient. Isn’t it revealing that our governments are incapable of even one of these approaches? How far do we have to sink into disaster before we get a change in course?

Off-topic but, on the Greek front, according to the Guardian UK, Amadeu Altafaj, spokesman for Europe’s commissioner for economic and monetary affairs, Olli Rehn, about the eventuality of a Greek default:

The consequences would be devastating for Greek citizens and particularly for the most vulnerable. Consequences would be felt throughout the eurozone and beyond,…

When we make these kind of statements it is because they are substantiated by thorough economic analysis. I am not in a position to share that with you.

So they don’t even bother with their confusing flawed propositions anymore, they just assert and then say they’re not in a position to share that with us… Have they simply run out of BS?

I think that it is not about giving people money to live on. It’s about keeping people in their place. A very significant portion of the unemployed are oppressed people (gays, refugees, Aboriginals etc.). It is the Australian way to want to see these people suffer. It’s a kind of Nazism under the pretense of economic rationalism.