Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern…

The Weekend Quiz – June 11-12, 2022 – answers and discussion

Here are the answers with discussion for this Weekend’s Quiz. The information provided should help you work out why you missed a question or three! If you haven’t already done the Quiz from yesterday then have a go at it before you read the answers. I hope this helps you develop an understanding of Modern Monetary Theory (MMT) and its application to macroeconomic thinking. Comments as usual welcome, especially if I have made an error.

Question 1:

As the sense of emergency surrounding the pandemic seemingly has been forgotten, the European Commission will reinstate the restrictions imposed on deficit and debt ratios by the Stability and Growth Pact, which will increase the solvency risk of the 19 member states.

The answer is False.

The proposal to create a European-wide bond is motivated by the desire to prevent sovereign defaults among member countries who are having trouble covering their net spending positions with market-sourced finance.

That part is true although the reasoning advanced by the EMU bosses is spurious to say the least.

But the linking of solvency risk and the Stability and Growth Pact is false.

The Stability and Growth Pact which is summarised as imposing a rule on EMU member countries that their fiscal deficits cannot exceed 3 per cent of GDP rule and their public debt to GDP ratio cannot exceed 60 per cent.

In the links provided below you will find extensive analysis of the nonsensical nature of these rules.

The SGP was designed to place nationally-determined fiscal policy in a straitjacket to avoid the problems that would arise if some runaway member states might follow a reckless spending policy, which in its turn would force the ECB to increase its interest rates.

Germany, in particular, wanted fiscal constraints put on countries like Italy and Spain to prevent reckless government spending which could damage compliant countries through higher ECB interest rates.

In a 2006 book I published with Joan Muysken and Tom Van Veen – Growth and cohesion in the European Union: The Impact of Macroeconomic Policy – we showed that it is widely recognised that these figures were highly arbitrary and were without any solid theoretical foundation or internal consistency.

The current crisis is just the last straw in the myth that the SGP would provide a platform for stability and growth in the EMU. In my recent book (published just before the crisis) with Joan Muysken – Full Employment abandoned – we provided evidence to support the thesis that the SGP failed on both counts – it had provided neither stability nor growth. The crisis has echoed that claim very loudly.

The rationale of controlling government debt and fiscal deficits were consistent with the rising neo-liberal orthodoxy that promoted inflation control as the macroeconomic policy priority and asserted the primacy of monetary policy (a narrow conception notwithstanding) over fiscal policy.

Fiscal policy was forced by this inflation first ideology to become a passive actor on the macroeconomic stage.

But these rules, while ensuring that the EMU countries will have to live with high unemployment and depressed living standards (overall) for years to come, given the magnitude of the crisis and the austerity plans that have to be pursued to get the public ratios back in line with the SGP dictates, are not the reason that the EMU countries risk insolvency.

That risk arises from the fact that when they entered the EMU system, they ceded their currency sovereignty to the European Central Bank (ECB) which had several consequences. First, EMU member states now share a common monetary stance and cannot set interest rates independently. The former central banks – now called National Central Banks are completely embedded into the ECB-NCB system that defines the EMU.

Second, they no longer have separate exchange rates which means that trade imbalances have to be dealt with in monetary terms not in relative price changes.

Third, and most importantly, the member governments cannot create their own currency and as a consequence can run out of Euros!

So imagine there was a bank run occuring in Australia, while the situation would signal mass frenzy, the Australian government has the infinite capacity to guarantee all deposits denominated in $AUD should it choose to do so.

If the superannuation industry collapsed in Australia, the Australian government could just guarantee all retirement incomes denominated in $AUD should it choose to do so.

The same goes for any sovereign government (including the US and the UK).

But an EMU member government could not do this and their banking or public pension systems could become insolvent.

Further, it could reach a situation where it did not have enough Euros available (via taxation revenue or borrowing) to repay its debt commitments (either retire existing debt on maturity or service interest payments).

In that sense, the government itself would become insolvent.

A sovereign government such as Australia or the US could never find itself in that sort of situation – they are never in risk of insolvency.

So the source of the solvency risk problem is not the stupid fiscal rules that the EMU nations have placed on themselves but the fact they have ceded currency sovereignty.

The following blog posts may be of further interest to you:

- Euro zone’s self-imposed meltdown

- A Greek tragedy …

- España se está muriendo

- Exiting the Euro?

- Doomed from the start

- Europe – bailout or exit?

- Not the EMF … anything but the EMF!

Question 2:

If the monthly Labour Force data shows that employment grew by 400 in net terms over the last month, unemployment rose by 10,700, and the participation rate fell by 0.1 points then we can conclude that:

(a) The labour force grew faster than employment but not as fast the working age population.

(b) The working age population grew faster than employment and offset the decline in the labour force arising from the drop in the participation rate.

(c) The labour force grew faster than employment but you cannot tell what happened to the working age population from the information provided.

The answer is Option (a) – The labour force grew faster than employment but not as fast the working age population.

If you didn’t get this correct then it is likely you lack an understanding of the labour force framework which is used by all national statistical offices.

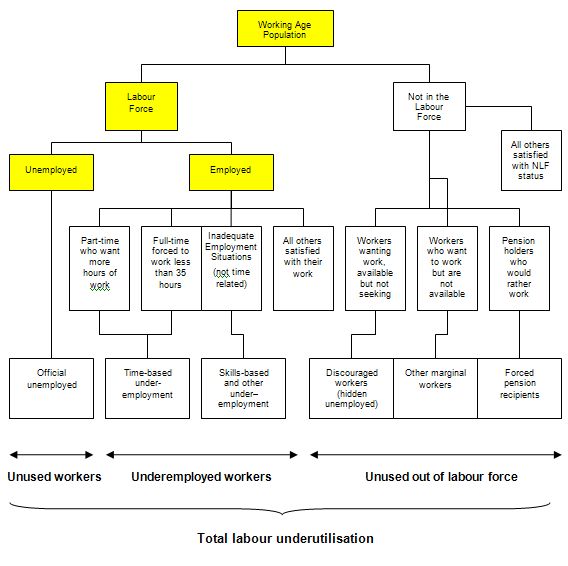

The labour force framework is the foundation for cross-country comparisons of labour market data.

The framework is made operational through the International Labour Organization (ILO) and its International Conference of Labour Statisticians (ICLS). These conferences and expert meetings develop the guidelines or norms for implementing the labour force framework and generating the national labour force data.

The rules contained within the labour force framework generally have the following features:

- an activity principle, which is used to classify the population into one of the three basic categories in the labour force framework;

- a set of priority rules, which ensure that each person is classified into only one of the three basic categories in the labour force framework; and

- a short reference period to reflect the labour supply situation at a specified moment in time.

The system of priority rules are applied such that labour force activities take precedence over non-labour force activities and working or having a job (employment) takes precedence over looking for work (unemployment).

Also, as with most statistical measurements of activity, employment in the informal sectors, or black-market economy, is outside the scope of activity measures.

Paid activities take precedence over unpaid activities such that for example ‘persons who were keeping house’ as used in Australia, on an unpaid basis are classified as not in the labour force while those who receive pay for this activity are in the labour force as employed.

Similarly persons who undertake unpaid voluntary work are not in the labour force, even though their activities may be similar to those undertaken by the employed.

The category of ‘permanently unable to work’ as used in Australia also means a classification as not in the labour force even though there is evidence to suggest that increasing ‘disability’ rates in some countries merely reflect an attempt to disguise the unemployment problem.

The following diagram shows the complete breakdown of the categories used by the statisticians in this context. The yellow boxes are relevant for this question.

So the Working Age Population (WAP) is usually defined as those persons aged between 15 and 65 years of age or increasing those persons above 15 years of age (recognising that official retirement ages are now being abandoned in many countries).

As you can see from the diagram the WAP is then split into two categories: (a) the Labour Force (LF) and; (b) Not in the Labour Force – and this divisision is based on activity tests (being in paid employed or actively seeking and being willing to work).

The Labour Force Participation Rate is the percentage of the WAP that are active.

If the participation rate overall is 65.2 per cent then 65.2 per cent of those persons above the age of 15 (in Australia) are actively engaged in the labour market (either employed or unemployed).

You can also see that the Labour Force is divided into employment and unemployment.

Most nations use the standard demarcation rule that if you have worked for one or more hours a week during the survey week you are classified as being employed.

If you are not working but indicate you are actively seeking work and are willing to currently work then you are considered to be unemployed.

If you are not working and indicate either you are not actively seeking work or are not willing to work currently then you are considered to be Not in the Labour Force.

So you get the category of hidden unemployed who are willing to work but have given up looking because there are no jobs available. The statistician counts them as being outside the labour force even though they would accept a job immediately if offered.

The question gave you information about employment, unemployment and the labour force participation rate and you had to deduce the rest based on your understanding.

In terms of the Diagram the following formulas link the yellow boxes:

Labour Force = Employment + Unemployment = Labour Force Participation Rate times the Working Age Population

It follows that the Working Age Population is derived as Labour Force divided by the Labour Force Participation Rate (appropriately scaled in percentage point units).

So if both Employment and Unemployment is growing then you can conclude that the Labour Force is growing by the sum of the extra Employment and Unemployment expressed as a percentage of the previous Labour Force.

The Labour Force can grow in one of four ways:

- Working Age Population growing with the labour force participation rate constant;

- Working Age Population growing and offsetting a falling labour force participation rate;

- Working Age Population constant and the labour force participation rate rising;

- Working Age Population falling but being offset by a rising labour force participation rate.

So in our case, if the Participation Rate is falling then the proportion of the Working Age Population that is entering the Labour Force is falling.

So for the Labour Force to be growing the Working Age Population has to be growing faster than the Labour Force.

So the correct answer is as above.

Of the second option:

The working age population grew faster than employment and offset the decline in the labour force arising from the drop in the participation rate.

Clearly impossible if both employment and unemployment both rose.

And of the third option:

The labour force grew faster than employment but you cannot tell what happened to the working age population from the information provided.

Clearly you can tell what happened to the working age population by deduction.

Question 3:

If the household saving ratio rises and there is an external deficit then Modern Monetary Theory tells us that the government must increase net spending to fill the private spending gap or else national output and income will fall.

The answer is False.

This question tests one’s basic understanding of the sectoral balances that can be derived from the National Accounts. The secret to getting the correct answer is to realise that the household saving ratio is not the overall sectoral balance for the private domestic sector.

To refresh your memory the sectoral balances are derived as follows. The basic income-expenditure model in macroeconomics can be viewed in (at least) two ways: (a) from the perspective of the sources of spending; and (b) from the perspective of the uses of the income produced. Bringing these two perspectives (of the same thing) together generates the sectoral balances.

From the sources perspective we write:

GDP = C + I + G + (X – M)

which says that total national income (GDP) is the sum of total final consumption spending (C), total private investment (I), total government spending (G) and net exports (X – M).

Expression (1) tells us that total income in the economy per period will be exactly equal to total spending from all sources of expenditure.

We also have to acknowledge that financial balances of the sectors are impacted by net government taxes (T) which includes all taxes and transfer and interest payments (the latter are not counted independently in the expenditure Expression (1)).

Further, as noted above the trade account is only one aspect of the financial flows between the domestic economy and the external sector. we have to include net external income flows (FNI).

Adding in the net external income flows (FNI) to Expression (2) for GDP we get the familiar gross national product or gross national income measure (GNP):

(2) GNP = C + I + G + (X – M) + FNI

To render this approach into the sectoral balances form, we subtract total taxes and transfers (T) from both sides of Expression (3) to get:

(3) GNP – T = C + I + G + (X – M) + FNI – T

Now we can collect the terms by arranging them according to the three sectoral balances:

(4) (GNP – C – T) – I = (G – T) + (X – M + FNI)

The the terms in Expression (4) are relatively easy to understand now.

The term (GNP – C – T) represents total income less the amount consumed less the amount paid to government in taxes (taking into account transfers coming the other way). In other words, it represents private domestic saving.

The left-hand side of Equation (4), (GNP – C – T) – I, thus is the overall saving of the private domestic sector, which is distinct from total household saving denoted by the term (GNP – C – T).

In other words, the left-hand side of Equation (4) is the private domestic financial balance and if it is positive then the sector is spending less than its total income and if it is negative the sector is spending more than it total income.

The term (G – T) is the government financial balance and is in deficit if government spending (G) is greater than government tax revenue minus transfers (T), and in surplus if the balance is negative.

Finally, the other right-hand side term (X – M + FNI) is the external financial balance, commonly known as the current account balance (CAD). It is in surplus if positive and deficit if negative.

In English we could say that:

The private financial balance equals the sum of the government financial balance plus the current account balance.

We can re-write Expression (6) in this way to get the sectoral balances equation:

(5) (S – I) = (G – T) + CAB

which is interpreted as meaning that government sector deficits (G – T > 0) and current account surpluses (CAB > 0) generate national income and net financial assets for the private domestic sector.

Conversely, government surpluses (G – T < 0) and current account deficits (CAB < 0) reduce national income and undermine the capacity of the private domestic sector to add financial assets.

Expression (5) can also be written as:

(6) [(S – I) – CAB] = (G – T)

where the term on the left-hand side [(S – I) – CAB] is the non-government sector financial balance and is of equal and opposite sign to the government financial balance.

This is the familiar MMT statement that a government sector deficit (surplus) is equal dollar-for-dollar to the non-government sector surplus (deficit).

The sectoral balances equation says that total private savings (S) minus private investment (I) has to equal the public deficit (spending, G minus taxes, T) plus net exports (exports (X) minus imports (M)) plus net income transfers.

All these relationships (equations) hold as a matter of accounting and not matters of opinion.

You can then manipulate these balances to tell stories about what is going on in a country.

For example, when an external deficit (X – M < 0) and a public surplus (G – T < 0) coincide, there must be a private deficit. So if X = 10 and M = 20, X – M = -10 (a current account deficit).

Also if G = 20 and T = 30, G – T = -10 (a fiscal surplus). So the right-hand side of the sectoral balances equation will equal (20 – 30) + (10 – 20) = -20.

As a matter of accounting then (S – I) = -20 which means that the domestic private sector is spending more than they are earning because I > S by 20 (whatever $ units we like).

So the fiscal drag from the public sector is coinciding with an influx of net savings from the external sector.

While private spending can persist for a time under these conditions using the net savings of the external sector, the private sector becomes increasingly indebted in the process.

It is an unsustainable growth path.

So if a nation usually has a current account deficit (X – M < 0) then if the private domestic sector is to net save (S – I) > 0, then the public fiscal deficit has to be large enough to offset the current account deficit.

Say, (X – M) = -20 (as above). Then a balanced fiscal position (G – T = 0) will force the domestic private sector to spend more than they are earning (S – I) = -20.

But a government deficit of 25 (for example, G = 55 and T = 30) will give a right-hand solution of (55 – 30) + (10 – 20) = 15. The domestic private sector can net save.

By only focusing on the household saving ratio in the question, I was only referring to one component of the private domestic balance.

Clearly in the case of the question, if private investment is strong enough to offset the household desire to increase saving (and withdraw from consumption) then no spending gap arises.

In the present situation in most countries, households have reduced the growth in consumption (as they have tried to repair overindebted balance sheets) at the same time that private investment has fallen dramatically.

As a consequence a major spending gap emerged that could only be filled in the short- to medium-term by government deficits if output growth was to remain intact.

The reality is that the fiscal deficits were not large enough and so income adjustments (negative) occurred and this brought the sectoral balances in line at lower levels of economic activity.

The following blog posts may be of further interest to you:

- Barnaby, better to walk before we run

- Stock-flow consistent macro models

- Norway and sectoral balances

- The OECD is at it again!

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

“Third, and most importantly, the member governments cannot create their own currency and as a consequence can run out of Euros!”

Hi Bill, I used to uncritically believe this until I listened to a podcast by Dirk Ehnts, the German MMTer.

He categorically stated that the Bundesbank creates Euros in exactly the same way as the BoE creates pounds.

The spending is authorised by the German government and the Bundesbank creates the money by marking up bank accounts. If this is the case govt bond sales become superfluous, simply corporate welfare, smoke and mirrors to con the people into believing that the government is finanicially constrained and borrowing and taxation are necessary to provision government spending. It also means we need to re-think how we conceptualise the workings of the ECB and the Eurozone.

Regards, Jon Camden

Off topic. Anyone, I just saw an economic youtuber claiming that Japan is in trouble.

The yen has dropped at least 11% in a week, or so.

I’m not sure about any facts here.

What is going on in Japan?

“Bundesbank creates Euros in exactly the same way as the BoE creates pounds”

I don’t think that’s exactly right. I think the Bundesbank creates Euros the way — say — Royal Bank of Canada creates CDN$.

As long as the Bundesbank’s own Euros are spent within Germany (or as long as the Euros spent are deposited back at the Bundesbank (Bb)) then the Bb has a free hand. But when the Euros get spent elsewhere in Europe, or elsewhere in the world, the transaction has to clear through the ECB, and the Bb has to have funds in its account to cover the expense. There are ways to arrange this, of course, but they all involve getting access to Euros from the ECB.

By contrast, the BoE is the final authority on who has GBP and who doesn’t. If somebody comes to BoE with a legal demand for GBP, the BoE can simply say “Fine, you have GBP.” and that’s the end of it.

Q1 = “As the sense of emergency surrounding the pandemic seemingly has been forgotten, the European Commission will reinstate the restrictions imposed on deficit and debt ratios by the Stability and Growth Pact, which will increase the solvency risk of the 19 member states.”

It seems to me that it is true that it will increase the solvency *risk* of the 19 member states.

To be false if might read, “As the sense of emergency surrounding the pandemic seemingly has been forgotten, the European Commission will reinstate the restrictions imposed on deficit and debt ratios by the Stability and Growth Pact, which will increase the solvency of the 19 member states.”

.