The other day I was asked whether I was happy that the US President was…

The bankruptcy machine

The so-called architect of the euro monetary system – died recently in Rome. I guess architects like to leave behind objects of style and beauty that also function well. There is a huge debate among architects about form and function and whether ornamentation is functional. Form follows function has been the catch cry of modernists in architecture and I am most familiar with the debate when it is applied to software development (and its architectural characteristics). Anyway, the euro architect has left behind a monetary system that neither has form or function. It is an ugly creation that is increasingly revealing its dysfunction. But try telling that to the EU leadership who have just finished another summit in Brussels, where I suppose the cuisine and setting was sumptuous and the wine was top class. And like all previous summits all that was forthcoming was further political rhetoric about the irreversibility of the euro and the political commitment to defend it. In real terms this translates into imposing a state of more or less permanent unemployment and austerity on millions of Europeans. Eventually the gap between the leader’s rhetoric and the underlying reality will become so wide the system will crumble. But in the meantime the EMU is a bankruptcy machine.

The Financial Times reported (December 19, 2010) that:

Tommaso Padoa-Schioppa, who has died in Rome aged 70, was a former Italian finance minister and founding member of the executive board of the European Central Bank who was regarded by many as a central architect of the euro. A passionate advocate of European integration, he was highly intelligent, well-versed in economics, and a first-rate financial technician. A central banker by training, he was witty, charming, deeply cultured and steeped in European history … He coined the phrase “a currency without a state” in 1999, to describe the euro. “Our new currency unites not only economies, but also the people of Europe,” he said … In earlier evidence to the European Parliament in 1998, however, he also spelt out a realistic view of the challenges: “I do not think that a single currency is an event for the last days of the history of mankind that simply crowns perfection,” he said. “It is something that has to be in reality while reality evolves.”

Padoa-Schioppa’s proposal that the euro would unite economies and the peoples of Europe is turning out to be true. The common unifying element is the entrenched unemployment that the system has delivered which will define the European landscape for years to come unless nations take the only sensible step and exit the defunct and unworkable monetary system.

Related unifying features will be the savaging of pension entitlements, loss of wealth and savings (therefore reduced personal risk management capacity), and an increasingly violent social fabric.

Some “building”. The EMU is nothing that I would be proud of as a legacy of my professional capacities and foresight.

Last weekend, the Eurozone leaders had yet another “leadership” summit and once again demonstrated that their concept of leadership has nothing to do with advancing the welfare of the people of Europe nor providing a solution to the on-going crisis that will worsen.

At the end of each of these summits we get the same message. This weekend they agreed to (Source) add the following “limited Treaty amendment”:

The Member States whose currency is the euro may establish a stability mechanism to be activated if indispensable to safeguard the stability of the euro area as a whole. The granting of any required financial assistance under the mechanism will be made subject to strict conditionality.

The EU boss sent a message to private sector creditors saying that “the EU will continue to adhere strictly to standard IMF and international practices”. The communique from the Summit reaffirmed that the leaders of the euro area “… stand ready to do whatever is required to ensure the stability of the euro area as a whole … [and the euro] … is and will remain the central part of European integration”.

So once again the same old words – “a political commitment to economic and monetary union and the irreversibility of the euro” (Source).

It gets fairly boring to an outsider and must be very depressing to the growing number of people without work and those who are having working conditions and pension entitlements cut.

All this tells us is that the bailouts will become part of the treaty and nations that suffer aggregate demand shocks which drive their fiscal parameters beyond the Stability and Growth Pact rules will be forced by the EU “leadership” to invoke harsh pro-cyclical fiscal policies which damage their domestic economies even further.

This is no future. And there is no alternative given the history of the system; its member states; and the way they have designed the system. The EMU is a perfect example of a system designed to fail. It is big on political rhetoric but at the level that matters – economic structure and behaviour and the capacity of governments to stabilise their own economies it fails badly and will always fail under the current leadership.

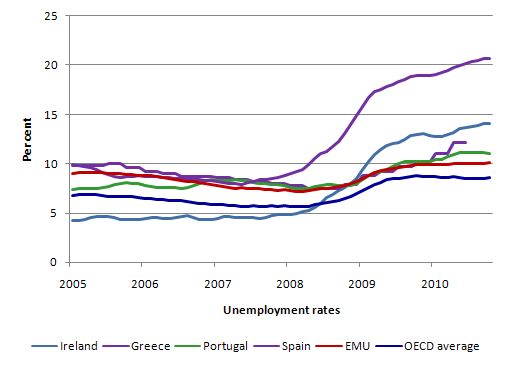

The following graph uses OECD Main Economic Indicators data for standardised unemployment rates and compares the average for the OECD with the EMU and some of the struggling Euro nations from January 2005 to October 2010 (the data is monthly).

The Eurozone overall has failed to produce low unemployment rates. A feature of the system has been the persistence of high unemployment.

This point is made by Martin Jacomb in his recent Financial Times article (December 19, 2010) – Europhiles risk ignoring the jobless tide. Jacombs, by the way, is not a believer in government intervention and has recently proposed privatising Oxford University.

But he is correct in saying that the flaw in the EMU was that there was “no central economic government” which could provide fiscal transfers to attenuate the reality that some regions are more succesful economically than others.

He said of the Eurozone design:

The flaw was this: productive activity always tends to migrate to centres of economic success and prosperity. This tendency is inevitable and visible in every single currency area. Within a sovereign country that has its own currency, a large proportion of taxes raised by the government goes to benefit the less economically successful areas. This does not happen through regional aid, although this may help a little. It is achieved through wages paid to public sector employees, capital expenditure by central and local government and welfare-system transfer payments and so forth. Taxpayers tolerate this in the interests of social harmony. In a single currency area, with no central economic government, as in the eurozone, there is no possibility of this.

While his conception of “taxpayers” funding government spending is erroneous the point remains that the ideologues who strut around as the Euro leaders deliberately eschewed the creation of this central fiscal capacity. They thought the Maastricht rules would be sufficient. Unfortunately, they didn’t consider what would happen when a large negative demand shock hit the system.

Even the normal (and welcome) operation of the automatic fiscal stabilisers blew the budget outcomes way beyond the SGP rules. It was no surprise to anyone who realised that these rules were more or less plucked out of the air and didn’t reflect any sensitivity to what might happen when a large demand shock arrived.

While the rules were bad enough the reaction of the Euro bosses once they were breached demonstrated their ideological obsession. They then required pro-cyclical discretionary fiscal policy to be introduced which was just the cat chasing its tail – that is, the contractionary fiscal strategies forced on these ailing nations worsened their real economic outcomes which, in turn, drove the budget further into deficit via the automatic stabilisers.

In forcing pro-cyclical fiscal stances onto nations these “leaders” were following exactly the path that mainstream economists argue is the problem with using fiscal policy in the first place. So it became a case of burying that argument for a while because it was more convenient to rehearse their public debt obsessions.

Fiscal policy can sometimes become destabilising and pro-cyclical if it pushed nominal spending growth beyond the capacity of the economy to absorb it via real output increases. In general, expansionary fiscal policy that is supporting real growth is desirable.

Contractionary fiscal policy at a time of private contraction and rising unemployment is never desirable or justified. It is this strategy that the Eurozone bosses think demonstrate their “leadership”. They are wrong … it just demonstrates that they are terrorists who use the most disadvantaged citizens of Europe as pawns in their political machinations.

The problem facing the poorer Euro nations which are being forced to increase taxes and cut public spending is that the only adjustment offered to them is deflation – cutting nominal wages and hoping that eventually they will export their way out of the mess. Historically, nations which face falling external competitiveness allow their currencies to depreciate. This is not possible for the Euro members.

So it will be a grinding process over the next decade or so – with chronic depressed domestic conditions and no certainty that sufficient restructuring will occur to allow these nations to export their way out of the mess.

Jacombs noted that such deflations are “not usually possible on a sufficiently wide scale without a prior economic collapse. Devaluation of a national currency is a more practical proposition” and while:

… leaving the eurozone, being against the rules, is a very expensive and disruptive procedure … if this is the only way to prevent the national economies of the peripheral countries becoming mired in failure, and save millions from falling into long-term unemployment, then it may begin to look like a price worth paying.

I agree with that assessment.

There are other possibilities as outlined in this Bloomberg Op Ed (December 21, 2010) – Five Ways to Start the Euro Rescue – by one Matthew Lynn.

Lynn said:

Another summit, another messy compromise. With the euro facing renewed crisis, and with Portugal, Spain, Belgium and Italy all under the same kind of pressure that forced Greece and Ireland into a bailout, the stage was surely set for a clear and decisive defence of the single currency. And what did the European Union’s leaders come up with after high-level talks in Brussels? A two-line treaty amendment. It’s crazy. It might be the case that the euro isn’t worth saving. This column has certainly argued that it has turned into a bankruptcy machine. It would be better for the peripheral nations to get out now — and better in the medium-term for the EU as well.

In criticising the lack of any “real” leadership among the EU bosses, Lynn outlines five steps that he considers are “required to save the euro”.

First, “boost public spending in Germany and run bigger budget deficits” – which would stimulate demand for exports from the “peripheral countries”. While the Germans hate budget deficits, but Lynn says that “either you want to save this thing or you don’t”. While this will help stimulate demand in the Eurozone, a more obvious solution is to allow the struggling member states to defend their own domestic economies directly via fiscal expansion.

Second, “double the size of the 750 billion euro ($980 billion) bailout emergency fund” because the “EU is engaged in a battle with the markets over the future of the euro” and it needs “ammo in the locker”. He correctly observes that the “markets” will only keep “hammering away” until the leadership makes “it clear they can’t win”.

This should never be a problem for a sovereign nation. They can always dominate the markets even though there is very little recognition of this fact. Please read my blog – Who is in charge? – for more discussion on this point.

However, this is more difficult in the EMU and requires the ECB to work with the national central banks to ensure that governments can “fund” their own spending. While the ECB is fulfilling this function in a roundabout way at present a central fiscal redistribution fund would also work. The problem is that the way the “treaty” is currently conceived (including the proposed amendment from the recent summit) any nation seeking assistance from this fiscal fund have to endure IMF structural adjustment style rules which just make matters worse.

Third, “create Eurobonds” which would pool “the debts of the peripheral and core nations into single euro-area bonds” and raise “enough money on reasonable terms to salvage the single currency”.

Again this is a move towards a central fiscal strategy. The problem is that richer nations don’t want to become the source of bailout for the struggling Eurozone nations. Lynn correctly notes that ultimately “Germany and France are on the hook for Greek, Irish and Spanish debts anyway” and “may as well raise money together” because it “will be cheaper” among other things.

Fourth, “rewrite the treaties so that euro-area governments cede ultimate control over budget and tax policies to Brussels”. So create a European monetary union fiscal authority and eliminate the fiscal role played by the individual states. For a multi-regional economy to function there has to be an alignment between the fiscal and monetary authorities. You cannot effectively have many fiscal authorities without currency sovereignty and facing a fixed exchange rate and one monetary authority with currency issuance powers.

The absence of a central fiscal authority was the glaring design fault in the initial EMU creation. The system cannot survive without it.

Lynn correctly notes that Greece and Ireland, for example, haven’t much “economic sovereignty … left anyway”. I read the Irish press daily and there is a continual thread coming from the government that they will not give up their sovereignty. This is pure political posturing aiming to appeal to some misguided nationalism.

The reality is that the Irish along with all the other EMU member states surrendered their economic sovereignty the day they entered the Euro and abandoned their currency issuance capacity, ceded monetary policy to the ECB and fixed their exchange rate. The further reality is that these economies are only surviving (if we can call it that) and their governments remaining solvent because the ECB is buying their debt (along with bailout money from the EU and the IMF).

It would be far better to create a central fiscal capacity if these nations really value the euro. I would personally consider that a retrograde step given the extreme heterogeneity in culture, history and economic structure that exists within the current EMU. But I don’t live there and I would now have national referendums throughout the zone (as was initially conceived until the Euro bosses realised the people would reject the creation of the zone).

I would ask straight out – do you value the euro enough to endure persistent recession and to cede all fiscal authority to Brussels? Yes or no!

Finally, Lynn says that the member countries have to “prepare for austerity”. He quotes research findings that suggest that:

… Greece, Ireland, Spain, Portugal and Italy will need to cut government spending by 10 percent, and consumer spending by 15 percent, to stay within the euro. That is slightly more than the 14 percent drop in consumption the British endured during World War II. It is going to involve massive sacrifices, so it would be better to lay out now what kind of pain is involved. People will be angry, but they will be a lot angrier if you don’t level with them.

I will comment more on that research report another day. The scenarios outlined are chilling.

They confirm my view that while it would be disruptive and very challenging to exit the euro, the southern nations will be better able to address their appalling domestic situations if they make that move. I suspect that in the medium term it will be cheaper (in real resources) to exit than to stay in.

Lynn agrees and says:

Of course, when you lay out starkly the things that need to be done to rescue the euro it becomes clear that it is hardly worth it. Few people in Europe are likely to sign up to that package of measures.

So the appropriate leadership initiative from Brussels would be to arrange national referendums throughout the EMU. Yes or No! Simple. The existing crop of politicians would find out quick smart that their rhetoric doesn’t match the desires of the voters.

Conclusion

Yes or No? Bankruptcy machine or not?

That is enough for today!

The problem with the European project as a whole is that it has no democratic legitimacy left. The only people who think it is a good idea are the political elite – as it is a tool for their further advancement.

Essentially the world has moved on since it was constructed and the issues that brought it about are no longer relevant.

Bill quotes Jancomb’s claim that (as per conventional wisdom) a “central economic government could provide fiscal transfers to attenuate the reality that some regions are more successful economically than others”. Oh yes? If Germans don’t like remitting large sums to Ireland now, why would they suddenly become enthused with the idea under a “central economic government”?

On a different point, Bill’s question to peripheral Euro countries is apt: “do you value the euro enough to endure persistent recession?” On the other hand the question assumes (again as per conventional wisdom) that when a Euro country devalues within the Euro, the effect has to be violent deflation.

Certainly to do what Ireland etc are currently doing, i.e. cutting just the items over which government has control (minimum wages, civil servants wages, etc) and waiting for the private sector to follow suit could take years. But if a country could cut ALL wages immediately (in Euro terms), that would amount to much the same as devaluation where a country has its own currency, and that was never famous for causing unacceptable austerity.

Cutting all wages immediately (or within a year or so) would be politically and bureaucratically difficult. But if the rationale was explained to the population, it might just be doable.

Moreover if one Euro country tried the “cut all wages immediately” wheeze, and it worked, then the idea would become widely acceptable in Europe, which would help sort out disparities in competitiveness in the future.

Neil Wilson – couldn’t agree more!

Professor Mitchell: the problem is not that there isn’t a central fiscal authority, because the ECB is fast on it’s way to become that CFA. EU leaders may not like it, but on that part they seem to be always behind the curve. The real problem is that for the Eurozone to function, it must become a full federation; there are just no other ways to solve the problems. The heart of the matter: it ain’t gonna happen.

Any thoughts on the potential for a “southern Euro” breaking off, with central fiscal and monetary policy for for the southern region (Portugal, Spain, Italy and Greece)?

Spain’s unemployment rate was above 15% since the early 80s, reached 24% in 1994, went down to 8% by 2007 and soared again to 20% after the crisis.

Ireland’s unemployment rate was above 12% since the early 80’s, reached 16% in 1993, went down to 4.5% by 2007 and soared again to 12% after the crisis.

Both countries enjoyed a much lower unemployment and a higher standard of living since 1993/4 until 2007. Even after the crisis their situation is much better than when they had a sovereign currency.

But let’s blame the Euro, the root of all evil!

Ralph: Cutting all wages immediately (or within a year or so) would be politically and bureaucratically difficult. But if the rationale was explained to the population, it might just be doable.

This “explanation” is already happening in the US. It’s called “increasing global competitiveness.” and it involves reducing US wages to compete with the Chinese, Indians and Indonesians. The middle class is figuring that out. Should be interesting to see what happens over the next few years.

Dear Ralph:

In thinking about your proposal, it seems that by cutting ALL wages one is addressing only half of the economy. ALL debts ( mortgages, loans, etc) must also be cut by the same percentage for the plan to work. This is what a devaluation of a sovereign currency achieves, all in-country real prices, wages and debts are reduced ( relative to the world), but nominal wages, prices and debts stay the same. It would be difficult to re-negotiate all debts to align with the wage decrease, but I suppose it could be done by government decree, just the same as the wages. I think the problem would be foreign debts ( or euro debts), so some debtors would still suffer.

This is really both on and off topic.

Understanding MMT for me opened many doors of thought about what is happening in the real world. It is particularly makes me understand what the real economy is and what it should be accomplishing. This is something that has puzzled me for many years. I am sure that many people who read this blog will understand.

What frustrates me however, is that trying to explain that “deficits” in the US are just accounting artifacts and that the real deficit is not using our resources is like trying to explain to a dog on a rope who has wrapped himself around a pole that he needs to go backwards to lengthen his rope instead of strangling himself by doing the same thing.

If we can’t come up with a way to make people realize the fallacies of their thinking in a larger manner we are wasting our time reading this blog and we should be out surfing or listening to music instead.

Any ideas?

Dear Ralph Musgrave (at 2010/12/21 at 22:27)

The problem with cutting nominal wages is that most contractual obligations are also in nominal terms and it is a sure way to increase mass bankruptcy. The workers have no way of juggling their expenditure mix once nominal wage cuts start to impede their capacity to honour these obligations.

This is one of the reasons Keynes eschewed a money wage cutting solution (to anything).

best wishes

bill

Dear sidchem (at 2010/12/22 at 6:23)

Going out surfing and listening to music instead is a good option – as long as you have a job and can afford the board and CD player.

But if my blog has helped you work out a few things then that tells me that I am not wasting my time. The audience is expanding significantly over the last few years. That means that more people are getting a different perspective on things and I notice that the discussions of these ideas etc is starting to proliferate around other blogs/forums etc.

But I also cannot “make” people realise the fallacies of their thinking. I can only offer a professional perspective that is suppressed by the dominant ideology and leave it up to them to work through the ideas if they are interested.

It still leaves time for some waves and some music though.

best wishes

bill

Sidchem’s comment is on the mark from my point of view

‘If we can’t come up with a way to make people realize the fallacies of their thinking in a larger manner we are wasting our time reading this blog and we should be out surfing or listening to music instead.’

I have posted comments on this and several other blogs which carry blogs by MMT-proponents (New Deal 2.0.com, New Economic Perspectives.com, and others) to the effect that the messages are read, but appear to not be fully appreciated by a rather limited audience among economists/financial ‘experts’. I believe that the MMT-proponents should try to reach a wider audience and should employ more visual communication techniques (e.g., videos, cartoons, animation- ‘comic’ strips, etc.). The series of videos which were recorded at the ‘Fiscal Sustainability Teach-In’ held at GW Univ, Washington D C on April 28 which Bill Mitchell linked to in a blog earlier this year were very well done, however, I do not recall that the video versions which were linked via billyblog were also found on YouTube.com. Actually, I would suggest that a series of lectures which simply deal with the fundamentals of MMT and its’ relationships to unemployment/job guarantees, other aspects of the economy would be a good start to spreading the message. The problem with most blogs by W G Mitchell, L R Wray, W Mosler, Marshall Auerback, S Fulwiler, and others is that they assume an audience which is susceptible to the points in their message; one problem which I frequently encounter is that many questioners are still basing arguments on assumptions related to a commodity-based money system. I am sure others have noted other misperceptions among commenters and I suspect that much of the general public doesn’t know whom to believe.

sidchem,

I agree…and for my part, I am now including bits and pieces on MMT in professional education courses that I teach to senior financial executives at various banks and industrial corporates, often public enrollment courses sponsored by a well-known international training firm. In fact, I have persuaded this training firm to list, for the first time, a publicly-open course for next year named Modern Money, Banking, and Economics. I have been shocked at how some of my delegates–very bright and supposedly senior decision makers/leaders in some major financial institutions– are clueless when it comes to some of the topics discussed in this blog and elsewhere. I try to start the first day of a course by mentioning the government budget spending and borrowing constraint questions while talking about the yield curve (these delegates all care about and often trade the yield curve)…and these ideas knock some off their feet. Most are skeptical, at first. Some delegates want more information, others want to argue their ideological views or their orthodox training. But this is another front opening up the battle lines combatting ignorance. Now, how do we work on educatiing the politicians?

So lets say the Euro breaks up and the weaker new currencies are devalued by the market and this helps their export industries. This will lower unemployment there, but will raise it in France and Germany. It may also set the stage for competitive devaluations, as every EU country tries to weaken their currency to support exports.

Is the Euro itself the main reason unemployment is high? Is it not more likely that the stupid rules about debt to GDP limits are to blame?

If the Eurozone scrapped these rules and instead allowed the member states to target unemployment rates by “printing euros” in sufficient quantity to bring unemployment below a predefined threshold (i.e. use appropriate fiscal stimulus), doesn’t this get at the heart of the unemployment issue?

Robert,

I could not resist…

The reason unemployment is high is not only because the governments in Europe “have run out of money” but also because it is supposed to be high. High unemployment is an element of mecroeconomic policy and is essential in maintaining price stability, reducing budget deficits and shaping the economies in the right way.

Please forget about all the hypocritical sympathy towards unemployed often expressed by the post-Solidarity and post-Communist parties in Poland especially before the elections. This is what the real bossess, NBP (National Bank of Poland) think:

“The non-accelerating wage inflation rate of unemployment is treated as some approximation of the equilibrium or natural unemployment rate. When unemployment is at its natural level, expectations are confirmed and wages should stay at their medium or long run track, so that no acceleration or deceleration of wages growth takes place.”

…

“The unemployment rate included into the second cointegrating vector is a measure of the labour market tightness and, at once, a discipline device for workers. The higher is the unemployment rate the stronger are fear (worse fallback position of workers after the

job separation) and threat (higher probability that the firm will be able to replace fired workers with some new ones) effects which in turn lead to lower wage pressure of employees.”

link_www.nbp.pl/publikacje/materialy_i_studia/48_en.pdf

Please have a close look at Figure 10.

If you still don’t have enough you may read this enlighting interview with prof Balcerowicz from 2003 as well (in Polish):

link_http://www.wprost.pl/ar/44430/Ekonomia-termiczna/?I=1069

So it has been scientifically proven that unemployment above 10% in Poland is essenital to maintaining the long-term growth.

If one disagrees he/she can always leave the country. I did this in 2003 because to me something was not exactly right with the society. It took me more than 5 more years to discover what was actually wrong as in 2003 I still believed in the neoliberal stuff… but it’s never too late.

Wesolych Swiat!

MamMoTh says:

Wednesday, December 22, 2010 at 5:14

“Both countries enjoyed a much lower unemployment and a higher standard of living since 1993/4 until 2007. Even after the crisis their situation is much better than when they had a sovereign currency. But let’s blame the Euro, the root of all evil!”

Exactly, but why let that get in the way of a good bashing.

So for a moment let’s consider what happens if the EMU is dissolved and everyone gets to be sovereign again. We have a huge default event on members’ debt and Germany, unencumbered by having to bailout the PIIGS gets to thrive even more than they currently are.

The assumption is that rich banks are the end holders of Eurozone debt and the default process is a good way to redistribute wealth however I would think a considerable amount of middle class savings are invested in mutual funds which in turn hold these bonds.

And once sovereign, what dummy would ever risk buying bonds issued by the smaller Euro countries again?

On the whole I would argue that with EMU Europe has become more socialised than under the former regime and the actions of the ECB in 2010 clearly prove this.

Adam,

So if I understand you correctly, the reason there is high employment in Europe is a matter of overall policy – and not simply because some of the countries have the Euro. So if the Euro were to disband, these high-unemployment policies would presumably remain.

Full disclosure: I am a Canadian of Polish descent who lived in Poland from 1994 to 2002.

Robert,

People in some European countries may finally decide to “change the paradigm” what may lead to leaving the Euro and ditching the budget constraints as a result of a bankruptcy. This may weaken the neoliberal straitjacket which I mentioned however I am not sure how likely this scenario is.

The current Polish NBP Chairman prof Belka openly admits that should one country leave, the whole project would be dead (he thinks that the Germans will always blink first so there will be no collapse). For him the main risk in 2011 will be associated with Spain and there can be some dramatic (rapid) changes during the next phase of the crisis.

link_http://wyborcza.biz/biznes/1,100896,8848448,Niemcy_placza__ale_euro_nie_porzuca.html

translated_link_http://translate.googleusercontent.com/translate_c?hl=en&ie=UTF-8&sl=pl&tl=en&u=http://wyborcza.biz/biznes/1,100896,8848448,Niemcy_placza__ale_euro_nie_porzuca.html&prev=_t&rurl=translate.google.com.au&usg=ALkJrhjYFQvgCGgeMV2i43pcqxVIqbmszw

Personally I agree that they may muddle through going through several more bailouts, possibly applying “haircuts” to investors and austerity packages to the people.

And once sovereign, what dummy would ever risk buying bonds issued by the smaller Euro countries again?

There’s a name for such dummies: the smart money. Lending after a borrower’s bankruptcy can be profitable. Before, not so much.

Ralph says – “But if a country could cut ALL wages immediately (in Euro terms), that would amount to much the same as devaluation where a country has its own currency, and that was never famous for causing unacceptable austerity.”

Correct me if I have your point wrong, but I’d much rather face the Aussie dollar depreciating by a third than my wage doing the same. Lucky we’ve multiple examples of this (of various magnitudes) in recent times. I like the idea of being able to buy most of my things in my currency at the same price. Any imports that increase in price I can probably do without.

Is a massive internal devaluation, via wages, not a very similar thing to increasing the price level in one fell swoop? Meaning…..that the economy has to adjust to the richness of just about every product in relative terms in local currency (Euros at the moment)….meaning…..the economy implodes under an unchanged level of liabilities and just chases deflation?

Who exactly was the mean @#$% who came up the the natural rate of unemployment? Why don’t the big exporters just tell Spain that the new natural rate of unemployment for Spain is 25% unemployment? Spain should be happy with that like Australia is perfectly happy with 5% unemployment. In Australia we have been tricked into believing the natural rate is 5% unemployment. So 5% of good people out of work is the same as zero. Why not 6% or 7% or whatever big companies want it to be to make sure wage increases stay low relative to profits. Politicians in Australia represent 95% of the population. The other 5% unemployed are on the scrap heap of life with no representation. Big companies in Australia are banging on again about skills shortages after they failed to train enough workers from the unemployment pool. They would have plenty of skilled workers if instead of tricking politicians and the press into believing 5% unemployment is Natural the 5% could have been working and training on the job. Instead the big companies post huge profits and then complaining that the Government should fix the skills gap. Weak Government is buckling to big business on the unemployment issue instead of putting the blame where it belongs, on big business failure to train enough ‘unemployed’. (raving now) Big exporters telling Spain and ors to prepare for austerity is another trick to keep the advantage with the exporters. If the big exporters realy cared about Spanish people the big exporter countries would be agreeing to shift manufacturing plants to Spain and ors to balance the “Natural” unemployment rate across the Europe.

“… the southern nations will be better able to address their appalling domestic situations if they make that move”.

Actually not. They’d be better off if they managed to rally together and impose to Germany (and acolytes, specially Netherlands and Austria) a weaker devalued euro at near-parity with US dollar, as it was some 8 years ago. This could push Germany out of the euro, but only Germany would lose from such a risky move (though much less than Latin Europe, they’d lose competitivity in the EU continental market, specially if the new DM would be as strong as now is the euro or the DM was in the past).

Also they’d be better off if they could push (or if they could make their sold-out governments) for a more socially-oriented and less big-capital-oriented EU, if they would invest themselves more in welfare (specially public housing, which acts as a subsidy to labor costs, improving competitivity everything-else-equal) and in general would make more public investment and rely less in the vampiric “non-markets” (and I say “non-markets” because free markets do not exist in oligopoly situations as the one we have right now, not just in EU).

In general the crisis calls for greater public investment, what calls for loans from the ECB, partly paid by devaluing the euro, what in turn would improve EU competitivity outwards.

Sadly Germany is too powerful in EU and politicians (same as in most other countries) are sold to the big banks and other big corporations, so the disaster situation is likely to continue until it blows up. However I do not think it will blow up only by breaking up the EU (which is possible but by no means certain) but, as it’s happening, by rapid exponential increase in social unrest (this is not Kansas, Dorothy: we have unions and even communist parties even if of a diluted or somewhat weakened nature) and will force social and political changes in particular states first and the Europe-wide.

Here we go. This was for me only a matter of time. The 1st German Anti-Euro-Movement was announced. (Only in German. Sorry.) These Austrian Economics lunatics never miss a marketing opportunity to try to catapult a society in their Libertarian Austrian Econonomics Nirvana. So now there’s a German Version of Ron Paul who wants me to pay for a beer in Goldmark.