The other day I was asked whether I was happy that the US President was…

Europe – the fierce urgency of tomorrow

When a democratic government fails to deliver on its promises it typically gets tossed out of office by the voters at the next election. Sometimes it takes a few elections for the rot to set in once it becomes clear that the strategy for the nation is not working. Yesterday, the European Union put out its – European Economic Forecast – Autumn 2011 – which categorically demonstrates that after 3 years of crisis and one grand plan after another the leadership is failing. Some of the leadership tokens – the Greek and Italian prime ministers have been pushed aside – but not by the people – rather by the cabal that rules Europe. The situation will worsen while this lot hold the power.

I note that the EU Autumn 2011 Review is the “provisional version” only – which just about sums up the way the leadership works over there. As the Editorial in the UK Guardian (November 10, 2011) said about the “European approach to this crisis”:

… talk in terms of great drama while acting with self-defeating slowness, or what one might call the fierce urgency of tomorrow.

The EU Autumn 2011 Review is one of those documents that you know will be revised heavily when next they have to report. The IMF World Economic Outlook and other “reviews”, “updates” whatever you like to call them always reflect a tension between the dominant ideology and the reality that – finally – forces its way into the protected bureaucratic offices where the servants of the ideologues enjoy secure employment and decent working conditions.

So we get a sequence of revised forecasts (downwards when times are bad) but never an admission of fault. The future is always just around the corner when “market sentiment” or “investor confidence” or “household outlooks” will improve and growth will return. The next edition wipes out the previous estimates of growth and pushes them forward again.

The pattern is very familiar to those who read these documents sequentially over time. The same ideological paradigm is imposed on the story so you don’t really get any understanding that the reality they have to acknowledge (after denying it in previous “forecasts”) is anything to do with the failure of the ideology.

The EU Report starts with this:

The global economy is in danger zone again. This time, the euro area is the focus of concern. In spring, it looked as if Europe’s sovereign-debt troubles remained contained. Moreover, there were signs of domestic demand taking over as the engine of a moderate recovery of the European economy, despite fiscal tightening and weakening global economic conditions. These hopes were dashed.

In Spring 2011 (earlier this year) it never looked liked the problem was contained. The time-bomb continued to tick and it was only the intervention of the ECB that had kept the bond markets at bay.

As I showed in Wednesday’s blog – The ECB is a major reason the Euro crisis is deepening – the ECB hardly conducted any secondary market bond purchases between support between about January 21, 2011 and August 5, 2011 under their SMP strategy.

The pressure was building though and it was clear the spreads on the German benchmark bond rate and the French and Italian bond rates were creeping up during this period.

The ECB could have stopped that creep and prevented the most recent escalation in spreads on the Italian bonds if it chose too. But, of-course, they are claiming that the responsibility for resolving the crisis lies with member governments despite the fact that none of those governments have the essential fiscal and monetary capacity to intervene. Only the ECB can provide a temporary cap to the crisis.

Further, note the ideology – they wanted us to believe that under the drag of fiscal austerity and the deliberate choice by politicians to allow unemployment to keep rising, that private demand would take “over as the engine of a moderate recovery”. It was never going to do that.

And note they are silent about their much-vaunted claims that there would be an export-led recovery once the fiscal austerity deflated the domestic economies sufficiently – that is caused so much entrenched unemployment that wage cuts were easy to push through.

But then the reality has to be acknowledged – they know that the situation is deteriorating quickly and all they can say is that their “hopes were dashed”.

The whole fiscal austerity mantra is built on these “hopes”. They somehow think that if they keep saying it enough – that consumers and firms will spend and invest more despite on-going job losses, huge debt overhangs, housing market collapses, and wage and pension cuts etc – that it will happen.

Some of them who try to put some “technical” authority into this mantra talk about Ricardian Equivalence or their versions of this rather insidious notion that mainstream macroeconomics invented to justify their call for smaller government and pro-cyclical fiscal policy. Apparently, private spending was being withdrawn not because jobs were drying up and sales were falling but because the resulting deficits (via the automatic stabilisers) were signalling higher taxes in the future and everyone was madly saving to meet their future tax obligations.

The notion has never enjoyed empirical support and at the theoretical level relies on some extreme (impossible) assumptions for its consistency. It is the stuff of fantasy land. The real motivation of the economists – of-course, was to limit the size and capacity of government and provide more scope for their beloved “self regulating free market”, an oxymoron if there ever was one – to appropriate real income from the workers.

Please read my blog – Pushing the fantasy barrow – for more discussion on this point.

The triumph was that the cabal captured governments completely and so now our so-called elected officials do the bidding for small elites and use public funds to lie to us about there being no alternative.

So who is in the cabal in Europe? The UK Guardian’s Larry Elliot summarised it nicely yesterday (November 10, 2011) in this article – The emergence of the Frankfurt Group has turned back the democratic clock.

He argues that “(e)lectorates are being bypassed as increasing austerity pushes Europe’s weaker countries into an economic death spiral” and the

The real decisions in Europe are now taken by the Frankfurt Group, an unelected cabal made of up eight people: Lagarde; Merkel; Sarkozy; Mario Draghi, the new president of the ECB; José Manuel Barroso, the president of the European Commission; Jean-Claude Juncker, chairman of the Eurogroup; Herman van Rompuy, the president of the European Council; and Olli Rehn, Europe’s economic and monetary affairs commissioner.

This group, which is accountable to no one, calls the shots in Europe. The cabal decides whether Greece should be allowed to hold a referendum and if and when Athens should get the next tranche of its bailout cash. What matters to this group is what the financial markets think not what voters might want. To the extent that governments had any power, it has been removed and placed in the hands of the European Commission, the European Central Bank and the IMF. It is as if the democratic clock has been turned back to the days when France was ruled by the Bourbons.

The press this week have been shouting how stupid George Papandreou had been in calling to the Greek people for their verdict – how naive of him and he surely had to fall on his sword for being so out of touch with the cabal. That exemplifies the problem Europe is in now.

The cabal is a tight ideological unit that has shown a total disregard for the damage its policy positions are causing.

The EU Autumn 2011 Review has now declared that Europe will not grow at all in the fourth quarter 2011.

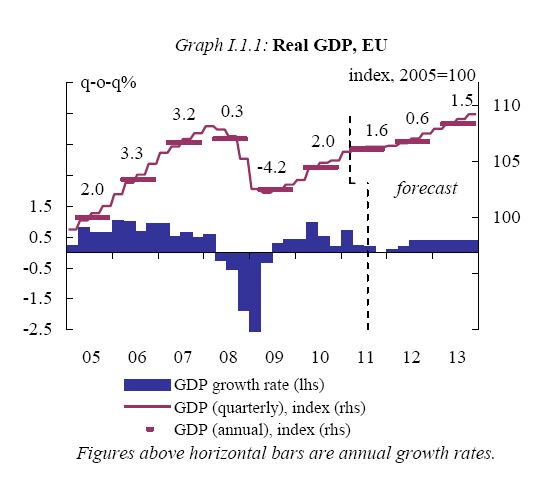

The following graph is reproduced from the EU Autumn 2011 Review and shows the EU’s latest forecasts for real GDP. They justify the return to growth in 2012-13 on the basis that “confidence might return faster than currently assumed”. It is all “might” and “may” whereas they know for sure that the on-going fiscal austerity will continue to damage growth.

So where is the private confidence going to come from? No credible answers are provided. They just “might return faster” sometime. Stay tuned for the next Review in 2012!

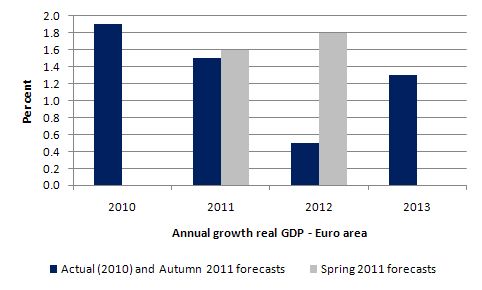

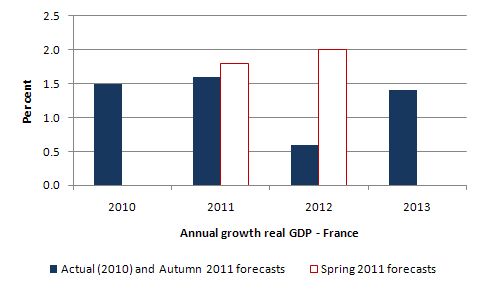

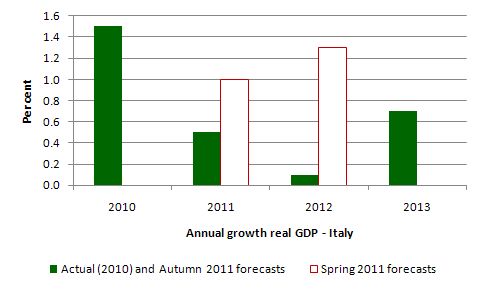

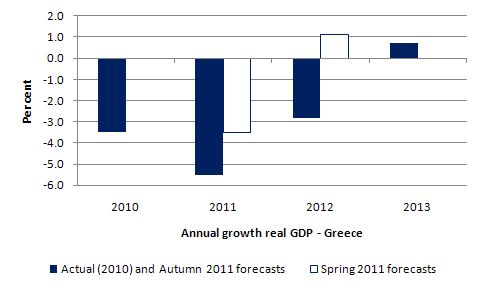

To give you some idea of how rapidly the forecasts are unwinding here is a sequence of graphs comparing the latest European Autumn 2011 forecasts with the EU Spring 2011 forecasts for the Euro area, Greece, Italy and France. A similar story can be shown for other nations. They acknowledge the reality and so downgrade 2011 forecasts but then re-assert the mantra of growth despite fiscal austerity for 2012 and 2013.

As noted above, there is no one in “power” who can be held accountable. As soon as one of the “tokens” is looking fragile – they are moved aside by the cabal and replaced with another lackey.

The failure of the leadership is written on every page of the EU Autumn 2011 Review although they never say that.

They claim that the reason for the dire situation is that:

Sharply deteriorating confidence and intensified financial turmoil is affecting investment and consumption, while urgent fiscal consolidation is weighing on domestic demand and weakening global economic conditions are holding back exports. Real GDP growth in the EU is now expected to come to a standstill around the end of this year, turning negative in some Member States.

Conclusion:

(a) Ricardian justifications by the neo-liberals for fiscal austerity did not work – as noted above.

(b) Domestic deflation justified on the grounds that it would stimulate exports did not work. Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

(c) Fiscal austerity wrecks domestic confidence which reduces private demand – so if growth was the imperative why would they deliberately undermine it by so-called urgent fiscal consolidation?

What was so urgent about it? Who said it was urgent? Clearly, the bond markets made noises but the ECB could have easily dealt the private bond markets out of the game – as they have shown emphatically since the SMP began.

The manifestations of failure are everywhere:

1. “Growth will be insufficient to deliver an overall reduction of unemployment within the forecast period”. That is, with “employment growth is expected to grind to a halt in 2012 … high unemployment is set to persist through 2013” at least.

2. “As a result of the domestic and external weaknesses, GDP in the EU is projected to stagnate towards the end of 2011”. And the common element is weak private demand and pro-cyclical fiscal policy making it worse. The governments are choosing to deny their citizens any hope of unemployment reductions and significant income growth for the next two years at least.

After Lagarde, Merkel, Junker, Draghi and the rest of them are long gone having enjoyed a luxurious retirement on high superannuations afforded from the public purse, the youth of today will be struggling as adults with the legacies that these leaders left. They will carry the disadvantage of entrenched unemployment for the rest of their lives in the form of poverty and diminished opportunities.

3. “However, the need for ongoing balance-sheet adjustment, both in the private and the public sector, the legacy of high unemployment and the negative impact of the crisis on potential growth will continue to weigh on the speed of growth going forward”. Which means that the victims of the policy failures will pay the price rather than the perpetrators. Unemployment is being used as a means for the cabal to get financial ratios into the ranges they have artificially imposed on the member states.

There is no reason for public deficit reduction in any EMU member state at present. There is an urgent need for private deleveraging and that can only really progress at speed if the public deficits are supporting growth.

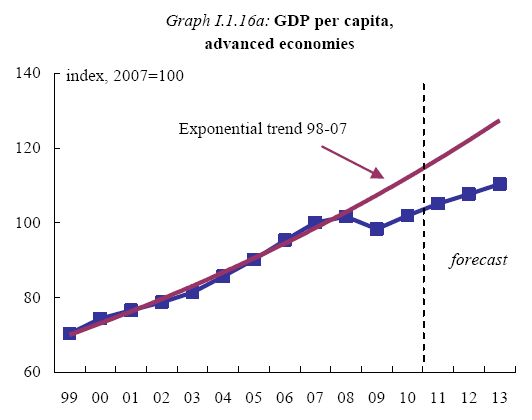

To really understand the damage the leadership is causing I thought this graph was pretty emphatic. It shows what might have happened to real GDP per capita (the red line) and what is now happening. Even the forecasts for the blue line are optimistic. These are losses that will never be regained. The current generation of leaders are making us (and our children) poorer.

Some might argue that we will have to do this for environmental reasons – that is, adopt a reduced material aspiration. I agree but the damage our leaders are inflicting on us provides no “green gains”. There is no “just transition” going on here where we all share in a lower real GDP per capita (as currently defined). What is happening is that the real GDP is falling but is also being redistributed further to the elites so that their levels of income are rising while the unemployed and their families become increasingly impoverished.

Meanwhile the Greeks have appointed as the new Prime Minister, a very “safe” bet from the perspective of the cabal. I make no observations about Dr Papademos as a person only about his ideas.

Larry Elliot (article noted above) said:

Bond dealers liked the idea that the government in Athens could soon be headed by Lucas Papademos, a former vice-president of the European Central Bank. Angela Merkel and Nicolas Sarkozy think Papademos is the sort of hard-line technocrat with whom they can do business.

The UK Guardian carried a story profiling Dr Papademos (November 10, 2011) – Lucas Papademos: avuncular technocrat much respected in Greece – and said be “seen as a safe pair of hands who will avoid the snake pit of Greek politics”.

I think the choice of words was telling. Check out the meaning of the word Avuncular:

Of or relating to an uncle

Kind and friendly toward a younger or less experienced person

Dr Papademos subscribes to the same neo-liberal ideology that is ensuring the youth of Europe are denied access to proper education, training and employment. The economics paradigm that he works within is anything but avuncular.

I first came across his work when I was an economics student. He was a PhD student of Franco Modigliani and in 1975 they published an article – Modigliani, F. and Papademos, L. (1975) ‘Targets for Monetary Policy in the Coming Year’, Brookings Papers on Economic Activity, Number 1, pp. 141-163 – which introduced the term NAIRU into the economics profession. I am sorry that I cannot make that article freely available.

There have been two striking developments in economics over the last thirty years. First, a major theoretical revolution occurred in macroeconomics (from Keynesianism to Monetarism and beyond). Second, unemployment and broader labour underutilisation rates have persisted at high levels.

In past work I have written about the development of the concept of full employment since the 1940s starting with the debate in the 1940s which emphasised the

Full employment as genuine policy goal was abandoned with the introduction of the so-called Milton Friedman’s natural rate hypothesis (NRH) and its assertion that there is only one unemployment rate consistent with stable inflation. In the NRH, there is no discretionary role for aggregate demand management and only microeconomic changes can reduce the natural rate of unemployment.

Accordingly, the policy debate became increasingly concentrated on deregulation, privatisation, and reductions in the provisions of the Welfare State with tight monetary and fiscal regimes instituted. High unemployment persisted. The fact that quits were strongly pro-cyclical made the natural rate hypothesis untenable.

But the idea of a cyclically-invariant steady-state unemployment rate persisted in the form of the NAIRU concept which was constructed as meaning that when unemployment is above it then inflation should decelerate and vice-versa.

While various theoretical structures have been used to justify the NAIRU as a viable concept, the conclusion from each is simple: there is only one cyclically-invariant unemployment rate associated with stable price inflation. The NAIRU concept has dominated macroeconomic policy making in most OECD countries since the late 1970s and the “fight-inflation-first” strategies have exacted a harsh toll in the form of persistently high unemployment and broader labour underutilisation.

Under the sway of the NAIRU, policy makers around the World abandoned the pursuit of full employment as initially conceived.

Of-course they couldn’t admit that so they started redefining what full employment meant. So if you read this literature you will quickly realise that the neo-liberals define full employment as being the NAIRU which is divorced from any notion that there has to be enough jobs available to meet the desires of the available labour force. So in one small change in taxonomy governments have been able to turn their failure to provide enough jobs into a success – well we are at full employment now because we are at the NAIRU. So it is a pernicious concept indeed.

Under the NAIRU approach, policy makers use unemployment as a tool to suppress price pressures and the OECD experience in the 1990s and beyond shows that this strategy has been successful.

The empirical evidence is clear that these economies have not provided enough jobs since the mid-1970s and the conduct of monetary policy has contributed to the malaise. Central bankers – pursuing price stability as their single goal – have forced the unemployed to engage in an involuntary fight against inflation and the fiscal authorities have further worsened the situation with complementary austerity.

How useful is the NAIRU as a guide to policy? In my 2008 book with Joan Muysken Full Employment Abandoned we analyse this topic in depth. The bottom line is that there is no empirical basis for believing in a rigid NAIRU.

Please read my blog – The dreaded NAIRU is still about! – for more discussion on this point.

It is interesting that Franco Modigliani, who introduced the term NAIRU to the economics profession, argued in 2000 – Modigliani, F. (2000) ‘Europe’s economic problems’, Carpe Oeconomiam Papers in Economics, 3rd Monetary and Finance Lecture, Freiburg, 6 April – that:

Unemployment is primarily due to lack of aggregate demand. This is mainly the outcome of erroneous macroeconomic policies… [the decisions of Central Banks] … inspired by an obsessive fear of inflation, … coupled with a benign neglect for unemployment … have resulted in systematically over tight monetary policy decisions, apparently based on an objectionable use of the so-called NAIRU approach. The contractive effects of these policies have been reinforced by common, very tight fiscal policies (emphasis in original).

That was strong statement by one of the founders.

Papademos left academic life to become the head to the Greek central bank from 1994 until the early 2000s and then became the vice president of the European Central Bank for several years.

He is pro-Euro and a mate of the cabal.

If you consider some of his speeches in his recent roles – for example – this November 19, 1999 speech while still Governor of the Bank of Greece – Greece and the euro – you will not be left wondering about his attitudes to fiscal austerity and the primacy of monetary policy.

He was a major player in the decision to shed sovereignty (giving up the drachma) for the euro.

On October 17, 2001 – he made this speech – The Completion of the Changeover to the Euro – where he said:

The macroeconomic and microeconomic benefits for Europe and Greece from the introduction of the euro are numerous, and have been enumerated in detail in the past … Our economy has already drawn numerous benefits from Greece’s adoption of the euro, since this adoption presupposed stability and led to it. Greece has achieved a high level of monetary and exchange rate stability in the long run, which promotes economic growth. The shielding of the economies of Greece and of the other euro area countries from exogenous shocks proved adequate in the aftermath of the tragic events of 11th September.

Later (June 15, 2007), in his ECB role he made these Opening Remarks to the ECB Financial Stability Review June 2007 – just before the crisis hit. He waxed lyrical about the “the macroeconomic environment … continued to be favourable” and the “robust” world growth prospects. He said that in “both the banking and insurance sectors, profitability continued to improve” and that:

Moreover, global financial markets have been characterised, for the most part, by unusually subdued volatility, while credit spreads have remained low.

Notwithstanding this favourable background, between late February and early March 2007, the shock-absorbing capacity of the global and euro area financial systems was again tested by the third significant burst of market volatility in the past two years. This was comfortably weathered and the stock market recovered quickly … Improvements in the risk management practices of financial firms appear to have contributed to ensuring that higher financial market volatility did not prevent capital markets from facilitating the intermediation of capital.

And it goes on.

So one wouldn’t give him marks for understanding what was happening in the build up to the crisis or for understanding the vulnerabilities that entering the euro ensured Greece would inherit.

He is a classic mainstream central banker who has been chosen by the cabal to provide more of the same – more austerity and more troubles for the people of Greece and Europe.

Conclusion

The Euro cabal is really incapable of resolving the problems that it faces. They are locked in an ideological warp that is in denial of the only solutions that are possible.

They have too much political capital – and raw power – to protect. To acknowledge the way forward was to manage an orderly break-up of the flawed monetary system would be too much to ask.

It will take an uprising of the citizens who finally get sick of the increased hardship the cabal is inflicting on them and decide to assert their democratic rights.

As someone said to be overnight (by E-mail) Europe, and he was talking about Germany specifically, seems intent on blowing itself up a few times each century, then a burst of democracy follows and then they blow themselves up again.

November 11

Today Armistice Day – I remembered our First World War soldiers who died or were injured. I also acknowledge the woman that were raped during that war who do not get any recognition.

Europe blowing itself up – and the rest of us were dragged into it.

Saturday Quiz

The Saturday Quiz will be back sometime tomorrow – about the same as last week.

That is enough for today!

A link to the paper of Modigliani and Papademos:

Targets for Monetary Policy in the Coming Year (PDF)

And YES. The Eurozone is a complete mess. At least the media (some) seems to take notice of the silent march towards technocratic dictatorship. In the past few days two articles in the Financial Times: “Europe: rise of the calculating machine” and “Europeans clutch at technocratic fixes”. Plus the mentioned article in the Guardian. And here in Germany Frank Schirrmacher (publisher of FAZ) with “Der griechische Weg: Demokratie ist Ramsch” (The Greek way: Democracy is Rubbish) and Jürgen Habermas with “Euro-Krise: Rettet die Würde der Demokratie ” (Euro-Crisis: Save the dignity of democracy)

Dear Bill,

Did the 2010 Jamaican debt default occur in a fiat currency, as you define it? I’d be interested to see whether its debt was denominated in its own sovereign currency.

http://www.guardian.co.uk/commentisfree/cifamerica/2011/jul/22/jamaica-debt-crisis

Bill, so Papademos is the Godfather of the Greek Tragedy.

Remember the furore when Gordon Brown became Prime Minister as he hadn’t been elected to that post?

Whereforart ye furore over Papademos, father of the people in Greek, double plus ungood irony?

On a separate note I’m ‘enjoying’, if that’s the word, The Slap’s insight into Greco-Australian life.

The problem is that what looks like a failure to most ordinary people might be seen as a tremendous success by elites, whose interests and long-term aims are never the same as those of ordinary people.

We know that in a crisis, the rich use the leverage and bargaining positions provided by their surplus to buy out the desperate and failing. In a crisis, the rich usually get richer.

Political power is just a kind of wealth. In a democratic society, that power is owned in common by the citizenry. But like any other form of wealth, the political power of the many is something the rich, who already possess much larger than average shares of political power, would like to get their hands on.

The people who own most of our world have been using this crisis to terrify people into austerity, and to force them into bankrupt conditions so they will then be willing to sell off the public sector to private owners. What the Frankfurt Group is doing is the same thing. The only difference is that what the Frankfurt group is wresting from public hands is not material holdings but political power.

Leonard Cohen knows the score:

Everybody knows that the dice are loaded

Everybody rolls with their fingers crossed

Everybody knows that the war is over

Everybody knows the good guys lost

Everybody knows the fight was fixed

The poor stay poor, the rich get rich

That’s how it goes

Everybody knows

Hey all!

I’m building a website around mmt for an assignment. It is supposed to be based on Bill’s quizzes, but it might become something a bit more ‘basic’. Since it is an assignment I will probably put more effort into presentation, rather than comprehensive site about MMT. Comments appreciated.

Lacky

ummt.org

btw there isn’t much loaded atm.

As these unelected technocrats increase their power over Europe at the expense of democracy, we are seeing the rise of the Eurobots.

Mark’s comment about Jamaica is interesting. How does one find out exactly.

My guess is that the Jamaican money is tied to the dollar, and hence, reacts like the euro. I.e. the debt is not in the sovereign currency of Jamaica, whatever that is.

I’m new to MMT and don’t pretend to understand it all. But my “takeaway” is the ECB buying of

bonds may, over the short run, relieve the “crisis” somewhat. However, with the “austerity

mentality” firmly in place, there will be no longer run relief as economic growth continues to

weaken – that is, the “crisis” will be back at some point Does that make sense?

Dear Mark (at 2011/11/11 at 19:57) and later CharlesD

I have been very interested in Jamaica myself and have spent some time building a database. I plan to write a book on the how the Caribbean economies have made themselves dependent (for no reason) on the international capital markets and how that cruels development. In part, this is because the governments hire economic policy advisers straight out of US mainstream graduate programs who impose neo-liberal restrictions on their nations. The IMF also has its dirty grip around the throat of many of these nations, particularly Jamaica.

If you go to the Bank of Jamaica http://www.boj.org.jm – you will learn that the central bank issues its own currency and its foreign exchange value floats. However, they violate sovereignty by borrowing heavily in foreign currencies and so rely on exports to generate the necessary funds to service the debt, which means that if exports falter, they face insolvency.

The Ministry of Finance publishes a Debt Management Strategies circular – the latest being April 2011 – http://www.mof.gov.jm/sites/default/files/dms/2011-2012-mtdms.pdf. Here is a relevant excerpt.

At the end of FY 2010/11, US dollar denominated debt accounted for 82.4% of the external debt compared with 79.2% at the end of FY 2009/10. Further, at the end of FY 2010/11, the proportion of the debt denominated in Euros represented 13.6% compared with 16.1% at the end of FY 2009/10. Yen-denominated loans represented 2.1% of the external stock, while other currencies accounted for 1.9% at the end of FY 2010/11 …

I might write a blog about this eventually.

best wishes

bill

Dear Bill

I just wanted to thank you for the wealth of information and the free tuition. I’ve just written a blog post about the inadequacies of BBC reporting of the financial crisis and quoted some of your analyses as being amongst the alternative views which are never reported. It seems that it is not just the Harvard Students who are subjected to a solely free-market perspective. A Dutch economist twittered that most university Economics Departments were the Madrassas of the financial elites.

http://think-left.org/2011/11/11/inadequacies-of-bbc-coverage-of-the-eu-financial-crisis/

US markets rallying on the good news that 3 of the PIIGS look set to commit to crushing their people with further harsh austerity…

“US STOCKS have jumped about two per cent after three struggling eurozone governments moved ahead on crucial austerity programs, boosting confidence that the region was on the right track.”

http://www.perthnow.com.au/business/europes-progress-boosts-us-stocks/story-e6frg2qc-1226193419618?from=public_rss

I am no longer of the opinion that an orderly break up of the Euro will occur – the big boys will simply not let the struggling peripherals exit. Increasing violence and perhaps even eventual war now seem more likely to me.

“But the SMP demonstrates that the ECB is caught in a bind. It repeatedly claims it is not responsible for resolving the crisis but realises that it is the only institution in the monetary system that has the capacity to resolve it – given it issues the currency.”

hi bill,

this was from you previous post, but i thought it sort of relevant 😉

cant eu member state treasuries run deficits which create net euro currency deposits in their banking system.

so arent they able to issue euro’s in this way, not just the ecb.

there may be legal or treaty restrictions, but the fact of a deficit above a mandated guidline surely means they have atleast the theoretical power to issue euro’s or create euro deposits.

yes/no, maybe ?

Dan Kervick says:

Saturday, November 12, 2011 at 0:16

“The problem is that what looks like a failure to most ordinary people might be seen as a tremendous success by elites, whose interests and long-term aims are never the same as those of ordinary people.”

Heard on the World Service: The Greek elite are expecting to purchase Greek assets at ‘knockdown’ prices.

mahaish says:

Saturday, November 12, 2011 at 18:21

“so arent they able to issue euro’s in this way, not just the ecb.”

It seems that the Irish have ‘printed’ Euro’s?

“The end-December figures from the Central Bank revealed that, while the amount that the Irish banks had borrowed from the ECB fell by €4.4bn to €132bn in the final month of 2010, this was more than offset by a €6.4bn increase to €51bn in the amount that they had borrowed from the Irish Central Bank.

With the ECB confirming that it is the Irish Central Bank that is creating this money and that the money is not being borrowed from the ECB, what is now happening is that the Central Bank is printing its own money. This money is then being lent to the Irish banks to plug the holes opening up in their balance sheets as nervous depositors continue to withdraw their money.”

http://www.independent.ie/business/irish/were-printing-billions-just-to-save-the-banks-2507432.html

The ECB can remove the toxic assets from the market the same way the the Fed did in the USA. It can buy all of the Greek/Italian debt and put it on their balance sheet and take it off the banks. They don’t have to print money to pay for it. They can pay for it by issuing bank bills that count as bank’s capital but not as monetary reserves. With the ECB holding the debt, bank’s do not need to recapitalise.

The ECB can remove the toxic assets from the market the same way the the Fed did in the USA. It can buy all of the Greek/Italian debt and put it on their balance sheet and take it off the banks.

I follow European blogs and here’s my observation : I have seen a marked shift in some neo-liberal/corporate circles from “buying assets is heresy” to your reasoning above. It tells me that the powerful creditors, who ultimately control policy (check my blog), have realized that they are gravitating towards a black hole and would rather anything other than be swallowed by it into disintegration. The alternative, of course, the one that I support, is that excess debt simply be repudiated, which has had been the norm, historically.

As a footnote, I nearly choked on my breakfast the other day after reading the insane sentence in, of all things, the Guardian:

“Increasing the demand for government bonds (which is the name given for the thousands of loans each government has built up from years of overspending) …”

So every government bond ever issued is an “overspend”?

The Fates play with us to amuse themselves. “Papa” is an almost universal Western word for father. “Demos” means the “village” or the “people”. So Papa-Demos is the Father of the People. Of course, it is not The Fates who play with us to amuse themselves. It is the rich elites who do so.

It is all very well to prove logically and empirically that counter-cyclical Keynesianism and MMT are broadly correct (as indeed they are). The questions are how do you get this theory into broad public debate and how do you convince the average citizen? The average citizen is philosophically and economically naive. The average citizen is deliberately under-educated by our current system and perversely proud to be anti-intellectual. The average citizen has a false consciousness implanted by the propaganda of corporate capital, consumerism and the mass media outlets.

My 17 year old daughter recently told me she knew how to fix many of the problems of our society. A little indulgently I said “How would you do it?” She said (essentially), “I would greatly increase the pay and resources of educators (teachers, professors etc) and educate the whole population properly.” I said with some surprise, “You know, I think that would work.”

syzygy,

I have left a comment on your blog, and I will reproduce it here because I am so angry about the way the BBC and others report on unemplyment:

One of the most basic points which are never mentioned in the media with regards to unemployment, is that typically 5.5% unemployment is maintained at all times either by central banks or governments to “prevent inflation”. Whenever the BBC or other media outlets report on unemployment, they interview unemployed people asking why they, specifically, are unemployed, and never mention the fact that much of it is generated by neo-liberal policy quite deliberately.

Given that the NAIRU is mentioned in most economics text-books (hidden in plain sight), I would suggest commentators and loggers launch a campaign to force media outlets such as the BBC to discuss it openly.

The perpetrators of what Max Keiser appropriately terms ‘financial terrorism’, would do well to reflect on the consequences of increasing inequality within our societies, as explicated by the author of “The Spirit Level”:

http://www.ted.com/talks/richard_wilkinson.html

I wonder how these neofeudal lords plan to protect themselves from the masses of disaffected debt peons. I suppose that there will be a large pool of unemployed who may be compelled to work as mercenaries on behalf of their oppressors? It doesn’t take too much imagination to see things heading to a very dark place.

A fragile democracy is not a good place from which to face looming resource constraints and climate change.