The other day I was asked whether I was happy that the US President was…

European growth positive but weak

It’s Wednesday, so just a few items that have passed me by this week. Eurostat published the latest national accounts data yesterday (September 7, 2021) that reveals that key Eurozone states are still lagging behind where they were before the pandemic. In some cases (Italy and Spain), they hadn’t even got back to pre-GFC levels of activity before the pandemic stuck. So a double hit to these nations in the space of a decade or so. That damage will be immense and demonstrates once again the dysfunctional nature of the currency union. Then I consider the latest nonsense from the Business Council of Australia – which is just a special pleading organisation for the top-end-of-town. They think it is time to go back to the deficits are bad narrative (except when their members are receiving corporate welfare that is). And to calm down after that we have some jazz, of course.

European growth

Eurostat released the second-quarter national accounts data yesterday (September 7, 2021) – GDP up by 2.2% and employment up by 0.7% in the euro area – which as the title suggests, economic growth has recorded a positive 2.2 per cent for the Euro area and 2.1 per cent for the EU.

The sources of growth (contributions) were:

1. Household and NPISH final consumption expenditure = 1.9 points.

2. Government final consumption expenditure = 0.3 points.

3. Gross fixed capital formation = 0.2 points.

4. Change in inventories = -0.2 points.

5. Net exports = 0 points.

So driven by domestic demand growth, mostly household consumption.

However, only five Member States out of 18 (excluding Luxembourg for which no second-quarter data is available yet) have gone past the pre-pandemic level.

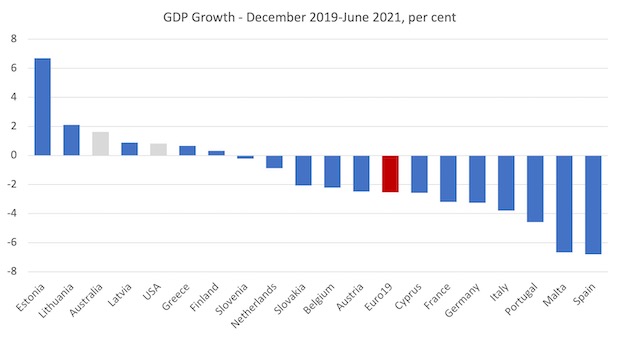

The following graph shows the growth between the December-quarter 2019 and the June-quarter 2021 (in percentage terms).

I included the US and Australia as comparisons of nations with their own currency.

There is not much to sing about there.

And while Greece looks to be better than some of the other weaker nations, don’t forget that its economy is still 27 per cent smaller than it was prior to the onset of the GFC.

So, its current growth is coming off a much smaller base than the other nations.

Spain is 6.8 per cent smaller than its pre-pandemic level, and, that level was still below the pre-GFC level.

Portugal is 4.6 per cent smaller than its pre-pandemic level, and, that level was only marginally above the pre-GFC level.

Italy is 3.7 per cent smaller than its pre-pandemic level, and, that level was still 8.6 per cent below the pre-GFC level.

For Germany, 30 per cent (approx) of the gains it has made since the GFC have evaporated during the pandemic.

For France, around 43 per cent of its gains since the GFC have evaporated during the pandemic.

This is despite the fact that the Stability and Growth Pact rules have been suspended temporarily and the ECB is effectively funding all fiscal deficits in the Eurozone.

Once again, this poor performance signals a system that is biased towards recession, even when its pernicious rules are somewhat relaxed.

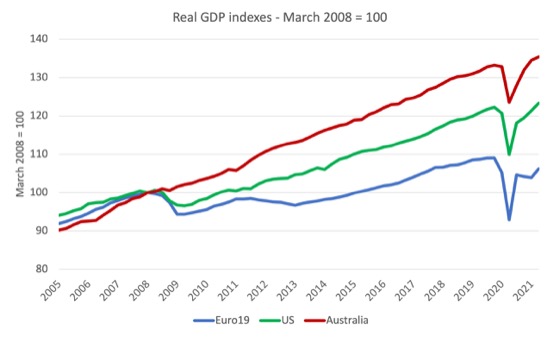

Consider the following graph, which shows real GDP indexed to 100 at the March-quarter 2008 for the Eurozone, the US and Australia.

In the period from the March-quarter 2008 to the June-quarter 2021, the Eurozone grew by 6.2 per cent, the US economy grew by 23.3 per cent and the Australian economy grew by 35.4 per cent.

And, to put that into perspective, the Australian economy has been constrained in growth by excessively tight fiscal policy.

There is more to life than economic growth clearly, but it does tell you something about the relative material prosperity of a nation.

The Eurozone is effectively a failed experiment.

And while they are operating a more flexible environment for the moment (with the SGP rules temporarily suspended and the ECB funding the deficits) that state will not last.

Even with that flexibility the monetary union under performs.

The Business Council of Australia up to its old story lines

It gets boring reading discussion papers from employer organisations like the BCA.

Their latest – Living on borrowed time (released June 30, 2021) – is no exception.

This is an organisation that consistently opposes wage rises for workers and lobbies government for more handouts and deregulation.

It represents the largest corporations in Australia, which have been creaming large profits for years at the expense of their workforces.

The latest data for the June-quarter – Business Indicators, Australia (released August 30, 2021) – show that:

1. Company gross operating profits rose 7.1% seasonally adjusted.

2. Wages and salaries rose 2.0% seasonally adjusted (which was a real cut in wages)

Anyway, in its latest lobbying document (cited above) it has resumed its attack on government debt (well sort of).

It repeats the myths that:

1. “Australia is also facing the global trend of an ageing population. This puts pressure on governments to fund services for a growing proportion of older Australians and decisions must be made about how to fund services from a relatively smaller pool of working Australians.”

The funding is simple. Press some computer keys at the central bank.

The only thing we will require from the “smaller pool of working Australians” is that they are more productive, if we want to preserve existing material living standards (which is a questionable goal given climate change).

Increasing the productivity of existing workers and our future workers will require large government outlays on education, training etc.

2. “the government’s principal strategy for paying down the debt and funding services into the future appears dependent on increasingly high taxes on the relatively smaller pool of Australian workers.”

Which means they should forget about ‘paying down the debt’. Simple.

3. “Government must be on a sustainable footing. We can’t carry high debt levels forever as we will need the buffers to meet future challenges – and there is no way of knowing what crises may come our way.”

Completely false.

The federal government can carry whatever debt level it chooses and for as long as it chooses.

There is never a question that the debt is unsustainable or risky.

That statement by the BCA is equivalent to saying that the non-government wealth that is represented in risk-free government debt cannot rise forever. Of course it can.

Further, the other myth is the “buffers” claim – that somehow the government has to save up its own currency to ensure it can spend it in the future.

It is an absurdity.

Saving is the act that households engage in to forego spending in the current period in order to have greater spending prospects in the future.

They have to sacrifice current consumption to expand their future consumption possibilities because they are financially constrained and are limited in their spending by their income sources.

The same logic does not apply to the currency-issuing government, which can spend however much they like whenever they like, irrespective of how much they spent yesterday.

There is no feasible concept that the government has to say the currency that it issues.

It makes no sense to say that.

Just more of the same from the BCA – and perhaps the government should look to cut the massive industry assistance first and see whether the BCA thinks that it’s a good move.

The Wire

One of the earliest box-set shows I watched, before streaming came along, was – The Wire.

It was a magnificent series (5 seasons).

One of my favourite characters was Stringer Bell, who ran B&B Enterprises in the first two seasons (as in the partners in crime Avon Barksdale and Stringer Bell).

B&B was the legal enterprise (property development, etc) that acted as the money laundering operation for their drug revenue.

Stringer was studying macroeconomics at the Baltimore Community College in his spare time and he wanted to run B&B according to the macroeconomic principles he was learning.

He declared at one meeting, while Avon was interned that “We gonna handle this shit like businessmen”.

This encourages all sorts of deviations from the plans that Avon had – such as market segmentation with Proposition Joe, a new cartel arrangement and other things he learns from economics.

I think the writer David Simon got confused between macroeconomics and microeconomics.

Stringer was really applying orthodox microeconomics principles.

Stringer wanted to be an economist and move beyond his criminal operations.

I was reminded of this earlier in the week with the death of Michael K. Williams who played the role of Omar Little, who was also a brilliant character who continually interrupted the Barksdale operation through his hold-ups.

He was my favourite character.

His death in the show (Season 5) was very sad (in the way that fictional media does that to you).

His early death in real life is shocking.

Music – Chill out day

This is what I have been listening to while working this morning.

After last week’s experimental album from Lee ‘Scratch’ Perry, I thought we had better go mainstream today and one of the better albums in that regard was – Night Lights – which was released by – Gerry Mulligan – in September 1963.

I didn’t get this record until about a decade later and it suited by mood at the time – chilled.

This is baritone sax at its coolest.

It was recorded in New York city at the Nola Penthouse Studios and featured:

1. Gerry Mulligan – baritone sax and piano.

2. Jim Hall – guitar (one of my favourite players).

3. Bob Brookmeyer – valve trombone.

4. Art Farmer – flugelhorn.

5. William Crow – bass.

6. Dave Bailey – drums.

Here is track 3 – In the Wee Small Hours of the Morning – which was a song made famous by Frank Sinatra in 1955.

So relax and listen to the breathing on that sax.

Here is the whole album if you want to go further:

As an aside, in 2014, the Nola Penthouse Studios were forced to move after their building on 111 West 57th Street was sold. They had been there for 70 odd years.

Not long after in 2017, its co-owner and main mixing technician – Jim Czak – died.

The Wire is the best TV drama ever made. As rich and thought provoking as any great work of literature. Work of genius, and as for the unforgettable Omar, well all I can say is……indeed. I must watch it all again.

I have been in Germany for the last 3 weeks and was at a SPD meeting on Friday.

I can find Eurozone Dystopia in German and gave everyone who was at the meeting the link to find it. Is there a German edition of Reclaim the state ? There isn’t a German version of the deficit myth but is a German version of Warren’s seven frauds.

Not many old SPD voters are happy with Olaf Schultz even the newspapers are saying there has never been such a deep red poster campaign combined with a not so red candidate.

A clone of Tony Blair. A liberal of the neo kind.

Stuttgarter Zeitung

https://www.stuttgarter-zeitung.de/inhalt.spd-im-umfragehoch-olaf-scholz-setzt-auf-rot-gruene-koalition-nach-der-bundestagswahl.f04a877e-9700-4598-b5c7-3e06aba7c32a.html

Berlin – In view of rising polls, SPD chancellor candidate Olaf Scholz hopes for a majority for a red-green coalition after the federal election. “I would like to govern together with the Greens,” said the Federal Finance Minister and Vice Chancellor of the “Tagesspiegel” (Sunday edition). “I have already worked with the Greens in various governments, both in the federal government and in Hamburg,” he emphasized. An alliance with the left, however, is out of the question for Scholz.

Should it not be enough for a government composed only of the SPD and the Greens, Scholz is aiming for a traffic light coalition with the FDP, according to “Tagesspiegel”. However, he does not want to form a coalition with the left. According to the newspaper, the main reason for this is the recent refusal of the left-wing MPs in the Bundestag to approve the evacuation operation of the Bundeswehr in Kabul. That was “bad”, said Scholz accordingly.

The FDP demanded from Scholz and the Green Chancellor candidate Annalena Baerbock that they “rule out a left-wing alliance crystal clear”. The deputy head of the FDP parliamentary group, Michael Theurer, affirmed: “Flattering the center to turn to the left-wing extremists is not possible.” Anyone who, like the left, wants to dissolve NATO and say goodbye to Germany from the military alliance, “mustn’t think about the future of the Country, ”he demanded.

In the meantime, Scholz wants to advance three core projects in his first year in office. On the one hand, he wants to raise the statutory minimum wage to twelve euros. Cashiers and parcel carriers, for example, would benefit from this. “It’s about recognition, but it also has to show on the bank account. Clapping once for the Corona heroes is not enough, “he told the” Tagesspiegel “.

The second important project is to clearly calculate how much electricity Germany will need in 2045 and to orient the expansion of electricity generation accordingly. “We need a lot more electricity from the sun and wind, and we need a more powerful power grid,” said Scholz. In order to achieve this, Scholz wants to pass the “necessary laws” as the third point, “so that the planning and construction of such systems can progress significantly faster than before.”

Of course that is why he is there. That is why he is the choice – the person you are allowed to choose but call it a liberal democracy.

Support the Eurozone And the Euro in its current form keep exporting unemployment to those countries in the periphery ✓

Support war in Middle East and propaganda against China and Russia at the snap of the fingers ✓

Support ECB without question ✓

Support to the hilt the failed economic policies of the current “geopolitical” era. ✓

Unelected and uncountable Banks are to create the currency and jobs not sovereign states. Bank lending not deficit spending. ✓

A liberal tribute act. Plenty of room for Kier Starmer to play drums. With Nicola Sturgeon as a back up singer and Justin Trudeau on keyboards. All promoted on their world tour by Macron. As Biden takes naps between speeches.

For the Guardian readers to claim the second coming of Christ and to open borders to accept the casualties of war. War they created with their liberal fantasies.

Summed up nicely by Jimmy Dore below.

https://m.youtube.com/watch?v=9jl-1MfWpbI