I started my undergraduate studies in economics in the late 1970s after starting out as…

When might that be?

With all eyes on the US wondering what would happen if the debt ceiling is not lifted you would think that bond markets would be losing interest in US government debt. If we trawled back through the debate over the last few years we could find many instances of commentators claiming interest rates would soar once bond markets ran out of patience with the rising US government debt. It was either that prediction or the other one – that all the “money” swishing around the system would cause inflation. Like some cult leader there was one self-styled US financial expert claiming that the Endgame was nigh. As the world didn’t slide into a void nor the debt-burdened US economy hyperinflate the date was shifted. Once, twice, thrice. Further, trying to overlay what is happening in the EMU at present onto US, UK, Japan or other sovereign nations is invalid. The monetary systems in place, in say the US, is vastly different to the system the ECB oversees when we focus on the member state level of the Eurozone. So it serves to remind people that none of the predictions the deficit terrorists have made have come true. The ideologues respond that it is only a matter of time. My reply, when might that be?

With regard to the debt ceiling it is clear that there will be a “last minute” compromise and the last several weeks will have just served to demonstrate the appalling self-serving nature of American politics driven by deep ideological disregard for the underprivileged (including the unemployed).

Anyway, I was updating my yield curve database this morning and thought we could look at some salient features and draw some conclusion – you know, “I told you so” sort of territory.

The conventional debate is that bond markets call the shots and that governments, desperate to fund their spending, have to be mindful that the markets might turn on them if they are extravagant. Extravagance to many begins when the government goes into deficit. In Modern Monetary Theory (MMT) extravagance – if we should ever use such a word – would begin when the economy is at full employment and the government then deliberately increases its deficit spending such that the only adjustment that occur is in rising inflation.

In my blog – Who is in charge? – it becomes clear that the bond markets are like parasites and rely on governments unnecessarily issuing debt. At any time a government chose it could stop issuing debt and ignore the parasitic need of the investors for risk-free assets.

From a MMT perspective it is preferable that governments stop issuing debt at all maturities. Sure enough debt-issuance is just an elaborate form of welfare assistance – the benefits of which are skewed to the more advantaged members of the society. But the usual concerns the conservatives have about it are without foundation.

And … the bond markets know it. Selected representatives from banks etc may talk tough from time to time – mouthing the mainstream mantras of default risk, rising interest rates etc – but when push comes to shove they line up for the next auction and wish they could buy more government debt than is available.

How do I know that? Answer: just look at the data on bid ratios (coverage ratio – the value of the bids relative to the tender amount) and the yields.

Then there are articles such as this Bloomberg piece (July 19, 2011) – Congress Bickers, Bond Markets Brace for Panic – where the commentator is clearly imbued with mainstream logic but just can’t seem to resolve that with the real world.

The article said:

Here are the facts: The yield on Greek sovereign debt is now at record highs for the euro era. Last week’s state-managed bond auction in Italy almost failed. And, while few seem to have noticed, the overnight repurchase market — for short-term, secured, corporate debt obligations — nearly seized up amid … “an almost panicky scramble” for less- risky paper.

Indeed, investors’ manic desire for safety last week reached levels not seen since the most acute days of the financial crisis in September and October 2008. Ironically, though, given the pathetic display in Washington and the country’s ongoing fiscal troubles, people turned in droves to the perceived security of the U.S. Treasury market, even though it has never looked shakier.

Upon what basis does he conclude that the US Treasury market “has never looked shakier”? Answer: that is just the conservative voice in him speaking – there is no basis provided other than the stupid politicians threatening each other in the debt ceiling debate. Both sides know that there will be a compromise and the bond markets clearly anticipate that.

The tension in the article is clearly that the demand for US government bonds is booming. That wasn’t in the conservative script at all.

I get asked a lot by readers to explain how bond markets operate. So to answer those queries in the context of the current debate I thought I would write a little about the behaviour of yields at present.

Ignoring specific nuances of a particular country, governments match their deficits by issuing public debt. It is a totally voluntary act for a sovereign government. The debt-issuance is a monetary operation that is entirely unnecessary for its spending decisions. The practice of debt-issuance gives the impression that the borrowing is funding the spending but that is a chimera. The arrangements that motivate that perception are ephemeral and can be altered by the government should it have the will to do so.

As the current US debate about coin seigniorage is proving – even these institutional structures by which debt is issued – do not constrain government spending. If the US Treasury is constitutionally able to mint a very large denomination coin and force the central bank to accept in return for a bank account balance then there is no financial constraint even under current arrangements.

Governments (more or less) use auction systems to issue the debt. The auction model merely supplies the required volume of government paper at whatever price was bid in the market. Typically the value of the bids exceeds by multiples the value of the overall tender.

A primary market is the institutional machinery via which the government sells debt to “raise funds”. In a modern monetary system with flexible exchange rates it is clear the government does not have to finance its spending so the bonds issuance does not “raise funds” that are required for spending.

But when I use words like “funding” you know it is in the context of the mainstream logic rather than the logic of MMT.

A secondary market is where existing financial assets are traded by interested parties. So the financial assets enter the monetary system via the primary market and are then available for trading in the secondary. The same structure applies to private share issues for example. The company raises funds via the primary issuance process then its shares are traded in secondary markets.

Clearly secondary market trading has no impact at all on the volume of financial assets in the system – it just shuffles the wealth between wealth-holders. In the context of public debt issuance – the transactions in the primary market are vertical (net financial assets are created or destroyed) and the secondary market transactions are all horizontal (no new financial assets are created). Please read my blog – Deficit spending 101 – Part 3 – for more discussion on this point.

The way the auction works is simple. The government determines when a tender will open and the type of debt instrument to be issued. They thus determine the maturity (how long the bond would exist for), the coupon rate (the interest return on the bond) and the volume (how many bonds).

The issue is then put out for tender and demand relative to the fixed supply in the market determines the final price of the bonds issued. Imagine a $1000 bond had a coupon of 5 per cent, meaning that you would get $50 dollar per annum until the bond matured at which time you would get $1000 back.

Imagine that the market wanted a yield of 6 per cent to accommodate risk expectations. So for them the bond is unattractive and so they would put in a purchase bid lower than the $1000 to ensure they get the 6 per cent return they sought.

The general rule for fixed-income bonds is that when the prices rise, the yield falls and vice versa. Thus, the price of a bond can change in the market place according to interest rate fluctuations.

When interest rates rise, the price of previously issued bonds fall because they are less attractive in comparison to the newly issued bonds, which are offering a higher coupon rates (reflecting current interest rates).

When interest rates fall, the price of older bonds increase, becoming more attractive as newly issued bonds offer a lower coupon rate than the older higher coupon rated bonds.

So for new bond issues the government receives the tenders from the bond market traders which are ranked in terms of price (and implied yields desired) and a quantity requested in $ millions. The government then issues the bonds in highest price bid order until it raises the revenue it seeks. So the first bidder with the highest price (lowest yield) gets what they want (as long as it doesn’t exhaust the whole tender, which is not likely). Then the second bidder (higher yield) and so on.

In this way, if demand for the tender is low, the final yields will be higher and vice versa. There are a lot of myths peddled in the financial press about this. Rising yields may indicate a rising sense of risk (mostly from future inflation although sovereign credit ratings will influence this).

But rising yields on government bonds do not necessarily indicate that the bond markets are sick of government debt levels. In sovereign nations (not the EMU) it typically either means that the economy is growing strongly and investors are willing to diversify their portfolios into riskier assets. It is also usually a time that the central bank pushes up rates and bond yields more or less follow.

There are two ways we can use yield data on bonds available from the government. First, to see what is happening to the demand for bonds from investors. Rising yields signal falling demand which then has to be interpreted according to the state of the economy as noted above. Second, to see what is happening to inflationary expectations and risk-assessments.

What has been happening with yields on US bonds over the course of this year?

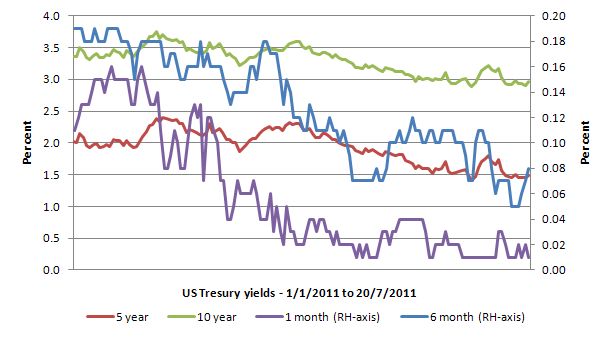

You can access complete sets of financial data from the US Treasury. The following graph compares the yield spreads of the US Treasury Bonds at 1 month, 3 months, 6 months, 1-year, 2-years, 3-years, 5-years, 10-years and 20-years and 30-years maturity.

The data is telling us what we know already – the bond markets investors are falling over each other to get hold of US Treasury Debt. The debt ceiling farce is having no impact on that. It is a sideshow in other words.

The Bloomberg article noted that:

Remember the days of negative yields on short-term U.S. paper — when effectively investors paid the government to keep their money safe? … Well, it seems those days are back. U.S. Treasury bills shorter than three months in duration traded at negative yields last week. Three-month bills were trading a yield of 1 basis point. Six-month bills traded to yield 4 basis points and one- year U.S. Treasuries were trading to yield 13 basis points.

In short, demand for the perceived security of the debt obligations of the U.S. government was so intense that “it was virtually impossible to find ANY amount of certain maturities of short duration Treasury bills,”

So if yields are going to soar as the markets wake up to the impending insolvency of the US government may I ask – when might that be?

The second way of looking at the yields is to consider the yield curve.

The yield curve is a graphical depiction of the term-structure of risk-free interest rates and plots the maturity of the government bond on the horizontal axis against the respective yields (return) on the vertical axis. We can use the term maturity and term interchangeably. So a 10-year Treasury bond matures in 10 years and in the meantime delivers some return (yield) to the bond-holder.

What determines the slope of the yield curve? There are broadly three shapes that the curve will take:

- Normal – Under normal circumstances, short-term bond rates are lower than long-term rates. The central bank attempts to keep short rates down to keep levels of activity as high as possible and bond investors desire premiums to protect them against inflation in longer-term

maturities. Combined, the yield curve is upward sloping. - Inverted – Sometimes, short-term rates are higher than long-term rates and we say the yield curve is inverted. The usual events which lead to an inverted yield curve are that the economy starts to overheat and expectations of rising inflation lead to higher bond yields being demanded. The central bank responds to building inflationary pressures by raising short-term interest rates sharply. Although bond yields rise, the significant tightening of monetary policy causes short-term interest rates to rise faster, resulting in an inversion of the yield curve. The higher interest rates may then lead to slower economic growth.

- Flat – A flat yield curve is seen most frequently in the transition from positive to inverted, or vice versa. As the yield curve flattens the yield spreads drop considerably. A yield spread is the difference between, say, the yield on a one year and a 10-year bond. What does this signal about the future performance of the economy? A flat yield curve can reflect a tightening monetary policy (short-term rates rise). Alternatively, it might depict a monetary easing after a recession (easing short-term rates) so the inverted yield curve will flatten out.

There are various theories about the yield curve and its dynamics. All share some common notions – in particular that the higher is expected inflation the steeper the yield curve will be other things equal.

The basic principle linking the shape of the yield curve to the economy’s prospects is explained as follows. The short end of the yield curve reflects the interest rate set by the central bank. The steepness of the yield curve then depends on the yield of the longer-term bonds, which are set by the market. But the short end of the curve is the primary determinant of its slope. In other words, the curve steepens mainly because the central bank is lowering the official cash rate, and it flattens mainly because the central bank is raising the official cash rate.

Bond traders link the dynamics of the yield curve to their expectations of the future economic prospects. When the yield curve flattens it is usually accompanied by deflation or steady and low inflation and vice versa.

One of the risks in holding a fixed coupon bond with a fixed redemption value is purchasing power risk. Economists believe that most people would prefer to consume now rather than later if there was to be a trade-off. To encourage foregone consumption now, a yield on savings must be provided by markets. The yield is intended to allow a person to consume more in the future than has been sacrificed now. But if the prices of real goods and services increases in the meantime, then even with the yield, the individual’s command over real things is less than it would be if prices were stable. It is possible, that the inflation could wipe out yield.

Take this example of a zero real interest rate. A person invests in a one-year $1,000 coupon Treasury Bond with a single coupon payment expected of $100. The individual will expect to get $1,100 on the redemption date. Assume that over the holding period, prices rise by 10 per cent. At the end of the year, a basket of goods that previously cost $1,000 would now cost $1,100. In other words, the investor is no better off at the end of the year as a result of the investment. The nominal yield has been swallowed by the inflation.

Purchasing power risk is more threatening the longer is the maturity. So it is one reason why longer maturity rates will be higher. The market yield is equal to the real rate of return required plus compensation for the expected rate of inflation. If the inflation rate is expected to rise, then market rates will rise to compensate. In this case, we would expect the yield curve to steepen, given that this effect will impact more significantly on longer maturity bonds than at the short end of the yield curve.

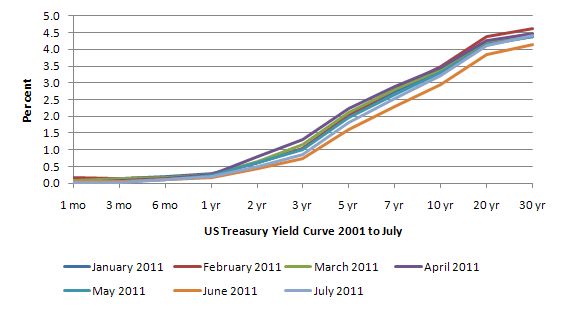

So what does the current US yield curve tell us about inflationary expectations and perceptions of risk? The following graph shows the US Treasury yield curve for the start of each month in 2011. If anything the curve has flattened a little over the year but there is not major change that we can see. It is a very normal looking curve – flat at the shorter end and then rising.

The slight narrowing of the long-term/short-term yield spread suggests that the markets are not foreseeing rising inflation in the long-term.

So if the budget deficits and central bank reserve operations (Quantitative Easing) are setting in place an impending hyperinflation may I ask – when might that be?

Survey of Australian Economists – in a minority again

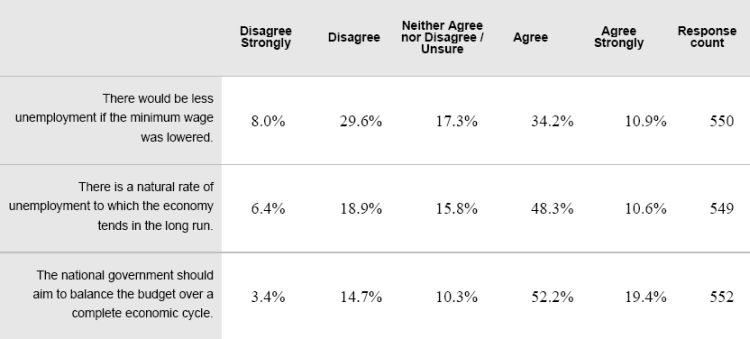

And just to demonstrate that my own profession doesn’t understand these things the Australia Society of Economists (of which I am not a member) released a survey of economists that it conducted during the recent “Economists’ Conference”.

Here are the answers to the first three questions.

So at least 71 per cent of my profession consider it appropriate for the private sector to be in deficit on average over the business cycle (that is, continually increasing its indebtedness) given that Australia typically runs external deficits.

Conclusion

How long should we wait for the ship to sink? The bond markets are certainly not seeing any breaches as yet. Au contraire!

That is enough for today!

” Both sides know that there will be a compromise and the bond markets clearly anticipate that.”

They don’t anticipate it. They know.

After all what else are they funding politicians for?

Three things struck me about that statement:

Firstly, your conclusion isn’t necessarily valid because some might simultaneously support aiming to run external surpluses.

Secondly, the really surprising thing was that 18.1% consider it inappropriate. You’re not as marginalized as you think!

And you can probably guess my third reaction: what’s wrong with that?

Which of the following statements do you disagree with?

• Governments should use a combination of fiscal and monetary policy to achieve some objective

• Therefore under normal conditions, a higher government surplus (or a lower government deficit) means lower interest rates are required to meet this objective

• Lower interest rates are good for the economy because they encourage business investment and make it easier for businesses to be profitable

• Therefore governments should opt for policies that will result in low interest rates

• If that means increasing private sector indebtedness, so be it!

It is worse than that. It is the basis of the intergenerational transfer (Kotlikoff) guilt trip that serves as such a convincing argument against (further) debt issuance (at least) in the US. What no one seems to notice in this process is that while debt is indeed being (sort of) issued, no liability is being incurred by that issuance, and so there is no liability caused by this debt issuance that can be transferred intergenerationally. Which in turn means that the entire US debt debate is based upon a mistaken accounting presentation.

[The liability is actually incurred when the borrowed currency is initially created. The debt issuance here would then be better (and more accurately) identified as a debt swap, where one form of debt (currency or bank reserves) is simply being exchanged for another form of debt (bonds) of equal value, and the liability is merely being transferred from the former to the latter.]

nice synthesis of bond markets bill.

I would just add one point to this part:

‘The market yield is equal to the real rate of return required plus compensation for the expected rate of inflation. If the inflation rate is expected to rise, then market rates will rise to compensate.’

As a matter of fact, I have been pushing for a long time a sligthly different version.

I suggets that market yield (on long maturity bonds) does not really include any ‘inflation expectation’, but in fact only reflects the investors’ anticipation of the average level of short term interest rates during the whole life of the bonds.

Which would explain how the promise from a central banker (Mr Bernanke) to keep its short term rates (Fed Funds) low for an extended period of time have a deeper effect on long term yields than any Quantitative Easing operation (which does have an effect anyway, as it is really only a maturity transformation operation, a carry trade, an asset swap).

By the way, this QE may also reinforce in the mind of investors the feeling that short term rates are going to stay low for a long period of time, so that this Fed carry trade does not cost it money…

And the longer short term rates stay low, the more investors get used to it, and animal spirits then kick into action, making them believe that this is the new natural state of things. They then tend to project this low levels of short term rates for a very long period, and so accpet lower long term yields on longer bonds. This has been especially noticeable on japanese governments bonds!

Best Regards.

From Fed Primary Dealers Operating Policy (http://www.newyorkfed.org/markets/pridealers_policies.html):

“Primary dealers should participate similarly in support of Treasury auctions: the New York Fed will expect a primary dealer to bid in every auction, for, at a minimum, an amount of securities representing its pro rata share, based on the number of primary dealers at the time of the auction, of the offered amount”

So given that the government sets the amount and the coupon primary dealers are obligated to at least match the requested amount with bids. That would mean that the requested price cannot fall below 100 (since then their offer would not match the requested amount) and bond auctions cannot fail, nor have a yield lower than the coupon.

Am i interpreting things correctly Bill?

Nevermind that last comment about not requesting a price below 100. They can request the same amount for a price under 99. So i guess it’s up to the Fed to set the yields (through it’s own biding) if things don’t go well in the auctions.

The second question in the survey above, and the 45% that agree to the first question, suggests to me that the majority of the economists in that society are ignorant of mathematics and the literature in economics.

Aidan,

2. is wrong and doesn’t follow from the first or anything else.

Reducing net public spending means less bank reserves than otherwise pushing upward pressure on interest rates, less incomes less saving.

3. investment is far more demand/sales/income sensitive than interest sensitive

4. we agree, zero interest is natural and best and achieved when public net spending is enought to fund private net saving desires! 😉

5. higher private debt would tend to syphon off income/demand from regular business to the FIRE sector, so less demand, less profit…oh dear.

The real issue is whether the value of a Dollar will suddenly decrease. The effect would be an added burden on exporters that are already hugely disadvantaged by the US tax code and foreign planned economic structures. In my opinion, this is why a global depression would be likely. I would appreciate reading any alternate views.