I started my undergraduate studies in economics in the late 1970s after starting out as…

Cut spending and unemployment rises – surprised?

Today I was reading the latest labour force data released by the UK Office of National Statistics which shows that the British labour market is now contracting as the public sector job cuts begin. The British government continues to claim that to reduce unemployment you have to deliberately create unemployment. They believe that by reducing public involvement in the economy (which means in a macroeconomic sense – withdrawing spending which generates both public and private employment) the private sector will spontaneously erupt in a surge of growth. They are in total denial of the obvious fact that spending equals income and public servants spend in exactly the same way as private employees – by handing over dollars to shopkeepers around the land. When have anyone of you been asked by a cashier whether you are working in a government or private sector job before they accept your cash? Never! As the public jobs are scrapped in the hundreds of thousands, the loss of spending will damage the private sector who will react by reducing their demand for labour and postponing their investment plans. The only hope is that exports will save them but that is highly unlikely. When do the people rise up against these ideological zealots? But the fact that when spending is cut unemployment rises – is no surprise to me. It is a basic macroeconomic reality. The problem is the neo-liberals never let basic facts get in the road of their religious convictions (or bald-faced power grabs).

The UK Office of National Statistics released the Labour Force data for December 2010 yesterday (December 15, 2010) which showed that:

The unemployment rate for the three months to October 2010 was 7.9 per cent, up 0.1 on the quarter. This is the first quarterly increase in the unemployment rate since the three months to April 2010. The total number of unemployed people increased by 35,000 over the quarter to reach 2.50 million … There were 839,000 people unemployed for over twelve months, the highest figure since the three months to February 1997 and up 41,000 on the quarter.

There were 158,000 redundancies in the three months to October 2010, up 15,000 on the quarter. This is the first quarterly increase in redundancies since the three months to April 2010.

The result was totally predictable in direction at least.

The ONS reported that “(t)he number of people in employment was 29.13 million in the three months to October 2010, down 33,000 from the three months to July 2010 … full-time employment … down 58,000 from the

three months to July 2010 … The number of people in public sector employment was … down 33,000 from June 2010. The number of people in private sector employment was .. unchanged from June 2010”.

So instead of the public sector providing employment leadership at a time when the private sector is not yet ready to expand jobs growth, the British government (at all levels) is cutting jobs and forcing unemployment up. As the austerity drive deepens the deflationary impact of these job cuts will undermine private sector employment growth. No surprises to me in that data – although plenty of sadness.

All the public sector job cuts were in “Public sector excluding financial corporations” and were concentrated in Civil Service (-8,000); Education (-8,000); National Health Service (-2,000), Other Health and Social Work (-3,000) for a total cut of 33,000 jobs, which totally accounts for the overall employment contraction in the December quarter.

The UK Guardian said that the fall in public employment:

… follows the government freeze on public sector employment and the announcement by local authorities of a wave of redundancies.

Which puts the statement by the British Employment minister as a strong contender in the “lie of the year” award:

These figures highlight the crucial importance of the action we are taking to keep the economy moving forward. It’s essential to create a stable environment where businesses can flourish and create jobs – with those on benefits at the front of the queue to take them up.

But the joke of the day came from the related UK Guardian story (December 15, 2010) – Unemployment rises unexpectedly – which just about says it all. What model of what is going on in Britain at present would you have in your mind if you considered these results were unexpected?

The austerity program is just beginning but has been signalled for some months. Public sector agencies are now contracting. Private business has had an opportunity to predict that demand conditions over the next 12 months are going to be tough and it is highly likely that they will deteriorate significantly. The neon sign that the British government has erected for private business is that spending is being cut and at least 330,000 thousand public sector workers will be without incomes (to spend) over the next few years.

What would a sensible business do in these circumstances? While the British government and all its sycophantic economists have tried to justify the austerity drive by appealing to the notion that households and firms are Ricardian agents – which is an arcane concept in mainstream economic theory that says that these decision-making units are so fearful that they will be clobbered by government to “pay back the deficit” that they are increasing their saving to accumulate the necessary funds to meet the tax rises. So the conservatives say that households and firms are on a spending strike and will immediately increase spending once they see some resolve from the government to reduce the deficit.

First, governments do not pay back deficits.

Second, austerity will worsen the deficit via the automatic stabilisers.

Third, the notion of Ricardian behaviour has been categorically refuted by a raft of empirical studies. Proponents of the notion have been sorely embarassed by major predictive errors at key points in history but continue to push the theory nonetheless, such is the arrogance of my profession that when confronted with facts that destroy their theories merely tell students that the facts are wrong.

Fourth, the assumptions underpinning the theory of Ricardian Equivalence are so restricted that the theory fails to be consistent or have any conceptual veracity if one of them is modified. None of the assumptions hold in the real world. So even on its own basis – without any recourse to empirical data – the theory has not authority.

The more realistic scenario that has the backing of a substantial research literature is that households and firms are not spending at present because they are pessimistic about the future. The austerity program will increase this pessimism and survey evidence is supporting that conclusion. The UK Guardian article quoted “an insolvency practitioner” in Britain who said that if:

For the UK’s businesses and their employees, 2011 is shaping up to be harsher than any of the past three years.

Anyone who thinks the private sector can take up the slack from the public sector is out of touch with what’s happening on the ground.

No surprise there.

So it is to be expected that the British labour market will deteriorate further over the next 12 months.

As in Australia, the bank economists in Britain (known as “City economists”) who embrace these nonsensical Ricardian arguments demonstrated an appalling record of prediction. The UK Guardian article reports that:

City economists had expected a drop of 15,000 in the number of people out of work, which would have lowered the unemployment rate to 7.7%.

Wrong again! As usual! They are part of the problem and should be ignored by policy officials and the general public.

The Prime Minister was reported as saying “(w)e must do everything we can to help people into a job” which would require him to learn some monetary economics so that he could see how unnecessary it was to try to “fix” the deficit via a harsh job-cutting austerity program. The reality is that he is the architect of the job losses and the destruction that will accompany them.

And today (December 16, 2010), the UK Guardian said that the Coalition wields axe over Christmas as 100,000 jobs to go by spring – which should really cement the Employment minister’s statement as the “lie of the year”.

Apparently “councils, police forces and other public services” have to “formally announce job cuts” as part of the austerity program being imposed on the British people by January 1, 2011.

Where will these people find work? Answer: they will not easily find alternative employment and many will enter the ranks of the long-term unemployed.

My proposal for Britain: – all the elected members of the British government should receive a pay cut for every per cent the unemployment rate rises. If by January 1, 2012 unemployment is continuing to rise then all should immediately resign.

Australia – tracking where the jobs were created last quarter

The Australian Bureau of Statistics released their Labour Force, Australia, Detailed data for the November quarter today which provides more insight at an industry and regional level of what has been going on in the labour market.

Recall that last week, the Labour Force estimates for November showed that the Australian labour market is improving with positive employment growth which was biased towards full-time job creation. In fact, part-time employment went backwards last month.

The summary statistics showed that employment increased 54,600 (+0.5 per cent) with full-time employment increasing by 55,100 and part-time employment decreasing by 400. This reverses the dominance of part-time employment growth in recent months.

Given a lot of negative news from other data sources over the last few months and the poor National Accounts results for the September quarter I was curious to examine where the full-time employment growth was coming from.

Further, with all the rhetoric about the robustness of the mining boom I was interested in how fast mining employment was growing given that it is biased towards full-time status.

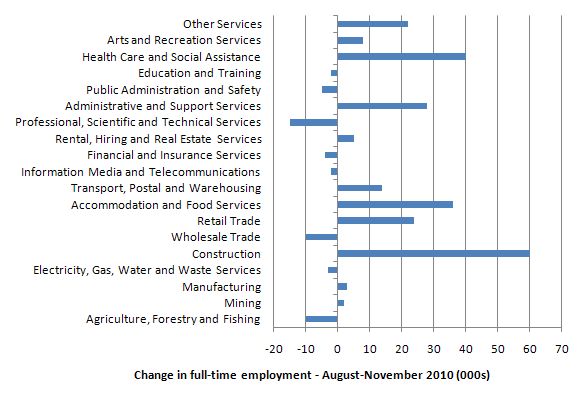

The first graph shows the change in full-time employment (000s) by the one-digit ANZSIC industry categories between August and November 2010. You can learn about the ANZSIC system of industries from the ABS Information Page which among other things provides detailed explanations of the industry characteristics including public and private sector involvement.

The data tells me that the public sector has been a dominant source of new full-time jobs. Construction which has benefited the fiscal stimulus packages (school construction program) accounted for 31.4 per cent of total net full-time jobs created (34.9 per cent of total net jobs) while Health Care and Social Assistance (strong public involvement) accounted for 20.9 per cent of the total net full-time jobs created in the fourth-quarter.

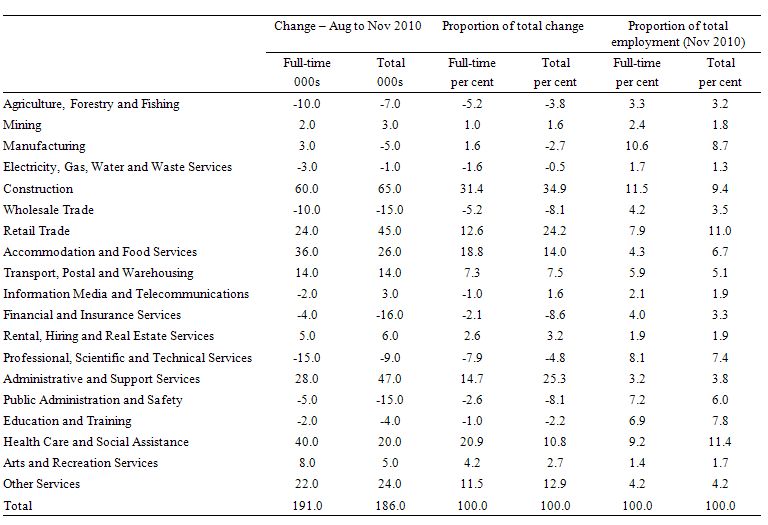

The following Table lets you compare the changes (000s) in industry full-time and total employment between the August and November quarters, the proportions of total change and the distribution of total employment by industry as at November 2010. This provides you with some basis for determining the contribution of each industry and whether it is proportional their shares in total employment.

It is clear that while Mining added some full-time employment in the November quarter it actually lost employment share because it contribution was below its share of total employment.

Conclusion

Travelling today again and have had very little time to study this data.

While the quarterly industry data does not allow us to exactly account for the November labour force changes, it is fairly obvious that the impact of the fiscal stimulus has been significant and with private activity still relatively subdued the withdrawal of the fiscal stimulus does not bode well.

That is enough for today!

“by handing over dollars to shopkeepers around the land”

Technically we still hand over Pound Sterling. We haven’t quite given up on the old currency yet. 🙂

Although if the ‘pay the national debt back’ crowd succeeds then of course it will disappear of its own accord…

Just for the record the 2.502 million in the UK figures is just the ILO unemployment figure (MGSC table at the Office of National Statistics). There is another table (LFM2), which is amusingly called ‘Inactive, wants a job’ that stands at 2.367 million.

So the total number of people wanting a job is 4.869 million people. I make that 14.3% of the UK workforce stood idle.

And that’s just unemployment. There is an ONS estimate of another 2 million full time equivalent positions required to sort out underemployment, although I haven’t managed to wrangle that number out of the statistics yet.

I still find it hard to believe that we are sacrificing so many lives – and for what?

The Guardian article:

“Howard Archer, chief UK and European economist at IHS Global Insight, said: “With real wage growth negative and the major fiscal squeeze increasingly kicking in from the start of 2011, it is hard to see consumer spending being anything else than limited for an extended period.”

…

“Details emerged yesterday of a government document that suggested the number of young people who are long-term unemployed is likely to double next year.”

From a comment:

full-time: -58,000

part-time: +26,000

And then in a few years we can read the reports on how the rich got richer while the majority of the people got the short end of the stick. It is of course done deliberately, after all this time with neo-liberal economics no one with some sense of honesty can claim that the policies would have any other result.

Neil Wilson,

That is good analysis on UK unemployment. The situation is the same in the US: the US official unemployment rate U-3 grossly underestimates unemployment. The most reliable measure is U-6: and that is currently at 17%.

John Williams of Shadowstats.com thinks that even U-6 is not wholly reliable and produces his own estimate, which is now running at a shocking 22%:

http://www.shadowstats.com/alternate_data/unemployment-charts

There is some evidence that even the official Australian rate underestimates unemployment:

Frank Agbola, Hidden Unemployment in Selected OECD Countries

Does anyone know of good and reliable estimates of Australia unemployment? (particularly estimates that allow meaningful comparison between the neo-liberal era 1980-2010 and the Bretton Woods era 1945-1973?)

I know of Roy Morgan’s data:

http://www.roymorgan.com/news/polls/unemployment.cfm?category=4

He estimates that from January to July 2010, 12%, 14% or 15% of Australian workers were unemployed or ‘under-employed’.

In 2009, it was at 16.6% in July.

So even in Australia unemployment and underemployment, when properly measured, may be in the double digits.

See also:

Kevin P. Phillips, “Numbers racket: Why the economy is worse than we know,” Harpers Magazine, May 2008

http://www.harpers.org/archive/2008/05/0082023

I guess unemployment is to be expected. However, I’ve argued the (US and UK) government really doesn’t need to spend right now and have advocated tax cuts. It appears plenty money resides in bank deposits already, the result of many years of government deficit spending. The trick is to get that money moving through the economy, not creating more private financial assets. Doing so should have little effect.

“When do the people rise up against these ideological zealots?”……..I’m afraid we’re seeing more of that now when you watch the austerity riots. This is going beyond “economics” now. The people seem to understand the scope and effects of internal devaluation far better than the economists and politicians (who really should know better)….and we in Australia know how relatively painless and effective external (AUD) devaluation has been at various times in the past couple of decades. The really sad thing is there’s an almost zero chance you won’t see more of these protests/riots, and likely more violent too.

“It’s essential to create a stable environment where businesses can flourish and create jobs”……unbelievable……what world does this guy live in? Almost as surreal as the the crowing over the last GDP report (surprising on the upside) when the austerity was really just beginning! Hold on to your hats in the next couple of quarters.

I happened to catch a Bloomberg television segment repeatedly run on the day of the UK budget cuts announcement a few months ago. This segment alleged that there were many private firms just waiting to hire redundant public workers. The one and only example given was a high-end faux castle B&B, perhaps catering to the rich, Russian oligarchs, and petro sheiks. During the interview with the manager of the B&B, he reported that the firm were looking to hire about 10 people to add to their “family” of about 30 employees and were looking forward to extra labour from public cuts. While he was talking, the film clips showed dish cleaners, waiters, chamber maids, and others at work at the B&B doing such jobs. Not that there is anything bad about these honest jobs and the people that are working them. But is this where trained government administrators and professional public employees made newly redundant must go to find jobs to survive? I can only surmise these jobs would pay fractions of what they had been earning and would grossly underutilise their skill sets. This is all the private sector can offer? Is this what it has come to for the UK…in times of crisis we can all hope to find jobs as chamber maids for the rich?

The UK has a long, rich history of suppressing and decimating the labor force.

After the Black Death moved through Europe, and the price of labor went up due to supply (down) and

demand (up), the landowners passed and viciously enforced the “Statute of Laborers” in 1351, specifically

to keep the cost of labor down, and preserve their own luxurious lifestyles.

The more things change, the more they remain the same.

Vinz

William Allen: Is this what it has come to for the UK…in times of crisis we can all hope to find jobs as chamber maids for the rich?

That’s the idea, isn’t it. “Expansion of the service sector” is a euphemism for growth of the servile class. With global labor arbitrage, what did anyone expect to happen as wages get pushed down and jobs exported? Without a mobilization to address these issues, the outcome is evident.

Chris Cook gets it:

Tax and Spend and other Myths

Norme:

All that deficit spending in the US mainly went to weapons contractors and tax cuts for the rich. Of course they were going to just stockpile that money! More government spending, directed at low income earners, would be respent almost entirely and have a massive stimulative effect.

Just have a look at empirical findings of multiplier effects for unemployment benefits vs. tax cuts. The difference is huge.

Bill, two questions:

1. As I understand it, UK gvt. debt is overwhelmingly (or only) in Sterling , not in foreign currency. True? Do you have numbers, also related to GDP?

2. Assuming 1. is the case, there is nothing in the way for anUK gvt. if it wishes, to spend the amount needed to employ the population and solve the problems in the public sector. Could you in this spirit suggest an alternative economic program for a (hypothetical) humane UK gvt.?

3. What would you do with the gvt. bonds held by banks and the public?

Dirk Bezemer responds to Chris Cook (see my link above at 12/17 @ 6:00) agreeing and citing Randy Wray and Warren Mosler.

Food for Thought.

How many of real transactions in goods, services and resources are engaged in a market exchange forum? Transactions are processes of operation and behavior expressed with mechanisms of generation and allocation conditioned by a development and distribution structure respectively. The development structure is arranged with lines and the distribution structure is arranged with channels through which transaction engagement takes place. Each transaction engagement consists of a series of steps of a) production, b) access, c) search and d) negotiation that are subject to friction, imperfection and complexity. The result is a map of distinct (bi/multi)lateral transactions that are uncoordinated, discrete, differentiated in contractual terms and seperable in time/space of agreement, payment and delivery. Are comparative advantage and economies of scale and scope significant in determining the outcome in each of the engagement steps? If many financial assets/titles are traded with market arrangements can we say the same thing about real transactions? Is the market model relevant for all economic transactions?

Found this which partly answers my questions to Bill a couple of messages back about the UK national debt:

http://www.economicshelp.org/blog/uk-economy/uk-national-debt/

Would still like to hear Bill’s sketch of an alternative economics program for a (hypothetical) progressive UK gvt.

I think the UK should be the focus now for people who want to advance the MMT position.

The UK gvt. is rabidly cutting down and – different from Eurozone countries – they are not at all fincially constrained.

@Panayotis

This is an interesting question. I don’t have the actual numbers at hand but the overwhelming number of real transactions in goods, services and resources takes place in the context of what economists would call a planned economy. This planned economy is also known as corporation. Millions of planners populate these corporations: investment planning, production planning, marketing planning, …

Stephan,

Is the market model relevant for all economic transactions? If not, as I think, we need alternative mechanisms of analysis whether internal in corporations as you imply, process analysis of generation/allocation as in my theoretical work and/or other alternative methods. Certainly, neoclassical microfoundations based on the market hypothesis distorts reality and fails to to understand the real dynamics that work in modern capitalist economies. Unless we recognize this fact, we will continue to build models that are divorced from reality and lead in erroneous conclusions with disastrous policy prescriptions.

Funny, I was thinking the same thing about salary cuts among incumbents.

if the government keeps all the employees at the time when its income (taxes) are reduced, where is the money for the salaries supposed to come from?