I started my undergraduate studies in economics in the late 1970s after starting out as…

Government deficits are the norm

I suppose I had to respond to this atrocious piece of deception pedalled by the New York Times (March 5, 2011) as an “Economic View”. The article – It’s Time to Face the Fiscal Illusion – is not economics. It is a religious diatribe with strays into lies and deception. The reality is that mainstream economics has learned nothing from the crisis that has left their key intellectual propositions being exposed as vacuous nonsense. The inability of my profession to move on and embrace the challenge that an alternative theoretical structure is more relevant is sad. Instead the same old mantra based on theories that have no empirical basis are being wheeled out – the same theories that pressured policy makers to create the conditions which ended in the crisis. In relation to today’s blog we should understand that government deficits are the norm and they generally never pay back their debt (overall).

Tyler Cowen is a US academic economist who cites one James M. Buchanan. The latter fits the Nobel Prize winner in economics stereotype to a tee – good at counting angels on the top of a pinhead – pretty useless for everything else.

You might like to read this blog – Mainstream macroeconomic fads – just a waste of time – for some background to today’s blog.

As further background, Buchanan specialised in a branch of mainstream economics referred to as public choice theory which essentially denies there is any viable (practical) concept which we can a public interest. There is only private interest. Why? Because all actions are allegedly driven by rational self-interest (called “utility maximisation”) and politicians pursue policy agendas which maximise their own individual interests.

So all the machinery of government is really a mechanism whereby the individuals involved pursue their own agendas which means that their is no collective (public) interest.

As a result politicians pass laws and impose regulations that benefit themselves – via kick-backs to those who benefit from the regulations/law. The public policy arena is seen as a massive fight for rents and kickbacks. No public interest considerations are involved. In some cases, politicians generate largesse for themselves by threatening not to create rents.

You might like to read this review of a 1997 attempt to apply public choice theory to US government decision making. One of the major problems with the theory is that the “politicians returns from rent extraction appear to be small, relative to the expropriable wealth threatened” a quandary that public choice theory has never been able to explain.

This review says that the 1997 book:

… concludes, “The one unambiguous solution for reducing rent extraction is reducing the size of the state itself and its power to threaten, expropriate, and transfer.” A better solution may be to beware of anarchistic economists wearing the clothes of political science.

Public choice theory was part of the era of economic imperialism – which refers to the attempt by economists to penetrate more broadly into social science research topics. The method was simple – assume free markets are best and that everyone is essentially rational and driven by self interest. Then apply these assumptions to everything.

So we had the economics of sex – where students learned that the move from kissing to heavy petting to intercourse was driven by a cost-benefit analysis (on the fly!) whereby the individuals would tote up the benefits from escalating the action against the costs and if the former outweighed the latter then things got steamier. The optimal amount of each stage was specified by complex calculations that resulted in tangencies between cost and benefit functions.

Similarly, the economics of marriage, the economics of slavery (a particularly nasty application where the analysis determined optimal levels of whipping based on cost and benefit).

In the case of public choice theory, economists were facing with an expanding role of the state – in macroeconomic policy and regulation which meant that the tools that economists traditionally used to analyse behaviour were useless. The answer was to apply those tools to political science – so that politicians were just like consumers – rational, maximising agents.

There is a vast body of literature drawn from sociology and psychology that debunks the rational, self-interest theory of human behaviour. Economists ignore this research because they rather think they know more about the human mind than any of branch of the social sciences.

The other problem for public choice theory is that by constructing political decision making as a “market” they limit the richness of what actually goes on. Politics is more about persuasion aimed at changing what people want rather than satisfying their wants. A market in economics is about satisfying pre-determined wants.

Further, public choice theory really ignores power because the driving unit of decision making is the individual who makes free choices aimed at maximising his/her own utility. The collective concepts of democracy or elites etc have no meaning in this framework.

There is also a complex literature on the problem of social order which economists are unable to participate in given their narrow methodological approach (based on rational, self interest). Social order is not rational in the way economists use that term. There are strong moral dimensions which require an understanding of culture and values. Economists deny that such things drive economic (and political) outcomes.

Finally, and I could go on for ages about this – collective action is a powerful and identified human tendency. Solidarity, group identity mean that individual aims become interdependent. As soon as there is interdependence, mainstream economics largely fails. The great political movements are all based on collective ideals that transcend the narrow and shallow way in which mainstream economists think – Nobel Prizes or not.

Like many branches of mainstream theory, public choice theory appears complex to students but can usually be summarised in a few sentences. In this context, I am reminded of a beautiful section in a book by American economist (and Marxist) Paul Sweezy who wrote in 1972 in the Monthly Review Press an article entitled Towards a Critique of Economics.

He argued that orthodoxy (mainstream) economics in recent times had:

… remained within the same fundamental limits” of the C19th century free market economist. He said they had “therefore tended … to yield diminishing returns. It has concerned itself with smaller and decreasingly significant questions … To compensate for this trivialisation of content, it has paid increasing attention to elaborating and refining its techniques. The consequence is that today we often find a truly stupefying gap between the questions posed and the techniques employed to answer them.

He then cites a wonderful example of mainstream written reasoning which the modern mainstream economists would be proud off. It is taken from Debreu’s 1966 mimeo on Preference Functions. Here is is for some light relief:

Given as set of economic agents and a set of coalitions, a non-empty family of subsets of the first set closed under the formation of countable unions and complements, an allocation is a countable additive function from the set of coalitions to the closed positive orthant of the commodity space. To describe preferences in this context, one can either introduce a positive, finite real measure defined on the set of coalitions and specify, for each agent, a relation of preference-or-indifference on the closed positive orthant of the commodity space, or specify, for each coalition, a relation of the preference-or-indifference on the set of allocations. This article studies the extent to which these two approaches are equivalent.

In my so-called economics “education” I have read countless articles like this one – saying nothing about anything that will be of any benefit to humanity. Studying mainstream economics with all the mathematics that came with it is like playing a boring version of chess. Public choice theory was like that but worse – because in the end it had an insidious purpose – to undermine the case for the state and to promote deceptions about the virtues of the free market – as if the world could be reduced to such a choice.

The end result of all the deregulation that this sort of theory has promoted and pressured for is not a self-regulating free market. But just a different sort of rent generating allocation mechanism based on power which shifts more real resources and output into the hands of the few – the rich and powerful. That is the sort of outcome that Tyler Cowan is representing – when you strip down the deception and the illusion of authority.

Anyway, back to Cowen who also invokes public choice theory in his critique of current US deficits.

He says that:

FISCAL policy debates often focus on technocratic questions about how much money the government should spend and when, yet the actual course of events depends not on the experts but on politics. The more that our government runs up unfunded obligations and debt, the more we are setting a trap for ourselves.

In the context of a federal government (such as in the US) the use of the term “unfunded” in relation to anything is meaningless. Such a government is never revenue constrained because it is the monopoly issuer of the currency. In that sense it doesn’t have to put a dollar away to spend it.

A household has to fund obligations and mind the level of indebtedness (or the scale of indebtedness relative to its earning capacity). That is because a household is financially constrained as the user of the currency.

There is no valid analogy between such a household and the federal US government although the mainstream economics critique of deficits begins by imposing that analogy. So from the starting point of the analysis you know that mainstream economics is flawed in this context.

It is possible that a government cannot deliver the implied “real” equivalent of its obligations because there will not be enough real resources available to go round. The only way that you could avoid that situation would be to stockpile real things in warehouses to match the pension and health care promises. That strategy would be equally ridiculous (and wasteful) but of-course that is not what the mainstream lot like Cowen are referring to.

He then invokes the authority of James M. Buchanan (and tells us he is “a Nobel laureate in economics” – so what? – that should be enough to immediately disregard what is about to follow). Apparently “a permanent disconnect between spending and revenue” results “because it brings short-term gains”.

What particular connection between revenue and spending should there be anyway? For there to be a “disconnect” there has to be a sensible notion of a connection. From the perspective of Modern Monetary Theory (MMT) there is no such state.

First, revenue doesn’t “fund” spending. So no connection there despite the myths that the mainstream economists want us to believe. How does a government that issues the currency ever need to fund itself in its own currency. It might pretend to do that by erecting an elaborate institutional machinery to collect taxes and allocate them to accounts etc. But that is all a sham. The US government does not fund itself via tax revenue (or bond issues).

Second, the mainstream attempt to gain traction in this debate by advocating a religious or moral position that the budget has to be balanced. What scientific rule dictates that? Answer: none. In pushing this rule, the mainstream isolate the budget from its broader context – the interplay of the sectoral balances derived from the national spending and income generating system.

The reality is that there is no sensible fiscal rule that can be specified in terms of a deficit to GDP ratio or any other financial ratio. Responsible fiscal policy management requires government to ensure that aggregate demand is sufficient to employ all the available labour and capital resources.

This requires the government take into account the supply side of the economy in relation to the external sector contribution to aggregate demand (spending) and the private domestic contribution to spending. Trying to fix a rule in isolation of the other sectors is a recipe for disaster.

But mostly it has no basis other than a moralistic view of government. There is nothing in economic theory that justifies the balanced budget rule.

Further, if you consider the current state of the US economy the only responsible conclusion one can make is that the fiscal deficit is way to small.

Cowen thinks that deficits:

… end up institutionalizing irresponsibility in the federal government, the largest and most central institution in our society.

How does that work? Democracy is about kicking governments out that do not fulfill their mandates. In the advanced nations, there are regular elections. I won’t say they are free and open given the role of the media but there is ample evidence that voters do rebel and kick governments they do not like out of office.

So it seems that a government that is “irresponsible” has a limited life span. That is what history tells us.

What Cowen is thinking is that politics becomes corrupted by rent-seekers (in the health care industry etc) who force all sides to entrench entitlements that cannot be afforded.

But that assumes that pensions and health care are now beyond the capacity of the federal government to afford them. There is no sense that that is the case. The federal US government can always pay its pension obligations in US dollars and purchase health care should it be available for sale in US dollars.

Then comes the Ricardian Equivalence argument:

Here’s an example: Say that you have $20,000 in Treasury bills. You probably believe that you own $20,000 in wealth. This will encourage you to spend and come up with ambitious plans. Yet someone – quite possibly you – will be taxed in the future to pay off the government debt. The $20,000 may be needed in order to do that.

The illusion is this: A government bond represents both a current asset and a future liability, yet for most people, those future tax payments feel less concrete and less real than the dollars they’re holding in a money market account.

Rubbish.

When have tax rates been deliberately hiked in the US to “pay off the debt”? What people are misled into believing is that the debt is actually paid off. Yes, individual maturing issues are honoured on a continuous basis by the government as new debt is issued. Has the US government ever had trouble honouring the retiring debt?

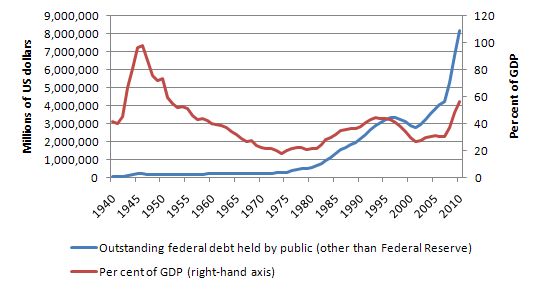

Consider the following graph.

The following graph is constructed from data available from the US Office of Management and Budget and uses the data in Table 7.1 Federal Debt at the End of Year: 1940-2016. It shows the outstanding federal debt held by the private sector other than the holdings of the Federal Reserve.

The component of the total held by the US Federal Reserve is minimal. Excepting for a brief period in the late 1990s (the Clinton surpluses) the outstanding debt has been rising in level terms consistently since 1940.

We also know what happened as a result of the Clinton surpluses – a major recession followed in the early 2000s.

The point is that in overall terms the US government never really pays off its debt.

The public debt ratio (red line) is a different matter and fluctuates with the economic cycle but is certainly contained within bounds (more or less determined by the trend rate of GDP growth given the monetary policy stance). The exceptional event was the Great Depression closely followed by the Second World War.

The deficit terrorists seem to suggest that things are dire now – but in historical terms the current period pales when compared to the 1930s.

The notion of Ricardian Equivalence falters on these grounds even before we examine its predictive capacity.

The modern version of Ricardian Equivalence was developed by Robert Barro at Harvard. For non-economists – this piece of neo-liberal dogma says that the non-government sector (consumers explicitly) having internalised the government budget constraint will negate any government spending increase whether the government “finances” its spending via taxes or borrowing. So if the government spends and borrows, consumers will anticipate higher future taxes and spend less now offsetting the stimulus).

The logic that the model is based on is as follows. First, start with the mainstream view that: (a) In the short-run, budget deficits are likely to stimulate aggregate demand as long as the central bank accommodates the deficits with loose monetary policy; and (b) in the long-run, the public debt build-up crowds out investment because it competes for scarce savings.

This view is patently false because deficits put downward pressure on the interest rate and central banks issue debt to stop that downward pressure from arresting control from them of their target interest rate. Please read the suite of blogs – Deficit spending 101 – Part 1 – Deficit spending 101 – Part 2 – Deficit spending 101 – Part 3 – for more discussion of that point.

Further, there is no finite pool of saving except at full employment. Income growth generates its own saving (investment brings forth its own saving) and governments just borrow back the funds (drain bank reserves) $-for-$ that the deficits inject anyway. Banks create deposits when they create loans not the other way around. Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion of that point.

But let’s stick with the mainstream argument for the moment so we can understand what Ricardian Equivalence is about. Barro then said that the government does “our work” for us. It spends on our behalf and raises money (taxes) to pay for the spending. When the budget is in deficit (government spending exceeds taxation) it has to “finance” the gap, which Barro claims is really an implicit commitment to raise taxes in the future to repay the debt (principal and interest).

Under these conditions, Barro then proposes that current taxation has equivalent impacts on consumers’ sense of wealth as expected future taxes.

For example, if each individual assesses that the government is spending $500 this year per head and collects $500 per head “to pay for it” then the individual will cut consumption by $500 because they are worse off.

Alternatively, if the individual perceives that the government has spent $500 this year but proposes to tax him/her next year at such a rate that the debt will be cleared then the person will still be poorer over their lifetime and will probably cut back consumption now to save the money to pay the higher taxes.

So the government spending has no real effect on output and employment irrespective of whether it is “tax-financed” or “debt-financed”. That is the Barro version of Ricardian Equivalence.

The models suggest that individuals assess the total stream of income and taxes over their lifetime in making consumption decisions in each period.

On tax cuts, Barro wrote (in ‘Are Government Bonds Net Wealth?’, Journal of Political Economy, 1974, 1095-1117):

This just means that lower taxes today and higher taxes in the future when the government needs to pay the interest on the debt; I’ll just save today in order to build up savings account that will be needed to meet those future taxes.

So what are the assumptions that Barro makes which have to hold in entirety for the logical conclusion he makes to follow? Note this is not to say that any of his reasoning is a sensible depiction of the basic operations of a modern monetary system. It just says that if we suspend belief and go along with him for the ride then the only way he can derive the predictions from his model that he does requires the following assumptions to hold forever.

Should any of these assumptions not hold (at any point in time), then his model cannot generate the predictions and any assertions one might make based on this work are groundless – meagre ideological statements. That is, one could not conclude that it was this particular model that was “explaining” the facts even if the predictions of the model were consistent with the facts. This brings us into the problem of observational equivalence haunts modellers like me. It is basically a problem where two competing theories are “consistent” with the same set of facts and there is no way of disentangling the theories on empirical grounds. I won’t go into the technicalities of that problem.

As I have noted previously, the predictions forthcoming by those who adhere to the notion of Ricardian Equivalence rely on the following assumptions holding always.

First, capital markets have to be “perfect” (remember those Chicago assumptions) which means that any household can borrow or save as much as they require at all times at a fixed rate which is the same for all households/individuals at any particular date. So totally equal access to finance for all.

Clearly this assumption does not hold across all individuals and time periods. Households have liquidity constraints and cannot borrow or invest whatever and whenever they desire. People who play around with these models show that if there are liquidity constraints then people are likely to spend more when there are tax cuts even if they know taxes will be higher in the future (assumed).

Second, the future time path of government spending is known and fixed. Households/individuals know this with perfect foresight. This assumption is clearly without any real-world correspondence. We do not have perfect foresight and we do not know what the government in 10 years time is going to spend to the last dollar (even if we knew what political flavour that government might be).

Third, there is infinite concern for the future generations. This point is crucial because even in the mainstream model the tax rises might come at some very distant time (even next century). There is no optimal prediction that can be derived from their models that tells us when the debt will be repaid. They introduce various stylised – read: arbitrary – time periods when debt is repaid in full but these are not derived in any way from the internal logic of the model nor are they ground in any empirical reality. Just ad hoc impositions.

So the tax increases in the future (remember I am just playing along with their claim that taxes will rise to pay back debt) may be paid back by someone 5 or 6 generations ahead of me. Is it realistic to assume I won’t just enjoy the increased consumption that the tax cuts now will bring (or increased government spending) and leave it to those hundreds or even thousands of years ahead to “pay for”.

Certainly our conduct towards the natural environment is not suggestive of a particular concern for the future generations other than our children and their children.

If we wrote out the equations underpinning Ricardian Equivalence models and started to alter the assumptions to reflect more real world facts then we would not get the stark results that Barro and his Co derived. In that sense, we would not consider the framework to be reliable or very useful.

But we can also consider the model on the basis of how it stacks up in an empirical sense. When Barro released his paper (late 1970s) there was a torrent of empirical work examining its “predictive capacity”.

It was opportune that about that time the US Congress gave out large tax cuts (in August 1981) and this provided the first real world experiment possible of the Barro conjecture. The US was mired in recession and it was decided to introduce a stimulus. The tax cuts were legislated to be operational over 1982-84 to provide such a stimulus to aggregate demand.

Barro’s adherents, consistent with the Ricardian Equivalence models, all predicted there would be no change in consumption and saving should have risen to “pay for the future tax burden” which was implied by the rise in public debt at the time.

What happened? If you examine the US data you will see categorically that the personal saving rate fell between 1982-84 (from 7.5 per cent in 1981 to an average of 5.7 per cent in 1982-84).

In other words, Ricardian Equivalence models got it exactly wrong. There was no predictive capacity irrespective of the problem with the assumptions.

Once again this was an example of a mathematical model built on un-real assumptions generating conclusions that were appealing to the dominant anti-deficit ideology but which fundamentally failed to deliver predictions that corresponded even remotely with what actually happened.

Cowen extends the Ricardian nonsense with this statement:

… the sorry truth is that our savings aren’t worth as much as many of us think, and a rude awakening is coming. One way or another, some of our savings will be taxed away to make good on governmental commitments, like future Medicare benefits, which we currently are framing as personal free lunches.

Keynesian economics talks of the “fiscal illusion” created by government debt: the issuance of such debt can stimulate the economy in the short run by encouraging a false perception of wealth and thus bolstering consumer spending. But, eventually, the books must balance. There is then a fiscal crunch, a sudden retrenchment of plans and great rancor over budgets, as we have been seeing lately at both the federal and the state level.

When is eventually? When will our savings be taxed away? If there was truth in this then we would expect to see it in the historical data. A close examination of the data doesn’t suggest that the US government raises taxes to pay back past deficits (which have to be manifest in the form our outstanding public debt). See the graph above.

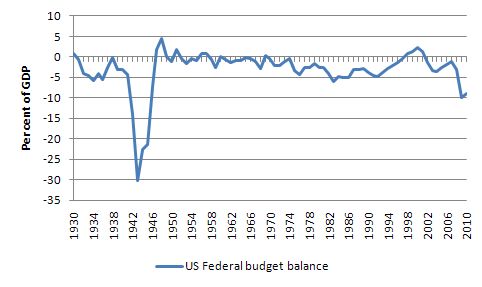

But consider the following graph which is taken from the Office of Management and Budget – Table 1.3-Summary of Receipts, Outlays, and Surpluses or Deficits (-) in Current Dollars, Constant (FY 2005) Dollars, and as Percentages of GDP: 1940-2016. It shows US federal deficit between 1930 and 2010 as a percentage of GDP.

Once again the exceptional nature of the 1930s is there for all to see.

But the reality is that of the 81 years shown, the US federal government ran a deficit in 68 of those years (that is, 84 per cent of the time). Deficits are the norm. Whenever the federal government has deliberately tried to run a surplus (and has succeeded) an economic downturn has followed soon after.

If households and bond holders are being systematically ripped off such that the wealth they think they hold in bonds is actually worth zero because it is “taxed away” to pay back the debt – that is, the Cowen story – why are they so stupid to repeat this behaviour over and over again for such a long period?

If deficits are so bad, why hasn’t America ground to a structural halt before now?

What evidence is there that governments tax away all the wealth that is held in the form of bonds? Answer: none.

The US Inland Revenue Service provides excellent Historical Statistics for research purposes.

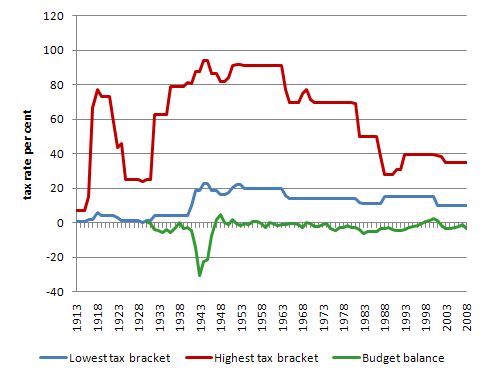

Consider the following graph which is taken from Table 23 – “U.S. Individual Income Tax: Personal Exemptions and Lowest and Highest Bracket Tax Rates, and Tax Base for Regular Tax” provides data from 1913-2008. So that should be a long enough sample to see if there is any relationship between tax rate changes and movements in the federal budget balance.

I caution anyone against reading to much into the following. The tax structure is very complicated because of personal deductions and changing brackets. But you can get some idea about whether personal tax hikes have occurred to pay back deficits. The following graph shows the movements in the highest and lowest tax and the budget balance as a percent of GDP between 1913 and 2008 (budget from 1930). You will not be able to find anything to verify the Ricardian argument in this data.

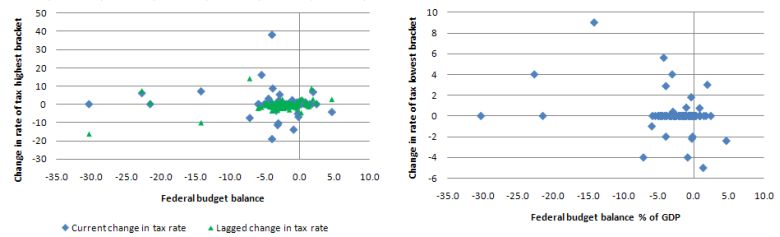

The next graph plots the change in tax rates (annual) (vertical axis) for the highest rate (left-panel) and the lowest rate (right-panel) and the budget balance on the horizontal axis. There is no relationship shown! Of-course the middle tax brackets might be taking all the pain and that conjecture cannot be shown to be incorrect using these graphs.

The point is that even a cursory look at the data demonstrates that Cowen’s statement that tax rates will rise to pay the debt back is sensationalist nonsense.

Cowen then says:

The technocratic Keynesian recommendation was to run deficits in bad times and surpluses in good times. But except for one stretch during the Clinton administration, this notion has been broken since the early 1980s. In the United States, at least, Keynesian economics has failed to find the necessary political institutions to enact and sustain a wise version of the theory.

64 out of 81 years since 1930 saw deficits of varying sizes matching the movements in the business cycle. Deficits are not a recent phenomenon (since the “early 1980s”) and are the norm rather than the exception.

Cowen then says:

Now that fiscal constraints are starting to bite, many politicians are afraid to reform or even to discuss changes in the largest problem areas: Medicare and Medicaid. Yes, some laudable cost controls on Medicare are embedded in the new health care law, but they’re not enough. Most likely, we will end up making other spending cuts that won’t solve our fiscal problems – and in areas that could instead benefit from Keynesian employment stimulus. These kinds of knee-jerk, poorly reasoned decisions are what happens when fiscal illusion reigns.

No fiscal constraints are biting. The politicians, aided and abetted by conservatives like Cowen, are constructing an artificial fiscal crisis.

There are no fiscal constraints other than the political?

What is the evidence that the “fiscal constraints” are biting? Bond yields? Low unemployment? Low underemployment? High rates of capacity utilisation? Above trend growth? There is no evidence at all that the deficit is too large.

Conclusion

These economists essentially lead sad professional lives. They bunker down in their offices and doodle away with mathematical models that are largely banal representations of some obscure untested assumptions about human behaviour and motivation which the other social science disciplines and relevant research show to be inapplicable.

They lead unadventurous lives – opting to perpetuate conservative myths that are continually violated by the facts. They hide their shame with arrogance.

Bush Telegraph today

I appeared on the National broadcaster ABC’s Bush Telegraph program today talking about Carbon tax or emissions trading?.

You can here the audio by going to the site or you can download it.

That is enough for today!

“A better solution may be to beware of anarchistic economists wearing the clothes of political science.”

An even better solution would be to beware those who think attacking the state on behalf of the wealthy elite is the same as anarchism! Let me quote the original “anarchistic economist”, Proudhon:

“But the people has a perfect grasp . . . that political economy, as taught by Messieurs Say, Rossi, Blanqui, Wolowski, Chevalier, etc., is merely the economics of the propertied, the application of which to society inevitably and organically engenders misery.

“I reckon that I have done more than anybody to establish this view…”

Proudhon, unlike the propertarians (a far better word for them), was well aware that the state existed to defend capital and so the “problem before the labouring classes… consists not in capturing, but in subduing both power and monopoly, – that is, in generating from the bowels of the people, from the depths of labour, a greater authority, a more potent fact, which shall envelop capital and the state and subjugate them.” Hardly a perspective a propertarian would agree with.

Suffice to say, space precludes my discussing Proudhon’s ideas here. For those interested, my I recommend the introduction to my new anthology of his works “Property is Theft!”:

http://anarchism.pageabode.com/pjproudhon/introduction-contents

Suffice to say, genuine anarchistic economics (as expressed in the works of such libertarian socialists as Proudhon, Bakunin, Kropotkin) has nothing in common with neo-classical or “Austrian” ideology.

The only illusion I found in TC’s piece is the last sentence: “Tyler Cowen is a professor of economics …” But I wouldn’t characterize TC and all the other folks at GMU as mainstream economists. GMU is the academic equivalent to the Church of Scientology: the Church of Austrian Economics. The former devote their life to the meticulous study of the writings of Ron Hubbard, the later to a now century long exegesis of the writings of their semi-gods Mises, Hayek, Kirzner, Buchanan, … (I like the statement from Peter Dorman about this lot: The colleagues of TC at GMU are beyond redemption.)

The part of la la pixies at the end of the garden fantasy world of ‘Ricardian’ Equivalence that strikes me is this idea that people save to pay taxes, when people pay future taxes out of future income and save now to spend later.

But but but…it’s “peddled”, not “pedalled”.

Jest sayin’…

Peter Dorman has a nice takedown of Cowen.

http://econospeak.blogspot.com/2011/03/economic-illiteracy-tyler-cowen.html#links

“TC is not making an argument about fiscal space or debt sustainability. He is saying that our treasury bonds are illusory because we will have to be taxed in the future to remove them from circulation. We are not talking about shades of opinion here, but the difference between having a basic idea of how economies work and flat-out ignorance.”

“Democracy is about kicking governments out that do not fulfill their mandates. In the advanced nations, there are regular elections.”

Elections in the US are like voting for the King (republican) or Queen (democrat). Both represent the monarchy (corporate America).

Bill,

I thought you presented the facts about Carbon Schemes very well on Bush Telegraph today.

Indeed I agree that a set of rules / regulations would be a better approach to reducing carbon emissions than any of the so called “market based alternatives”.

I did though have a chuckle when Kevin Parton said he agreed with what you said and then he started banging on about how he’d prefer a market based program rather than rules / regulation.

His reasoning being that the”invisible hand” would produce the best / most efficient outcome.

Blind faith Neo-liberalism.

Were you rolling your eyes and shaking your head by this stage as well ?

Cheers Alan.

TC is a Libertarian ideologue. The reason he has a voice is that he presents himself as marginal Libertarian, willing to abandon the crazy to fit into the mainstream, where he does his insidious work by assuming the role of a “Very Serious Person” (h/t Paul Krugman).

He knows the truth though, as he inadvertently lets on here:

The a few paragraphs later he contradicts this by claiming:

He obviously just can’t help himself. That’s the mark of an inveterate ideologue.

“Ricardian Equivalence ”

“There are some ideas so stupid that only an intellectual would believe them.”

George Orwell

Bill,

Thank you! Thank you! Thank you!

As neo-liberalism keeps its boot on the throat of my business I’ve had some time on my hands: I’ve been waging a comments battle every where I can attacking that damned TC article in the NYT. Brad Delong here, http://delong.typepad.com/sdj/2011/03/political-illusions.html makes the most convincing critique from within the neo-liberal consensus, but the poor guy does not know what fiat money is! Your post is exactly the link I’ve been looking for.

Also, anyone, I’m looking for a chart that shows US annual deficits, the accumulating stock of US debt and US GDP growth from 1946 to present in inflation adjusted dollars. If it exists I’m looking for a link. If someone knows where a rube (me) could find the data sets and tools to chart them, I could make a short term hobby of it. Victoria Chick and Ann Pettifor had that essay last year showing that deficits offset themselves through growth in the UK, I’m looking for a comparable look at the US.