I started my undergraduate studies in economics in the late 1970s after starting out as…

Deficits are here to stay … get used to it

Today I am writing about the sectoral balances which are derived from the national accounts. A recent article in the Financial Times uses these balances to demonstrate that attempts to reduce the UK public deficit can only be successfully achieved by engineering growth in non-government spending. That is an insight that is core to Modern Monetary Theory (MMT) but typically escapes the understanding of most commentators. The article is interesting because it shows how the sectoral balances – which are accounting statements and thus true by definition – can be interpreted in different ways and influence different policy strategies. But the fundamental understanding you gain from knowledge of these balances is that at present public deficits are here to stay … and if you don’t like them … you better get used to it!

Yesterday’s (April 13, 2010) release of the latest Trade Data, by the UK Office of National Statistics, showed that:

The UK’s deficit on trade in goods and services was £2.1 billion in February, compared with a deficit of £3.9 billion in January

This is the smallest trade gap in nearly three years and has been driven by rising exports with imports largely unchanged. So this trade boost is coming mainly courtesy of the significant sterling depreciation (25 per cent since the crisis began in 2007).

This boost to growth may be short-lived because the main export market – the Eurozone – is flagging badly.

In this context, a common topic these days is that the World economy has to be rebalanced. It is usually presented as a veiled attack on China but reflects the obsession policy makers, aided and abetted by the mainstream economists, have with export-led growth. The rebalancing is in terms of the broad macroeconomic sectors – government, private domestic and external.

These sectors are often used in MMT to demonstrate basic national accounting relationships that have to hold at all times. To refresh your memory here is a quick summary.

Sectoral balances approach

The national accounts concept underpin the basic income-expenditure model that is at the heart of introductory macroeconomics. We can view this model in two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

So from the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

From the uses perspective, national income (GDP) can be used for:

GDP = C + S + T

which says that GDP (income) ultimately comes back to households who consume (C), save (S) or pay taxes (T) with it once all the distributions are made.

So if we equate these two perspectives of GDP, we get:

C + S + T = C + I + G + (X – M)

This can be simplified by cancelling out the C from both sides and re-arranging (shifting things around but still satisfying the rules of algebra) into what we call the sectoral balances view of the national accounts.

(I – S) + (G – T) + (X – M) = 0

That is the three balances have to sum to zero. The sectoral balances derived are:

- The private domestic balance (I – S) – positive if in deficit, negative if in surplus.

- The Budget Deficit (G – T) – negative if in surplus, positive if in deficit.

- The Current Account balance (X – M) – positive if in surplus, negative if in deficit.

These balances are usually expressed as a per cent of GDP but that doesn’t alter the accounting rules that they sum to zero, it just means the balance to GDP ratios sum to zero.

A simplification is to add (I – S) + (X – M) and call it the non-government sector. Then you get the basic result that the government balance equals exactly $-for-$ (absolutely or as a per cent of GDP) the non-government balance (the sum of the private domestic and external balances). This is also a basic rule derived from the national accounts and has to apply at all times.

Most countries currently run external deficits. The crisis was marked by households reducing consumption spending growth to try to manage their debt exposure and private investment retreating. The consequence was a major spending gap which pushed budgets into deficits via the automatic stabilisers.

The only way to get income growth going in this context and to allow the private sector surpluses to build was to increase the deficits beyond the impact of the automatic stabilisers. The reality is that this policy change hasn’t delivered large enough budget deficits (even with external deficits narrowing). The result has been large negative income adjustments which brought the sectoral balances into equality at significantly lower levels of economic activity.

Please read my blogs – Stock-flow consistent macro models“> – Barnaby, better to walk before we run – Norway and sectoral balances – The OECD is at it again! – for more discussion on the sectoral balances.

But this framework while strict in accounting terms is open to interpretation by policy makers. For example, you can sustain economic growth with a private domestic surplus and government surplus if the external surplus is large enough. So a growth strategy can still be consistent with a public surplus. Clearly not every country can adopt this strategy given that the external positions net out to zero themselves across all trading nations. So for every external surplus recorded there has to be equal deficits spread across other nations.

Rebalancing the UK economy

In his recent Financial Times column (April 13, 2010) – UK economy must perform a rebalancing act – Martin Wolf continues this theme, although to my pleasure, he actually presents the sectoral balances correctly.

The article is useful because it shows you how the basic national accounting relationships that are produced at the macroeconomic level can be interpreted in different ways but not ignored, as most mainstream analysis does.

While he is talking about the UK (given his readership), the principles he discusses are applicable to all nations although EMU nations constrain their macroeconomic policy and trade environments so severely that they cannot enjoy the sectoral flexibility that sovereign nations benefit from.

As I read his opening gambit, I said to myself … not this bs again. Wolf starts off:

The one point on which everybody agrees is over the depth of the fiscal hole: the government is borrowing a pound for every four it spends. But nobody wants to discuss what might need to be done. This is not surprising: today’s fiscal deficits exceed those of any previous period in peacetime. Yet even if one accepts that these deficits must be tackled, huge questions remain over the timing and content of such action.

Question: Am I not included in everybody? My basic recollection of set theory tells me that everybody must be a Union of the sets A (All others) and B (BILL), denoted A U B, which, in turn, is the set of all objects that are a member of A, or B, or both. Answer: definitely.

Which means that Wolf is lying. Everybody doesn’t agree over the depth of the fiscal hole because I don’t even think that is a concept worth considering. What does it mean? A hole is something you fall down or … I consulted the definition.

A hole is:

* an opening into or through something

* one playing period (from tee to green) on a golf course; “he played 18 holes”

* an unoccupied space

* a depression hollowed out of solid matter

* a fault; “he shot holes in my argument”

So does a budget deficit fit any of these concepts? This is how it arises.

Every day the government is crediting private bank accounts (directly or via cheque issuance) to pursue its socio-economic program. Each day also, they collect tax revenue by debiting private bank accounts (or writing receipts over counters to payees). The tax revenue is accounted for but “doesn’t go anywhere” in a physical sense.

A deficit arises when the spending exceeds the revenue and the net result is an addition of net financial assets (bank reserves). In achieving this outcome, the government hopes that its spending will boost aggregate demand (“finance” the leakages from the income-expenditure system), and, hence maintain high levels of employment and material prosperity.

The only hole I can see is one that needs to be filled. That is the spending gap – the leakages from the income-expenditure system – that are created when there is a CAD and/or a desire by the private sector to save.

Budget deficits should aim to fill that hole in and not allow aggregate demand to “fall through it”, which would lead to income and employment collapses.

If budget deficits are underwriting income growth, then workers can enjoying secure employment and achieve their saving desires – which will enable them, should they wish to use purchase some golf clubs and play a few “holes” in their leisure moments. Sounds good.

Please read my blog – We are in trouble – squirrels are falling down holes – for more discussion on this point.

So even considering the dollar amount of the deficits per se or the ratio to GDP (that is, without reference to anything else) is meaningless. What does it mean to say that “today’s fiscal deficits exceed those of any previous period in peacetime”. All it means is that the non-government surpluses exceed those of any previous period in peacetime. The question is what is going on rather than focusing on the $ or sterling values of the aggregates or balances.

It was at this point in his article, that Martin Wolf showed he realises this, which makes his opening paragraph gratuitous:

In the UK at least, the fiscal deficits are mirror images of private sector surpluses. Moreover, the direction of causality is from the latter to the former. The necessary conditions for a return to fiscal (and economic) health are a recovery in private spending, a huge increase in net exports or, ideally, both. The big question is whether the essential recovery in private spending and net exports will occur before, or after, it becomes difficult for the government to borrow on reasonable terms. If it comes before, a smooth fiscal exit is feasible. If it comes after, a crisis would intervene. I am optimistic on this, but am not blind to the risks.

That is very clear. The shift to non-government surpluses has left a huge spending gap and firms responded to the failing sales by cutting back production. Employment falls and unemployment rises. Then investment growth declines because the pessimism spreads. Before too long you have a recession. Without any discretionary change in fiscal policy (now referred to in the public media as “stimulus packages”) the government balance will head towards and typically into deficit.

Why? As a result of the automatic stabilisers. Tax revenue collapses and welfare payments increase – not in rates but in volumes as economic activity wanes.

The greater the decline in non-government spending, the greater the rise in the government deficit. The current situation has also been influenced by the stimulus packages which have put a floor in the downward spiral and saved the World from depression.

So the causality is from the non-government balance to the government balance. This is another way of saying that the budget balance is endogenous and driven largely by the spending and saving choices made by the non-government sector. Private households and firms have it within their capacity to drive the public deficit down whenever they choose. They can simply spend more.

You can also use the sectoral balances framework to understand what the impacts of the current demands for fiscal austerity might be. Then the causality will initially shift from government to non-government via income changes and then reverse as the latter reacts to the net spending cuts.

So an attempt to achieve a discretionary reduction in the budget deficit – via tax rate hikes or public spending cuts – will reduce aggregate demand immediately.

This reduction in demand will reduce output and income. The only way this will not cause a further contraction in the macroeconomy is if it stimulates private investment and growth in the same outstrips the household saving (so the private domestic sector goes into deficit); or households stop saving and borrow more to spend up; or net exports grow to offset the reduction in the deficit.

The first two possibilities are virtually impossible to imagine. Investment falls when demand plunges and households save more. Credit becomes tighter and so borrowing falls. Further, net exports might grow as imports fall (due to the contraction in income) but it is very unlikely the required demand offset would ever be forthcoming from this source.

So it is highly likely that the government would not be able to achieve its aim anyway, because the non-government sector balance will remain in surplus. This situation is what I have, on many occasions, termed a “bad deficit”. You get the deficit but for all the wrong reasons – a contracting economy and rising unemployment. Bad deficits are produced by the automatic stabilisers moving to shore up demand as the economy falters.

The government could have had the same deficit to GDP ratio but with high employment and a growing economy. That is a virtuous or “good” deficit.

Anyway, given Wolf’s worry about the public deficits he sees the sectoral balances in terms of demonstrating a need for the non-government sector to lead the growth charge. He clearly understands that that has to come “before, a smooth fiscal exit is feasible”. So that is a start.

Wolf thus distances himself from the manic deficit terrorists who do not understand these sectoral relationships and are advocating that the government leads the charge by introducing austerity packages – just when the state of private demand is still stagnant or fragile. A very silly thing to be advocating.

The problem I have with Wolf’s perspective is that he is taking it as given that the fiscal deficits are “unsustainable” and dangerous. That is certainly not the case and I will come back to it in a moment.

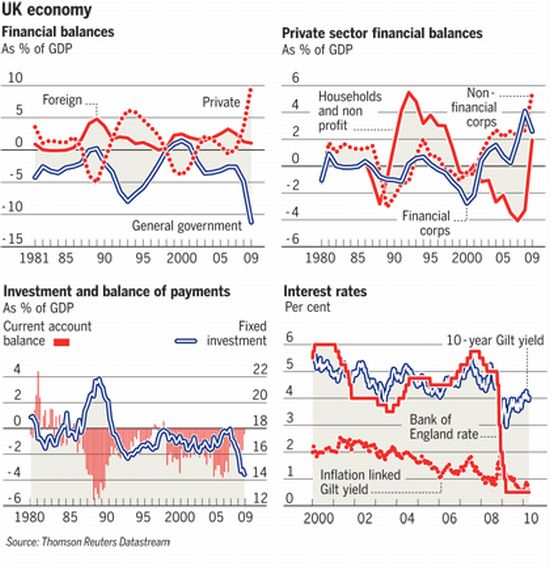

Wolf then analyses some very interest sectoral balance graphs which I reproduce here.

In the top left-hand graph, you can see the startling rise in the private sector balance (“jumped by a massive 9.8 per cent of gross domestic product”) and virtually no change in the external position. As a result, the government balance moved into an increasing deficit (“jumped by 8.6 per cent of GDP between 2007 and last year”).

Even though he understands the sectoral balances, Wolf displays his prejudices when he describes this private “shift towards frugality” as the government’s shift “towards profligacy”.

First, endogenously-driven shifts in the public deficit, reflecting causality moving from behavioural changes in the non-government sector to the government sector via the automatic stabilisers can hardly be called profligate.

Second, the discretionary fiscal changes in the UK that have added to the deficit have clearly not been enough given how long the UK economy was in recession and the rise in unemployment. I would actually describe the current British budget balance as being irresponsibly frugal rather than anything that connotes extravagance.

You can also see (top right-hand graph) how the British households shifted to saving during the crisis years. Wolf notes that the “impact of the crisis on private spending has overwhelmed the monetary policy offsets from the Bank of England, at least in the short term”. He is referring to the quantitative easing and low interest rate regime that the BOE has followed and everyone (other than those who know how the system works) claimed would stimulate credit growth and be inflationary. It did and was never going to achieve either. Please read the following blogs – Building bank reserves will not expand credit and Building bank reserves is not inflationary – for further discussion.

Wolf then turns to the “policy challenge”:

… the policy challenge: it is not to cut the fiscal deficit, regardless; it is to cut the fiscal deficit, while sustaining recovery and growth. It is stabilisation with growth, not stabilisation at the expense of growth. Economic misery is not desirable but detestable.

At this stage, I am sure I heard loud cheers emanating from the computer rooms around the World as readers grasp the fact that Wolf is a complicated deficit terrorist rather than the plain vanilla variety deficit terrorist, which is as thick as two planks. He hates deficits but understands enough to know that these austerity plans will cause economic … which means … human misery.

So what is required?:

If the actual fiscal deficit is to be cut by, let us say, 10 per cent of GDP, then the sum of the financial surpluses of the domestic private and foreign sectors must fall by the same amount. If this is to occur with growth, there needs to be a strong surge in spending in these sectors … this is impossible without a massive improvement in the external balance.

The reason is that despite the move into surplus by the private domestic sector “the UK’s net household savings are exceptionally low” which is a result of the debt binge between 1992 and 2007. So “(h)ousehold savings need to rise, not fall” to reduce the vulnerability of highly indebted households. Wolf also considers “an offsetting jump in residential investment … is unlikely to occur”.

That is why net exports have to rise if you want the public deficit to fall. He discusses some recent research, which suggests that the UK external balance is heading south rather than north. That is, it will drain growth rather than add to it.

They run a policy line that the UK government has to introduce an industry policy aimed at “nurturing a more dynamic manufacturing sector”.

So bad luck if you are a deficit-hater and you live in the UK. You are not going to get a reduction in the public deficit anytime soon. Wolf is clearly anxious about this:

Yet even if fiscal tightening is far more likely to follow recovery than cause it, it does not follow that current fiscal deficits will be easy to finance for long enough to permit the needed economic adjustments to occur. While the UK’s private sector surpluses are nearly big enough to finance the fiscal deficit, this may well not be how it decides to invest its money, at least at present prices. It might buy foreign assets instead.

At that point, you just turn off again and say well he had some good points in his article amidst all the trash.

It is crucial to understand that fiscal deficits are not “financed” at all. The games that governments play with Offices of Debt Management (as in Australia) or whatever is the analogue elsewhere whereby they have set up elaborate institutional mechanisms to allow private “investors” to purchase government paper via complex tendering and auction processes have nothing to do with funding the government net spending.

This is true, even when the auctions of the debt are $-for-$ matched to the net spending increase.

Most people are seduced by the intuitive logic that the coincidence of the timing (of the net spending and the borrowing) must be causal and flow from latter to the former. Where do they get this “intuition” from?

They have been taught by the mainstream economists and their media-lackey mouthpieces that the government budget is just like the household budget. We clearly have a close connection with our household budgets and know very well that when we want to purchase something beyond the capacity of our current income that we have to either run down saving, sell something else, or borrow. We thus correctly understand the borrowing to be funding the net spending.

Then we apply that logic – as intuition – to the government sector and the conclusion we reach not be more wrong if we tried.

As noted many times, a sovereign currency-issuing national government is not like a household despite what the mainstream macroeconomics textbooks teach the students to believe. The household uses the currency that the national government issues. The latter is never revenue-constrained unlike the former.

Once you abandon this erroneous “intuition” you can see that the constraints that governments place upon themselves are entirely voluntary. This realisation then leads you to ask: why would they do that?

The answer is that they have been influenced by conservative mainstream economists who have forced the policy makers to continue gold standard logic (where net spending had to be “financed” with debt-issuance) into the fiat currency system. Why? Because the mainstream economics profession is ideologically opposed to governments being involved in the economy (unless it is handing money to the same economists as consultants or providing corporate welfare to companies they own shares in).

Once you get to this point, you just laugh at statements such as the current fiscal deficits may not “be easy to finance for long enough to permit the needed economic adjustments to occur”.

The problem here is that the UK government (like most) are so stupid that they will voluntary lie down and be screwed by the constraints they have imposed upon themselves. The sensible thing would be to instruct the BOE to manage the yield curve and/or stop borrowing altogether.

So Wolf is probably correct in saying the bond markets will push rising interest rates onto the economy and a further malaise will be probable. But this will only be because the BOE will allow that to happen. It will be all self-inflicted and unnecessary.

However, by perpetuating these myths, Wolf himself becomes part of the problem. He should be using his position of influence to change public perceptions and pressure government to change their institutional structures (borrowing etc).

The challenge for our side of the debate is to expose these voluntary constraints for what they are. The dominant commentary assumes the institutional landscape is given and therefore not to be questioned. It is of-course essential that conservatives argue for a status quo, which serves them well.

The progressive side of the debate should be challenging everything rather than operating within the constrained institutional environment and arguing neat little things about how the deficit could be better spent or similar. That sort of argument is essential too, but has to follow a basic challenge to the whole structure that the conservatives have put in place to preserve their position as elites.

So questions like why would the government issue debt – have to be central to the debate. That is where I see MMT as being a crucial knowledge structure to help progressives prosecute the case for eliminating all this ideologically-conservative machinery that is used to maintain persistently high rates of labour underutilisation and entrenched poverty around the globe.

The last point I would make, is that the UK solution is to expand the deficit at present on a discretionary basis to support the private saving desires and to build confidence among the investment community (real investments that is). That is the best way to revitalise private spending. Once the households have achieved their desired saving ratio and reduced their indebtedness to prudent levels, then the support from the fiscal deficits will lead them to resume spending. Until income levels are at the levels consistent with these saving desires the deficits will have to remain (and grow) notwithstanding the modest improvement in the UK external position reported yesterday.

Interesting letter to the former shadow minister for finance

I was sent this by one of the regular billy blog readers today. He was outraged sometime ago when Barnaby Joyce, the hapless former shadow finance minister who was finally dropped by his leader to some remote portfolio, said that Australia was about to default on its sovereign debt. He claimed he knew this because he had a background in accounting.

I wrote this blog about that public statement – Barnaby, better to walk before we run.

Anyway, here is the letter my mate sent to Joyce. I think you will like it. For overseas readers, Mr Stevens is the Governor of the RBA and Mr Henry is the boss of the Federal Treasury. Exchange Settlement Accounts are the reserve accounts that all member banks have to have at the RBA to faciliate clearing and payments.

Dear Senator

I heard and read the news story on the ABC about you questioning whether the Government could repay its debts.

Obviously, as I am typing this message to you, keyboards still have keys including numbers, and therefore, assuming the Government uses the same type of keyboard as myself then the Australian Government being the monopoly issuer of the $A will never default on its debts unless for political purposes it decides to. The Australian government budget is not revenue constrained like a household budget, and to compare the two is to compare apples with iron ore.

Why?

Just say that you own $1m of Australian federal government treasury bonds and come maturity you decide not to roll over but to redeem you cash. Mr Henry will send a note to Mr Stevens say that you want to be repaid and here are your bank details.

Mr Stevens then enters the following journal entry in the RBA general ledger:

Debit – Department of Treasury Account – $1m

Credit – Exchange Settlement Account – Your bank $1m.Mr Stevens then lets your bank know that the $1m added to their Exchange Settlement Account is for you and your bank enters the following journal into their general ledger:

Debit – RBA Exchange Settlement Account – $1m

Credit – Mr Joyce $1m.So until such time that we lose the ability to run accounting systems, the Australian Government being the monopoly issue of its own non-convertible currency (as are Japan, United States, United Kingdom, but not Greece, Ireland, Italy, Portugal, France, Germany) will never have default forced on it.

Paying the interest is no different.

“We’re going into hock to our eyeballs to people overseas”

Are we?

As at 31 December 2007 per RBA statistic table E3, there was $59bn of Treasury securities on issue, of which the Australian Bureau of Statistics estimates $38.7bn or 65.55% was owned by non-residents. As at 30 June 2009 the figures were $52bn of $101bn or 52% of Treasury securities were owned by non-residents.

If you then go to RBA statistic table E10, as at 30 June 2009, of the $101 bn of Australian government securities on issue, only $1m is repayable in UK pounds, and $7m in USD. Therefore, the Australian Government cannot default on $52bn of Treasury securities owned by non-residents unless it wanted to, because it is repayable in Australian dollars, which then leaves it up to the non-resident to decide whether what they want to do with their Australian dollars. There is no obligation for the Australian government, (other than $1m UKP, and $7mUSD securities) to provide anything other than $AUD to redeem government securities. That is, the non-residents are voluntarily deciding to acquire Australian dollar denominated financial assets. They and not the Australian government assume the exchange rate gain.

Inflation

I know that you are probably going to suggest that this is printing money, and that this will lead to inflation and then hyperinflation alia Germany and Zimbabwe. This is not true unless you contract the supply side of the economy at the same time like what happened in those two countries. For a detailed explanation see the following: https://billmitchell.org/blog/?p=3773

Senator I would also suggest that you read Bill Mitchell’s other writings on how the monetary system works. Whilst you may look at Bill’s writings and you may think that him is some left-wing nut, if you open your mind up, what he says has application to Coalition polices as well, for example:

* Low interest rates. Stop $ for $ issuing of treasury bonds and notes to “finance” the deficit. The accumulated bank reserves left in the system will be lent between the banks in the inter-bank market forcing down inter-bank rates. Also, there are no ‘risk-free’ assets available for sale forcing entities such as life insurers, and pension funds to invest in private assets, or leave the money in the bank putting downward pressure on rates. The build up of bank reserves will not cause inflation – see https://billmitchell.org/blog/?p=6624

* Job Guarantee:

Providing a job is the best form of welfare. Deregulation of the labour market – Work Choice/Fair Work Australia – could be completely repealed, with the minimum work conditions regulated via what is offered under the work guarantee.

* Encouraging self-support through saving. The non-government sector’s desire to save and invest is supported by government running deficits, not the other way around.

My only complaint is the suggestion that the Senator might consider me to be “some left-wing nut” when I have spent years developing my image as a right-wing conservative [note: American readers the previous comment was a joke] [note: the reference to American readers was also a joke!]

Conclusion

My band is playing tonight so …

That is enough for today!

Hi,

Am finding your blog very interesting and learning lots – please do keep it up!

Re: central banks (which issue their own currency) managing their yield curves, I/your readers (I’m sure) would be interested to hear your opinion of Japan’s latest idea? http://www.telegraph.co.uk/finance/financetopics/financialcrisis/7587346/Japan-mulls-monetisation-of-public-debt-and-yen-devaluation.html

Bill,

Do you think the name Modern Monetary Theory is authoritative enough ? Semantics indeed, but a lot of people consider a theory to be something that is either unproven or only relevant on paper.

If James Mill referred to Say’s Law as Say’s Theory of Markets I wonder how long it would have lasted ? I doubt very long.

I’m not taking the piss either I just think you get lost in the detail and don’t focus on what the average person on the street can relate to.

cheers, Alan

Bill,

MMT is utterly fascinating, and seems pretty obvious to me. The Sovereign government has to be the ‘pump primer’ for the currency flow. Otherwise it just can’t work.

I’m in the UK and at my wits end about the level of debate over the financial position here. There is no way we can slash public spending to get back to a ‘neutral’ budget position without social anarchy and the debate over fiscal policy is infantile – with one party ruling out income tax rises.

However from my simplistic viewpoint we still have problems. Retail price inflation appears high, but most importantly house price inflation is taking off. From what I understand of MMT that suggests that the large deficit is stoking asset prices again. Doesn’t that suggest that we have already reached the limit of the economy’s capacity and we need to cut back?

Also one factor of MMT concerns me. I understand that you can run a deficit, but doesn’t that just increase the money supply spreading the same amount of goods across more pound notes – thereby increasing asset prices?

And I haven’t seen you explain yet (and I may have missed it) how the free floating exchange rate balances things in a positive manner. From what I can see if the UK continues to run the deficit as it is doing, then the exchange rate with other countries will deteriorate and our import costs will shoot up. For a country that is addicted to overseas production wouldn’t that cause catastrophic price inflation?

One final thing is fiscal policy. From my understanding tax policy is generally set annually, whereas here in the UK the BOE meets monthly to set the monetary policy target rate. What fiscal mechanisms are there to stabilise over/under production during the year – but that still give businesses a degree of certainty to plan ahead.

Hope you can help!

Bill, brilliant post. One of your best, made even better since you are commenting on doyen Martin Wolf. You have really boiled it down here.

You also suggest in several places that the problem is institutional. This is generally overlooked in discussions that focus on ideas and ideology. Neoliberal ideologues typically spout fine ideas about the freedom, democracy, free markets, free trade, free choice, incentives, etc., and ignore that while these ideas have extraordinary power, they do not exert much of this power independently of being concretized through conventions and institutions. However, the resulting conventions and institutions are not necessarily perfect reflections of those ideas, and often they are not even near reflections but distortions. That is to say, inherently good ideas can be hijacked and be corrupted when they are expressed through corrupt institutions.

So-called left-wingers are often attacked as trying to undermine “freedom,” “capitalism,” etc., in order to institute “socialism,” which the last time I checked was state ownership of the means of production. This is clearly a patent distortion of what progressives are saying. The political definition of “progressive” is one who advocates reform, not revolution. What progressives are demanding is an end to corruption of ideas through corrupt conventions and institutions, and a return to the actual intent and practice of the idea.

As you point out, a lot of the social, political and economic rhetoric coming from conservatives is based on self-serving moralizing designed to perpetuate corrupt institutions instead of on logic and evidence, or even faithfulness to the norms of their espoused ideal. All of the handwringing over “economic inefficiencies,” “public indebtedness,” “inflationary expectations,” and the like ignores the huge opportunity cost of chronic output gaps and the resulting unemployment and debt deflation, when going this route is a political choice rather than an economic necessity. It also attempts to conceal the quantitative and qualitative magnitude of these conditions in terms of degradation of human resources and decline of national prosperity

Hmm. So, am I understanding your point that increases in deficits are really not a problem — at least, not in terms of inflation — so long as the private sector’s ability to provide supply (things to be purchased with the currency) is not artificially constrained as well?

In other words, you can’t really look at currency issuance (federal gov’t spending in the US) in isolation to judge the future effect on inflation or price levels — you have to also consider whether the productive capacity of the country is able to “absorb” the issuance.

If I’m on the right track, then — in the US — the real concern is not deficits or “burdening our children with debt,” but rather policies that artificially constrict the private sector from being able to produce.

Am I way off base?

–Phil

Alan: Do you think the name Modern Monetary Theory is authoritative enough ? Semantics indeed, but a lot of people consider a theory to be something that is either unproven or only relevant on paper. If James Mill referred to Say’s Law as Say’s Theory of Markets I wonder how long it would have lasted ? I doubt very long.

Agreed. George Lakoff has convinced me of the importance of framing. Unfortunately, conservatives tend to be better at framing than progressives so far. Conservatives have also developed simple messaging, whereas liberals often come across is wonky, and the public sees simple as strong and nuanced as weak. Rhetoric is important. Logic and evidence alone don’t cut it in the political marketplace that influences elections and political decision-making.

I’m not taking the piss either I just think you get lost in the detail and don’t focus on what the average person on the street can relate to.

Alan, I think that the professionals have to step it down as much as the can without being too simplistic. I think that Bill generally hits it about right. It’s up to others to get the word out in terms that ordinary folks can understand and appreciate. Warren is learning a lot on the stump, for instance, and those of us flogging this on the blogs are learning how to present things simply and address objections. But when it comes down to the nitty gritty, the experts have to be there to deal with it. I’m glad we have Bill and other pros to rely on and back us up.

I do agree, however, that some professionals are pretty good at getting complex ideas across pretty simply. Paul Krugman’s NYT column and blog come to mind. He shows that it can be done effectively. Too bad he either doesn’t get MMT or won’t admit it if he does. He’s got the bully pulpit.

Tom,

Neo-Liberals are no more self-serving than MMT advocates. They each may disagree on how things should be but they are alike in that they believe it is their way or the highway.

Hence, both camps seek control with little if any regard for how it will effect others. As long as they get their name in lights or profit from the situation all is fine and any collateral damage can simply be swept under the carpet.

At the end of the day it is simply a case of meet the new boss, same as the old boss.

Cheers , Alan.

Forgive me for getting too political, but I have to respond:

> “Unfortunately, conservatives tend to be better at framing than progressives so far.”

If you are talking about the US, then I have no idea what you are looking at. Assuming that you would consider Obama a progressive, I think he won on presentation (framing) alone — he really had no experience to point to. Granted, “hope” and “change” are not particularly strong messages (even though just about every politician seems to use them); but the “conservative” candidate (McCain) was running around with “Country First,” which was very, very weak in the face of the financial crisis at the time.

> “Conservatives have also developed simple messaging, whereas liberals often come across as wonky,”

Conservatives think in terms of a gold standard, where money is a thing, not an accounting entry. Real things are always going to be more readily grasped than abstractions because we form understanding through experience, not logic alone. Even someone who is highly logical will mentally “walk through” a line of thought to understand it.

>” and the public sees simple as strong and nuanced as weak.”

With some exceptions, I think it would be more accurate to say that the public sees conservatives as honest and progressives as dishonest. Many conservatives did not like Bush because they did not feel that he was being completely honest in looking out for their interests. Obama, Pelosi, and Reid are making the impression of progressives as dishonest much worse, not better.

> “Rhetoric is important. Logic and evidence alone don’t cut it in the political marketplace that influences elections and political decision-making.”

Maybe it’s just me, but most of the logic and evidence I hear about in the political marketplace amounts to finger-pointing and “sob-stories.” It could be a problem with the news media in general — being too focused on the emotive instead of the logical — but even when you look below the surface, there’s not much logic or evidence there. If anything, I think that conservatives in the US seem to be trying harder to present evidence than progressives, at least in general.

Dear Bill,

Thanks for refreshing the sectoral balances – have pinned the formulae on my fridge so that I can think about the human implications.

Am wondering if you could work into one of your blogs an ‘aerial’ perspective of the economy from the aspect of demand – am thinking of effects on the landscape of the economy as the desires of people to save and spend change; the supply responses; and the mechanisms of constraining demand and supply, to meet societal acceptance.

Am asking this because I see (currently) demand as the most central force in our society. I also see demand and supply being highly organised and cultivated these days, setting up constraints to be broken later. And one tiny little well-spring of demand that rises up as humanitarian waters, important to some!

Sincerely,

jrbarch

1. I have not seen the evidence and the theory that shows how monetary polcy can manage the long tail of the yield curve which is subject to expected shortfall shocks that are less rare events (as normally assumed) and follow asymptotic hyperbola functionality (power law) as the period is prolonged and inflationary expectations are less anchored with time.

2. National Account balances as identities are time point correct but they do not reveal the “black box” or internal dynamics of the interactions across the sectors. It needs more behavioral relations and feedback factors to support the hypothesis, which can be done as my framework demonstrates with the same results as MMT. I believe that MMT, as I know and understand it, must explicitly introduce these factors in the analysis. Foe example,how exactly is speculation factored in?

3. Voluntary constraints of fiscal policy are given because policy is trapped and “captured” by private interests and cannot escape unless there is a crisis that reveals the contradictions of the constraints, not only intellectually but also materially, and allows a regime switch.

Assuming that you would consider Obama a progressive,

I didn’t when he was campaigning and I don’t now.

I’ve got a kind of an off-topic historical question related to MMT. Are there any examples of present day governments that do not issue debt to match their spending? What about historical examples? I think I may have read somewhere that the Soviet Union did not offset its spending with debt issuance. Is this correct?

It would definitely be helpful if proponents of MMT could point to concrete examples of governments accepting the reality that they are not revenue constrained. As it is, most every government behaves as if it is revenue constrained so eventually perception becomes reality.

> “I didn’t when he was campaigning and I don’t now.”

Hmm. That’s an issue, because many people would consider Obama, Pelosi, and Reid as progressives. In fact, I think most Americans make no distinction between the terms progressive, liberal, and democrat. (Same for the terms conservative and republican.) Perhaps a new label is in order.

Who would be more representative of a progressive view?

<i?Do you think the name Modern Monetary Theory is authoritative enough ? Semantics indeed, but a lot of people consider a theory to be something that is either unproven or only relevant on paper.

A rebranding exercise, eh? Let’s see last September Bill wrote:

Many readers keep calling for my views on Austrian economics… wasn’t aware that the Austrian school was anything more than a cobbled together bunch about as large as the modern monetary school (laughing).

https://billmitchell.org/blog/?p=4870

Perhaps Bill was the victim of a regrettable spellcheck design flaw, and in fact, the many readers really wanted the authoritative views on Australian economics from the man who started it all (personally, I think Australian Rules economics is catchier). :o)

Phil, in the US conservative generally means small government, low taxes, strong military, and traditional values. This is interpreted somewhat differently by social conservatives, fiscal conservatives, and libertarians of the right. Liberal means social liberalism, fiscal flexibility, especially counter-cyclically, distributive justice and welfare programs. Progressives are similar to liberal but they emphasize reform, specifically addressing the constitutional crisis precipitated by Bush/Cheney, reform of campaign finance and lobbying, closing the revolving door, and comprehensive reform of FIRE.

Obama ran as a stealth candidate, with some progressive sounding slogans like change and hope, suggesting reform, but overall his proposals were very centrist, as was his call for post-partisanship when it was obvious that the GOP is intensely partisan and must be to retain its base. I also suspected that Obama was chiefly a Chicago pol, which proved immediately by selecting Rahm Emmanuel as White House chief of staff. It’s been downhill from there. His economic appointments and policies have been generally neoliberal and relatively conservative considering his position on change. I could go on from there. Obama has shown himself many times over not to be either a liberal (someone who favors the role of government) or a progressive (someone who favors reform). He has pretty much stuck with the status quo, and many now call him Barack W. Obama to imply that his administration is a continuation of the Bush administration and policies. As far as traditional Democratic policy goes, Obama has been a disaster, as repeat of Clinton’s Republican lite. This is particularly disappointing to those who supported Obama over Hillary Clinton, hoping to avoid a Clinton repeat.

Nancy Pelosi represents the San Francisco Bay Area, which is probably the most liberal and progressive area in the US. She is rightly considered a Democrat of the left.

Harry Reid comes from Nevada which is a conservative to libertarian state and he is a Democratic centrist that lean conservative. Most liberal and progressive Democrats are disappointed that he is the Senate majority leader. To date, the Senate has blocked most bills that have come out of the House, about 190 of them.

The progressive choice for president would have been Dennis Kucinich, whose economic advisor was Michael Hudson, but he was marginalized early on.

Maybe it’s just me, but most of the logic and evidence I hear about in the political marketplace amounts to finger-pointing and “sob-stories.” It could be a problem with the news media in general – being too focused on the emotive instead of the logical – but even when you look below the surface, there’s not much logic or evidence there. If anything, I think that conservatives in the US seem to be trying harder to present evidence than progressives, at least in general.

Phil, the progressive position almost never gets presented in the mainstream media other than as caricature. Ownership of the mainstream media in the US is highly concentrated and very monolithic. Studies have shown that “the liberal media” is a myth created by conservative spin meisters. Fox News is an ultra-conservative propaganda machine run by arch-conservative Roger Ailes and owned by conservative Rupert Murdoch. Conversely, most of the media presenting the liberal and progressive viewpoints in a nuanced form are specialized. Most people are unaware of them, and although there are progressive commentators like Ed Schultz, Keith Olbermann and Rachel Maddow on MSNBC, their ratings are overshadowed by conservative TV and talk-radio hosts like Glen Beck, Bill O’Reilly, Sean Hannity, and Rush Limbaugh.

The problem is that most people get their information from headlines and soundbites and these are not very useful for conveying detail and nuance. As a result most political discourse is pretty dumbed down, and the framing is simplistic, giving the impression of being intuitive but designed to influence instead of inform. For example, the impression that Obama, Pelosi and Reid are “dishonest” has been created by the conservative spin meisters. The impression that conservatives are honest is laughable, since it is based on rhetoric evoked by emotion as well as mendacity. Now they are just making things up willy nilly based on the public’s hot buttons.

The disinformation is so thick that even many progressives are taken in by some of the things that are repeated over and over, like the household-government finance analogy. Look at the response to MMT on many progressive blogs, for instance. Pretty appalling, but this is the environment in which we are operating.

NKlein1553, even forgetting that USSR formally lived in the gold standard, it did have external as well as domestic debt. All external debt (as well as assets) was taken over by Russia and later fully paid off (afair). This was know as Paris Club. Domestic debt was hyper-inflated in the collapse of the supply economy in the late 80s and during 90s. Domestic debt was also typically dealt with via currency reforms 🙂

Tom,

Thanks for your thoughtful response to my question. I have to concur that the disinformation is pretty thick — on both ends of the political spectrum. What you describe as the progressive position is news to me — and I’m sure it would be news to a lot of others as well. I don’t (as you can tell) hang out in progressive circles. I’m more trying to understand what policies are being advocated, regardless of whether I agree with them.

A couple of thoughts:

First, I do know a bit about communications theory and marketing and I can tell you that part of the reason that political discourse is “dumbed down” is because people only have so much time to think about it. There’s only so much attention to give in a day and most people go through life scanning for things that need their attention. It’s not always a sign of “dumbness” — rather a sign of preoccupation. Any message that doesn’t immediately trigger a response along the lines of “I need to pay attention to this” is going to have a difficult time.

A case in point would be Warren Mosler’s tagline on his site “Don’t vote for anyone who wants to balance the federal budget.” It has merit in that it’s honest with regard to what he wants to do, but I can’t imagine anyone who would hear that and think “this matters to me; I better pay attention.” If anything, most people would hear that and either dismiss it immediately or think “this guy is crazy.”

A better version would be “Make the government pay.” The improvements there are 1) it’s shorter, 2) it’s still relatively honest about what he’s talking about, and 3) it has a light double entendre that taps into current anti-gov’t-policy (tea party) sentiment and thus is more likely to trigger a response like “maybe I should listen a bit to what this guy is saying.”

Second, I have to disagree with this comment: “the impression that Obama, Pelosi and Reid are “dishonest” has been created by the conservative spin meisters.” Obama, Pelosi, and Reid are doing just fine all by themselves at cultivating an impression of dishonesty. No spin has been necessary, unfortunately.

Obama, Pelosi, and Reid are doing just fine all by themselves at cultivating an impression of dishonesty. No spin has been necessary, unfortunately.

To me, dishonesty means lying. Would you care to cite any lies you have detected coming from them? BTW, broken or unfulfilled campaign promises don’t count. No intelligent person expects a candidate to live up to campaign promises 100%. One can be angry about this, but it doesn’t constitute lying in the world of political realities. If you mean “back room dealing,” that’s US politics. Legislating is like sausage-making. This isn’t going away anytime soon without major reform that limits the influence of special interests. It’s the American way, given interest-driven politics and campaign finance and lobbying. This is part of politics as usual, and I don’t see any way around it other than comprehensive campaign finance reform. The opposition is being disingenuous in criticizing this.

If you want a detailed example of an expert examining conservatives and progressives in relation to framing, see George Lakoff’s post at The Huffington Post today, The Poll Democrats Need to Know About

“BTW, broken or unfulfilled campaign promises don’t count. No intelligent person expects a candidate to live up to campaign promises 100%. One can be angry about this, but it doesn’t constitute lying in the world of political realities.”

It is precisely this sentiment (among other things) that promotes the impression that those on the left side of the political spectrum are dishonest. Perhaps you can clarify what you mean by “lying” so I know what I can say that won’t be heard as “oh, he just changed his mind” or “of course he didn’t know the exact details of that” or some such.

And I’m sorry to say this but the Lakoff analysis is a bit flawed in my opinion. For example:

> “…the word ‘taxes’ is not neutral or objective. It has been hijacked by the right. By virtue of their communications system, they have changed the framing of the word to mean…’money that individuals have earned without government help that is taken out of their pockets by the government and given to people who haven’t earned it and don’t deserve it.’ … It is for this reason that I have chosen the word ‘revenue.’ ‘Revenue’ is a neutral word in that it has no such doctrinal meaning. It is a word that comes from business. To run a business, you need revenue; and the same is true of running a government.”

“Revenue” in the sense of business is far from neutral. It is money that is voluntarily given to a business in exchange for services or products. For a business, if potential customers don’t want the service or product, they don’t have to pay for it and there’s no penalty for them to just not do business. The same idea is not true for governments that have penalties for not paying taxes. In that case, if one does not like the service provided by a government, the person has to either pay the tax or leave the jurisdiction, both of which may be undesirable.

Also, this statement that taxes are “money that individuals have earned without government help that is taken out of their pockets by the government” is consistent with a gold-standard view of money, which is what most people (left or right) have. It’s hardly a right-wing hijacking — it’s what anyone would infer from experience.

Phil –

What do you mean “among other things”?

I agree with Tom that Obama is far from being a progressive. He may have been a progressive when he was a state senator from Southside of Chicago but not now. That transformation doesn’t make him any more a liar than John McCain saying he never considered himself a “maverick”. Reid is far from a progressive and Pelosi is more progressive than both of them only because of her congressional district.

As for lying, I do believe Obama lied during the campaign but he is not the only one who has lied – Bush II lied his ass off and so did Reagan. So Democratic politicians certainly have company with lying. This doesn’t mean that lying is admirable. It has a lot to do with messaging – as you seem to know.

Oh, your play on words using “gold standard” is very cute.

Lastly, whether someone is lying or trustworthy can be very subjective. I maybe wrong but polls that I have read about say the public “trusts” Obama over republicans on a host of issues. I guess it’s all about controlling the message. Right?

“Logic and evidence alone don’t cut it in the political marketplace”

That is quite true; they certainly don’t. Politics is basically sales, and sales are made on emotions wedded to self-interest and justified a posteriori by logic and evidence. The presuppositions of the logical operation must be properly chosen, and and the evidence carefully selected and spun so as to serve that purpose.

Perhaps you can clarify what you mean by “lying”

Philosopher Harry Frankurt composed a wonderful disquisition entitled, On Bullshit (2005), that investigates with this in detail. Basically, voters expect BS (stretching the truth to gild the lily or put lipstick on a pig) and tolerate it, but they draw the line at lying (speaking falsely with an intention to deceive). There’s a fine line between the two, but people generally recognize it.

Here are some reviewers:

Phil: “Foe example,how exactly is speculation factored in?”

This query, if I understand it correctly, merely underscores Billy’s basic point: The government’s deficit/surplus position is essentially ENDOGENOUS, i.e., determined by the actions of non-government actors. It’s a basic point that even I, a true ‘left wing nut’, have a difficult time grasping.

Bob

@ Tom — Your book recommendation made me smile. You’ve got some pluck. I respect that. 🙂

I’m going to drop the lying tangent because I don’t think we’re going to come to agreement on what constitutes lying in that regard. It’s not exactly germane to my initial point anyway — my point was not about lying per se, it was about cultivating an impression of dishonesty. You don’t need actual “black-letter” lies to do so.

When you say “Basically, voters expect BS (stretching the truth to gild the lily or put lipstick on a pig) and tolerate it…”, I think that voters have tolerated it, and maybe the more cynical voters expect it. But, I also think sentiment is changing, at least on the “righter” shades of the political spectrum. In fact, I think the rejection of this sentiment (that we should expect B.S. from politicians) is part of the make up of the tea party gatherings.

You can call it naivete, but there are many people in the US who expect policians to say what they mean on the campaign trail and then, if elected, make a sincere effort to do what they said. This view, in my limited experience, is much more prevalent on the right than the left; and, in fact, I think some on the left take advantage of this view in order to defeat non-left candidates. That is, much more noise is made over a right-spectrum politician governing against his/her promises than a left-spectrum one. I’ll go so far as to say that I think a left-spectrum polician (in the US) has to work harder at governing against his/her promises for it to even be noticed.

I don’t think that’s conspiratorial; rather, it’s practical — it works. The fact that it works contributes to the impression that those on the right are more “honest” or trustworthy than those on the left.

The other element that is contributing to the impression of dishonesty is the seeming increasing willingness of politicians to vote against the expressed will of the majority. Going back to Mr. Bush (W. not H.W.), when the TARP matter came up for a vote, the calls coming in to congressional offices were approxmately 300:1 against the legislation. It was passed anyway. Many people on the right-side of the spectrum were so disgusted by how that was handled that they either didn’t vote in the following election or they voted for Mr. Obama.

(In fact, I think that TARP was a large contributing factor to Mr. Obama’s win. He ran as the un-Bush; whereas Mr. McCain actually stopped his campagin to promote TARP. Mr. Obama should at least buy Mr. Bush a drink for that one.)

Then, there was the handling of the first stimulus bill, where it was rushed through without much opportunity for even a first-pass reading.

Then, the healthcare legislation was very much mis-managed. Towards the end, Mrs. Pelosi even suggested that congress should deem it passed without a vote.

These incidents, to me, seem to be increasing in frequency. I think people on the right are much more frightened by this kind of governing than by any size deficit.

@RebelCapitalist —

I’m not sure what polls you are referring to. Last one I heard from Rasmussen had 34% of respondents saying that they think the US is heading in the right direction. (Granted, I take polls with a grain of salt.)

Another recent one had Mr. Obama and Mr. Ron Paul closely tied in an election race. That poll validates my point, I think. Ron Paul is widely perceived as trustworthy and honest even by people who disagree with him — he certainly has a long, very consistent voting record in congruence with his campagining. (I don’t know a whole lot about Dennis Kucinich’s positions, but I have heard similar respects given toward him as Mr. Paul.)

@Henry —

> “Politics is basically sales, and sales are made on emotions wedded to self-interest and justified a posteriori by logic and evidence.”

Interesting comment. A few points:

1. There is some evidence that nearly all human decision making, not just sales, is made on emotions (or at least unconcious “thinking”) and then justified a posteriori. Here’s a starter for more information: http://www.consciousentities.com/?p=64

2. The reason for this is most likely because the emotive or unconcious processes seem to be much, much faster than logical thought processes. Unconcsious conclusions “get there first,” so to speak.

3. I’m pointing this idea out because too many people think that in order to sell, you must take the perspective that people are selfish, emotional dunderheads. No, people are pre-occupied with important matters in their lives and are unconsiously made conscious of information that may be relevant to them.

4. Properly designed selling materials aim first for the unconscious and then the conscious minds. How? By choosing wording or imagery that is likely to be closely associated with what the target population already thinks is important.

5. Self-interested does not equal selfish.

Phil, I’d say that the heat of the “political debate” is largely generated by the state of the economy, in which the previous administration landed us. Both sides complain about the other party when out of power, but the amplitude gets ramped up in tough times, and the tone deteriorates.

I am still livid about the constitutional crisis provoked by Bush/Cheney, with an illegal aggression and use of torture. Everything pales in comparison in my book, even all the crony capitalism that led to the meltdown that the world is still trying to dig its way out of.

Obviously, the financial crisis and subsequent contraction of the real economy are clearly economic issues. I believe the Iraq war was also, basically a naked grab for trillions of dollars of untapped oil reserves.

Everything comes back to economic issues.

Bob In Seattle,

The query you mention is mine. It is made to underscore the fact that National account Identities used in MMT flow-stock consistent but static model cannot factor in speculation which is a dynamic phenomenon of excessive behavior leading to instability (Marx/Minsky) and crisis feedback spirals. These effects should be incorporated and I believe that the MMT model can do it if modified accordingly, as my own framework of analysis does.

Food for thought.

In an economy where the effective demand is not satisfied by domestic supply because of production and capital inefficiencies/inadequacies, there is an output shortfall as firms are discredited (ex ante) and distressed (ex post) and they are discouraged in their ability to produce competitively. Furthermore, the internal/external counterparty demand is rationed against domestic output as it considers its purchase to be subject to adversity (ex ante) and evasion (ex post). In these circumstances, public deficit spending, will only increase public/private services, the demand of foreign goods and/or inflation, a case of stagflation and current account deficit. Therefore, in this case public deficit spending of automatic (vertical) stabilizers is neccessary but not sufficient to resolve output shortfall by itself, without structural reorganization/innovation with foreign technology/capital, human capital investment, skill training and comparative advantage specialization. Horizontal/voluntary public investment spending is neccessary to assist this restructuring. It is obvious that austerity prescriptions with market oriented restructuring (IMF ideology) with devaluation, wage cuts and market access/participation procedures will not cure the problem but instead it will bring a demand deficiency problem as well.

“I believe the Iraq war was also, basically a naked grab for trillions of dollars of untapped oil reserves.”

You mean “Operation Iraqi Liberation”? Only later changed to “Operation Iraqi Freedom” for obvious reasons. 🙂

Phil (and Tom)

I hope you dont mind me butting in on your conversation that I have been following with some interest. You are exploring some interesting topics in the manner in which people of differing perspectives should explore them.

You, Phil are correct about the cultivation of an impression of dishonesty within our political system and our society. You seem to think this has come from the left while Tom disagrees. My thoughts here are this. The ideas of the “right” not just in this country but within all cultures originated mostly within certain, what I would call, power institutions. The church (catholic/christian/judaeic in the west and muslim in the east) was the original power instiutiton and through history has played a dominant role in shaping all cultures simply because most laws were made with an eye to church doctrines and text. The left has always been the “counter culture” those that questioned the authority of ancient texts, promoted different ideas (usually through science- a very leftist school of thought originally) and basically told people that “truth” was much more nuanced than the “authorities” were telling them. So the left has always been that element which the power institutions were trying to discredit and muzzle.

The power institutions are pretty good at messaging and have been largely successful at painting counter culture types as untrustworthy and dangerous. I think you see that to this day.

In general I think that when you look on the intellectuals of the right you find people who usually are merely looking for new ways to validate the “truth” they think has already been revealed in old books or understood by someone like Adam Smith. There is no questioning of the current “accepted reality” with new research into completely new paradigms. That comes almost exclusively from the left IMO. So again you have the left venturing into uncharted waters and hence they are in some “untrusted” areas. As our culture has become more comfortable and has seen the fruits we’ve born from questioning the authorities in the past we have moved more left, the cultural overton window so to speak has been moved and I think all the shrieks of “left wing bias in the media” by the right, while overblown, are somewhat true, or WERE somewhat true.

It hasnt been hard pointing out the outright lies of the right in the past, that resulted in slavery, womens oppression, child labor and bad working conditions for the average joe. None of these would have been overcome without a strong left wing counter cultural narrative that rang true to the overwhelming majority of average citizens. TO THIS DAY we still have the right wing working to overturn much of those gains. They are still living that lie in the name of defending the power of business interests, and the church in many cases.

So its not a mystery really why the left is viewed as less honest by the powers. This is a centuries old meme.

——————————————————————————————-

“When you say “Basically, voters expect BS (stretching the truth to gild the lily or put lipstick on a pig) and tolerate it…”, I think that voters have tolerated it, and maybe the more cynical voters expect it. But, I also think sentiment is changing, at least on the “righter” shades of the political spectrum. In fact, I think the rejection of this sentiment (that we should expect B.S. from politicians) is part of the make up of the tea party gatherings.”

The Tea Party gatherings are also inhabited by people who want no govt intervention into their govt delivered health care. They are living examples of “cognitive dissonance” and should never be used as a barometer for anything. I do agree though that people want new political rhetoric AND action to match it the rhetoric. I would put the first point of deterioration with the Gingrich revolution and “Contract for America”. The willful disregard for lawmaking exhibited by that congress in response to Bill Clinton was pathetic. See to me it was the rabid rights insistence that govt couldnt do anything right and was always the problem that was the ORIGINAL big lie. It is wrong that govt can fix everything but it is more wrong that they cant do anything right.

———————————————————————————————————

“You can call it naivete, but there are many people in the US who expect policians to say what they mean on the campaign trail and then, if elected, make a sincere effort to do what they said. This view, in my limited experience, is much more prevalent on the right than the left; and, in fact, I think some on the left take advantage of this view in order to defeat non-left candidates. That is, much more noise is made over a right-spectrum politician governing against his/her promises than a left-spectrum one. I’ll go so far as to say that I think a left-spectrum polician (in the US) has to work harder at governing against his/her promises for it to even be noticed.”

You are correct about the average conservative voter and their insistence on consistency but my comments regarding the Tea Party apply here as well. Too many hold truly conflicting views in their head ( I want my job protected but unions are bad……??? ) I hear a lot of noise about flip flopping and waffling EVERYWHERE. Its political sport here to be the first one to make the charge of flip flopping. Usually the first one to point it out gets the other guy playing defense (right out of KARL ROVES” playbook.

—————————————————————————-

“The other element that is contributing to the impression of dishonesty is the seeming increasing willingness of politicians to vote against the expressed will of the majority. Going back to Mr. Bush (W. not H.W.), when the TARP matter came up for a vote, the calls coming in to congressional offices were approxmately 300:1 against the legislation. It was passed anyway. Many people on the right-side of the spectrum were so disgusted by how that was handled that they either didn’t vote in the following election or they voted for Mr. Obama.”

Voting against the will of the people is a tough one. The “will of the people” would not have passed a civil rights act. Its true that sometimes people have no clue whats best for them. We all suffer from an inability to understand completely the fallacy of composition.

————————————————————————————————————–

“Then, there was the handling of the first stimulus bill, where it was rushed through without much opportunity for even a first-pass reading.

Then, the healthcare legislation was very much mis-managed. Towards the end, Mrs. Pelosi even suggested that congress should deem it passed without a vote.

These incidents, to me, seem to be increasing in frequency. I think people on the right are much more frightened by this kind of governing than by any size deficit.”

Well I think people on the right are always more frightened for the reasons I laid out in my opening. They see the left as the “counter culture”, actually today that has morphed in to the “anti culture”. Certainly just because someone is frightened we need not appease them and being frightened because so much is being done is silly when everyone knows much NEEDS to be done. Yes we need to talk about what needs to be done but we talked for over a year on healthcare (and ended up with the Gingrich congress’ republican health plan alternative to Hillary care!!) and have been talking for almost three on financial reform. The stimulus package should NEVER have to be discussed. If you hang out here you know that fiscal response is not only the most effective at spurring aggregate demand but that what ever affect it has on the deficit is meaningless. Yes too many democrats dont understand our monetary system either but the republicans just wanted to stop anything that might make Obama look good…….THEY SAID THAT UNASHAMEDLY!! Do you as a conservative want the economy to recover even if Obama gets “credit” for it?? I hope so but waaaayyy tooo many on your side do not. And I’m not sure I can give you a better example of dishonesty than that. THATS the kind of governing that should give them pause not the ugly look into the sausage making in our govt. Lets have a look inside all the corporate boardrooms around America too. We might all be disgusted there as well.

——————————————————————————————————————

:

“1. There is some evidence that nearly all human decision making, not just sales, is made on emotions (or at least unconcious “thinking”) and then justified a posteriori. Here’s a starter for more information: http://www.consciousentities.com/?p=64

2. The reason for this is most likely because the emotive or unconcious processes seem to be much, much faster than logical thought processes. Unconcsious conclusions “get there first,” so to speak.

3. I’m pointing this idea out because too many people think that in order to sell, you must take the perspective that people are selfish, emotional dunderheads. No, people are pre-occupied with important matters in their lives and are unconsiously made conscious of information that may be relevant to them.

4. Properly designed selling materials aim first for the unconscious and then the conscious minds. How? By choosing wording or imagery that is likely to be closely associated with what the target population already thinks is important.

5. Self-interested does not equal selfish.”

1 and 2 are inarguable. Lots of recent cognitive studies have shown this to be so. 3 is more your opinion and I think you should consider that being “pre-occupied with important matters in their live” IS what being a selfish emotional dunderhead looks like( or I should say PART of what being a selfish…….). Your really not disagreeing with Henry your making a category error. 4 is inarguable as well. 5 is almost unnecessary to say.

No one would deny being self interested (nor apologize for it ………. thankfully) but almost all would deny being selfish by our cultural terms of the word. Every creature is self interested but many are not selfish by OUR definition. By the biological definition we all are selfish but what is also true is that when we are in groups selfishness is optimized by different strategies, many which include self sacrifice. Selflessness is a biological strategy for perpetuating your genes to the next generation. It is also a strategy within human culture for societal and individual gain. Thats why so many people “fake” selflessness, we really do value real selflssness.

TO ME, the real turn off of the modern American conservative movement is its focus on self or individualism. I think this is a natural result of a paradigm that started with a belief in a supreme being (God or Jesus) and has since gravitated to strong individuals who were seen as chosen leaders and just a little more perfect than the rest. Business men who are “necessary” to our economy and should be treated special, presidents whose decisions shouldnt be questioned (unless they have a D in front of their name) and religious leaders who can hide themselves behind church doctrine and not face secular world scrutiny. I value individual achievement but try to recognize that TRULY I am not a self made man. None of us are.We all have benfited necessarily and willingly from the untiring efforts of others like teachers, policeman, firemen, friends, coworkers etc etc etc .Yes many have achieved more and did better on some standardized tests than others but no matter what we are NOT self made, we are products of the groups which we have chosen and sometimes been forced too interact with. The modern conservative movement is so hyperindividualistic and anti collectivism it flies in the face of all we KNOW about how our universe operates. Therefore in that respect it is the biggest “untruth” out there.