These notes will serve as part of a briefing document that I will send off…

New research report finds massive price gouging across all sectors of Australian economy

Over the last few years, the RBA has been emphatically denying that price gouging from corporations with significant market power has been driving the movements in the inflation rate. They knew that if they conceded that reality then there would be no justification for the 11 interest rate hikes they have introduced since May 2022. It was obvious that firms were pushing up profit margins – that is, increasing prices beyond the increases in costs. Still, the RBA denied it and claimed that firms were facing wage pressures and excessive demand, which justified the interest rate rises, despite the evidence not being supportive. On Tuesday (February 6, 2024), a new study has found that there is massive price gouging across all sectors of Australian economy by corporations, many of them operating in sectors that were heavily privatised (for example, airlines, electricity, child care, banking). There is systematic profit margin push going on which has been a significant contributor to the persistent inflationary pressures. These findings strip the RBA of any justification for their unconscionable rate rises which have transferred billions to the financial elites at the expense of low income mortgage holders.

On April 5, 2023, the then RBA Governor addressed the National Press Club in Sydney and in his prepared speech – Monetary Policy, Demand and Supply – he said:

… while firms on average have been able to pass on higher costs and maintain profit margins, inflation has not been driven by ever-widening profit margins.

In the Q&A session that followed he elaborated on the growing claims that the inflationary episode was being driven by corporate profit-gouging rather than wage demands (Transcript of Q&A):

… rising profits are not the source of the inflation pressures we have. Outside the resources sector, the share of national income that goes to profits is basically unchanged. I think what’s been happening is demand is strong enough to allow firms to pass on the higher input costs into prices, so the firms have not suffered a decline in their profits as their costs have gone up, with the exception of the construction sector. But most sectors have been able to pass on the higher input costs into higher prices and have kept their profit margins the same. So rising profits as a share of national income is not the source of inflation; it’s the supply-side issues and the strong demand in parts of the economy because of the pandemic response. That’s our interpretation of the data, and we’ve looked at this very carefully.

The RBA had been consistently claiming it was witnessing wage pressure which was spilling over into the accelerating price inflation – a claim that the official data could not back up.

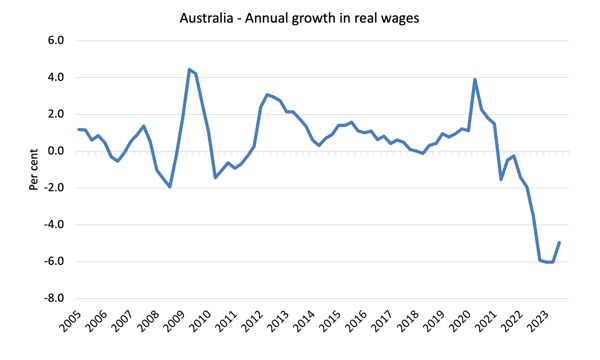

The following graph shows the annual growth in real wages from 2005 to the September-quarter 2023 (latest data).

What we observe over the course of the recent inflationary period is a systematic attrition in the real purchasing power of nominal wages in Australia.

There is no sign of the ‘saw tooth’ pattern that would signify an element of real wage resistance from workers, where they are able to at least partially reverse the purchasing power attrition with successful wage claims.

That sort of pattern was prominent in the 1970s inflationary episode, which was drawn out because labour and capital engaged in a distributional battle as to who would bear the real income losses arising from the rises in imported oil prices.

No such struggle has been evident in the last few years.

So any notion that excessive wage demands justified the interest rate hikes since May 2022 cannot be justified by the data.

The RBA also claimed that they were pushing up rates because the inflationary pressures reflected excess demand and they had to increase unemployment to choke of the ‘excess’ spending.

Once again, it was hard to make this case when examining the official data.

The Statement on Monetary Policy – May 2023 provided a special analysis – Box B: Have Business Profits Contributed to Inflation? – where they pushed the profits argument further:

There is little evidence that there has been a broad-based increase in domestic non-mining profit margins, suggesting that changes in domestic profit margins have not been a significant independent cause of the increase in aggregate CPI inflation … At the firm level, there has been little change in the distribution of margins. These observations are consistent with firms having generally passed on higher costs to maintain their profit margins, and aggregate inflation having been driven by the balance of demand and supply factors – rather than changes in firms’ pricing power.

As the evidence mounted to refute this view, the RBA massaged its position.

For example, in the – Minutes of the Monetary Policy Meeting of the Reserve Bank Board (June 6, 2023) – the RBA noted that:

… members observed that some firms were indexing their prices, either implicitly or directly, to past inflation. These developments created an increased risk that high inflation would be persistent, which would make it more difficult to keep the economy on the narrow path.

So a slight concession – an admission that firms are using their price-setting power in the market to ensure that the inflationary pressures persist.

The current RBA governor has proven to be a major disappointment – see yesterday’s blog post – RBA is now a rogue organisation and the Government should act to bring it back into check (February 7, 2024) – on her shifts regarding the NAIRU.

New report finds massive price gouging in Australian economy

However, on Tuesday (February 6, 2024) a major report was released that reveals just how lacking the RBA’s claims have been.

The Report – Inquiry into Price Gouging and Unfair Price Practices – was prepared by the former head of the Australian Competition and Consumer Commission, Professor Allan Fels.

I was taught in my Masters coursework program at Monash University by Allan and he supervised a special reading unit on price setting that I did during that program.

The research was commissioned by the Australian Council of Trade Unions who were obviously witnessing the real purchasing power of workers being systematically undermined by the inflation and knew that firms were taking advantage of the inflation and their market power to push up profit margins.

So they wanted an independent study to validate what they were seeing in the ‘street’.

The study covered:

… a broad suite of industries, including banks, wholesale electricity and retail pricing, early childhood education and care, supermarkets, and electric vehicles.

The RBA had claimed only the mining sector had improved profits.

The research report concluded that there have been a “dramatic increase” in prices paid locally which cannot be justified by cost increases.

In other words, corporations are expanding their profit margins and that push has driven the movements in the CPI.

The study found that:

1. “The exercise of market power and limits on competition in specific markets have exacerbated what began as a global problem.”

So the initial supply constraints emerging as a result of the pandemic and then the Ukraine situation, have been amplified by the margin push by corporations with excessive price setting power.

2. “Prices in Australia are often too high reflecting the many markets where there is less than fully effective competition. Not only are many consumers overcharged continuously but ‘profit push’ pricing has added significantly to inflation in recent times.”

3. “There is currently a gap in government policy. It does not pay sufficient attention to high prices. It needs to. It needs to investigate and expose their causes and, as far as possible, remedy the problems: ineffective competition, vulnerable consumers, and exploitative business pricing practices.”

4. “Of great concern is price gouging in the electricity sector, a very concentrated industry at all levels.”

This is a heavily privatised sector that governments promised would deliver lower prices and better services in private hands when they sold them off.

The reality has been the opposite.

There has been “routine price gouging … at the generator wholesale level as it sets prices in the price bidding system” and the “bidding system used to determine energy prices is not fit for purpose”.

“At the transmission level of the industry there has been a history of setting prices too high” – which, in part, is because the regulative structure is weak and poorly enforced.

“At the retail level (which is accompanied by a high degree of vertical integration with generation suppliers) there is very substantial price discrimination between business and consumers which is hard to explain on the basis of cost differences.”

The complexity of the retail offerings is designed to make it hard for consumers to know what is going on with respect to the “best prices in the retail market”.

5. “The banking sector has a significant lack of competition and the major banks’ position is protected by the bodies which make up the Council of Financial Regulators in their pursuit of stability.”

The big four banks generate returns that are so out of kilter with global trends – they “charge high prices quickly, engage in unfair pricing practices, and exploit their position in a highly complex industry”

6. “The duopoly in the aviation sector in Australia is dominated by Qantas and there is price gouging by Qantas.”

In fact, QANTAS alone has contributed significantly to movements in the CPI over the last few years through its price gouging.

7. “Both early childhood education and the care sector are riddled with overcharging, principally due to the market’s design and the difficulty users have in switching services.”

Again this is in part due to the abandonment of public child care centres in favour of privatised arrangements.

8. The supermarkets form an oligopoly and systematically overcharge and profit push.

In general:

– Corporate profits have added significantly to inflation and some businesses have too much power over their customers, their supply chain, and their workers.

– Many businesses are resorting to dodgy price practices, including loyalty taxes, drip pricing, excuse-flation, rockets and feathers strategies, and confusion pricing.

– A range of sectors are insufficiently competitive or insufficiently regulated, leading to poor consumer outcomes and higher prices.

So, when the research is done, the results are clear – systematic profit push through price gouging exists across all the major sectors of the economy.

It also means that interest rate increases designed to quell excess demand are missing the point entirely and just further hurting the consumers with debt who are already being squeezed by the profit gouging.

Conclusion

This report from Allan Fels is humiliating for the RBA which has systematically denied the presence of price gouging in the Australian economy.

What is clear is that the RBA uses its position to misinform the public by holding itself out as an authority when in fact it has been captured by the financial elites who are profiting significantly from the latest round of interest rate increases.

That is enough for today!

(c) Copyright 2024 William Mitchell. All Rights Reserved.

Arguably all rises in prices charged should be subject to an investigation by the Competition Authorities to root out oligopolies and collusion.

And that would be aided if there was a threat of introducing a public competitor into a market that is driving up prices.

Our expectation is that the fox will take our criticism to heart, and diligently guard the henhouse in the future?

I’m not surprised by the RBA’s findings. Its research department is a shambolic mess. Just before Covid hit I had a conversation with some of its more recent PhDs. None of them understood the most basic concept of economics. It was a parade of wannabe New Keynesians. I was disappointed, but should have expected nothing more.