It is true that all big cities have areas of poverty that is visible from…

Where’s bill gone this Monday?

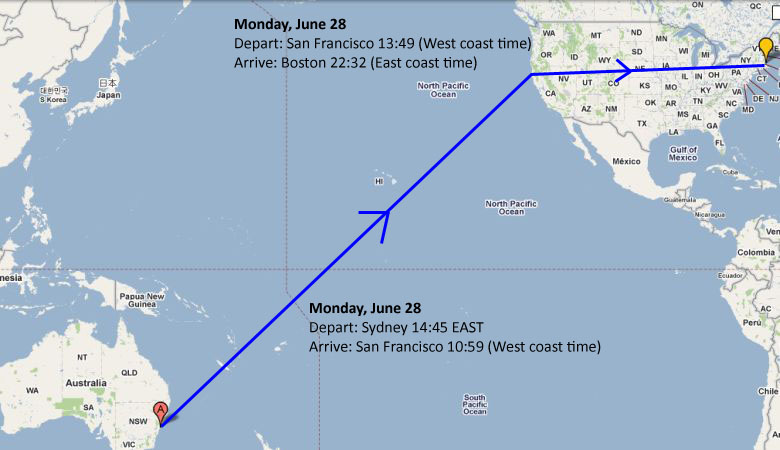

I am travelling today and the blog will be back sometime tomorrow. Why and where?

I will be presenting a workshop on fiscal sustainability in Boston on Wednesday. An investment banker has invited me to talk about this topic and has arranged about 40 of his financial market contacts to attend. My friend Warren Mosler will also be there. So it will be interesting to see how this group respond to the Modern Monetary Theory message.

Given I moderate some of the comments there might be delays in seeing your comment published because I will be flying for some 18 hours or so. I will be able to get access in San Francisco while I am waiting for the Boston flight. You can minimise the possibility of your comment being delayed by not putting any external links into the body of the text. I monitor all comments with links embedded (in case they are taking my readers to communist or socialist sites (-:

I will post the next real blog sometime later in the afternoon on Tuesday (Australian East Coast Time).

Bill,

The word is getting out there! Congratulations.

FYI I’ve presented on MMT to an actuarial conference here in Sydney last month and have been asked to repeat this presentation to a wider actuarial audience next month in Sydney and Melbourne. A couple of weeks ago I presented to a CFA group in Singapore with, I think, a positive response.

Frank Ashe

Bill,

I have enjoyed immensely the downcast looks on those who try to throw Weimar Germany or Zimababwe at me to “refute” MMT, and I confidently reply with the knowledge you have imparted. But I’m still not on firm footing with respect to the “great stagflation” of the 1970’s. The Flat Earth Economists (FEE’s) always bring it up.

As best as I can recollect (yes, I live through it), we had:

1. Exogenous price shocks (oil embargos in ’73 and ’79). Obviously, this cannot be laid at the doorstep of MMT.

2. Structural reactions and reallocations in the real economy due to those price shocks-see above.

3. We were in an already overheated economy from the 60’s.-MMT says to reduce fiscal/monetary stimulus?

4. Increased monetary stimulus (growth)–?

5. High interest rates, not low ones. Taken together with 4, this is indeed confusing.

6. Closing the gold window, and ending Bretton Woods for good.

7. Wage and price controls (ultimately ineffective).

8. Dollar devaluation and the onslaught of low price imports from fully revived Germany and Japan, and loss of foreign markets despite dollar devaluation.

Many factors—I have no coherent framework for them. Perhaps you could lend a hand.

Many thanks.

Bob

Hm, most of the inflation in the US happened before Oct, 1973 (in August 1973 prices rose by 22%, based on the monthly CPI), and started taking of in 1968. And inflation in other countries which were hit by the shock remained at roughly 4-7% (Spain, Switzerland), so the theory lacks asymmetry. I think inflation had more to do with the exponential rise in transfer payments (if you graph Oz, US and Japanese transfer payments, they literally show an exponential rise).

I object to Bill travelling anywhere because travel involves risk, and no risks should be taken with Bill’s life. Even though I disagree with him sometimes, I think he is an Australian national treasure and world treasure. He should be put under armed guard and made to continue with his blog.

I’m agree with Ralph Musgrave,

I’ve been indoctrinated with junk economics most of my undergraduate and graduate life, Bill has brought hope in the subject of economics to be more useful for findings solution towards human needs.

I’ve read most of Paul Krugman’s books/writings about this and past crisis, Krugman did not seems to be consistent in many of his arguments.

I used to wonder why, but not anymore. . . .

Looking forward to it and see you soon, mate!

Ralph Musgrave,

Regarding the risk, are you referring to the flight or the room full of investment bankers or both?

I agree with Ralph Musgrave and Anas. A true national treasure.

I’m delighted to know the brain is headed our way, thought I’m a bit South in the gut of the quantifier (NY), maybe I should head to Boston!

An article in the NYTimes today mentioned that CNBC’s Dylan Ratigan was going to do something populist this week with the Deficit discussion. A comment from “Billyum” on this site last Thursday inspired the following parable I have posted to Mr. Ratigan’s site. I would be deeply grateful to anyone who could take the time to read the parable and suggest improvements or point out errors. With feed back I hope to extend the parable. I am also looking for efficient ways to distribute it in the hope of affecting the debate. All comments welcome:

“With regard to Fix It Week and the twin budget and current accounts deficits, please consider that most of the folks who pontificate on the issue have significant skin in the game and that an individual or entity that knows how to extract money from the economy does not necessarily know how the economy works, only how to bleed it.

The rhetoric of Deficit Hawks illustrates their failure to recognize the essential differences between gold backed currency and the fiat money we have used since the Nixon Administration. With gold, if you ran a current accounts deficit you exported bullion. With fiat money, you export IOUs. With gold if you want to run a deficit you must issue bonds. With fiat money we have continued to issue bonds, but only because we choose to: with fiat money the government can spend whatever it wants. Main stream economists say doing so would be inflationary, but that is only because they do not understand accounting and have never run a business. Deficit spending can be inflationary, but main stream economists have no answer to Japan’s 20 year deflationary hiatus with massive deficit budgets. There is a simple explanation that has to do with accounting.

Postulate that an economy is a circular flow of the exchanges of goods and services between business, individuals and the government denominated in the fiat currency issued by that government. Postulate further that at any given moment, money is finite and obeys the rules of accounting. For simplicity sake lets call the business sector “Pat” and the household sector “Gene” and we’ll refer to the government as “The Gorilla”.

The Gorilla issues that currency required to produce the volume and velocity of trade that Pat, Gene and the Gorilla agree is reasonable for their mutual needs. Pat and Gene make and consume things and the Gorilla protects them and issues them money to facilitate their exchanges. If the Gorilla holds the money supply constant in a given year and Pat decides to “save money” and at the end of the year has saved $10,000, because the money supply is constant, by the basic rules of accounting, Gene will have a $10,000 short fall. This arrangement works out in a normal economic environment through the agency of banks who facilitate this sort of transfer of money through the debt markets wherein eventually Pat and Gene come back into balance over time.

Suppose however that Pat and Gene both have considerable debts that require a certain percentage of their annual income to service and both decide to save at the same time, to pay down debt. If they do that, because of the reality of accounting that no dollar can be in two places at the same time, the economy friezes: the Gorilla has spent what it is going to spend, but Pat and Gene have both quit spending to try to raise their savings at the same time, so the circular flow stops.

To prevent this freeze, all the Gorilla must do is issue more money through the purchase of goods or services from Gene or Pat. This is deficit spending which is a euphemism for private savings. When a Deficit Hawk tells you they want to end deficit spending, what they are saying is that they want to end private savings. Looked at this way, it is an astonishingly stupid proposition.

When the economy is booming and Pat and Gene suffer irrational exuberance, it is appropriate for the Gorilla to run a surplus because it will deplete Pat and Gene’s savings, perhaps sobering them up a bit before they reach the credit freeze above. But once you are at the freeze point, to pursue a surplus is to choose to liquidate the productive assets of your economy because you will starve them of demand.

Now suppose that Pat as a banker has made a lot of money by lending Gene lots of money in really opaque ways that are very profitable for Pat. So profitable in fact that Pat spends a decent chunk of it on various PR ploys to convince Gene that Gene is being virtuous by going further and further into debt and at the same time tossing a pretty steady stream of bananas to the Gorilla. After 40 years of this Pat is very very rich, Gene is very very in debt and the value of almost all of Pats wealth is dependent on Gene staying current on his payments.

Over this period the Gorilla has deficit spent except for a brief interlude where it took a momentary concern with Gene’s debt position. A couple dozen bananas latter and it was back to deficit spending. One day Gene arrives at the point where his debt service is more than he can afford. At this point 90% of the money from historical deficits is concentrated in Pats private accounts and Gene asks the Gorilla for some more deficit spending so he can make payments to service his debt to Gene and go on living. At this moment, Pat meets Pete Peterson who tells him the Gorilla’s deficits are Gene’s moral failure and that Pat should dissuade the Gorilla from deficit spending. Pete and Pat think that if this happens, Gene will magically disappear and leave them to enjoy the benefits or their 90% wealth accumulation, but like China, they do not understand what fiat money is.

Pat and Pete think it would be a good idea if the Gorilla quit requiring taxes because they think the Gorilla collects taxes to pay for services for Gene. If the money was gold, they would have a point. It is not. The only reason the Gorilla requires taxes is to create a demand for the money it issues to prevent Pat and Gene from participating in the economy of some other unit of exchange. If the Gorilla stops requiring taxes, Pat and Pete’s money has no value.

So now Gene is starving and Pat and the Gorilla have piles of unused goods and services and Gene is asking the Gorilla to purchase some of Gene’s goods and services so that Gene can pay his debts and continue to subsist. Pat and Pete insist that if the Gorilla buys anything from Gene that Gene pays his debts and buys his food this will somehow result in hyper inflation. What do these guys use for brains?

A version of this is what happened to Japan twenty years ago. So long as almost all of the extra money the Gorilla creates ends up in Pat and Pete’s private accounts that expenditure will not be inflationary because as owners of means of production built up when Gene was still solvent their capacity is vastly beyond Gene’s demand. The situation is deflationary if the Gorilla fails to help Gene.

Now the trade deficit adds to Pat, Gene and the Gorilla, Lo (China). Our accounting equation now looks like this: Pat’s balance + Gene’s balance + the Gorilla’s balance + Lo’s balance = 0. Lo has been draining money out of the Gorilla’s local economy for 30 years. Pete and Pat are quite worried about this because they mistake IOUs for gold. In fact Lo has been taking the productivity of his economy and exporting it to the Gorilla’s economy so that after 30 years Pat and Gene have all kinds of stuff that Lo’s folks made and all they got in return is IOUs. But more importantly in the short term, the balance of trade between the Gorilla and Lo favors Lo so that an external negative balance is making it even harder for Gene and Pat to save. Again, if the Gorilla NOW begins to soak up SAVINGS, that is to RUN A SURPLUS, it will destroy Gene’s ability to pay his debts and survive which will destroy most of the asset value on Pat’s books.

Pete is an ass and Pat a rube who in their smugness stand to ruin first Gene, but then themselves.

Bill,

Unfortunately I’ve some very bad news from the Federal Reserve Bank of Richmond for you while you try to convince some investment bankers otherwise: You are a LOSER! According to this paper from Kartik Athreya, Research Department, Federal Reserve Bank of Richmond:

“Economics is Hard. Don’t Let Bloggers Tell You Otherwise”

https://docs.google.com/fileview?id=0B6yuUpUNGf0pZGQ0YmQ5MjctM2ZiNS00NGIxLTg3OWItYWIxOTcxNDYyMzY5&hl=en

PS: Given the fact that I’m not a native English speaker but even I would formulate the conclusion of Kartik Athreya in a different way I’m wondering whether the Federal Reserve Bank of Richmond would better hire me to publish this sort of findings 😉

“Economics is Hard. Don’t Let Bloggers Tell You Otherwise”

Thanks Stephen for the link . . .

https://docs.google.com/fileview?id=0B6yuUpUNGf0pZGQ0YmQ5MjctM2ZiNS00NGIxLTg3OWItYWIxOTcxNDYyMzY5&hl=en

Just finished reading it, the paper doesn’t tell anything except junk. . . the logic of the paper on economic issue if applied to ‘political science’ would be; every citizen should not discuss politics although they’re allowed to vote.

The writer clearly felt threaten not because of economist as a profession will no longer be relevant, but rather the neo-classical idea base on Dynamic Stochastic General Equilibrium model that the writer subscribes (i’m assuming) to and been telling others to believe in is collapsing. . .

and maybe he realizes that when the general public know that very complicated metamathematical models are used to disguised very simple blatant lie that “market is perfect” or at least “market is much way better than democratic elected government policies” to solve human needs, then economist of his type will no longer have secure govt job at the Fed . . .

BTW, I strongly believe that his model also may include; ‘Central Bank should be kept independent’ . . .

He may be viewed as a smart but useful idiot for those who wants to maintain the status quo

Oh one more thing, forget to highlight,

Kartik Athreya, in this paper https://docs.google.com/fileview?id=0B6yuUpUNGf0pZGQ0YmQ5MjctM2ZiNS00NGIxLTg3OWItYWIxOTcxNDYyMzY5&hl=en , he is not just attacking any bloggers, he also included Paul Krugman and Brad de Long (which I considered as centre left advocating pro people’s policy but lacking coherent economic tools since both still formulate their ideas based on mainstream economics perspectives, they’re deficit doves as what Bill calls them) in his assault.

He said that these two economists have nothing else to do and that’s why serious economists such as Mankiw do not blogging . . . . having used and bought Mankiw’s macroeconomic textbook during my undergraduate years, I could tell that Mankiw has nothing to say about this crisis except just left the adjustment to the ‘market’ and govt should not intervened. . .

Stephan,

For some of us mere non economist bloggers (and blog commentators) economics is hard, but we’re learning (albeit sometimes by our mistakes).

I see a sort of oxymoron in Kartik Athreya’s comment because if ‘open-minded lay public’ were to ignore ‘non-economist bloggers, nor economists who….’ blah blah blah, then they would hardly be ‘open-minded’ would they.

If Kartik Athreya finds economics too difficult, then maybe he/she should try to find another job.

Kind Regards

Charlie

Dear Bill,

Have to echo CharlesJ comments:

Recently, contrary to Kartik Athreya’s argument who sees light only in his own tunnel and believes economics is complicated, I have begun to think of a fiat (let it be) currency quite perversely and simply as an elephant; because wherever it walks the dogs bark!! Government that can buy anything for sale – sound the alarm! Government that can create and destroy fiat currency at will – sound the alarm! A non-government sector whose assets and liabilities sum to zero, powerless before the fiat – sound the alarm! Better we manacle the elephant before it tramples us all is what the loan sharks say. And once we have him manacled and under our control, we can use him to stampede through the village – teach everybody who’s boss!

Then (the best part) we can blame it ALL on the villagers; tell them they will have to pay for the paper-profit losses. After that they can pay to fix up their village. If anybody asks why the loan sharks have control over the elephant remind them government isn’t responsible!

Economics is sooooo…. complicated. Especially for the pundits who cannot decide on the colour of the howdah or number of straps.

Tom Hickey had an interesting post on political philosophy the other day and placed his hopes with the people, to which I agree – but people protected by humane Laws and Regulation from their own government and the loan sharks I believe.

The elephant could do a lot of good work if the mahout had public benefit legislated as mandated guiding kol.

jrbarch