In the annals of ruses used to provoke fear in the voting public about government…

Argentina entering the usual doom loop that austerity inevitably creates

‘A picture is worth a thousand words’ is an old adage, which means that some image can express a very complex message more quickly than a written tract – of the sort that will follow in this blog post. At the Spring 2025 meetings of the IMF in Washington, the IMF boss Kristalina Georgieva was ebullient about how well Argentina was doing as a result of the harsh austerity (‘shock therapy’) that the current President Javier Milei has unleashed on his nation. If you watch the IMF boss please also have a brown bag handy for the obvious nausea that will follow. The scene became even more bizarre when the new Minister of Deregulation and State Transformation. aka El Coloso, one Federico Sturzenegger, during a panel with others including Rachel Reeves, pinned a little badge of a chainsaw to Georgieva’s lapel. It was all very lavish and symbolic and ignored the plight that these elites have imposed on ordinary citizens back in Argentina. What is happening back in Argentina is once again demonstrating how the ideology of austerity initially promises the world to the citizens only to backfire and turn to crisis.

Here is the picture.

It tells us many things but the most significant message is that the foremost multilateral economic agency in the world is a central cog in the neoliberal machine that seeks to sustain the capacity of the elites to take as much of the national enterprise for themselves as they can, while juggling the social instability that such a strategy always creates.

While Sturzenegger was ingratiating himself with Georgieva, down (up) the road in New York, Trump and Milei met.

At that meeting during the recent UN General Assembly in New York, Trump promised the South American nation $US20 billion in financial support to shore up its foreign exchange holdings which are now running low.

The Treasury Secretary Scott Bessent announced the “economic rescue package” despite the IMF lavishly praising the austerity programs of Milei.

It seems you can have it both ways – hammer the economy into the ground as a symbol of a successful fiscal strategy and then put the hand out to be rescued from the immense damage the fiscal strategy has inflicted.

The rescue package, of course, is in fact a demonstration of the way the Americans consistently interfere in national elections around the globe, despite crying foul (like little babies) when other nations seek to influence the American political process.

The package is designed to calm the financial markets – who also have praised the fiscally-induced wreckage and rising poverty rates – until, of course, the reality backfired on them and they ran from the peso as fast as they could.

Why calm the markets now?

Because next month there is the midterm election (October 26, 2025) and Milei and his Far Right cronies are in trouble.

At the November 2023 presidential runoff election, Milei won 56 per cent of the vote.

That popularity is now falling fast and the Americans want to do as much as they can to get him across the line, given his policies are consistent with advancing the interests of US capital.

After his election, the financial markets assumed they were in for a party and the Argentinian – Merval Index – of its share market rose significantly as the speculative frenzy unfolded.

The Merval is now falling fast as the graph below shows.

The El Pais article (September 20, 2025) – Milei’s fall from grace: Argentina’s stock market becomes the world’s worst performer in 2025 (behind a paywall) – noted that:

The Merval index, which groups more than 20 major companies in the country, has declined around 30% so far this year, making the local stock market the worst-performing in the world during the first eight and a half months of 2025.

We learn that while there has been a lot of ‘profit taking’ this year, the main reason for the share market rout was Milei’s defeat in a provincial election in Buenos Aires earlier this month.

The Peronist Left (a combination of parties) secured the election by 13 points and this province accounts for around 40 per cent of the national electorate.

The message from the Left was clear – stop hurting the people to advance the interests of the few, particularly foreign investors.

The point also is that Milei invested his own political capital in the election, even though it was for a provincial legislature, pitting himself against so-called – Kirchnerism – (the centre-left movement of the Kirchner dynasty).

I don’t classify Kirchnerism as a functional Left alternative because it has struggled to abandon its initial neoliberal (mainstream) macroeconomic thinking.

But it is distinct from the Far Right that Milei represents.

As the Merval started its descent, the government sought to sustain its peso peg with the US dollar, which led to massive losses of foreign exchange reserves.

A typical outcome when a central bank tries to maintain an unsustainable exchange rate peg.

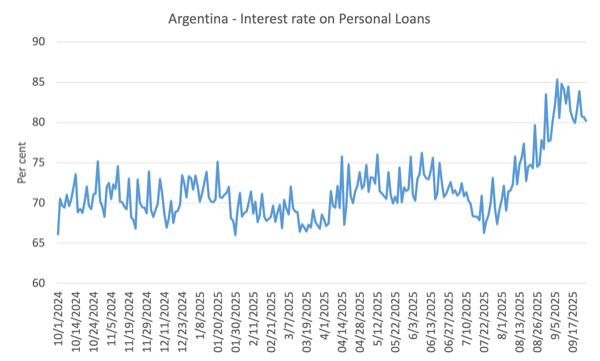

Its first misstep came in early September (4th) when interest rates were pushed up to over 80 per cent and continued rising until September 15, when they peaked at 84.47 per cent.

Here is the evolution of interest rates on personal loans since the beginning of 2024 – almost the full Milei period to date.

The next policy failure as the financial crisis deepened was to increase the reserve requirements for banks to 50 per cent as a way of reducing peso liquidity.

That didn’t work and then they were forced to sell US dollars in the foreign exchange market.

The sell-offs continued.

One might initially see this as a victory for the Left.

But my reading of the situation is that it is more an own goal from the Far Right, who are becoming mired in the inevitable personal corruption scandals (for example, see this UK Guardian story (August 27, 2025) – Javier Milei embroiled in corruption scandal tying his sister to alleged bribes).

There is a curious tension – perhaps we will use that word – between the way the US president and his regime are conducting economic policy.

I call it a regime now rather than an Administration, because the latter term usually implies some order and lawful behaviour, which is not the way we see the goings on in the US these days.

On the one hand, it is acting like the anathema of neoliberalism domestically and effectively dismantling the operations of key neoliberal institutions on the world stage (for example, the WTO).

But on the other hand it is providing fiscal support to the Far Right in Argentina who have vowed never to record another fiscal deficit – which the IMF considers the epitome of virtue.

But at any rate, Trump’s bailout for the Argentinian Far Right government has exposed frictions in the US.

The Politico article (September 25, 2025) – Trump-pledged support for Argentina stirs anger among Republicans – quotes an observer as saying:

Milei is done politically, his sister is corrupt, his finance minister is an insider trader, and they have pissed away $15 billion in IMF money and $15 billion in central bank reserves propping up a crap currency, and now Treasury wants American taxpayers to double down on stupid …. was a fraud. Came in, betrayed all the conservatives and libertarians that supported him … it’s all a wash.

But while all these global gymnastics and posturing has been going on, the reality is that on the ground in Argentina things have turned sour because the austerity regime that Milei and his cronies imposed could never live up to the narrative that they were essential to improve the living conditions of the poor and the weak.

The initial growth surge the nation enjoyed on the back of Milei’s electoral win is dissipating.

That growth surge did little to address the chronic poverty in Argentina even though official poverty rates, which peaked at 53 per cent in mid 2024 are lower.

It is clear that the official data from National Institute of Statistics and Censuses (INDEC) is over-stating the actual changes in living conditions.

This article in the Buenos Aires Herald (September 27, 2025) – Poverty is down again — but are Argentines really faring better? – helps us understand the statistical elements of that overstatement.

Poverty measured in income terms is only one element.

Other factors, such as, “access to health services, water and sanitation, social security, decent housing, and quality employment” (Source) are also important and they have been ravaged by the Milei austerity.

Real wages have fallen significantly in the public sector for registered workers.

In Argentina, registered workers are those with formal contracts, pay social security, and benefitting from legal protections, while unregistered (“informal”) workers operate without official contracts, lack social security benefits, and face significant wage gaps and precarious working conditions.

The following graph shows the evolution of real wages for registered workers since Milei assumed office.

The impact on public sector workers of the fiscal cuts has been significant.

Overall, for the most protected workers in the nation, real wages are now 6 per cent below the level at the start of Milei’s period in office.

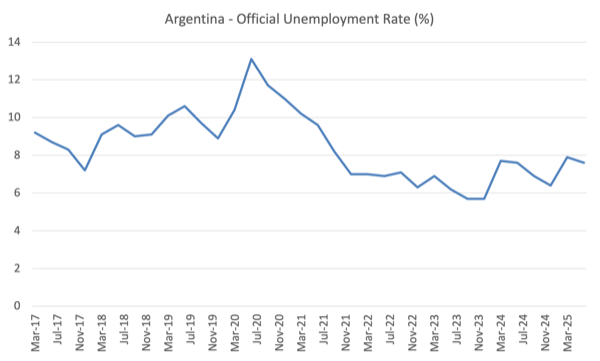

Official unemployment was 5.7 per cent when Milei came to office.

By June 2025 it had risen to 7.5 per cent.

But within that aggregate there is massive disadvantage among certain cohorts.

For example, in June 2025, women aged between 14 and 29 are enduring an unemployment rate of 16.9 per cent.

The corresponding male rate was 12.7 per cent.

The rate for prime-age males has risen from 3.2 per cent in September 2023 to 4.9 per cent and rising fast.

Total employment has fallen by 214 thousand since the December-quarter 2023 as a result of Milei’s spending cuts and direct targetting of public sector workers.

And a lot of the workers that have remained employed have moved into precarious jobs with major income consequences.

The rate of unregistered workers is also rising and is currently above 36 per cent.

These are workers with little material future.

There is also huge and growing income inequality as a result of these labour market shifts, which reinforce the negative consequences of increasing precarity.

In the March-quarter 2025, INDEC data shows the following family income statistics:

| Quintile | Proportion of Households | Proportion of Total Income |

| Bottom quintile | 15.2 | 5.3 |

| 2nd quintile | 18.7 | 10.1 |

| 3rd quintile | 21.0 | 15.3 |

| 4th quintile | 21.5 | 22.7 |

| Top quintile | 23.6 | 46.7 |

Moreover (Source):

… 40% of the population with the lowest income receive, on average, less than the SMVM, while the highest income sectors can earn up to 13 times more.

This is a doom loop being exacerbated by the on-going fiscal austerity.

The other point is that while the nation is not in recession yet, there is a reluctance to invest in new productive capital given the rising uncertainty that the austerity has caused.

Ultimately, as at the turn of the century, the unsustainable currency peg against the US dollar will probably be the factor that hastens the government’s downfall.

They will require further IMF and US government support to maintain this peg and that will come at a cost of the conditionality, which in the context of the IMF, with its chainsaw pin wearing boss, will involve even more damaging austerity.

Conclusion

A doom loop following the typical path that libertarian governments pursuing austerity drive themselves into.

That is enough for today!

(c) Copyright 2025 William Mitchell. All Rights Reserved.

Michael Hudson posted, last 5 of March (“Why Banking Isn’t What You Think It Is”), that assassinations are back in Argentina.

Chainsaws in Argentina are allways a little bit more literal than you would expect.

Or maybe that’s just one more “cool war”, just like the genocide in the middle east.

Neil Wilson Reddit comments:

“ In a floating exchange rate system there is no external imbalance. It has to all be balanced by definition. What he’s doing is missing an export – savings in the denomination of issue. Savings that can be produced like gold bars from a gold mine.

We have to start seeing exported savings as we see ‘non-monetary gold’ exported from a country with a gold mine.”

Specific about Argentina

“ The greater the exports the poorer a nation gets. As we discovered with the East India Company for about two centuries. How well did Bangladesh do out of that arrangement? The Company definitely increased “aggregate demand” and GDP in Bangladesh as it transferred wealth to the imperial centre in England.

With FDI economies of scale benefits tend to accrue to the foreign currency area not the local currency area.

Argentina, for example, effectively rents quite a lot of its physical area to the US dollar currency zone for its benefit. Hence why the Peso currency zone is permanently in crisis.”

I don’t really understand Milei’s goal, but I was of the opinion that perhaps in his own view, in order not to create inflation (although there’s seems to be inflation on domestic goods now I think), he was going to be running a managed float for a while until he gets to export more natural resource produce, instead of allowing the peso to float or at least float at a much lower rate (where even inflow from tourism could come in and help boost local businesses and the currency as well).

You have written about such a plan in the past (I think for Iceland, can’t remember) that involves using loans from an international organization to maintain the rate of the local currency for a certain standard of living, while looking to export more or get more foreign exchange into the country in the main time, of course without the austerity.

@Kenneth Isaac

Couldn’t it be said that his ‘goal’ is to allow the rich to take convert their Pesos for Dollars at a discounted exchange rate? Then devalue/allow depreciation and have the public shoulder the cost i.e. more expensive essential goods imports all while the country is saddled with more foreign currency debt.

@Sid

Yes, that is exactly it. Caputo’s (economy minister) economic policy is based in guaranteeing high returns for the carry trade. High interest rates, managed exchange rates. Devastating to the economy…but very lucrative for a select few. And that’s what they’re in power for, serve those interests. And he’s addicted to debt, he was partly responsible for the huge IMF loan under Macri’s administration, which for all intents and purposes, they pissed down the toilet.

@Sid

that is what it is turning out to be, but then again he really needs the election coming up so maybe he’s just following his school of economics. I read that they’ve started or going to start exchange controls, I’m not sure what effect it would have but most def, the rich are the winners and they’re winning very big.

Well, Argentina chose to destroy its own sovereign currency status for greed.

Capitalism hijacked politically, which is how it rolls, but sadly, in the west, with strings pulled by massive private capital all made possible by the greedy politicians (legislators) approving the redistribution of wealth to a minority using such tools as lobbying, think tanks and party donations.

This is what happens when voters get polluted by myths, lies and fairytales in economics by the very people who are meant to represent them, as being trusted.

Its a grubby system, and I don’t like it, because its represented by a uniparty in the collective west. Two major party system merely uniparty with neoliberalism.

It is most certainly political decisions by legislation that decides where the magic keyboard deposits the created money.

All under a US hegemony thats gone rogue, what hope does the majority have in the west, except Japan by the looks, but that could change too.

forgive me for asking, but what is the effect of increasing the rates on personal loans and how is it a misstep? Also,

So, I’m not sure if it’s because the currency is pegged or if the personal income rate is the rate we should looking at for developing economies as opposed to the central bank rate which is at 29% (although they did put out a LECAP bond denominated in the Argentine Peso at 50-60%).

Thank you.

I forgot to add some additional information, that’s why I have an “Also, ” in my last comment.

I wanted to say that I only just discovered after re-reading this article again today that the Argentine peso is actually pegged. I always thought it was a managed float because that’s what they and everyone (except Bill) said even before the first time I read this piece. I had to even quickly confirm the currency of my own country is a managed float like they said.

Check out IMF AREAR, it talks about exchange rate regimes of various countries, with details and all on capital/current account convertibility. Though it hasn’t been updated since 2023.

https://www.elibrary-areaer.imf.org/Pages/Reports.aspx

@Sid thank you. it was still useful.