The Reserve Bank of Australia (RBA) increased the policy rate by 0.25 points on Tuesday…

The delusional RBA has everyone convinced that they are the reason inflation is falling

It’s Wednesday and as usual I present commentary on a range of topics that are of interest to me. They don’t have to be connected in any particular way. Today, RBA interest rate decisions, COVID and some great music. Yesterday, the Reserve Bank of Australia (RBA) held their target interest rate constant. In their media release (June 18, 2024) – Statement by the Reserve Bank Board: Monetary Policy Decision – the RBA claimed that “higher interest rates have been working to bring aggregate demand and supply closer towards balance”. The journalists duly digested the propaganda from the RBA and throughout yesterday repeated the claim relentlessly – that the RBA had done a great job in ‘getting inflation down’ and now was attempting to ‘navigate’ a sort of knife edge between effective inflation control and the increasing probability of recession. It was an amazing demonstration of being fed the narrative from the authorities, and then, pumping it out as broadly as possible through the mainstream media channels to the rest of us idiots who were meant to just take it as gospel. Not one journalist that I heard on radio, TV or read questioned that narrative. The emphasis was on the ‘poor RBA governor’ who had a difficult job protecting us from inflation and recession. Well, my position is that the decline in inflation since the December-quarter 2022 has had little to do with the 11 interest-rate hikes since May 2022 and more to do with factors changing that are not sensitive to domestic interest rate variations. Further, the impact of two consecutive years of fiscal austerity (the Federal government has recorded two fiscal years of surpluses now) has mostly been the reason that GDP growth is approaching zero and will turn negative in the coming quarters at the current policy settings.

Monetary Policy

The RBA claimed that there was “continuing excess demand in the economy, coupled with elevated domestic cost pressures, for both labour and non-labour inputs”, which they then conclude means that interest rate diligence is essential.

It is very hard to make the ‘excess demand’ argument given how weak total spending is at present.

The latest National Accounts showed that GDP grew by only 0.1 per cent in the March-quarter 2024.

There is growing excess capacity in Australia – meaning that the nominal spending is not absorbing the capacity of the economy to produce.

Further, the ridiculously low wages growth in Australia is interpreted by the RBA as “above the level that can be sustained given trend productivity growth”.

In the last two years, the RBA bosses claimed that wages growth was about to break out and threaten the ‘fight’ against inflation.

It was a 1970s-style narrative – we have to increase unemployment to stifle the non-sustainable wages pressure.

Except, the problem for them was that the wages pressure never eventuated and their so-called private business briefings, which were never published, were obviously false.

The RBA acknowledge that “growth in unit labour costs have eased” but fail to mention that the change in real unit labour costs (the relationship between real wages and productivity) has fallen consecutively over the last 6 quarters, and that the private sector real wage has since the June-quarter 2021 fallen in 10 of the 12 quarters and remains below the June-quarter 2021 level.

Trying to push the blame for the inflationary pressures on wages growth is one of the more insidious aspects of the current RBA leadership.

Interestingly, the RBA talk about the “high level of uncertainty about the overseas outlook” and how the “geopolitical uncertainties, including those related to the conflicts in the Middle East and Ukraine, remain elevated, which may have implications for supply chains.”

Yes.

And how the RBA thinks interest rate movements in Australia will have any impact on those ‘risks’ is another question.

In her press conference yesterday, the RBA Governor who in June last year claimed the NAIRU was 4.5 per cent and then later in the year denied that the RBA knew what ‘full employment’ meant (which in the New Keynesian paradigm that she operates means the NAIRU is unknown), expressed a bullying tone, with veiled threats that interest rates might have to continue rising because as the statement yesterday claimed “Inflation is easing but has been doing so more slowly than previously expected and it remains high.”

Threats are the norm for this institution now.

The whole narrative has shifted though given that inflation has fallen considerably since 2001.

Now the story is that it is not falling fast enough and that sort of nonsense has no basis in any economic theory.

The only tenuous link is that the New Keynesians claim that inflation rates will become embedded in expectations and then become a self-fulfilling event.

The evidence – that inflationary expectations are very moderate at present and have been for some years – doesn’t help establish that link in Australia (or anywhere at present).

So it is just another of the many dodges that the RBA has been using to justify their unjustifiable rate hikes.

What the rate hikes have done is redistribute huge amounts of national income from low income mortgage holders to high income and asset rich cohorts who hold financial assets.

They have presented the shareholders of the commercial banks with a windfall.

And an Oxfam Australia report released today (June 19, 2024) – Cashing in on Crisis – demonstrates that the profit and price gouging was instrumental in creating and sustaining the inflationary pressures.

I will comment more on that another time.

But the conclusion is clear:

Between the COVID-19 pandemic and high inflation caused by war and corporate profiteering, it was a tough start to the decade for most. Even in relatively wealthy countries like Australia, millions of people have been pushed to the brink by rising prices of food, energy and unaffordable rent. In stark contrast, this has been a profits bonanza for some of Australia’s biggest corporations.

The RBA has consistently denied that there was any profiteering going on and even went as far as lying about the profit boom.

Finally, if we look at the movements in the components of the Australian CPI since the pandemic it is very hard to make the case that the inflationary pressures were the result of an excessive spending event where the supply side was operating at potential.

The dominant contributors to the pressures were food and non-alcoholic beverages (in the face of drought, floods and fires and pandemic supply problems), housing (most rents), transport (OPEC oil price hikes), and recreation and culture (post pandemic adjustments to travel in the face of profit gouging by the airlines).

The housing component in interesting because this is one way in which the RBA rate hikes have actually been inflationary.

The major driver here has been rents and landlords have taken the liberty in a tight rental market to push the rising rate costs onto the tenants.

The other major drivers are due to the pandemic, war and OPEC and are hardly sensitive to local shifts in interest rates.

And as they abate, the inflation rate abates.

Nothing much to do with the RBA.

More data coming through on COVID outcomes

Regular readers will know that I have taken a rather different perspective on the pandemic from what seems to be the norm.

My position is that humanity is dealing with a dangerous virus and has not demonstrated sufficient caution and will rue the long-term consequences of that indifference and myopia.

As time passes, the evidence is mounting to support my position and is demonstrating that those who considered it a ‘bad flu’ or something similar and/or who claimed it was best just to let it ‘run through the herd’ to build immunity have underestimated the threat significantly.

Those who bombarded us with Tweets, Op Eds and books about the folly of being cautious and laced their berating with all sorts of conspiracy type theories have done us all a disservice.

We are slowly gaining a clearer picture about the disease – what it does, who it impacts on, etc.

A recent ABC analysis (June 16, 2024) – Too many children with long COVID are suffering in silence. Their greatest challenge? The myth that the virus is ‘harmless’ for kids – synthesised the most recent knowledge on the issue, with specific reference to children.

The denialists all claimed that COVID was not a problem for children and any attempt to protect them via restrictions, better ventilation in schools, mask-wearing protocols and vaccination was an affront and would cause untold mental health problems.

The mounting evidence is contrary to those claims.

In terms of long COVID, there are now:

… millions of children who have it worldwide are practically invisible, their suffering — and the formative years they’re losing to this disease — obscured by the myths that COVID is “harmless” for kids and the pandemic is “over”.

And the medical profession in Australia is in denial about the problem preferring to take the position that the children that present with debilitating symptoms are malingering in some way – “their pain and fatigue is ‘all in their head'”.

The teaching profession that has refused to demand proper ventilation in schools are also implicated as “parents have been gaslighted and blamed” for the ‘laziness’ of their children.

The article notes that:

… experts are concerned that all this ignorance and apathy — and the unwillingness of governments to do more to curb COVID transmission — is exposing a generation of children to the same chronic illness and disability, with potentially devastating consequences.

I had dinner with some friends the other day, after ensuring that they were free of any respiratory illnesses, and I was amazed to hear them articulate a denialist viewpoint.

They are both highly educated, progressive and great people.

An expert who runs a newly badged long COVID clinic in New York told the ABC that:

We see kids missing school, being unable to participate in sports, we see social isolation.

The other problem is that the “acute phase” of a COVID infection is typically milder for kids.

But the evidence is mounting that:

It doesn’t matter how mild your acute COVID infection is … You have the same risk of developing long COVID. And I say ‘cumulative’ because the latest data shows us that with every reinfection, your risk of long COVID increases.

What does the data say about proportions?

Up to 5 per cent of kids are now vulnerable.

Even if the proportion was 1 per cent, that is:

… significant given huge swathes of the population are getting (re)infected — and the impacts of long COVID are so severe …

… long COVID can affect multiple organ systems and trigger a constellation of symptoms that can last for months or years: the most common are fatigue, including post-exertional malaise (PEM) or “crashing” after even light activity; cognitive dysfunction and headaches; gastrointestinal issues and allergic reactions; nerve and muscle pain; dysautonomia; and shortness of breath.

The New York doctor summed it up:

I just worry we’re going to have a generation of kids who have a post-acute infection syndrome because we failed to protect them.

There was also a new study published on Monday (June 17, 2024) in JAMA – I just worry we’re going to have a generation of kids who have a post-acute infection syndrome because we failed to protect them – that adds to our knowledge of how bad this disease is turning out to be.

I will leave it to those interested in the topic to read it in full.

The research design is sound.

Its conclusion:

In this cohort study of 4708 participants in a US meta-cohort, the median self-reported time to recovery from SARS-CoV-2 infection was 20 days, and an estimated 22.5% had not recovered by 90 days. Women and adults with suboptimal prepandemic health, particularly clinical cardiovascular disease, had longer times to recovery, whereas vaccination prior to infection and infection during the Omicron variant wave were associated with shorter times to recovery.

More than 20 per cent of people are still sick 3 months after infection.

And what will be the consequences in the years to come for these people?

That remains to be seen but the growing evidence suggests bad things are coming.

My response: I am keeping my mask on when in public and avoiding public situations where I have no control on the interactions.

Advance orders for my new book are now available

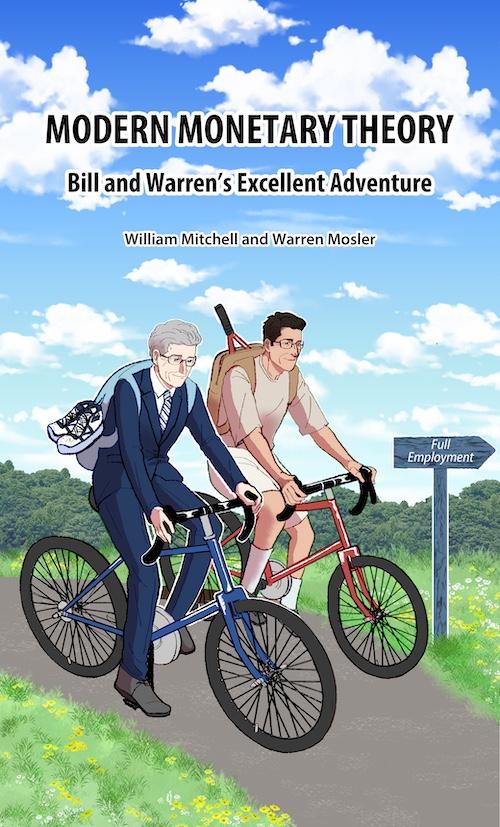

The manuscript for my new book – Modern Monetary Theory: Bill and Warren’s Excellent Adventure – co-authored by Warren Mosler is now with the publisher and will be available for delivery on July 15, 2024.

It will be launched at the – UK MMT Conference – in Leeds on July 16, 2024.

Here is the final cover that was drawn for us by my friend in Tokyo – Mihana – the manga artist who works with me on the – The Smith Family and their Adventures with Money.

The description of the contents is:

In this book, William Mitchell and Warren Mosler, original proponents of what’s come to be known as Modern Monetary Theory (MMT), discuss their perspectives about how MMT has evolved over the last 30 years,

In a delightful, entertaining, and informative way, Bill and Warren reminisce about how, from vastly different backgrounds, they came together to develop MMT. They consider the history and personalities of the MMT community, including anecdotal discussions of various academics who took up MMT and who have gone off in their own directions that depart from MMT’s core logic.

A very much needed book that provides the reader with a fundamental understanding of the original logic behind ‘The MMT Money Story’ including the role of coercive taxation, the source of unemployment, the source of the price level, and the imperative of the Job Guarantee as the essence of a progressive society – the essence of Bill and Warren’s excellent adventure.

The introduction is written by British academic Phil Armstrong.

You can find more information about the book from the publishers page – HERE.

You can pre-order a copy to make sure you are part of the first print run by E-mailing: info@lolabooks.eu

The special pre-order price will be a cheap €14.00 (VAT included).

Music – Fleetwood Mac

This is what I have been listening to while working this morning.

The original – Fleetwood Mac – which was formed by one of my favourite guitar players – Peter Green – were one of my favourite bands when I was a teenager trying to learn guitar.

I had a lot of their records and just loved the way Peter Green played.

This Peter Green song, which was not one of their big ‘hits’ – Black Magic Woman – was released in 1968.

It demonstrated his sharp, biting tone and exquisite phrasing in a D minor blues setting with Latin overtones.

It is 2:46 of some of the greatest playing one could ever hope to hear.

It was first released as a single then was included on a ‘compilation’ album released in 1969 – The Pious Bird of Good Omen.

Readers will be more familiar with the version by Carlos Santana that became one of his biggest hits.

Unfortunately, Santana altered the chord pattern and rendered the song relatively uninteresting from a musical perspective, although his own playing was exceptional.

Peter Green’s run down from Dm7 to C7 to Bb7 to A7 back to Dm7 – which is not included in Santana’s version is a thing of beauty in shift and resolution.

Magnificent.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

“Inflation is easing but has been doing so more slowly than previously expected and it remains high.”

If there is any truth in this, it is more than likely the result of rising interest rates, where the increased financing costs for businesses have been passed onto consumers in the form of higher prices. In Japan, where interest rates were scarcely raised at all, inflation barely rose and quickly fell once the worst supply-side effects of the COVID pandemic subsided (also helped by anti-inflation measures taken by the Japanese Govt).

The following is a statement typically made by mainstream economists and central bankers: “When interest rates are high, the cost of borrowing is high, and consumers typically respond by spending less”.

One could also say the following: “When interest rates are high, the interest income on financial assets is high, and consumers typically respond by spending more”.

The former applies to some consumers (not all consumers) and the latter applies to the rest. Since one person’s interest payment is another person’s interest income, the latter effectively offsets the former. In fact, the latter usually exceeds the former because some interest income is earnt from the possession of central-government securities, which constitutes a net increase in total consumer income. Whatever the case, higher interest rates do little to reduce private-sector spending, as evidenced by the fact that aggregate spending has not fallen precipitously since the RBA raised interest rates and whatever weakening has ensued it has been largely due to the dampening impact of the Fed Govt’s budget surplus and Australia’s current account deficit (more income flowing to the ROW than vice versa).

In addition, private sector borrowing has risen since January 2023 and Australia’s household saving to income ratio fell in the first quarter of 2024 from 1.6% to 0.9%. Australians don’t seem to be borrowing less. I haven’t checked, but they might also be drawing on the savings generated by the peak-COVID Fed Govt deficit spending.

(S – I) = (G – T) + Current Account

With G – T < 0 and Current Account < 0, S – I must also be < 0

Giordano Bruno was burnt alive for telling the truth.

The truth about the laws of macro-economics is a taboo for the establishment, because the elites, that command the establishment, want you to believe that the “sun orbits around planet earth”.

Giordano Bruno lived in the middle ages and we going back to those times at high speed.

The RBA is still selling magic beans…

It’s very sad that sales are booming in the wider community.

RBA has beliefs more dangerous that belief in NAIRU.

RBA believes in economic growth.

Welcome to the world of financial journalism where the population remains uninquisitive churnalists and stenographers for the RBA line. Don’t they, at least, consider how the times impinge upon their own day to day economic circumstances and what they see around them before writing up the RBA line as gospel? Bullock was recently surprised by an increase in petrol prices when she went to fill her car. That became the flawed driver of her argument that followed immediately thereafter as if increasing interest rates, which add to the cost of doing business that get passed on to an end consumer, could have any bearing on reducing supply side petrol pricing.

Take note that when the decision makers don’t want to explain something they exclaim that “It’s complex” and the media rolls over and moves on without calling for a “try me with your explanation”.

Where’s the discussion within the financial media of all those past years during which productivity growth was not equitably shared by capital with the workforce and where the lion’s share of the increase had gone and continues to go to owners of capital? It’s as if those years never happened and the workers must now start from the current inequitable baseline for any future distribution of an increase in productivity before becoming “entitled” to a pay rise. No catchups allowed for past inequities in our capitalist economy to rebalance between capital and the workers, just a continuation of a race to the bottom for the many with disproportionate financial benefits flowing to the few.

Humans remain the most self-delusional species (in the face of reality) that ever existed. Our inability to change based on facts, logic and reason continues following the groupthink tribal view till catastrophe arrives to throw everything into turmoil. We seem to lack the capacity to evolve from children to true adults and remain a society controlled by lots of old children.

Bill – thanks for comments and commentary.

Have you seen this:

Why Does the Government Borrow When It Can Print?, by Ellen Brown:

https://dissidentvoice.org/2024/06/why-does-the-government-borrow-when-it-can-print/

Further to Black Magic Woman.

Sadly, Peter Green’s stature as an incredible guitarist seems to have diminished over the years.

Like you Bill, Greeny is one of the main reasons I took up guitar; Mick Taylor, who followed Green in the Bluesbreakers, being another.

Interesting in the very original line-up there was no Mac – the bass player was Bob Brunning, who went into Savoy Brown.

I had an adult guitar student 15 years ago – big Peter Green fan – who once remarked to me “There were no sheilas in Fleetwood Mac.” (Probably not the sort of comment that’d pass muster today?)

As usual, thumbs up for all the above!

/& yes, always preferred the Green version of BM Woman – other standout on that album of course is Need Your Love So Bad, a cover of Little Willie John’s original.

Fred Schilling and readers, in view of what Fred has said, you may be interested in the following article:

https://mahb.stanford.edu/wp-content/uploads/2023/02/855-Article-Text-4479-1-10-20230131.pdf

Great post, Bill.

In regards to inflation, I wonder if there is also a phenomenon where, with most households being squeezed by the prices of rents, mortgages and necessities, small businesses (eg the local takeaway shop) are putting up prices to try to maintain revenue from their remaining customers. This would be another factor that would make the tightening of monetary policy contrary to the aim of reigning in inflation.

I’m right there with Bill Rees, Phil. I don’t know about you but the most difficult thing I’ve ever had to deal with in my near 75 years have been people. Starting out thinking that others see what you see but sooner or later realising that just isn’t so. Then trying to work out how to navigate through that mire to achieve best outcomes with loads of difficult people doing their darndest to prevent that.

Our failings were probably summed up very many years ago but one of more recent vintage that has never left me is when I read of Andre Malraux talking to an old priest who had listened to confessions for half a century and asked of him what he had learned about people. The priest thought for a moment and then responded “First of all people are much more unhappy than one thinks…and the fundamental fact is that there is no such thing as a grown up person.” Amen. Well, I think that was about right but the priest left out “absurd”.

Should others be interested in seeking further understanding of our absurd species I recommend the musings of Henry Madison (RageSheen on X) and the writings of Caitlin Johnstone on Substack.

Now, how do we get those in charge to publicly reveal that they’ve been lying to us about the realities of the operations of fiat money?