I started my undergraduate studies in economics in the late 1970s after starting out as…

CofFEE Conference 2010 – Day 1 Report with update

Today is the first day of the 12th Path to Full Employment Conference/17th National Unemployment Conference in Newcastle, hosted by my research centre. As host I am tied up in the event but here are some snippets. All of the presentations in the parallel sessions have been very interesting. I also note some economic news out from the Australian Bureau of Statistics today for October 2010 which provide more news that the Australian economy is growing only modestly. More tomorrow. UPDATE: Audio file now available.

My talk today

Here is the presentation that I gave today.

Here is the complete audio of my presentation in mp3 format. You can download it via this LINK. Right-click the link and choose “Save link as” – the file is about 45 mgbs.

You can also listen to it via my audio player directly if you prefer:

[audio:http://e1.newcastle.edu.au/coffee/podcasts/2010/Bill_Mitchell_CofFEE_Conference_Dec_2_2010.mp3|titles=Professor Bill Mitchell Dec 2, 2010]All comments appreciated.

How does the European Monetary Union avoid the fate of the great Ozymandias?

One of the Keynote speakers on Day 1 of the CofFEE Conference was Marshall Auerback who posed the question in the heading. What was he referring to?

Well first a blush of the sonnet written in 1818 by Percy Byshhe Shelley – Ozymandias:

I met a traveler from an antique land

Who said: Two vast and trunkless legs of stone

Stand in the desert. Near them, on the sand,

Half sunk, a shattered visage lies, whose frown,

And wrinkled lip, and sneer of cold command,

Tell that its sculptor well those passions read

Which yet survive, stamped on these lifeless things,

The hand that mocked them, and the heart that fed;

And on the pedestal these words appear:

“My name is Ozymandias, king of kings:

Look upon my works, ye Mighty, and despair!”

Nothing beside remains. Round the decay

Of that colossal wreck, boundless and bare

The lone and level sands stretch far away.

The message is of “the inevitable complete decline of all leaders, and of the empires they build, however mighty in their own time”.

Marshall noted that there is a growing call for “a fully fledged supranational fiscal union to complement the supranational central bank, the ECB” but the paper investigated whether this was the best option for the EMU. Perhaps it is ” time to consider the notion that giving up the euro is a wiser alternative in the long run”.

The successes of the EU in reducing “the probability of violent nationalist conflict among some of its members … took place before the adoption of the euro”. The “great European project” had “one key unstated” goal – “how to deal with the so-called German problem”. This problem is of a nation that “has historically been too powerful for its neighbors” (with some exceptions).

Marshall then provided historical insights about the period from 1865 to 1871 which really saw the rise of Germany as “the most powerful state on the Continent”. Subsequently, modern European history is defined by how this power manifested and how other states reacted to it including the rise of international organisations such as NATO.

He also talked about the rise of the “philosophic and market biases” which define the modern German state. This could be defined in terms of the “social market economy” which largely relied as a free market (“free play of supply and demand”) but allowed the “state … to intervene to ensure that free competition was not unduly hindered by cartels and monopolies, and that an extensive welfare state should provide assistance to the less fortunate”.

This “vision” defined the triumphal West Germany after the destruction brought on by World War II. Reunification in 1990 and the collapse of the Soviet empire provided further scope for Germany to become “an economic colossus that would overshadow France.”

Then we reach the Treaty of Maastricht in 1991 and with it:

… Germany’s sovereign powers were further reduced, in spite of the country’s tremendous post-war economic successes. Equally significant, the Treaty was passed in the absence of nationwide referendum, a conspicuous early illustration of technocratic vision trumping popular legitimacy. This was and remains one of the key flaws inherent in the so-called European project.

What did monetary union mean for Germany? Clearly the Germans lost their beloved Deutschmark and the “all-powerful Bundesbank” became subjugated to the European Central Bank (ECB). This reduced the position of the German state. In addition, there was a “common foreign and defense policy and the frontiers between the member states of the European Union were open”. Provinces within Germany could even “make direct representation to Brussels, as opposed to Berlin”.

But the erosion of the mighty German state did not end there. Marshall noted that:

In spite of the many benefits offered by a single market underpinned by a single currency, a strong case could be made that the euro’s long-term viability was more readily achievable in a smaller zone consisting of a more limited group of nations with a more cohesive set of economic and political philosophies. The “small is beautiful” school (of which the Bundesbank was surely a core member) argued that pooled national sovereignty, greater monetary and fiscal co-ordination, were surely more feasible where the countries involved had comparable political and economic structures and similar social outlooks. A large expansion of the euro zone amongst a larger group of heterogeneous nations with substantially different ideological and historical traditions substantially complicated the drive to converge, as can be seen in the current crisis.

This was a central aspect of the debate leading up to the monetary union. Was it an optimal currency area? Answer: definitely not. So why did the northern european states (including Germany) agree to allow the southern nations into the union when it was obvious that this decision introduced a large disparity in terms of economic and political philosophies.

The alternative view the “big and broad” Europe wanted the euro to compete with the US dollar as a “reserve currency alternative”. But they could not deny the “substantial regional disparities amongst the 12 founding member countries (both in terms of unemployment rates and per capita income levels)”.

These disparities were always going to generate problems once the union received its first major demand or supply shock. The GFC delivered a negative demand shock that was highly asymmetric in its impact.

Marshall wondered why Germany, which clearly enjoyed considerable wealth as a result of its industrial, agreed to join such a restricted monetary union. The Bundesbank was not enthusiastic with the “big and broad” European vision.

He postulates that you have to view these developments through the “prism of the Three Germanys”:

Germany 1 is the Germany of the Bundesbank: the segment of the country which to this day retains huge phobias about the recurrence of Weimar-style inflation, and an almost theological belief in sound money and a corresponding hatred of inflation. It is the Germany of “sound finances” and “monetary discipline”. In many respects, these Germans are Austrian School style economists to the core … many would probably love to be back on an international gold standard system.

Germany 2 is the internationalist wing of the country, led by Helmut Kohl. They are probably the foremost exponents of the idea that Europe can rid itself of the “German problem” once and for all if Germany firmly binds itself to a “United States of Europe” and continues to construct institutions that broadly move the EU in this direction …

… Germany 3, Industrial Germany, the Germany of Siemens, Daimler, Volkswagen, the great steel and chemical companies, the capital goods manufacturers. Clearly, these companies benefited substantially from the economic stewardship provided by institutions such as the Bundsebank, along with the broad adherence to Erhard’s social market economy. But they also recognized the benefits entailed by a completely open and integrated European market (still the largest component of their sales). Currency union, even if it meant admission of fiscal profligates such as Italy and Spain, also minimized the threat of competitive currency devaluation, given the implementation of a European wide euro (as opposed to the narrow currency zone which represented the limits of the Bundesbank’s internationalism). Industrial Germany rightly perceived that a broadly based euro zone which incorporated chronic currency devaluers such as Italy, permanently entrenched their competitive advantage. And with the support of this key component of German society, Chancellor Kohl, was able to embark on the huge institutional transformation embodied in the Maastricht Treaty.

These three influences were playing out in German politics prior to the agreement to go into the union and help us understand the current attitudes that come out of Germany.

Marshall conjects that the creators of the union knew full well that the prospective entrants were very disparate in economic and political cultures and clearly did not define an optimal currency union. However, they hoped that over time there would be a convergence in economic, political and popular dimensions.

The leaders hoped that the trade and investment flows would dominate the cultural differences and create a convergence of productivity and consumption. Political convergence was another matter but given the neo-liberal nature of the era there was a fundamental belief that economic matters would dominate and the politics would follow.

They also hoped that there would be a convergence between the pro-euro views of the political elite and anti-euro views of popular opinion.

How has that hope reflected reality? Not very well. First, the dictatorial nature of the EU bosses – pushing rules, regulations etc down to the member states – have largely been seen as “annoying” by national electorates. The distance between the bureaucracy and the citizenry has mostly been too large for the former to be taken too seriously. That is, until the crisis hit.

Marshall said:

The implementation of a policy which has profound economic consequences, notably the economic austerity packages demanded of Greece, Spain, Ireland, Portugal, etc., changes everything.

Now, the Maastricht and Lisbon rules are now being interpreted by “unelected bureaucrats, operating out of institutions which are devoid of any kind of democratic legitimacy”. The problem then is that national governments face huge political backlashes in applying the bureaucratic dictates. It is clear that there are grass roots political movements emerging out of the angst of the collapse of the euro economy. Much of this political activism is right-wing and extreme right wingers are now gaining popularity and traction in the public debate.

While they “largely represent disaffected (albeit significant) minority votes” at present, the anti-Brussels sentiments are spreading into mainstream politics.

Marshall argues that:

… an externally imposed fine by a bunch of Brussels bureaucrats could engender significant mainstream political backlash. Voters for the Front Nationale in France, or Vlams Blok in Belgium, are symptomatic of a growing body of opinion which sees the European Union and its attendant institutions characterized by a huge democratic deficit. This in turn has led to an increasing sense of political alienation and a corresponding move toward extremist parties hostile to any kind of political and monetary union in other parts of Europe. Under politically charged circumstances, these extremist parties might become the mainstream.

The Greek crisis has now exposed the flaws in the euro “marriage”. While Greece and Portugal intitially benefitted in an economic sense from the lower interest rates (single monetary policy) the market reality is clearly that one EMU nation’s debt is not equal to another nation’s debt.

The German powerhouse is being reasserted as the marriage partners grow apart with commensurate political tensions emerging. The southern European EMU states “are struggling to compete with the much more productive German economy” and they cannot “devalue their way out of trouble”.

As we have noted, austerity (domestic deflation of wages and prices) becomes the only alternative path to reducing unit costs to improve trade competitiveness – the so-called “internal devaluation”. So the weaker EMU nations are learning the hard way – that when there is an asymmetric demand shock in the union, the citizens have to reduce their standards of living in very profound ways which was never really considered in the political argy bargy that led to the introduction of the euro across a “big and broad” Europe.

In turn, these economic divergences are eroding the political goodwill.

The German position seems to be that the weaker European economies are paying the price for not being as hard-working and skilled as Germans – and must now shape up or ultimately leave the euro … Some Greek politicians have responded to German pressure with angry references to the Nazis’ brutal occupation of their country during the Second World War. So much for European solidarity.

There has also been no convergence between “elite and public opinion”. So the hopes of the creators of the union have been thwart on all fronts.

The problem is that the opportunities that might attentuate the crisis are being ignored. There has been very little debate about “German under-consumption” and its “export-addiction”, which in part has worsened and prolonged the EMU crisis.

Marshall noted that:

… having lost monetary sovereignty by adopting the euro, Germany has more to gain if it stabilizes its domestic economy by running large deficits during a downturn than if it tries to reap the long-term structural benefits of deficit reduction, as called for in the Stability Pact.

The EMU would be much stronger if all countries realised that spending equals income.

The political leaders have also adopted the “public debt is invariably an evil” mantra – a myth that the mainstream economics profession has propagated. The relative costs of fiscal austerity (huge) and deficits (with voluntary debt issuance) have never been fully understood and so the political debate has been skewed towards imposing huge costs on the national economies.

This bias has also reduced scrutiny on private sector balance sheets.

Marshall says:

But as events of the past decade have clearly demonstrated, excessive private sector debt build-up, notably in Asia and the United States, has played a far more destabilizing role in the global economy than fiscal profligacy, which undercuts one of the main rationales for retaining the Stability Pact in its current form. If we say that the government can run budget surpluses for 15 years, what we are ignoring is that this means the private sector will have to run deficits for 15 years-going into debt that totals trillions of dollars in order to allow the government to retire its debt. Again it is hard to see why households would be better off if they owed more debt, just so that the government would owe them less.

This is one of the myopias of neo-liberal economics. It fails to understand the national income relationships between the broad sectors (government, external, and private domestic) and the dynamics that link these sectors. You cannot run government surpluses without running non-government deficits. If there are external deficits, then the non-government deficit will show up as increasing indebtedness of the private domestic sector. That is an unstable growth strategy but lies at the heart of the fiscal rules that the Euro bosses are enforcing on its member states.

Further, “the export sales of German and Dutch companies will fade with the falling import demand of the periphery”. Please read my blog – Fiscal austerity – the newest fallacy of composition – for more discussion on this point.

Marshall also noted that as the real crisis spreads, the “markets” are starting to zero in on the banking sector and it is clear that individual member states do not have the “fiscal” capacity to defend their banks. Only the ECB stands between bank failure and bank solvency.

Which brings us to the last point:

The immediate problem is that we have a monetary union (common currency) without a fiscal union. It works fine when everyone is expanding, but when recessionary pressures set in, the contradiction makes it impossible to shape harmonious EU wide counter-cyclical fiscal and monetary polices.

And that effectively is the nub of the problem. If the monetary union had have a unified (supra-national) fiscal capacity that could have dealt with asymmetric demand shocks then all the problems that would have remained would have been political. While the political issues are profound, the deliberate decision (driven by neo-liberal ideology) to not create such a fiscal capacity has meant that the Euro problem is also an economic one and the national governments can be insolvent.

In turn, the economic tensions have exacerbated the political and cultural tensions.

Marshall says that “the current financial crisis paints a picture of a continent increasingly marked by divergence with old historical enmities re-emerging”:

… suggests that the creation of a supra-national fiscal entity, however institutionally elegant it might appear, is probably unworkable (especially given that it would likely represent nothing more than a “United States of Germany” with a European accent). The middle class and upper middle class citizens of the richer countries, especially Germany but also the Netherlands, Luxembourg, and perhaps France would oppose the establishment of such an authority, and doubt whether such a consolidation could have fully fledged representation that does not incorporate German domination.

So the “German problem” creates another “German problem” which prevents the monetary union from being functional. The creation of such a fiscal authority “runs the risk of inflaming nationalist passions and making countries like Germany more vulnerable to demagogic “beggar-thy-neighbor politics”.

The long-run future of the EMU is thus doubtful.

Meanwhile … back at the shops

The Australian Bureau of Statistics released the Retail Trade data for October 2010. The data provides additional evidence to support my case that the Australian economy is slowing as a result of the withdrawal of the fiscal stimulus and the contraction in monetary policy as a result of the rise in interest rates.

The ABS reports that:

The seasonally adjusted estimate for Australian turnover fell 1.1% in October 2010 following a rise of 0.1% in September 2010 and a rise of 0.2% in August 2010.

This is a large fall in retail sales.

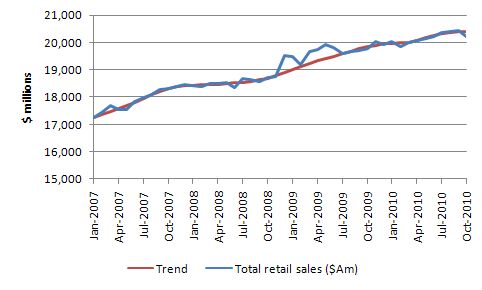

The following graph shows the total retail sales and trend from January 2007 to October 2010 ($A millions). The trend is now down. You can also see the stark fiscal stimulus effect which coincided with the first stimulus package (December 2008) and the second stimulus package (February 2009). These packages contained cash payments to households and clearly provided support to demand.

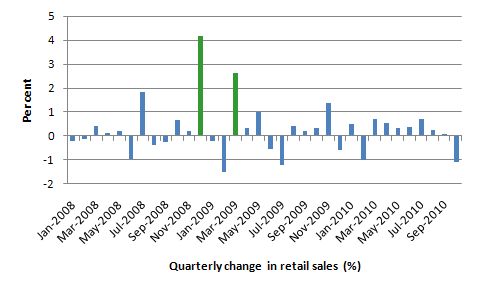

The following graph shows the quarterly growth in retail trade – and allows you to see the current fall in retail spending against the recent history (from January 2007). The green bars are the fiscal stimulus months.

Remember spending equals income. It is clear that households are now increasing their saving ratio and spending less. This is good in the context of the record and unsustainable levels of debt households are carrying. But it is bad in the context of a retreat by government spending (mindless pursuit of budget surpluses), a fairly flat investment performance and a sketchy exports sector. Please read my blog – The Australian economy loses to the snail – for more information of the slowdown in the broader spending aggregates

Meanwhile, in the ships …

The ABS also published the International Trade in Goods and Services data for October today which will feed into the fourth quarter National Accounts data which will not be known for a few months yet.

While net exports subtracted from growth in the September quarter, the results for October are modestly positive. Exports were up 1 per cent courtesy of continuing strength in the agricultural sector (appreciating exchange rate notwithstanding). Imports were down by 3 per cent although capital good imports rose modestly (signalling good news for investment).

So while the growth in exports is not spectacular the boost to net exports came from the import side which is consistent with the sharp fall in retail sales and the rising household saving ratio.

Conclusion

That is all I can provide today. The audio for my talk will be available later.

That is enough for today

Michael Pettis is not optimistic about Euroland either and sees it boiling down to politics, as interest groups conflict over distribution of inevitable pain.

The rough politics of European adjustment

The Germans do run a tight ship, don’t they.

Whenever you think about Europe you can’t ignore the big bear in the east. If the US was out of the picture, any infighting in Western Europe would attract a hungry bear to the doorstep. It would take a special brand of conceit and stupidity to let that happen.

Andrew Wilkins says:

Thursday, December 2, 2010 at 18:04

“Whenever you think about Europe you can’t ignore the big bear in the east. If the US was out of the picture, any infighting in Western Europe would attract a hungry bear to the doorstep.”

A different era. One good thing about Russia’s rise in the free market is that greed and corruption are governing factors which keep the leadership from allowing the old Soviet-style steamroller subjugating other states.

One must feel for the West Germans however. They were a post-war Japan without all the warts and have endured;

. monetary union at an outrageous exchange of parity between deutschemark and ostmark

. shouldering the bulk of ECB obligations during the GFC and now with the PIIGS. The East still accounts for much lower per capita output

At least they enjoy somewhat the benefit of the EUR being significantly weaker than the DEM would have been. If there ever would have been an alternative to the USD the DEM would have come closest and I shudder to think how strong it would be now without EMU.

Bill, fist thanks for the great post and speech! Call, me ungrateful, but I’ve come to expect no less :-).

You asked for comments: there is one thing that came to mind while listening to your speech at the conference. And it’s something that’s been bugging me since I came across MMT in general and your blog in particular. Namely the story about bond interest payments being a freebie to ominous investors. Not that I take issue with the financial argument that interest payments support a certain part of the population that isn’t per se productive. Nor with the fact that the whole pricing machinery may be at odds with macroeconomic interests at times. But, politically, this is land mine territory and to me, the tone doesn’t quite fit in with what I believe you want to convey. I’m referring to the fact that the beneficiaries of said interest payments divide into at least two groups. First, there are pensioners and private savers, who represent a growing part of the electorate and surely cannot by definition be seen as parasitic to society, and then there are those within the financial sector who represent them and syphon off commissions for doing so and also corporations that use the same parking spaces for their profits (am I missing any others?). While I can follow the macroeconomic argument that it is the total amount of real goods and services available that determines the wealth of society and that it is thus imperative to direct spending towards productive ends, for the individual there always remains a (microeconomic) fear that by reducing interest income, the ability of the individual to take home a ‘fair share’ of the output will be diminished.

Now my questions: how, assuming no quick or fundamental change to pension and other savings systems, or even then, would you guarantee the accrual of an equal share of the real cake to those pensioners and small savers without burdening them with the risk of of having to invest in commercial papers? I assume this could only be achieved by offering some sort of interest at or slightly above inflation? Is there a system in your mind by which one could separate the pensioners / small savers from the other groups? Or are they logically inseparable? Could one separate ‘real’ people from other legal entities such as private corporations? Or would interest payments on reserves do the trick? And would you favour this as a permanent solution?

And would it not make sense to mention this when arguing bonds, or indeed no bonds? It just seems like you’re diving into a political cesspool if you lash out against ‘grandma and grandpa’ without offering an immediate, comforting alternative. I’m looking specifically for immediate, i.e. politically viable, answers that don’t revert to macro or otherwise aggregated / abstract arguments. Or is the shadow of the elephant in the room obscuring my vision?

Regards, Oliver

Oliver,

The solution is to break the mirage. Rather than the ‘financial instutions’ offering annuities, the currency issuer takes your ‘pension pot’ and boosts your state pension to a level based on your savings. In other words they burn the currency you have amassed and promise you it back in chunks over the next X years until you die – probably index linked.

That gets rid of the primary ‘need’ for government bonds – and the need for most financial institutions as well.

Or you could go the next step and simply promise everybody a final salary linked pension and forget about savings completely.

Thanks, Neil. That doesn’t quite meet my condition of ‘no substantial changes to the system’, but yes, I can see how that would work. I still maintain there needs to be some catchy way of describing this or any other solution before engaging in what will otherwise be perceived as ‘granny bashing’.

A few thought on the “non-Euro” E.U periphery…

European integration is very important to many post-communist nations in Central and Eastern Europe. There is a deep fear of potential Russian domination that will take many generations to eradicate. Most of these countries (i.e all of those which use the Latin alphabet) see themselves as “Western” in the cultural sense. The years spent apart from their cultural “cousins” during the Warsaw Pact era are by-and-large viewed as wasted years. Now that that have been re-admitted to the club, they will do everything possible to maintain their club membership.

That is why I think all these countries will adopt the euro in time – for they view it as cementing their place in the kind of Europe they have felt is their right.

Yes, Robert. What you describe is the logical consequence of making the Euro the symbolic centrepiece of European integration. On the less visible side, I wonder to what extent the non-Euro members are actually being bribed to join, in that they are put on a double diet of large fiscal transfers from the EU on the one side in exchange for implementing austerity and ‘fiscal prudence’ reforms on the other, thus rendering them less autonomous than before. Before the GFC, the transfers were large enough to substantially push growth. Now, in the aftermath, the forced dependency is rearing its ugly head. The EU needs to attract attention to a new symbol of integration quickly, if it wants to reopen the political door for countries to exit or not join the Euro. It’s proving an expensive membership card.

Oliver, the catchy word is “subsidy.” Since bond issuance is unnecessary operationally, the interest constitutes a subsidy instead of an expense. The problem is that “everyone knows that bond issuance is necessary” even though it is no longer the case. If people knew the truth about current operations, then this subsidy would properly become a political question.

Of course, interest groups would vie with each other over it, and since the financial sector is the most powerful interest group, then there would likely be no change. But at least the truth would be told and all the handwringing over the debt would done with. It would just be acknowledged as the special interest subsidy it is.

“If the monetary union had have a unified (supra-national) fiscal capacity that could have dealt with asymmetric demand shocks then all the problems that would have remained would have been political. While the political issues are profound, the deliberate decision (driven by neo-liberal ideology) to not create such a fiscal capacity has meant that the Euro problem is also an economic one and the national governments can be insolvent.”

The various stability arrangements etc. that have been constructed ad hoc out of the crisis are in effect a form of supra-national fiscal triage. They constitute a pooling of EZ specific risk among the group/system. Although these measures are band-aids, there is nothing in theory that stands in the way of using them as supra-national fiscal capacity, indefinitely, at will. This would probably require increasing the amounts allocated for nation specific support, lifting deficit restrictions across the board, and using ECB reserve issuance as backup “financing”. With that, the fiscal capacity that might have been an upfront structural design feature is instead bolted on through crisis management, albeit piecemeal and awkwardly. The ultimate effect would seem to be a matter of pure political willpower – with the group effectively imbuing national governments with fiat solvency by backing them up with specific risk absorption insurance. Given this mechanical possibility, “insolvency” for individual EZ nations then becomes a political decision that is defined implicitly by the event of group inaction.

I believe standard MMT thinking is that comparison of such a situation with that of the US is inappropriate. However, a corresponding set of political and mechanical considerations could in theory affect the US in the context of its own monetary and fiscal architecture. Arguably, it would be much easier for Congress politically (in theory) and mechanically to react to a combination of deflationary pressures and bond market woes by authorizing further deficit spending increases and imposing more active use of the Federal Reserve balance sheet as a conduit for deficit “finance” through bank reserve issuance. Conversely, the difference between the US as a single nation and the EZ as a group of nations in the possible event of similar bond market challenges has to do with ease versus complexity of fiscal/monetary coordination – but the EZ could still manufacture a comparable coordination effect, if it really wants to.

“The various stability arrangements etc. that have been constructed ad hoc out of the crisis are in effect a form of supra-national fiscal triage.”

I was also going to say that JKH.

Its a confused supranational fiscal authority driven by struggle rather than a Federal Government made by the people, for the people etc. Its making equalization payments, though on a lesser scale compared to what happens in a nation.

Oliver,

I think you really nailed it on the head about there being two distinct groups with a common interest. It is not just about protecting their interest yields in bonds and central bank reserve accounts. These are the groups squealing loudest about inflationary threats.

1) The ultra wealthy and corporate interests.

2) Granny savers, middle class pension savers and first time buyers with house deposit. (Ray, are you here or in #1?)

Group #1 is definitely using group #2 to run interference for them. The mere hint of inflation rates rising higher than interest rates, will elicit tales of Grannies freezing to death and ascerbic comment about the prudent and profligate. These are two extremely vocal and powerful interest groups. Clearly they are winning the public debate at present.

Divide and conquer would be a good policy choice here. I’d hazard a guess these interest groups would be outnumbered (and eventually outgunned) by the majority of the working population (Gen X and Y) who would probably benefit in a low yield environment with some mild wage inflation. Political apathy and lack of support from the media is holding back the counter argument. I think I do see grass roots of a serious dialogue starting.

I also agree with Neils assessment. Privatisation of pensions is the neo-liberal master stroke that causes the common man to act as an unwitting accomplice to the wealthy elites. We may see the wealth gap widening for the remainder of my life if the trend continues unabated. Private superanuation schemes are another knot in the noose for Australians. Far better to hold the monies in a Government “account” and pay interest and anuity on terms agreed at the ballot box.

A private pensioner is largely drinking from the same tap as the civil servant on an index linked pension, but on worse terms. A financial service company is also acting as intermediary, creaming off a slice for doing next to nothing. There is an argument that private pensioners fund business investment, but it is a foolhardy pension scheme manager that speculates with any degree of business risk. There may be quite a bit of money in corporate bonds, stable dividend paying corporations and utility companies. Hardly setting the business investment world on fire, more likely profiting from state endorsed ologopolies.

God forbid if social security is privatised. We will be on the streets (in more ways than one) if it comes to pass.

Ramanan,

Those papers written by Steiger are the first decent thing I’ve seen written on the detailed monetary operations of the EZ. He even agrees on just how bad and misleading the publications of the ECB itself are on the topic.

JKH,

Yes he has gone into details on the operations – MRO/LTRO tenders etc.

Btw, your usage of the phrase “triage” is apt!

My opinion on the whole thing is that the only way forward is a creation of a supranational fiscal authority. The reason I hold this opinion is that the EMU was partly created by frustrations of the nations on their currencies. Nobody has the will to leave the system and I strongly believe that the currency markets will hold a nation a hostage if it does that. Germany is probably an exception.

On the other hand, I disagree with distribution *per capita*, because it will lead to greater polarization instead of convergence.