The US is now a rogue state. One example is the conduct of the US…

Cash machine capitalism – it is getting uglier by the day

The current period is really exposing what is wrong with the world order based on Capitalism. Those in the know have always understood that the system is not designed to advance human prosperity generally. At times in history, it has required the general improvement in material living standards to accomplish its aims – which are different from that improvement. So, it has tolerated a more equitable distribution of income and access to consumption purchasing power. But while the masses became complacement as they polished their big (oversized) SUVs, which sit in their driveways next to their big (oversized) motor boat and out the front of their big (oversized) house that is ill-designed for a carbon-neutral future, the bosses have been beavering away working out how to continue to meet their aims independent of us.

Current market conditions

The International Energy Agency (IEA) was established in 1974 “to help co-ordinate a collective response to major disruptions in the supply of oil.”

I regularly consult its data resources, which are of high quality.

In its most recent report – Oil 2021 (published March 2021) – the IEA notes that:

Global oil demand, still reeling from the effects of the pandemic, is unlikely to catch up with its pre-Covid trajectory. In 2020, the start of our forecast period, oil demand was nearly 9 mb/d below the level seen in 2019, and it is not expected to return to that level before 2023.

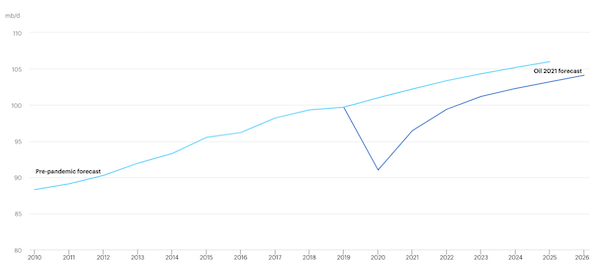

They provided this graph which shows their previous pre-pandemic forecasts of demand for oil and what has happened since.

What we conclude is that the the demand for oil is below where it would have been without the interruption from the pandemic and is not accelerating at a faster rate than the IEA predicted previously.

So when you read commentators claiming that the demand for oil is going ‘through the roof’ you have to wonder what planet they are on.

The problem is all supply related.

The question then is whether policy makers deliberately engineer a reduction in demand to match the supply shortfall in the knowledge that such a reduction would likely lead to recession with rising unemployment, massive income losses and disrupted capital formation (and reduced future growth potential).

That is what happened in the 1970s.

And it is what is behind the increased interest rates that everyone who won’t lose a job as a result is calling for.

Whether the rising interest rates reduce the price pressures is questionable. But they will almost certainly increase unemployment.

Which means that the policy shift isn’t very sensible in the current environment.

It doesn’t make any sense to starve someone on low income by cutting their income just because prices have risen and squeezed the income.

But the other question that should be asked is whether the current demand (which is below the pre-pandemic forecast) is above the potential supply levels?

Then, the demand has to be reduced.

The IEA is clear that this is not the case.

In their – Oil Market Report – March 2022 – the IEA note that:

The prospect of large-scale disruptions to Russian oil production is threatening to create a global oil supply shock …

But we also read that:

The OPEC+ alliance agreed on 2 March to stick with a modest, scheduled output rise of 400 kb/d for April, insisting no supply shortage exists. Saudi Arabia and the UAE – the only producers with substantial spare capacity – are, so far, showing no willingness to tap into their reserves.

At present, global oil stocks are filling the gap but they are “depleting rapidly”.

The point is that the interest rate/fiscal austerity camp’s perspective is based on an excess demand situation and want to undermine economic growth.

But it is clear that the current oil price hikes are due to a reluctance of Saudi and UAE producers to reduce their “substantial spare capacity”.

That is what we call an abuse of market power and causing a recession does not address that.

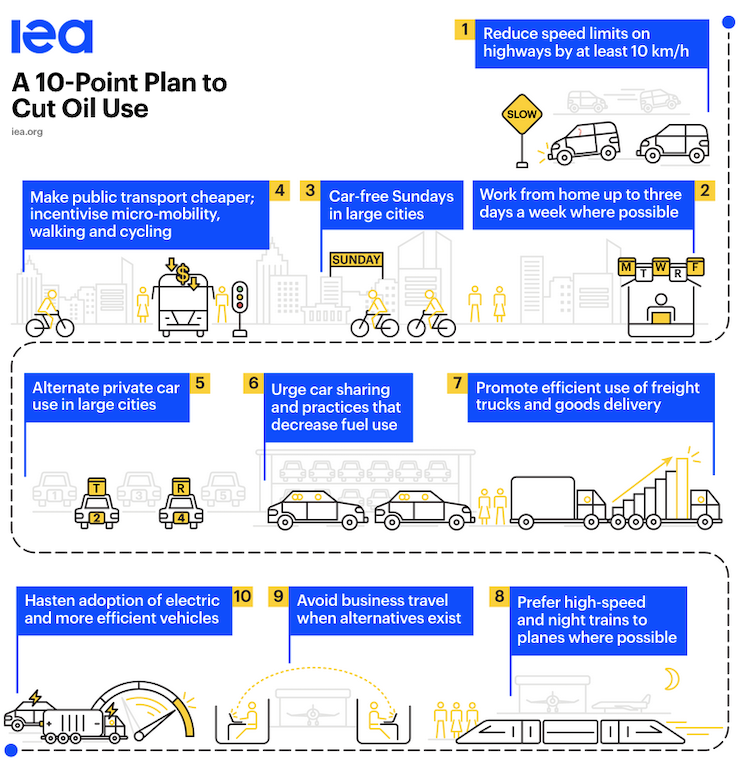

On March 18, 2022, the IEA released a – 10-Point Plan to Cut Oil Use – which is summarised in this graphic:

Some of these choices are at the volition of all of us but most require strong government legislation and enforced regulation for them to become operational.

Government could start by declaring all public transport is free to all from now on (Covid notwithstanding).

They could announce that all their public servants can continue to work from home indefinitely.

They could force reduced speed limits on highways.

They could provide substantial subsidies for EV uptake (in the same vein as the solar panel incentives that have been spectacularly successful when implemented).

They could force local authorities to create bike only roads.

And more.

These will not only ease the energy price squeeze in the short-run, but, also, will help us transition to a greener, carbon-neutral future.

I don’t see much action from governments in this direction as yet.

Moreover, using policies that aim to cut spending do not address the market power issue, which is endemic in Capitalism – and defines the ambitions of Capital – to achieve high rates of anti-competitive concentration and price setting power to extract as much profit as possible.

Everything else is secondary for owners of capital in this sort of system, which is why it fails to deliver on societal needs.

The Capitalist system was never designed to satisfy societal needs.

That is not its logic.

And it is why we should heavily regulate it on the way to transitioning away from it.

Which brings me to the problem of Capitalism

More than a decade ago, I wrote this blog post – L’horreur economique (January 30, 2010) – where I reviewed a disturbing book written by the French writer Viviane Forrester.

In her 1996 book called – L’horreur Economique – about unemployment (you can get the 1999 English version – HERE – essential reading) – she proposed that governments are failing to generate enough employment but at the same time they are promoting a backlash against those who are jobless.

Viviane Forrester wrote:

The panaceas of work-experience and re-training often do nothing more than reinforce the fact that there is no real role for the unemployed. They come to realize that there is something worse than being exploited, and that is not even to be exploitable …

The book ventures into the notion that governments (elected by us) have made the unemployment dispensable to ‘capitalist production and profit’ and have instead been content to keep them alive. But soon, why would it not be implausible to declare this growing group of disadvantaged citizens totally irrelevant.

We allow our neoliberal governments to claim there is not enough ‘money’ to solve all these problems.

But if the unemployed and homeless are ultimately dispensable for capitalist production (and that is what persistent long-term unemployment suggests); and they cannot do anything productive if we employ them in the public sector (that is the overwhelming view of the mainstream); and they are a nuisance to manage (you know all the arguments – income support corrupts etc) – then ultimately society might start asking “what is the point of the unemployed?”.

That is the disturbing question that Viviane Forester poses.

She postulates that then different solutions might be advanced such as getting rid of them altogether. Don’t think this is off the track … after all only 70 odd years ago Germany decided that a definable cohort was dispensable and could be exterminated.

L’horreur Economique is one of those books that you just go back to from time to time to remind yourself of the message.

I thought about it when I read the financial news that Shell made £14 billion in profits last year (2021) and paid its CEO Ben van Beurden £6.2 million in wages – a 26 per cent pay rise on the year.

Then I read that BP made £9.2 billion in profits and paid its boss £4.5 million – a rise of more than 50 per cent on the previous year.

Recently, the BP boss boasted that:

When the market is strong, when oil prices are strong and when gas prices are strong, this is literally a cash machine.

That is the sort of hubris that we are accustomed to hearing from the top-end-of-town.

A few weeks ago a financial funds manager in Sydney said that greed was the best approach for his firm in the way of the the massive and destructive flooding in NSW recently because during these calamities people are scared and vulnerable.

The inflationary pressures are particularly burdensome for low income individuals and their families because they have less discretionary spending relative to their income.

Higher income earners have more room to adjust to the real income loss (purchasing power loss) that rising inflation creates.

But low-income earners have little scope to make those adjustments and as a result get into financial trouble quickly – falling behind in utility bills, rents etc.

It is clear that wages growth for workers is not occuring at any rapid rate (and is not driving the inflationary pressures).

Below, I report on the state of the oil market and options facing government.

But the existence of market concentration allows companies like BP to become ‘cash machines’.

Economists have this notion of a ‘normal profit’, which is an opportunity cost concept.

Accordingly, a firm earning a ‘normal profit’ is earning just as much as is required to keep their capital in that use. Any profits above that level are supernormal and can be taxed away without any distortion to resource allocation.

Note that the definition and conclusion is not Modern Monetary Theory (MMT). Rather, it is basic neoclassical micro theory.

What does it mean in this instance?

Well the ‘cash machine’ profits that the energy companies are making reflect their price setting power in the market and the ability of suppliers to restrict supply and create ‘excess demand’ situations in order to push up prices.

But to characterise the problem as ‘excess demand’ is as inane as saying when farmers deliberately withhold food supply to push up prices, people should stop eating and starve to eliminate the ‘excess demand’.

The existence of profits above ‘normal profits’ means that the government has scope, even within the current system, to invoke tax hikes on corporations and not risk altering the distribution of resources.

There is also evidence of anti-competitive behaviour in various energy markets – for example, the European gas market, which would break the regulative rules.

In the first instance, governments should introduce ‘cash machine’ taxes, aka ‘windfall profits’.

BP has done nothing clever to reap such profits. There is no advance of human well-being involved in that company having such massive profits and being able to pay its arrogant CEO such an obscene wage.

The market concentration has delivered them the bounty.

Apparently, BP breaks even at a crude oil price of $US40 per barrel.

So the government could reap massive tax revenue, which could be used as a bargaining chip to pressure these energy companies into reducing prices – a sort of sliding scale quid-pro-quo tax scale.

There is also the small (rather large) matter of corporate welfare in this sector.

The IMF Working Paper (WP/21/236) – Still Not Getting Energy Prices Right: A Global and Country Update of Fossil Fuel Subsidies (released September 24, 2021) – updated previous estimates of the corporate welfare involved in this sector. It is massive.

In Australia, the federal and state governments hand out massive subsidies to coal, gas and oil companies. It would divert me to document this in this post but there are ample examples of governments building dedicated infrastructure for these companies (rail and port facilities, etc), which essentially provide public funding for profit.

Governments should reduce this support dramatically.

Then we get to the public-private ownership issue.

Regular readers will know that I favour the public ownership of all essential activities and energy production is one of them.

We have a good example of how that ownership difference matters at present.

The Bloomberg article (March 13, 2022) – France Unveils Rule to Partly Protect EDF From Power Price Jump – reported that:

To help cap the increase in electricity bills for small users at 4% this year, the government has cut a levy on power, postponed part of the increase of regulated tariffs into next year, and has asked EDF to raise by 20% the volume of nuclear power it sells to rivals at a deep discount to market prices.

No such action is being taken in Australia against the ‘privatised’ energy companies.

Governments can also introduce straight-out price controls, which are common during war-time. While the Ukraine conflict is not (yet) a world war, the interlinked nature of the world economy now makes the consequences of this single-country war zone felt by all.

The US government used such controls during the two World Wars and the Korean War, and again, late in the Vietnam War. The controls were opposed by many economists and corporations but were highly successful in containing price rises in the face of supply constraints.

The point is that the current situation is highlighting everything that is wrong with Capitalism.

Workers are getting screwed by suppliers with market power deliberately withhold supply and inflate the profits of the corporate sector beyond anything that should be considered reasonable.

The system is thus generating massive increases in inequality and governments are being pressured to hike interest rates and cut spending – which will further screw workers and further help financial market speculators make enormous profits.

You can be assured the spending cuts will not be targetted at the subsidies the corporations receive.

It is a system that doesn’t work for us and it should be changed.

Conclusion

Viviane Forester foresaw a future where Capital would find a way to eliminate those it felt were redundant to their aims – to make massive profits and enrich the few.

This tendency is broadening as neoliberalism ensues – as it hollows out the middle class and further enriches the elites.

The current period where firms who claim to be energy provides admit to having become ‘cash machines’ exemplifies the way that most of us are just considered to be fodder for the profit-making system.

If we don’t do something about it then the system will work to make more of us redundant.

And then what?

Depressing.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Wouldn’t it be wonderful if accumulation of wealth is no longer the dominant driver of societies and instead personal growth, contribution to our commonwealth, health and education, care for the natural world, sustainability and a focus scientific advances that serve everyone became the prime motivator?

Such a society was envisioned in Gene Roddenberry in the Star Trek franchise, it was rather lame but it did imagine a society where there was no greed or obsession with wealth because there was plenty that was available to everyone.

@Barri mundee

Ha! I immediately thought of Star Trek when I read your first paragraph and then saw you actually made specific mention in the second.

I remember Captain Picard saying words to the effect that “we work for the greater good of society overall” and Mr Data describing the Ferengi social structure as “embracing the worst aspects of 20th century Earth capitalism”.

Unfortunately, I think we’re still a long way from a Star Trek type society.

“Viviane Forester foresaw a future where Capital would find a way to eliminate those it felt were redundant to their aims – to make massive profits and enrich the few.”

The more people there are to buy things the more profit there is to be made.

So eliminating some doesn’t seem such a good move for the capitalist.

The few can’t do without the many.

Oops a post with no content,@hillbilly: to continue the Star Trek theme…. We are currently light years from a less greedy, wealth obsessed society. There is hope but matters may have get much wore first,

“the masses became complacement as they polished their big (oversized) SUVs…”

What a remarkably elitist and condescending opinion you have towards ordinary people Bill. The “masses” have it too good to fight. Is that really the argument? I guess it has nothing to do with the all out assault by capital and the open class warfare which has occurred in the neoliberal era.

Depressing it is…especially when the spread of disinformation to keep society ignorant is more valuable than the value of a more knowledgeable society.

Just as it has not been enough time for “Nietzsche’s people”, I feel the same for MMT progressives. Nietzsche wrote about the “last man” and how in their depths of nihilism reason that they must have “invented happiness” – being disconnected from the earth and its balanced cycles. The people hearing of these great men and their happiness and success wish to experience the same for themselves and want the secrets – not realising that they themselves have the ability to powerfully create and change…

Capital just facilitates the TRUST that is brokered in exchange for ideal conditions….

@james. I’m with Bill, SUV’s, boats and houses way larger than needed are wasteful of resources. I don’t see it as elitism at all.

The European Federation Of Energy Traders (lobby group of energy trading houses, oil companies and utilities) wrote a letter to european governments, asking for emergency liquidity support.

You could ask, as I did: so now government should go big? What happened to the small government mantra?

In the 4 page letter, the word “risk” apears 22 times.

They are complaining about the huge amount of collateral that finance is demanding for hedging the energy trading.

Surging prices get reflected in the tip of the pumping station, of course.

But, this is the logic of the capitalist-rentier-version-system.

In other words, the old monopoly game.

Once there is the oportunity, you just grab your neigbhors assets.

Hedge-funds used the GFC to double their assets portfolio.

They used to amass more during the pandemic and now the Ucranian war will make things tightier.

You shouldn’t expect anything from the FIRE sector, as descarbonization is concerned, as already said that they only invest in green technology, if governments take all the risks.

Ucranians have a risk issue right now: the risk of loosing their lives.

Our risk management is about keeping oligarchs happy.

Henry Rech,

It’s actually very helpful to eliminate brown and black people because that reduces demand for commodities in the third world, keeping their prices down for us.

If you think I’m exaggerating, see The Divide by Jason Hickel (free copies available on the internet) or blogs by Prabhat Padnaik (also freely available), among others.

Dr. Mitchell,

I started to review J.K. Galbraith’s theory of prices in a technologically advanced oligopoly economy in his “The New Industrial State” and his work on price controls “A Theory of Price Control” over the weekend. I don’t know if you find his work to be of value. Nevertheless, any comment you could provide would be of interest. Thank you for your post.

Best,

Justin Holt

I sat me up and took note today when I read this blog. It’s been a while.

I get the criticisms above: yes, the SUV drivers are not representative of the many; yes, I don’t think disposal of unemployed is an advantage to capitalists.

It was the 2 practical policies which I noted and posted on social media: free public transport, windfall taxes on super profits.

Someone on Facebook today stated that our problems lie at the foot of the 4th estate. I think that’s true.

Ideally fuel guzzling motor vehicles would be discouraged by taxing them more heavily whilst fuel efficient vehicles snd ev’s would be encouraged by purchase subsidies. In Australia there has been a trend towards SUV’s. Some are used to tow caravans and for off-road use but many are just the herd going with the trend plus a belief SUV’s are safer.

There will be howls of protest but we’ve had higher taxes on luxury vehicles without a revolt so it’s not politically out of the question.

Dear James (at 2022/03/21 at 4:48 pm)

Do you think that Karl Marx was an elitist?

In his posthumously published work – A Contribution to the Critique of Hegel’s Philosophy of Right – we find:

“Religion is the sigh of the oppressed creature, the heart of a heartless world, and the soul of soulless conditions. It is the opium of the people.”

This is often shorted to “Religion is the opiate of the masses” but you should understand the full text and the context in which he was writing.

In the C20th, mass consumption took over from religion to serve the same function. It keeps the system stable in the face of the (in your words) ‘all out assault by capital’ on the workers.

It segments the workers and binds them in many ways.

That was what I was referring to.

I cannot see how that generalised commentary is condescending in any way.

best wishes

bill

Remember?

“A barrel of conventional crude oil contains the equivalent of roughly 4.5 years of continuous human labour; or around 11 years at 35 hours per week, 48 weeks of the year. But the capitalist doesn’t pay for the value of the fuel, merely the cost of extracting it. For a mere £49 (at pre-pandemic prices) the capitalist purchases £330,000 worth of work (at the current UK median wage). It is the exploitation of fossil fuels rather than the exploitation of labour which generates the vast majority of the surplus value in an industrial economy. . . .

{As Nicole Foss once put it – if conventional oil was like drinking draught beer from a glass, fracking was the equivalent of sucking the spilled dregs from the carpet.}”

@Postkey, the capitalist is expropriating both rent (the return to land/natural resources) and surplus labour. Land, like capital, is inanimate and passive and their returns are unearned income (economic rent). The simplest way to eliminate economic rent is to tax it. Taxes have more than one purpose.

All the arguments put forward with reference to energy providers and in particular to OPEC+gang are just as equally applied to bigpharma, bigtech, bigbank and a multitude of other big industries that use their market power to screw helpless consumers and enjoy their super normal (monopoly) profits. The irony is that although even mainstream economists openly admit the resultant resource misallocation of such practices and in spite of the existing antitrust laws in capitalist countries, governments in many cases are reluctant to enforce the law. And they always resort to the same old failed policies of curbing excess demand in their quest of disciplining inflation knowing that unemployment will grow, when in reality the appropriate medicine would be to manipulate the supply side by eliminating the production bottlenecks in some key sectors. How much better things would be, if policy makers were to open their eyes and see how the monetary system and economy operate from the MMT perspective.

Bill @16:46,

That is a great explanation. I was a little confused by what you meant in that part of the blog post also. Maybe you could insert that explanation into the original post? I had known what Marx thought of religion’s role, but I did not see how consumerism can play the same role when I first read the original post.

norman,

“It’s actually very helpful to eliminate brown and black people because that reduces demand for commodities in the third world, keeping their prices down for us.”

Thanks for referencing Hickel’s book. I was able to find a paper on his website which he wrote which seems to be a concise version of his book, “The Development Delusion: Foreign Aid and Inequality”.

He highlights the disparity between the inward aid flows to poor countries and the outward economic and financial flows from these countries. He cites that in 2012, these figures were estimated to be $1.3T and $3.3T respectively. He neglects to say, in the paper at least, that these flows result from the economic activity generated in these countries. He does not account for the benefits of this economic activity. He also argues that the economic component of these outward flows are made in such away so as to avoid tax, which seems to be a fair thing to say. Some portion of these outward flows also represent endogenous corruption.

The Third World of the 1960s could be divided into several regions: Africa, South America, the Middle East (non-oil producers), India and South East Asia.

What is puzzling is that only South East Asia seems to have prospered in the late 20th century. Why is this?

Has South East Asia received more aid, more commercial development capital?

Hickel does say: “I do not mean to say that endogenous problems play no role in poverty and underdevelopment, or that the governments of developing countries bear no responsibility for their own misfortunes. They do.”

Perhaps these endogenous factors were more benign in South East Asia?

Henry,

From personal observation rather than any reading/study, I’d guess that south-east Asia may have prospered more than those other regions in the late 20th century partly due to:

1. Overseas Chinese networks facilitating trade & investment

2. The US war in Indochina, with its enormous spending in the region (until 1975)

3. The Japanese co-prosperity sphere (taking advantage of cheap labor & raw materials)

4. Abundant locally grown food throughout the region

5. The rise of China

Norman

I’d agree they are all good reasons and probably explain why the US, Europe and Japan were big commercial investors in South East Asia.

Perhaps endogenous factors have more weight than Hickel attributes to them and might explain why the West has not ploughed more money into the so-called global south and why the global south is not as prosperous as it might be.

Henry,

Recommended reading:

https://astralcodexten.substack.com/p/book-review-how-asia-works?s=r

“Joe Studwell claims this isn’t mysterious at all. You don’t have to bring in culture, genetics, or anything complicated like that. Japan, South Korea, Taiwan, etc, just practiced good economic policy. Any country that tries the same economic policy will get equally rich, as China and Vietnam are discovering. Unfortunately, most countries practice bad economic policy, partly because the IMF / World Bank / rich country economic advisors got things really wrong. They recommended free markets and open borders, which are good for rich countries, but bad for developing ones. Developing countries need to start with planned economies, then phase in free market policies gradually and in the right order. Since rich country economists kept leading everyone astray, the only countries that developed properly were weird nationalist dictatorships and communist states that ignored the Western establishment out of spite. But now the economic establishment is starting to admit its mistakes, giving other countries a chance to catch up.”

Paulo, I see Japan, South Korea Taiwan differently. I don’t think there is only one explanation for the success of these three countries, but a big part of their success, in my eyes, is that the great fear of wealth is communism, socialism, in addition to great power politics, provided the necessity that they succeed with a capitalist system, a wall of private wealth and power against the force of communist China and the Soviet Union. The infection must not be allowed to spread. Weak societies here, at the border, would provide a fertile place. For the US, this meant that these countries had to succeed, and so we worked for those countries to succeed, encouraged their growth, similar to Marshall Plan.