I started my undergraduate studies in economics in the late 1970s after starting out as…

Day by day the evidence mounts

I was looking at yields today and you cannot help noticing that bond markets are become more attracted to government debt each day. So much for the arguments we have been hearing ad nauseum over the last few years that governments were about to feel the cold hand of the markets who would punish them by dumping their debt unless they imposed harsh austerity. The problem is that the attraction of government debt does not signify that markets are rewarding governments for their fiscal austerity efforts. In fact, it is exactly the opposite. The markets are realising that austerity is now undermining economic growth and the claims by politicians and economists that we would enjoy a “fiscal contraction expansion” if only the government got off the backs of the private sector are now being revealed as lies. The world economy is tanking. Day by day the evidence mounts. The safest place to be when the economy heads south is in cash or government bonds.

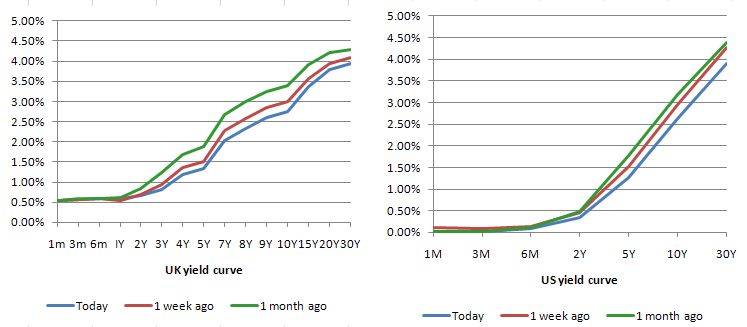

Consider the following graphs which show the UK and US benchmark yield curve for today, yesterday and 1 month ago.

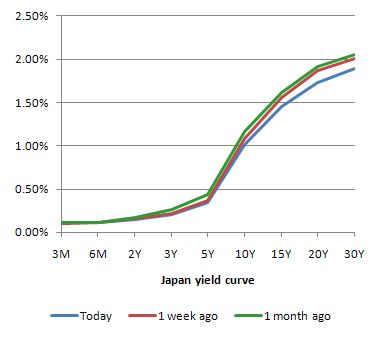

Then consider Japan’s yield curve – they are after all 2.5 times at least over the so-called default threshold public debt ratio that gets bandied around by commentators. Compare the vertical scale to that of the UK and the US.

Pause for a moment and reflect on what these graphs are telling us.

They are not telling us that the bond markets are happy that the British government is pursuing a harsh austerity program which is what George Osborne (British Chancellor) would like you to believe.

They are not telling you that the farcical debt ceiling debate in the US has destabilised bond markets who feared the US government would default.

They are not telling you that the bond markets expect galloping inflation to result from the higher than usual budget deficits that these governments are running.

They are not telling you that the bond markets expect interest rates to rise because the higher than usual budget deficits are competing for scarce savings and crowding out private spending.

They are not telling you that investors are buoyed by the fiscal austerity being imposed on economies all over the world and that they think private sector confidence is about to burst forth and fill up the spending gaps left by the declining government spending.

In the British case, the 10-year gilt yield dived to a “record low” yesterday such was the strength of demand for them from the bond markets.

As each day passes, the real economic news (decline of manufacturing, construction and services etc) gets worse in Britain and growth forecasts, already abysmally low, get revised downwards.

The market talk is about an “intensifying flight-to-quality flows supporting gilts”.

The same pattern is occurring in all the major government bond markets and has been consistent over the last month or more.

While the IMF and other right-wing think tanks control idiot politicians like ventriloquists and have them parrot mantras like “fiscal contraction expansion” … “austerity is pro-growth” etc the money boys and girls know otherwise. They know several things.

They know that other assets are unsafe in a declining world economy. The recent plunge in sharemarkets has just about wiped off the gains made in recent months. In Australia’s case the All Ords which follows world trends is lower than it was a year ago. Investors are starting to understand that central banks are not about to fight a rear-guard inflation spiral with rising interest rates and instead are facing a deflationary environment, the price of energy notwithstanding.

They know that government bonds are risk free because the governments are sovereign in their own currency. I know some will say but German yields are also falling and they are hardly sovereign in their own currency. While both statements are true, Germany is the least likely of the EMU nations to come up against its inherent credit risk. Its economy is so large.

A Wall Street Journal report (August 2, 2011) noted that:

The strong demand for these safe-haven assets amid a selloff in stocks and other risky investments suggests that market participants are increasingly nervous about the pace of the global economic recovery … Investors are getting pummeled by myriad factors: fears about a potential economic drag from the spending cuts, the risk of a downgrade on the U.S.’s credit rating, signs of contagion in the euro zone spreading to larger economies and disappointing global data over the past several sessions.

None of this tells me that the austerity campaigns being waged in Britain, the US, and across the Eurozone are promoting confidence among investors. Indeed, the opposite is the case. We are all seeing the real economies falling backwards and the risk of a global double-dip recession is much higher than it was a year ago.

Further, the farce that the EU bosses played out in their latest bailout of Greece – which was presented as the solution to the instability in Euro bond markets has been shown for what it was. Now the bigger kills are in the sights of the bond markets – Italy and Spain – while the ECB continues to prop up the failed monetary system by acting as a “quasi-fiscal” authority.

One commentator (in the right-wing UK Daily Telegraph) at least gets it right (August 3, 2011) – Whatever George Osborne believes, Britain will spend years in the doldrums.

When I say gets it right – I should qualify that. He gets it wrong but in doing so gets it right. Ok!

The article by one Jeremy Warner is an indictment of the British government although the author thinks that Britain was the next Greece. How could it ever have been that when it issues its own currency and has its own central bank?

But that aside, Warner is correct when he says:

… there is also an altogether less comforting conclusion to draw from these almost unbelievably low interest rates.

It is that, for the third time since the financial crisis began – nearly four years ago to the day – investors are beginning to price in a depression, or at the very least a Japanese-style hiatus in growth lasting years into the future, if not decades. The reverse image of improving bond yields is a plunging stock market. Bond yields are falling not as a mark of confidence in the economy, but because markets believe that the economy is likely to remain so weak that it will be years before the Bank of England is able to raise interest rates again.

This, regrettably, is not just a British phenomenon. To a greater or lesser extent, these same fears of a “double-dip” afflict all advanced economies

Warner says that “‘Animal spirits’ are not reviving as they are supposed to” and that “(m)ore radical solutions, such as those routinely applied in the command economy of China, may be called for.”

What? A very big dose of fiscal stimulus aimed at increasing spending in the domestic economy as export demand fell? That is what the Chinese did when the world economy collapsed in 2008. They didn’t um and ah about whether the financial markets would punish them or whether there would be hyperinflation – they just did what any sensible government would do when faced with an economy that is slowing because non-government sector spending has fallen.

If that is a radical solution, then the word radical has lost all meaning.

Warner notes that:

Repeated rounds of externally imposed austerity in Italy and Spain have further undermined prospects for growth, which in turn has worsened the outlook for correcting the crisis in the public finances. Slowing global growth makes it tougher still to overcome the eurozone’s debt woes.

The only time nations have grown when there has been a savage cut in public spending is when they were doing that in isolation and the rest of the world economy was relatively strong. The IMF keeps raving on about export-led expansion replacing the fiscal austerity but you cannot expect export growth when all nations are contracting as a result of public sector spending cuts.

Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

As this downward spiral gets worse, the EMU will rely solely on the ECB to keep it intact. Any single nation should pick up their bat and ball and go home – that is, leave the Eurozone as soon as they can.

The depressing reality facing our children who have been told by the conservatives fiscal vandals that they are in good hands is that the next decade or more will be pretty bleak with diminished job opportunities, poor wages growth and shrinking public services. The long-run access to first-class health care and pensions is also under threat for our children.

The conservatives tried to argue our children were being freed from palpable debt burdens by fiscal austerity. Instead, governments are deliberately undermining the future prospects of this generation and condemning many of them (especially from disadvantaged homes ravaged by unemployment) to a very meagre future.

A future that the politicians themselves will not have to face.

I also thought this Financial Times article (August 3, 2011) – The coming crises of governments – by Harvard’s Robert Barro was indicative of how far detached mainstream economics is from reality.

I have written about Barro before – Pushing the fantasy barrow – the guy lives in a dream world although one where his pension entitlements are secure and he has a very well paid and secure job.

It is the same all over. If their job security and wages growth were tied in some way to the general health of the economy they would advocate totally different policy prescriptions.

Barro claims that the “global crises of financial and housing markets are now being superseded by new crises of governments” which is the way the mainstream debate has evolved such that economists (like Barro), who advocated deregulation of markets which caused the “financial and housing market” crisis, are now able to shed responsibility for that catastrophe by sheeting blame home to governments.

It fits their whole approach – that governments are to blame for everything and they should leave it to the markets to sort out. It amazes me that people have believed this “sleight of hand” argument.

Barro argues that:

In the aftermath of the debt ceiling agreement there will be calls for further stimulus for America’s economy. This would be a grave mistake. In the financial turmoil of 2008, bail-outs by the US and other governments were unfortunate, but necessary. However, the subsequent $800bn American stimulus package was largely a waste of money that sharply enlarged the fiscal hole now facing our economy.

I just love the way he says “unfortunate, but necessary” which disloses his ideological position in three words. He hated the fact that fiscal policy was restored as the only way to prevent the world economy from entering another Great Depression. It was the antithesis of everything he had written about in the several decades before that.

It signified how poor an understanding of the real world he possessed. It was very unfortunate, I agree, for his credibility.

But now he, like the majority of my rotten profession, are back fighting – arrogantly strutting out the argument that the stimulus packages were a waste of money.

How does he come to that conclusion (that the spending multipliers were low)?

Well by stating next that:

In any event, the elimination of the temporary spending is now contractionary and, more importantly, the resulting expansion of public debt eventually requires higher taxes, retarding growth.

Run that by me again! The fiscal stimulus was a waste meaning it didn’t stimulate but withdrawing it is contractionary and higher taxes (austerity) retards growth.

I know he had a space constraint writing for the FT but at least he could have done a better job staying consistent.

Then he says:

I agree that budget deficits were appropriate during the great recession and, for that reason, the kind of balanced-budget rule currently proposed by some Republicans should be avoided.

Whew a dose of Modern Monetary Theory (MMT). So a few paragraphs ago he challenged the concept of the multiplier and then he admits that the only thing that saved the nation was the stimulus.

Hard to criticise his endorsement of fiscal expansion though.

The rest of the Barro article is about spending cuts (cutting healthcare and pensions) and tax cuts for the corporate sector and high income earners (for example, permanently setting the corporate tax rate to zero etc).

He also suggests that “a broad-based, flat-rate expenditure tax” (VAT) of 10 per cent should be imposed., such as a value added tax. A rate of 10 per cent, with few exemptions, would raise about 5 per cent of gross domestic product.

He realises it is regressive (proportional impact higher on low income earners) but considers it “a highly efficient tax” (which in economics-speak means it doesn’t distort resource allocation).

So he wants the lower income groups to be squeezed and the top-end-of-town (who caused the crisis in the first place) to get access to even more real income to play with in their financial market casinos. If you didn’t work in this profession (as I do) you would consider this so brazen. After a while you become inured to the raw, crude, unsophisticated nature of the ideological and class-motivated intent of my mainstream colleagues.

I am not against regressive taxation per se. Most so-called progressives rail against it and think of it in isolation. The reality is that you have to assess the fiscal impact overall rather than isolate components of it.

Barro’s plan is overall regressive and that is not something that anyone who cares about equity should support. But a regressive tax is not bad as it stands if it is supported by strong spending measures that increase the welfare of the less advantaged workers and do not provide corporate welfare.

I will write a more detailed blog about that issue some time in the future because it is an area where I think progressive economists miss the point.

Conclusion

The evidence mounts – day by day – that the mainstream economic position is deeply flawed and incapable of resolving the economic disaster that its application caused.

People generally, however, seem incapable of understanding that. The Tea Party in the US is destroying the lives of the very people that support it and give it air. It is an amazing conflict.

That is enough for today!

The day after the debt fraud was done, I turned on CNBC and James Cramer was explaining how things were going to improve now that the debt deal was done and people could turn their attention back to business. I looked above his head and noticed that the 30 year had fallen from 4.08 to 4.04 that morning. I closed my eyes and clicked my heals three times and said, “There’s no place like home.” I opened my eyes, Cramer was still eulogizing the deal, and the sticker said 4.03. That gives new meaning to Cramer bull. We’re not in Kansas anymore Toto. It closed yesterday 3.9.

“I know some will say but German yields are also rising and they are hardly sovereign in their own currency.”

Eh? The German 10yr is down to 2.42% and moving in lockstep with the US and UK. I would say this is evidence that the Euro is effectively a German currency that some other countries happen to use.

Dear Max (at 2011/08/04 at 20:11)

Sorry – I was rushing and I meant to type FALLING (I have now edited the post accordingly). The meaning of my next sentence could only be sensible in the context of falling yields.

But thanks for the vigilance.

best wishes

bill

Hey Bill,

What do you make of the increasing money supply in the US?

http://www.telegraph.co.uk/finance/comment/ambroseevans_pritchard/8673577/America-is-merely-wounded-Europe-risks-death.html

My guess is that it’s a rush into money during the debt ceiling debate. What do you think?

Phil

Still waiting for the private sector to impart stimulus. What, with all that cash and all…..

Unfortunately the neo liberals will say this is evidence of what raising the debt ceiling has done. I could call it now.

Re: The safest place to be when the economy heads south is in cash or government bonds.

You don’t think gold is safe? It seems to be heading straight up, and a bunch of countries are buying a lot of it…

@Steven

Gold unlike government bonds does not pay you interest, therefore it is purely speculative asset. It is not about rise in price but rather about how much money you can extract to live on. For example, pension funds are biggest buyers of government bonds as they provide them with a clear projection of the future and guaranteed income of 3-4.5% for life.

How much of the failure of the recovery to gain traction is caused by the offshoring of (formerly) developed world jobs? It seems to me we are on a path of decline as a result of our weak job base. Under those circumstances, why not impose tariffs and force industry to relocate domestically?

“For example, pension funds are biggest buyers of government bonds as they provide them with a clear projection of the future and guaranteed income of 3-4.5% for life.”

Which of course is pretty much the same as the government paying the pension in the first place – not that you’ll ever hear the middlemen kept in jobs by pension tax relief (ie more government money) pointing that out of course.

@Neil Wilson

Fully agree but it has rather to do with the ideology than the economy. However, to be honest, I see much more understanding than it used to be 2 years ago than I encountered MMT, for a first time. I think there is hope.