Today (January 22, 2026), the Australian Bureau of Statistics (ABS) released the latest labour force…

US labour market cannot be healthy with rising numbers of sick people

Last Friday (January 7, 2022), the US Bureau of Labor Statistics (BLS) released their latest labour market data – Employment Situation Summary – December 2021 – which reported a total payroll employment rise of only 199,000 jobs in December and a 0.3 points decline in the official unemployment rate to 3.9 per cent, while participation was unchanged at 61.9 per cent. While the US labour market is still creating work – it is doing so at a declining rate and there are unequal patterns across the industrial sectors. The US labour market is still 3,572 thousand jobs short from where it was at the end of February 2020, which helps to explain why there are no fundamental wage pressures emerging. Any analyst who is claiming the US economy is close to full employment hasn’t looked at the data. The failure to introduce a renewed fiscal stimulus will definitely leave the economy worse off, especially with the renewed virus onslaught from Omicron.

Overview for December 2021:

- Payroll employment increased by 199,000.

- Total labour force survey employment rose by 651 thousand net (0.42 per cent).

- The seasonally adjusted labour force 168 thousand net (0.1 per cent).

- The employment-population ratio rose 0.2 points to 59.5 per cent (down from February 2020 peak of 61.1 per cent).

- Official unemployment fell by 483 thousand to 6,319 thousand.

- The official unemployment rate fell by 0.3 points to 3.9 per cent.

- The participation rate was unchanged at 61.9 per cent.

- The broad labour underutilisation measure (U6) fell by 0.4 points to 7.3 per cent.

For those who are confused about the difference between the payroll (establishment) data and the household survey data you should read this blog post – US labour market is in a deplorable state – where I explain the differences in detail.

Some months the difference is small, while other months, the difference is larger.

Summary Reflections

The first point to be clear on is that the employment slowdown evident in this data reflects the situation in mid-December and thus does not capture the Omicron impacts, which will be severe as more people are forced to remain at home.

The second point is that all the talk about tightening policy settings because inflation is temporarily higher than desired is madness, given that 3.6 millions jobs are still missing relative to February 2020.

When inflationary pressures are driven by the supply side as they are now – cartel behaviour (oil), and production and delivery issues (Covid) increasing interest rates and cutting spending will not only not reduce the price pressures but will damage the gains in unemployment reductions.

It is obvious that the real wage in the US is declining fast. Again no time for policy austerity.

With the inflationary pressures, think about corporate profits, which are at record levels. That tells me that corporations are using the supply shortages as an excuse to disproportionately hike prices.

And the mantra coming from governments the world over is that we have to ‘live with Covid’, yet unless workers are healthy, there can be no sustained economic recovery.

And cutting fiscal support to those who remain disadvantaged by the increasing number of workers who are becoming ill or the voluntary spending withdrawals by people scared to go out much, is the worst thing our governments can do.

That will be the narrative for the next period.

Payroll employment trends

The BLS noted that:

Total nonfarm payroll employment rose by 199,000 in December. Job growth averaged 537,000 per month in 2021. Nonfarm employment has increased by 18.8 million since April 2020 but is down by 3.6 million, or 2.3 percent, from its pre-pandemic level in February 2020 …

Employment in leisure and hospitality continued to trend up in December (+53,000) … but is down by 653,000 since February 2020.

Employment in professional and business services continued its upward trend in December (+43,000) … is slightly below (-35,000) its level in February 2020.

Manufacturing added 26,000 jobs in December, primarily in durable goods industries … is down by 219,000 since February 2020.

Construction employment rose by 22,000 in December, following monthly gains averaging 38,000 over the prior 3 months … is 88,000 below its February 2020 level.

Employment in transportation and warehousing increased by 19,000 in December … Since February 2020, employment in transportation and warehousing is

up by 218,000, reflecting job growth in couriers and messengers (+202,000) and in warehousing and storage (+181,000).Employment in wholesale trade increased by 14,000 in December but is 129,000 lower than in February 2020.

Mining employment rose by 7,000 in December. Employment in the industry is down by 81,000 from a peak in January 2019.

In December, employment showed little or no change in other major industries, including retail trade, information, financial activities, health care, other services, and government.

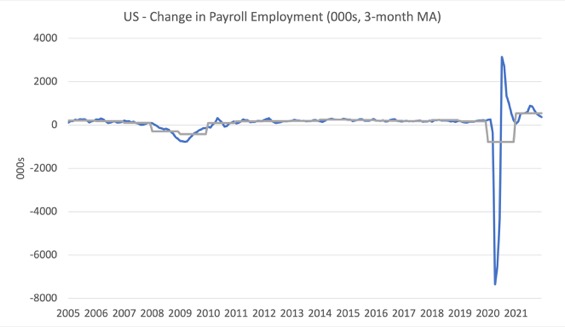

The first graph shows the monthly change in payroll employment (in thousands, expressed as a 3-month moving average to take out the monthly noise). The gray lines are the annual averages.

The data swings are still large and dwarf the past history.

The US labour market is still 3,572 thousand jobs short from where it was at the end of February 2020 and the commentary from the BLS above tells us how this shortfall is distributed across the sectors.

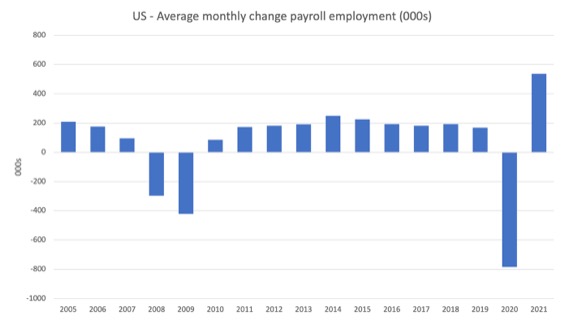

The next graph shows the same data in a different way – in this case the graph shows the average net monthly change in payroll employment (actual) for the calendar years from 2005 to 2021.

The red marker on the column is the current month’s result.

The final average for 2019 was 168 thousand.

The final average for 2020 was -785 thousand.

The average for 2021 (so far) is 537 thousand.

Labour Force Survey – employment growth continues at lower pace

The data for December 2021 reveals:

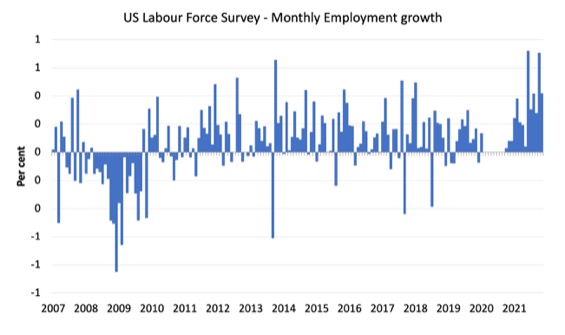

1. Employment as measured by the household survey rose by 651 thousand net (0.42 per cent).

2. The labour force rose by 168 thousand net (0.10 per cent).

3. The participation rate was unchanged at 61.9 per cent.

4. As a result (in accounting terms), total measured unemployment fell by 483 thousand to 6,319 thousand and the unemployment rate fell by 0.3 points to 3.9 per cent.

The following graph shows the monthly employment growth since January 2008 and excludes the extreme observations (outliers) between March 2020 and October 2020, which distort the current period relative to the pre-pandemic period.

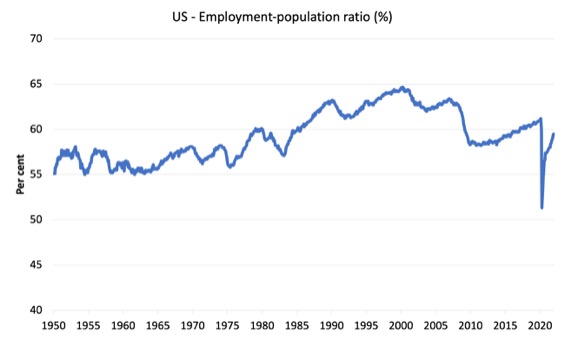

The Employment-Population ratio is a good measure of the strength of the labour market because the movements are relatively unambiguous because the denominator population is not particularly sensitive to the cycle (unlike the labour force).

The following graph shows the US Employment-Population from January 1950 to December 2021.

While the ratio fluctuates a little, the April 2020 ratio fell by 8.6 points to 51.3 per cent, which is the largest monthly fall since the sample began in January 1948.

In December 2021, the ratio rose by 0.2 points to 59.5 per cent.

It is still well down on the level in February 2020 (61.1 per cent).

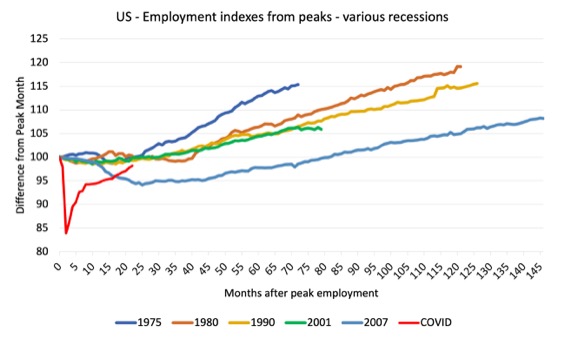

As a matter of history, the following graph shows employment indexes for the US (from US Bureau of Labor Statistics data) for the five NBER recessions since the mid-1970s and the current 2020-COVID crisis.

They are indexed at the employment peak in each case and we trace the data out for each episode until one month before the next peak.

So you get an idea of:

1. The amplitude (depth) of each cycle in employment terms.

2. The length of the cycle in months from peak-trough-peak.

The early 1980s recession was in two parts – a short downturn in 1981, which was followed by a second major downturn 12 months later in July 1982 which then endured.

Other facts:

1. Return to peak for the GFC was after 78 months.

2. The previous recessions have returned to the 100 index value after around 30 to 34 months.

3. Even at the end of the GFC cycle (146 months), total employment in the US had still only risen by 8.3 per cent (since December 2007), which is a very moderate growth path as is shown in the graph.

The COVID collapse was something else but the recent gains are evident, although the gains have been slowing relative to early in the recovery.

After 22 months, total employment is still 1.8 points below the February 2020 level.

Unemployment and underutilisation trends

The BLS note that:

The unemployment rate declined by 0.3 percentage point to 3.9 percent in December, and the number of unemployed persons decreased by 483,000 to 6.3 million. Over the year, these measures are down by 2.8 percentage points and 4.5 million, respectively. In February 2020, prior to the coronavirus (COVID-19) pandemic, the unemployment rate was 3.5 percent, and unemployed persons numbered 5.7 million. …

The number of long-term unemployed (those jobless for 27 weeks or more) declined by 185,000 to 2.0 million in December. This measure is down from 4.0 million a year earlier but is 887,000 higher than in February 2020. The long-term unemployed accounted for 31.7 percent of the total unemployed in December.

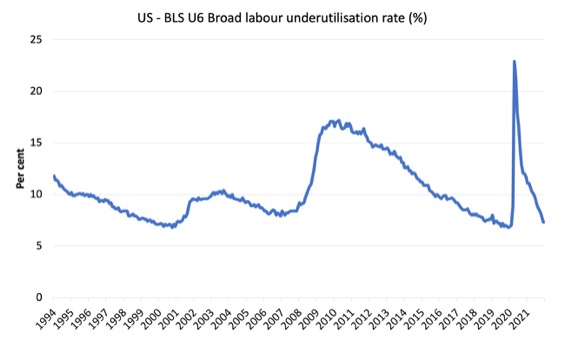

The first graph shows the official unemployment rate since January 1994.

The official unemployment rate is a narrow measure of labour wastage, which means that a strict comparison with the 1960s, for example, in terms of how tight the labour market, has to take into account broader measures of labour underutilisation.

The next graph shows the BLS measure U6, which is defined as:

Total unemployed, plus all marginally attached workers plus total employed part time for economic reasons, as a percent of all civilian labor force plus all marginally attached workers.

It is thus the broadest quantitative measure of labour underutilisation that the BLS publish.

Pre-COVID, U6 was at 6.8 per cent (December 2019).

In December 2021 the U6 measure was 7.3 per cent, a decline of 0.4 points on the previous month.

Some of this fall was due to the decline in official unemployment and the further decline in the workers in the part-time for economic reasons cohort (the US indicator of underemployment).

Ethnicity and Education

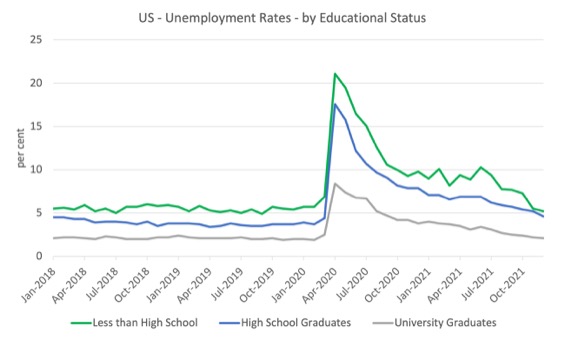

The next graph shows the evolution of unemployment rates for three cohorts based on educational attainment: (a) those with less than high school completion; (b) high school graduates; and (c) university graduates.

As usual, when there is a crisis, the least educated suffer disproportionately.

In the collapse in employment, the unemployment rates rose by:

- 14.1 points for those with less than high-school diploma.

- 13.0 points for high school, no college graduates.

- 5.9 points for those with university degrees.

The period since April 2020 has seen the unemployment rate fall by:

- 15.9 points for those with less than high-school diploma meaning the unemployment rate is now 1.7 points below the March 2020 level.

- 13 points for high school, no college graduates meaning the unemployment rate is now 0.2 points above the March 2020 level.

- 6.3 points for those with university degrees meaning the unemployment rate is now 0.4 points below the March 2020 level.

In the last month, the change in the unemployment rate has been:

- a fall of 0.3 points for those with less than high-school diploma.

- a fall of 0.6 points for high school, no college graduates.

- a fall of 0.1 points for those with university degrees.

So the fall in official unemployment in December 2021 was driven mostly by the decline in those with less than bachelor’s degree.

For those who consider that the least educated represent a ‘structural’ constraint, the data shows that as the labour market tightens employers will turn to the least educated and they absorb them into employment.

In the US context, the trends in trends in unemployment by ethnicity are interesting.

Two questions arise:

1. How have the Black and African American and White unemployment rate fared in the post-GFC period?

2. How has the relationship between the Black and African American unemployment rate and the White unemployment rate changed since the GFC?

Summary:

1. All the series move together as economic activity cycles. The data also moves around a lot on a monthly basis.

2. The Black and African American unemployment rate was 6.8 per cent in March 2020, rose to 16.6 per cent in May and is at 7.1 per cent in December 2021. In the last month, it was rose by 0.6 points, which runs counter the trend.

3. The Hispanic or Latino unemployment rate was 6 per cent in March 2020, rose to 18.9 per cent in April and is at 4.9 per cent in December 2021. In the last month, it fell by 0.3 points.

4. The White unemployment rate was 3.9 per cent in March 2020, rose to 14.1 per cent in April and fell to 3.2 per cent in December 2021. In the last month, it fell by 0.5 points.

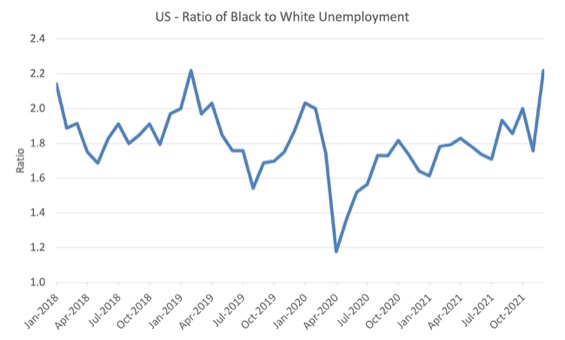

The next graph shows the Black and African American unemployment rate to White unemployment rate (ratio) from January 2018, when the White unemployment rate was at 3.5 per cent and the Black or African American rate was at 7.5 per cent.

This graph allows us to see whether the relative position of the two cohorts has changed since the crisis.

If it is rising, then the unemployment rate of the Black and African American cohort is either rising faster than the white unemployment rate or falling more slowly (or a combination of that relativity).

While there is month-to-month variability, the data shows that, in fact, through to mid-2019, the position of Black and African Americans had improved in relative terms (to Whites), although that just reflected the fact that the White unemployment was so low that employers were forced to take on other ‘less preferred’ workers if they wanted to maintain growth.

In April 2019, the ratio was 2.1 (meaning the Black and African American unemployment rate was more than 2 times the White rate).

By April 2020, the ratio had fallen to its lowest level of 1.2, reflecting the improved relative Black and African American position.

As the pandemic hit, the ratio rose and peaked at 1.8 in October 2020.

In December 2021, the ratio was 2.22, a sharp rise of 0.5 from the previous month, which indicates that the relative position of the Black and African American cohort has improved quite significantly.

This is the result of a combination of a significant decline in the white unemployment rate and a rise in the black rate.

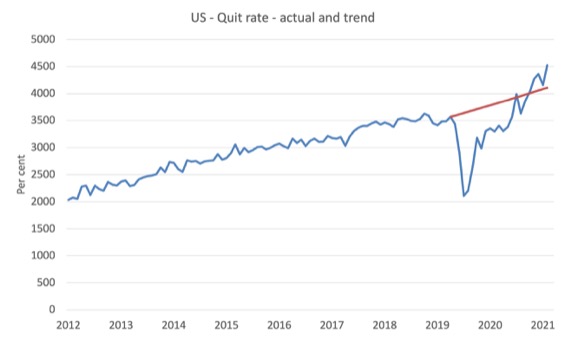

Special analysis this month – The ‘great resignation’

The current hyped storyline is about the ‘great resignation’ – which argues that workers are sick of bad bosses and are quitting their jobs at record rates (the November rate was 3 per cent whereas the average between October 2012 and February 2020 was 2 per cent).

Employers are now finding it hard to retain workers if they have abused them in the past with poor working conditions and pay.

Further, the ‘great resignation’ is a narrative about workers’ power – workers exercising their right to quit and expressing their desire for better working conditions etc.

It is am empowerment story.

But the reality is a bit different.

The first graph shows the quits rate for the US from December 2000 to November 2021 (the total JOLTS data span).

It is very cyclical – rising after a time once the labour market is doing better and falling sharply during recessions.

It is the sudden spike that is driving the ‘great resignation’ story line.

However, it is misleading.

The next graph shows the period since October 2012 and adds a trend extrapolotion (red line).

That line crudely shows where quits would have gone if the pre-pandemic behaviour continued and there was no pandemic.

You can see that there has been a modest overshoot as the labour market opened up again.

Whether that steeper trend continues is the question.

Some of that quit behaviour clearly is consistent with the ‘great resignation’ narrative – workers feeling better about prospects after the dire pandemic years (to date).

But it is also being driven by other factors, including being able to gain higher pay as real wages are squeezed.

The BLS – Job Openings and Labor Turnover – November 2021 – release shows that:

Quits increased in several industries with the largest increases in accommodation and food services (+159,000); health care and social assistance (+52,000); and transportation, warehousing, and utilities (+33,000).

So the highest quit rates are in the low-paying sectors and the JOLTS data shows that there are more vacancies (job openings) than workers seeking jobs in those sectors.

But I don’t think this is a sign that a wages breakout is about to happen.

Participation is still well down on pre-pandemic levels – 61.9 per cent in December 2021 compared to most recent peak of 63.4 per cent in January 2020.

On current working age population, that is around 3.933 thousand workers who are sitting outside the workforce – and it is hard to suggest that their disappearance is permanent (such as in the ageing society situation).

When the pandemic eases, these workers will be pushing the labour supply situation, which will militate against major supply shortages and wage pressures.

These workers are not participating as a result of a lack of job opportunities, but, rather, because they are scared of geting sick, or are forced, by personal circumstances (and the terrible US health system) to care for people who are sick.

There is a great reluctance by many workers to join the front line of those who are getting (and dying of) Covid.

I will provide more analysis of this effect in another blog post, once I have crunched some more numbers.

But I would call the ‘great resignation’ the ‘great reluctance’.

Conclusion

The December 2021 US BLS labour market data release suggests that the labour market continues to add jobs (albeit at a declining rate) is improving but still not close to full employment.

The US labour market is still 3,572 thousand jobs short from where it was at the end of February 2020.

The employment-population ratio is still well down on the February 2020 peak.

Taken together, there are no fundamental wage pressures emerging at present despite the spikes in inflation arising from supply chain constraints.

And the so-called ‘great resignation’ is hiding a worrying shortfall in participation for Covid reasons.

That is enough for today!

(c) Copyright 2022 William Mitchell. All Rights Reserved.

Bill, I stopped reading to point out 2 things.

1] That for the 1st graph, I don’t see what the gray and blue line are.

2] That for the 2nd graph, I don’t see a red mark.

@Steve_American: I agree with you that the second chart lacks the red mark described in the text. However, as for the first chart, the text states, “The first graph shows the monthly change in payroll employment (in thousands, expressed as a 3-month moving average to take out the monthly noise). The gray lines are the annual averages.” By implication, the blue line is the 3-month moving average.

James, I think Bill has added the part about the gray line.

Here in Australia, governments have “found the answer” – just change the laws so potentially (and given the scale of the infection, likely) infected and infectious people can go back to their workplaces if they fall into a broad criteria.

Given the current disruptions to food production and distribution causing bare supermarket shelves all over the country (in a country that produces far more food than it’s population can possibly consume) and the potential threat to basic essential service such as the electricity grid and water supply, they’ve decided they have no choice but to “push through” the latest Covid wave by allowing something that medical experts generally consider unthinkable.

While this may relieve essential worker shortages in the immediate term, it would seem all but guaranteed to accelerate the spread of the infection throughout the population as a whole. And the hospital system in many places is having difficulty coping as it is now – if it were not for Australia’s relatively high rates of vaccination and the apparent reduced likelihood of the now-dominant Omicron strain to cause serious illness, there’s no doubt that the ability to deliver modern medical care would have already been completely wiped out by the extraordinary number of infections. How this is going to play out remains to be seen.

The decision taken a month or so ago by the New South Wales government (with continual encouragement and hectoring from the Federal government) to just “let the virus rip” with other states (barring Western Australia) more or less following suit, would have to be the most monumental piece of stupidity and recklessness I’ve witnessed from our policy makers in my 50 years.

It underscores the title of Bill’s article, that an economy cannot be healthy if the people are sick. And we haven’t seen how it’s going to end yet.