These notes will serve as part of a briefing document that I will send off…

Vast majority of NZ economists seem to support MMT

Yesterday, I published a full analysis of the national account release in Australia, so today I am pretending it is my Wednesday ‘news’ blog with the music segment that seems to be popular. The news is all floods in Australia, death and destruction in the Ukraine and big talk (about 2 or more decades too late) from the Western governments. I note that the German government has confiscated a luxury yacht owned by some Russian ‘oligarch’ (don’t you just love their terminology) while stacks of other oligarch yachts are heading or are in the Maldives to avoid such a fate. Stupid question: if these oligarchs are so bad and their fortunes ill-gotten why have we waited so long to do something? Today we talk briefly about the resolve of the RBA to resist the gambling addiction of speculators in the financial markets. We also consider a discovery I made last week that top New Zealand economists seem to support Modern Monetary Theory (MMT), and then if that isn’t enough – some music.

RBA stays firm on interest rates

On Tuesday (March 1, 2022), the Reserve Bank of Australia decided to keep interest rates constant.

In the – Statement by Philip Lowe, Governor: Monetary Policy Decision – the RBA governor acknowledged that:

Inflation in parts of the world has increased sharply due to large increases in energy prices and disruptions to supply chains at a time of strong demand … increased further due to the war in Ukraine …

How long it takes to resolve the disruptions to supply chains is an important source of uncertainty regarding the inflation outlook, as are developments in global energy markets …

The Board is committed to maintaining highly supportive monetary conditions to achieve its objectives of a return to full employment in Australia and inflation consistent with the target. The Board will not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. While inflation has picked up, it is too early to conclude that it is sustainably within the target range. There are uncertainties about how persistent the pick-up in inflation will be given recent developments in global energy markets and ongoing supply-side problems. At the same time, wages growth remains modest and it is likely to be some time yet before growth in labour costs is at a rate consistent with inflation being sustainably at target.

Kick in the pants for all the financial market players who have been screeching, almost on a daily basis, how the ‘markets have priced in rate hikes’, as if that is a foregone conclusion.

The RBA is not buckling to that pressure and should not.

There are no long-term structural forces present to push this inflation into an accelerating spiral just yet.

The RBA knows that, which is why they talk about the modest wages growth constantly.

Vast majority of NZ economists seem to support MMT

I gave a talk to the Law and Economics Association of New Zealand last week on the inflation issue.

The seminar was on the same day that the RBNZ raised interest rates to ‘fight inflation’.

The other speaker was a former governor of the Reserve Bank of New Zealand and now an academic at a unversity in Wellington.

His presentation was mainstream standard stuff – inflation out of control, interest rates must rise and fiscal policy has to turn to austerity.

All the normal arguments we have heard over and over that have never been correct.

After my contribution, there was a discussion with a question and answer segment.

At one point, the other speaker said that Modern Monetary Theory (MMT) was crazy and totally unsupported by the profession.

To evidence that assertion he referred to a recent – Survey – conducted by the New Zealand Association of Economists, which is the professional body for economists in that country.

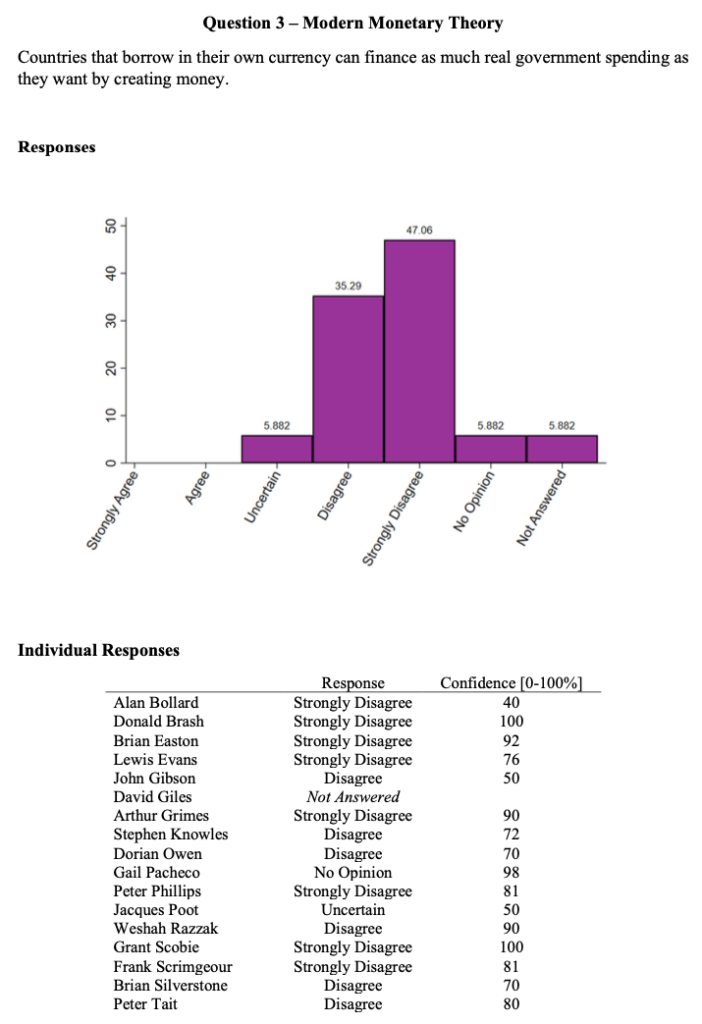

There were several questions and Question 3 was about Modern Monetary Theory (MMT), which served as his ‘gotcha’ point or so he thought.

Here is the question and the responses.

So read the question carefully.

And guess what I would have answered?

Answer: Strongly disagree (Confidence 100%).

What?

Yes, some character in the Economics Association thought they were being clever by summarising Modern Monetary Theory (MMT) with this proposition that they suspected all the participants (mainstream economists) would reject strongly.

End of MMT. Discredited by the profession. Move on.

However, the person(s) who framed this question clearly do not understand what MMT is about.

No MMT economist has ever claimed that a nation that borrows in its own currency or for that matter just issues its own currency without borrowing can finance as much “real” spending as it wants by creating money.

That is the point of the shift in focus that MMT provides from financial to real resource constraints.

Governments spend in nominal amounts – so many dollars, so much yen.

They secure real resources (productive inputs, products) with that nominal spending as long as the productive sector can respond to the spending in output terms and the resources are not already engaged.

If they want to secure a greater share of real resources through nominal spending and they try to compete with existing users then inflation results.

They must then reduce the capacity of existing users to deploy those resources and there are several strategies the government can employ to accomplish that end, including taxation.

Taxation frees up real resource space by creating idle resources, which the government can bring back into productive use or realise sales through nominal spending.

But the limit on nominal spending is available real resources or resources that can be diverted to public use through taxation and other strategies, as above.

At some point, the hard resource constraint binds and no amount of nominal spending by government in the short-term will change that. Inflation will result.

So you can see, these experts in NZ, who are in top positions in the RBNZ, Treasury etc all thought they were answering a question that would expose the fallacies within MMT.

All they were doing was ratifying a key proposition of MMT.

Which makes you wonder what goes for an expert in New Zealand.

The legacy of shock therapy

I wonder how the likes of Jeffrey Sachs are now thinking given all the shocking destruction in the Ukraine right now?

I imagine, given their hubris in the 1990s when they marched into the wreckage of the Soviet Union and proceeded to impose – Shock therapy – on Russia and the satellites.

Instead of taking the time to build the social, legal and political institutions that protect nations against dictatorships this gang of Washington-consensus economists created havoc – dramatically increasing inequality and poverty, reducing life expectancy and setting the new nations up for failure and a return to authoritarian regimes.

The IMF and the gang of economic consultants from US universities and elsewhere that went into these nations seemed to believe that if social protections for citizens were abandoned, public wealth handed over to a new generation of bandits, and an open slather was created for greed and speculative ventures that somehow the nations would mature and become havens for democracy and stability.

The arrogance and idiocy of that lot is beyond imagination.

They marched into Russia under Boris Yeltsin’s impramatur and forgot to see what the people who lived there would like to see for their nations freed from the Soviet rule.

In their haste to sell the wealth off and kick old people out of their apartments and turn of their heaters – as market prices were imposed on housing etc – they didn’t think for a moment that a legal framework, based on a constitution that gave rights and freedoms would be necessary.

I saw this first hand when I did some work in Kazakhstan some years ago.

There were old people living in tin sheds in the harshest of winters on the outskirts of Almaty, who had lost their housing and pensions when the Shock Therapy gang rode into town.

I learned a lot first hand of the consequences of the approach taken immediately after the Soviet system collapsed.

They also didn’t eliminate the culture of authoritarianism – and the resentment to the so-called ‘liberalisation’ allowed it to consolidate under a new set of authoritarian types.

They also created a new breed of capitalist who commandeered the public wealth and companies and created untold personal wealth at the expense of the people.

This wealth found its way into property markets in London and elsewhere, into luxurious possessions and has been used to pervert political processes around the world by capturing Western political parties through funding and personal payola.

And remember the so-called – 1993 Russian Constitutional Crisis – which saw the elected parliament dissolved after they rejected a decree by Boris Yeltsin who rode into Moscow with tanks, and had the army storm the Supreme Soviet Building (parliament)and murder at least 137 citizens and injure many more as he imposed Presidential rule by decree.

The likes of Putin were on training wheels watching all that.

And in 1996, Yeltsin, on the advice of his close adviser, engineered things to have Putin installed as the President of Russia (Source).

Putin wasn’t elected – he was installed by an authoritarian predecessor under a constitution that allowed Presidential decree.

Putin had played along with the Shock Therapy gang and enriched himself in the process, along with his mates.

But his Presidency has largely rejected that approach and consolidated power among a cabal of … ‘oligarchs’.

And as an aside – don’t you just love the terminology of the West – ‘oligarchs’. The Koch Brothers and their types are financiers or industrialists or entrepreneurs. But the Russian capitalists are ‘oligarchs’.

Meanwhile, the IMF and the Jeffrey Sachs types have moved on – oblivious to their on-going destructive legacy and reinventing history to absolve themselves of responsibility.

I also could talk about the role the IMF and the West, in general, has played in modern day Ukraine.

This article is interesting in that regard – What You Should Really Know About Ukraine (January 27, 2022).

Don’t get me wrong though.

I do not intend to ameliorate the Russian behaviour which is unambiguously shocking.

Further, on the new confiscation drive – luxury yachts etc – if these fortunes are so illegitimate, why are we just confiscating their ill-gotten gains now.

Why has the British government – both parties – allowed these characters to distort property markets in London and why have they taken funding from them?

Why don’t the Western governments immediately stop buying gas and oil from Russia – sales of which dominate their massive current account surplus which gives Russia the capacity to continue to buy whatever imports they desire?

Why hasn’t the banking restrictions been imposed on Sberbank and Gazprombank, which facilitate those trades?

I also note that the British Labour Party bosses are now threatening expulsion of any members including MPs who dare to question NATO or the role of the West in all of this.

The freedom party it seems.

Shocking hypocrisy given its role in Iraq.

And, finally, my friends at the Rose Mark Campaign in Japan have recently issued (February 26, 2022) a statement – [Statement] No War! Let us condemn the invasion of Ukraine along with the struggle between Great Powers for spheres of influence – which is worth reflecting on.

Which of the Western powers in recent years has not been complicit in given the Putin regime in the Russian Federation the scope to pursue his agenda?

I just wish Russia would stop killing children and citizens in general.

Our edX MOOC – Modern Monetary Theory: Economics for the 21st Century continues

Week 4 – the final week – began yesterday in our MMTed/University of Newcastle MOOC – Modern Monetary Theory: Economics for the 21st Century.

The course is free and will run for 4-weeks.

You need to invest about 2 hours of time per week, so if you have the will to catch up you can.

So, it is not too late to enrol and became part of the already large class.

Learn about MMT properly with lots of videos, discussion, and more.

We have already had two live events this year which added to last year’s material. And next week another two live, interactive sessions will occur.

So even if you completed the course last year, these live events might be a reason for enrolling again, just to be part of these sessions.

Further Details:

https://edx.org/course/modern-monetary-theory-economics-for-the-21st-century

Music – New version of a classic

Here is a contemporary interpretation (2020) of a classic R&B number from the 1960s – I’m a Man.

It was first recorded by – The Spencer Davis Group – and released in January 1967.

It was the last single that the band recorded with organ player – Steve Winwood – before he departed for – Traffic – another great band.

He wrote the song with record producer – Jimmy Miller – who later produced some of the great Rolling Stones’ records.

The album of the same name, released later in 1967, is worth listening to regularly. One of my favourites among many.

Unfortunately, the song has been used by many spurious advertising campaigns, which I consider to be totally inappropriate, but that is the way Capitalism perverts our culture.

Every budding musician in the 1960s who got their hands on a guitar learned this song and played it in garage bands – few chords, great pattern, and strong riff. All the hallmarks of a jamming track.

This version from a studio performance from Steve Winwood at his own studio – Wincraft Studios – which is in the west of England (Cotswolds).

And for purity, here is the original from Spencer Davis Group, which I prefer.

But whenever a Hammond B3 and Leslie Cabinet is involved it is hard not to like the offering.

Aah, the late 1960s, when nothing made sense to us teenagers, yet everything seemed possible, and revolution was hope.

And, those hopes were disappointed.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

And NZ should know they were the early ones into the neoliberal project of disaster!

“The war is likely to increase the price of fuel and wheat. This should be dealt with through the reduction of the consumption tax and suspension of the petrol tax. ”

The problem with that is that the loss has to be allocated somewhere. By all means let us stand against war, but let’s do it with realistic economics.

Russia supplies 10% of the world’s oil and 30% of the world’s wheat. That means we have to get by on a lot less oil right now and probably quite a lot less wheat.

What all that means, as Keynes’s ‘how to pay for the war’ rightly pointed out, is that consumption has to come down. That will either be via taxes (either government or mortgage company imposed), or via inflation.

Demand has to match supply – particularly when supply is relatively inelastic. And unlike Russia the West hasn’t got a war machine to soak up those who will lose their jobs.

“And unlike Russia the West hasn’t got a war machine to soak up those who will lose their jobs.”

Or an internal suppression machine yet? MMT surely begs to differ on the financial side?

Mainstreamers say that “printing money” is inflationary.

But, isn’t QE all about “printing money” – and give it away to 1%?

Central banks do “print money” to buy back government bonds from private investors, who bought them in the primary auctions.

But, mainstreamers haven’t got any problems with QE.

You can imagine why QE doesn’t trouble those feeble minds: they are, or plan to be, in the 1% co-hort.

With so many cash floating in their hands, the 1% are frantic to invest it.

And there are not so many options to invest.

Government bonds are in historic lows and securities markets are high risk casinos.

And so, they turned to real estate. Housing allways appreciate with time.

But, prices of real estate have very low weight in the computation of inflation.

So, inflation might be higher than the oficial figures might show, not because of wage pressure, but because of QE.

Doesn’t that benefit the real estate industry and hamper other industries?

The Greek and Roman empires did the same thing as the American empire (meaning US, EU, UK, Australia, Brasil, Israel, and some more) is doing: channeling all wealth to the 1%.

And then, all crumbled to the ground.

The article linked above – What You Should Really Know About Ukraine by Bryce Greene – calls the removal of Yanukovych a coup and asserts his removal was facilitated by involvement of the US.

It’s not exactly that straight forward.

There is evidence that the Russians were involved in managing the efforts to put down the Euromaidan/Maidan protests.

After concerted protests, Yanukovych fled Kyiv and was removed from office by a vote of the Ukrainian parliament. Yanukovych was charged by an interim government with mass murder of protestors.

Isn’t a “suppression machine” one that allows private sector bankers to repeatedly blow asset bubbles as Hyman Minsky and now Steve Keen (“The New Economics: A Manifesto”) tell us with government creation of money from thin air often used to mop up the mess? In other words a two card trick!

As a New Zealander I do have to admit that our economists are a particularly misinformed and misguided group of ‘professionals’. They display no understanding of sectoral balances and where private savings originate from. They are firmly of the belief that taxation and borrowing finance government spending and they even seem to be totally unaware that banks create money through their lending. Try to oppose anything that they have to say and you are then met with hostility and anger. Our journalists and newspapers are no better and are just unquestioning mouthpieces for the orthodoxy.

These strongly (dis)agree questionnaires always play on the requirement of an answer and respondents emotional need to complete. I’d suggest that if there isn’t an option to reply that this is a misleading question or in this case, the statement is not a truthful reflection of the subject, then the questionnaire should be sent directly to delete bin.

Bill, quite correct regarding the economy with the truth. Allowing our land to be bought with the gains from exploitation abroad (hardly limited to Russians) serves only the foreign exploiters and our landed/loaded class, certainly not any housing need. The EU that oversaw the flow of cheap labour from Eastern Europe, rather than any economic leveling, is now seeing a flow of immigrants (and too many women and children) at a rather faster rate than it would like with its ideal plan for Ukraine inclusion in the EU.

Neil Wilson ‘consumption has to come down either by taxes or inflation’. Or perhaps a revival of covid (I long for the joyous cleaner air traffic-free days of the 1st lockdown), an extension of the war or a real facing up to, with consumption constraints, the climate emergency.