It is a public holiday in Australia today celebrating our national day - the day…

What exactly is a rout?

Its Wednesday and just a few items today. I have a fair number of commitments today and some writing deadlines. But I thought a brief comment on a Financial Times article last week (April 30, 2021) highlights how paradigm shift creates wedges in those devoted to the degenerative paradigm. Some embrace change more than others. Some hang on to any thread to maintain their credibility. We might write something about Modern Monetary Theory (MMT) and power tomorrow. That should appeal, eh!

What exactly is a rout?

The Oxford Dictionary tells us what a rout is.

A pretty big event really.

This was a rout in cricket.

Sorry England readers.

Pretty amazing batting collapse.

This was a rout in military history.

That will make you Englanders feel better perhaps.

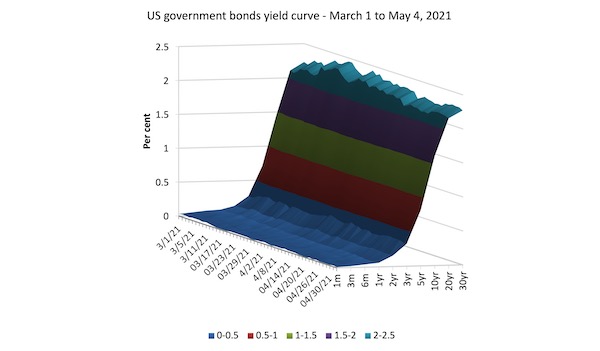

The following graph does not represent a rout!

This is the US Treasury yield curve surface from March 1, 2021 to May 4, 2021.

A bit of movement but not much.

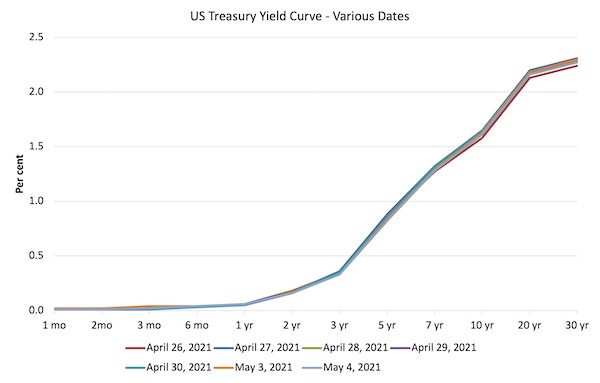

Neither is this a rout.

This is the US Treasury yield curve in the last 7 days.

On April 26, 2021, the ten-year Treasury bond was yielding 1.58 per cent, it rose to 1.63 per cent over the next two days, rose again to 1.65 per cent for the following two days after that, and yesterday was back to 1.61 per cent.

Maximum shift 0.07 per cent.

That is not a rout.

So, why did the Financial Times think it could publish an article about nothing but use this headline – Fed struggles to contain bond rout as investors bank on recovery (April 30, 2021)?

Good question Bill!

The Financial Times claimed that towards the end of April there was a “global bond retreat” which questioned whether the US central bank could control yields through its on-going bond-buying program.

The article told its readers:

But US Treasuries swiftly gave up their price gains on Thursday, pulling down European bonds in their wake. Some fund managers pointed to the fleeting price increases as a sign that the Fed will struggle to contain a further rise in Treasury yields as the economy booms in the coming months.

Thursday was April 29, 2021.

The “rout” was of course a minor adjustment and just reflected some selling of treasury bonds as portfolio managers started to adjust their wealth positions towards more risky assets, given the increasing confidence in the sustainability of the recovery.

So while a “rout” usually signifies something bad, the reality is quite different and the FT should not have been using such lurid and misleading headlines.

The rest of the article was blather from portfolio managers claiming they had power over the government.

Not likely.

MMTed Update

For those interested in what we are up to at present with the development of – MMTed – the following news will be relevant.

After the successful offering of the edX MOOC recently, we are now engaged in two projects.

First, we are making some minor changes to the MOOC learning materials and will be able to offer the 4-week course again in about 8 weeks for those who are interested.

We will make this a more selective offering on the MMTed platform rather than through edX, which will give us more technical control to help students with problems.

Some live, interactive sessions with the teaching staff will also be offered on a limited basis.

Second, we are scoping out and have started filming the intermediate course, which flows on sequentially from the MOOC course.

At present, a full 4-week course takes about 6 months to construct from inception to the final stages. So I am hoping that will be available for enrolments by no later than October.

We are still negotiating the platform for that course, but it will probably be offered through the MMTed platform.

Thanks to all those who provide financial support for the project.

The work is very labour intensive and expensive as a result.

We appreciate all the support we can get.

Music – Sugar Mountain

This is what I have been listening to while working this morning.

It seems that a lot of people I have known for years and been close to in one way or another are leaving us. I guess that is one of the aspects of ageing that one has to come to terms with.

It is a strange sensation when a person you were close to is here one minute and gone the next. I am still trying to work that out.

This song – Sugar Mountain – reminds me of how we look back on our youth as we age.

I always liked it.

I had a bootleg copy from a concert that I acquired in about 1970.

This is a live version from a concert on November 10, 1968 at Canterbury House in Ann Arbor, Michigan.

Pressure Drop back live this Thursday – after 15 months

My band – Pressure Drop – will be playing live again this Thursday night at the Bar Next Door, 211A High Street, Northcote.

This is our first live gig since March 2020 and marks a sort of renewal for live music in Melbourne for us as more venues return after the pandemic.

Live music begins at 20:30 until about 23:00.

If you like reggae and dub with a left-wing political slant then I would love you see you tomorrow night.

It is especially important that people start coming back to live music to support the venues after struggling without government support for so long during the lockdowns and restrictions.

I can even talk Modern Monetary Theory (MMT) during the breaks!

That is enough for today!

(c) Copyright 2021 William Mitchell. All Rights Reserved.

OK But I would say the de Freitas lbw decision was highly questionable! 🙂

We English have become as accustomed to batting collapses as to people (many of us) holding themselves out as progressive, while cheerleading for anti-progressive causes such as the EU, and recently championing proportional representation to inbed ‘centralism’ and avoid anything radical that might cause tea to be spilled. Note to American friends: a rout is pronounced as ow (I hit my thumb with a hammer) but adding on an e as in route or router changes the sound to an ou.

Thank you Bill for sharing the music you have been listening to. I have added Neil Young to my playlist.

Rout is an Expert Level illusion spell in Elder Scrolls: Skyrim.

Since mainstream economics demonstrably operates in the realm of fantasy and witchcraft, it’s likely they were referring to a similar sort of confection.

Many mainstream media outlets have become instruments of desinformation.

They continually distort and falsify the news, not because they are misinformed, but because they intentionaly make the dirty toil that media owners order them to do.

Many of them pretend to be independent, but then they have these editorials, these op-eds and even the way that news are conveyed, that continually usher the reader into right-wing narratives and away form the facts.

Allow me to give an example:

In the last electoral campaign to general legislative electrions in Portugal, there was an interview made by a supposed journalist of the public broadcaster, to a right-wing candidate.

In one of the questions he asked the candidate, the “journalist” said the following:

“We all know that the Left-Bloc proposals are reckless…”.

So how does a supposed independent journalist permits himself to make considerations in a public interview?

Like the so-called independence of central banks, the media outlets also thrive in the trope of independence that, right now, is nothing but a joke.

Clearly, they are not independent.

Whether they are beeing paid for the job, or are volunteers, is something to be seen.

Either way, we cannot call this people journalists.

They are propaganda peddlers.

Can’t wait for tomorrow’s post on power and MMT. Maybe I will try to stay up late to read it.

“This was a rout in cricket”

No need to go back so far Bill. There was an excellent example in 2015.

https://www.youtube.com/watch?v=fY0Ym30X5GU

And here I am at the Wesley Anne doing sound for another show on Thursday night, reading your blog in the break… Wish I could catch your gig. Hope it’s going well!

Warning: “Sugar Mountain” becomes an ear worm that is hard to shake out of your head once in there. Niel Young whittled it down to four verses from his original 126; however I think I have surpassed 126 in my own improvisations, just since Bill posted this.