Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

Employment fell in December, no it didn’t employment rose – and other apparent inconsistencies

In the last few weeks I have done several radio interviews about the veracity of the labour force data published by the Australian Bureau of Statistics. The pretext has been an increasing awareness among commentators and journalists of an alternative series published by pollster – Roy Morgan. The juxtaposition of an ABS unemployment rate estimate for December 2011 of 5.2 per cent against Roy Morgan’s estimate of 8.6 per cent worries people and curious minds have been seeking to find out what is going on. The curiosity also extends to matters like seasonal adjustment. Last week, I consistently said that in seasonally adjusted terms people were dropping out of the labour force (as evidenced by the falling participation rate), which had lessened the impact of the negative employment growth on the unemployment. But in one interview I complicated matters by saying that in fact more people were in the labour force in December and employment rose. The two statements were not inconsistent. The former was about the seasonally-adjusted data and the latter was about the original time series produced by the ABS. I often get E-mails about this question. Which estimates should we use to tell us what is going on? So I thought I should write a blog about that – to catalogue these issues.

First, we will deal with the issue of seasonal adjustment.

The Australian Bureau of Statistics has an excellent on-line manual covering – Methods and Standards. The section on Time Series Analysis contains a detailed account of seasonal adjustment.

You can also find out some relevant information from the – US Census Bureau Seasonal Adjustment FAQ.

Further, this Eurostat publication Ess Guidelines on Seasonal Adjustment – has some interesting discussion.

Seasonal adjustment is an aspect of time series analysis, which is a specialist field in statistics and econometrics.

The ABS manual says that:

A time series is a collection of observations of well-defined data items obtained through repeated measurements over time. For example, measuring the value of retail sales each month of the year would comprise a time series. This is because sales revenue is well defined, and consistently measured at equally spaced intervals. Data collected irregularly or only once are not time series.

An observed time series can be decomposed into three components: the trend (long term direction), the seasonal (systematic, calendar related movements) and the irregular (unsystematic, short term fluctuations).

Time series data is in contradistinction to cross-sectional data which consists of observations taken at a point in time rather than over time. For example, we might collect data about expenditure and income in 2011 from a sample or population. That would create a cross-sectional database. Period census collections fit into this category.

Hybrid databases can be panel or pooled where you collect a cross-section at regular points in time.

Time series decomposition is a specialist field of enquiry within statistics and consists of decomposing raw time series data into the components noted above. As the terms suggests, the trend is an indication of the underlying movement in the data, the irregular component reflects short-run spikes in the data which have no systematic explanation.

That leaves the seasonal component.

In response to the question “What are seasonal effects?”, the ABS say:

A seasonal effect is a systematic and calendar related effect. Some examples include the sharp escalation in most Retail series which occurs around December in response to the Christmas period, or an increase in water consumption in summer due to warmer weather. Other seasonal effects include trading day effects (the number of working or trading days in a given month differs from year to year which will impact upon the level of activity in that month) and moving holidays (the timing of holidays such as Easter varies, so the effects of the holiday will be experienced in different periods each year).

The US Bureau of Labor Statistics say:

Seasonal adjustment is a statistical technique that attempts to measure and remove the influences of predictable seasonal patterns to reveal how employment and unemployment change from month to month.

Over the course of a year, the size of the labor force, the levels of employment and unemployment, and other measures of labor market activity undergo fluctuations due to seasonal events including changes in weather, harvests, major holidays, and school schedules. Because these seasonal events follow a more or less regular pattern each year, their influence on statistical trends can be eliminated by seasonally adjusting the statistics from month to month. These seasonal adjustments make it easier to observe the cyclical, underlying trend, and other nonseasonal movements in the series.

The US Census Bureau add the following:

Seasonal movements are often large enough that they mask other characteristics of the data that are of interest to analysts of current economic trends. For example, if each month has a different seasonal tendency toward high or low values it can be difficult to detect the general direction of a time series’ recent monthly movement (increase, decrease, turning point, no change, consistency with another economic indicator, etc.). Seasonal adjustment produces data in which the values of neighboring months are usually easier to compare. Many data users prefer seasonally adjusted data because they want to see those characteristics that seasonal movements tend to mask, especially changes in the direction of the series.

The Eurostat publication says:

The main aim of seasonal adjustment is to filter out usual seasonal fluctuations and typical calendar effects within the movements of the time series under review. Usual seasonal fluctuations mean those movements which recur with similar intensity in the same season each year and which, on the basis of the past movements of the time series in question, can under normal circumstances be expected to recur.

Fluctuations due to exceptionally strong or weak seasonal influences (for example, extreme weather conditions or atypical holiday constellations) will continue to be visible in the seasonally adjusted series to the extent that they exceed, or fall short of, the normal seasonal average. In general, other random disruptions and unusual movements that are readily understandable in economic terms (for example the consequences of economic policy, large scale orders or strikes) will also continue to be visible.

Seasonal adjustment also includes the elimination of calendar effects insofar as influences deriving from differences in the number of working or trading days or the dates of particular days which can be statistically proven and quantified (e.g. public holidays, weekday on the last day of the month in the case of stock series).

In this way, the seasonally adjusted results do not show “normal” and repeating events, they provide an estimate for what is new in the series (change in the trend, the business cycle or the irregular component). Therefore, seasonally adjusted data help to reveal the “news” contained in a time series, which is the ultimate goal of seasonal adjustment.

In this blog I won’t go into the technicalities of time-series decomposition including seasonal adjustment. This is a very specialised area which interests me but probably will bore most people.

The major advantage of using seasonally-adjusted data is to make better comparisons over time particularly when one is comparing two or more time series which might be driven by very different seasonal patterns. So we can compare December (Christmas effect), January (school-leaver effect) with say May (no obvious labour market seasonality) in any year because we have removed the seasonal fluctuations in each month.

So the seasonally-adjusted data provides us with a better basis for comparison across time and data series.

It allows us to better compare long-term and short-term movements in data and helps in cross-country analysis.

But it introduces an “abstraction” layer over the underlying data. So when the seasonally-adjusted data shows a variable has fallen in the current month but the original data shows it has risen what has actually happened?

The actual movement in the data is that the underlying time series has risen. So if raw estimates of participation rates show a rise then more people are coming into the labour force for a given working age population.

But if the seasonally-adjusted series shows the participation rate has fallen, then once we adjust for the fact that in that month (or period) we would expect the participation rate to rise due to seasonal events (such as the Christmas retail boom and the increase in casual jobs associated with it), then participation is lower than we would otherwise expect.

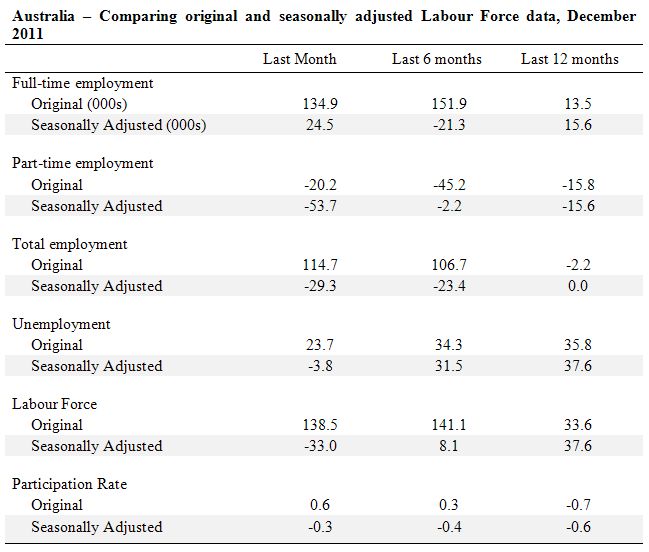

To see how different the raw and seasonally-adjusted estimates can be consider the following Table which I constructed from last week’s ABS Labour Force data release for December 2011.

My analysis of the seasonally-adjusted data – Australian labour force data – things are getting worse – showed that:

- Employment decreased 29,300 (0.3 per cent) with full-time employment increasing by 24,500 persons and part-time employment decreasing by 53,700. Over the last year, employment has grown by only 0.2 per cent – that is, virtually not at all.

- Unemployment decreased 3,800 (0.6 per cent) and is now at 629,900.

- The official unemployment rate remained unchanged at 5.2 per cent.

- The participation rate decreased by a sharp 0.3 points to 65.2 per cent.

Which led me to conclude that the results thus indicate that the deterioration in the labour market is continuing and now influencing participation.

I also said that unemployed workers are giving up looking for work and moving from official unemployment into hidden unemployment (outside the official labour force estimate). This is because there is a serious deficiency in vacancies.

If employment had actually increased by 114.7 thousand and participation had actually risen by 0.6 percentage points how could I have concluded that things have gone from bad to worse?

Further, how could I have concluded that more people are now giving up searching for work and leaving the labour force when the actual (raw) data showed the labour force had expanded?

Was I exaggerating or something? Answer: everything I said in relation to the facts as presented was 100 per cent accurate.

All these questions and more are tied up in understanding the difference between original (raw) data derived from the Labour Force Survey and the seasonally-adjusted version of that data.

You can see that over the year (last 12 months) the estimates between the two time series are essentially the same. Further, in certain months the results will be similar (if there are no special seasonal factors at play).

But the December estimates always deviate substantially because of the impact of the Christmas retail surge and the employment that accompanies that.

So all the following statements are true:

- Full-time employment in December 2011 rose by 134.9 thousand but also rose by only 24.5 thousand.

- Part-time employment fell by 20.2 thousand but also fell by 53.8 thousand.

- Total employment rose by 114.7 thousand (a surge) but also continued the recent collapse by falling by 29.3 thousand.

- An additional 23.7 thousand people became unemployed while unemployment fell by 3.8 thousand.

- The labour force expanded sharply by 138.5 thousand while 33 thousand workers gave up looking for work and left the labour force.

- This was evidence by a sharp rise in the participation rate (0.6 percentage points) but the participation rate fell by 0.3 percentage points, which was consistent with the labour force shrinking.

The first proposition in each point, of-course relates to the original time series while the second proposition relates to the seasonally-adjusted version of the original. But all statements are true according to the estimates.

So the original (unadjusted) data shows that employment in December 2011 rose (on the month) by 114.7 thousand but the seasonally-adjusted series shows that employment decreased by 29.3 thousand.

How do we understand that difference?

First, 114.7 extra workers were employed in December. Employment grew.

Second, as the US Census Bureau note (they are comparing April with March which we can read as December and November):

This difference in direction can happen only when the seasonal factor for April is larger than the seasonal factor for March, indicating that when the underlying level of the series isn’t changing, the April value will typically be larger than the March value. This year, the original series’ April increase over the March value must be smaller than usual, either because the underlying level of the series is decreasing or because some special event or events abnormally increased the March value somewhat, or decreased the April value somewhat.

Given there were no “abnormal” or “special” events in November, the conclusion we draw is that while we know December has a larger seasonal fact than November as a result of the normal surge in retail activity (and the jobs that are created to service it), the rise in December was smaller than usual – much smaller given the numbers involved.

Sampling variability and standard errors

Overlaying these differences is also the sampling variability. I provided a detailed explanation of the impacts of standard errors in these blogs – A surprise every day … employment rises! and Labour force data surprises ….

All statistical agencies, such as the ABS, publish standard errors which reflect the fact that the estimates are derived from a sample survey. The standard errors provide an indication of the sampling variability involved in trying to draw population estimates from a sample. Statisticians use these standard errors to construct what are called 95 per cent confidence intervals which can be interpreted as showing the range that the true value will lie within 95 times out of a 100. So we can be fairly confident that the true value lies within the 95 per cent confidence interval, which is expressed as an upper and lower value of the survey estimate.

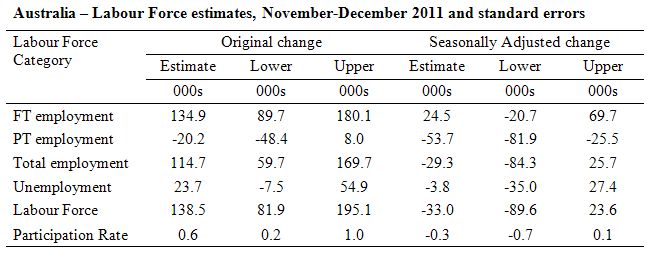

The following Table uses the standard errors published in the ABS Labour Force, December 2011 and shows the original and seasonally-adjusted estimates of the change between November and December 2011 in the major labour force aggregates and the 95% confidence interval for each. The upper limit is the upper 95 per cent confidence interval and the lower limit is the lower interval.

For example, taking the seasonally adjusted data, we could be equally certain that total employment fell by 84.3 thousand as we would that it rose 25.7 thousand between November and December 2011.

In other words, you have quite large standard errors associated with the estimate.

Even a comparison between the original and the seasonally-adjusted series could lead you to conclude that unemployment actually fell in terms of both (given the lower confidence interval for the original data is -7,500 and point estimate for the seasonally-adjusted data is -3,800.

Activity tests etc – the Roy Morgan Polling data

In 2003, Gary Morgan CEO of Roy Morgan Polls, a public polling company in Australia wrote a letter to the Australian Financial Review, which was never published. That is no surprise given the neo-liberal bias of that publication.

The letter said, in part, that:

“It’s Time” for a Realistic Measure of Unemployment in Australia

… the monthly unemployment statistics…understate the numbers of people who are seeking more work, or would like to get a job but did not fit the official definition of unemployed …

The Australian Bureau of Statistics Unemployment Estimate classifies an unemployed person as part of the labour force only if, when surveyed, they have been actively looking for work in the four weeks up to the end of the reference week and if they were available for work in the reference week. That instantly cuts out those who have become disenchanted with the process of looking for a job and so are not regularly seeking employment – not because they don’t want a job but because they have given up hope of finding one. It is obvious that these people must be included in the unemployed if Australia is to have an accurate picture of the true state of unemployment …

Essentially, this comes down to a discussion about the Labour Force framework, which is the foundation for cross-country comparisons of labour market data. The framework is made operational through the International Labour Organization (ILO) and its International Conference of Labour Statisticians (ICLS). These conferences and expert meetings develop the guidelines or norms for implementing the labour force framework and generating the national labour force data.

The ABS disseminate their data according to these conventions.

The rules contained within the labour force framework generally have the following features:

- an activity principle, which is used to classify the population into one of the three basic categories in the labour force framework;

- a set of priority rules, which ensure that each person is classified into only one of the three basic categories in the labour force framework; and

- a short reference period to reflect the labour supply situation at a specified moment in time.

The system of priority rules are applied such that labour force activities take precedence over non-labour force activities and working or having a job (employment) takes precedence over looking for work (unemployment). Also, as with most statistical measurements of activity, employment in the informal sectors, or black-market economy, is outside the scope of activity measures.

Paid activities take precedence over unpaid activities such that for example ‘persons who were keeping house’ as used in Australia, on an unpaid basis are classified as not in the labour force while those who receive pay for this activity are in the labour force as employed.

Similarly persons who undertake unpaid voluntary work are not in the labour force, even though their activities may be similar to those undertaken by the employed.

The category of ‘permanently unable to work’ as used in Australia also means a classification as not in the labour force even though there is evidence to suggest that increasing ‘disability’ rates in some countries merely reflect an attempt to disguise the unemployment problem.

Underutilisation is a general term describing the wastage of willing labour resources. It arises from a number of different reasons that can be subdivided into two broad functional categories:

- A category involving unemployment or its near equivalent. In this group, we include the official unemployed under ILO criteria and those classified as being not in the labour force on search criteria (discouraged workers), availability criteria (other marginal workers), and more broad still, those who take disability and other pensions as an alternative to unemployment (forced pension recipients). These workers share the characteristic that they are jobless and desire work if there were available vacancies. They are however separated by the statistician on other grounds.

- A category that involves sub-optimal employment relations. Workers in this category satisfy the ILO criteria for being classified as employed but suffer time-related underemployment – for example, full-time workers who are currently working less than 35 hours for economic reasons or part-time workers who prefer to work longer hours but are constrained by the demand-side. Sub-optimal employment can also arise from inadequate employment situations – where skills are wasted, income opportunities denied and/or where workers are forced to work longer than they desire.

An additional was in which workers can be underutilised is via underemployment.

Underemployment may be time-related, referring to employed workers who are constrained by the demand side of the labour market to work fewer hours than they desire, or to workers in inadequate employment situations, including for example, skill mismatch.

Clearly, if society invests resources in education, then the skills developed should be used appropriately. This latter category of underemployment is however, very difficult to quantify. For the purposes of this question I assumed that we were only discussing time-based underemployment.

In conceptual terms, a part of an underemployed worker is employed and a part is unemployed, even though they are wholly classified among the employed.

Time-related underemployment is defined in terms of a willingness to work additional hours, an availability to work additional hours, and having worked less than a threshold relating to working time. In Australia, in line with the standard measurement of unemployment, persons actively seeking additional hours of work are distinguished from those who are not.

Reflecting changing employment relationships and an increase in multiple job-holding, in Australia the questions collecting underemployment information reflect a wider range of situations where people are seeking to work more hours. This is in line with the standard international practice.

Two main reasons for time-related underemployment are identified:

- Part-time workers wanting more hours of work;

- Full-time workers who worked less than 35 hours in the reference week for economic reasons (stood down or insufficient work).

The official measure of the Labour Force is divided into employment and unemployment. Most nations use the standard demarcation rule that if you have worked for one or more hours a week during the survey week you are classified as being employed.

If you are not working but indicate you are actively seeking work and are willing to currently work then you are considered to be unemployed.

If you are not working and indicate either you are not actively seeking work or are not willing to work currently then you are considered to be Not in the Labour Force (that is, inactive).

So you get the category of hidden unemployed who are willing to work but have given up looking because there are no jobs available. The statistician counts them as being outside the labour force even though they would accept a job immediately if offered.

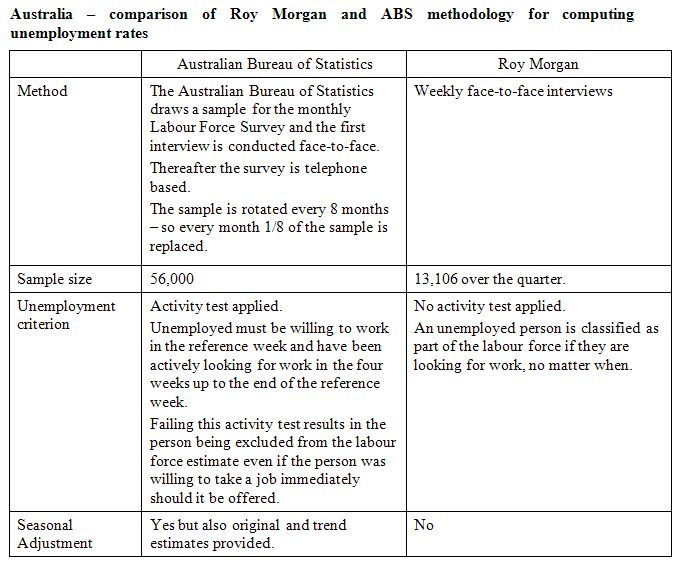

The following Table captures the essential differences between the Roy Morgan measure of unemployment and the ABS official measure. You can see that the real difference is that the former do not apply an activity test as strictly as the ABS and thus include a number of workers which we might consider to be “hidden unemployed” as per the previous discussion.

The Roy Morgan method asks whether the person who is “not employed if they are actually looking for a paid job (regardless of whether they’ve looked in the last four weeks)” and so they include the ABS official unemployed plus some estimate of the hidden unemployed although we cannot be certain whether any of these “additional” workers would be ready to start work immediately.

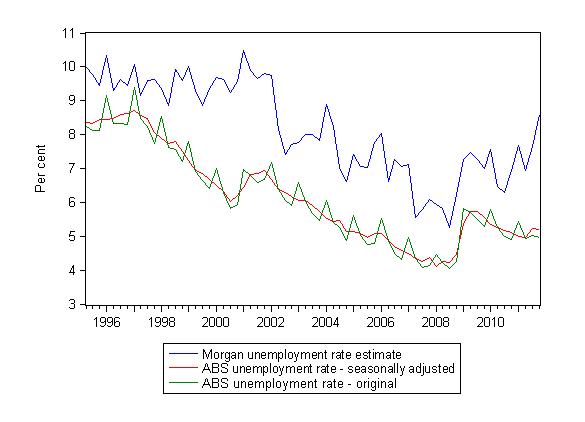

The following graph shows the evolution of the official ABS unemployment rate series (original and seasonally-adjusted) and the Roy Morgan measure.

First, the seasonal spikes in the ABS raw data are clear – occurring every January as the school-leavers flood into the labour market and the December retail surge in casual employment wanes. You can clearly see the smoothing effect of the seasonal adjustment.

Second, it is no surprise that the Roy Morgan estimate consistently exceeds the ABS estimate of the unemployment rate. Certainly when the economy slows and the participation rate falls (suggesting that workers are leaving the ABS measure of the labour force because there are not enough jobs to justify active search

Conclusion

So which estimates are more correct?

Long before the ABS started publishing their broader measures of labour underutilisation – including their quarterly estimates of underemployment, my research centre published our CofFEE Labour Market Indicators. You can also read working papers (subsequently published in academic journals or books) – Estimating Hidden Unemployment in Australia and the United States (1999) and Beyond the unemployment rate – labour underutilisation and underemployment in Australia and the US (2000) – which outline the methodology that I developed to provide broader measures of labour underutilisation.

In general, broader measures are better than the more narrow indicator which is the ABS official unemployment rate. But that is not to say that the ABS estimates are wrong. They simply measure something different to that being estimated by the Roy Morgan Polling organisation.

The broad rule of thumb that economists such as me use to provide an estimate of the state of the labour market is to double the official unemployment rate and then add some for hidden unemployment. However, we might have to rethink that rule given that underemployment is now becoming a much more serious problem than in the past.

What is clear though is that once you understand the underlying state of the labour market – the components of labour underutilisation – you gain a much better appreciation of how bad the labour market is at present – seasonally-adjusted, original, Roy Morgan, whatever.

That is enough for today?

Apparently there is lot of attention on the new mckensey report on debt and develeraging.

http://www.mckinsey.com/Insights/MGI/Research/Financial_Markets/Uneven_progress_on_the_path_to_growth

Maybe Bill you would like to comment?

Going over the way the statistics are collected – is that why the Roy Morgan figures are so volatile compared to the ABS? Or is it just the smaller sample size?

Bill ~

I’m curious as to your opinion on John Williams’ Shadowstats, as a number of commentators here in the states reference them as more realistic measures of unemployment and other critical economic measurements. Supposedly Williams simply backs out changes to the definitions of these measure from when they were first created; changes which he claims have often been made for purely political reasons. His results present a picture of the US economy that it is almost always worse than the official view.

Is there any veracity to his claims? Are his number useful?

@Senexx: I think the activity check makes up alot of the difference.

@Bill:

“…when the economy slows and the participation rate falls (suggesting that workers are leaving the ABS measure of the labour force because there are not enough jobs to justify active search)”

This i find incredibly interesting. How the number of workers per vacancy affects participation rate in the long run, that is. I would expect participation to fall slowly with the years with few workers per vacancy and vice versa. Are there any solid statistics on this?

Thank you again for the best blog on the ‘net!

The comparison of ABS stats are both unnecessary and flawed.

First, the same definitional estimate of unemployed can be gleaned from ABS data. It releases data on those classified as Not in the Labour Force by the different categories. Its been a little while since I looked at it but from memory it includes people who are marginally attached to the Labour Force i.e. dont fit the strict criteria of unemployed. So the definition of unemployed can be extended to those that fit Roy morgans definition. And from memory its not that much higher than the offical rate.

Second, If you look at the amount of effort that goes into the sample design and weighting methodologies by the ABS and compare this to the polling methods that Roy Morgan utilises, well if you are serious you wouldn’t give Roy Morgans numbers the time of day.

In addition there is good econimic reason to use the definition the ABS uses, which a Professor of Economics should realise. It provides a point in time estimate of Labour supply, this is important for many boring reasons but it isn’t a government conspiracy to ower the number of unemployed. Why else would they supply more detailed disaggregations?

I find that people use the number that fits their narrative, irrespective of the facts. This doesn’t mean that the number they use is right it just means they have succumbed to their own intellectual failings.